Global Health and Medical Insurance Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global health and medical insurance market is a business that will continue to expand its reach far beyond minimum coverage, determining how societies perceive access to healthcare and economic protection in the years to come. It will not be limited to covering treatments or hospitalization but will shift towards developing systems that promote preventive care, digital access, and global collaboration. As patients shop for medicine across borders, insurers will have to construct bridges that enable better interfacing between patients, hospitals, and digital platforms so that healthcare not only becomes a service but an embedded part of life.

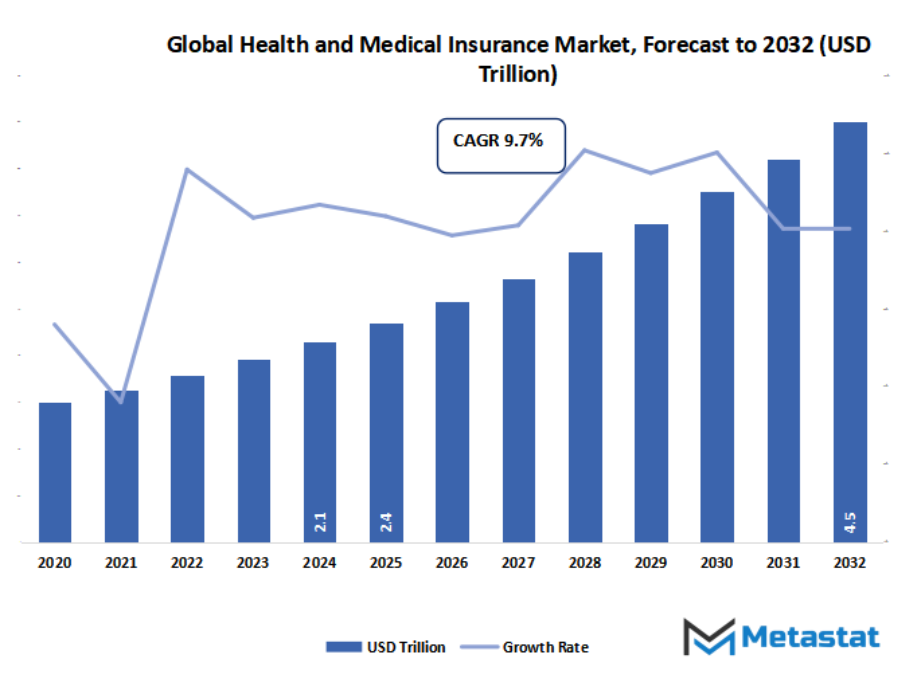

- Gobal health and medical insurance market valued at approximately USD 2.4 Trillion in 2025, growing at a CAGR of around 9.7% through 2032, with potential to exceed USD 4.5 Trillion.

- Health Maintenance Organization (HMO) account for nearly 24.0% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising healthcare costs and increasing frequency of chronic diseases., Growing consumer awareness and demand for financial security against medical risks.

- Opportunities include Expansion into personalized wellness programs and preventative care incentives.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

What will the destiny of the global health and medical insurance market look like as digital fitness technology, telemedicine, and AI-pushed diagnostics start to reshape how guidelines are designed and claims are processed? Could transferring demographics, rising healthcare charges, and unpredictable international health crises disrupt conventional insurance fashions and open the door for more personalised, bendy coverage solutions? And how may the developing emphasis on preventive care and wellness applications redefine the position of insurance providers past economic protection to turning into energetic companions in lengthy-term health control?

This market will also reach into the domain where health is entwined with technology, lifestyle management, and long-term safety. Insurance will not only protect people when they have a medical emergency, but also nudge them toward healthier choices through tools such as wellness tracking, virtual consultations, and early diagnosis assistance. Through this, the market will narrow the distance between treatment and prevention, driving models in which customers see insurance as a partner in health, not merely as a financial cushion.

Market Segmentation Analysis

The global health and medical insurance market is mainly classified based on Type, Payor, Mode, Distribution Channel.

By Type is further segmented into:

- Health Maintenance Organization (HMO) - Future demand for HMO plans in the global health and medical insurance market will rise as individuals opt for cheap care within organized networks. With increasing medical expenses, more people will opt for prepaid services where preventive care and periodic check-ups are covered, providing lower long-term costs.

- Preferred Provider Organization (PPO) - PPO plans will remain in the limelight in the global health and medical insurance market due to their flexibility. Customers in the future will demand flexibility in doctors and hospitals while still having coverage, offering room for providers to create hybrid policies balancing convenience and cost.

- Exclusive Provider Organization (EPO) - EPO designs in the global health and medical insurance market will expand as patient coordination is enhanced by digital systems. Stringent network-based services will follow technological advancement, providing more efficiently managed care. Such frameworks will catch up with future customers who value cost savings over out-of-network availability, thus promoting their use globally.

- Others - Other plan designs in the global health and medical insurance market will grow in various regions to address specific healthcare needs. New models will meet specialized requirements like chronic illness management, geriatric care, or family protection, an indication of how insurance structures will evolve to suit various demographic needs.

By Payor the market is divided into:

- Private - Private insurance in the global health and medical insurance market will grow as levels of income increase and individuals seek personalized coverage. Increasing numbers of people will require customized packages, providing faster claim settlements, greater access to hospitals, and specialized benefits, making private policies increasingly significant in determining future trends.

- Public - Public payers will continue to be essential in the global health and medical insurance market, particularly where governments emphasize universal healthcare. In the coming times, states and global institutions will be collaborating more to enhance access to low-cost care, minimizing gaps in treatment and broadening coverage to poor segments across the globe.

By Mode the market is further divided into:

- Offline - The offline segment in the global health and medical insurance market will remain pertinent, particularly in developing markets where direct human contact creates trust. One-on-one consultations and paperwork-based procedures will appeal to individuals who are less comfortable with digital technology, so offline distribution remains a steady player.

- Online - The digital mode of the global health and medical insurance market will grow at a rapid pace with digital platforms taking over. Technology will enable direct comparison of policies, quicker enrolment, and effortless claims, which will attract younger age groups. More transparency with the help of apps and websites will make online insurance products more popular across the globe.

By Distribution Channel the global health and medical insurance market is divided as:

- Direct Sales - Direct sales within the global health and medical insurance market will become more robust through digital outreach and mobile apps. Policy providers will more often use tailored offers and direct-to-customer campaigns. This will be less expensive, remove middlemen, and offer real-time information, making direct sales a top future trend.

- Agents - Agents will remain significant in the global health and medical insurance market, particularly for customers looking for personal advice. Personal interaction and trust factors will be important, especially in conveying complex policy information. Agents will use more digital tools, but with traditional service in addition to the technology-based solutions for improved customer experience.

- Brokers - global health and medical insurance market Brokers will evolve to the future through superior comparisons among multiple insurers. Having access to various plans, brokers will lead customers to appropriate options. Brokers will still be relevant as a way of easing complicated options and bringing clarity to an expanding market.

- Banks - Banks will become more prominent in the global health and medical insurance market as part of bundled financial services. Insurance will be coupled with loans, savings, or investment products. This approach will make customers believe that banks are a safe source of not only financial security but also healthcare security.

- Others - Other channels in the global health and medical insurance market will extend to cover e-commerce sites, retail partnerships, and workplace-based products. With shifting consumer patterns, non-traditional networks will increase in power, bringing insurance products to broader segments of the population through innovative and collaborative methods.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2.4 Trillion |

|

Market Size by 2032 |

$4.5 Trillion |

|

Growth Rate from 2025 to 2032 |

9.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

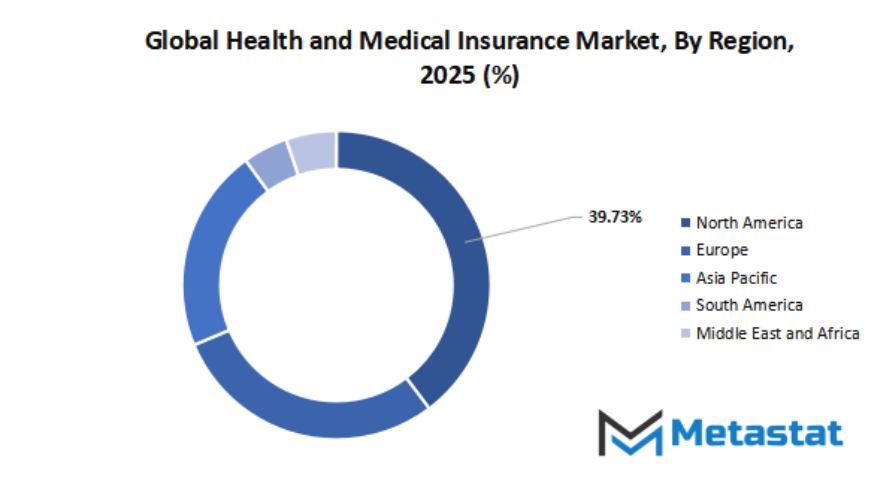

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global health and medical insurance market has evolved right into a critical element of modern-day living, because it gives financial protection in opposition to the escalation of healthcare expenditures and the capability to get right of entry to first-class hospital treatment. The area is ruled with the aid of an aggregate of mature multinational firms and aggressive regional players that keep booming their footprint. With fitness care rising as a global precedence, insurance organizations are emphasizing flexible coverage that fits the man or woman, circle of relatives, and enterprise. This intersection of global presence with nearby know-how renders the marketplace competitive in addition to attentive to evolving wishes.

Some of the most powerful individuals on this arena consist of UnitedHealth Group, Cigna Healthcare, Allianz, Aetna Inc., and Aviva. These insurers have set up a recognition for offering comprehensive insurance, robust provider networks, and customer-centered services. Their worldwide presence permits them to cowl various populations, and their monetary muscle permits them to invest in digital structures, telemedicine services, and progressive policy designs that meet the evolving nature of healthcare wishes. In addition to them, AXA, Ping An Insurance (Group) Company of China, Ltd, and Zurich Insurance Group no longer most effective bring scale however also local understanding, in particular in international locations where healthcare systems vary notably.

The inclusion of entities like Assicurazioni Generali S.P.A, Centene Corporation, Anthem Insurance Companies, Inc., and Bupa additionally contributes to the competitiveness of the marketplace. These insurers keep innovating with new products to offer individualized fitness plans, lower rates, and quicker claims settlements. Regional and specialist competitors such as MSH International, April International, William Russell, and Now Health International compete on their own strengths through special attention to expatriates, travelers, and specialized healthcare requirements. Their capacity to address defined groups indicates how the market will find itself increasingly influenced by scale and specialization.

While the demand for health and health insurance will increase, those players will remain at the vanguard of expanding coverage and tackling healthcare issues. Competition between global giants and regional experts will pressure innovation, growth accessibility, and enhance the customer experience. The global health and medical insurance market with its varied players will not only offer protection from medical expenses but will also shape the manner in which individuals interact with healthcare services in the coming years.

Market Risks & Opportunities

Restraints & Challenges:

Regulatory complexity and compliance costs across different regions. - The global health and medical insurance market will also have to contend with the issue of varying regulations in every nation. Compliance procedures will not only increase operational expenses but also hinder international growth. The lack of cohesive frameworks will require continuous adjustment, hindering efficiency and influencing long-term planning.

Increasing claim frequencies and fraud impacting profitability. - The global health and medical insurance market will see increasing pressure due to increased claim submissions, as well as fraudulent actions. Both will decrease profitability and raise premiums for consumers. Sophisticated fraud detection systems will become a necessity, yet the overall cost pressure will still be a significant insurer challenge.

Opportunities:

Expansion into personalized wellness programs and preventative care incentives. - The global health and medical insurance market will shift towards incorporating wellness solutions based on individual health objectives. Incentives for preventative care like fitness rewards, nutrition tracking, and online health coaching will open up new opportunities. Such programs will drive claim costs down over the long term while promoting healthier lifestyles among policyholders.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 2.4 Trillion in 2025 to over USD 4.5 Trillion by 2032. Health and Medical Insurance will maintain dominance but face growing competition from emerging formats.

The global health and medical insurance market would also broaden its scope to reflect increasing concerns about aging populations, changes in the environment, and global worker migration. All these factors would pose a demand for policies that are flexible and are inclusive in covering diversified cultural and geographic requirements. Insurance won't be confined within boundaries but will foretell the expectations of people on the move, such as students, expatriates, or professionals relocating for work. Thus, the sector will enter a wider role, influencing healthcare access and setting up resilience for generations to come.

Report Coverage

This research report categorizes the global health and medical insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global health and medical insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global health and medical insurance market.

Health and Medical Insurance Market Key Segments:

By Type

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Others

By Payor

- Private

- Public

By Mode

- Offline

- Online

By Distribution Channel

- Direct Sales

- Agents

- Brokers

- Banks

- Others

Key Global Health and Medical Insurance Industry Players

- UnitedHealth Group

- Cigna Healthcare

- Allianz

- Aetna Inc.

- Aviva

- AXA

- Ping An Insurance (Group) Company of China, Ltd

- Assicurazioni Generali S.P.A

- Zurich Insurance Group

- Centene Corporation

- Anthem Insurance Companies, Inc.

- Bupa

- MSH International

- April International

- William Russell

- Now Health International

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252