MARKET OVERVIEW

The global lithium-ion battery management system for vehicles market will be one of the largest and most influential fields of innovation in the next few years, as transportation shifts toward cleaner and intelligent solutions. The use of lithium-ion technology for vehicles has already proved its effectiveness in enabling electric mobility, yet the future of this sector will reach far beyond simple application. Battery management systems, which can be viewed as the "intelligent heart" of an electric vehicle, will increasingly become vital as the need for safer, longer-life, and more efficient batteries drives the expectations of consumers and manufacturers alike.

In the coming years, this market will not remain within the realm of passenger vehicles or fleets alone but will extend to varied means of transport such as marine, aerial, and even industrial specialized vehicles. This growth will demand more sophisticated and flexible systems that can accommodate varying battery sizes, chemistries, and operational environments. As lithium-ion batteries become increasingly embedded in public and private infrastructure, the global lithium-ion battery management system for vehicles market will sit at the focal point of innovation that will transform mobility as we know it.

The attention will no longer be on the mere tracking of charge cycles or cell balancing. Rather, the systems will evolve into predictive and preventive platforms where artificial intelligence and data analytics will predict possible faults far in advance. As the electric drivetrain becomes more complex, smarter control will become a distinguishing characteristic, and the market will shift from basic electronic protection to being an enablement of increased performance and increased range. This will tighten the relationship between original equipment manufacturers and end users, as reliability and confidence in battery systems will be established as the basis for greater electric transportation uptake.

Another facet that will influence the global lithium-ion battery management system for vehicles market is sustainability. As pressure mounts to embrace circular economy principles, systems in the future will not only regulate energy in the vehicle but will contribute to second-life applications as well. Batteries that don't meet mobility's high standards anymore will find a second life in stationary storage, and smart management systems will make sure that such batteries perform efficiently and safely. Such integration will extend the limits of this market beyond vehicles and position it at the intersection of automotive, energy storage, and renewable power ecosystems.

As connectivity further reshapes transportation, the sector will also advance towards networked systems where cars share battery information with makers, service firms, and even grid managers. Sharing will redefine battery management's purpose, making it a communication center that maximizes efficiency not just for the individual vehicle but also for entire fleets and infrastructures. The Global Lithium-Ion Battery Management System for Vehicles industry will thus develop into a necessary component of a broader technological platform that merges transportation with energy technology.

Over time, this market will overcome its own constraints and redefine the role it plays in global development. What will arise is not only a sector standing behind electric cars, but an anchor for integrated energy and mobility solutions that will define the transport and sustainability of the future.

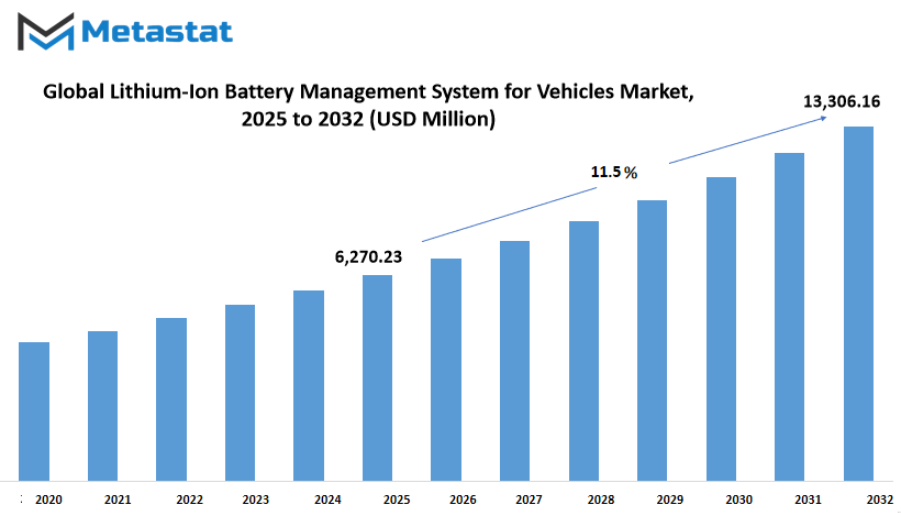

Global lithium-ion battery management system for vehicles market is estimated to reach $13,306.16 Million by 2032; growing at a CAGR of 11.5% from 2025 to 2032.

GROWTH FACTORS

The global lithium-ion battery management system for vehicles market will maintain strong growth since more countries and customers are gravitating toward electric vehicles. The key motive force for this tempo is the increasing use of electrical cars globally. Governments are enforcing extra stringent emission policies, while customers are elevating their stage of focus approximately the environmental outcomes of conventional fuels. While electric vehicles are catching on, the demand for efficient and reliable battery management systems will increase to make batteries work in their best capacities and for longer periods. Coupled with this, the demand for greater battery life and safety features is compelling auto manufacturers and technology providers to invest a lot in battery management systems. Motorists desire cars that drive further before having to be recharged, and safety is also a top concern with the increasing use of high-energy batteries.

While there are obvious benefits and increasing demand, the market is not problem-free. One of the major limiting factors is the expense of advanced battery control systems. Such systems need advanced hardware and software, so they cost automakers a lot to incorporate, particularly on more modestly priced vehicle models. This increases the cost of electric vehicles overall, which may deter price-conscious consumers. Technical hurdles of system integration and thermal management are another difficulty. Lithium-ion batteries produce heat on use, and poor temperature control can result in safety concerns and shortened battery life. Effective management involves sophisticated engineering, which presents further obstacles to manufacturers.

Although cost and technological hindrances are obstacles in the way, doors are opening that will make the market stronger in the future. One of the largest growth drivers is the expansion of charging infrastructure across locations. With charging stations becoming more available and common, consumer confidence in electric cars will grow, with subsequent adoption levels improving. This change will have a direct impact on the market for sophisticated battery management systems because they will be needed to keep more vehicles on the road efficient and safe.

There is also potential in the increasing development and research of smart battery management solutions powered by AI. Artificial intelligence could be a key tool in forecasting battery performance, tracking fitness in real-time, and optimizing power intake. By optimizing structures to be smarter and greater efficient, AI will enable the overcoming of today's constraints and new tiers of overall performance to be unlocked. These technology will no longer only permit automakers to beautify their motors but also make purchasers who're seeking out reliability, protection, and affordability of their electric motors confident.

MARKET SEGMENTATION

By Battery Type

The global lithium-ion battery management system for vehicles market is forming itself as a necessary infrastructure for the next generation of transportation. With the ever-increasing demand for electric and hybrid vehicles, the need for strong systems which could control, alter, and guard battery performance has set up exponentially. These systems are not best equipment for coping with energy output; they are the idea for safety, efficiency, and extended battery lifestyles. Automakers globally are now using battery management as a determining factor that will make a difference on how far and how well vehicles will travel in the future.

A deeper examination of the battery type segmentation reveals the extent to which the industry has diversified. Lithium Nickel Cobalt Manganese Oxide Battery (NMC) is the current leader with a value of $3,086.73 million on account of its energy density, thermal stability, and cost factor. Lithium Iron Phosphate Battery (LFP), however, has gained acceptance due to its toughness and safety features and is a strong contender in commercial transport and applications involving long life. Lithium Nickel Manganese Spinel Battery (LNMO) is picking up as makers seek methods of saving costs without sacrificing performance, while Lithium Nickel Cobalt Aluminum Oxide Battery (NCA) is being embraced in high-performance vehicles due to its high energy density. Meanwhile, Lithium Manganese Oxide (LMO) and Lithium Cobalt Oxide (LCO) will still find application in certain niches where cost or small size are critical factors.

Each of these types of batteries has management systems specific to its specific chemistry, and therefore development in this sector will continue to increase in significance. The BMS technology has to guarantee cells are working within safe voltage and temperature limits, avoid overcharge or deep discharge, and maximize balance between cells. With increasing reliance on lithium-ion batteries for vehicles, how well a BMS is able to detect faults and stabilize will have direct implications on consumer confidence and vehicle take-up rates. This transformation from merely concentrating on raw battery performance to incorporating sophisticated management systems demonstrates how the industry is converging towards sustainable and easy-to-use solutions.

The global lithium-ion battery management system for vehicles market in the years to come will not just grow in terms of value but also become diversified in terms of technology to adapt to varied vehicle demands. The battery type segmentation indicates that any one chemistry will not control all applications, so BMS suppliers will need to develop flexible and adaptable systems capable of fulfilling several uses. From passenger vehicles to trucks and buses, the variety of vehicles based on these systems will expand, and the demand for innovation will constantly remain the same. This constant change will make sure that the market continues to be a driving force for the change to cleaner and more efficient transport.

By Vehicle Type

The global lithium-ion battery management system for vehicles market will keep drawing eyes as transport goes in the direction of clean and efficient solutions. The market is segmented by vehicle type into railways, electric vehicles (EVs), electric two-wheelers, electric buses, and others. Each one of these segments has its own set of requirements and possibilities, determining the way the battery management system will operate in the future. The increasing emphasis on minimizing fuel use and emissions will ensure that these systems become more significant in various transportation industries.

Rail transport will increasingly utilize lithium-ion batteries for auxiliary power and hybrid train operations. These systems not only decouple reliance on conventional energy sources but also ensure that railway systems become more efficient in terms of energy. As infrastructure emerges and governments make more investments in green public transport, railways will be among the better players in fueling market growth. The necessity of increased battery life, improved safety, and guaranteed monitoring will leave management systems as the core of this revolution.

When it comes to electric cars, battery management systems will be crucial for performance, safety, and optimizing the range. As EVs will continue to be at the forefront of the world's shift toward electric mobility, this segment will still account for a big portion of the market. Due to improvements in fast charging and high-density batteries, the function of such systems will continue to increase, keeping energy usage efficient and prolonging battery life. For consumers, that will mean cars that are not only green but also more reliable on the road.

Electric two-wheelers and electric city buses will introduce yet another dimension of diversity to the market. Two-wheelers, which are especially common in cities and developing nations, will gain from low-profile and affordable battery management systems offering dependable daily performance. Electric buses, however, will require solid systems that can withstand repeated charging cycles and heavy-duty use. The use of electric buses will be heavily encouraged by government-sponsored initiatives for replacing the fleets of public transportation. Combined, these segments will consolidate the market presence in both private transport as well as public transport.

The "others" segment, potentially consisting of specialized vehicles like industrial transport, logistics carriers, or defense use, will also provide new opportunities. These vehicles tend to have unusual conditions of operation that necessitate sophisticated battery monitoring and control, and hence are an essential yet less conspicuous segment. With industries shifting towards electrification, this segment will gradually increase and drive the requirement for flexible and smart battery management solutions.

By Topology

The global lithium-ion battery management system for vehicles market will keep growing as the demand for electric mobility increases globally. Battery control device, or BMS in short, is vital for guaranteeing the safety, efficiency, and durability of lithium-ion batteries for motors. These batteries are liable to overheating, short circuits, or a decrease in performance if not controlled properly. As automobiles transition from legacy fuel-burning engines to electrified powertrains, the importance of BMS grows as a determinant of overall performance and reliability self belief for both consumers and producers.

By topology, the market is segmented further into centralized, distributed, and modular systems, each with its own design philosophy and applications. With a centralized system, all of the control tasks are performed by one unit, which is cost-effective and comparatively simple for the manufacturers to implement. Although centralized systems are simpler to control, they can be challenged when used with larger battery packs because any fault in the central unit will impact the whole system. In spite of this drawback, simplicity allows them to be used in small cars and low-end electric vehicles.

Distributed systems do the opposite, mounting control boards on battery cells or modules themselves. This arrangement offers more monitoring and enhanced fault detection, thus making it safer overall. With each unit able to monitor performance on its own, distributed systems are better at fitting larger battery configurations. They are certain to find traction in commercial trucks and high-performance electric vehicles where accuracy and safety are more important. But their somewhat higher price may restrict adoption where price sensitivity is a factor.

Modular systems fill the gap between distributed and centralized designs through splitting manipulate into wonderful modules that trade records with a master unit. This layout affords layout flexibility and expandability, taking into account including or reconfiguring battery packs while not having to replace the complete machine. Modular BMS is predicted to discover increasing application as producers are seeking solutions that meet price, safety, and flexibility demands. With electric mobility gaining traction in passenger automobiles, buses, and even heavy trucks, modular solutions offer a bendy way ahead.

All three of these topologies underscore the varied methods being pursued under the global lithium-ion battery management system for vehicles market. While manufacturers balance affordability, safety, and scalability, the actual topology choice will be instrumental in driving vehicle electrification direction. The market will not be based on a single design but will instead develop with a combination of solutions aligned to various vehicle types and customer requirements. Variety ensures BMS technology will be at the center of electric vehicle development for many years ahead.

By Application

The global lithium-ion battery management system for vehicles market will keep receiving interest as the transportation and commercial markets shift in the direction of electrification. Fundamentally, a battery management gadget ensures that lithium-ion batteries are secure and green, balancing overall performance with sturdiness. As the market expands, applications are becoming an increasing number of specialized, each segment calling for unique functionalities and resilience degrees. By software, the market is segmented into three essential areas: car, business, and locomotive, and every of these will dictate demand for these structures in wonderful manners.

In the automotive industry, the increasing recognition of electrical and hybrid vehicles is using a sturdy call for for stylish battery control systems. Such structures now not handiest music the properly-being of batteries however additionally lengthen their lifespan and enhance protection, that's paramount for consumer recognition. Automakers will increasingly depend on BMS solutions to report precise energy monitoring, prevent overheating, and support fast charging. Passenger and commercial vehicles, as they evolve toward sustainable energy, will see the automobile segment continuing to be one of the largest and most rapidly growing applications in the market.

Industrial applications, however, will need battery management systems to accommodate a wide range of heavy-duty applications. From forklifts and construction equipment to backup power units, industries rely on consistent energy supply and extended operating times. For such applications, lithium-ion batteries driven by robust systems will be crucial. In these uses, efficiency and durability matter over minimal size, so battery management systems in these will prioritize stability in running and reduced downtime. This need will only increase as energy solution investments from industries are made to lower fossil fuel reliance and increase productivity.

Locomotives are another sector where the use of lithium-ion battery management systems increases. As rail systems seek alternative, cleaner methods of powering traditional fuel-based engines, battery-powered locomotives will become increasingly prevalent. For trains, which demand high power and long endurance, a durable BMS will be necessary to sustain performance over distance. The safety and scalability of these systems will be a determining factor of just how far battery-powered locomotives are integrated into the future. This segment, while smaller than in automobiles and industries nowadays, will continue to make up the bulk of the overall growth of the market as transportation agencies demand cleaner alternatives.

In total, the worldwide Lithium-Ion Battery Management System for Vehicles market by application illustrates how various sectors will dictate its advancement. Cars will remain at the forefront of demand with growth driven by consumers, industries will seek long-term and reliable solutions, and locomotives will slowly increase their presence as energy-efficient rail transport becomes more prominent. All applications mirror the broader trend towards sustainability, with battery management systems as a backbone that will make safety, efficiency, and reliability universal.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6,270.23 million |

|

Market Size by 2032 |

$13,306.16 Million |

|

Growth Rate from 2025 to 2032 |

11.5% |

|

Base Year |

2024 |

|

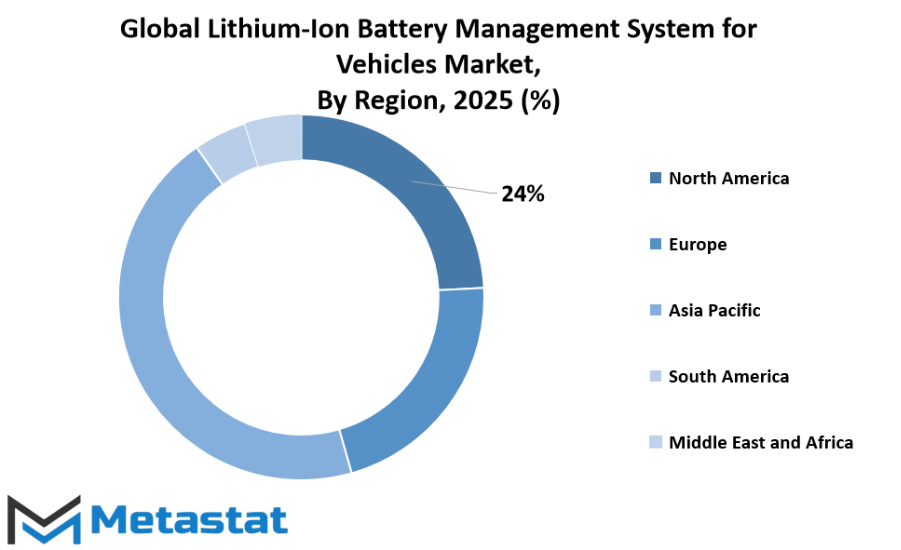

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global lithium-ion battery management system for vehicles market is growing in various regions of the world, with each developing its own distinct patterns influenced by its economic, industrial, and technological history. North America has its market segmented into the United States, Canada, and Mexico. The U.S. is a prominent contributor because of high adoption of electric vehicles and developed automotive manufacturing industry. Canada follows with increasing interest in cleaner mobility solutions and government incentives that favor the use of electric cars, and Mexico gains from being a production center for international automobile firms, driving demand for efficient battery systems in automobiles produced there.

Europe is another key region, divided into the UK, Germany, France, Italy, and the Rest of Europe. Germany, with some of the world's biggest car manufacturers, will remain a driving force for the industry. France and Britain are significant, led by their high-profile green policies and growing take-up of electric and hybrid vehicles. Italy, too, and the rest of Europe are slowly stepping up their effort, with the policies of the European Union regarding carbon emissions and sustainability serving to drive investment into battery technologies and their management systems.

In the Asia-Pacific region, i.e., India, China, Japan, South Korea, and Rest of Asia-Pacific, the market is picking up good pace. China continues to be the biggest player with its huge production of electric vehicles and government-friendly policies. Japan and South Korea, with their cutting-edge tech and experience in battery innovation, will also remain at the forefront of world advancements in this field. India is rapidly closing the gap with its increasing emphasis on electric mobility as a component of national energy transition objectives. Other nations in the region are gradually enhancing capacity, making the Asia-Pacific region one of the most promising lithium-ion battery management system for vehicles market.

South America, broken down into Brazil, Argentina, and the Rest of South America, remains at the initial phase with respect to other areas but is indicative of growing signs. Brazil, with its well-established automotive industry, is currently the leading performer while Argentina and neighboring nations are gradually establishing themselves. Correspondingly, the Middle East & Africa region, divided into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa, is slowly penetrating the market. The GCC Countries, driven by technology investments and mobility diversification, are showing development, while South Africa and Egypt are becoming significant markets because of their increasing interest in clean energy solutions.

In total, the global lithium-ion battery management system for vehicles market exhibits diverse development across geographies. Each geography is developing at its own rate, driven by manufacturing competitiveness, government agendas, and consumer embrace of electric vehicles. This ensures that the market will not evolve evenly but rather pursue regional development trajectories each contributing to the overall global shift towards cleaner and more efficient mobility solutions.

COMPETITIVE PLAYERS

The global lithium-ion battery management system for vehicles market is gaining increasing significance as the market for efficient, safe, and long-life energy storage continues to grow. As electric and hybrid cars move from niche to mainstream, the function of a battery management system (BMS) has evolved from being an auxiliary item to a vital technology. It not only promises to save the vehicle operation from accidents but also prolong the life of the battery, usually the costliest component of the vehicle. With governments of different countries imposing ever-tightening emission and fuel efficiency standards, car manufacturers will look ever more to sophisticated BMS technology to achieve these requirements and at the same time continue to offer performance and dependability to consumers.

An expanding ecosystem of crucial players is defining the competition in this business, each contributing in terms of innovation, research, and mass production. Players like Tesla Inc., Samsung SDI, and LG Chem Ltd. contribute their experience in battery manufacturing and system integration, while others like Infineon Technologies AG and Texas Instruments Inc. supply the electronic components that are the bedrock of battery monitoring and control. Panasonic Holdings Corp. and BYD Company Ltd. are also significant players with well-established positions in the worldwide electric vehicle battery supply chain, and their involvement in BMS development is essential to the future path of the market.

Specialized firms are also contributing significantly to enhancing BMS functionality. For example, Elithion Inc. and Lithium Balance AS specialize in developing highly efficient management systems that enhance consumer and commercial vehicle performance. Dana Inc. and Gentherm Inc. add with thermal management solutions, which are critical to the maintenance of battery health, while A123 Systems LLC and GS Yuasa Corp. add years of experience in advanced energy storage technologies. These companies will continue to compete and collaborate and introduce products that can support higher energy densities, high-speed charging, and increased safety features.

The contribution of material and chemical experts like Johnson Matthey Plc and Hitachi Chemical provides another dimension of innovation, particularly in electrode material and cell chemistry. This synergy between chemicals businesses, electronic suppliers, and automotive firms indicates how multi-disciplinary this industry is. The inclusion of companies such as Dober and Ecobalt Solutions also indicates the need for sustainable operations, as recycling and ethical sourcing of raw materials will continue to be core to market expansion. Renesas Electronics Corp. and AVL List GmbH further augment the ecosystem by providing cutting-edge hardware and system-level engineering solutions specific to the future needs of the vehicle market.

Overall, the global lithium-ion battery management system for vehicles market is being characterized by a varied group of players who are competing on every front to outdo one another in terms of safety, performance, and sustainability. Their joint efforts will determine how soon electric and hybrid cars gain popularity. As technology grows, the competition between these players will take the industry forward, making cars run on lithium-ion batteries not only efficient but also secure and reliable for day-to-day usage.

Lithium-Ion Battery Management System for Vehicles Market Key Segments:

By Battery Type

- Lithium Nickel Cobalt Manganese Oxide Battery (NMC)

- Lithium Iron Phosphate Battery (LFP)

- Lithium Nickel Manganese Spinel Battery (LNMO)

- Lithium Nickel Cobalt Aluminum Oxide Battery (NCA)

- Lithium Manganese Oxide (LMO)

- Lithium Cobalt Oxide (LCO)

By Vehicle Type

- Railways

- Electric Vehicles (EV)

- Electric Two-wheelers

- Electric Buses

- Others

By Topology

- Centralized

- Distributed

- Modular

By Application

- Automobile

- Industrial

- Locomotive

Key Global Lithium-Ion Battery Management System for Vehicles Industry Players

- A123 Systems LLC

- AVL List GmbH

- BMS Powersafe

- BYD Company Ltd.

- Dana Inc.

- Dober

- Ecobalt Solutions

- Elithion Inc.

- Gentherm Inc.

- GS Yuasa Corp

- Hitachi Chemical

- Infineon Technologies AG

- Johnson Matthey Plc

- LG Chem Ltd.

- Lithium Balance AS

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252