MARKET OVERVIEW

The Global Inactive Yeast Cultures Market and its corresponding industry is likely to figure prominently in shaping the future of many sectors such as food and beverage, pharmaceuticals, and animal feed. Inactive yeast cultures refer to cells of yeast made unviable through pasteurization or thermal treatments-alien to the living condition but still containing all nutritional and functional values. It can be utilized for a variety of flavor enhancements, texture complements, and as an unfermented source of vitamins and minerals without being dependent upon the fermenting capability of active yeast.

Thus, the Global Inactive Yeast Cultures Market covers a myriad of applications driven largely by the increase in demand for natural products and health-centric products. In fact, as inactive yeast cultures contribute significantly towards savory applications in the food and beverage industry like soups, sauces, and seasonings, they would provide richness in flavor scripted as umami. This is in line with today's trend towards clean-label products because of consumer preference, as the culture serves an enhancing flavor feature within a natural sense.

In the pharmaceutical industry, inactive yeast cultures are gaining importance because of their health-promoting impact. These appear as an ingredient in the preparation of many dietary supplements and functional foods because of their wonders of containing more beta-glucans, which promote healthy immunity. Also, being one of the important components of probiotic and prebiotic products, they are known for their potential in gut health development, digestion improvement, and many others.

The Global Inactive Yeast Cultures Market has important targets in the animal feed sector. These cultures are incorporated into feeds as nutritional enhancers with some added disease resistance. Their benefit for gut health, improved immunity, and feed conversion efficiency make them promising products in the eyes of animal nutritionists and feed manufacturers.

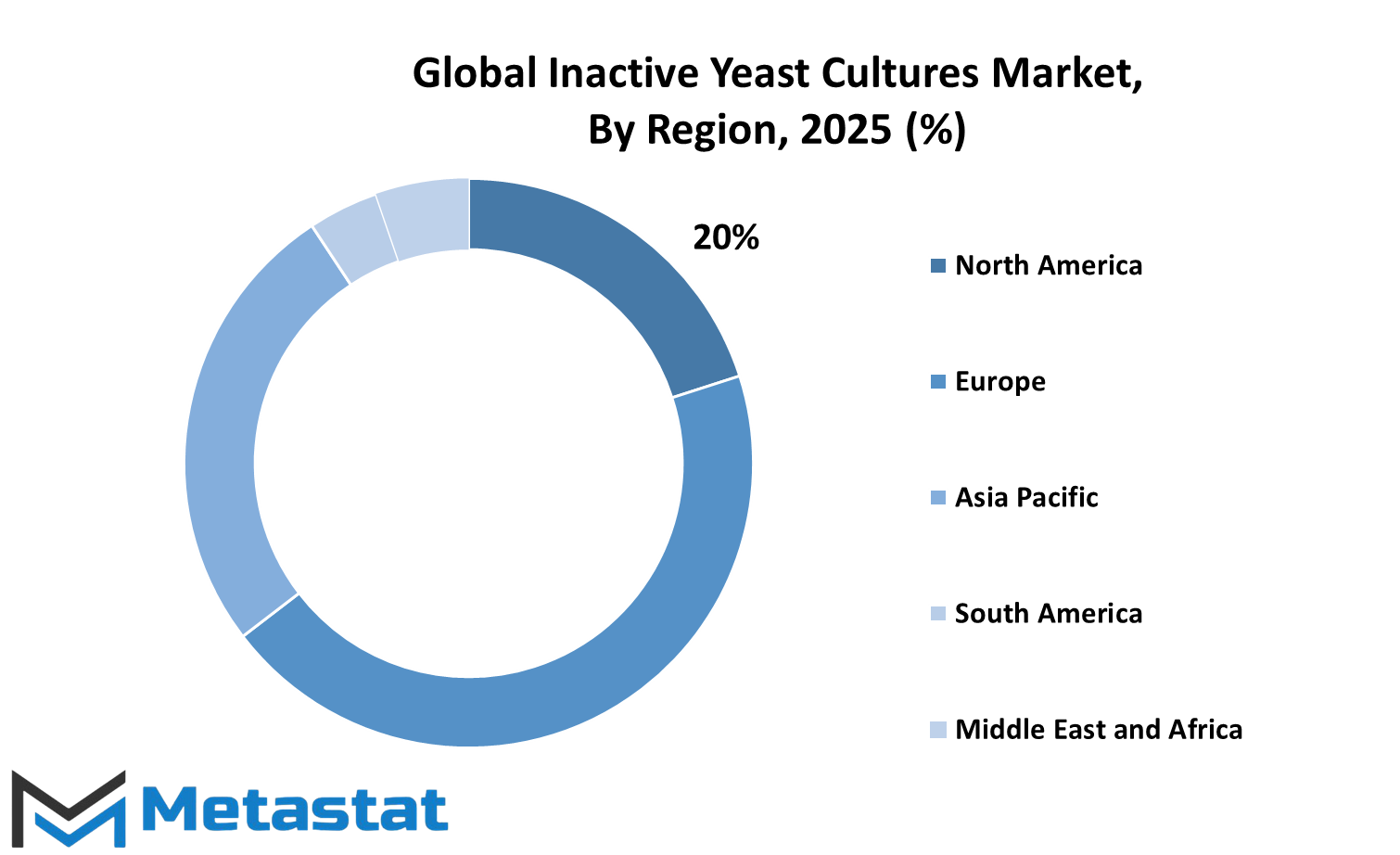

Geographically, the reach of this market spans North America, Europe, Asia-Pacific, Latin America, as well as the Middle East and Africa. Each of these has different specific opportunities and challenges, depending on consumer preferences, regulatory environment, as well as industrial advancement. In both North America and Europe, this demand may translate into an increase in consumption of such products and subsequently into market growth. There will also be an increasing demand in the Asia-Pacific regions as these countries are developing their food industries and pharmaceutical industries very rapidly.

However, with the changing nature of the Global Inactive Yeast Cultures Market, product development, and innovation in application would come into greater focus. Manufacturers would be expected to modernize the functional properties of inactive yeast cultures to diversify their flavor profile, increase their nutritional content, and widen their application range.

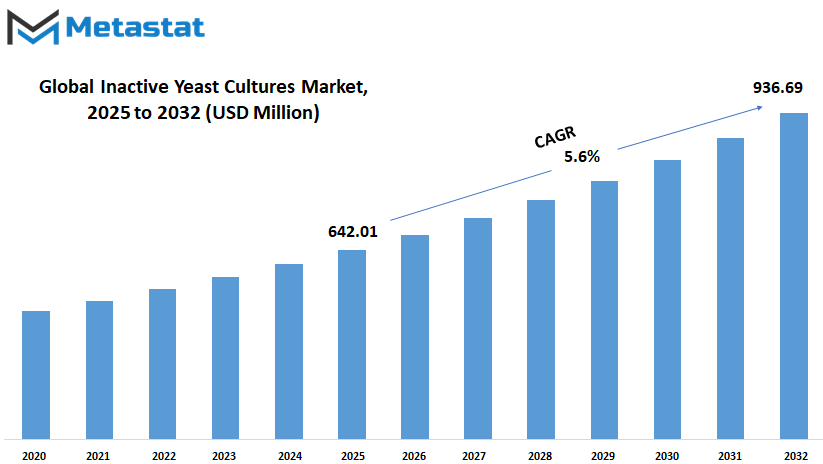

Global Inactive Yeast Cultures market is estimated to reach $936.69 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The Global Inactive Yeast Cultures market is expected to grow positively in the future. With rising awareness of naturality and sustainability, this demand for natural feed additives is emerging as an essential driver of this growth in animal nutrition - such and the growing emphasis on finding alternatives to antibiotics owing to concerns of antibiotic resistance and the need to produce healthier livestock.

With the objectives of improving gut health, immunity, and growth in animals without the risk factors associated with antibiotic use, inactive yeast cultures are now seen as preferred solutions. This trend will develop further, leading to wider adoption of these yeast-based products.

Another major growth driver for Global Inactive Yeast Cultures is the expansion in fermentation-based industries. The growing ferments, namely, in foods and beverages, and the burgeoning biofuels industry, have demanded higher quantities of yeast cultures. Inactive yeast cultures are very crucial for flavor improvement, texture enhancement, and contribution in production of various fermented products. As industries focused on innovating and scaling expand, the demands for these high-quality yeast cultures will increase. This growing application across the broad scope of sectors promises to keep the momentum up for the market.

All these, however, have their own drawbacks that may affect Global Inactive Yeast Cultures hindering growth. One of the biggest challenges would be an inconsistency in the availability of raw material. Yeast production highly relies on agricultural from and industrial by-products; thus, any stoppage in the supply chain results in hardship on production costs and pricing. This inconsistency also brings uncertainty in this market and may affect its consistency in inactive yeast culture availability. Also, some end users still know little about the advantages and uses of inactive yeast cultures. For some countries, improper education and understanding regarding their benefits leads to narrow adoption, hence slowing down the market growth.

Future opportunities will be work on promising advances in the applications of functional yeasts. Novel applications in nutrition and health will also be opened to research into yeast-derived bioactive compounds. With continued research and development, the potential to develop new yeast-based products with specific health benefits will increase. Such progress may bring in new markets and applications and make Global Inactive Yeast Cultures even more important for many industries.

There will be demands for natural feed additives, expansion of fermentation-based industries, and constant innovation that will define market growth in the future. Addressing things like fluctuations in supply chains and lack of awareness would become very important for exploiting this market potential.

MARKET SEGMENTATION

By Grade

In the coming days, global inactive yeast cultures are going to garner much more importance in most industries. These yeast cultures are not alive but retain all their nutritional and functional properties; they are thus very versatile and effective. As the demand for sustainable and natural products becomes increasingly global, there is a large chance that inactive yeast cultures will gain even more exposure and use. The use of inactive yeast across various sectors will continue to evolve and make them promising for the future of food production, animal nutrition, and pharmaceuticals.

One of the largest applications, among the various applications of inactive yeast cultures internationally, is within the animal feed industry. The feed-grade version is a simple natural enhancement to the diet of livestock. With increasing concern for healthier livestock practices, inactive yeast cultures will become increasingly busy in making available the nutrients that are needed. They improve digestion, boost immune systems, and support the general well-being of animals. More farmers are emphasizing reducing antibiotics used in farming and this type of yeast culture will provide a safe and effective alternative preparation for animal benefits. This will likely promote wider adoption of feed-grade inactive yeast cultures by farmers worldwide and hence promise future generations of sustainable responsible livestock management.

Among the areas that are most likely to be ever more relevant to food-grade inactive yeast cultures is the food industry. These cultures are used improving the flavor, texture, and nutrition of numerous food products. As consumers become more demanding regarding natural and minimally processed foods, so does to the quest for clean-label ingredients rise. Food-grade inactive yeast cultures completely fulfill this demand, as they might provide a wealth of vitamins, minerals, and proteins. These cultures would very likely entice health-conscious consumers as they could act as natural flavor enhancers for umami taste without any artificial additives. In the future, they are likely to find applications in an even larger variety of plant-based and functional foods, contributing to the worldwide current for healthier eating patterns.

The pharmaceutical sector would, of course, widen its range on even more pharma-grade inactive yeast cultures. Such cultures have a great potential in supplementing and developing medicines for human health. They contain rich amounts of beneficial compounds that help improve immunity, gut health, and overall wellness. As preventive health care will increase as we go forward, so will pharma-grade yeast cultures become very important ingredients for next-gen health products. This area of observation and development would seem likely to complicate matters somewhat by opening new applications for further enhancing these cultures' claims regarding staying healthy over a long period.

By all indications, the market for inactive yeast cultures will not dwindle anytime soon and will most likely continue to grow as associated benefits gain more and more awareness. Similarly, benefits derived from inactive yeast cultures across the feed, food, and pharmacy industries will mirror a sea change towards natural, sustainable, and health-oriented products.

By Form

Already, much of the health and nutrition industry turns to inactive global yeast cultures. Such products will most likely demand as many customers as the world grows ever-more health-centric and turned toward natural plant-based supplements. Inactive (almost) yeast cultures consist of dried inactive yeast cells rendered from yeast culture by being killed by heat treatment so that they no longer ferment but do have their nutrients retained in such forms. Rich in vitamins, minerals, and other physiologically active components, they provide an alternative way to be healthy in a simple, easy, and effective way.

With regards to form, the global market of inactive yeast cultures has many forms to meet different requirements and preferences. Powder is the most common and widely used. It can be easily introduced into food and beverages without any hassle, so its usage becomes an everyday affair. It is often sprinkled on top of smoothies, blended into soup, or added to baked goodies, for instance, to boost nutrition along with taste. These powdered yeast cultures are essentially popular among health enthusiasts as they have a lot of versatility.

The other popular form is in the form of flakes, which is often used for seasoning or topping. It has a slightly cheesy and nutty flavor, making it a perfect match for salads, popcorn, or pasta. These flakes not only improve the taste of dishes, but they will also add a little extra dose of nutrients to the dishes, meaning that they would also grab attention from people interested in flavor.

Further, there are tablets and capsules that can make taking global inactive yeast cultures a really simple and controlled affair. For busy people leading hectic lives and wanting no-fuss supplementation, this form is the best usage of them all. No measuring, no mixing, with these you just pop one with a glass of water and you are on your way. This is a kind of form often favored by those who would want convenience and consistency in their health routine.

The future is certainly bright for global inactive yeast cultures, as the awareness of their benefits should continue to grow. The more such benefits are unearthed through research-the more important contributions such cultures can make in supporting immunity, digestion, or general well-being-the greater the spread of demand for all forms of these products will become. Innovations may also come up with newer and better production and formulation options that would create more age-appropriate, user-specific formulations.

Like any other predictive element of the future, in which people will constantly be seeking natural and efficient health solutions, global inactive yeast cultures will stay at the player's end. Whether it is powdered, flaked, tablet, or capsule form, it brings flexibility and reliability in support of a healthy lifestyle and making it a modern ingredient in nutrition.

By Application

Global Inactive Yeast Cultures have a flourishing future ahead, with a common notion that demand for more natural and sustainable ingredients would hit various applications globally. Increasing applications with considerable benefits make these yeast cultures popular now. The growing awareness of what goes into one's food as well as the impact it has on health and environment will increase the market for inactive yeast cultures for food and beverages, dietary supplements, animal feed, and many more.

Due to their intrinsic properties as well as the capability to provide flavor and nutrition to foods, inactive yeast cultures are widely valued in the food and beverage industry. In fact, they're gaining popularity as clean-label ingredients to work easily with consumers looking for products loaded with the nutrients, rather than artificial add-ins. They improve texture and taste of everyday foods while offering nutritional components. Consumption of inactive yeast cultures should grow in product categories as more people adopt plant-based or healthy diets around the world. This will create a way for these products to develop flavorful and nutritious formulations using environmentally-friendly techniques.

Dietary supplements will also be a major market for inactive yeast cultures in the future. The population is turning towards preventive health, thus the heightened need for natural health supplements. Filled with vitamins, minerals, and antioxidants, inactive yeast cultures are a must-have ingredient that aids in overall health benefits. Boosting immune functions, aiding the digestive system, and making up for several nutrients missing in modern diets, and as consumers continue to realize the benefits of natural supplements, inactive yeast cultures will play a great role in the future.

Animal feed is another important application where these yeast cultures are used and offer nutritional benefits to livestock. Inactive yeast cultures are used to improve the well-being, digestion, and growth of animals. Farmers and producers today increasingly seek better, natural, effective feed components to assure highest animal welfare and meet growing food production standards. This trend of creating more sustainable and efficient feeding options would most probably enhance the demand for inactive yeast cultures in the future.

Inactive yeast cultures have not been wholly confined to these applications: the other potential application areas could include pharmaceuticals, cosmetics, and biotechnology through their natural properties and nutritional content. In the course of research and innovation, additional applications or development opportunities for inactive yeast cultures will probably emerge which could further their impact in different sectors.

Inactive yeast cultures have a very bright future, primarily shaped by the increasing demand of consumers require for products to be natural and sustainable in nature.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$642.01 million |

|

Market Size by 2032 |

$936.69 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global inactive yeast cultures market is characterized by the unique features and requirements of different regional markets, each playing a different role in the development of the market and its future outlook. North America, in turn, assumes a unique dimension, whose overall advancements in agriculture, high demand for nutritional supplements in animal feed, and intensive R&D activities drive it. The United States is expected to spearhead this trend due to the highly advanced industries and technological innovations. However, Canada and Mexico will also add a substantial part owing to the growing potential among the two countries through developing livestock sectors and focusing their attention to high-quality feed production.

Europe remains to take part in it, with the likes of the UK, Germany, France, and Italy leading the way. Add to that the region's emphasis on sustainable farming and its stringent regulations on feed additives, which will become even more supportive for incorporating Inactive Yeast Cultures into feeds. Awareness on the advantages of natural and safe feed products are sure to boost the market further, while research-backed enhancing product quality and energy efficiency. The rest of Europe will eventually follow suit and take up such cultures into its fold as a vital part of modern agricultural practice.

The Asia-Pacific market stands to benefit most in this regard, marked by rapidly developing economies with ever-growing demand for high-quality animal products. Leading this charge is India, with its expanding agriculture and rising awareness of advanced feed solutions. China follows close behind. Driving markets are also those of Japan and South Korea, concentrating on their technological innovation and quality standards. Importantly, as modernization takes place in farming practices, a gradual rise in demand for Inactive Yeast Cultures in the region is envisaged, thereby ensuring a steady growth of this market force.

Brazil and Argentina promise bright prospects for the rest of South America, where agriculture contributes substantially to the economies. Increasing livestock and improving health and productivity among animals are possible ways to fuel demand concerning advanced feed solutions. The rest of South America will continue along the same lines as these two, creating parts of potential growth areas for the market because of increased awareness and adoption.

Countries such as the GCC nations, Egypt, and South Africa are the driving forces behind the growth of this market within the bounds of the Middle East & Africa. The gradual adoption of modern agricultural practices by these areas tends to incorporate an increased interest in livestock productivity as well as feed quality. This aspect is expected to encourage proliferation in the use of Inactive Yeast Cultures, translating to new potentials for growth and development as infrastructure and technology continue to improve. The global inactive yeast cultures market represents itself as a truly diverse scenario, with every region contributing to its ongoing evolution.

COMPETITIVE PLAYERS

The Global Inactive Yeast Cultures industry is on track to witness extraordinary growth in the future, buoyed by rising demand from various sectors and persistent efforts on the part of key industry players. As more and more industries realize the advantages of inactive yeast cultures, companies are aiming to capitalize on them, widen their product range, and improve their market presence. With the nutritional profile and versatility of these cultures, they are steadily gaining acceptance within the areas of food production, animal nutrition, and pharmaceuticals. Therefore, as acceptance grows, more players will find increased competition, with innovation, quality, and customer satisfaction gaining importance.

In this industry, a few leading companies are seen to be moving this industry forward in the interest of greater financial gain. Lesaffre and Lallemand Inc. have always been renowned for their know-how and global presence, ceaselessly testing the limits of product development and research. Angel Yeast Co., Ltd. gained further clout with its renowned production technology and quality, while ADM Animal Nutrition pushes animal health more with new-age solutions.

Concurrently, Leiber GmbH and Biorigin have significantly developed specialized yeast-based products for the industry in question. Ohly GmbH and ABF Ingredients are also actively present in the same area and build their portfolios with active yeast cultures to meet the changing needs of the market. Titan Biotech Limited has been able to earn esteem by virtue of its excellent quality and reasonably priced solutions, while DSM Nutritional Products stands out with an extensive research and development setting. Bio Springer and Pakmaya are important contributors, too, supplying reliable products and forging strong partnerships in global markets.

The future looks even tougher for competitive forces within this industry. Companies will invest more in technologies and sustainability in order to secure their positions in the market. Product development will focus on innovations toward the yeast-based range for health-conscious consumers and industries looking for natural functional ingredients. There might also be some increase in partnerships and collaborations that would allow companies to pool their expertise and cater to a wider audience.

As demand increases, the outlook for the Global Inactive Yeast Cultures industry seems optimistic. The combined efforts of these leading companies to enhance products and quality are shaping growth in this industry in response to market needs. With sustainability, innovation, and customer satisfaction, these players are set to push the industry ahead to fulfill the ever-evolving needs of different sectors worldwide.

Inactive Yeast Cultures Market Key Segments:

By Grade

- Feed Grade

- Food Grade

- Pharma Grade

By Form

- Powder

- Flakes

- Tablet

- Capsule

By Application

- Food and Beverages

- Dietary Supplements

- Animal Feed

- Others

Key Global Inactive Yeast Cultures Industry Players

- Lesaffre

- Lallemand Inc.

- Angel Yeast Co., Ltd.

- ADM Animal Nutrition

- Leiber GmbH

- Biorigin

- Ohly GmbH

- ABF Ingredients

- Titan Biotech Limited

- DSM Nutritional Products

- Bio Springer

- Pakmaya

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252