MARKET OVERVIEW

The global integrated circuit (IC) substrate market stands as one of the highest contributors to the electronics industry, responsible for all connections made between semiconductor chips and printed circuit boards. The ever-evolving electronic devices necessitate the advent of high-performance, reliable yet cost-efficient substrates that might define the future of this market. Keeping in pace with the ongoing technological developments, this industry is likely to witness several transformational changes-in the manufacturing processes, the material selection, and design capabilities of PCB technology making it one of the most important components of a semiconductor supply chain.

New technological innovations are likely to be the trends that manufacturers of the *Global Integrated Circuit (IC) Substrate market will pursue as they seek ways to improve product performance while cutting production costs. With shrinkage and increased functionality of devices, high density interconnect (HDI) substrate will increase demand on miniaturization.

The industry is shifting to advanced substrate technology, with the ability to support complex circuit patterns and higher ratios of input-output (I/O) density, in response to smaller devices coupled with more functionality. Companies will spend heavily in the latest modified epoxy resins and advanced build-up film substrates that are superior in electrical properties and mechanical strength. All of these developments will push the market towards more efficient and compact solutions that meet the demands of next-generation semiconductors.

The advanced packing technologies, which are gaining momentum in this area, will change the course of the semiconductor packaging industry, such as chiplet architectures. With the combination of several dies within a single package, the importance of such IC substrates will increase with regard to seamless interconnection and signal integrity within the chip assembly. Such trends call for the new refined fabrication techniques incorporated by substrate manufacturers and such high-speed transmission, low power consumption, and high thermal management capability. Therefore, developments in heterogeneous integration will also determine further advances in IC substrate reliability and scalability.

In the coming years, substrate manufacturing will make more strides in automation as well as in artificial intelligence. Efficiency improvements, along with defect reduction, will be achieved with process optimization using AI-driven analytics and smart production lines. Automation will mold the manufacturing workflows so as to eliminate as much waste as possible but at the same time achieving the highest possible quality standard. Sustainability will be central to this, pushing companies towards energy-efficient fabrication processes and environmentally friendly materials. Thus, inherent with the growing awareness of electronic waste and its environmental concerns, production will heighten into greener production techniques influencing industry practices that last years to come.

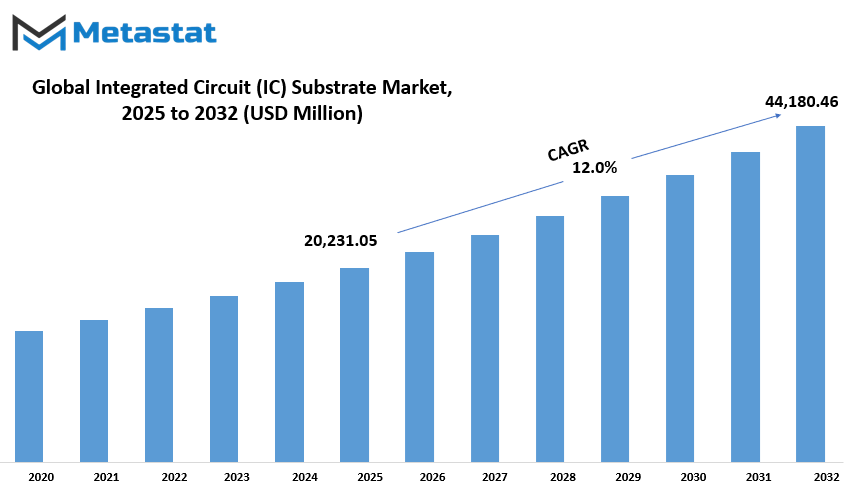

Global Integrated Circuit (IC) Substrate market is estimated to reach $44,180.46 Million by 2032; growing at a CAGR of 12.0% from 2025 to 2032.

GROWTH FACTORS

The Global Integrated Circuit (IC) Substrate market expansion is driven positively by the growing requirement of advanced packaging in semiconductors. The evolution of artificial intelligence, 5G networks, and the Internet of Things leads to increasingly demanding requirements for high-performance chips and the substrate solutions that support those chips. As technology continues to advance it is expected that miniaturization and greater functionality will drive packaging innovation in the semiconductor field. All of these factors contribute to making the IC substrate market critical to the overall industry of electronics by solidifying the calm yet incredibly quick processing and connectivity of data.

Consumer electronics, together with the automotive, would significantly stimulate the growth of the market. Increases in demand for efficient chip package solutions from the popularity of smart devices, gaming consoles, and wearable technologies have given rise to increasing demand. Though the automotive sector is overall transforming toward electric and autonomous vehicles, it will significantly rely on advanced semiconductor components.

This has substantially increased the demand for high-quality IC substrates, capable, in turn, of supporting very complex electronic systems. With more and more industries making continuous efforts toward digital transformation, dependence on semiconductor technology continues to rise-this further increases demand for IC substrates.

Strong demand, coupled with the possibility of growth, brings several attendant challenges to the market. Probably the most touted of these is that of disruption in the supply chain, which has led to shortages of raw materials and substrates. The semiconductor industry has had a major backlog from this along with other major problems like delayed production and raised costs for manufacturers.

The cost of producing IC substrates is another issue that troubles market growth. The process of fabrication entails very sophisticated design and precision engineering, making it costly and complex. Advanced manufacturing techniques should be invested in by the companies to maximize production efficiency and reduce costs for sustainability in the market.

Advancements in substrate technology should provide them promising opportunities. Innovation such as embedded IC and fan-out packaging is beginning to gain attention for its potential to improve performance while eliminating dimension constraints. Ultimately, these will push manufacturers towards producing even smaller and more efficient semiconductor solutions that meet the increased demand for high-speed and energy-efficient devices.

Along with this is continuing research and development efforts that net early breakthroughs toward IC substrate technology, which opens the door for further applications across various industries. It seems that the market may continue to grow steadily in the next few years, given further investment in innovation and supply chain improvements.

MARKET SEGMENTATION

By Type

The Global Integrated Circuit (IC) Substrate market is an area of core concern in the semiconductor industry since it largely determines the functionality and efficiency of any electronic product. The function of substrates is to bridge the semiconductor chip to the printed circuit board to permit the electrical contacts and signal transmission. As technology advances, there is higher demand for high-performance and more reliable IC substrates all due to the unprecedented growth in areas such as consumer electronics, telecommunications, automotive, and industrial applications. Companies do recurrent work in design improvement, durability enhancement, and optimizing production processes to reach a consensus with the dynamic requirements in the market.

Some of the segments involve the types of Flip Chip Ball Grid Array (FC-BGA) and are worth $6,740.50 million, Flip Chip Chip Scale Package (FC-CSP), Ball Grid Array (BGA), Chip Scale Package (CSP), Multi-Chip Module (MCM), and others. Each one has defined features and applications because they serve different industry needs. The FC-BGA segment comprises a substantial amount of market due to the significant capabilities it has for high-density components while maintaining best stability and performance. In contrast, widely used within FC-CSP and BGA substrates are mobile devices and computing applications, thus drawing in their vast adoption. CSP and MCM technologies provide more compact, high-speed solution alternatives for advanced semiconductor packaging.

The reality is that widespread digitalization in industries and automation propels the urgency of the IC substrates for high-speed computing and connectivity. With the emergence of 5G in the fast adoption of artificial intelligence applications and IoT devices, it demands highly advanced semiconductor solutions that any company can provide. This is why the companies are investing in R&D in order to innovate better techniques and improve substrate materials that would otherwise assure excellent thermal management, signal integrity, and cost efficiency. Advances in semiconductor packaging will refigure the industrial future with more efficient performance of devices and their miniaturization.

Strong as it is, the market faces some adversities such as disrupted supply chains, increased cost of materials, and increased production technology complexities. Production becomes more challenging as manufacturers must solve these challenges while meeting and maintaining efficient production and expected quality standards from industries. All these gaps will be filled through strategic partnerships, native collaborations, and investments into advanced manufacturing processes.

In the near future, the scenario for the Global Integrated Circuit (IC) Substrate market seems rosy, sustaining the continuing advancements that would contour the landscape of semiconductors forever. It is indeed an important role by which IC substrates will remain in the future in progressing technological development and enabling next-generation innovations, as industries push toward more refined and efficient electronic solutions.

By Material

The Global Integrated Circuit (IC) Substrate market is a constituent of semiconductor industries which forms a very important part of electronic development and performance. The substrates are bases for semiconductor chips which provide electrical connections and structural support requisite for functional needs. The IC substrate market is poised for growth due to increasing demand for advanced electronic products stemming from technological advances, the trend toward miniaturization, and growing complexities of semiconductor designs.

The performance of IC substrates are heavily influenced by materials, which make up the pertinent market segmentation of organic substrates, ceramic substrates, glass substrates, and metallic substrates. All types of materials have their own sets of advantages and applications, specifically tailored for the various requirements of their industries.

Organic substrates are becoming trendy these days; they are cost-effective, lightweight, and have a chance of high-density interconnections. Organic substrates are used in industries like consumer electronics, automotive, and communication devices, where flexibility and performance count. Ceramics provide high thermal conductivity and electrical insulation; hence, ceramic substrates are used in high power and hostile environmental conditions.

Further, high-temperature reliability and operational dependability have been additional factors enhancing the use of ceramics in industrial and aerospace sectors. Glass substrates are gaining their footing because of their better dimensional stability and incapacity of supporting advanced display technologies and radio frequency applications. With an uptick in demand for high-performance computing and 5G technologies, steady adoption is expected for glass substrates in the coming years.

Metal substrates are extremely suitable for applications needing high reliability and thermal management capability since they are mechanically quite strong and reliable for heat dissipation. They find applications in power electronics, LED lighting, automotive electronics, and anywhere heat resistance and durability are prime factors.

The surging uptake of AI, IoT devices, and high-performance computing is shaping the next generation of IC substrates. Substrate technology will shape the industry for the time being as semiconductor manufacturers concentrate on maximizing chip performance at a minimum power consumption. Innovations in substrate materials and designs are being pushed even more by the transition towards heterogeneous integration and chiplet-based architectures.

On top of that, environmental sustainability and the trend towards green manufacturing technologies have set companies on an exploration of new materials and production methods. The Global Integrated Circuit (IC) Substrate market will continuously evolve with the support of ongoing research and development programs to meet the ever-increasing demand of the electronics industry.

By Manufacturing Process

The Global Integrated Circuit IC Substrate market broadly formed the base of the contemporary electronics world, which is indispensable as semiconductor devices would be nowhere in existence without it. The high-performance IC substrate market does not remain static, yet further grows with increases in computing the innovative telecommunications industry with consumer electronics. An IC substrate forms the connecting link between semiconductor chips and circuit boards, ensuring an efficient electrical connection and providing mechanical stability. The application areas of IC substrates also cut across automobile, industrial automation, and health care industries, emphasizing the need for a reliable and miniaturized construction.

Some of the factors that affect the market include the rapid growth of 5G networks, the increasing penetration of artificial intelligence, and the rising demand for small high-speed electronic devices. The companies are continuously evolving IC substrate performance with advanced materials and manufacturing processes. By manufacturing process, the market is further segmented into Surface Mount Technology (SMT), Through-Hole Technology (THT), and others. All these processes provide various advantages associated with different applications and designing approaches. Surface Mount Technology has become popular because it allows for smaller and less massive devices. On the other hand, Through-Hole Technology is still a valid term in applications that need high durability and strong mechanical bonds.

All the time, if semiconductor manufacturing is moving forward, IC substrate manufacturers are spending millions of dollars on R & D for enhanced thermal management, better signal integrity, and improving overall efficiency. It has resulted in the increasing number of smaller nodes in the semiconductor fabrication process, which has subsequently increased the complexity of substrate design, allocating even more sophisticated materials and precision engineering. Sustainable production is part of the focus of the companies toward reducing wastes and increasing recyclability of electronic components.

Despite all the opportunities, the market is still challenged by supply chain disruptions, uneven raw material pricing, and the need for continuous innovation in line with the evolving semiconductor scenario. The competition among key industry players is very high, thus pushing these companies to develop cost-effective and high-performance solutions. The more the demand for advanced electronics increases, the more the Global Integrated Circuit IC Substrate market is expected to develop into controlling future prospects in semiconductor packaging and electronic device performance.

By End-Users

The Global IC Substrate market is the backbone of the electronics industry in terms of all possible applications. This market will sustain its course of growth, powered by the quest for innovation towards better efficiency and reliability in semiconductor solutions, as well as the rising demand for electronic devices due to technological advancements. The IC substrate also acts as a bridge between the semiconductor chip and the circuit board, electrically connecting and providing structural support. This makes it an essential component within several industries and provides overall performance and functionality of modern electronics.

The market is classified by end-user segments, where consumer electronics ranks among the top segments. However, the segment is witnessing a huge demand spike, given the immense traction that smartphones, laptops, consoles, and other smart devices command. These high-performance IC substrates will enhance the performance of devices by enabling faster processing and improving power consumption management.

The main market contributor apart from consumer electronics is the automotive sector, driven by the growing adoption of electric vehicles and growing numbers of advanced driver assistance systems. In modern automotive electronics, IC substrates will enable efficient communication between sensors, processors, and control systems. As automation and connectivity increase, the need for reliable and high-quality semiconductor components will continue to increase.

The other important segment of the IC substrate market is, of course, the telecommunications industry, which is gearing towards the development of 5G networks and does also now rely heavily on high-speed data connections. Advanced substrates enable efficient signal processing and power management, supporting infrastructure needed for a seamless communication sesstwon. The industrial sector also capitalizes on these components for automation and robotics in smart manufacturing processes. That being said, the more now moving toward digital transformation an industry becomes, the more it will require strong and efficient semiconductor solutions.

Healthcare applications are another primary area where IC substrates are increasingly important. Accurate processing of information and live monitoring of data in healthcare applications are achieved through such medical devices, diagnostic instrumentation, and wearable health monitors. The integration of semiconductor solutions will further enhance patient care and diagnostics through the incorporation of latest technology in healthcare systems. In addition, the aerospace and defense sector heavily relies on high-performance IC substrates for mission-critical applications. Such components must work even under extreme conditions, promising their durability under reliable performance in satellite systems, radar technology, and military-grade electronics.

Manufactures, thanks to their ongoing research and development, henceforth have been focused on the efficiency, miniaturization, and durability of IC substrates. The need for sustainability and energy efficiency has also led to innovating our products to use more eco-friendly materials and manufacture products in more eco-friendly processes.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$20,231.05 million |

|

Market Size by 2032 |

$44,180.46 Million |

|

Growth Rate from 2025 to 2032 |

12.0% |

|

Base Year |

2025 |

|

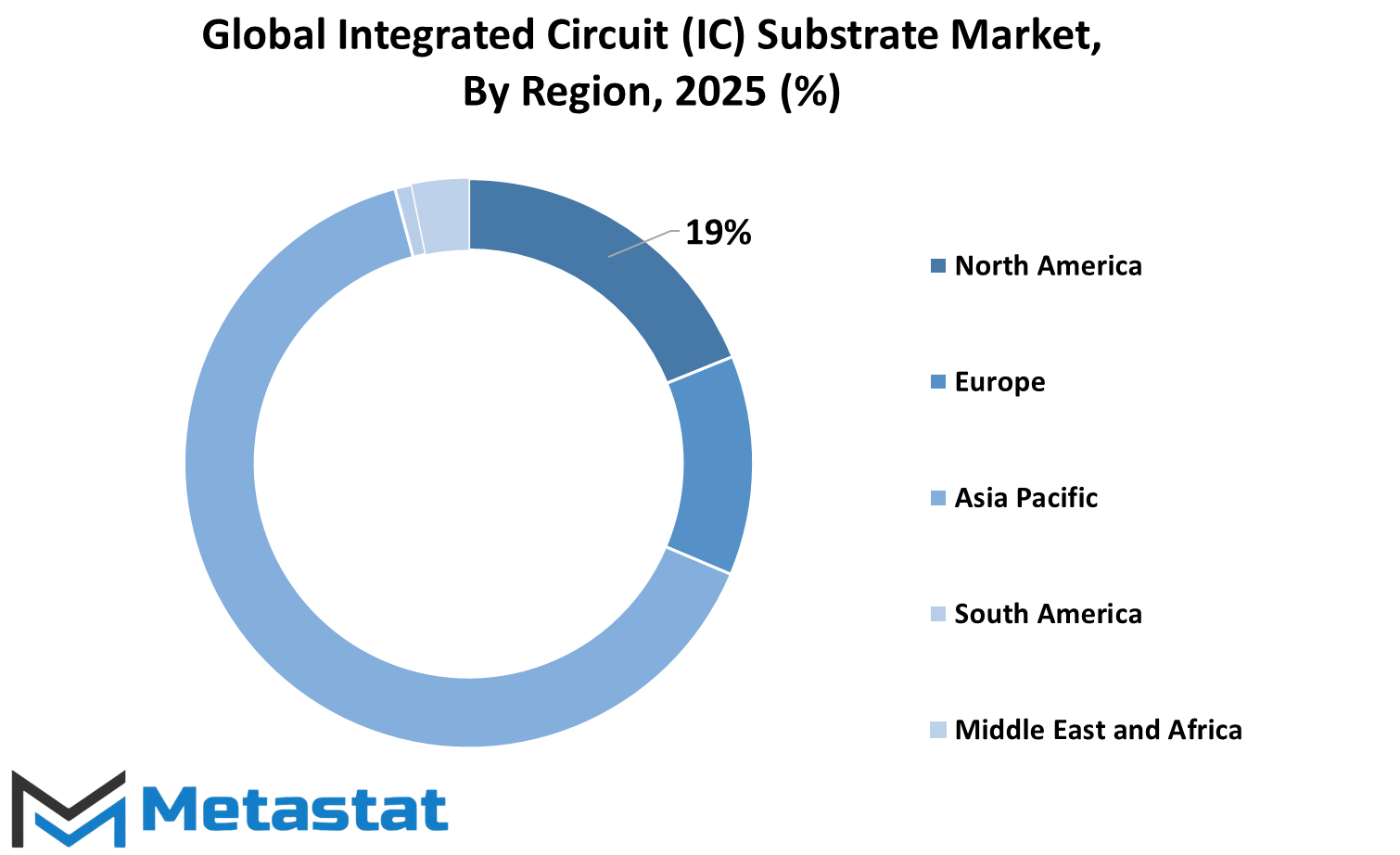

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global IC Substrate Market exhibits regional division that reflects the state of the technological advancement, manufacturing capabilities and market demand in these regions and other market developments will normally require access to transforming integrated circuit substrate market demand.

The most unique point in the IC Substrate Market regarding regions is that it has dispersed states of technological advancement, manufacturing capabilities, and market demand for these areas. In addition, the market is further disaggregated into key geographical segments upon which most vital pillars of growth and development of the industry rely. North America widely refers to the United States, Canada, and Mexico- where the market is driven by the advancement of semiconductor technology, backed by extensive research and development activity. The area flourishes from manufacturing capabilities from the strong electronics industry, support for innovative technology by the government, and presence of semiconductor manufacturers in the states.

Europe comprises countries from the United Kingdom to Germany and France, Italy and the remaining part of the continent. Germany and France are home to some established semiconductor industries while the UK stands a research and design hub for chip manufacturing. The European IC Substrates market influences regulatory frameworks, policy initiatives biased towards innovations, and increasing focus on sustainability and efficiency in electronic components.

Asia pacific stands among the fastest growing regions in the IC Substrate market with India, China, Japan, and South Korea as its key drivers. China is known for manufacturing capacity at scale unmatched globally and dominates the world's semiconductor supply chain. Most of the investments in research and development and production are poured by firms in Japan and South Korea with a rich technological background. India is on course to be a force to reckon with as by government incentives to encourage domestic semiconductor production coupled with foreign direct investment to producing electronics.

Gradually, the South American region, made up of Brazil, Argentina, and other neighboring countries, is debuting into the world semiconductor market. Brazil is an important demand contributor because of its burgeoning consumer electronics market. Even as the region continues to battle infrastructure and logistical challenges with supply chain-related issues, investment in technology could elevate the long-term prospects of the industry.

The Middle East & Africa region can be broadly classified as the Gulf Cooperation Council (GCC) countries, Egypt, South Africa, and the rest of the region. There are currently great opportunities for investment in smart cities, digital transformation, and telecommunications, which can really enhance the underdevelopment of the semiconductor market in this area. The country has increased demand for electronic components in South Africa, while GCC companies are just starting to deploy high-end technologies.

Government policy, industrial growth, and technological advancement will shape how different regions can benefit from the investment in the Global IC Substrate market. Thus, such ever-increasing demands on semiconductor components will, in turn, require transformation in integrated circuit substrate market demand for regional collaborations, overall enhancement of infrastructure, and other market developments.

COMPETITIVE PLAYERS

The global IC substrate market is one of the core segments through semiconductor physics, supplying the basic support for fabrication and working of advanced electronic devices. In this modern age, there has been rising demand for high-performance, reliable, and efficient IC substrates ever since they began to influence neighboring industries such as consumer electronics, telecommunications, automotive, and industrial automation. Interconnectivity among chips and circuit boards is established by substrates, which work as a critical part of semiconductor packaging, while maintaining the durability and electrical performance of these packages.

The increasing relevance of IC substrates lies in how their design completely dictates the overall performance and efficiency of electronic devices. Digital applications are on the wheel of continuous evolution, thus, the IC substrate industry caters to more than just device functionality. With electronics getting more complicated, substrate materials need to be designed for super thermal management, signal integrity, and miniaturization. The industry in itself is innovating in order to keep pace with the ever-settling demands posed by advanced designs of semiconductors. Whatever new developments in the focus sectors i.e. high-performance computing, artificial intelligence, 5G technology, and electric vehicles have majorly demanded advancements in IC substrates.

In this product market presided by stiff competition where the major players lay maximum emphasis on R&D in order to mitigate rivals in competition, some prominent innovators include Unimicron Technology Corporation; Ibiden Co., Ltd.; Samsung Electro-Mechanics (SEMCO); Nan Ya PCB Corporation; Shinko Electric Industries Co.; and Kinsus Interconnect Technology Corp. The companies innovate in substrate material, manufacturing processes, and production efficiency to meet ever-increasing global demand. Providing solutions that have been specifically designed for certain technology applications in the IC substrate industry are companies like AT&S, Simmtech Co. Ltd., Daeduck Electronics Co. Ltd., LG Innotek Co. Ltd., and TTM Technologies Inc.

Market growth of semiconductor packaging methods, establishment of data centers, and enhanced demand for miniaturization and efficiency in electronic devices have fueled growth. For the fulfilment of these demands, high-quality IC substrates from the Nation of ASE Group; Kyocera Corporation; Fujitsu Interconnect Technologies Limited; and Shenzhen Fastprint Circuit Tech Co., Ltd. play a crucial role owing to the strong market alignment.

Even while the industry is rapidly growing, it contends with obstacles such as supply-chain disruptions, raw material shortages, and high production costs. Nonetheless, companies have also been working on certain strategic levers as a way to counteract such predicaments by improving manufacturing efficiency and investing in sustainable production.

Integrated Circuit (IC) Substrate Market Key Segments:

By Type

- Flip Chip Ball Grid Array (FC-BGA)

- Flip Chip Chip Scale Package (FC-CSP)

- Ball Grid Array (BGA)

- Chip Scale Package (CSP)

- Multi-Chip Module (MCM)

- Others

By Material

- Organic Substrates

- Ceramic Substrates

- Glass Substrates

- Metal Substrates

By Manufacturing Process

- Surface Mount Technology (SMT)

- Through-Hole Technology (THT)

- Others

By End-Users

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial

- Healthcare

- Aerospace & Defense

Key Global Integrated Circuit (IC) Substrate Industry Players

- Unimicron Technology Corporation

- Ibiden Co., Ltd.

- Samsung Electro-Mechanics (SEMCO)

- Nan Ya PCB Corporation

- Shinko Electric Industries Co., Ltd.

- Kinsus Interconnect Technology Corp.

- AT&S (Austria Technologie & Systemtechnik AG)

- Simmtech Co., Ltd.

- Daeduck Electronics Co., Ltd.

- LG Innotek Co., Ltd.

- TTM Technologies, Inc.

- ASE Group

- Kyocera Corporation

- Fujitsu Interconnect Technologies Limited

- Shenzhen Fastprint Circuit Tech Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383