MARKET OVERVIEW

The Integrated Platform Management System (IPMS) market is a critical segment of the maritime and naval industry that plays a pivotal role in the efficient operation and control of naval vessels. Integrated Platform Management Systems are advanced technological solutions designed to oversee and manage various critical systems on board naval vessels. These systems include propulsion, power generation, navigation, fire control, damage control, and auxiliary services. The primary goal of IPMS is to provide real-time data, control, and automation capabilities to enhance the overall performance, safety, and survivability of naval vessels.

The implementation of an efficient IPMS is crucial for modern naval vessels, as it enables seamless communication and coordination between diverse shipboard systems. This integrated approach is instrumental in optimizing resource utilization, reducing crew workload, and enhancing the ship's operational readiness. Furthermore, IPMS aids in rapid decision-making during emergencies, contributing to the overall safety and mission success of naval operations.

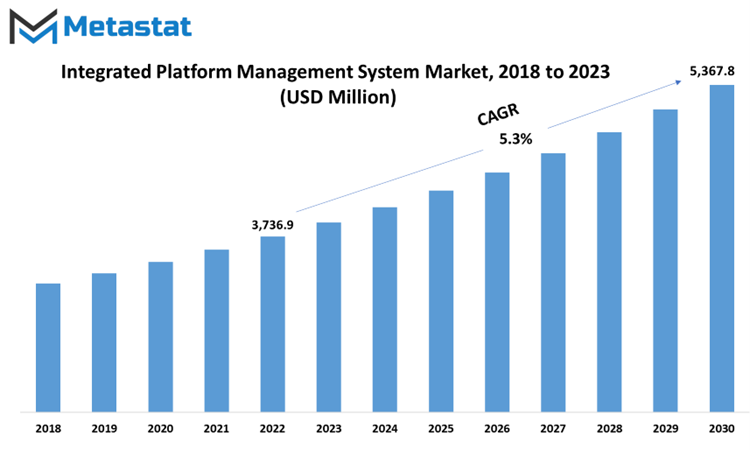

Global Integrated Platform Management System (IPMS) market is estimated to reach $5,367.8 Million by 2030; growing at a CAGR of 5.3% from 2023 to 2030.

MARKET DYNAMICS

The Integrated Platform Management System (IPMS) market is experiencing a period of dynamic change and growth driven by various factors. This research report explores the market dynamics, including driving forces and potential challenges, as well as emerging opportunities in this niche sector.

Driving Factors

The increasing emphasis on naval modernization across the globe is a primary driving force behind the growth of the IPMS market. As naval fleets seek to enhance their operational capabilities and stay competitive, they are investing in advanced technologies like IPMS to streamline vessel management, improve situational awareness, and optimize resource allocation.

Automation has become the buzzword in the maritime industry. Shipowners and operators are progressively recognizing the benefits of automation in reducing human errors, enhancing operational efficiency, and achieving cost savings. IPMS plays a pivotal role in realizing these objectives by providing centralized control and monitoring of ship systems, leading to smoother operations.

Challenges

While IPMS solutions offer significant advantages, the initial investment required for their implementation can be substantial. This can deter some budget-constrained organizations from adopting these systems, particularly smaller maritime operators. Overcoming this challenge involves finding cost-effective solutions and demonstrating the long-term ROI of IPMS. In an era marked by increasing cyber threats, the maritime sector is not immune. IPMS, being a networked system, poses cybersecurity risks that must be addressed comprehensively. Ensuring the security of critical vessel systems and data is paramount, and any breach can have severe consequences. As a result, robust cybersecurity measures and continuous updates are essential.

Emerging Opportunities

The market is witnessing a surge in the demand for retrofit solutions, which presents a promising opportunity. Many existing vessels are being equipped with IPMS to upgrade their capabilities and meet evolving regulatory requirements. Retrofit solutions cater to this demand by providing customizable and cost-effective options.

The Integrated Platform Management System market is experiencing dynamic shifts driven by factors such as naval modernization initiatives and the focus on automation and efficiency. However, challenges like high implementation costs and cybersecurity concerns pose potential obstacles to growth. Despite these challenges, the growing demand for retrofit solutions signifies an exciting opportunity for market players. To thrive in this evolving landscape, companies must navigate these dynamics strategically, offering innovative and cost-effective solutions that meet the evolving needs of the maritime industry.

MARKET SEGMENTATION

By Type

The market for naval combat systems is a dynamic landscape influenced by various factors, including the type of operating systems and their applications. Let's delve into the segmentation of this market, focusing on the different types of operating systems and their respective applications.

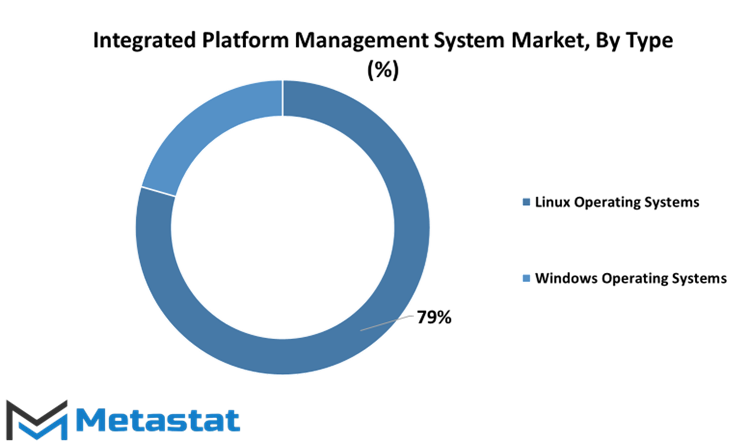

In this market, the type of operating systems plays a pivotal role. It's crucial to understand that there are two primary categories in this regard: Linux Operating Systems and Windows Operating Systems. The Linux Operating Systems segment held substantial value in 2022, amounting to 2831.1 USD Million. This signifies the widespread use and importance of Linux-based systems in naval combat applications. Linux, known for its robustness and versatility, finds application in various aspects of naval combat systems, contributing significantly to the market's overall worth.

On the other hand, we have the Windows Operating Systems segment, which was valued at 734.6 USD Million in 2022. While not as prominent as Linux in this context, Windows Operating Systems still play a vital role in specific naval applications. Their user-friendly interfaces and compatibility with various software make them valuable assets in certain naval systems.

By Application

The Frigates segment, which held a value of 1143.7 USD Million in 2022. Frigates are essential components of naval fleets, serving various purposes, including escorting larger vessels and conducting anti-submarine warfare. The substantial value associated with this segment reflects the significance of frigates in modern naval operations. Next, the Aircraft Carriers segment, valued at 783.7 USD Million in 2022. Aircraft carriers are the crown jewels of naval power projection. They serve as mobile airbases, enabling a wide range of operations, from air superiority to power projection. The value attributed to this segment highlights the strategic importance of aircraft carriers in naval combat systems.

The Submarines segment is another critical component of this market, with a value of 1029.8 USD Million in 2022. Submarines operate stealthily beneath the waves, performing tasks such as intelligence gathering and launching strategic missile strikes. Their value underscores the significance of underwater capabilities in modern naval warfare.

There is the others category, which encompasses various applications not covered by the segments. This category is valued at 932.1 USD Million in 2030, indicating its potential for growth and diversification within the naval combat systems market.

REGIONAL ANALYSIS

The North America Integrated Platform Management System (IPMS) market had an estimated value of 1084.4 USD Million in 2018. This figure reflects the substantial presence and importance of IPMS in the region. However, it's not just North America; the market for Integrated Platform Management Systems is a global phenomenon. In 2022, the European Integrated Platform Management System (IPMS) market held a significant share, accounting for 29.4% of the total IPMS market. This indicates a strong presence and demand for IPMS solutions in Europe. It's essential to recognize that IPMS is not limited to a specific region; it has a global reach and impact.

Integrated Platform Management Systems play a crucial role in various industries worldwide. These systems are designed to enhance the management and control of complex platforms, such as naval vessels, by integrating and centralizing various functions. They improve efficiency, safety, and operational capabilities.

As technology continues to advance and industries seek more sophisticated solutions for managing complex systems, the IPMS market is expected to grow further. Its applications span across not only naval vessels but also other domains like offshore platforms, commercial ships, and even in some cases, land-based systems. The global nature of the IPMS market reflects the universal need for efficient and integrated platform management. Whether it's for defense, offshore industries, or any sector that relies on complex systems, the demand for IPMS solutions remains strong worldwide.

While North America and Europe have significant stakes in the Integrated Platform Management System market, it's a global industry with applications and demand spreading across the world. The value and importance of IPMS extends beyond regional boundaries, making it a critical technology for various sectors worldwide.

COMPETITIVE PLAYERS

In the world of maritime and industrial sectors, there are several significant players who contribute greatly to the optimization of operations and the reliability of essential systems. Two such companies, Logimatic and Marine Electricals, stand out as key figures in this landscape. Logimatic and Marine Electricals are significant players in the maritime and industrial sectors, each contributing uniquely to the optimization and reliability of operations. Logimatic's focus on software solutions and innovation, coupled with its commitment to customer success, positions it as a leading force in shaping the future of these sectors. Meanwhile, Marine Electricals' dedication to excellence, innovation, and customer satisfaction solidifies its role in ensuring the reliability and performance of electrical systems at sea. Together, these companies play pivotal roles in driving progress and efficiency in their respective domains.

Integrated Platform Management System (IPMS) Market Key Segments:

By Type

- Linux Operating Systems

- Windows Operating Systems

By Application

- Frigates

- Aircraft Carriers

- Submarines

- Others

Key Global Integrated Platform Management System (IPMS) Industry Players

- ECA Group

- L3Harris Technologies, Inc.

- Logimatic

- Marine Electricals

- Navantia, S.A.

- Northrop Grumman Sperry Marine B.V.

- Praxis Automation Technology B.V.

- Rolls-Royce Plc

- Seastema S.p.A.

- RH Marine B.V.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252