Global Loyalty Programs Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global loyalty programs market evolved from simple reward schemes to a sophisticated mechanism that matches evolving consumers' needs and the ingenuity of emerging business strategies. Rooted in retailing and service enterprises, its history traces back as early as the early twentieth century when retailers first issued stamps and tokens for encouraging repeat purchase. These initial attempts were small but established the psychological principle of rewarding customer loyalty a principle that would come to permeate borders and industries over time. The late 1980s marked a watershed with the debut of frequent flyer programs.

Airline carriers discovered that retaining customers paid more than continuous acquisition and thus came to create institutionalized reward systems that linked travel behaviour to points and status. Quickly following, supermarkets, banks, and cellular operators also began offering rewards, each of them designing rewards to suit their clientele. This growth set the stage for the global loyalty programs market since it started linking emotional involvement with transactional value.

- Global loyalty programs market of around USD 94 Billion in 2025 at a growth rate of around 6.2% until 2032 and scope for extending over USD 143.3 Billion.

- Points Programs hold a share of around 30.4% of the market, leading to new applications and growth on the back of rigorous research standards.

- Growth-enabling key trends: Increasing competition between brands to keep customers, Increasing demand from consumers for incentivized rewards and experiences

- Opportunities include: Integration with AI and analytics to create more customized and dynamic loyalty programs

- Key insight: The market will grow exponentially in value within the next ten years, highlighting high growth prospects.

Data-based systems substituted plastic cards that could track conduct in real time. Companies then began using analytics to predict buying behaviour and target offers. Mobile applications then made it easy to interact, so customers could get rewarded in the moment and companies could get eyes on journeys about consumers. It wasn't just technology, however. It was about redefining what loyalty looked like in a world of infinite choice. Shifting regulatory regimes, particularly data privacy in the European Union and beyond, rewritten the playbook for companies to practice personalization and openness. Firms had to be careful walking the tightrope between being able to utilize data effectively and holding respect for the consumer rights. At the same time, shifting consumer attitudes calling for authenticity, ethical involvement, and responsiveness encouraged brands to establish programs that felt more like partnership than transaction. Today, the international business of loyalty programs is the proof of technological creativity and cultural sensitivity. Its future would be post-discounts and points, rather one of nurturing long-term emotional connections fueled by predictive analytics, values of sustainability, and frictionless digital convergence. From a gesture of gratitude, it has evolved to be a strategic building block of customer experiences in today's era.

Market Segments

The global loyalty programs market is mainly classified based on Program Type, Channel, Deployment Mode, End-Use Industry.

By Program Type is further segmented into:

- Points Programs: Points Programs will continue to be a go-to customer loyalty option, where customers collect points on each purchase. Product or service rewards or special offers are offered in place of points. Instant redemption and electronic monitoring via mobile apps will be part of the future of such programs, which will make it even more convenient and rewarding.

- Tier-based Programs: Tier Programs will have tier-based rewards that encourage customers to spend more to achieve higher tiers. Firms will use data analytics to track spending and provide benefits tailored to individuals. Emerging technologies will enhance these programs to be more transparent and engaging by providing real-time progress notifications and dynamic reward schemes.

- Cashback Programs: Cashback Programs will remain popular because they are easy and concrete rewards. The programs will improve with e-payment system integration so that rewards can be processed more quickly. Seamless integration and automation will make cashback rewards more appealing and effective for consumers across all industries.

- Mission-driven Programs: Mission-based Programs will be in the spotlight as consumers become more aware of ethical and sustainable values. These programs will enable consumers to contribute to social or environmental cause through purchasing behavior. Innovation in the future will be driven by transparent tracking of contributions, creating deeper emotional connections between consumers and brands.

- Other: The other loyalty program models will be hybrid with over a single reward mechanism. They will be dynamic and accommodate different customer preferences. Artificial intelligence integration will enable companies to forecast user patterns and provide customised incentives to create enhanced engagement and retention rates.

By Channel the market is divided into:

- In-Store: In-Store loyalty programs will remain popular with consumers by way of hands-on interaction and instant reward. Merchants will integrate digital technologies into in-store experiences, including QR code scanning and mobile device check-in, to facilitate participation. Tailored offers at the checkout will even boost customer satisfaction and repeat business.

- Online: Internet rewards programs will grow along with e-commerce and online channels. Companies will use sophisticated algorithms monitoring shoppers' behaviour and providing personalized rewards. New online programs will feature interactive dashboards showing rewards status, making the experience transparent and encouraging repeat use.

- Mobile: Mobile loyalty programs will be the norm as a result of rising smartphone penetration. Real-time messaging, location-based offers, and simple redemption will come via mobile apps. It will be digital wallet-enabled and contactless payment-enabled, making it an easy experience. Mobile programs will also include push notifications to maintain activity active.

By Deployment Mode the market is further divided into:

- Cloud-Based: Cloud-Based loyalty programs will grow rapidly because of scalability and easy data access. Businesses will adopt cloud technology for faster updates, better integration, and cost-effectiveness. Cloud-based systems will also support advanced analytics and security, helping companies track and manage customer engagement efficiently across multiple platforms.

- On-Premises: On-Premises deployment will continue to serve organizations that prioritize full control over data and system management. Such setups will be preferred by industries handling sensitive customer information. Future improvements will focus on enhancing security, automation, and integration with existing infrastructure to ensure stable and reliable program operations.

By End-Use Industry the global loyalty programs market is divided as:

- Retail: Retail will remain the leading sector for loyalty programs, using them to boost customer retention and sales. Retailers will employ data-driven insights to create targeted offers and improve shopping experiences. Digital receipts and personalized recommendations will encourage continuous participation and long-term customer value.

- Financial Services: Financial Services will use loyalty programs to reward account activity and transaction frequency. Programs will include cashback, reward points, and exclusive offers on financial products. With the growth of digital banking, these programs will rely on data analytics to deliver personalized incentives and improve client loyalty.

- Healthcare & Wellness: Healthcare & Wellness programs will emphasize encouraging healthy lifestyles and consistent engagement with health services. Rewards will be given for activities like regular checkups or purchasing wellness products. Future programs will integrate wearable technology, allowing users to track health achievements and earn rewards automatically.

- Restaurants & Food Delivery: Restaurants & Food Delivery services will expand loyalty offerings to increase repeat orders and customer retention. Personalized deals, birthday offers, and instant discounts will enhance user engagement. Digital ordering platforms will integrate loyalty tracking, making rewards accumulation and redemption faster and more convenient.

- Travel & Hospitality (Cabs, Hotels, Airlines): Travel & Hospitality programs will focus on enhancing the overall customer journey by offering flexible redemption options. Partnerships between airlines, hotels, and cab services will allow shared benefits. Future systems will include AI-powered personalization, making every experience more tailored and rewarding for frequent travelers.

- Telecoms: Telecom companies will use loyalty programs to reduce churn and reward long-term subscribers. Offers such as data bonuses, discounted plans, and exclusive entertainment access will strengthen customer relationships. Integration with digital services and real-time analytics will help providers understand usage patterns and create better reward structures.

- Media & Entertainment: Media & Entertainment programs will encourage engagement through points earned from content subscriptions or participation in online activities. As streaming and gaming grow, rewards will include access to exclusive content or premium features. These programs will rely on user interaction data to deliver more personalized experiences.

- Other: Other industries will adopt loyalty programs to maintain customer retention and strengthen brand loyalty. Education platforms, fitness centers, and automotive services will use custom reward systems to encourage ongoing participation. The adoption of digital tools and data tracking will make these programs more adaptive and effective in the future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$94 Billion |

|

Market Size by 2032 |

$143.3 Billion |

|

Growth Rate from 2025 to 2032 |

6.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

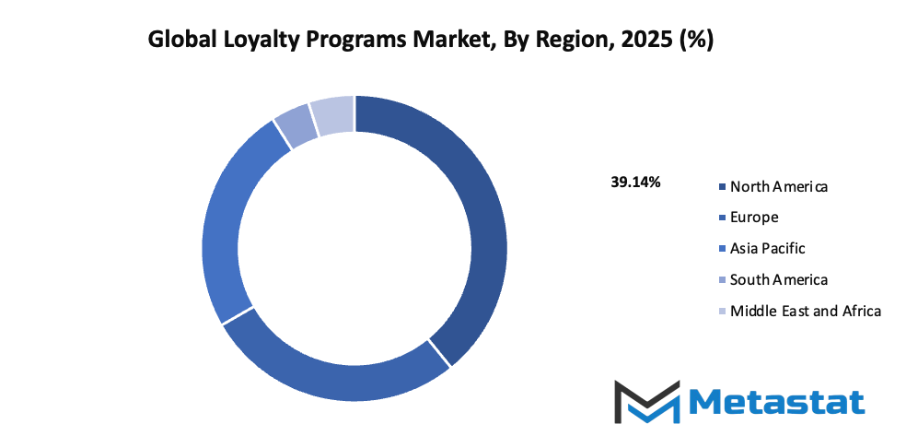

By Region:

- Based on geography, the global loyalty programs market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising competition among brands to retain customers: As the global loyalty programs market becomes more competitive, businesses will turn to loyalty programs to maintain a loyal customer base. The challenge of standing out among multiple choices will push companies to design creative and attractive reward systems. Discounts, early access to products, and exclusive services will be offered to strengthen long-term connections. Companies that fail to invest in such systems may find it harder to retain customers who seek better value and recognition elsewhere. Thus, loyalty programs will serve as a vital tool for sustaining customer relationships and brand identity.

- Growing consumer preference for personalized rewards and experiences: Consumers will increasingly expect loyalty programs that reflect their personal preferences and shopping habits. Generic rewards will lose their appeal as customers look for offers that match their individual needs and lifestyles. This change will motivate companies to collect and analyze consumer data to deliver more relevant experiences. Personalized offers, tailored discounts, and custom recommendations will become standard features in loyalty programs. Brands that adapt to this demand will enjoy higher engagement levels and stronger emotional connections with their customers, ensuring sustained loyalty.

Challenges and Opportunities

- High operational and management costs of running loyalty programs: Running a loyalty program can involve significant expenses, including technology setup, maintenance, staff training, and marketing costs. Smaller businesses may struggle to compete with large companies that have more resources. Over time, firms will look for cost-effective solutions such as automated systems and shared loyalty networks. Managing these programs efficiently will require careful planning to ensure that expenses do not outweigh the benefits. Cost management will therefore remain a key concern as companies aim to balance profitability with customer satisfaction.

- Difficulty in maintaining customer engagement and program effectiveness: Keeping customers consistently engaged in loyalty programs will be a major challenge. Many participants lose interest when rewards are hard to redeem or when benefits seem repetitive. Companies will need to continuously update their programs with new offers and features to maintain interest. Communication will also be crucial, as regular updates and personalized messages can help improve participation. The ability to evolve with customer expectations will determine whether a loyalty program remains effective in the long term.

Opportunities

- Integration of AI and data analytics to create more personalized and dynamic loyalty programs: Artificial intelligence and data analytics will transform the global loyalty programs market by making programs more responsive and personalized. AI will analyze customer behavior to predict preferences and suggest relevant rewards in real time. This will help companies offer dynamic experiences that adjust to individual habits and needs. Data-driven insights will enable better segmentation, ensuring that each customer receives targeted offers that enhance satisfaction. This smart integration will redefine customer loyalty, making programs more efficient, engaging, and future-ready.

Competitive Landscape & Strategic Insights

The global loyalty programs market is undergoing steady transformation as technology, data analytics, and customer engagement strategies continue to evolve. The industry is a mix of both international industry leaders and emerging regional competitors, each striving to offer unique and personalized customer experiences. Leading companies such as SAP SE, Annex Cloud, Antavo, Bond Brand Loyalty, Brierley+Partners, Capillary Technologies, Comarch SA, Epsilon, Cohora Inc., Yotpo Ltd., LoyaltyLion, Maritz Holdings Inc., Merkle Inc., Oracle Corporation, Paystone Inc., Punchh, Inc., SessionM (Mastercard Company), and Smile.io are shaping the direction of this market. Their efforts focus on creating systems that build long-term customer loyalty through better use of data, rewards, and technology.

The global loyalty programs market is witnessing a significant shift toward digital engagement and real-time personalization. Traditional point-based reward systems are being replaced by intelligent platforms that track customer behavior, predict preferences, and adjust offers instantly. Cloud-based solutions and artificial intelligence are making it possible for businesses to manage large customer bases efficiently while maintaining a personal connection. This change is driving both established global players and new entrants to invest heavily in research and innovation, ensuring that their offerings remain relevant and competitive in a fast-changing business environment.

A futuristic viewpoint suggests that loyalty programs will move beyond simple reward systems and become a key part of the overall customer journey. Companies are expected to use advanced analytics to anticipate customer needs even before a purchase occurs. Predictive data models will help design highly targeted campaigns that not only increase customer retention but also strengthen emotional connections with brands. The focus will shift toward creating value-driven relationships, where rewards reflect a customer’s lifestyle, social impact preferences, and digital engagement patterns.

In the coming years, the integration of blockchain and secure data-sharing technologies is likely to redefine transparency and trust within loyalty programs. Consumers will have greater control over their data, choosing how and where it is used, while businesses will benefit from improved accuracy and security in tracking transactions and redemptions. Mobile-first approaches will dominate, as customers expect seamless access to rewards and promotions through apps and digital wallets.

Sustainability and ethical engagement will also play a growing role in shaping loyalty strategies. Businesses will move toward rewarding eco-friendly actions and social contributions, making loyalty programs not just a marketing tool but a platform for shared values. Global leaders and regional innovators will continue competing to deliver systems that blend emotional connection, digital efficiency, and responsible engagement.

Market size is forecast to rise from USD 94 Billion in 2025 to over USD 143.3 Billion by 2032. Loyalty Programs will maintain dominance but face growing competition from emerging formats.

Ultimately, the global loyalty programs market will continue to expand as brands realize that long-term success depends on meaningful and data-driven relationships with customers. As technology becomes more refined and expectations rise, companies that balance innovation with trust and transparency will define the future of customer loyalty. This evolution will mark a turning point where loyalty programs become central to how businesses understand, retain, and reward their audiences across the world.

Report Coverage

This research report categorizes the global loyalty programs market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global loyalty programs market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global loyalty programs market.

Loyalty Programs Market Key Segments:

By Program Type

- Points Programs

- Tier-based Programs

- Cashback Programs

- Mission-driven Programs

- Other

By Channel

- In-Store

- Online

- Mobile

By Deployment Mode

- Cloud-Based

- On-Premises

By End-Use Industry

- Retail

- Financial Services

- Healthcare & Wellness

- Restaurants & Food Delivery

- Travel & Hospitality (Cabs, Hotels, Airlines)

- Telecoms

- Media & Entertainment

- Other

Key Global Loyalty Programs Industry Players

- SAP SE

- Annex Cloud

- Antavo

- Bond Brand Loyalty

- Brierley+Partners

- Capillary Technologies

- Comarch SA

- Epsilon

- Cohora Inc.

- Yotpo Ltd.

- LoyaltyLion

- Maritz Holdings Inc.

- Merkle Inc.

- Oracle Corporation

- Paystone Inc.

- Punchh, Inc.

- SessionM (Mastercard Company)

- Smile.io

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252