MARKET OVERVIEW

Global Healthcare Polymer Packaging is specialized; that is, a niche area of both the healthcare and packaging industries, due to the concentration on the development of polymer-based packaging solutions for satisfying more stringent application needs of healthcare and pharmaceutical applications. With their extensibility, durability, and compatibility with the several methods of sterilization, polymer materials have emerged as very favorable packaging materials in healthcare applications. This market has grown due to the increasing need for safe, reliable, and cost-effective packaging solutions that help ensure medical products from contamination, moisture, and other external factors.

Polymer packaging in healthcare applications play a very important role in guarding sensitive products that are medicines, surgical instruments, diagnostic devices, and implants. The integrity and safety of these products are critical since any breach could have direct implications for patient health. For this reason, the Global Healthcare Polymer Packaging market experiences a high level of scrutiny from the regulatory perspective because packaging materials must comply with health and safety standards set by international authorities. Polyethylene, polypropylene, and polyvinyl chloride are some of the leading polymers because of their flexibility and ability to be molded into different forms, including film, bags, trays, and blister packs.

This market is believed to show continuous innovation that forms its core feature. Companies in the Global Healthcare Polymer Packaging market would likely focus their research and development activities toward producing advanced material with improved properties such as biodegradability, recyclability, and resistance to chemical interaction, thereby improving functionality and performance. For instance, the development of antimicrobial polymers will reduce the risk of infection associated with any medical device or packaging in the hospital setting, which is increasingly a concern.

Secondly, because healthcare products are becoming more complex and diverse, manufacturers will probably have to design solutions that target the specific needs of individual products. In other words, customized polymer packaging solutions will increase in the following years. This can be in the form of packaging that maintains the integrity of products at extreme temperatures or has a greater degree of tamper resistance for controlled substances. Moreover, the integration of smart packaging technologies-distant example, integrated sensors capable of tracing and monitoring the condition of medicinal supplies throughout their supply chain-can further augment the product integrity requirements in the Global Healthcare Polymer Packaging market.

As more patientcentric models of care get a growing prominence within the healthcare sector, the needs for home healthcare devices and drug delivery technologies may also increase in the future. In this regard, the Global Healthcare Polymer Packaging market will likely be affected by that because polymers have to be designed to package an entire set of new equipment and pharmaceuticals that would be used outside of conventional healthcare facilities in order to have effective treatment. Easy-to-handle, lightweight packaging that ensures a high shelf life will be an important consideration as new healthcare delivery models emerge.

The Global Healthcare Polymer Packaging industry is quite dynamic and constantly evolving, which supports the healthcare industry. As innovations in material science, sustainability, and smart technology keep changing this market, it will remain an important component in ensuring safety, efficacy, and availability of medical products in the world at large.

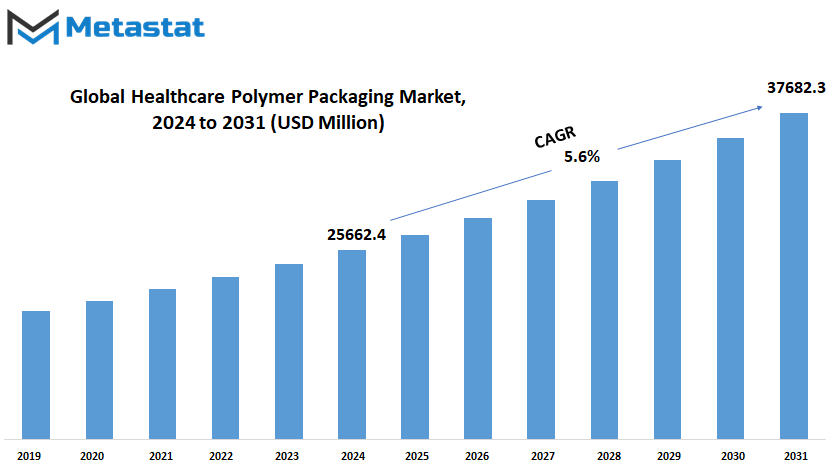

Global Healthcare Polymer Packaging market is estimated to reach $37682.3 Million by 2031; growing at a CAGR of 5.6% from 2024 to 2031.

GROWTH FACTORS

Various key factors will drive significant growth of the Global Healthcare Polymer Packaging market in the years ahead. Some of the main ones include rising demand for safe and hygienic packaging solutions by a broadening sector of healthcare. The pursuit for improved global health standards is causing an ever-increasing need for reliable packaging materials that can prevent the contamination of medical products. Polymer packaging is becoming popular nowadays because it is lightweight, has lower costs, and has great durability and protection. This can be supported by the fact that modern advances in technology have improved the quality and flexibility of the polymer material to become increasingly serviceable for a large number of health-related products.

In addition, the increasing need for sustainability is driving the growth of the market. A lot of players and companies within the healthcare sector are looking for environmentally-friendly alternatives in packaging that creates a minimum environmental impact. Polymer packaging, especially those from recyclable or biodegradable products, are particularly appealing in this regard. As organizations continue to join the bandwagon of sustainability goals, the demand for such packaging will increase, propelling more revenue into the Global Healthcare Polymer Packaging market.

However, there are factors that may impede this growth. One of these is the tight regulations pertaining to healthcare packaging. In most countries, each country has its own standards for packaging materials which requires painful changes in implementations for manufacturers to comply with requirements that entail massive costs and logistically take time. There is further the growing environmental concern over plastic waste that may change policies on polymer-based packaging and restrict market growth in some regions.

Despite such imperatives, the future of Global Healthcare Polymer Packaging can be regarded as bright. New material developments will bring together the properties of polymers with greater environmental sustainability for an excellent chance in the industry. New packaging types are expected to be invented by R&D that will not only comply with regulations but also bring high-grade recovery of the environment. These innovations will lead to several new growth opportunities since companies that are successful in adopting and integrating such materials in their packaging solutions will be ahead in the race to address the healthcare market's requirements, as these requirements will continue to evolve.

While challenges such as regulations and the concerns around the environment still exist, growth within the Global Healthcare Polymer Packaging market will be notable, augmented by technology advancements and the greater impetus placed on more sustainable solutions for packaging.

MARKET SEGMENTATION

By Packaging Type

This market, being segmented into packaging types, includes various products such as syringes, IV bottles and pouches, clamshells, blisters, bottles and jars, containers, tubes, IV parental packaging, and others. The global healthcare polymer packaging market is estimated to grow significantly in the coming years. The healthcare industry is likely to be positioned significantly on increased productivity, high comfort, and innovation. The need for innovative and reliable packaging solutions will become more important in this industry as it continues to advance. Polymer-based packaging is further in high demand for the preservation of medical products safety and integrity to ensure delivery to the patient in optimal condition.

The main driver behind the market is greater demand for safer and more efficient packaging solutions, especially syringes, with a material that ensures sterility and prevents contamination.

Similarly, IV bottles and pouches should be rugged and flexible enough for safe storage and transportation of critical fluids used in health care. Demand in this regard is quite likely to push the discovery of new polymer materials that meet newer standards of health care providers as well as regulatory bodies.

Technological advancement would further affect the global healthcare polymer packaging market. Biodegradable polymers may be the leading candidate due to the current increasing environmental-friendliness that they represent. Such a scenario would not only improve the ecologic footprint of medical packaging but may also bring low-cost innovations to the healthcare system. Even blister packaging, widely used in pharmaceuticals, will change because more integration of smart packaging is likely to trace the medication from outlay to the patient and assure compliance with a treatment.

The future may also allow for other types of packaging besides those products that are so often associated with syringes and bottles. Further growth in even more specialized treatment protocols can be anticipated for both containers and tubes, for example. IV parental packaging will be an area where improved polymers will be particularly important to create safety and ease of use.

The growing global population, in tandem with the increasing demand for sophisticated healthcare, will guarantee the requirement for high-quality polymer packaging. The global market for healthcare polymer packaging is going to continue its growth momentum because of innovation in new, safe, and sustainable solutions. Medical technologies will advance significantly, and packaging is sure to have a pivotal role in ensuring effective delivery of products in the health care sector, adaptable to future expectations and challenges.

By Type

In the coming years, the Global Healthcare Polymer Packaging market is expected to grow considerably. The drivers are rapid technological advancement and an increased demand in the healthcare sector for dependable and efficient packaging solutions. With health systems changing rapidly in all regions around the world, there is increasingly a need for packaging materials that protect medical products from all types of damage in terms of safety and integrity. This is the flexible yet tough; cost-effective polymer packaging, which has emerged as a popular choice for the healthcare sector.

Among the factors that are responsible for the growth of the Global Healthcare Polymer Packaging market is the growing requirement for secure and sterile packaging. So medical equipment and pharmaceuticals need protection against contamination, and yet, it is found inside robust yet flexible packaging through polymers. The packaging material used here is lightweight, yet strong enough to bear the stresses of transportation and storage. Thus, polymer packaging is the best choice for healthcare products when protection and ease of handling are sought.

The market will fall into two broad categories: regulated and non-regulated packaging in the future. This is regulated packaging, where the products are held under strict oversight and standards, especially the sensitive ones, like pharmaceuticals and medical devices. Regulations regarding the packaging will ensure that it meets specific criteria to not contaminate, maintain sterility, and assure the safety of the product. Regulated packaging is expected to be in even bigger demand considering that the globe will have very high standards on excellent practices of healthcare.

Non-regulated packaging is, however largely used for less sensitive items, where the level of scrutiny may not be so intense. This non-regulated packing still protects the product but is still not on a similar par with its counterpart in terms of regulations. The non-regulated packaging will, however continue to have its share of specific usage in aspects such as distribution of non-critical healthcare products while the market stays on its continued growth trajectory.

By Polymer Type

The Global Healthcare Polymer Packaging market is expected to boom in the future, driven primarily by increasing demand for safe, effective, and cost-effective packaging solutions. The need for secure packaging in the healthcare industry is mounting because it forms the critical juncture in maintaining product safety, extending shelf life, and ensuring integrity of the product. Different types of polymers being used led the market to display a promising expansion across different types of materials.

The most widely used materials in the market are polymers, which include LDPE (Low-Density Polyethylene) and HDPE (High-Density Polyethylene). There is said to be flexibility yet robustness of LDPE, which is suitable for packaging solutions making low-weight options. On the other hand, it is reported that HDPE boasts of stiffness as well as chemical resistivity that offers high-level protection for healthcare products. Most likely, these materials will be well represented in the market for long.

Adding to this, the market of Homo-polymer (Homo), Random Copolymer (Random), and Block Copolymer (Block) is also gaining momentum. These materials have varying degrees of strength and flexibility, while others have barrier properties that make them suitable for a particular kind of need that is uniquely associated with healthcare packaging. For example, tensile strength is high in Homo-polymers; Random Copolymers offer good transparency and flexibility. These materials contribute to the overall diversity in Global Healthcare Polymer Packaging, as they are aptly suited for a number of different packaging applications.

Other materials such as PET, Polystyrene, Polyvinyl Chloride and Polyamide / EVOH are also highly likely to come into greater prominence in the future of the market, due to their specific properties. Clarity and recyclability have made PET one of the most widely used bottle and container material for medicines. Polystyrene would provide good insulation properties and is well-suited for producing products that have to be kept at a controlled temperature. Polyvinyl Chloride and Polyamide / EVOH possess excellent barrier properties and keep sensitive products away from contamination.

With the continued evolution of the healthcare sector, the future demand for innovative packaging solutions in the healthcare sector is expected to be on the rise. The investment in more research and development to create more sustainable, lightweight, and cost-effective materials will gain momentum in the Global Healthcare Polymer Packaging market. A delicate balance between functionality and environmental responsibility will allow the further use of these materials while being environmentally conscious enough to ensure what is required for protection is provided without causing a negative environmental impact. This will shape the future of the Global Healthcare Polymer Packaging market, with a focus on innovation and sustainability.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$25662.4 Million |

|

Market Size by 2031 |

$37682.3 Million |

|

Growth Rate from 2024 to 2031 |

5.6% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

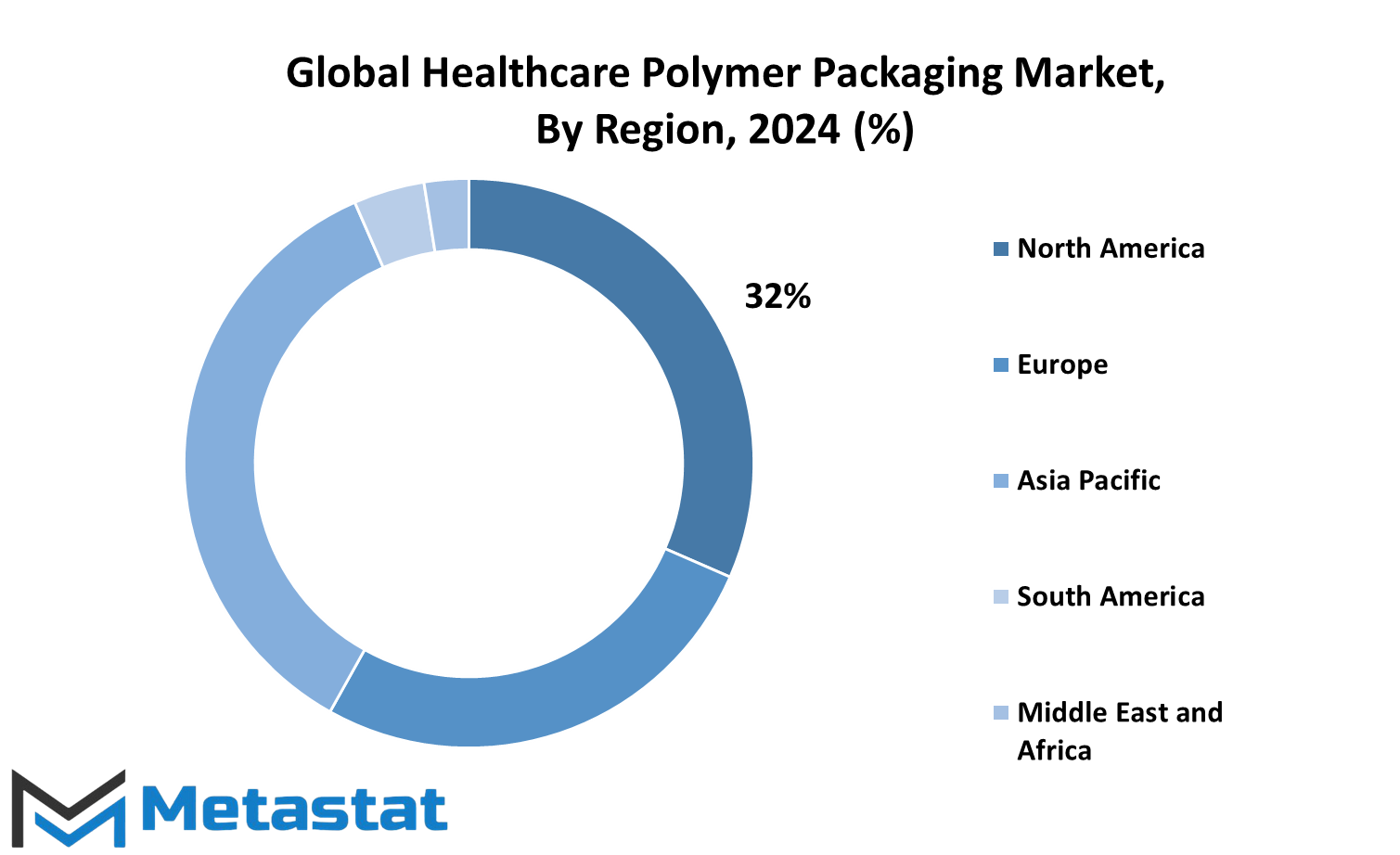

The Global Healthcare Polymer Packaging market possesses a unique geographical distribution related to demand by region, regulatory environment, and technological advancement. The prime regions for this industry are North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, and they all contribute differently to the growth of this market.

In total, North America is likely to hold the majority market share, as the region has already established well-developed health care systems and technological advancement. This remains boosted by continued thrust for innovation in medical and pharmaceutical products in the US. Advanced polymer packaging solutions also help to maintain sterility and safety associated with medical products. Meanwhile, Canada and Mexico continue to support growth in the region and are seeing expansion in their healthcare sectors. In the near future, with the development of healthcare, North America is most likely to find an even greater role, especially in sustainable and recyclable packaging materials.

Market size in Europe is dominated by countries such as the UK, Germany, France, and Italy. The medical packaging in these countries is highly regulated to ensure the safety and quality of healthcare products. Demand for new innovative packaging solutions will continue being pushed by Europe's aging population and increasing healthcare needs. Although considerably smaller in comparison, the rest of Europe adds up to the overall demand as health care systems around the continent continue their modernization processes.

Asia-Pacific will probably grow to become one of the fastest-growing markets with countries such as India, China, Japan, and South Korea spearheading the market. These countries are experiencing rapid growth in their healthcare industries due to the surging population, improved access to medical facilities, and an augmenting healthcare infrastructure. In Asia-Pacific, with more development, the demand for effective, affordable, and environmentally friendly packaging will increasingly be felt. Growth in this region in the future is likely to be spurred by ongoing urbanization, increased health care spending, and striving for a broad improvement in the standard of medical services.

South America, though smaller in terms of market size, has growth that has been seen to be progressive and stable. Brazil and Argentina are some of the primary countries in this region, where their ever-growing healthcare needs will call for better packaging solutions. With time and these countries implementing better health infrastructure, the market for healthcare polymer packaging is deemed to increase.

Finally, the Middle East & Africa, and in particular the GCC countries, Egypt, and South Africa, have an evolving health care sector, becoming more sophisticated in packaging technologies. The region will witness significant growth due to investments being made in health care and infrastructures in progress.

COMPETITIVE PLAYERS

Advances in technology, growing demand for innovative packaging solutions, and rising concerns for sustainability promise a healthy growth trajectory for the Global Healthcare Polymer Packaging market. In fact, these major players in this market have continued to shape the trajectory of this market, respectively, by engaging with the immediate and not-so-immediate needs of the healthcare industry. Other market players, such as 3M, Amcor plc, and Berry Global, Inc., are researching and developing better packaging options that are more efficient, robust, and eco-friendly. The overall growth of this market is highly dependent on the increasing demand for safe and secure packaging materials that meet stringent medical and regulatory requirements.

With the rising trend of health care across the globe and the emphasis on better safety and more qualified care, the need for innovative polymer packaging solutions will increase significantly. The market for these products has companies designing medical packaging that not only ensures the sterility and safety of medical products but also fulfills the global push to stop waste plastic. Therefore, Fresenius Medical Care AG and Honeywell International are researching biodegradable and recyclable options, which will be able to alter healthcare packaging for the future.

While sustainability is one of the factors of the future market influence, technology in its own right will play a great way in influencing the future of this market. Some smart packaging solutions offered by companies like Gerresheimer AG and Huhtamäki Oyj include, for example, tamper-proof seals and real-time temperature monitoring, promising possible security for medical products’ safety and efficacy. Such innovations will likely become the new normal as healthcare services gradually become part of digitization, requiring not only robust but also engaging packaging.

This aspect of competition has led to massive mergers, acquisitions, and partnerships, where corporations vie to come out top and hold a stronger grasp in this industry. It is reflected in the kind of collaborations in terms of partnerships between established players like Sealed Air Corporation and emerging innovators that will fuel faster innovation cycles and sooner market introduction of new cutting-edge products.

After this, the Global Healthcare Polymer Packaging market will discover even more collaboration coming in from the names like WestRock Company and Toray Plastics as they try to find their way in meeting the changing needs of healthcare providers and patients. This market will continue to be a significant part of effective healthcare solutions around the world, driven by great research and innovation.

Healthcare Polymer Packaging Market Key Segments:

By Packaging Type

- Syringes

- IV Bottles and Pouches

- Clamshells

- Blisters

- Bottles & Jars

- Containers

- Tubes

- IV Parental Packaging

- Others

By Type

- Regulated

- Non-regulated

By Polymer Type

- LDPE (Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- Homo-polymer (Homo)

- Random Copolymer (Random)

- Block Copolymer (Block)

- PET

- Polystyrene

- Polyvinyl Chloride

- Polyamide/EVOH

- Others

Key Global Healthcare Polymer Packaging Industry Players

- 3M Company

- Amcor plc

- Avery Dennison Corporation

- B. Braun Medical Inc.

- Ball Corporation

- Berry Global, Inc.

- Billerud AB (MediKraft, SteriKraft)

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- DS Smith Plc

- Dunmore Corporation

- Fresenius Medical Care AG

- Gerresheimer AG.

- Honeywell International

- Huhtamäki Oyj

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383