MARKET OVERVIEW

India Heat Exchangers Market will be one of the critical market segments in the industrial sector in the coming years. This industry will be integral to every kind of industry, ranging from power generation to oil and gas, chemical processes, and HVAC systems. An increasing interest in energy efficiency and sustainability will increase the demand for heat exchangers, leading to the enhancement of designs and technology. Energy consumption and carbon footprints would decide the product developments in this respect as environmental regulations trickle down.

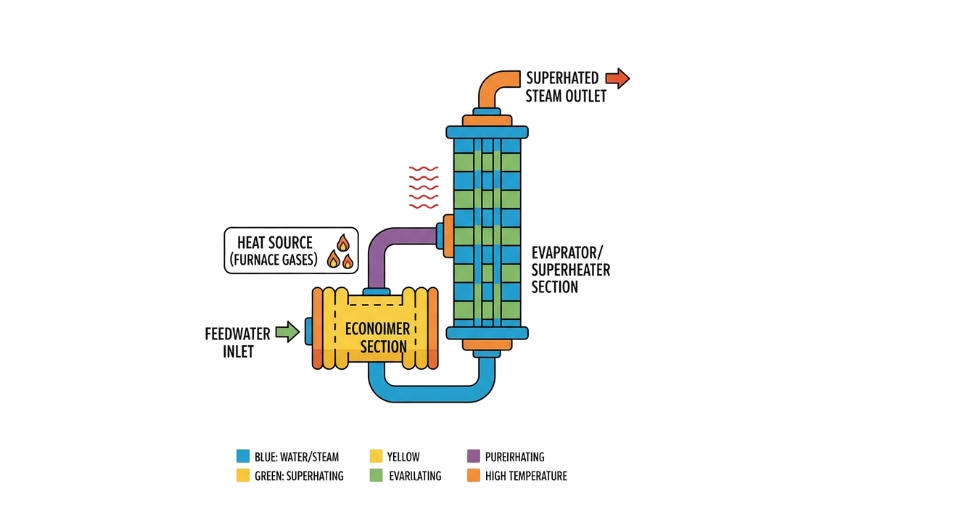

The applications for the product in the India Heat Exchangers market would be quite broad in the near future. In the power generation sector, heat exchangers would allow for efficient thermal energy transfer so that power plants can work at the maximum possible efficiency. This shall gain in importance with continuous expansion of India’s energy infrastructure to meet the incessant demand for electricity. Besides, in the context of renewable energy sources being sought for India, innovative heat exchange solutions are going to find tremendous demand in solar thermal applications and waste heat recovery systems.

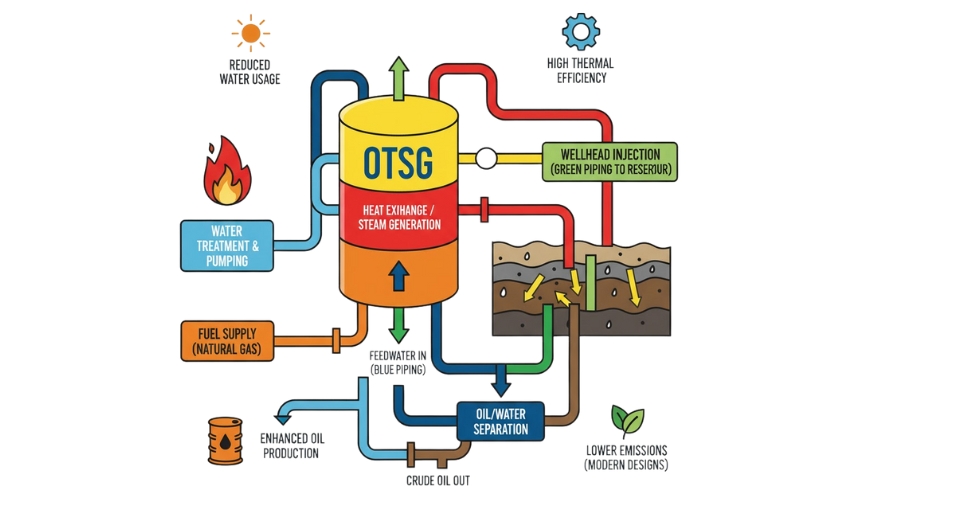

The oil and gas industry too will make tremendous progress through the India Heat Exchangers market. As exploration and production activities continue to gain momentum, reliable and efficient heat transfer systems will become increasingly necessary for productivity while maintaining safe and compliant production. Moreover, increases in automation and digitalization will make their presence more common as operators optimize performance while reducing downtime.

Further increase of the use of the heat exchanger in the chemical processing. As regards its maximization and decrease waste, it would focus on the engineering process development. Hence, producers will develop novel solutions to maximize their efficiencies. Cost of operation for the companies operating chemical plants will be decreased due to improved thermal management and recovery of energy by means of the heat exchanger. The future of the India Heat Exchangers market is going to become defined by collaboration, with technology providers and manufacturers coming together to create bespoke solutions specific to the needs of the industries they serve.

Advances in the India Heat Exchangers market will also contribute to developing HVAC systems. As urbanization increases, the demand for efficient heating and cooling solutions increases along with it. The change will be towards more compact and efficient designs that can easily fit into available systems. Superior heat exchangers will be a major positive influence on indoor air quality and energy performance, which would help to blend with the increased focus on sustainability in building design and operation.

Research and development activities would be a significant driving force for innovation in India’s Heat Exchangers market. Manufacturers will focus on new materials and technologies for better performance and life of the heat exchanger. Additionally, growing digital solutions will enable real-time monitoring and predictive maintenance for efficient functioning of these systems. Eventually, as the market matures further, companies will begin to focus on developing sustainable practices in which the products aid towards a greener future.

The India Heat Exchangers market will grow in terms of demand, owing to growing necessity in a wide array of industries. As industries go through more transformation, more innovation, and collaborative effort, with sustainability being at the forefront, a very bright future will unfold with heat exchange technology. This would not only boost economic development in India but also create a relatively cleaner and more energy-efficient environment.

India Heat Exchangers market is estimated to reach $1380.2 Million by 2031; growing at a CAGR of 6.9% from 2024 to 2031.

GROWTH FACTORS

Vast growth prospects of the market can be seen with pivotal and vital roles that heat exchangers play in the industry. With industrialization and modernized infrastructure, demand for oil and gas, power generation, and HVAC will inevitably move upwards. These are very essential systems in the pursuit of establishing processes that will help in creating minimal energy loss as well as developing waste for the optimal purpose of temperature control. As sustainability and energy conservation continue to gain momentum, investments that businesses undertake in an attempt to develop technologies that can be developed to their fullest efficiency are bound to propel this market forward.

The major growth factor is the enlarging manufacturing sector in India. Scaling up for industries calls for excellent thermal management systems. The primary function here is the use of heat exchangers, which allows processes that need heating or cooling and maximises energy use. The government's promotion of Make in India and other similar initiatives help in increasing local manufacturing further and thus stimulate demand for these systems.

The market is also driven by technological advances. On the material and design front, more efficient and compact heat exchangers are made possible for manufacturers. These will probably be of better performance and lower cost, thus attracting more industries. Then, with the adoption of automation and smart technologies by businesses, heat exchangers will also adapt to work with such a system to improve process control and monitoring.

However, a few factors can retard the growth of the market. Fluctuation in the economy and geopolitical instability can influence investment in infrastructure and industrial projects, thus putting a break on the growth of the heat exchangers market. In addition, high initial investments associated with advanced technologies in heat exchangers would dissuade the smaller organization from upgradation of their system, which in turn would also negatively impact the growth of the market as a whole.

Despite these issues, there are several opportunities for the India Heat Exchangers market. The rising demand in renewable energy will open opportunities for innovative thermal management solutions. As the country starts investing in solar, wind, and bioenergy, such systems will require heat exchangers in optimizing them. In addition, environmental issues will gain attention, giving rise to sustainable industries, which will help the market for energy-efficient, waste-minimized heat exchangers.

India Heat Exchangers Market is on the verge of great growth due to factors and opportunities present. While challenges do exist, the near future looks promising for the potential of this market continuing to grow and expand over the years.

MARKET SEGMENTATION

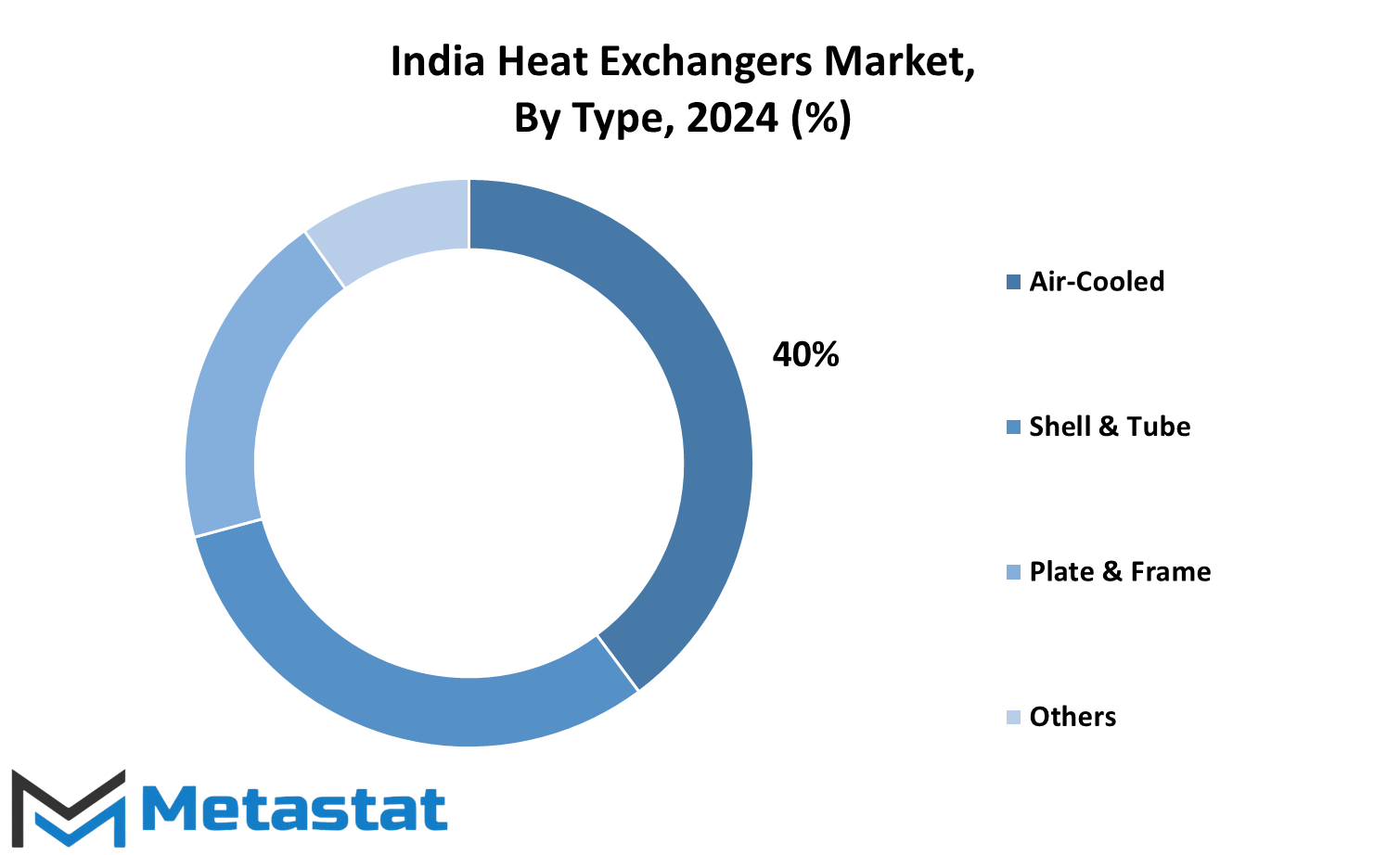

By Type

Technological developments and the increasing consciousness for energy efficiency will bring about a sea change in the India Heat Exchangers market. It encompasses heat exchangers, playing a crucial role in various industries by transferring heat between two or more fluids. This technology becomes increasingly important with growing scales in HVAC, power generation, and chemical processing. Thus, there will be an increase in demand for effective management of energy, driving up this market’s growth in the near future.

There are a variety of market types, and air-cooled, shell and tube, and plate and frame heat exchangers are some of the common ones. Air-cooled heat exchangers will be in very good growth because industries will be looking for good and eco-friendly solutions, and these systems use ambient air to cool fluids, thus reducing their water resource requirements, which is a particularly relevant concern for most regions in India. Their operation without water makes them quite crucial for maintaining safe operations for industries in arid regions.

Shell and tube exchangers, which are quite robust as well as efficient in the market will also be predominant in the market. These are tubular and contain a series of tubes- one fluid flows through the tubes and other fluid flows around them. This design enables shell and tube exchangers to have effective heat transfer, thus being an excellent solution for high-pressure applications. The general versatility and the value lying in that make it a continued demand at a wide scale across various industries- particularly the oil and gas industries wherein the efficiency and safety are always of premier importance.

Plate and frame exchangers, compacted with high efficiencies, will be the need of the future as industries continue pushing for more space efficacy and thermal performances. These exchangers comprise several very thin plates with a highly diverse surface area of heat exchange, thereby enabling effective thermal transfer. As far as applications are concerned, they are versatile and range from food processing to pharmaceuticals. Since companies stress saving energy and the environment, this will spur the demand for plate and frame heat exchangers.

India Heat Exchangers market exhibits a state of growth on account of adopting leading-edge technologies and energy efficiency in various industries. Further, the segmentation into air-cooled, shell and tube, and plate and frame heat exchangers represents the wide range of industrial requirements to address performance improvement with reduced adverse environmental impacts. The rising concerns among industries with respect to sustainable business models will help in further evolution of the market through innovative solutions for better management of issues in tomorrow’s world.

By Material

It is a growthful and dynamic market that goes ahead in different industries like the power generation, manufacturing, and oil and gas. Heat exchangers are indispensable equipment that transfer heat from one or more fluids without mixing with each other and are considered an important aspect of improving energy efficiency and optimizing processes. As India continues to industrialize and modernize its infrastructures, the need for heat exchangers will continue to grow. This would be up for grabs for the both energy-efficient solutions and the country's commitment toward sustainable development.

The India heat exchangers market can be categorized based on materials. The main ones are carbon steel, stainless steel, nickel, and others. Carbon steel is among the most used, as it offers high strength along with being cost-effective. This makes it applicable to many but may not be the best for corrosion-prone areas. The stainless steel can also be considered excellent in corrosion resistance; thus, it can be very good for use in food and pharmaceutical industries. These sectors aggressively promote the idea of hygiene and cleanliness, so demand for stainless steel heat exchangers will boom in the future.

Nickel-based heat exchangers are also essential in the market, particularly for specific applications requiring extreme temperature and aggressive media. The aerospace and chemical processing industries leverage nickel's advantage regarding reliability and performance. Other materials also find application depending on required conditions, such as titanium and aluminum, where there are particularly exclusive benefits regarding weight and thermal conductivity.

India heat exchangers continue to be on the growth path with proposals from the government for renewable sources of energy such as solar and wind, which would increase the space for utilization by heat exchangers in systems of energy. Technological developments would make the heat exchanger more compact and efficient, and hence the attractiveness factor for application in various sectors of industry. The requirement for energy-efficient solutions will push companies to seek newer innovations in the market, and with this, the demand for heat exchangers will increase. Their future is therefore well secured in India, driven by diversity in material options and a need for efficient energy solutions. Heat exchangers will remain essential to industries in pursuit of sustainability and operation efficiency as they strive to adapt to change.

By End-Users

This India Heat Exchangers market is growing due to increasing recognition, by many industries, of the role of thermal management in their operations. Thus, within heat exchangers, there lies a vital role in transferring heat between fluids in various applications to achieve efficiency in energy transfer and efficiency in process optimization. Let us look at future factors that will influence this market.

Growth in the chemical and petrochemical sectors, which will require heat transfer solutions to produce more efficiently and minimize energy consumption, will be one of the main drivers. The increasing importance of the chemical manufacturing industry in India will raise great demand in heat exchangers. Demand for advanced technologies to comply with increasingly stringent environmental laws and better efficiency will be the driver of innovation and investment.

The oil and gas industry will also have a significant influence on the India Heat Exchangers market. With India’s on-going efforts to enhance energy security and reduce import dependence, exploration as well as production activities are expected to surge. This would require a significant demand for heat exchangers mainly in upstream and downstream operations. Companies will look at making changes to their thermal management systems so that their processes can be optimized, costs reduced and environmental standards met.

In other industries, HVAC and refrigeration markets will see maximum growth in view of growing urbanization and a rise in population. There is an ever-growing demand for heat exchangers throughout residential and commercial buildings as the necessity to build efficient heating and cooling systems increases. With enhanced technological designs of heat exchangers, there is expected to be increased energy efficiency and lower business ventures operating costs.

Another critically significant sector that will be shaping the India Heat Exchangers market is the power generation sector. With India setting its sights on renewable sources of energy and upgrading its already existing infrastructure, companies would look at stable heat transfer solutions as a top priority. Companies would focus more investments in heat exchangers that make power plants highly efficient and low on environmental debacles.

The production segment will continue to grow due to the increasing thrust of demand from food and beverage manufacturers, including temperature maintenance as the trend becomes healthier and more sustainable food options for the consumer.

Overall, the India Heat Exchangers market is poised to be an enormous growth market in different spheres of the end user. As the said industries evolve their mindset toward challenges and future needs, so improvement in the process is looked for. The demand for effective heat transfer solutions, through the use of a heat exchanger, will necessarily be higher in the future. And new innovations and development will bring forth much excitement in the role of the different applications of these heat exchangers.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$866.8 Million |

|

Market Size by 2031 |

$1380.2 Million |

|

Growth Rate from 2024 to 2031 |

6.9% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

COMPETITIVE PLAYERS

The India Heat Exchangers market is poised for significant growth as the country continues to advance in various industrial sectors, including power generation, oil and gas, food processing, and chemical manufacturing. Heat exchangers play a crucial role in these industries by facilitating efficient heat transfer, thereby improving energy efficiency and reducing operational costs. As India aims to enhance its manufacturing capabilities and reduce its carbon footprint, the demand for advanced heat exchanger technologies is expected to rise sharply in the coming years.

Key players in this market are well-positioned to meet this growing demand. Companies such as Thermax Limited and Alfa Laval have established themselves as leaders in the industry by offering innovative solutions that cater to diverse customer needs. Thermax, known for its energy and environment solutions, provides a range of heat exchangers that cater to various applications, ensuring efficiency and reliability. Similarly, Alfa Laval’s expertise in heat transfer technology positions it as a preferred choice for many industrial applications.

Larsen & Toubro Limited, another significant player, leverages its engineering prowess to deliver high-performance heat exchangers tailored to complex projects. Meanwhile, the MERSEN Group specializes in designing custom solutions for challenging thermal management requirements, ensuring that industries can operate effectively under various conditions. Godrej & Boyce Mfg. Co. Ltd. and Kelvion Holding GmbH also contribute to the market with their comprehensive product offerings, focusing on sustainability and energy efficiency.

Bharat Heavy Electricals Limited (BHEL) is renowned for its large-scale manufacturing capabilities and offers heat exchangers that meet international standards. Companies like Heat Transfer Equipments Pvt. Ltd. and HRS Process Systems Ltd. focus on niche applications, providing specialized products that enhance efficiency in specific industrial contexts. SPX FLOW, Inc. and GEA Group are notable for their emphasis on technological innovation, ensuring that their heat exchangers are equipped with the latest advancements.

As the demand for energy-efficient solutions continues to rise, other players such as Hindustan Dorr-Oliver Ltd., Thermal Systems (Hyderabad) Pvt. Ltd., and Universal Heat Exchangers Limited are also expected to thrive in this market. In addition, firms like Kinam Engineering Industries Pvt. Ltd. and BGR Energy Systems Limited are leveraging their engineering expertise to develop cutting-edge heat exchanger solutions.

In summary, the India Heat Exchangers market will witness significant transformation driven by the key players who are committed to innovation, efficiency, and sustainability. As industries evolve, these companies will play a vital role in shaping the future landscape of heat exchange technology in India.

India Heat Exchangers Market Key Segments:

By Type

- Air-Cooled

- Shell & Tube

- Plate & Frame

- Others

By Material

- Carbon Steel

- Stainless Steel

- Nickel

- Others

By End-Users

- Chemical & Petrochemical

- Oil & Gas

- HVAC & Refrigeration

- Power Generation

- Food & Beverage

- Pulp & Paper

- Others

Key India Heat Exchangers Industry Players

- Thermax Limited

- Alfa Laval

- Larsen & Toubro Limited

- MERSEN Group

- Godrej & Boyce Mfg. Co. Ltd.

- Kelvion Holding GmbH

- Bharat Heavy Electricals Limited (BHEL)

- Heat Transfer Equipments Pvt. Ltd.

- HRS Process Systems Ltd.

- SPX FLOW, Inc.

- GEA Group

- Hindustan Dorr-Oliver Ltd.

- Thermal Systems (Hyderabad) Pvt. Ltd.

- Universal Heat Exchangers Limited

- Kinam Engineering Industries Pvt. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252