MARKET OVERVIEW

The Global Life Insurance Policy Administration Systems Software market provides an important segment in the insurance technology industry, which caters to the ever-increasing demand for efficient and streamlined insurance operations. This software market is integral in the management of life insurance policies by digital methods, replacing traditional paper-based methods. It offers a platform to life insurance companies in process automation, better customer service, and enhanced policy management. This technology is of cardinal importance in changing how life insurers run their operations and in enabling them to respond quickly to changes in the market and consumer demand.

In the future also, the Global Life Insurance Policy Administration Systems Software market will continue to change along with the new inventions in technology. The insurers would look for solutions that do much more than basic policy management, such as predictive analytics and artificial intelligence or machine learning. These advanced features will enable companies to devise policies that will meet customer requirements even before they are asked for, thus personalize policy products in such a manner as to effectively minimize risks. As the industry becomes more competitive, life insurance companies will turn to sophisticated software systems to help gain an edge over their rivals.

The second major driver for the insurance industry will be the software market, which will aid in enhancing customer experience. Since consumers demand seamless digital interactions, companies will have to invest in software that provides a user-friendly interface and easily accessible services. Business firms will have to make information on policies available in real-time, process claims digitally, and facilitate personalized communication. This shift towards digital transformation will call for robust software solutions that can handle complex data and deliver insights to drive business decisions.

The Global Life Insurance Policy Administration Systems Software market will be greatly influenced by cloud-based platforms. More and more insurers will shift their operations to the cloud, which has better scalability and flexibility, and offers cost savings. Cloud technology will provide companies with the ability to access data remotely, smoothening operations with reduced extensive IT infrastructure. This will not only bring improved operational efficiency but also enhanced data security and adherence to regulatory provisions.

Taking this further, and since life insurance companies will then have to adhere to stringent regulations concerning policy management and personal data protection, compliance will continue to be an imperative in the software market. The software must integrate features to ensure that its functionality remains compliant with the evolving regulations, thereby giving insurers a basis to manage risk and minimize legal exposure. This sector of the industry will be in continuous need of renewal and enhancement, so it could meet new developments in regulations that would allow companies to be legally operating.

While growing, the global life insurance policy administration systems software market is expected to gain a substantial channel of growth through strategic partnerships and collaborations. Insurers will be partnering with technology providers aiming to develop customized solutions that help them to meet their specific needs. Such collaborations will be instrumental in incorporating emerging technologies like blockchain and the Internet of Things into life insurance operations. Armed with these innovations, insurers will be well-placed to create improved service offerings and new value propositions for their clientele.

The Global Life Insurance Policy Administration Systems Software presents a crucial part of the technological environment of the insurance industry. This software market will grow further, as was its ever-growing demand in a digital-first world, through innovations in technology, customer experience, and compliance matters. The future for this market will shape according to the pace of industry change, innovation, and solution delivery that not only smoothen the operations but also enhance the overall insurance experience for customers. This will make the Global Life Insurance Policy Administration Systems Software market a linchpin in the evolution of life insurance to ensure that companies remain agile, efficient, and responsive in a rapidly changing environment.

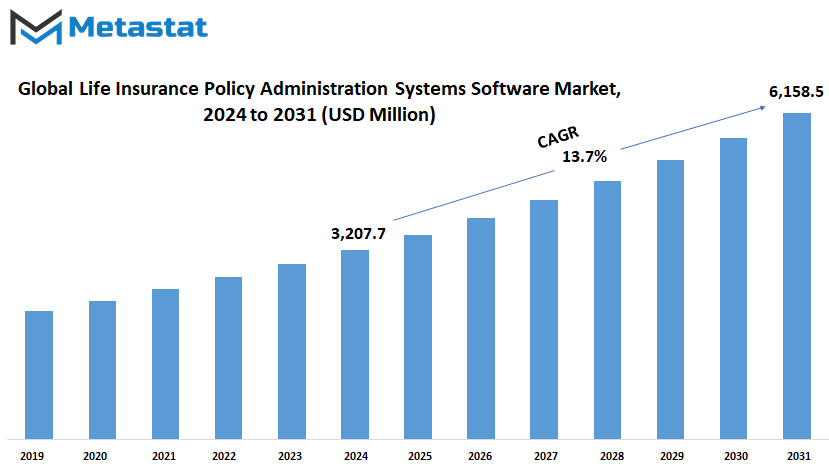

Global Life Insurance Policy Administration Systems Software market is estimated to reach $6,158.5 Million by 2031; growing at a CAGR of 13.7% from 2024 to 2031.

GROWTH FACTORS

The Global Life Insurance Policy Administration Systems Software market is poised for substantial growth, driven by various transformative factors. A key catalyst for this expansion is the increasing demand for digital transformation and automation in insurance operations. As the industry continues to evolve, insurance companies are recognizing the necessity to adopt advanced software solutions to streamline their processes. These systems will enable more efficient management of policies, improving overall operational efficiency and customer satisfaction.

Another significant growth factor is the growing complexity of insurance products. As insurance offerings become more diverse and intricate, there is a pressing need for advanced systems that can handle these complexities. Sophisticated policy administration systems will provide the tools required to manage these varied products effectively, ensuring that insurers can offer comprehensive solutions to their clients while maintaining operational efficiency.

However, the market faces challenges that could impact its growth trajectory. High implementation and maintenance costs present financial barriers, particularly for smaller insurance firms. These costs can be prohibitive, limiting the ability of smaller players to invest in advanced policy administration systems. Additionally, integrating new systems with existing legacy infrastructure poses a considerable challenge. Many insurance companies still rely on outdated systems, and the process of integrating new software with these legacy systems can be complex and disruptive.

Despite these challenges, the future of the Global Life Insurance Policy Administration Systems Software market holds promising opportunities. Advances in artificial intelligence (AI) and machine learning (ML) are set to revolutionize policy management. These technologies will facilitate the development of more sophisticated and efficient solutions, allowing insurers to manage policies with greater precision and effectiveness. AI and ML will enable predictive analytics, automated decision-making, and enhanced customer service, further driving the adoption of advanced policy administration systems.

In summary, the Global Life Insurance Policy Administration Systems Software market will experience significant growth as the demand for digital transformation and the complexity of insurance products continue to rise. While there are financial and integration challenges to overcome, the advancements in AI and ML will provide lucrative opportunities, shaping the future of policy administration systems and driving continued market expansion.

MARKET SEGMENTATION

By Deployment Type

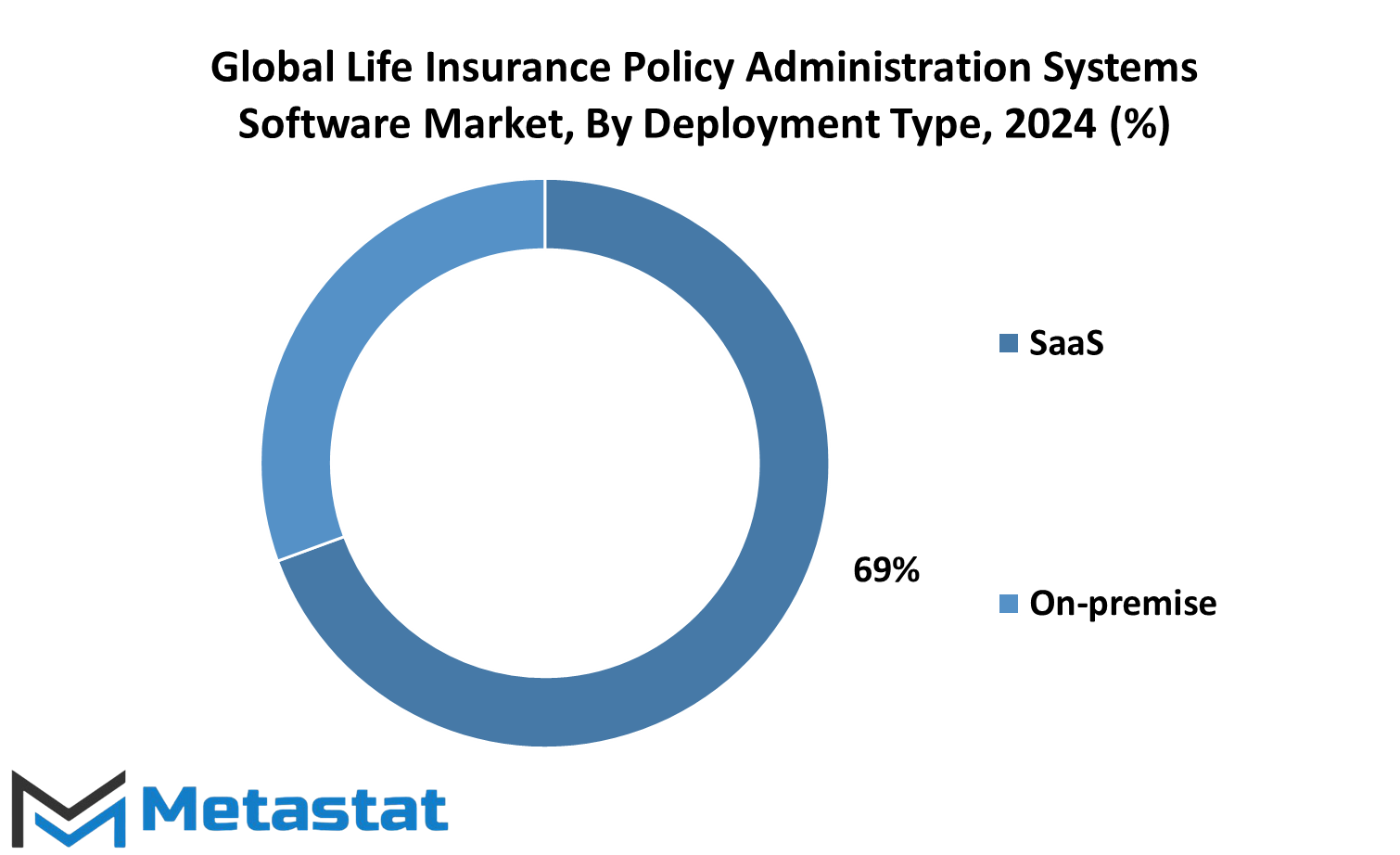

The life insurance policy administration system implemented globally is expected to surge in the next few years. This is driven by the trend and innovation in this category of deployment types are SaaS and On-premise solutions—as the insurance sector rides the wave of digital transformation.

These SaaS-based life insurance policy administration systems are therefore preferred for their simplicity and flexibility in scaling. This in a way opens up a cost advantage for the insurance companies, as it reduces in providing the customer premise demands and infrastructure care. SaaS options would allow insurers to access their systems from anywhere, hence enabling working remotely and efficiently. Cost-effectiveness is one major driving point, since SaaS would not require huge and heavy starting-from-scratch investments in hardware and software. Instead, companies will adopt a subscription-based model that more aligns with their operational needs. Furthermore, SaaS solutions will provide access to never-ending updates and support so that insurers may take advantage of new features and security updates without incurring more overhead costs.

Where on-premise systems will come and play a niche but important part in the market, the difference will be that these are systems installed and operated from on the infrastructure belonging to the insurer themselves. Although the on-premises solutions are much more costly when being implemented originally and over the course of maintenance, they allow more control and data adjustment. In cases where the carrier handles extremely sensitive data or numerous quite strict regulations, an on-site system would provide that extra level of required security and compliance. Additionally, these systems can be customized according to operational requirements—an important attribute for large organizations with distinctive needs.

Hybrid models of the same in the Global Life Insurance Policy Administration Systems Software Market in the future shall see insurers adopting both SaaS and On-premise solutions. The model offers the strengths of SaaS in elasticity and cost-effector with the control and customization benefits of On-premise systems. Insurers will adopt this approach to balancing their technological needs and strategic goals so that they can adapt to changes in market demand over time and maintain their operational excellence.

By Policy Administration Category

The Global Life Insurance Policy Administration Systems Software market is bound to grow several folds in the times to come. Growth in complexity and demand for managing life insurance policies will drive the same. These will be segmented into different policy administration categories, all of which play a very important role in enhancing operational efficiency and effectiveness within insurance operations.

Out of these, one of the major categories is Policy Lifecycle management. This segment will deal with an entire set of activities pertaining to a policy, from its initiation to pass through its different stages. The process will be streamlined by making sure accuracy and efficiency in managing the data of policyholders. Leveraging advanced technologies, the companies would be better positioned to automate routine tasks thereby reducing errors and cutting down operational expenses manifold. This would bring tremendous improvement in the policy management experience for both insurers and customers.

Another important area is underwriting, which logically provides an assessment of risks and coverage terms. Sophisticated algorithms and data analytics integrated into underwriting processes will add accuracy to the assessments of risk. More informed decisions can thus be made by insurance companies, leading to better pricing and improvement in profitability. Further evolution of underwriting technology in the future will result in insurers being better equipped to price and manage their risks.

A Very Important Section This will aid in changing the current policies. The systems will have to be such that they are able to change policies effectively and efficiently with changing customer requirements in the times to come. Hence, future developments in this area will be oriented toward seamless and user-friendly interfaces that permit updates and adjustments speedily. That way, insurance policies will remain relevant and current with respect to policyholders' changing needs.

Another major category is that of claim settlement. In terms of efficiency and speed, the processing of claims will be a big factor. The innovations of the segment will target a reduction in processing times and accuracy in the handling of claims. Advanced software solutions will bring in quicker decision-making and more transparent processes, therefore enhancing trust and loyalty from customers.

Another focal point will be the user experience. It is in this regard that insurers will strive to provide better user experiences as the competition heightens. Therefore, future software solutions will focus on more intuitive interfaces and improved features for customer service. This would help them offer a more engaging and user-friendly experience, thus differentiating them in the insurance market.

Others category will refer to additional features and services not reflected by major segments. It involves several supporting features and integration that will realize more competencies of policy administration systems.

In a nutshell, the Global Life Insurance Policy Administration Systems Software market will keep changing with improving technology and changing consumer expectations. Major innovations are due across all segments to change policy management into efficient customer satisfaction.

By End-User

Global Life Insurance Policy Administration Systems Software is poised to exponential growth with the industry transforming to meet needs engineered in a rapidly transforming landscape. This can be defined as software solutions that are aimed at streamlining and managing the entire lifecycle of life insurance policies. Turning into the future, some major trends and developments are expected to shape the outlook of this market.

Insurance companies will, however, remain as the biggest end-users of life insurance policy administration systems software. These companies are rapidly implementing advanced software solutions that help them improve operational efficiency and offer improved service to their customers. The increasing demand for automation and integration within insurance companies is acting as a driver for highly advanced software solutions, which can deliver policy management, underwriting, claim processing, and contract changes accurately and speedily.

Banks are also rising as powerful players in the Global Life Insurance Policy Administration Systems Software market. As bancassurance—essentially, banks selling insurance products as an extension of traditional financial services—continues to rise, so does the corresponding demand for software that can easily fold insurance policy management into general banking operations. This integration is expected to provide more comprehensive financial service to customers and smoothen the overall process.

Furthermore, these other firms—third-party administrators and service providers—are also seeing growth within the market. This would include the use of life insurance policy administration systems software by organizations in order to administer and manage insurance policies for insurance companies and banks. Rising complexity of the products in tandem with evolving regulatory requirements has brought about increasing demand for software that gives robust support to very distinct functions within policy lifecycle management, underwriting, claim settlement, and betterment of the user experience.

By Module

The Global Life Insurance Policy Administration Systems Software market is about to grow and change drastically in the years to come. This very essential insurance industry market will go on developing further to keep up with the changing world. Attention to key modules, such as CRM, product development, training and development, business intelligence, and others can help in taking cues with respect to the future direction this sector is heading toward.

The CRM module will still be the core module, providing the tools that will enable insurance companies to effectively manage the interaction of their clients. This module will support enhanced customer service through effective and timely attention given to the needs of clients. As the market expands in this line of growth, CRM systems are more likely to have the incorporation of advanced technologies like artificial intelligence and machine learning that can help better customer engagement and satisfaction.

Product Development will be yet another area that will need critical attention. With a change in consumer tastes and preferences, new regulatory environments, and legal requirements, insurance providers will need to reformulate their products. This software will help in designing new insurance products and managing them to meet the changing market needs while adhering to the set industry standards. This module will be very important for companies desiring to remain competitive and innovative within the ever-changing insurance business environment.

Training & Development will also undergo dramatic changes. The technology is going to keep on changing, and thus insurance companies will have to ensure that their employees are adequately trained to use the new systems and tools that will be available. The software will provide training and development resources that enable staff members to keep their skills current in the latest industry practices and in using new technologies. This will be important for guaranteeing a continuing supply of people able to exploit new technologies and maximize operational effectiveness.

Business Intelligence will be core to the decision-making process. The software provides enhanced analytical and reporting features that insurance firms will use to derive meaningful insights from the data. This will help in making informed strategic decisions, identifying trends, and optimizing the operations of the business. As the market continues to grow, demand for advanced business intelligence tools is likely to increase and may drive innovations in this module.

Other modules within the software will also be designed to cater for other operational needs, with added functionalities to assist in the general management of life insurance policies. All these contribute to the versatility of the software so that it is able to cover as many different requirements as possible within the industry.

The Global Life Insurance Policy Administration Systems Software market is going to evolve further to meet the changing demands of the insurance industry. It shall emphasize developing the above-mentioned modules like CRM, Product Development, Training & Development, Business Intelligence, and so on, for helping insurance companies survive in today's highly competitive business environment.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$3,207.7 million |

|

Market Size by 2031 |

$6,158.5 Million |

|

Growth Rate from 2024 to 2031 |

13.7% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Life Insurance Policy Administration Systems Software market will continue to grow significantly in the global dimension in the near future on account of wide adoption in different regions, sui-generis in characteristics, and growth opportunities. Geographically, it is split into North America, Europe, Asia-Pacific, South America, and Middle East & Africa, and each region contributed differently to the overall growth trajectory.

Regionally, the market will advance significantly in North America, since it includes countries such as the U.S., Canada, and Mexico. Now, the U.S. will continue with its contribution to the regional market, as it has the gigantic insurance industry coupled with the existence of many technology vendors. This will be supported by Canada and Mexico, who are on the verge to witness growth in the near future, driven by the growing adoption of advanced insurance technologies and the requirement for effective policy administration systems.

Europe will be a significant market and, importantly, it will include the UK, Germany, France, Italy, and the Rest of Europe. The UK and Germany will dominate in market development for insurance due to well-established markets on the back of matured insurance industries, while France and Italy will be potential markets as the insuring companies are trying to upgrade and replace their systems in order to achieve operational efficiency. The same will be benefited from in terms of digital transformation initiatives that are underway and regulatory changes to drive up administration of policy .

The region of Asia-Pacific, which would be India, China, Japan, South Korea, and Rest of Asia-Pacific, will grow rapidly. This growth will be contributed highly by China and India, fueled by its blooming insurance markets and rising demand for sophisticated policy administration systems. Japan and South Korean countries should also be important players with respect to innovative technologies, which they are developing for the modernization of the insurance procedures. The diversity in this region will encourage the software houses to supply a range of solutions to match these differing requirements.

South America Growth will be Slow, Including Brazil, Argentina, and Rest of South America. Here, the growth will be led by Brazil and Argentina, which have developing insurance markets and a gradually increasing focus on technological enhancements within policy administration. Investments in insurtech, coupled with improvements in regulatory frameworks, will filter out slowly across the rest of the South American region.

In the Middle East & Africa- market in the GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa- shows strong growth. Key markets in the GCC Countries are backed by strong economic performance and investments in technology. Infrastructural improvements in insurance and the adoption of new technologies are sources of growth in Egypt and South Africa. Improvements in policy administration and a growing focus on digitalization and efficiency in the policy administration process will benefit the region's market.

In general, the future of the Global Life Insurance Policy Administration Systems Software market is predisposed to regional growth, which will be driven by technological developments, changing regulations, and rising demand for efficient policy management solutions.

COMPETITIVE PLAYERS

Key players in the global life insurance policy administration systems software market are geared up to shape its future with their innovative solution and strategic approach. With advancements in technology, these companies will bring dramatic changes in the way that life insurance policy administration is managed.

One of the larger players within this space is Accenture Plc. The company has a fully comprehensive suite of services and solutions aimed at improving operational efficiency and customer experience. This company will most likely be at the forefront of the market, with its concentrated approach to technology and data analytics in assisting insurers in streamlining policy administration.

Another key player would be Concentrix Corporation, which will play its role with its comprehensive suite of customer engagement and business process outsourcing solutions. The focus of Concentrix on customer interactions and operational efficiencies is definitely going to make a difference in changing the face of policy administration systems.

With extensive experience in the area of enterprise software solutions, Oracle Corporation will continue to have an optimistic market impact. It will provide better ways of managing policy administration tasks to the insurers with the products offered by it in database management and enterprise resource planning.

The DXC Technology Company will also be instrumental in offering an expansive portfolio of IT services and consulting. Insurers will have to change to the market demands and technological advancement by ability in integration of complex systems, tailored solutions, to change insurers' ability.

EXL Service Holdings, Inc. is a data analytics and business process outsourcing company that will bring into the market solutions enhancing decision-making and operational efficiency. Analytics-focused insurers could make better decisions in management policies.

Verisk Analytics, Inc., being one of the giants in data analytics and risk assessment, would continue to help insurers understand better the management of their policy portfolios. The company has already focused on more accurate and efficient policy administration through data-driven solution support.

A major contribution is expected from Infosys Limited and Sapiens International Corporation due to their insurance-industry-based software solutions that will help insurers automate and optimize their policy administration process, bringing in greater operational efficiency.

In this respect, specialized software solutions and consulting services that address specific needs of life insurers will also be played by such entities as Majesco, Mphasis Wyde, and Capgemini. Their expertise will help insurers adapt to new challenges and opportunities arising in policy administration.

Andesa Services, Ebix, Inc., FIS, Guidewire Software, Insurity, Inc., and Microsoft Corporation at the other end will further enhance the market with their diversified offerings across software and technology solutions. These firms are likely to make insurers competitive through advanced toolsets and platforms required for efficient policy administration.

Most of the prominent players would continue to drive innovation and growth with the evolution of the global life insurance policy administration systems software market, whose contribution towards the future would shape policy administration for insurers in delivering services better and managing their operations more effectively.

Life Insurance Policy Administration Systems Software Market Key Segments:

By Deployment Type

- SaaS

- On-premise

By Policy Administration Category

- Policy Lifecycle

- Underwriting

- Contract Changes

- Claim Settlement

- User Experience

- Others

By End-User

- Insurance Companies

- Banks

- Others

By Module

- CRM

- Product Development

- Training & Development

- Business Intelligence

- Others

Key Global Life Insurance Policy Administration Systems Software Industry Players

- Accenture Plc

- Concentrix Corporation

- Oracle Corporation

- DXC Technology Company

- EXL Service Holdings, Inc.

- Verisk Analytics, Inc

- Infosys Limited

- Sapiens International Corporation

- Majesco

- Mphasis Wyde

- Capgemini

- Andesa Services

- Ebix, Inc.

- FIS (Fidelity National Information Services)

- Guidewire Software

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383