MARKET OVERVIEW

In the pharmaceutical and dietary supplement industries, the Global Isorhamnetin Market has emerged as a noteworthy player, wielding its influence in diverse applications. Isorhamnetin, a naturally occurring flavonoid, has garnered attention for its distinctive properties and potential health benefits. Isorhamnetin, found in various plant sources, is renowned for its antioxidant and anti-inflammatory attributes. Unlike generic antioxidants, the uniqueness of isorhamnetin lies in its ability to scavenge free radicals effectively, contributing to cellular protection and mitigating oxidative stress. This distinctive feature positions isorhamnetin as a sought-after component in the formulation of pharmaceuticals and nutraceuticals aimed at promoting overall well-being.

The significance of the Global Isorhamnetin Market becomes evident when delving into its applications. Studies have shown the potential of isorhamnetin in preventing chronic diseases, including cardiovascular conditions and certain types of cancers. Its anti-inflammatory properties further enhance its therapeutic potential, making it an asset in the development of medicinal products addressing a spectrum of health issues.

Moreover, the importance of isorhamnetin extends beyond the realm of human health. Its antimicrobial properties make it a compelling candidate in the food industry, where natural preservatives are increasingly sought after. The global trend towards clean-label products and a growing consumer preference for natural ingredients have amplified the demand for isorhamnetin as a safe and effective food preservative.

In the context of dietary supplements, the Global Isorhamnetin Market plays a pivotal role. The rising awareness of the link between diet and health has fueled the demand for supplements that offer not just nutritional value but also additional health benefits. Isorhamnetin, with its multifaceted advantages, has found a niche in the formulation of supplements aimed at supporting immune function, cardiovascular health, and overall vitality.

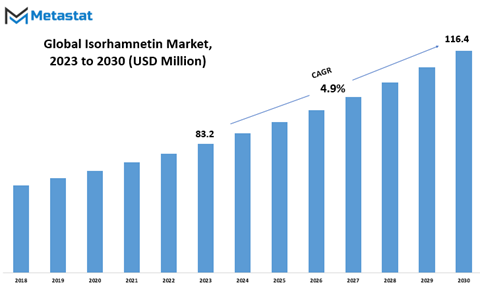

Global Isorhamnetin market is estimated to reach $116.4 Million by 2030; growing at a CAGR of 4.9% from 2023 to 2030.

GROWTH FACTORS

The global Isorhamnetin market, a subject of considerable interest and economic significance, is currently experiencing noteworthy growth. Several key factors contribute to this upward trajectory. Firstly, the rising awareness among consumers about the health benefits associated with Isorhamnetin has spurred its demand. This flavonoid, found in various plants, has been linked to potential health advantages, attracting attention from health-conscious individuals globally.

Another driving force behind the market's expansion is the increasing prevalence of chronic diseases. Isorhamnetin, with its purported antioxidant and anti-inflammatory properties, is being explored for its potential role in preventing or managing such health conditions. As people become more health-conscious and seek natural remedies, the demand for Isorhamnetin as a dietary supplement or functional ingredient in food products has witnessed a noticeable uptick.

Despite these positive aspects, certain challenges loom over the Isorhamnetin market. Regulatory hurdles and uncertainties surrounding its safety and efficacy could impede the market's growth. As governments tighten regulations on dietary supplements and functional foods, manufacturers and distributors of Isorhamnetin-containing products may face compliance challenges.

Additionally, the market may be impacted by supply chain disruptions and fluctuations in raw material prices. The dependency on specific plant sources for Isorhamnetin extraction makes the market susceptible to variations in crop yields and environmental factors. Any disruptions in the supply chain could lead to shortages, affecting the overall market dynamics.

However, despite these challenges, the Isorhamnetin market is poised to capitalize on emerging opportunities. The growing trend towards natural and plant-based products presents a significant avenue for market expansion. As consumers increasingly seek alternatives to synthetic additives and chemicals, Isorhamnetin, derived from plants, aligns with this preference.

Furthermore, ongoing research and development efforts to explore new applications and formulations of Isorhamnetin open doors for innovative products. The identification of novel sources or the development of more efficient extraction methods can enhance the market's potential. Companies investing in research to unlock the full potential of Isorhamnetin stand to gain a competitive edge in the market.

MARKET SEGMENTATION

By Type

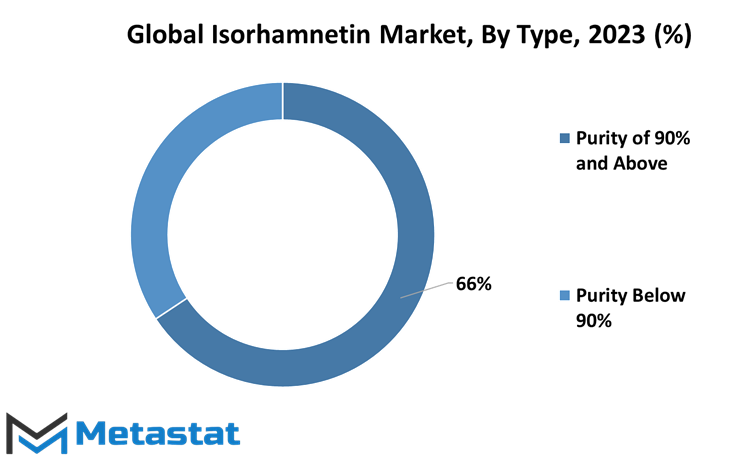

In types, the market is categorized into two distinct segments: Purity of 90% and Above, and Purity Below 90%. This classification plays a pivotal role in understanding the variations in the chemical composition of Isorhamnetin, thereby catering to diverse consumer needs.

Further delving into the specifics, the two purity categories offer a clear distinction. The Purity of 90% and Above signifies a higher concentration of Isorhamnetin, suggesting a purer form of the substance. On the other hand, Purity Below 90% implies a lower concentration, making it a more diluted variant. This categorization is crucial for industries and consumers alike, as it enables them to choose Isorhamnetin based on their specific requirements and applications.

By Application

Shifting the focus to the application aspect, the Isorhamnetin market is segmented into three key areas: Laboratory, Pharmaceutical Factory, and Hospital. Each of these segments represents a distinct setting where Isorhamnetin finds practical utility.

Laboratories, being the first category, emphasize the role of Isorhamnetin in experimental and research settings. Its applications in laboratories might range from scientific studies to product development, contributing to advancements in various fields.

The Pharmaceutical Factory segment underscores the industrial applications of Isorhamnetin. Within this context, Isorhamnetin serves as a vital component in the production processes of pharmaceutical products. Its usage in this setting is a testament to its relevance in the synthesis of medications and other pharmaceutical formulations.

Hospitals, points to the medical applications of Isorhamnetin. Whether it’s incorporated into treatment protocols or used for research purposes, Isorhamnetin plays a role in the healthcare sector, showcasing its versatility beyond industrial and laboratory settings.

REGIONAL ANALYSIS

In examining the global Isorhamnetin market, it's crucial to delve into its geographical distribution. The market is categorically segmented globally but majorly into two major regions: North America and Europe. These geographical divisions play a pivotal role in shaping the dynamics of the Isorhamnetin market.

North America, with its diverse consumer landscape and robust economic presence, stands as a significant player in the Isorhamnetin market. The region's market dynamics are influenced by various factors, ranging from consumer preferences to regulatory frameworks. Understanding the nuances of the North American segment provides key insights into the demand patterns and market trends for Isorhamnetin.

On the other side of the Atlantic, Europe contributes significantly to the global Isorhamnetin market. The European market, characterized by its cultural diversity and varying economic conditions, presents a unique set of challenges and opportunities for Isorhamnetin stakeholders. Factors such as regulatory compliance and consumer awareness impact the market trajectory in Europe, making it essential to dissect these elements for a comprehensive understanding of the market dynamics.

These geographical segments, while distinct, are not isolated entities in the Isorhamnetin market landscape. The interplay between North America and Europe creates a dynamic ecosystem where market trends in one region can influence the other. This interconnectedness necessitates a holistic approach when analyzing the global Isorhamnetin market, recognizing the interdependence of these geographical divisions.

COMPETITIVE PLAYERS

The global Isorhamnetin market involves various key players, and among them, Tokyo Chemical Industry Co., Ltd., and Sigma-Aldrich stand out. These companies play a significant role in the Isorhamnetin industry, contributing to its growth and development.

Tokyo Chemical Industry Co., Ltd. is a notable player in the market, actively participating in the production and distribution of Isorhamnetin. Their commitment to quality and innovation has positioned them as a reliable source for Isorhamnetin-related products. With a focus on meeting market demands, Tokyo Chemical Industry Co., Ltd. has become a prominent contributor to the global Isorhamnetin landscape.

Similarly, Sigma-Aldrich is another key player in the Isorhamnetin industry. Renowned for its extensive range of biochemical and organic chemical products, Sigma-Aldrich has a notable presence in the global market. Their involvement in the Isorhamnetin sector signifies a commitment to providing high-quality products that cater to diverse needs within the industry.

Both Tokyo Chemical Industry Co., Ltd. and Sigma-Aldrich play pivotal roles in shaping the dynamics of the Isorhamnetin market. Their contributions extend beyond mere participation; they actively influence the trends and standards within the industry. As key players, they not only meet market demands but also set benchmarks for quality and reliability.

Isorhamnetin Market Key Segments:

By Type

- Purity of 90% and Above

- Purity Below 90%

By Application

- Laboratory

- Pharmaceutical Factory

- Hospital

Key Global Isorhamnetin Industry Players

- Tokyo Chemical Industry Co., Ltd.

- Sigma-Aldrich (Merck Group)

- MedChemExpress LLC

- Cfm Oskar Tropitzsch GmbH

- Biosynth AG

- Carbone Scientific Co., Ltd.

- APAC Pharmaceutical, LLC

- abcr GmbH

- Toronto Research Chemicals Inc.

- Santa Cruz Biotechnology, Inc.

- Chemodex Ltd.

- Cayman Chemical Company

- Apollo Scientific Ltd.

- Glentham Life Sciences Ltd.

- SimSon Pharma Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252