Global Home Healthcare Providers Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global home healthcare providers market has developed into one of the biggest and most important parts of the healthcare sector, having grown from its modest origins into a well-structured system that still evolves to meet contemporary demands. Its origins can be traced to early community nursing activity in the nineteenth century, when care away from the hospital was largely disorganized and based on voluntary helpers or family members. Eventually, with the advancement of more medical expertise and the increasing demand for more professionalized care, organized visiting nurse programs started to develop. These established the groundwork for what would ultimately become a more regulated and commercially centered market.

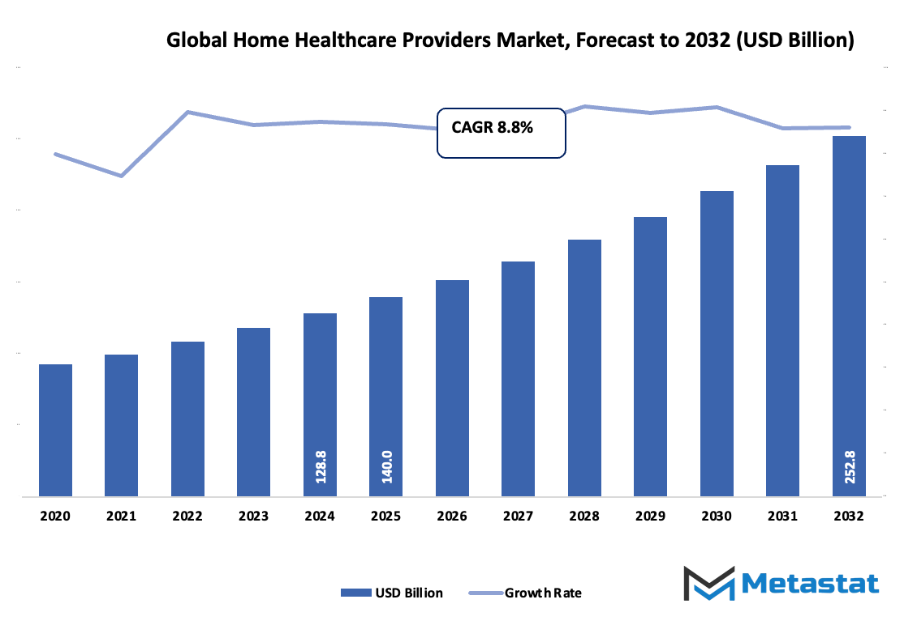

- Gobal home healthcare providers market worth around USD 140 Billion in 2025, with the CAGR of around 8.8% from 2032, and with the ability to cross USD 252.8 Billion.

- Skilled Nursing hold close to 41.7% market share, spearheading innovation and broadening applications through extensive research.

- Key trends fueling growth: accelerating aging population and rising rates of chronic illness, In-growing demand for cost-effective and customized home care

- Opportunities: Synthesis of telehealth and remote patient monitoring to provide home-based care

- Take-home key: The market will increase in value exponentially over the decade, with main opportunities for growth.

By mid-twentieth century, a combination of diminishing populations and medical equipment technological advancements caused governments and private agencies to seek alternatives to extended hospitalization. Systems of insurance came to recognize the fiscal benefit of providing care in the home, establishing thereby the formal reality of agencies specializing in skilled nursing, rehabilitative therapy, and daily living tasks. Integration into national healthcare plans, rather than being supplementary service, was one step along the path of this market. The late twentieth and early twenty-first centuries saw yet a shift. Portable medical technology, including blood pressure monitors, glucose monitoring devices, and respiratory therapy, enabled the provision of hospital-quality care in the home.

Concurrently, shifting consumer attitudes started to redefine the business. Family members wanted more individualized care that preserved dignity and autonomy in older relatives, while surgical patients liked the convenience of familiar surroundings over the duration of hospital stays. Regulatory changes were also involved, with more stringent quality controls and regulation providing guarantees of equal standards of professional care. The adoption of electronic health records and remote monitoring technologies in the last ten years also pushed the business towards a future scenario of home-based care, where communication by providers with physicians and specialists is an easy affair. Worldwide, the global home healthcare providers market will continue to advance with social, technological, and policy innovations. The need for home-delivered care will persist because societies crave solution that depicts affordability without sacrificing quality care, and this will still keep the market at the center of providing healthcare in the years to come.

Market Segments

The global home healthcare providers market is mainly classified based on Type of Service, Care Setting, Type of Patient, Provider Type.

By Type of Service is further segmented into:

- Skilled Nursing: The Global Home Healthcare Providers Market will keep growing with skilled nursing leading the way. Increased demand for specialist care outside the hospital will continue to put a premium on trained nurses who can oversee post-operative recovery, drug administration, and managing chronic disease, offering cost-effective service and increased comfort for patients in the home environment.

- Therapy Services (Physical/Occupational/Speech): Therapy solutions will continue to be important in the global home healthcare providers market. Increasing rehabilitation demands, aging populations, and greater awareness of recovery processes beyond hospitals will propel adoption. Home physical, occupational, and speech therapies will reduce rehospitalization and speed up recovery rate, making care efficient, accessible, and sustainable.

- Personal Care and Non-Medical Support: Non-medical care and personal care will be critical in the global home healthcare providers market. Activities of daily living like mobility, grooming, and coordination of home care will remain significant for individuals who wish to live independently but need care. Support services will grow as families move toward secure alternatives to care homes or institutional care.

- Hospice And Palliative Care: The global home healthcare providers market is expected to experience robust growth for hospice and palliative care services. As the instances of chronic diseases and terminal illnesses increase, patients are going to be provided comfort care at home. Emotional care, pain management, and quality of life improvement will continue to be important, and home palliative services will continue to be in demand across the world.

- Other: The global home healthcare providers market services will address several supportive care needs, ranging from distant health monitoring to nutrition counselling. These services will provide utmost flexibility of home-based solutions that ensure extensive solutions that match patient needs. As technology advances, more advanced and innovative home services will see common availability.

By Care Setting the market is divided into:

- Post-Acute/Home Transitional Care: The global home healthcare providers market will grow under post-acute and home transitional care. Hospital-discharged patients will turn towards at-home services in greater numbers to avoid readmission and enable recovery in a safe way. Such care under transition will provide medical, nutritional, and therapy requirements, which will provide continuity of care through bridging home and hospital settings.

- Chronic Disease Management at Home: Home treatment for long-term illness management will play a massive role in the global home healthcare providers market. Heart disease, diabetes, and respiratory ailments need to be monitored constantly, and this can be done at home. Technology-based tools, coupled with professional advice, will enable patients to stay stable, lowering hospitalization and enhancing life quality.

- Home/Extended Care for The Aged: The global home healthcare providers market will experience demand for long-term elderly care. Aging populations in the world will mean that home-based care will be essential to provide for independence and safety. Services will include daily living support, around-the-clock medical supervision, and companionship, offering elderly individuals dignity and individualized care without movement to institutional facilities.

- Post-Surgical/Home Rehabilitation: Post-operative care and rehabilitation will propel the global home healthcare providers market growth. Surgical patients who recover will get highly skilled assistance, dressing, and structured therapy in their own homes. Such services will decrease complications risks, minimize healthcare expense, and promote a return to regular activity.

By Type of Patient the market is further divided into:

- Pediatric Patients: The global home healthcare providers market will cater significantly to pediatric patients requiring specialized care. Children with developmental conditions, chronic illnesses, or recovery needs will benefit from home-based services tailored to growth and comfort. Support for families combined with advanced pediatric nursing will ensure comprehensive care in a familiar and safe setting.

- Adult Patients: The global home healthcare providers market, adult patients form a growing segment. Services will focus on those managing injuries, chronic health conditions, or disabilities that require consistent oversight. Adult care at home will improve accessibility, reduce stress of hospital visits, and ensure treatment is integrated with daily living needs.

- Geriatric Patients: The global home healthcare providers market will experience significant demand from geriatric patients. Seniors with mobility challenges, chronic health conditions, and cognitive disorders will prefer home-based assistance. Personalized programs that address both medical and emotional well-being will become essential, supporting independence while ensuring safety and professional healthcare delivery in home environments.

By Provider Type the global home healthcare providers market is divided as:

- Agency-Based Home Health Providers: Agency-based providers will remain dominant in the global home healthcare providers market. Professional agencies deliver standardized services, skilled staff, and quality monitoring for patients at home. Their structured approach and reliability will make them trusted sources for families seeking consistent healthcare solutions, especially in complex medical or long-term support situations.

- Franchise/Network Home Care Agencies: Franchise and network agencies will add scale and reach to the global home healthcare providers market. With standardized systems, trained caregivers, and wide accessibility, these networks will meet growing demand for consistent services across regions. Their model will allow families to rely on trusted names while receiving personalized, home-based care.

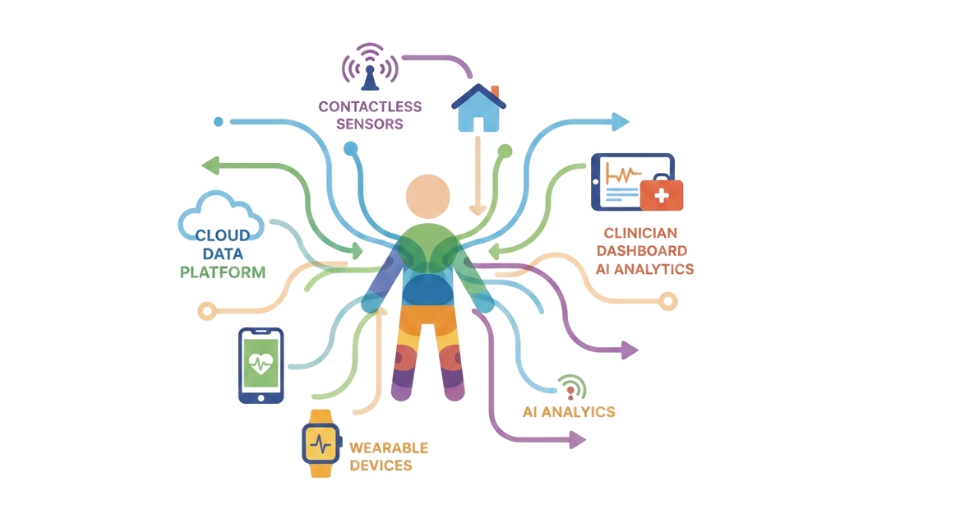

- Technology-Enabled Home Care Platforms: Technology-enabled platforms will transform the global home healthcare providers market by connecting patients with caregivers digitally. Remote monitoring, telehealth consultations, and AI-driven solutions will enhance care efficiency and reduce costs. These platforms will expand access to healthcare professionals, making home services more flexible, timely, and integrated into modern healthcare systems.

- Integrated Health System/Home Care Divisions: Integrated health systems will strengthen the global home healthcare providers market by bridging hospital and home environments. Dedicated divisions will ensure continuity of treatment, smoother transitions, and coordinated management of patient records. This structure will improve quality of care, reduce duplication, and ensure better outcomes through connected and patient-focused services.

- Independent/Home Care Entrepreneurs: Independent providers and entrepreneurs will contribute to the global home healthcare providers market by offering personalized and localized services. Flexibility, close relationships with patients, and community-focused approaches will attract families seeking trusted support. Growth of independent care options will add diversity to the market, ensuring greater accessibility and innovative solutions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$140 Billion |

|

Market Size by 2032 |

$252.8 Billion |

|

Growth Rate from 2025 to 2032 |

8.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

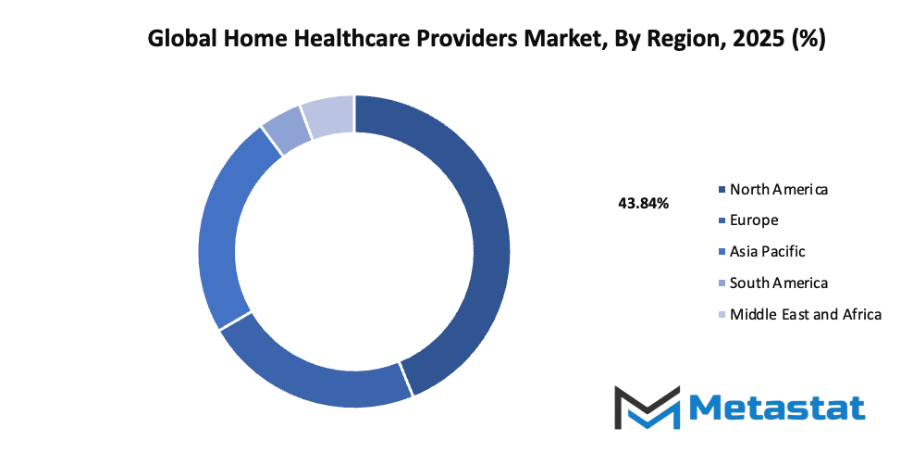

By Region:

- Based on geography, the global home healthcare providers market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising aging population and increasing prevalence of chronic diseases: The global home healthcare providers market will grow due to a rapidly aging population and higher cases of chronic diseases such as diabetes, cardiovascular conditions, and respiratory illnesses. With longer life spans, the need for continuous, personalized, and affordable home-based treatment will significantly increase, ensuring steady demand in coming years.

- Growing preference for cost-effective and personalized in-home care: The global home healthcare providers market will expand as patients increasingly prefer receiving treatment at home rather than in hospitals. In-home care is cost-effective, reduces hospital stays, and improves patient satisfaction. With rising awareness about customized healthcare services, home-based care will gain stronger acceptance among patients and families worldwide.

Challenges and Opportunities

- Shortage of skilled healthcare professionals for home-based services: The global home healthcare providers market is restrained by the limited number of trained professionals who can deliver quality care at home. Increasing demand for home-based services requires a skilled workforce. Without sufficient staff, patients face longer wait times, reduced service quality, and challenges in accessing reliable treatment.

- Reimbursement and regulatory complexities in home healthcare delivery: The global home healthcare providers market encounters difficulties due to reimbursement policies and regulatory procedures. Complex approval systems and inconsistent payment structures often delay service adoption. Addressing these barriers through clearer guidelines and supportive policies will encourage more providers to participate and improve accessibility for patients seeking home-based care.

Opportunities

- Integration of telehealth and remote patient monitoring to enhance home-based care: The global home healthcare providers market will benefit greatly from telehealth and remote patient monitoring. These innovations allow real-time tracking of patient conditions and reduce the need for frequent hospital visits. With digital connectivity, healthcare professionals can deliver timely interventions, ensuring better outcomes and greater convenience for patients at home.

Competitive Landscape & Strategic Insights

The competitive landscape of the global home healthcare providers market is shaped by a combination of established international corporations and fast-growing regional players. Companies such as Amedisys, Inc., National HealthCare Corporation, LHC Group, Inc., Addus HomeCare, AccentCare, Enhabit Home Health & Hospice, Interim HealthCare, Gentiva Health Services, Inc., Home Instead, Visiting Angels, Comfort Keepers, Right at Home, Signify Health, Medco Home Healthcare, Inc., CVS Health with its home care initiatives, Extendicare, Bayada Home Health Care, Tender Loving Care Health Care (TLC), Elderwood Home Care, and Tricare Home Health all contribute to the high level of competition. This mix of established leaders and agile newcomers ensures that the market continues to advance rapidly while responding to both technological progress and changing patient expectations.

In the future, strategic insights will be centered on how organizations use innovation, partnerships, and value-driven models of care to strengthen their positions. With an aging global population, the demand for efficient and affordable home-based care is expected to rise significantly. Competitors will need to balance quality with cost efficiency, while also adopting digital tools that can streamline operations and improve patient monitoring. Artificial intelligence, remote diagnostic solutions, and personalized care programs will likely become defining features of home healthcare strategies. Companies that can adapt quickly to these technological shifts will gain a clear advantage over those slower to adjust.

The competitive pressure will encourage collaborations between healthcare providers, insurance companies, and technology firms. Large-scale corporations are already moving in this direction, and future strategies will likely place even greater emphasis on integrated systems of care. This will make it easier for patients to access services while ensuring providers can operate more effectively within complex healthcare networks. Regional players, on the other hand, will continue to build strength by focusing on local needs, cultural familiarity, and cost-effective service models. By tailoring services to specific populations, these companies will remain relevant despite the presence of global giants.

Market size is forecast to rise from USD 140 Billion in 2025 to over USD 252.8 Billion by 2032. Home Healthcare Providers will maintain dominance but face growing competition from emerging formats.

Looking ahead, the market will not only be defined by size and financial strength but also by agility, innovation, and the ability to provide holistic patient-centered care. Strategic insights suggest that companies which invest in workforce training, digital transformation, and community-based partnerships will be positioned to lead. As competition intensifies, the success of providers will rest on how well they combine compassionate care with modern technology, creating sustainable systems that meet the growing demand for reliable home healthcare.

Report Coverage

This research report categorizes the Home Healthcare Providers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Home Healthcare Providers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Home Healthcare Providers market.

Home Healthcare Providers Market Key Segments:

By Type of Service

- Skilled Nursing

- Therapy Services (Physical/Occupational/Speech)

- Personal Care and Non-Medical Support

- Hospice And Palliative Care

- Other

By Care Setting

- Post-Acute/Home Transitional Care

- Chronic Disease Management at Home

- Long-Term/Home Support for Seniors

- Post-Surgical/Home Rehabilitation

By Type of Patient

- Pediatric Patients

- Adult Patients

- Geriatric Patients

By Provider Type

- Agency-Based Home Health Providers

- Franchise/Network Home Care Agencies

- Technology-Enabled Home Care Platforms

- Integrated Health System/Home Care Divisions

- Independent/Home Care Entrepreneurs

Key Global Home Healthcare Providers Industry Players

- Amedisys, Inc.

- National HealthCare Corporation

- LHC Group, Inc.

- Addus HomeCare

- AccentCare

- Enhabit Home Health & Hospice

- Interim HealthCare

- Gentiva Health Services, Inc.

- Home Instead

- Visiting Angels

- Comfort Keepers

- Right at Home

- Signify Health

- Medco Home Healthcare, Inc.

- CVS Health (home care initiatives)

- Extendicare

- Bayada Home Health Care

- Tender Loving Care Health Care (TLC)

- Elderwood Home Care

- Tricare Home Health

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252