MARKET OVERVIEW

The global malt ingredient market, falling within the food and beverage processing industry, will be a sole trade and production platform for malt-based ingredients used in a wide variety of consumables. These ingredients, primarily cereal grain extracts like barley, wheat, and rye, will undergo a specific process of malting involving controlled germination and drying. As a result of this transformation, enzymes will be triggered and sugars will be formed, producing a product highly ideal for brewing, distilling, and food manufacturing applications. The global malt ingredient market won't just supply large breweries but also address the differentiated requirements of little craft manufacturers and food businesses that will ask for unique flavor structures and functional characteristics.

The marketplace will extend way beyond alcoholic beverages. Though malt will remain a key material in the brewing of beer and whiskey, its application will extend progressively to bakery items, breakfast cereals, confectionery, and milk replacers. Food technologists and ingredient formulators will rely on malt for its natural sweetening ability, enzymatic function, and flavoring technology. Consequently, the global malt ingredient market will be a key foundation for businesses aiming to cater to both flavor and texture requirements of processed foods without relying on artificial additives.

Raw material procurement will be the prime force in determining the direction of this market. Geographical conditions like soil health, climatic conditions, and availability of clean water will influence the choice of grain variety and their malting capabilities. It will create a network of supply chains connecting farming districts in countries like Canada, Germany, Australia, and Argentina to processing facilities and commercial wholesalers on different continents. Malt quality will have a direct impact from farming practices; thus traceability and transparency will determine competitive forces between manufacturers.

Processing techniques will also differentiate products within the global malt ingredient market. Producers will continue to grow with varying levels of kilning and roasting, allowing for the creation of base malts, specialty malts, and extracts that will meet a variety of requirements in the final product. The variation will be critical for developers who require optimizing aroma, color, and mouthfeel in their final product. Additionally, solubility of malt, enzyme strength, and stability of color will be required to meet technical specifications in a number of industries, requiring rigorous quality control and standardization processes.

Market boundaries will be defined by regulatory standards, particularly on food safety, GMO claims, and clean labeling requirements. Companies in the global malt ingredient market will have to stay competitive with evolving demands in labeling and transparency in processing declarations, especially as consumers demand more content information on products. This will affect even packaging designs up to the audit process at production levels.

With emerging consumption trends and improved food manufacturing technologies, the global malt ingredient market will offer a platform for innovation, collaboration, and supply chain establishment. The business will redefine the role of malt continuously a role that is not limited to being a raw material but as a way to drive product identity, performance, and customer satisfaction in global markets.

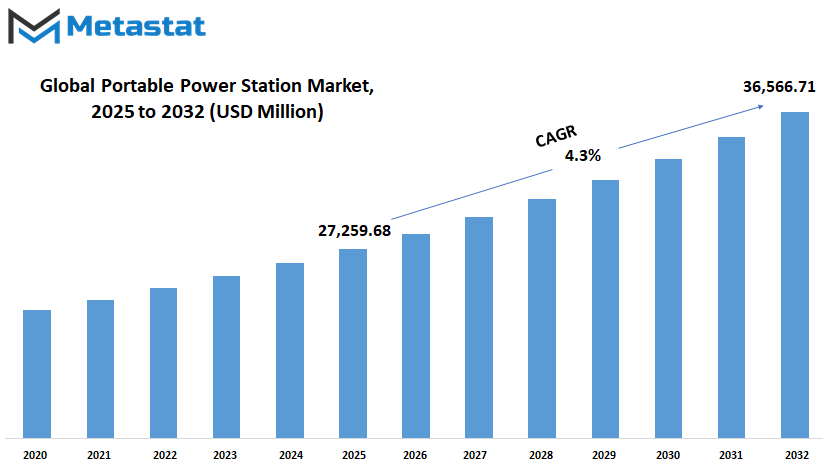

Global malt ingredient market is estimated to reach $36,566.71 million by 2032; growing at a CAGR of 4.3% from 2025 to 2032.

GROWTH FACTORS

The global malt ingredient market is poised to witness significant growth in the coming years, led primarily by a change in consumer behavior and evolving food and beverage trends. One of the key drivers that are fueling this growth is the rising need for alcoholic and craft beers. With consumers increasingly interested in trying out distinct and locally-made beverages, small breweries remain highly popular. These companies tend to depend intensely on good malt ingredients in order to gain unique flavors and scents, which promotes steady demand and creativity in the malt industry.

Apart from alcoholic drinks, malt is also increasingly being used in common foods. Products like baked foods, confectioneries, and health-oriented snacks have begun using malt for its natural sweetness, dense texture, and nutritional value. Customers are getting more knowledgeable about what is placed in their food, and malt is perceived as a healthier alternative to synthetic additives. As people increasingly look for products with fewer simple, recognizable ingredients, manufacturers will increasingly look to malt to meet their demands.

But this market also has challenges that can keep it from going further. One of the largest issues is the volatile supply of barley, the primary raw material for malt. Barley is very responsive to climatic change, and volatile weather conditions can impact both the quantity and quality of the crop. The volatility creates risk for producers who depend on stable supplies to ensure output and pricing. Another challenge arises from the increasing availability of alternative sweeteners and flavoring products. As food manufacturers seek lower-cost or more versatile alternatives, these replacements may reduce demand for conventional malt-based ingredients.

Even with these obstacles, the future of the global malt ingredient market remains promising. The increasing popularity of clean-label and natural foods provides a significant opportunity for malt manufacturers. Increasing numbers of brands are opting to emphasize ingredients that are easy to comprehend and of natural origin, making malt a perfect fit. As health-consciousness and awareness increase, the image of malt as a natural and healthy choice will enhance its position in product development.

Ahead, firms investing in sustainable agriculture, open sourcing, and modern processing technologies will be well placed to take the lead. With changing markets and shifting consumer focus, the versatility and time-tested popularity of malt will most likely continue to find a place across a broad range of applications, with consistent growth and opportunity.

MARKET SEGMENTATION

By Type

The global malt ingredient market will expand further as increasing industries seek out natural and versatile ingredients to enhance their products. Malt finds application not just in brewing but also in food, medicines, and even beauty products. As consumer awareness about what they eat grows, demand for malted products is bound to rise. Manufacturers will have to react to this trend by producing superior-quality ingredients that enable both conventional and innovative product developments.

One of the keyways the market is expanding is through variety. Within type, malt ingredients further split into Base Malts, Specialty Malts such as Caramel, Roasted, and Crystal, Rye Malts, Wheat Malts, Organic Malts, and Other Grain Malts such as those produced from oats and corn. Each contributes something unique, whether it's flavor, color, or nutritional content. This type of variety enables companies to be more innovative, which enables them to address various customer demands. As they test new recipes and product lines, these malt types will be central in informing flavor and performance.

The food and beverage sector, particularly craft brewing and healthy food companies, will continue to innovate further ways to incorporate such malt varieties. Wheat and rye malts could become increasingly used in baked items due to their texture and richer flavor. Organic malts specifically will see greater demand as the clean-label trend becomes an even larger part of consumers' routine. Consumers want to look at something they can relate to, and organic malts work well with that. This pressure for transparency in food labeling will also encourage more companies to add such ingredients to their items.

Technology will also influence the global malt ingredient market. With improved processing techniques and equipment to monitor quality, manufacturers will be in a position to provide reliable products while reducing waste. They will probably employ information to make demand forecasts, enhance yields, and even identify how varied grains can be utilized more effectively. This will assist in making malt manufacturing not only more consistent but also sustainable.

In the years to come, the global malt ingredient market will be at the forefront of shifts in both industry behavior and consumer demand. As consumers search for new flavors and healthier options, businesses will meet this demand by providing even more from this single ingredient. Its worth will continue to increase, not only in what it does for products, but in how it contributes to bigger ends in health, variety, and sustainability.

By Application

The global malt ingredient market will experience consistent growth due to evolving food and beverage choices globally. As individuals become increasingly conscious of what they eat, the need for ingredients that are natural and functional will determine the future of this market. Malt, as a cereal grain product that has been germinated and dried, finds application in a multitude of products. It provides flavor, texture, and nutritional content, which makes it in high demand by manufacturers who are interested in clean label trends and ingredient openness.

Brewing will remain a significant position within the market. As consumers need more taste and quality variety, beer and craft beer will gain interest from consumers who desire traditional brewing with a twist of modernity. Non-beer will also gain traction, particularly because healthy-conscious consumers seek low-calorie or alcohol-free beers with the same taste profile. This trend in consumption will make the companies change their approach to using malt ingredients to preserve flavor and mouthfeel without depending on alcohol.

In the world of distillation, the global malt ingredient market will expand as demand grows for whiskey, vodka, and gin. Each beverage utilizes malt in a separate manner, providing manufacturers with flexibility when creating the different tastes. Craft distilleries especially will venture into new methods that enable further personalized or regional flavors. This type of innovation will provide opportunities for malt suppliers who can ensure consistent quality and customized solutions.

Off-premise beverages, the application of malt in bakery and confectionery foods will increase as consumers seek comforting foods that are wholesome. Bread, pastry, and cookie products with malt are characterized by rich taste and tender texture, which drive consumer acceptability. Being staples in daily meals, these foods' demand will remain robust, and manufacturers will turn to malt as an assurance ingredient improving quality.

Animal feed, another use sector, will also be affected. As attention to animal health and nutrition increases, animal feeds that include malt will be prized for their digestibility and energy value. This will enhance improved livestock productivity and welfare.

For nutraceuticals, malt-based energy bars and protein powders will be more prevalent. Since individuals want a combination of health and flavor, these items will serve as a compromise. Even snacks and cereals will use more malt as consumers prefer products that are tasty but natural. All of these indicate a gradual and deliberate increase in the global malt ingredient market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$27,259.68 million |

|

Market Size by 2032 |

$36,566.71 Million |

|

Growth Rate from 2025 to 2032 |

4.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

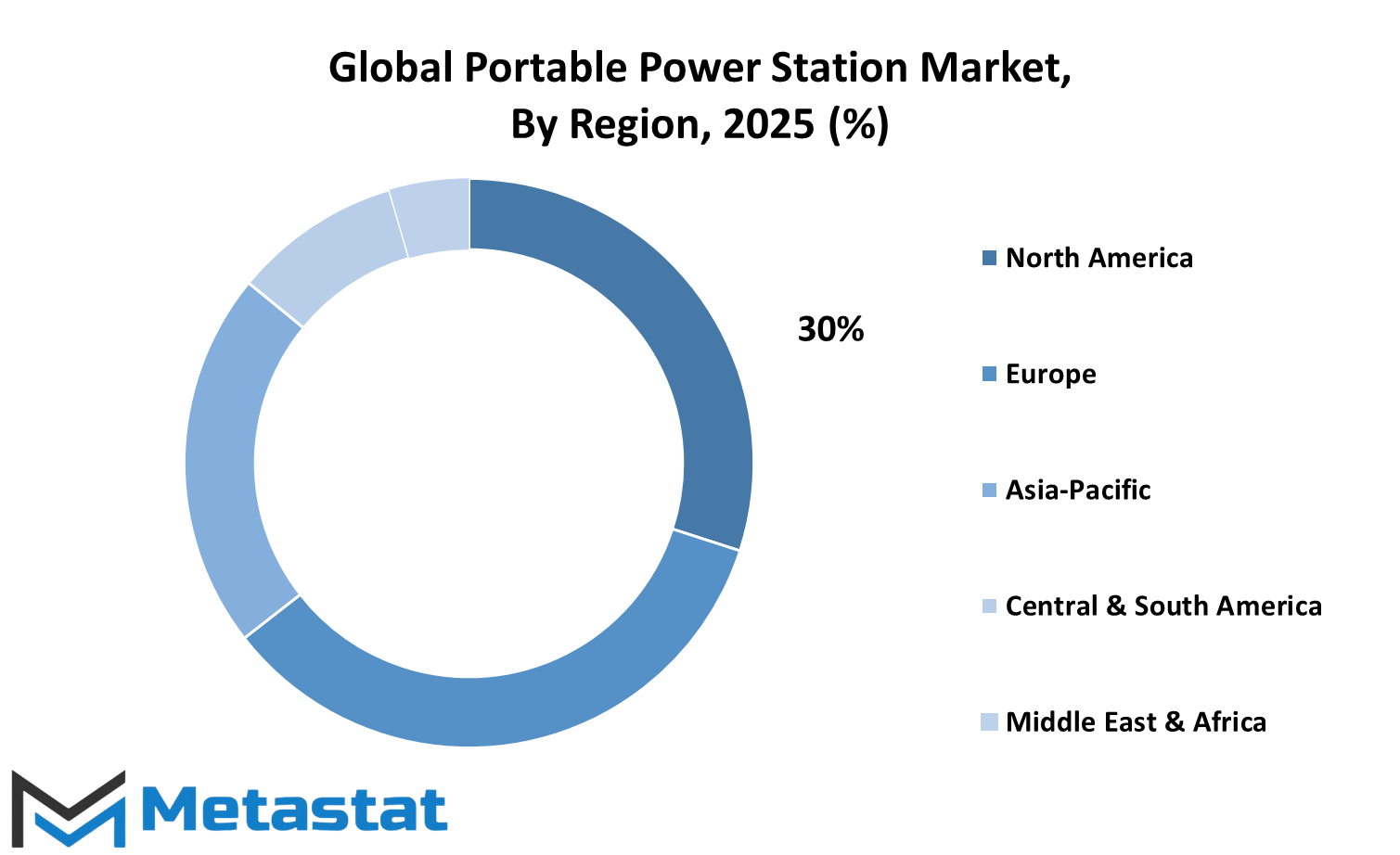

Based on geography, the global malt ingredient market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

COMPETITIVE PLAYERS

Looking forward, the global malt ingredient market is at a thrilling juncture of past tradition and future innovation. Here, new technology and sustainable approaches will combine to optimize processes and enhance quality. The future of this market is bright as research fuels the implementation of cleaner production technologies and intelligent automation. The production processes utilised in the making of malt will change, such that manufacturers provide safe, consistent ingredients without loss of flavor or texture.

Innovation will pave the way for more effective production and intelligent resource utilization. As changing consumer demands drive industry research, developments will ensure less waste and increased sustainability. Manufacturers will reap gains as new methods combine with age-old practices, enabling them to address increasing demand for top-quality ingredients. This thinking ahead not only meets existing market demand but also positions the industry to adapt to forthcoming alterations.

Most of the competitive players will be at the center of these developments, each bringing its own experience and expertise. Major players like Viking Malt, Castle Malting, Weyermann Specialty Malting, Muntons Plc, Boortmalt, Ireks GmbH, MaltEurop, Bairds Malt, Soufflet Group, Warminster Maltings, Cargill, and Simpsons Malt will be at the center of improving product quality and efficiency of operations. Their emphasis on merging cutting-edge technology with conventional practices will define the future of the market. Investing in research and development, they guarantee that their products remain up to par with the high expectations demanded by global viewers.

The sector will enjoy a smooth integration of technology into production routines, ensuring consistency and enhancing quality of output. With up-to-date systems, producers are able to control temperature, humidity, and other vital aspects more effectively, resulting in ingredients conducive to healthier eating habits. As the combination of science and art increases in potency, the market will adjust rapidly to shifts in legislation and food fashion, creating room for a more dynamic and sustainable future.

All in all, the global malt ingredient market is poised to develop in a manner that respects established techniques while fully leveraging the capabilities of contemporary science and technology. Competitors who are dedicated to innovation and quality will assist in steering this market toward a promising future, keeping the industry relevant and healthy as it addresses challenges and opportunities in the years ahead. The sector will keep on flourishing as market trends evolve and innovation gives rise to new practices that hold out the prospect of a sustainable, dynamic future based on collaborative expertise ahead.

Malt Ingredient Market Key Segments:

By Type

- Base Malts

- Specialty Malts (Caramel, Roasted, Crystal, etc.)

- Rye Malts

- Wheat Malts

- Organic Malts

- Other Grain Malts (Oats, Corn, etc.)

By Application

- Brewing (Beer, Craft Beer, Non-Alcoholic Beer)

- Distilling (Whiskey, Vodka, Gin)

- Bakery and Confectionery (Breads, Pastries, Cookies)

- Animal Feed (Livestock Feed)

- Nutraceuticals (Energy Bars, Protein Powders)

- Other Food Applications (Cereal, Snacks)

Key Global Malt Ingredient Industry Players

- Viking Malt

- Castle Malting

- Weyermann Specialty Malting

- Muntons Plc

- Boortmalt

- Ireks GmbH

- MaltEurop

- Bairds Malt

- Soufflet Group

- Warminster Maltings

- Cargill

- Simpsons Malt

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383