MARKET OVERVIEW

The global macrocell baseband unit market will continue to be at the forefront of leading the future of the telecommunications industry, with its strategic positioning in wireless infrastructure being highlighted. As the pressure placed on mobile networks keeps increasing and next-generation connection architectures take centre stage, this market's future will be determined by its ability to handle increasing amounts of data, support more extensive frequency bands, and cope well with city and suburban territories. The global macrocell baseband unit market will no longer be seen as a straightforward subsegment of telecom hardware but as a source force for innovations in mobile architecture and operational capacity.

In the future, the players in the industry will be striving to optimize latency, enable disaggregated architectures, and empower smart processing at the edge. These transformations will require a radical restructuring of traditional unit configurations. The market will reflect a shift from monolithic systems to modular, scalable infrastructures that allow carriers to respond quickly to changes in network demand and traffic flows. As 5G networks take hold and discussion of 6G builds, the market will transform in response to these next-generation models. The devices will function as bridges that relate the requirements of today's hardware to future standards of performance for communication systems.

Next will come the turn toward software-defining upgrades providing greater control and flexibility to network operators. This transformation will change not only the production of how the devices are made but how they are deployed and remotely accessed as well. The global macrocell baseband unit market will see a tsunami of intelligent orchestration tools that assist in load balancing, fault detection, and energy management. As network conditions get more complicated, automation will become the focus of ensuring that mobile service is never disrupted, particularly in dense environments and in large data events.

Future expansion will also concentrate on green footprint and energy consumption. Operators will opt for power-saving baseband units without compromising on performance. Materials used, design practice adopted, and cooling systems employed will all be in harmony with this trend. The global market will respond by embracing innovation in line with world sustainability standards and regulations, resulting in greener and more moral network extension plans.

Another significant direction will involve closer collaboration among telecom vendors, cloud providers, and government agencies. The traditional boundaries between physical infrastructure and virtual networking will gradually start to disappear. As a result, the market will venture into new domains where open interfaces and vendor-agnostic solutions become the norm for building flexible systems. Security features will also be redefined, not just to protect against external attacks but to enable secure interoperability among heterogeneous network layers.

In the years to come, the global macrocell baseband unit market will see an increasing embedding of technology, strategy, and policy. It will be a technical foundation and a strategic asset, shaping the way communication is delivered, managed, and secured at a global scale. Where it goes will ultimately decide the future of connectivity itself

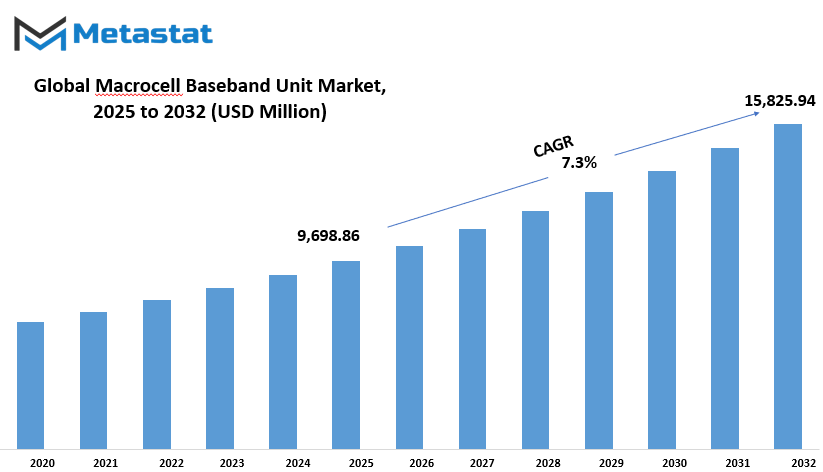

Global macrocell baseband unit market is estimated to reach $15,825.94 Million by 2032; growing at a CAGR of 7.3% from 2025 to 2032.

GROWTH FACTORS

The global macrocell baseband unit market will continue to expand at a steady rate in the coming few years driven by the increasing rollout of 5G infrastructure and the ongoing development of mobile networks. With the growing use of mobile devices for work, entertainment, and communication, demand for quicker and safer connectivity has never been stronger. This demand continues to grow with each new service moving online, and customers are demanding smooth experiences, whether video streaming, online meetings, or apps that rely on real-time information. As such, mobile operators are focusing on developing their network capabilities, and this includes investments in macrocell baseband units that handle the data transmission as well as making communication smooth.

The second major driver for this market is growing data traffic. With users consuming more digital content and more devices becoming connected, networks need to carry more data more quickly and more efficiently. To address these greater demands, more low-latency and high-speed communication is increasingly needed. Baseband units help deliver on these demands by supporting faster signal processing and more efficient data handling. Their role is even more important since 5G networks are to not only offer faster internet speeds but also support applications that require prompt response, including autonomous cars and telemedicine.

The other challenges can also hold back this market's growth. Installation of macrocell networks is expensive. It is not only the initial cost of buying and installing the hardware but also the long-term operational costs. These costs can be a barrier for smaller companies or companies in less lucrative markets. Aside from the monetary barrier, there's also the issue of upgrading old systems. A lot of today's current networks still run on old technology, and the process of shifting to high-end baseband units involves enormous upgrades, which is time-consuming and technically demanding.

Despite these barriers, the market's future looks bright. One area that is extremely promising is the shift towards virtualized and cloud-native baseband processing. This can improve network functions to become more efficient and flexible and will allow for easier upgrading and better resource utilization. It also offers a chance for new services and apps to be supported in a simpler manner. With this trend set to continue, it should provide excellent prospects for expansion within the global macrocell baseband unit market over the next several years.

MARKET SEGMENTATION

By Technology

The global macrocell baseband unit market is expected to grow steadily due to ongoing change in mobile network infrastructure. With increasing demand for faster and more stable connectivity, technology remains a prime driver in driving this market. Mobile operators are forced to upgrade their networks to deal with higher data volumes while keeping services stable and efficient. This is where baseband units come in—they deal with and process all the signals that pass between a user's device and the rest of the network, and hence are the backbone of mobile communication.

Technology here bifurcates into a variety of segments, each having a growth path of its own. The 4G LTE segment, for example, is valued at $4,838.76 million, meaning that it continues to be very much in the picture in a large part of the world. Although 5G NR (New Radio) is receiving ample attention, 4G remains important, especially where 5G has yet to be implemented. However, 5G NR is expanding dramatically with its ability to offer less latency and increased speed, as demanded by services like remote surgery, smart cities, and autonomous vehicles. Cellular operators are investing heavily in the infrastructure of 5G, and baseband units for 5G are now becoming centerpieces.

Wi-Fi 6 and subsequent technologies are also in sight as key drivers of the market's future. These more recent wireless networking iterations provide enhanced performance in high-density environments, which is valuable in today's networked world. Wi-Fi technology is coexisting with mobile networks, and this dual functionality means that baseband units must be capable of processing a variety of signal types. At the same time, Legacy Systems such as 2G and 3G are operational in certain parts. Despite their declining existence, they cannot be completely overlooked. The majority of the rural or developing world is still using these networks for basic communication needs, and their baseband units would have to be maintained until newer systems are fully functional.

In a nutshell, the market is being shaped by the need for increased speed, reliability, and increased coverage. Each segment - 4G LTE, 5G NR, Wi-Fi 6 and beyond, or Legacy Systems is part of this evolution. With new technology spreading and old systems declining, there will be continued needs for flexible, efficient baseband units that facilitate the backbone of mobile communication worldwide.

By Deployment Type

The global macrocell baseband unit market has been segmented based on deployment type into On-Premises Deployment, Cloud-Based Deployment, and Hybrid Deployment. Each of the deployment types comes with its own merits, based on the needs and goals of the organizations that use them. On-premises deployment refers to a setup where the hardware and data are controlled and housed in a company's own facilities. This type of deployment is also the best for companies that are worried about control, security, and physical access to their infrastructure. It usually bests suits companies handling sensitive information and having enough resources to own and manage systems independently. While this mode gives organizations complete control, it may also incur greater costs in hardware, maintenance, and expert individuals.

Cloud deployment, nevertheless, allows companies to rely on remote servers and platforms to perform their operations. It is most often appreciated for its flexibility and affordability. Companies that use cloud services can scale up or down more easily and do not have to worry so much about the technical upkeep, since the providers of the service handle most of this. This model is especially suited to companies with fluctuating demand or limited budgets for IT. It also supports remote access, which is only becoming more important as more people work remotely from different locations.

Hybrid deployment takes the best features of both cloud and on-premises models. It gives companies the ability to maintain certain important data on-premises while taking advantage of the cloud for other uses. This hybrid allows companies to strike a middle ground between flexibility and control. Hybrid configurations can be customized based on priorities, such as compliance needs, expense, or operations priorities. It is a sensible solution for the majority, especially those growing incrementally from mature systems to the newer, cloud-based method.

With the demand for better connectivity and faster transmission of data becoming a growing concern, the deployment type is critical in determining the manner in which companies deal with their network setup. Every model has its downsides and drawbacks but is also oriented towards maximum performance, scaling, and availability. It basically comes down to what works for the company on cost, control, and ease considerations.

By Application

The global macrocell baseband unit market is on the rise with the increasing demand for quicker, more dependable mobile communication. As mobile networks extend and develop further, scalable and efficient baseband solutions become all the more indispensable. The baseband units are the fundamental building blocks of the mobile network infrastructure, facilitating processing and handling enormous volumes of data passed on between the users and the core network. This market is critical to the efficient functioning of mobile communication, especially where there is network congestion or high-speed connection is critical.

The market by application has segments that are Mobile Network Operators (MNOs), Private Network Operators, Public Safety and Emergency Services, and Internet of Things (IoT) Applications. Mobile Network Operators make up a massive share of demand as they constantly look to expand coverage and accommodate more users. The push toward 5G networks has raised this demand even higher as MNOs need more advanced baseband units that support higher data speeds and better service quality. Baseband units enable operators to carry out various network functions more effectively, thereby enhancing the experience of users.

Private Network Operators are also becoming a growing segment of this market. Having reliable baseband units allows these private operators to provide high levels of service without depending on external entities. For Public Safety and Emergency Services, a solid and reliable communications network is vital. These services need to be connected during emergency situations when public networks are saturated. Baseband units help to build dedicated networks that are always active and reliable, allowing responders to work without interruption. This makes communication safer and more dependable when it's needed most.

The growth of the Internet of Things (IoT) is also a major factor to consider. With more and more devices connected to the internet every day, there is a need for networks that can handle different kinds of data and traffic levels. Baseband units enable such IoT applications by ensuring smooth data transmission and secure connections. Smart homes, industrial sensors, and connected cars – these units keep everything connected and in working order.

By End-User Industry

The global macrocell baseband unit market is segmented by end-user industry into Telecommunications, Transportation and Logistics, Healthcare, Manufacturing, and Smart Cities. All these industries are important in the sense that they have a tendency to drive the demand for macrocell baseband units, based on how much they rely on strong and stable communication networks to carry out day-to-day operations.

In telecommunications, macrocell baseband units play a central role. They support the management of signals and ensure communication is as seamless as possible between devices. With the growing world interconnectivity and higher users and data, the telecommunication firms have to upgrade their infrastructure. This will require higher demand for more productive baseband units to carry higher loads without losing out on speed as well as reliability. These units help in bringing down network downtime and enhancing call and internet quality, directly affecting customer satisfaction.

The transport and logistics sector is also greatly benefited by futuristic baseband units. There needs to be dependable communication systems to ensure that motor vehicles, warehouses, and shipping routes keep running smoothly. From scheduling a trucking fleet to tracking global shipments, these systems need steady networks. Macrocell baseband units help ensure that such networks run without any delays, which reduces the risk of late or missed deliveries. It is especially pertinent as companies increasingly utilize intelligent logistics systems based on real-time information.

In medicine, an unbroken and fast communications network is just as crucial. Telemedicine, electronic patient records, all rely on continuous connectivity within hospitals and clinics. Baseband units are also helping to make this a reality by making possible the network equipment employed day by day by health professionals. The more hospitals go online, the higher demand for reliable baseband units is likely to escalate, particularly within emergency units where a matter of seconds lost through delayed communications would influence treatment given to the patient.

Manufacturing plants have also introduced more automated and networked processes. Equipment, sensors, and control systems often need to communicate with each other in real-time. Macrocell baseband units enable simpler connectivity, reducing errors and downtime on factory floors. Better communication means smoother operations and can even improve workplace safety.

Smart Cities, by definition those that utilize smart technology to improve the daily lives of citizens, also need strong communications systems. Security cameras and traffic lights all depend on speed and security in networking. Macrocell baseband units keep these systems up and running by ensuring they remain online and responsive. The more cities plan to integrate smart technology into their structure, the more business this sector is going to receive in the future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9,698.86 million |

|

Market Size by 2032 |

$15,825.94 Million |

|

Growth Rate from 2025 to 2032 |

7.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

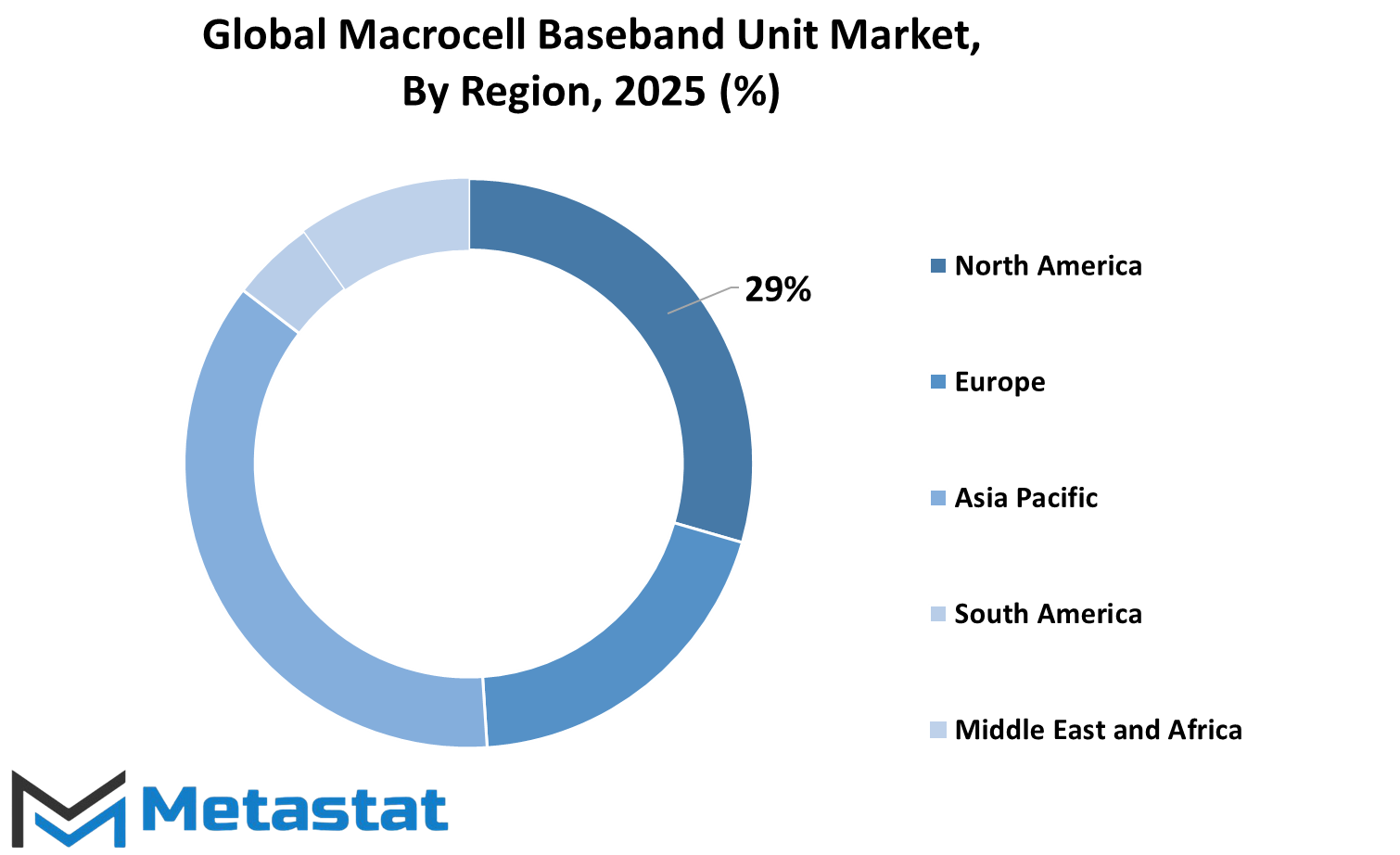

The global macrocell baseband unit market is segmented into different regions based on geography. These include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America is also segmented into the United States, Canada, and Mexico. In Europe, the market is segmented into the United Kingdom, Germany, France, Italy, and the Rest of Europe. Asia-Pacific includes India, China, Japan, South Korea, and the Rest of Asia-Pacific. South America's base countries include Brazil, Argentina, and the Rest of South America. Last but not least, Middle East & Africa is segmented into the GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

All these areas have a particular role to play in shaping the direction and growth of the market. North America, with its advanced technological infrastructure and high demand for enhanced mobile connectivity, is still a key contributor. The United States, in particular, has a massive share because of ongoing improvement in network infrastructure and increasing investments in 5G technology. Canada and Mexico are also moving steadily, driven by increasing mobile subscribers and increasing data traffic.

In Europe, Germany, the UK, and France are all striving to improve their network performance. All these countries are investing in digital growth and the development of telecommunications infrastructure. Italy and the remaining European nations are also doing their part through private and public sector efforts towards better internet access and reliability.

The Asia-Pacific region is among the fastest-growing markets. China and India, with their massive populations and growing mobile usage, are the drivers behind demands for more network coverage and greater signal capacity. Japan and South Korea, long the early innovators in new technology, are the pacesetters in advanced network solutions. The rest of the Asia-Pacific region is gradually catching up with mobile access expanding to rural and remote areas.

In South America, Argentina and Brazil are building up their network infrastructures. Growth may be slower than elsewhere, but there is certainly a drive to enhance mobile communications services. In the Middle East & Africa, countries such as those in the GCC, Egypt, and South Africa are focused on digital transformation. They are striving to narrow the connectivity divide through national plans and global alliances. The rest of the region has potential, especially as access to and awareness about new communications equipment increases.

COMPETITIVE PLAYERS

The global macrocell baseband unit market is crucial in making mobile network infrastructure possible. Given the constantly increased need for connectivity, the market for high-capacity and energy-efficient baseband units is as necessary as ever. These baseband units play a central role in signal processing and communication handling between cell towers and the network core. Following the launch of 5G and ongoing build-up in cellular networks, the Macrocell Baseband Unit market will likely increase steadily.

Baseband Units are responsible for performing critical operations such as signal demodulation, modulation, and encoding. They are usually mounted at the ground of cell towers and work in conjunction with Remote Radio Units to offer seamless wireless communication. They play a crucial role in offering fast internet and uninterrupted calls to customers. As smartphone and internet-connected device usage is on the rise, data traffic grows too, and thus the demand for advanced baseband units will keep growing.

Key competitors in the Macrocell Baseband Unit market are Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Nokia Networks, Samsung Electronics, ZTE Corporation, Qualcomm Technologies, Inc., Intel Corporation, and Anritsu. They are investing greatly in R&D to come up with faster, more efficient, and power-saving units. Their objective is to assist mobile operators who are under pressure to deliver enhanced coverage and support more subscribers at a time.

Technology is evolving quickly, and firms are creating baseband units that cater to current and future wireless standards. That would mean catering to 4G LTE, 5G, and in some cases, something more. As networks evolve towards virtualization and cloud deployment, baseband units are also becoming programmable and software-centric, which implies they can be upgraded more easily and do a better job over time.

Governments and telecom regulators around the world are also playing a part in the formation of the market. Policies favoring enhanced mobile infrastructure and greater coverage are forcing telecom companies to adopt newer and more innovative technologies. That, in its turn, creates a demand for Macrocell Baseband Units. As competition becomes more intense and consumers require faster and more reliable service, the value of these units will be even more evident. The industry is in a trend of steady growth, driven by innovation, changing user habits, and the ongoing competition to offer better mobile service.

Macrocell Baseband Unit Market Key Segments:

By Technology

- 4G LTE

- 5G NR (New Radio)

- Wi-Fi 6 and Beyond

- Legacy Systems (2G/3G)

By Deployment Type

- On-Premise Deployment

- Cloud-Based Deployment

- Hybrid Deployment

By Application

- Mobile Network Operators (MNOs)

- Private Network Operators

- Public Safety and Emergency Services

- Inteet of Things (IoT) Applications

By End-User Industry

- Telecommunications

- Transportation and Logistics

- Healthcare

- Manufacturing

- Smart Cities

Key Global Macrocell Baseband Unit Industry Players

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Nokia Networks

- Samsung Electronics

- ZTE Corporation

- Qualcomm Technologies, Inc.

- Intel Corporation

- Anritsu

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252