MARKET OVERVIEW

The global healthcare supply chain management market is on the verge of an era in which technology and human creativity will revolutionize the way medical resources move from source to site of care. This sector will cease to be a mere procurement and inventory role. Rather, it will transcend the conventional frameworks, growing into an intelligent network powered by intelligence, robustness, and elasticity. In the years to come, the healthcare sector will require accuracy at each step, right from the procurement of raw materials for drug products to the delivery of life-saving equipment to the right place and time.

The future technologies will redesign the entire ecosystem. Healthcare institutions will embrace high-end predictive analytics to foresee disruptions many years ahead of time. This will minimize reliance on backward-looking responses and permit smooth continuity, even in the face of international crises. These changes will make the market not just a logistics framework but a living facilitator of patient care superiority. Hospitals and clinics will demand supply chains to run like harmonized systems where visibility, velocity, and adherence will be the markers of efficiency.

The other change will be digital connectivity. Blockchain generation, synthetic intelligence, and device mastering will not remain peripheral ideas; they will be infused into day-to-day operations. These technologies will make certain transparency and authenticity in each transaction in order that counterfeit products or behind schedule shipments emerge as passé. This methodology will growth stakeholders' trust while streamlining fees and minimizing wastage. For health practitioners, this may result in a destiny wherein elements will arrive at sufferers sooner, safer, and with trackability this is self assurance-inspiring.

Sustainability may also take middle stage, compelling industry to embody greener practices. Strategies down the line will combine environmentally pleasant packaging, green transportation, and sustainable sourcing. Not handiest will this shift meet regulatory needs, however it's going to additionally meet an growing preference for ethical practice. Manufacturers and distributors may also assemble partnerships that transcend contracts, constructing an atmosphere where shared accountability ensures relentless carrier.

With the panorama evolving, the workforce could be reshaped thru automation. Machines and IoT devices will manipulate repetitive obligations, leaving specialists to concentrate on strategic choice-making. This synergy among human capability and digital power will lessen human mistakes and enhance operational accuracy. Further, real-time data exchange will enable each member of the chain, starting from suppliers through clinicians, to work on a common platform, minimizing silos and enhancing response times in emergencies.

In reality, the global healthcare supply chain management market will no longer be an invisible function but will become a strategic center of healthcare delivery. It turns into an included framework that improves patient effects, protects fine, and drives innovation. The future will no longer best require performance; it'll require agility, transparency, and resilience because the cornerstone of healthcare logistics.

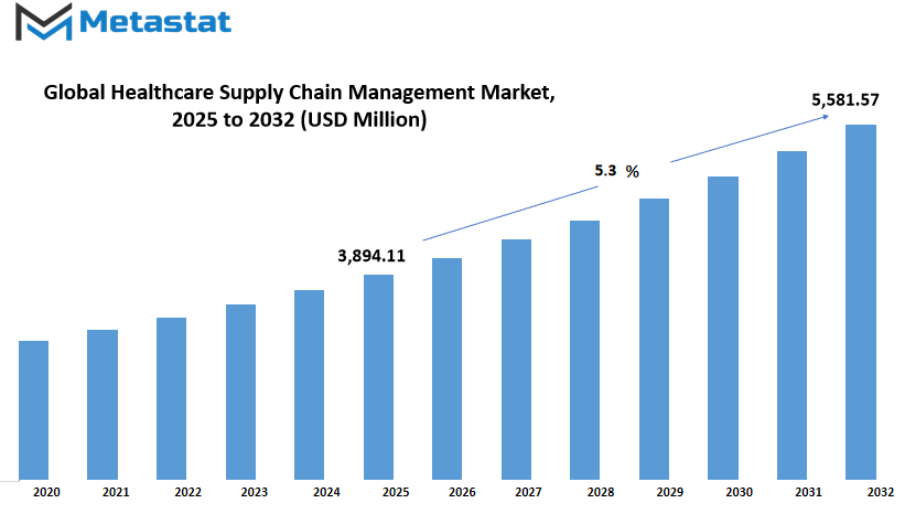

Global healthcare supply chain management market is estimated to reach $5,581.57 Million by 2032; growing at a CAGR of 5.3% from 2025 to 2032.

GROWTH FACTORS

The global healthcare supply chain management market is faced with tremendous transformation as the requirement for efficiency and cost savings becomes more intense. Healthcare providers are increasingly subjected to pressure to provide improved patient outcomes while keeping costs within check. This has resulted in an increasing need for cost-saving solutions in the supply chain. Hospitals, clinics, and pharmaceutical firms are now seeking means to reduce unnecessary expenditure without compromising quality. Effective supply chain systems are key to the attainment of this through minimizing wastage, enhancing inventory control, and optimizing procurement. With increased healthcare expenditure across the world, organizations will increasingly look to more intelligent and leaner supply chain approaches.

Yet another driver of the global healthcare supply chain management market is the increasing implementation of advanced technologies in supply chain operations. Digital transformation is now not non-compulsory but an imperative for healthcare structures. Technologies like real-time visibility, automatic stock systems, and predictive evaluation are preserving agencies a step ahead of call for and away from shortages. These technologies enhance visibility and accuracy throughout the network, which ensures that the precise medical merchandise are in the best place at the right time. This trade closer to technology-based answers no longer most effective complements efficiency but is also making affected person protection more strong by means of decreasing delays and errors.

In spite of these advantages, the market is subject to some issues that can't be ignored. One of the biggest challenges is the very high cost of implementing supply chain management systems. Most healthcare providers, particularly in developing areas, are bogged down by the initial investment for sophisticated systems. This encompasses costs pertaining to software, infrastructure, and training employees. Data privacy and security issues are also a perpetual menace in healthcare networks. Since there is sharing of sensitive patient information through various points in the supply chain, there is always a threat of breaches and cyberattacks. All these issues need to be addressed with strong security features and adherence to stringent regulations, and that can add more costs.

Despite these issues, the future holds great opportunities. The growth of cloud-based solutions is facilitating supply chain management to become more affordable and scalable for healthcare providers of any size. Cloud generation offers scalability, lowers infrastructure charges, and facilitates progressed statistics sharing among places. In addition to this, the growing convergence of synthetic intelligence and advanced analytics will rework system optimization. AI is able to forecast demand behaviors, force inventory optimization, and pick out inefficiencies in real time, saving companies each time and money. All of this will no longer just streamline features but also make the general gadget more responsive and robust.

MARKET SEGMENTATION

By Delivery Model

The global healthcare supply chain management market is undergoing profound change with the power of technology to reshape the way healthcare systems function. The supply chain is central to the issue of delivering on time essential drugs, medical equipment, and other materials to hospitals, clinics, and pharmacies. With health organizations seeking to optimize efficiency, transparencies, and economies, digitalization and intelligence in logistics have been a priority area. This change is fueled by the increasing need for effective inventory management, enhanced forecasting, and enhanced patient care, thereby making supply chain solutions a core part of contemporary healthcare.

One of the significant developments within the global healthcare supply chain management market is the move to sophisticated delivery models. In the past, on-premise solutions used to be the norm, providing organizations with end-to-end control of their system and data. This strategy represented a market size of around $2,091.33 million, which establishes its significance in large-scale healthcare establishments with a focus on security and customization. Although on-premise solutions have been traditionally favored, they need massive infrastructure costs and maintenance, raising expenses for healthcare providers.

Within recent times, cloud-based solutions gained robust acceptance as a viable delivery alternative. Cloud structures provide flexibility, scalability, and reduced initial charges, so they are suited for companies that desire to streamline strategies with out the heavy investment of infrastructure. They provide the capacity to percentage information in real-time, integrate with different systems straightforwardly, and offer remote access, which is vital for hospitals and supply chains which have a couple of locations. This fee-saving and convenience have rendered cloud-primarily based models a favorite, and their utilization is probable to growth drastically over the next few years.

Overall, the transition from legacy on-premise structures to cloud-primarily based models shows the healthcare enterprise's quest for innovation and performance. By adopting cloud generation, healthcare agencies are able to gain extra transparency, improve decision-making, and remove operational issues. With this evolution ongoing, each models will coexist for a while, with businesses choosing the approach that is maximum suited to their specific necessities. Healthcare supply chain control of the destiny will relaxation on answers which might be value-effective, secure, and agile enough to respond to changing desires quickly.

By Function

The global healthcare supply chain management market is gaining momentum as the healthcare zone continues to broaden and evolve with multiplied affected person necessities. An prepared supply chain is needed to ensure that pills, medical device, and essential commodities are delivered on time to hospitals, clinics, and sufferers. This community minimizes waste, avoids shortages, and manages expenses while making sure excellent standards. With extended demand for health care services throughout the globe, streamlining these tactics is greater essential than ever.

Inventory Management is one of the key roles in this industry and aims to have the correct quantity of stock present at hand without overstocking or being short of critical items. Hospitals and health care providers must have precise tools and methods to monitor medication and hardware in real-time. Not only does this prevent financial loss but also provides patients with timely treatment. Advanced technologies such as computerized systems and analytics are assisting companies in ensuring stable inventory levels and minimizing errors.

Another significant function is Supplier Management, which is ensuring strong and trustworthy relations with suppliers of medical products and equipment. Having a well-managed supply network ensures timely delivery of quality material at an appropriate cost. Failure or delay in suppliers can influence patient care, making this function crucial. Organizations are emphasizing the development of open communication channels and performance contracts to ensure trust and efficiency with suppliers.

Demand Planning is responsible for forecasting what products will be required and when. It ensures that healthcare organizations do not experience stockouts when they are needed most, and minimize unnecessary spending. This function relies on the examination of patient statistics, seasonal patterns, and market situations. Well-performed demand making plans enables greater green operations and progressed patient consequences, particularly in unforeseen activities which include pandemics or natural disasters.

Lastly, Logistics Management sees to it that merchandise glide smoothly in the deliver chain, from producers to consumers. This includes transportation, warehousing, and transport of medication and equipment. Good logistics decrease delays and charges even as ensuring the protection and excellent of the products at some point of transportation. In an global market, where merchandise tend to go borders, logistics turns into increasingly problematic and essential in affected person care.

The global healthcare supply chain management market will preserve to make bigger as healthcare companies flip their interest to growing performance, reducing prices, and preserving uninterrupted patient care. By enhancing these foundational factors—Inventory Management, Supplier Management, Demand Planning, and Logistics Management—healthcare providers could be properly geared up to fulfill both each day demands and severe health crises within the future years.

By End-User

The global healthcare supply chain management market is gaining significance as healthcare systems look for effective means to manage the movement of medicines, medical devices, and necessary supplies. With expanded call for for timely provision of healthcare, it's far now a pinnacle time table for businesses throughout the globe to have an uninterrupted deliver chain. This machine makes certain that hospices, clinics, laboratories, and other healthcare centers obtain the essential substances without any postpone. It isn't always pretty much fee reduction, but additionally approximately making to be had essential products which can keep lives. In a world wherein the care of sufferers is based on immediately availability of resources, deliver chain management has an essential position to play in facilitating healthcare carriers.

Hospitals are proper at the center of the market since they deal with a high number of sufferers and want uninterrupted get admission to a huge type of supplies. From operating gadgets and drugs to state-of-the-art clinical gadget, hospitals need an efficient deliver chain to make sure their day-to-day functioning. The slightest disruption can affect remedy timetables and patient protection. Hospitals make investments enormous amount of cash in modern day deliver chain control that monitors stock, predicts demand, and controls stock ranges. It permits them to respond to emergencies more effectively and save you shortages, that is vital to provide non-stop care.

Pathology laboratories are also particularly reliant on green deliver chain management. Pathology laboratories want specialised reagents, testing kits, and correct units to provide precise diagnostic reviews. Prompt delivery of these resources is very important when you consider that delays can also impact test consequences and affected person treatment schedules. Efficient supply organization allows laboratories to have high accuracy and reliability standards to ensure that right information reaches doctors at the right time. With increased demand for diagnostic examinations, particularly following global health crises, supply chains for pathology labs have been more organized and technologically advanced.

Clinics, being generally smaller in scale compared to hospitals, also require trusted supply chains for the delivery of quality care. Clinics need drugs, generic equipment, and protective clothing to take care of patients effectively. While their inventory isn't always as large as hospitals, shortages can also result in critical problems. Advanced deliver chain fashions enable clinics to streamline the procurement procedure, minimize wastage, and save charges at the same time as ensuring on-time delivery of essential merchandise. Even other healthcare institutions, like nursing homes and specialized care centers, additionally rely on sturdy supply chain fashions to keep operations stable. Together, these tasks underscore the essential role deliver chain management plays in keeping healthcare as accessible, green, and dependable.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3,894.11 million |

|

Market Size by 2032 |

$5,581.57 Million |

|

Growth Rate from 2025 to 2032 |

5.3% |

|

Base Year |

2024 |

|

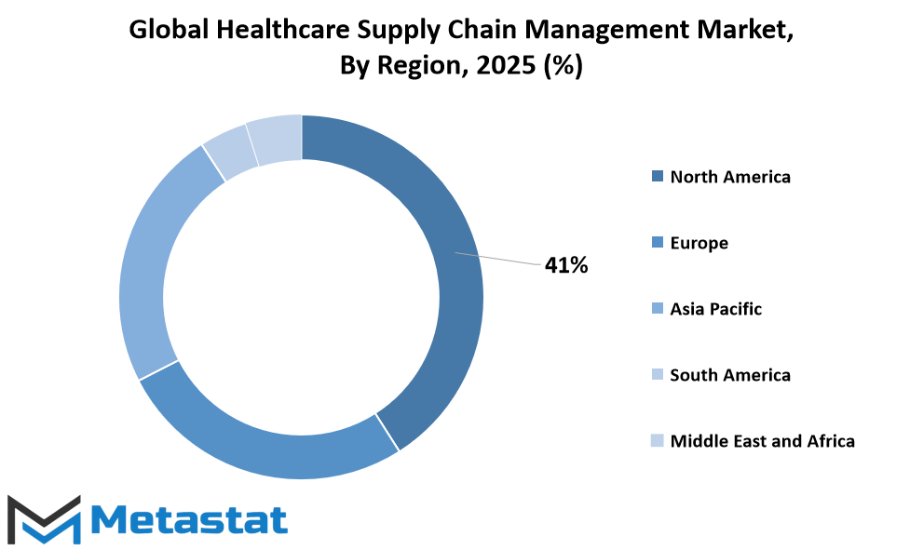

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global healthcare supply chain management market is influenced by regional forces that drive its expansion and approaches. Geographically, this market is categorized into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Every region contributes to healthcare resource distribution and optimization in accordance with varying infrastructures, levels of economic development, and technology uptakes. The above differences make geography a significant aspect of determining how supply chain solutions are implemented worldwide.

North America is in a dominant position in the market, thanks primarily to sophisticated healthcare systems and embracing modern technologies. The region is divided into the U.S., Canada, and Mexico, with the U.S. ahead in the areas of innovation and digitalization. Heavy investment in healthcare IT and keen emphasis on patient safety have positioned this region as a front-runner in deploying solid supply chain management solutions. Canada and Mexico are also seeing their improvements, facilitated by government initiatives and collaborations with international healthcare companies to reinforce supply networks and guarantee timely delivery of life-critical medical products.

Europe is close behind with the UK, Germany, France, and Italy being key contributors to the market. These countries are focused on efficiency and cost management without compromising on quality in healthcare provision. Sophisticated logistics systems and growing demand for supply chain transparency are fueling growth within the region. The remainder of Europe is slowly embracing digital supply chain solutions to address the growing need for quick, secure, and compliant healthcare delivery.

Asia-Pacific is also a significant contributor, with nations such as India, China, Japan, and South Korea making considerable strides. Industrialization, healthcare expenditure growth, and government initiatives to expand healthcare accessibility have driven demand in this region for effective supply chain management. The use of digital technologies, automation, and analytics is on the rise, especially in China and Japan, while India and other emerging economies are looking to mitigate supply chain losses and enhance medical product distribution networks.

South America and Middle East & Africa are the emerging markets in this segment with Brazil, Argentina, GCC nations, Egypt, and South Africa being proactive in upgrading their healthcare infrastructure. These regions place a premium on increasing supply chain effectiveness because of geographical hurdles and unequal access to resources. Investment in logistics and alliances with multinational firms are closing gaps and providing for the presence of necessary medical supplies. With increased emphasis on strengthening their healthcare infrastructure, these regions will increasingly need effective supply chain solutions, which will make them key players in the international market.

COMPETITIVE PLAYERS

The global healthcare supply chain management market is important in that it ensures medical facilities, clinics, and hospitals get the correct products at the right time. This framework is the backbone of healthcare provision, and it enables timely treatment to be delivered as well as ensuring patient safety. The market is growing due to healthcare organizations' efforts to make operations more efficient, lower their costs of operations, and prevent delays in deliveries of critical supplies. With more patient expectations and growing advanced medical technologies, a robust and trustworthy supply chain is not a luxury anymore; it is a requirement.

Businesses here are moving towards solutions that accelerate the pace of operations and make things more transparent. Digital platforms, predictive analytics, and automation have now become everyday devices for controlling the flow of medical products, medicines, and equipment. Through enhancing visibility and eliminating errors, these technologies enable healthcare professionals to better manage inventory, reduce waste, and react rapidly to emergency demands. As healthcare systems globally become increasingly complicated, the necessity for optimized supply chain solutions will further increase, rendering this a region of high investment and technological development.

Some large firms are dominating the global healthcare supply chain management market with their experience and solutions. The key companies are McKesson Corporation, SAP SE, Oracle Corporation, Infor Inc., Blue Yonder, Inc., GHX (Global Healthcare Exchange), TECSYS Inc., Kinaxis Inc., Manhattan Associates Inc., Jump Technologies Inc., Cardinal Health Inc., Epicor Software Corporation, AmerisourceBergen Corporation, Tracelink Inc., Omnicell Inc., and Zebra Technologies Corporation. These firms provide software platforms, inventory management systems, and end-to-end solutions that enable healthcare providers to streamline every aspect of their supply chain. Their work is targeted at keeping costs low while making life-saving products accessible whenever they are needed.

The fact that there are already such well-established companies is also a reflection of competition fueling innovation. All the players concentrate on making available better technology, more effective tracking systems, and solutions that address the unique requirements of healthcare organizations. From automated inventory management to analytics, the products and solutions provided by these organizations are revolutionizing the way the healthcare industry handles its resources. As the need for improved patient care keeps increasing, these organizations will become the defining factor in the future of healthcare supply chain management.

Healthcare Supply Chain Management Market Key Segments:

By Delivery Model

- On-Premise

- Cloud-Based

By Function

- Inventory Management

- Supplier Management

- Demand Planning

- Logistics Management

By End-User

- Hospitals

- Pathology Laboratories

- Clinics

- Other

Key Global Healthcare Supply Chain Management Industry Players

- McKesson Corporation

- SAP SE

- Oracle Corporation

- Infor Inc.

- Blue Yonder, Inc.

- GHX (Global Healthcare Exchange)

- TECSYS Inc.

- Kinaxis Inc.

- Manhattan Associates Inc.

- Jump Technologies Inc.

- Cardinal Health Inc.

- Epicor Software Corporation

- AmerisourceBergen Corporation

- Tracelink Inc.

- Omnicell Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

.jpg)

US: +1 3023308252

US: +1 3023308252