MARKET OVERVIEW

The global asset management market, rooted inside the financial offerings sector, will continue to reshape how people and institutions manipulate capital allocation in a fast-evolving monetary environment. While the arena's monetary ecosystems are undergoing elaborate alterations, this marketplace will area itself above conventional portfolio management by way of leveraging technology, behavioral intelligence, and multi-faceted approaches to funding. While in the past it has been guided by traditional return-centric models of risk management, the future will require a much more expansive definition of value one that brings purpose and performance together.

No longer limited by geography or antiquated asset classes, the global asset management market will grow in scale as financial products become more complex and digital interfaces supersede traditional systems. Blockchain and artificial intelligence, instead of being peripheral innovations, will probably become the main drivers of how portfolios are monitored, optimized, and analyzed. Institutional and retail investors alike will look more and more for customized solutions instead of off-the-shelf ones. This will not only prompt asset managers to revisit their products but also will compel retooling of business models and internal skill sets.

Another hallmark of the global asset management market will be investment journeys personalized at an individual level. The days of using generic risk profiles to make most decisions are behind us. More precise analysis of personal preferences, values, and time horizons will determine portfolio construction so that client experience becomes a pillar of strategic delivery. The Global Asset Management industry will thus trend toward hyper-personalization, fueled by user behavior and life event-evolving algorithms. This change will reorganize the client-manager relationship as collaborative, data-driven, and ever-evolving.

In addition to functionality, the industry will also be influenced by larger socio-economic narratives. Geo-political tensions, demographic changes, and the digital divide will drive the way and where capital is directed. The asset management sector will no longer be a onlooker; it will become an active player in determining capital flow, especially into underrepresented areas and sectors. With increased financial knowledge and availability of investment instruments, a new investing class will arrive more knowledgeable, more aggressive, and more critical.

In addition, regulation will proceed with subtlety as it balances creating innovation and guarding interests. The global asset management market will become more closely scrutinized, particularly in transparency, ethical investing, and fiduciary duty. All these pressures, however, will not be its downfall. Rather, they will tighten it. Companies that will come out alive and well are those that internalize agility into their fabric, embracing policy change as strategic opportunities in lieu of threats.

Over the next few years, the Global Asset Management industry will do more than just serve as a means of managing wealth it will become an expression of global priorities, personal aspirations, and technological advances. Its boundaries will not be set by product lines or client types but by its capacity to anticipate ahead of need. As new financial worlds open up, this market will define and be defined by them, making it not only relevant, but necessary.

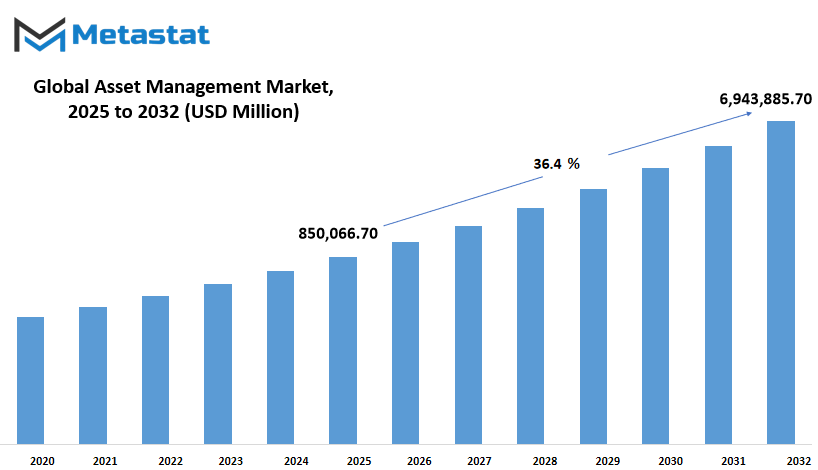

Global asset management market is estimated to reach $6,943,885.70 Million by 2032; growing at a CAGR of 36.4% from 2025 to 2032.

GROWTH FACTORS

The global asset management market, which Metastat Insight has introduced, is gaining considerable interest because of the increasing demand for smart use of assets and improved lifecycle management across industries. As businesses grow and become more reliant on technology, the urgency to utilize resources prudently is increasing. Firms today are not only concerned with productivity but are looking to maximize the life and worth of their assets. This trend is influencing the demand for trustworthy asset management tools and techniques that make it simpler to monitor, sustain, and maximize precious resources.

A perceptible change is also occurring in the investment space. As more global investors are seeking to manage risk and return, there is a growing interest in portfolio diversification particularly among high-net-worth individuals. This has prompted increased dependence on asset management services that provide customized strategies to address unique financial objectives. The requirement to preserve and accumulate wealth in an evolving economic environment has made asset management more than a function of support today it is a mainstream aspect of financial planning.

This momentum notwithstanding, the global asset management market is far from smooth sailing. Draught-tight compliance regimes and involved auditing techniques usually render implementation difficult, particularly for firms that are unfold across numerous areas. Keeping pace with evolving prison conditions is time-eating and aid-in depth, and it can restrict decision-making. Additionally, the initial price and the impediments involved in integrating asset management software program into installed structures upload another obstacle. To small and medium-sized firms, but, such boundaries could be particularly disheartening in proscribing their ability to employ full-scale asset solutions.

Nevertheless, the future is shiny. The developing adoption of AI and IoT-based totally answers is revolutionizing how agencies manage assets. In places together with clever factories and infrastructure improvement, predictive protection is increasingly turning into the standard. These answers do not simplest perceive issues before they rise up yet they also provide suggestions on a way to save you them. With improvements in those technology, companies might be able to lower charges, decrease downtime, and enhance safety, turning asset management into proactive rather than reactive.

In short, though the global asset management market by Metastat Insight is fraught with challenges such as regulatory complexity and high initial costs of setup, its trajectory points toward expansion. Strategic investment, along with smart tools driven by AI and IoT, will soon mold an efficient and smart asset management paradigm. Early adopters of businesses will most benefit from these developments, not just in terms of efficiency but also profitability.

MARKET SEGMENTATION

By Asset Type

The international asset management industry is in a gradual shift, fueled by technological change and the increasing significance of maximizing the use of assets in various industries. With companies moving toward more formalized and fact-based decision-making, the efficient management of various types of assets has evolved from being a logistical imperative to a strategic imperative. From the tracking of equipment to the monitoring of personnel, corporations are looking for greater visibility and command over what they own and what they operate.

Among the significant segments, Digital Assets have stepped ahead, reaching a substantial value of $285,929.23 million. These are software, data, and other intangible assets that are becoming as critical as physical assets. Their increasing prominence demonstrates how companies are responding to a more connected and digital business space. Besides digital assets, businesses are also overseeing physical assets like Returnable Transport Assets and In-transit Assets, which play a pivotal role in supply chain effectiveness. These minimize losses and delays by having better control of goods in transit or packaging that goes through various touchpoints.

Manufacturing Assets are another vital group, serving to assist operations in numerous industries. From heavy equipment to tools, these play a vital role in upholding productivity and quality. With effective management, businesses are able to lengthen the life of their equipment, minimize unplanned downtime, and more accurately predict when replacements or repairs will be necessary. At the same time, having Personnel or Staff under asset portfolio management is becoming increasingly widespread. This entails having employees distributed efficiently, well-trained, and equipped with suitable tools to perform their tasks.

All of these types of assets have an individual role in enabling organizations to work smarter and more sustainably. When industries turn towards the future, there will be increasing interest in solutions that provide improved tracking, analytics, and automation across all these asset classes. The movement isn't so much about managing physical assets anymore it's about establishing an environment where assets, both physical and virtual, support a more responsive and more efficient operation.

The global asset management market represented by Metastat Insight demonstrates this continued trend towards smarter, technology-enabled systems that enable businesses to take greater control of their assets. At the forefront, with Digital Assets leading, and others such as Transport, Manufacturing, and Personnel hot on its heels, this environment will continue to influence how organizations quantify value, eliminate waste, and perform more strategically.

By Component

The global asset management market is formed by way of various additives that play wonderful roles in how assets are tracked, maintained, and utilized. At its middle, this market specializes in technologies and strategies that help agencies keep better manage in their physical and virtual assets. Tools which includes Real-Time Location Systems (RTLS), barcodes, and GPS help in locating and monitoring assets with greater accuracy. These tools make sure that businesses can avoid loss, reduce idle time, and enhance operational efficiency. Mobile computers and labels are also widely used, making an allowance for less difficult tagging, scanning, and on-the-pass access to asset information. These gadgets help streamline information series and asset tracking across exclusive departments and bodily locations.

Beyond the generation used for tracking, the global asset management market additionally consists of unique methods to handling property. Strategic Asset Management focuses on lengthy-time period planning and decision-making, helping agencies prepare for future growth or adjustments. Operational Asset Management deals with the every day use and performance of belongings, ensuring the whole thing runs easily. Then there’s Tactical Asset Management, which helps quick-term planning and resource changes to meet instant needs. Each of these techniques helps a one-of-a-kind layer of selection-making, from the boardroom to the warehouse floor.

The inclusion of “Others” in the type displays how bendy and adaptable the global asset management market has end up, providing additional gear and techniques that organizations would possibly undertake depending on their precise necessities. Whether it’s thru a combination of software program and hardware or through manner-stage changes, organizations will maintain to are seeking for out ways to improve asset usage, lessen waste, and reduce needless charges. As extra industries put money into these systems, the function of each element will develop in importance, shaping how corporations operate in a extra efficient and organized manner.

By Function

The global asset management marketplace is step by step reworking how agencies control their physical assets. This marketplace specializes in using structures and technologies to reveal, arrange, and maintain assets in a wiser and more efficient manner. Instead of counting on manual logs or scattered spreadsheets, corporations at the moment are turning to virtual solutions that assist them song assets from the instant they are added to the inventory until their very last use or disposal. This shift not best reduces loss and misplacement however also saves precious time and value.

By function, the marketplace is similarly divided into place and movement tracking, take a look at-in/check-out, restore and renovation, and different offerings. Each of these performs an critical position in how property are treated. Location and movement tracking assist agencies recognise precisely where an asset is and whether or not it’s in use or idle. This avoids confusion and unnecessary delays, in particular in industries in which time is vital. The check-in/test-out characteristic helps higher duty. When personnel borrow or go back equipment, the entirety is recorded, ensuring tools are available when wanted and now not misplaced due to poor documentation. Repair and renovation functions are vital because they hold treasured belongings in operating condition. Regular servicing guarantees that machines don’t smash down all of sudden, leading to downtime. Other features within the machine upload extra cost by means of assisting duties that might be unique to a positive enterprise or area.

What makes the global asset management market extra significant nowadays is its potential to evolve across industries. Whether it’s production, healthcare, creation, or IT offerings, all gain from stepped forward asset visibility and control. As businesses grow and their operations make bigger, the want for dependable asset coping with will become greater urgent. Without a proper device in area, sources may fit underutilized or even vanish from the statistics. This marketplace presents an answer that ensures assets are not just managed, but used neatly to help operations.

In the future, those answers will become even extra big. Companies will count on greater from their asset control structures not just monitoring or scheduling maintenance, but insights into usage patterns, fee performance, and life cycle making plans. As a end result, this marketplace will keep to attract attention from businesses that want to live aggressive by means of the use of their assets accurately.

Introduced and explored in research published with the aid of Metastat Insight under a unique wording, the global asset management market is displaying robust signs and symptoms of boom and change. This marketplace gives more than simply digital enhancements; it presents real tools for higher choice-making and smarter resource coping with. In last, the global asset management marketplace presented by means of Metastat Insight of their record suggests that corporations are prepared to take manipulate in their property with technology that works no longer simply to hold tune, however to get in advance.

By Application

The global asset management market, as introduced by Metastat Insight, continues to increase in size because companies and institutions look for improved methods of structuring, tracking, and maximizing their precious assets. Across industries from aviation to healthcare, infrastructure, and enterprise sectors, the demand for efficient asset management has led firms to adopt structured systems that guarantee accountability and performance. These systems are not only a matter of record-keeping they assist in planning, asset life extension, and maximized performance. With assets typically making up a significant proportion of an organization's value, it is not only convenient, but a requirement, to manage them.

Through application, the world Asset Management market is segmented into a number of specialized areas. Infrastructure Asset Management is focused on the maintenance and modernization of public and private networks of roads, bridges, and water supply systems. Enterprise Asset Management aids companies in the monitoring of equipment, machinery, and other operational devices to prevent downtime and enhance productivity. In the healthcare industry, asset management of medical equipment, patient monitoring equipment, and facility tools is critical for cost containment as well as safety of patients. Aviation Asset Management manages aircraft fleets, ground equipment, and spares in a safe and regulated manner. Outside these categories, other industries also have segments embracing asset management systems with their own specific requirements.

All of these applications are examples of moving toward more intelligent decision-making. Organizations are no longer simply keeping records they're leveraging data to plan more effectively, respond more quickly, and prevent unnecessary expenditures. The market has experienced heightened demand for digital options, such as cloud-based platforms and AI-driven tools that make it easier to track and forecast. As these technologies evolve, they will continue to make asset management even more responsive and flexible, enabling companies to adapt to shifting conditions without sacrificing control of their resources.

Looking forward, the global asset management market as seen in the report by Metastat Insight will continue to evolve as technology becomes more and more easily accessible and companies focus more and more on being sustainable and cost-efficient. With many industries dependent on this method of safeguarding and expanding their investments, asset management will be an integral part of strategic planning and operational success.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$850,066.70 million |

|

Market Size by 2032 |

$6,943,885.70 million |

|

Growth Rate from 2025 to 2032 |

36.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

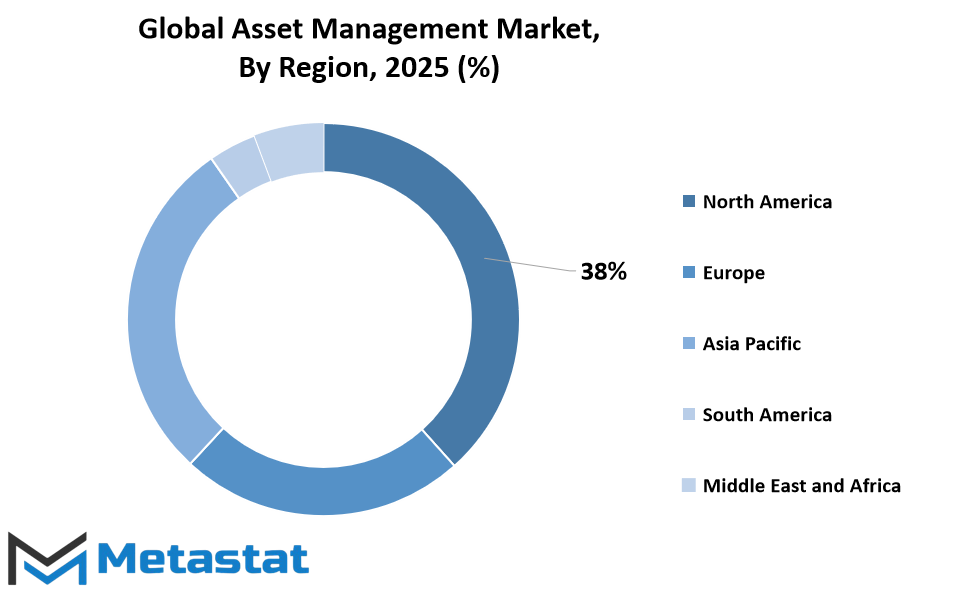

REGIONAL ANALYSIS

The global asset management market is defined by unique regional dynamics that affect its structure and path. These geographies, regulatory approaches, and investor attitudes create variety in the application of asset management services, their provision, and their extension. North America is a central market, divided between the U.S., Canada, and Mexico. Of these, the United States is strongest with its advanced financial infrastructure, broad use of digital technologies, and extensive base of individual and institutional investors. Canada is next, with a solid but modern perspective on asset techniques, and Mexico is progressively accepting asset management as attention and financial increase.

In Europe, countries just like the UK, Germany, France, and Italy make a contribution to a strong backdrop. The UK is a key financial center, mainly in asset servicing and personal wealth management, whilst Germany and France upload with their emphasis on sustainable funding and regulatory stability. Italy, together with the rest of Europe, helps more conventional investing but is slowly embracing more diverse portfolios and pass-border fund interest.

Asia-Pacific is another outstanding vicinity, divided into India, China, Japan, South Korea, and the rest of the vicinity. China and Japan are sturdy because of their massive economies and growing interest in various investment. China, with fast growth and a growing center class, is experiencing increase in both foreign and locally managed budget. Japan, via contrast, also has installed establishments which are evolving closer to newer patterns of asset allocation. India, pushed by using a rising investor base and developing fintech penetration, is also emerging as a sought-after marketplace for each neighborhood and international gamers. South Korea's technology-driven approach is contributing to the vicinity's transition, whilst different international locations in Asia-Pacific are slowly falling consistent with rising economic literacy and digital tools for funding.

South America encompasses Brazil, Argentina, and other regional markets. Brazil is still the most active, demonstrating potential in both private and public asset classes. While Argentina experiences economic ups and downs, it demonstrates stability-driven interest in structurally managed investments. The remainder of South America, while smaller in size, demonstrates increased curiosity and gradual adoption of asset management services.

Middle East & Africa is subdivided into GCC nations, Egypt, South Africa, and the rest. GCC nations are picking up steam with government-supported funds and schemes for long-term wealth retention. South Africa continues to be the most advanced financial hub on the continent, promoting the development of private asset companies and diversified portfolios. Egypt and others in the region are progressing through financial reform and increased access to global markets.

Each geography has its own blend of cultural inclinations, investment patterns, and financial infrastructure. Though the market structure could appear segmented geographically, the growing interconnectedness of world finance brings the different areas nearer in their ambitions, tools, and techniques. Though expansion might occur at varied rates around the world, the Global Asset Management industry, segmented by geography, will keep evolving to cater to a growing aware and diverse base of investors.

COMPETITIVE PLAYERS

The global asset management market, as presented with the aid of Metastat Insight, is shifting via a segment marked by means of rapid digitalization and growing demands for operational performance. Businesses across diverse sectors are spotting the value of handling assets greater strategically no longer only to cut fees however additionally to boost long-time period performance. From manufacturing units and infrastructure tasks to IT systems and public services, the want to screen, hold, and optimize property is developing more potent with every passing 12 months.

Asset control nowadays is no longer a reactive process. Organizations are becoming extra proactive, the use of superior gear and software to expect renovation wishes and avoid surprising breakdowns. This shift towards smarter practices is reshaping how companies method productivity and performance. Technology, specially AI, IoT, and cloud-primarily based platforms, is becoming vital to asset tracking and decision-making. With real-time insights, firms can now act faster and plan extra correctly, main to better effects and decreased waste.

What stands proud in this market is the growing integration of virtual structures. Companies are turning to automation and smart structures that no longer simplest music bodily property however also provide analytical insights. These developments are supporting lessen guide mistakes, enhance lifecycle tracking, and assist sustainability goals. Managing strength use, preventing equipment failure, and extending asset existence are just a few blessings that current systems offer. As those equipment come to be greater on hand, even small and mid-sized businesses are locating ways to make their operations leaner and extra responsive.

At the heart of this shift are groups which are helping set the direction. Key players working in the asset control industry consist of ABB Inc., Adobe Systems Inc., Brookfield Asset Management Inc., Honeywell International Inc., IBM Corp., Oracle Corp., Rockwell Automation, Inc., Siemens AG, WSP Global Inc., Zebra Technologies Corp., Hitachi, Ltd., General Electric Company, Bentley Systems, Incorporated, Hexagon AB, AssetWorks, Inc., and SAP SE. These companies deliver collectively technological innovation and deep industry understanding, pushing the bounds of how property are handled throughout sectors. They keep to put money into studies and enlargement, making asset management equipment more advanced and extensively to be had.

Looking in advance, the marketplace will in all likelihood see in addition changes as industries hold adapting to global demanding situations, environmental pressures, and evolving purchaser expectations. Sustainability will play a more potent function, and the focus will be on growing solutions which might be each cost-efficient and green. Businesses will anticipate more from their gear no longer simply facts, however clean steering on wherein to act and a way to enhance.

In this changing panorama, asset control is turning into a strategic pillar as opposed to a history characteristic. It helps smarter increase, better danger control, and higher operational requirements. As the marketplace grows, the corporations involved will need to live centered on innovation, usability, and real-world consequences. The record on the global asset management market brought ahead through Metastat Insight shows a destiny in which asset intelligence isn’t a luxury it’s a need.

Asset Management Market Key Segments:

By Asset Type

- Digital Assets

- Returnable Transport Assets

- In-transit Assets

- Manufacturing Assets

- Personnel/ Staff

By Component

- Real-Time Location System (RTLS)

- Barcode

- Mobile Computer

- Labels

- Global Positioning System (GPS)

- Strategic Asset Management

- Operational Asset Management

- Tactical Asset Management

- Others

By Function

- Location & Movement Tracking

- Check In/ Check Out

- Repair and Maintenance

- Others

By Application

- Infrastructure Asset Management

- Enterprise Asset Management

- Healthcare Asset Management

- Aviation Asset Management

- Others

Key Global Asset Management Industry Players

- ABB Inc.

- Adobe Systems Inc.

- Brookfield Asset Management Inc.

- Honeywell International Inc.

- IBM Corp.

- Oracle Corp.

- Rockwell Automation, Inc.

- Siemens AG

- WSP Global Inc.

- Zebra Technologies Corp.

- Hitachi, Ltd.

- General Electric Company

- Bentley Systems, Incorporated

- Hexagon AB

- AssetWorks, Inc.

- SAP SE

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252