MARKET OVERVIEW

The global impact investing market is building a future where financial return and social benefit coexist in new ways that blur the lines on conventional investment thinking. As the sector shifts beyond its nascent phase, it will no longer be considered a niche option but as a dominant driver of how capital will be allocated globally. Future market trends will not just focus on profitability but insist upon quantifiable outcomes that support social and environmental advancement.

In the future, the global impact investing market will experience an increasing use of technology to enhance transparency and accountability. Sophisticated data analytics and AI will establish stronger systems for quantifying the actual impact of investments. It will enable investors to move beyond commitments and receive precise impact reports prior to making investment decisions. The awareness on proof of positive effect will construct self assurance, drawing a brand new technology of buyers who want each economic returns and actual contribution to society.

Geographically, the growth will not be confined to developed economies. Emerging markets will play a pivotal role in figuring out destiny opportunities, specifically in fields like renewable electricity, schooling, and available healthcare. These markets will offer rather socially relevant projects in addition to capacity for sustainable economic returns. Infrastructure creation, clean power shifts, and inclusive economic structures will become pillars of funding techniques in those markets.

Another aspect that will drive the global impact investing market to its next level is the evolution of regulations. Governments and international bodies will bring in structured systems to measure impact uniformly. This will level the playing field so that all investors will be able to analyze projects using a uniform set of criteria. With time, this regulation will lead to increased participation of institutional investors, making impact investing an optional strategy a mainstream necessity in global portfolios.

The behavioral and cultural change among consumers will also be defining. Consumers will keep to anticipate that corporations will make contributions in the direction of addressing essential worldwide issues which include climate exchange, inequality, and get right of entry to schooling. Such an expectation will upload stress on companies to become extra sustainable, a good way to cause them to extra appealing to impact-pushed buyers. As a end result, those businesses that don't undertake those values risk undermining long-term credibility, whilst those companies adopting them might be seen as leaders inside the market.

Staying in advance of quick-term horizons, the destiny of this area might be marked via collaboration. Collaborations among governments, non-profits, and personal organizations will accentuate, building an atmosphere wherein financial resources and social missions operate aspect by means of facet. This collaborative approach will hasten the development of worldwide challenges, confirming that investments are not merely about individual interests but about creating a more favorable world. The global impact investing market will not just grow in size but also reshape the rules of investing, making purpose and profit the inextricable engines of economic and social change.

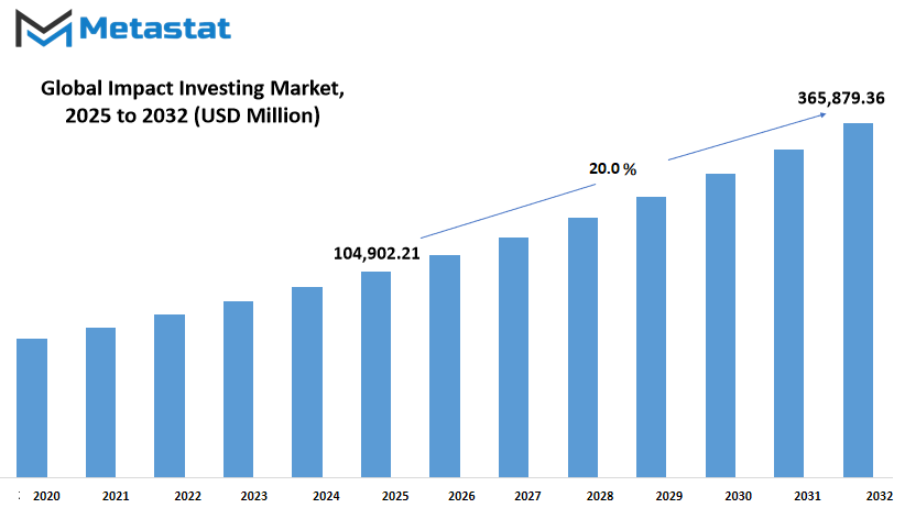

Global impact investing market is estimated to reach $365,879.36 Million by 2032; growing at a CAGR of 20.0% from 2025 to 2032.

GROWTH FACTORS

The global impact investing market will keep growing as more and more investors seek options for aligning their portfolio with social and environmental values. Among the strongest forces behind this trend is the increasing demand for sustainable and socially responsible investments. People now not want to have their cash producing earnings best; they also want it to do a little top. Individual and institutional investors are more and more focusing on where their money is going and what impact it has on society and the sector. This changed perspective is encouraging economic establishments to offer merchandise that respond to this, supplying a stable floor for the growth of effect investing globally.

A 2d key motive force is increasing awareness about environmental and social governance (ESG) values. ESG isn't a nicety anymore; it's far an imperative attention for businesses and buyers. Firms are being driven to expose moral conduct, decrease their carbon imprint, and make a contribution to social well-being. Investors perceive firms with sturdy ESG performance as less risky and greater sustainable over the long term. This growing interest in the direction of ESG isn't always only defining company strategies but also funding decisions international. As phrase spreads, it's going to similarly spur the enlargement of impact investments.

Even with this optimistic forecast, the global impact investing market has challenges that cannot be discounted. Among the largest constraints is the absence of standardized frameworks for measuring impact. While numerous organizations profess to be creating positive impacts, there is no common framework to calculate and compare these effects. This complicates it for investors to assess if their funds are actually creating the desired impact. Another obstacle is that there are few quality impact investment options. Though demand is strong, the supply of viable and scalable projects is still playing catch-up, which might deter some investors from participating in the space.

Alternatively, these gaps present great opportunities. The use of technology for impact reporting and assessment will revolutionize the way results are measured and reported. Digital solutions, data analytics, and AI-based platforms will assist in developing transparency and investor confidence through clean, credible metrics. Moreover, the growth of impact investment funds in the emerging markets will be a key player in the future. These markets hold the untapped potential for ventures that can provide both financial returns and social impact. As increasingly more money pours into these markets, they not only will benefit the local economy but also propel global impact investing to new levels.

MARKET SEGMENTATION

By Asset Class

The global impact investing market is becoming more and more popular as traders searching for investments that offer both economic returns and nice social and environmental effect. It is more than just conventional making an investment, because it combines measurable effect with profitability. From a gap activity, it has advanced into a first-rate method that establishments and people use whilst building lengthy-term portfolios. The imaginative and prescient to address issues inclusive of weather trade, social injustice, and sustainable improvement has became effect investing into a serious and meaningful choice for cutting-edge traders.

Asset class segmentation is among the most fundamental features in this market since it enables investors to diversify while adhering to their value principles. The major segments are Equity, Fixed Income, Multi-asset, and Alternatives. Of these, Fixed Income is a prominent share, with investments amounting to around $365,879.36 million. This shows the excessive call for predictable and stable returns, commonly associated with projects in renewable energy, low priced housing, and community development. Equity is also crucial in that it enables direct investment in corporations that area emphasis on sustainability and excellent governance, thereby attractive to buyers looking for growth and impact.

Multi-asset strategies avail a balanced strategy by bringing collectively specific sorts of funding to be able to control danger at the same time as on the same time encouraging favorable impacts. Such a framework is appealing to buyers who choice flexibility as well as diversification without compromising their sustainability targets. Alternatives, however, contain investments in non-public equity, infrastructure, and actual belongings. These alternatives tend to attraction to investors who're inclined to pursue much less traditional routes for doubtlessly greater returns and extra giant long-time period effect. Every asset magnificence has a one-of-a-kind feature, so that effect making an investment can reply to numerous monetary desires.

In the future, the global impact investing market will continue to grow as know-how increases and measurable effect will become the vital expectation of investors. This revolution is fueled via developing transparency, advanced reporting standards, and technology that monitors the social and environmental impacts of investments. When more investors require duty and performance, the market will maintain to adapt, with innovative solutions marrying income with reason. Investing in the destiny is not just about returns but about developing a global where boom and obligation move hand in hand.

By Investor Type

The global impact investing market is increasing as investors increasingly look to mix monetary return with high-quality social and environmental effect. In evaluation to conventional investments that target profit generally, impact investing channels capital into tasks and organizations that searching for to generate a quantifiable effect in fields which includes sustainability, training, and healthcare. This method will no longer only yield returns but may even fund initiatives that yield long-time period benefits to the network and the arena. As consciousness keeps increasing, the need for investments that are both financial and ethical will become more prominent globally.

In terms of investor type, the global impact investing market is split between institutional investors and retail investors, and each has a big role to play in shaping its expansion. Institutional investors consist of pension funds, insurance funds, and asset managers who have control over large amounts of capital. Their involvement has provided impact investing a solid base, as these institutions lend scale and stability to the market. With organized strategies and means for measuring risks and returns, institutional investors will remain key drivers in the size and direction of impact investments. Their capability to invest significant amounts of money in long-term ventures makes them a force to be reckoned with in this industry.

Individual investors, conversely, are those who desire that their investment will represent their values and worldview. They do not possess the same capability as institutions, but increasing interest from their side will provide a broader base for the market. Having access to web-based platforms and financial investment instruments has facilitated the involvement of people in impact investing, including with smaller sums. This transition will make the market more inclusive as individuals with various backgrounds can contribute to social causes and develop their wealth. Retail investors' emotional attachment to environmental and social causes will also ensure that their interest remains high.

The destiny of the global impact investing market hinges on cooperation between these two groups of investors. Institutional investors will contribute specialist knowledge, formal policies, and massive funding, while retail investors will introduce diversity and increase the outreach of impact capital. Together, they will create a market that harmonizes financial return with accountability towards people and the planet. With this model gaining traction, it will be transforming the way investments are understood, beyond profit to a system where purpose and progress are held in equal esteem.

By Offerings

The global impact investing market is defining a new way of thinking about how capital is directed, with the goal of creating quantifiable social and environmental impact as well as financial returns. It isn't always genuinely approximately making an investment in corporations but also about making a fine difference even as still being profitable. Investors in the cutting-edge technology are increasingly more aware about the lengthy-time period effect their investments could make on society and the world. This increasing feel of social duty will pressure an endured alternate in how money is invested, shifting beyond the antique profit-primarily based strategies to models that are sustainable and motive-driven.

One of the foremost manners in which this market capabilities is through Equity troubles, where buyers purchase stocks in corporations that actively encourage social or environmental development. These agencies may function in sectors like smooth energy, schooling, or healthcare to make certain increase benefits the network, too. Equity investments will hold to enchantment of people and institutions who need to assist companies that percentage their values. What makes equity attractive is its promise of high returns and sustainable impact, that is why many modern buyers choose it.

In addition to fairness, Bond Funds are a significant presence within the Global Impact Investing region. They channel capital into initiatives that yield strong returns whilst enhancing dwelling standards or enhancing infrastructure in underdeveloped regions. Green bonds, for instance, are designed to be used for projects that diminish carbon footprints or lessen the intake of assets. Bonds will remain a valid choice for those who choose lower-hazard investments however nevertheless need to make sizeable contributions. Their constant nature provides stability, that's appealing to investors who want consistency similarly to favorable returns.

Another increasing sector is ETFs and Index Funds that enable investors to engage in impact investing through a diversified portfolio. These funds mirror indexes composed of companies that are compliant with sustainability parameters, facilitating easy risk spreading for people as well as institutions while investing in responsible businesses. The ease of use and clarity of ETFs will continue to make them popular by providing both access and assurance to investors seeking quantifiable impact without having to deal with individual stocks.

Finally, Alternatives and Hedge Funds introduce a further stage of opportunity by way of offering get entry to effect-oriented non-public fairness, project capital, or different area of interest strategies. These strategies frequently are trying to find out innovative solutions and current technology that assist clear up worldwide problems, from clean power to greater inclusive economic systems. Though they may represent extra risk, the potential for big rewards and real transformation makes them appeal to investors who are willing to make competitive moves. With increasingly more humans looking for sustainable approaches, those new options will preserve growing, paving the way for innovation and trade inside the global of finance.

By Investment Style

The global impact investing market has end up increasingly distinguished during the last few years as investors increasingly more are seeking method of producing both economic returns and beneficial social or environmental impact. In assessment to standard investing, wherein profit stays the valuable concern, effect making an investment seeks to create tangible high quality change through projects in education, healthcare, renewable electricity, and poverty remedy. This approach draws people and organizations that preference their funds to enter long-term solutions for global issues. The concept isn't constrained to giving however blends profitability with responsibility and brings about equilibrium between income and giving.

Depending on investment style, the global impact investing market is categorized into large classes: Active and Passive. Active investment styles in impact investing are characterized by using an interventionist approach, in which fund managers actively pick out businesses, projects, or industries that meet positive sustainability or social targets. This approach tends to involve ongoing interaction with businesses to make certain compliance with set up impact requirements. Active investors tend to track performance, quantify impact outcomes, and reinvent approaches to optimize returns as well as societal outcomes. Although this method might take more resources and brains, it tends to yield better accountability and focused results.

Passive impact investing, however, emphasizes a more systematic and long-term strategy. Rather than frequently rearranging portfolios, passive investors tend to invest in indexes or funds constructed around sustainability or social responsibility elements. Passive investing is a lower-cost approach compared to active investing and is a method enjoyed by those who seek a more straightforward, time-efficient strategy. Although passive strategies do not entail direct interaction with firms, they have a staunch commitment to positive impact through ensuring investments are in line with some environmental, social, and governance (ESG) standards.

Active and passive strategies both have a vital role to play in determining the future of the global impact investing market. Active strategies will innovate and ensure accountability by challenging companies to deliver measurable results, whereas passive strategies will open up impact investing to a broader investor base. As demand rises and awareness increases, these two approaches to investing will complement one another ever more, presenting investors with a number of methods through which they can bring their financial goals into alignment with contributions to the world and society.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$104,902.21 million |

|

Market Size by 2032 |

$365,879.36 Million |

|

Growth Rate from 2025 to 2032 |

20.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

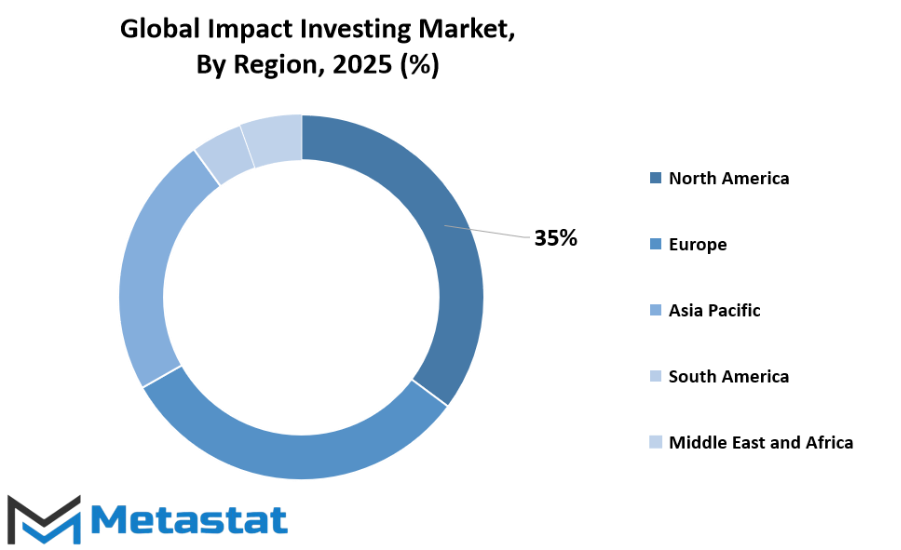

The global impact investing market is increasing with an increasing number of investors seeking to generate positive social and environmental impacts in addition to financial returns. This practice is influencing investment globally and drawing interest from institutional as well as individual investors. Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. The adoption, areas of interest, and project type supported illustrate a distinct trend in each region.

North America is firmly positioned in this market, with nations like the U.S., Canada, and Mexico playing a major role. The U.S. is still leading the way based on its extensive pool of investors who are growingly inclined towards sustainable finance. Canada is also experiencing an increase in green investment, facilitated by government programs that support sustainable development. Mexico is slowly embracing impact investment norms, with increasing interest in socially inclusive projects and renewable energy initiatives. Both these indicators indicate that North America will continue to be a major contributor in the near future.

Europe is also a significant market for impact investing, and the UK, Germany, France, and Italy are at the forefront. The countries of Europe have been steadfastly supporting sustainability and ethical investment strategies. The UK and Germany have very robust markets fueled by policy support and investor appetite for responsible finance. France and Italy are also present, supporting initiatives in clean energy, healthcare, and social welfare. The balance of Europe is gradually gaining traction, with enhanced awareness and regulation favoring impact-led initiatives.

Asia-Pacific is becoming one of the most vibrant impact investing regions. India, China, Japan, and South Korea are experiencing increasing demand from investors looking to finance social development alongside financial returns. India is investing in education, health, and rural development, whereas green technology and sustainable production are the focus areas in China and Japan. Social enterprises are also gaining ground in South Korea. The Rest of Asia-Pacific has prospects as awareness increases and new sources of funding emerge.

South America and Middle East & Africa are smaller markets in relation to the above regions, but they are full of opportunity. In South America, Brazil and Argentina are progressing, particularly in agriculture, renewable energy, and community development. The Middle East & Africa comprises GCC nations, Egypt, and South Africa, which are investing in areas such as clean energy, water resources, and social programs. While these markets experience problems like political uncertainty and restricted access to capital, the increasing appeal of sustainable solutions means that impact investing will pick up momentum here in the future.

COMPETITIVE PLAYERS

The global impact investing market has come into the spotlight for directing money towards endeavors that bring in financial returns along with social or environmental benefits. In contrast to conventional investments that seek profit above all else, this type of investment directs capital towards activities that enhance people's lives, safeguard resources, and develop sustainable growth. Investors are no longer content with profits alone; they expect their funds to bring about positive change. This change is a reflection of increasing consciousness amongst individuals, corporations, and institutions that investments can directly contribute towards solving global issues like poverty, education deficits, healthcare shortages, and climate change.

One of the reasons this market is growing is the intersection of purpose and profit. Investors desire that their money bring quantifiable outcomes more than bottom-line numbers. The fact that sustainability objectives and social metrics are included in them enables them to monitor progress in actual terms. While transparency and accountability grow in significance, impact investing will become even more solidly credible in the finance world. It is for this reason that key operators are not only offering capital but are also developing strategies to assess social and environmental performance in addition to economic performance.

Key players are defining the pace of this market. Institutions such as The Rise Fund (TPG), LeapFrog Investments, BlueOrchard Finance Ltd., and Goldman Sachs are establishing the benchmarks by initiating massive projects in the areas of education, healthcare, and climate change. Others, including Manulife Investment Management Holdings (Canada) Inc., Triodos Investment Management, and ResponsAbility Investments AG, are further consolidating their hold by financing companies in underpenetrated regions. Organizations such as SEAF (Small Enterprise Assistance Funds), Gray Ghost Ventures, and Omidyar Network are renowned for focusing on emerging markets, where impact can both be immediate and long-term. Calvert Impact Capital, Prudential Impact Investments, Bamboo Capital Partners, Vox Capital, Symbiotics, Amundi, and Blue Earth Capital have each also played a role in establishing a competitive yet collaborative environment for positive change.

The global impact investing market will sustain its appeal as an increasing number of investors look to reconcile their portfolios with their values. With robust engagement from traditional financial institutions and dedicated firms, the market will not only grow in terms of size but also of impact. By funding endeavors that tackle pressing needs and provide sustainable returns, these entities are demonstrating that purpose and profit need no longer be mutually exclusive. This momentum indicates impact investing no longer as a niche strategy but as a mainstream approach for those who are dedicated to creating a better world.

Impact Investing Market Key Segments:

By Asset Class

- Equity

- Fixed income

- Multi-asset

- Alternatives

By Investor Type

- Institutional Investors

- Retail Investors

By Offerings

- Equity

- Bond Funds

- ETFs/Index Fund

- Alternatives/Hedge Funds

By Investment Style

- Active

- Passive

Key Global Impact Investing Industry Players

- The Rise Fund (TPG)

- LeapFrog Investments

- BlueOrchard Finance Ltd.

- Goldman Sachs

- Manulife Investment Management Holdings (Canada) Inc.

- Triodos Investment Management

- ResponsAbility Investments AG

- SEAF (Small Enterprise Assistance Funds)

- Gray Ghost Ventures

- Omidyar Network

- Calvert Impact Capital

- Prudential Impact Investments

- Bamboo Capital Partners

- Vox Capital

- Symbiotics

- Amundi

- Blue Earth Capital

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252