MARKET OVERVIEW

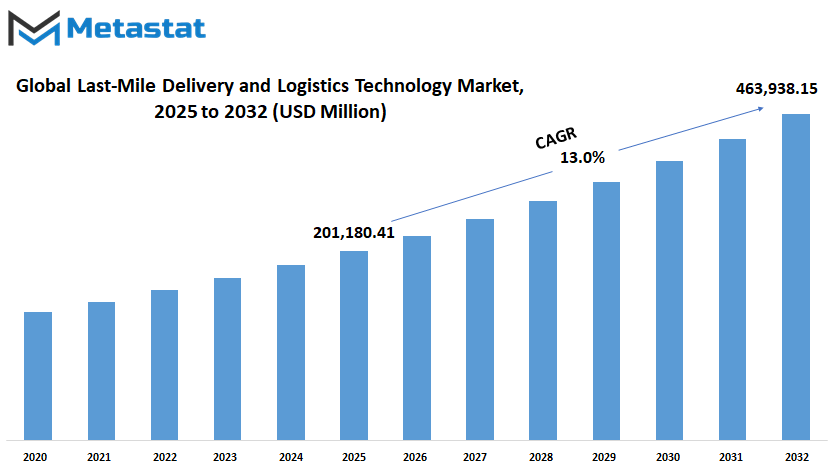

Global last-mile delivery and logistics technology market is estimated to reach $463,938.15 Million by 2032; growing at a CAGR of 13.0% from 2025 to 2032.

The global last-mile delivery and logistics technology market encompasses a wide range of technologies and solutions that make last-mile delivery easier. These include routing optimization software, real-time tracking systems, self-driving delivery vehicles, drones, and advanced analytics platforms. Each of these technologies helps make deliveries faster, lower operational costs, and make logistics operations more efficient. Companies making their mark within this space continue to innovate to meet the expanding expectations from consumers for faster and reliable delivery services.

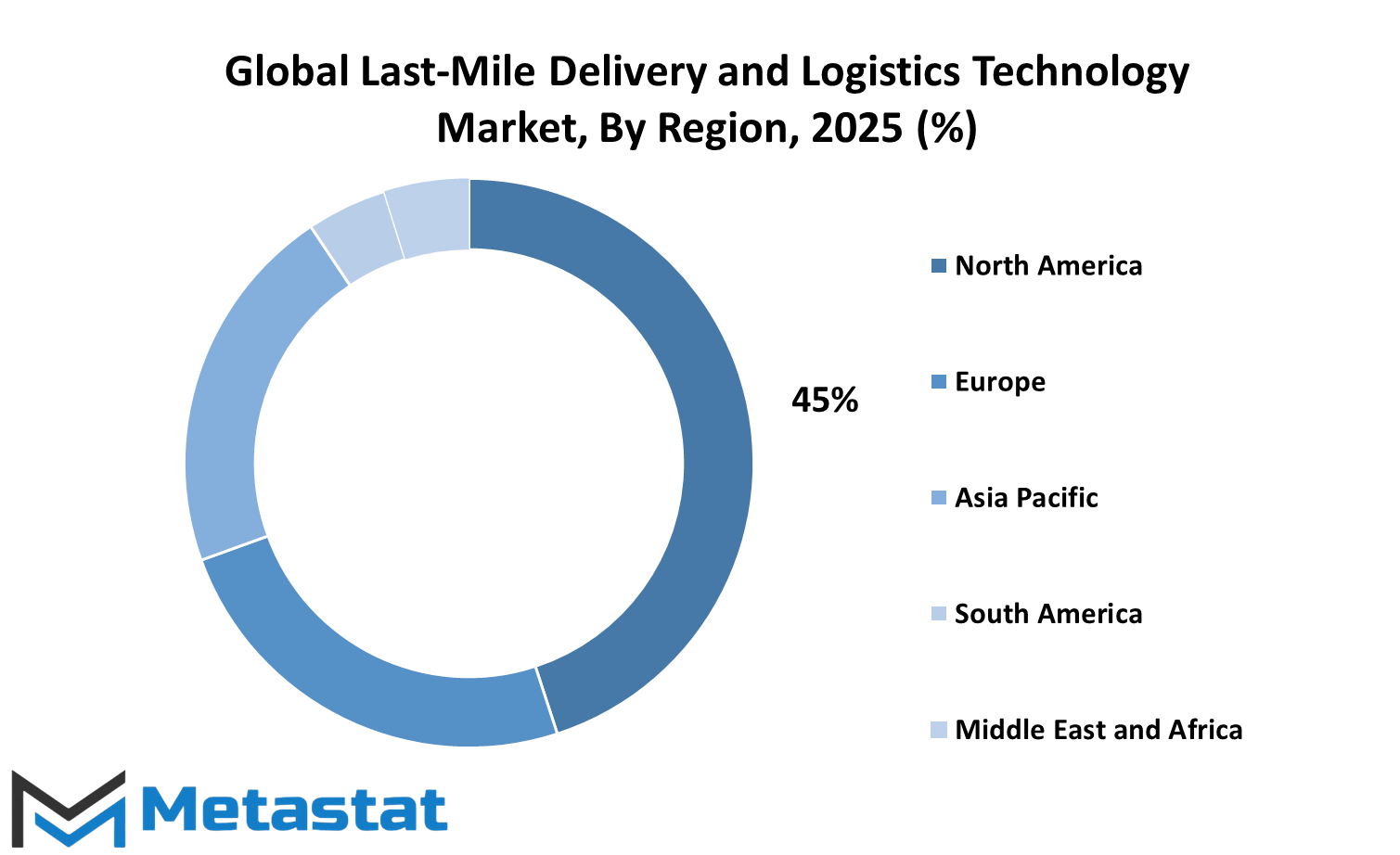

The global last-mile delivery and logistics technology market ranges from e-commerce to retail, healthcare, and food and beverage. E-commerce is one of the biggest drivers; online retailers invest heavily in last-mile solutions as a competitive edge. The healthcare sector also relies on accurate and timely deliveries, especially for essential supplies and pharmaceuticals, making it a critical part of this market. In addition, the food and beverage industry will benefit from the temperature-controlled logistics technologies developed, thus ensuring safe and timely delivery of perishable goods. Geographically, the market extends to North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Traditionally, North America and Europe have been the front-runners in adopting advanced logistics technologies, which are driven by high consumer expectations and robust e-commerce activity.

However, there is anticipation of strong growth in the Asia-Pacific region: first, rapid urbanization and successive strength gains in the e-commerce sector; second, strengthening investments in logistics infrastructure. Emerging markets in Latin America and Africa will present additional opportunities as these markets further establish their logistics capability and adopt technological innovation. Nearly all these changes with new technologies and changing consumer behaviour are going to transform the global last-mile delivery and logistics technology market. It integrates artificial intelligence and machine learning to improve the predictability of logistics operations so as to predict demand patterns and optimize routes more effectively.

Autonomous vehicles and drone technologies are also said to further change the game as it reduces human dependence on drivers and makes deliveries more efficient in high-density traffic urban centers. Over and above this, sustainability will take a center focus within the market, with an intent to lower carbon footprints and environmental compliances. More and more will experience electric delivery vehicles and embrace green packaging solutions to align with the international climate change agendas. Further, these new smart cities along with the IoT device expansion will also create the possibility of producing real-time data collection and analytics to improve efficiency and reliability for last-mile delivery services.

With the changing global last-mile delivery and logistics technology market, companies will have to be adaptable to the emerging trends and invest in innovative solutions to remain competitive. New business models and partnerships will further fuel the ongoing digital transformation of the logistics industry, making it a dynamic and rapidly changing market landscape. In the coming years, success will depend on the use of cutting-edge technologies and an exceptional customer experience.

GROWTH FACTORS

The global last-mile delivery and logistics technology market is witnessing fast growth, with changing consumer behavior and rapid technological improvements. In light of the unprecedented growth of e-commerce, companies are receiving pressure to deliver Goods in faster and more efficient ways. Customers will have expectations of same-day or next-day delivery, which then motivates companies to innovate and streamline operations. This shift has significantly increased the demand for smart logistics technologies such as AI-based route optimization, real-time tracking, and autonomous delivery solutions. These technologies, although improving efficiency, also significantly reduce delivery times, making logistics operations more reliable and affordable. Artificial intelligence optimizes last-mile delivery.

AI-based systems analyze the patterns of traffic, weather conditions, and a delivery schedule to determine the most efficient routes. All of these result in a decrease in fuel usage, decrease costs, and decrease in delay time. Also, the use of drones and autonomous delivery cars are on testing phases now for the packages to be delivered. It would bring the company’s competitive edge with this emerging technology because this is seen as an innovation with human dependency being lessened and speeding up services with the costs reduced on human labor. Growth, though promising, brings numerous challenges to the expansion of the global last-mile delivery and logistics technology market. Some of the main challenges arise due to the cost and high operational activities related to last-mile delivery. High operational cost of last-mile delivery is one of the biggest hurdles.

Companies need to invest in advanced tracking systems, fleet management, and warehouse automation that requires large capital investment. Furthermore, the challenge has been seen with urban congestion, since traffic delays tend to increase delivery and operating costs. Rural regions also pose a challenge, in that delivering shipments to rural destinations typically requires further distance and a greater cost. A third, important issue relates to the legal and environmental consequences of logistics services. Many metropolitan areas are developing stringent emission requirements to reduce air pollution and congested traffic conditions. Conventional delivery vehicles result in carbon emissions, which questions sustainability.

In order to address this, companies are focusing on green delivery solutions such as electric vehicles, bicycle couriers, and drone-based logistics. These options not only help reduce environmental impact but also align with government policies promoting sustainable urban mobility. In the near future, the global last-mile delivery and logistics technology market is expected to expand further with improvements in electric and autonomous delivery solutions. The quest for sustainability will make green logistics more mainstream as a standard approach rather than an option. Those companies that innovate and invest in smart technologies will lead the market, ensuring that last-mile delivery solutions are efficient, cost-effective, and environmentally responsible.

MARKET SEGMENTATION

By Technology Type

The global last-mile delivery and logistics technology market is evolving rapidly with constant upgradation in the technology and growing concern among the consumers for faster, efficient deliveries. E-commerce expansion makes the requirement for businesses to enhance supply chain efficiency with respect to speed and accuracy. With that said, organizations are introducing newer technologies to manage their workflow and surface more transparency for smooth delivery for businesses and customers.

Innovations which would help to untangle challenges such as congestion, environmental impact, and cost efficiency going to frame the future of this market. The biggest developments in this field include Delivery Management Software which incorporates routing optimization, dispatching, and tracking. Companies are embracing smart algorithms to measure traffic patterns and weather as well as live data for route delivery that cuts delay time and fuel consumption in order to make last-mile delivery more sustainable.

WMS is also evolving to optimize for improving inventory control and order execution. For instance, the integration of AI-based forecasting tools will allow companies to better predict demand, reduce storage amounts, and ensure smooth and speedy delivery. Automation really serves as the main driver of this process, and warehouse functions are now being streamlined by means of robotic systems, making it faster and less labor-intensive.

Transportation Management Systems, too, are becoming more complex and provide organizations with a holistic view of their logistics network. The system can optimize the allocation of loads to minimize transit time and generally maximize supply chains. Fleet Management Systems that use real-time GPS tracking, telematics, and predictive maintenance assist business in keeping track of fleet performance and in preventing any unwanted breakdowns, thus ensuring that there is minimum disruption in the operations and reliable delivery.

The second game-changing technology is Real-Time Tracking and Visibility Solutions, which use GPS and IoT sensors to provide real-time updates on shipments. Consumers expect accurate delivery timelines, and businesses that invest in these solutions gain a competitive edge by offering improved transparency. IoT-enabled smart tags help track packages in transit, reducing the risk of lost or delayed shipments.

With delivery drone, autonomous vehicles, and Automated Guided Vehicles (AGVs), automation will be even more vital in changing the landscape of how deliveries reach consumers. Companies are testing self-driving delivery robots that can navigate urban environments and reduce dependence on human couriers. The trend toward automation will bring about cost savings and greater efficiency in high-demand areas.

Also, the industry is changing with the advent of mobile computing and communication devices such as handheld scanners or smartphones. These allow drivers and warehouse staff to update order statuses in real time, thereby improving coordination and reducing errors. Digital proof-of-delivery systems reduce paperwork and enhance record-keeping, making logistics operations smoother.

Meanwhile, blockchain technology is coming to supply chain transparency and security. Blockchain technology ensures authenticity through tamper-proof records of transactions and shipments, hence reducing fraud risks. This is likely to improve trust between logistics providers and their customers.

The global last-mile delivery and logistics technology market will continue to develop along with innovations in automation, AI, and digital solutions in the coming future. The ones who are able to incorporate such innovation will be able to sustain themselves ahead in this increasingly competitive market while ensuring faster, reliable services that keep pace with ever-increasing consumer expectations.

By Service Type

The global last-mile delivery and logistics technology marke, however, shows tremendous growth-owing to advanced technology, greater demands for delivery on time, and making these systems more efficient. The highly digitalized, globalized world necessitates proper last-mile delivery as a mean to satisfy customer demand. The trend toward increasing the speed and reliability of delivery because of growing e-commerce and demand for convenience is driving the shift toward this trend. The last-mile delivery and logistics technology market is changing dramatically, with different services and solutions being developed to address the increasing need for increased speed and reliability in supply chain.

The market, based on the type of service, can be broadly categorized into two segments: solutions and services. Solutions fall within a range of technologies aimed to optimize and bring greater efficiency within the delivery processes. It involves the automation of tools, which enables the implementation of route optimizations through software products that aid organizations in real time with predictive analysis, allowing deliveries to be arranged accordingly. Along with an overwhelming dependency on the usage of data and technology by organizations, enormous investment is focused on solutions developed for reduced times and costs through higher accuracy when it comes to fulfilling orders. These solutions will play a critical role in the future as companies aim to meet growing customer expectations for quick, hassle-free deliveries.

Last-mile delivery and logistics services encompass the operational dimensions of the delivery process. The service includes courier and logistics firms, which handle the physical task of delivering products to the ultimate consumer. Therefore, as businesses look to develop delivery systems to achieve efficiency and convenience, there is a guarantee that third-party logistics providers will experience increased engagement in the services. Such services are increasingly important to businesses as they ensure fast and efficient delivery of goods. Consequently, the role of last-mile delivery providers will change as firms introduce new technologies that would be applied to meet future demands and improve their service offerings.

Going forward, the global last-mile delivery and logistics technology market will be expected to extend its growth curve on innovations in solutions as well as in services. And the more advanced is the technology, the more automated systems, better analysis of data, and more intelligent designs of logistics planning could come together for enhanced efficiency and swifter deliveries. With these technologies garnering popularity, the market is going to turn out highly competitive, with companies facing challenges to innovate further to meet changing consumer demands. It can be said that the future of the market is a mix of technological advancement and operational efficiency being powered by solutions and services to deliver improvements in last-mile delivery and logistics.

By Deployment Model

The global last-mile delivery and logistics technology market is changing rapidly, and its future evolution is going to reshape the delivery of goods in quite a significant manner. As e-commerce continues to grow and as the consumer's expectation rises, companies are increasingly looking toward advanced technologies for improving the efficiency of deliveries. One major facet of this change is how the market is segmented by deployment model, particularly into two major categories: Cloud-Based/SaaS and On-Premise solutions.

Cloud-Based or Software-as-a-Service (SaaS) is one of the most popular models being used nowadays in the global last-mile delivery and logistics technology market. It gives the users logistics software through internet access, thus enabling businesses without costly infrastructures or hardware investment. Moreover, cloud-based solutions offer flexibility, scalability, and ease of updates that allow companies to easily change according to the volatile changes in the market demands. Looking ahead, this deployment model is likely to form the market leadership, as it offers efficient management of deliveries across wide geographical areas. With cloud technology, logistics companies can integrate real-time tracking systems, predictive analytics and even AI algorithm that may improve route optimization. Customer demand for faster and better accuracy of deliveries is bound to grow, and cloud-based solutions are most likely to offer the needed agility and speed to stay ahead.

On the other hand, there are On-Premise solutions. In these solutions, the logistics technology software is hosted on the company's server. This approach gives more control over security, customization, and data management. It would be used by businesses that need specific flexibility or operate under strict data privacy regulations. However, On-Premise solutions have their own advantages, which include higher upfront costs and maintenance challenges that may be burdensome for smaller companies. In the future, On-Premise models may continue to serve niche markets where customization and data security are paramount. As technology continues to improve, the line between cloud-based and On-Premise solutions may become less distinct.

Hybrid models will surface as a result of combinations between the two above-mentioned models, which will be used by businesses to combine the advantages of the two deployment options. Business companies that can balance cost-efficiency with high standards of service in such a changing marketplace would dominate the global last-mile delivery and logistics technology market. Through looking to the future, it becomes clear that technological advancements will continue to reshape how goods are delivered by the focus on bringing products to the door steps with speed precision, and customer satisfaction.

By Application/Industry Vertical

The global last-mile delivery and logistics technology market is booming nowadays as most sectors of industries look for the advancement of technology and improve their system of operations as more consumers request deliveries in minimal time. However, the foremost driving force to boost the development of this market is the advancement of e-commerce. Online consumers have grown steadily and demanded greater efficiency and accuracy in their shipments. Companies are embracing last-mile delivery technologies for products in order to achieve the shortest time to the customer, because of the new prime importance given to speed and accuracy. Smart lockers, drones, and self-driving cars would determine the novel inbound delivery technology with regard to reduced human interface and greater speeds and lesser cost.

Retailer opportunities are being built up also through advances in last-mile delivery technology. The retailers will always make sure that the customer gets the products as quickly and with less hassle as possible. In this market, integration of real-time tracking systems is expected to be done more intensively so that the customers may follow their delivery closer. More investments in delivery are also going to be seen as the companies attempt to adopt the growing demand of environmentally friendly practice by switching to electric vehicles for delivery purposes. This trend of increased consumption of rapid, reliable deliveries of products to the end users would drive new innovations in the field of technology of last-mile logistics.

Similarly, the application of last-mile delivery technology in food and beverages industry is altering it. As these products, in most cases, are prepared foods, accurate methods of food delivery are critical in maintaining product quality and hygiene. When the food delivery business becomes popular, technologies will always dominate the mechanism of delivery in the form of temperature-controlled vehicles and real-time tracking. For the next coming years, customers will continue being satisfied with higher service experience by advanced delivery automation by robots in delivering locally reduces waiting time.

Healthcare sector is another domain that will heavily benefit from technological advancements in last-mile delivery and logistics. Delivery of pharmaceuticals, medical supplies, and equipment is critical, and advancements in logistics systems will help healthcare providers ensure delivery on time and securely. Moreover, sensitive products will need to be followed by temperature-controlled vehicles for integrity maintenance. As health care grows, so do the logistics solutions that ensure the timely delivery of essential supplies for patients.

With the implementation of advanced technologies, CEP services will also evolve. These services are not only important to businesses but to the entire individual looking to rely on rapid and safe delivery. In the future, last-mile delivery solutions within CEP will be focused on the elimination of operational cost and improvement of delivery times. Delivery networks will involve adding new technologies, including drones and autonomous vehicles, to make the delivery process seamless from start to finish.

Therefore, the global last-mile delivery and logistics technology market will continue to be a significant part of the manufacturing and automotive industries. Manufacturing firms will look for better delivery strategies to increase efficiency in supply chains and ultimately reduce the total cost of production. Automakers will invest more in logistics technology to enhance auto parts delivery with minimal delays.

This would lead to further growth of the market, where emerging industries would consider last-mile delivery technologies in respect to their specific needs. The future of the global last-mile delivery and logistics technology market promises higher efficiency, reduced costs, and a more focused concern for the satisfaction of customers' expectations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$201,180.41 Million |

|

Market Size by 2032 |

$463,938.15 Million |

|

Growth Rate from 2024 to 2031 |

13.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global last-mile delivery and logistics technology market is poised for significant growth in the future as innovation takes precedence. Consumers demanding faster delivery of goods will, in the foreseeable future, further drive the increase in the dependency of businesses all over the world on advanced logistics technology to reach their destination products in time. This growth is not restricted to one region; it has spread across different parts of the world, each with its unique challenges and opportunities.

In North America, the market is growing rapidly, led by the United States, Canada, and Mexico. The U.S. is expected to have the highest growth due to its advanced infrastructure, high demand for e-commerce services, and a strong focus on adopting innovative technologies. Canada and Mexico are also building their logistics networks, but the growth will still be in step with the U.S. in terms of the technological advancements and increased investment in the region.

Europe is also a significant market for the global last-mile delivery and logistics technology market. The United Kingdom, Germany, France, and Italy are among the leading ones, all improving their delivery systems through automation and better route planning. A fast-paced market in Europe, it offers end-consumer markets to major logistics companies based herein. Companies are looking to optimize their delivery networks in the region, further driving its development. The Rest of Europe will also witness significant growth, further fuelled by expanding e-commerce and enhanced logistics technology.

In Asia-Pacific, rapid adoption of last-mile delivery technologies can be seen in India, China, Japan, and South Korea. China is at the forefront, with its huge e-commerce industry that is forcing logistics companies to innovate and streamline their delivery services. India and Japan are not far behind, with significant investments in technology to cater to the ever-growing demand for fast and reliable deliveries. South Korea is also focusing on the improvement of its logistics systems by incorporating advanced robotics and automation for efficiency. The rest of Asia-Pacific should also continue to grow steadily, especially in emerging economies where e-commerce is booming.

South America is another region with huge growth potential in the logistics technology market. Brazil and Argentina are the leading countries in this region, with Brazil having the largest e-commerce market in South America. As logistics technology becomes more advanced, these countries will continue to make improvements in their delivery systems to meet the growing demands of consumers.

The Middle East & Africa region is relatively small but has promising growth in the global last-mile delivery and logistics technology market. GCC countries, including the United Arab Emirates and Saudi Arabia, are investing heavily in logistics infrastructure to enhance their delivery capabilities. Egypt and South Africa are also making strides in improving their logistics systems, although their development may take longer due to various economic and infrastructure challenges.

In general, the global last-mile delivery and logistics technology market is experiencing robust growth in all regions. As technology advances, transformation in the means of delivering goods will take place in all regional markets. In this context, significant impact would be seen in the use of drones, autonomous vehicles, and advanced route planning systems. As online commerce continues to evolve with deepening dependence, the market will expand in size and transform itself to meet the growing demands of consumers globally.

COMPETITIVE PLAYERS

The global last-mile delivery and logistics technology market is expected to witness significant change in the next few years with an increase in e-commerce, technological advancements, and a growing demand for faster delivery services. SAP, Oracle, Blue Yonder (formerly JDA Software), Manhattan Associates, and Descartes Systems Group have been the key players that have shaped this market. They, over the years, have evolved into leaders of modernizing innovative solutions that further enhance the last-mile delivery process. They are helping logistics drive into a better future with more streamlined, faster, and even cheaper operations.

Both SAP and Oracle are considered the most excellent enterprise resource planning software, as well as the world's most renowned supply chain management software companies. They have strong systems in most aspects of logistics operations such as route planning, inventory management, and real-time tracking for companies undertaking challenging last-mile delivery operations. The logistics systems are improved by Blue Yonder in that it brings forth high-class AI solution solutions enabling it to bring forth predictive analytics and thus intelligent decision making. This in turn enables firms to manage fleets efficiently and thereby get timely delivery.

Niche solutions are the answers provided by Manhattan Associates and Descartes Systems Group, to last-mile logistics. In this, Manhattan Associates emphasizes optimizing supply chain efficiency through improvements to warehouse management systems, transportation logistics, and business demand forecasting. In comparison, Descartes offers superior routing and scheduling technologies that enable optimum delivery routes at lower transport and delivery times.

Some other notable players such as Trimble, Verizon Connect, Geotab, and Teletrac Navman focus on telematics and fleet management solutions. All these companies help companies track the vehicle in real time, monitor driver behavior, and reduce fuel consumption, thus improving delivery efficiency. As cities become more congested and concern for the environment grows, this technology will come into greater demand to reduce the environmental footprint of delivery fleets with high service levels.

Some of them include the well-known UPS Supply Chain Solutions, FedEx Supply Chain, and DHL Supply Chain. These companies always invest in modern technologies that upgrade their logistics systems globally for accurate last-mile deliveries. These firms apply automation and robotics at workstations with better performance against the pressure of labor scarcity and increased wages.

Therefore, with the constant expansion of this last-mile delivery technology market comes companies like XPO Logistics and Project44 in which both entities will play leading roles in cross-communication regarding real-time update of data flow through the various chains of distribution. It enables businesses to get closer to excellent customer service deliveries that fuel industrial growth.

The future of the global last-mile delivery and logistics technology market will be defined by the competitive landscape, as these players adopt emerging technologies, reduce costs, and improve service delivery. Companies that can efficiently leverage innovations in AI, machine learning, and automation will be well-positioned to lead the market and meet the evolving demands of the modern consumer.

Last-Mile Delivery and Logistics Technology Market Key Segments:

By Technology Type

- Delivery Management Software (Route Optimization, Dispatch, Tracking)

- Warehouse Management Systems (WMS) (Inventory Management, Order Fulfillment)

- Transportation Management Systems (TMS)

- Fleet Management Systems (GPS Tracking, Telematics, Maintenance)

- Blockchain Technology (Supply Chain Transparency, Security)

- Automation and Robotics (Delivery Drones, Autonomous Vehicles, Automated Guided Vehicles (AGVs))

- Real-Time Tracking and Visibility Solutions (GPS, IoT Sensors)

- Mobile Computing and Communication Devices (Handheld Scanners, Smartphones)

By Deployment Model

- Cloud-Based/SaaS

- On-Premise

By Service Type

- Solutions

- Services

By Application/Industry Vertical

- E-commerce

- Retail

- Food and Beverage

- Healthcare

- Courier, Express, and Parcel (CEP)

- Manufacturing

- Automotive

- Others

Key Global Last-Mile Delivery and Logistics Technology Industry Players

- SAP

- Oracle

- Blue Yonder (formerly JDA Software)

- Manhattan Associates

- Descartes Systems Group

- Trimble

- Verizon Connect

- Geotab

- Teletrac Navman

- UPS Supply Chain Solutions

- FedEx Supply Chain

- DHL Supply Chain

- XPO Logistics

- Project44

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383