Global Harsh Environments Rugged Mobile Computing Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

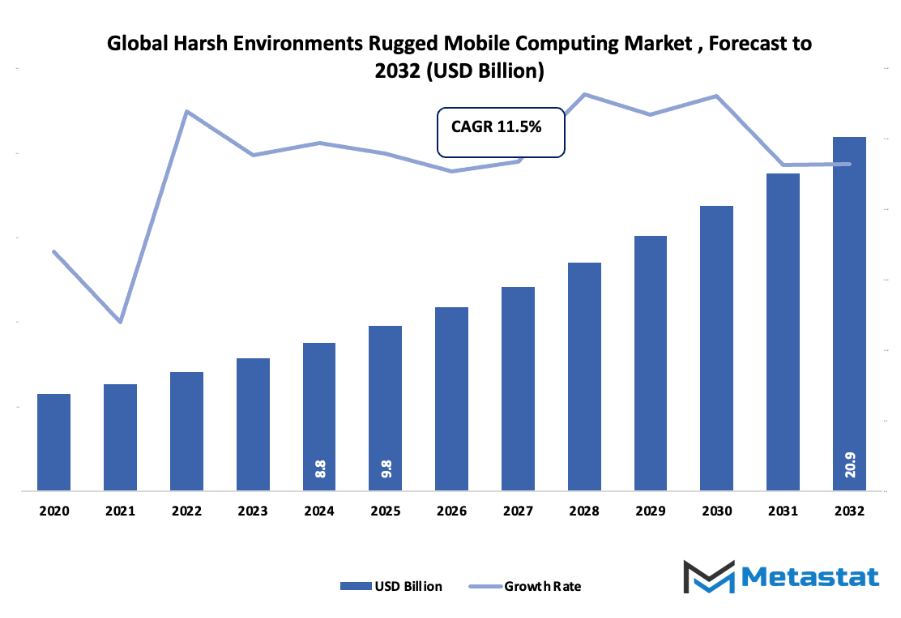

- The global harsh environments rugged mobile computing market is projected to be worth about USD 9.8 billion in 2025, with a CAGR of approximately 11.5% until 2032, thus it is expected to easily surpass USD 20.9 billion.

- Rugged Laptops are foreseen to hold nearly one-fifth of the market in 2024, and thus they will be the continuous source of innovation and the expansion of applications, as well as the field of research with the most intense scientific development.

- Some of the key trends that will drive the mentioned growth are: The increasing need for lasting computing in defense, mining, and field operations., The rapid penetration of IoT rugged devices and connected field-service workflows.

- On the other hand, some of the lucky factors are: The gradual acceptance of 5G-enabled rugged tablets and edge computing solutions in remote regions.

- An important conclusion is that the market will undergo a tremendous transformation regarding value over the next ten years, thus opening up the possibilities for substantial growth.

Market Background & Overview

The global harsh environments rugged mobile computing market along with the industry has primarily been developed by the need for electronics that are field-ready. This growth is credited to the defense and energy sectors that started demanding the portable devices that could resist dust, vibration, moisture, and even very high or low temperatures as the earliest point in the development of the rugged computing segment. The first manufacturers' actions of making slight changes to the commercial laptops for having rugged computers led to the complete opposite as it was acknowledged that the traditional hardware was failing far too often in less-than-perfect running conditions. By the middle of 1990s, technological advancements in tougher casings, shock-mounted parts, and reinforced connectors had been achieved and the point of no return in the development of rugged computers was reached, where devices could be made with the utmost reliability that could easily be used in cases where failure would mean the loss of life or that a critical task would be delayed.

During the 2000s, public infrastructure upgrades, satellite-based navigation growth, and growing digitization of field service pushed rugged computing to new areas like border security, emergency rescue, and earthquake studies, to name a few. At that point, specifications for durability were already being published in government procurement documents from the likes of the U.S. Department of Homeland Security and the UK Home Office, among others, outlining things like MIL-STD-810 testing and IP-rated sealing. Over time these standards became a norm across different industries as they had a major influence in the designing and validating of equipment by the manufacturers. According to data provided by the U.S. Bureau of Labor Statistics, the number of employees in the field-based jobs like utility maintenance, surveying, and environmental monitoring has been increasing steadily during the last decade which in turn is creating a need for long-term supply of rugged equipment that can stand the wear and tear of harsh working conditions.

Today’s rugged mobile systems are influenced by changing user behaviour and rising expectations for seamless field connectivity. Workers who once relied on paper logs now depend on real-time video, GIS mapping, and sensor-rich diagnostics, pressuring manufacturers to integrate stronger processors, custom antennas, and longer-lasting batteries into hardened frames. Government reports from agencies such as NASA and the European Space Agency have documented ongoing use of rugged computing platforms in remote expeditions and instrumentation support, demonstrating how the technology moved beyond basic communication tools and into high-stakes operational environments.

As the market moves forward, durability will continue to merge with advanced mobile capability. Manufacturers will push for lighter builds without sacrificing resilience, and new regulatory updates around data security, environmental safety, and energy efficiency will influence both design and deployment. Through this continuous evolution, the global harsh environments rugged mobile computing market will remain shaped by the demands of workers who rely on technology that cannot fail when conditions do.

Market Segmentation Analysis

The global harsh environments rugged mobile computing market is mainly classified based on Type, Application, End User.

By Type is further segmented into:

- Rugged Laptops:

Rugged laptops support demanding tasks where strong build quality and steady performance are required. Strong casings, reinforced screens, and long battery life help these devices manage outdoor duties, harsh handling, and constant travel. Dependable computing power allows smooth operation of essential software in locations where conventional devices often fail. - Rugged Tablets:

Rugged tablets offer flexible usage for on-site inspections, data entry, and digital reporting. Touch-friendly designs, strengthened bodies, and resistance against dust, moisture, and impact support practical use in demanding surroundings. Lightweight frames allow easy movement between tasks, making these devices useful for continuous field activity in challenging work areas. - Rugged Smartphones:

Rugged smartphones deliver communication, navigation, and real-time data access in situations that involve rough handling or exposure to tough conditions. Strong protective layers guard against drops and vibration, while sealed designs block dirt and moisture. Reliable connectivity supports fast coordination across teams working in high-pressure outdoor or industrial settings. - Rugged Handheld Devices:

Rugged handheld devices assist with scanning, tracking, and operational monitoring across various work zones. Tough materials protect internal components, ensuring stable performance even during extended use. Built-in tools such as barcode scanners help maintain accuracy in daily activities, supporting efficient task management within demanding professional environments. - Rugged Wearable Devices:

Rugged wearable devices give hands-free support for activities that require constant movement. Durable straps, shock resistance, and long-lasting batteries allow these tools to function during full work shifts. Quick access to alerts, instructions, or sensor data helps workers maintain focus on immediate duties without holding separate equipment.

By Application the market is divided into:

- Field Service:

Field service operations benefit from sturdy devices that handle outdoor travel, inconsistent weather, and frequent handling. Reliable performance allows smooth access to manuals, reports, and diagnostic tools. Strong connectivity also supports steady communication between team members and central offices, helping maintain service timelines in challenging job locations. - Public Safety (Police, Fire, EMS):

Public safety units use tough devices for mission-critical tasks under pressure. Fire, police, and emergency crews depend on equipment that functions despite shock, heat, water, or rapid movement. Rugged tools support navigation, reporting, and coordination, helping teams respond quickly and maintain situational awareness during urgent operations. - Military & Defense:

Military and defense activities rely on reinforced devices designed to withstand extreme temperatures, vibration, and rough terrain. Strong hardware supports mapping, communication, and secure data handling during demanding missions. Long battery performance and protective design help maintain operational continuity in remote or unpredictable surroundings. - Mining Operations:

Mining operations require equipment capable of resisting dust, vibration, moisture, and rough contact. Rugged devices track materials, guide machinery, and support worker safety checks. Bright screens and sealed enclosures allow clear visibility and reliable functioning deep underground or in surface sites where harsh conditions are constant. - Energy & Power:

Energy and power sectors use durable devices for inspections, monitoring, and repair tasks across wide geographic areas. Strong casings, long battery life, and stable wireless access enable efficient field reporting. These features help crews maintain productivity during maintenance and troubleshooting, even around heavy machinery or extreme weather. - Transportation & Logistics:

Transportation and logistics tasks depend on rugged devices to manage routing, package tracking, and warehouse coordination. Strong protection prevents failure during movement across trucks, terminals, or storage areas. Reliable scanning tools and connectivity support accurate inventory control, ensuring smoother workflows throughout the supply chain. - Industrial Manufacturing:

Industrial manufacturing sites require tools that stand against heat, vibration, and accidental drops. Rugged devices help monitor equipment, record production data, and guide quality checks. Strong screens and sealed structures offer steady use near machinery or heavy materials, supporting continuous improvement across manufacturing lines. - Automotive Repair (Garage):

Automotive repair work benefits from sturdy devices that handle grease, vibration, and rough surfaces. Rugged tools allow technicians to read diagnostics, view repair steps, and update service records without concern for damage. Durable designs maintain clear performance even when exposed to accidental impact or fluid contact. - Others:

Other sectors with demanding conditions use rugged devices to support reporting, tracking, and operational planning. Strong structures protect hardware from sudden impact, dirt, and harsh surroundings. Reliable screens, batteries, and communication tools help maintain steady workflows in locations where standard systems often lose performance.

By End User the market is further divided into:

- Public Safety Departments (Police, Fire, EMS):

Public safety departments rely on rugged equipment to maintain dependable communication and accurate reporting during emergencies. Strong build quality supports use in fast-moving situations with exposure to water, heat, or shock. Clear screens and secure systems help teams stay coordinated throughout rescue or law-enforcement duties. - Military & Defense Forces:

Military and defense forces use rugged devices designed for extreme endurance. Reinforced materials support navigation, secure messaging, and mission planning in remote or unstable environments. Vibration resistance, long battery performance, and sealed frames help maintain operational trust even during high-risk field assignments. - Mining Companies:

Mining companies adopt rugged devices to monitor production, track safety conditions, and manage equipment activity. Devices resist dust, vibration, and moisture common in underground and open-pit operations. Steady performance supports inspections, mapping, and communication, helping maintain efficiency and safety across mining zones. - Energy & Power Companies:

Energy and power companies depend on durable devices for field inspections, maintenance logging, and remote monitoring. Tools withstand weather exposure, rough handling, and constant travel between sites. Reliable communication and long-lasting power help crews maintain continuity during repair work and system evaluations. - Transportation & Logistics Firms:

Transportation and logistics firms use rugged devices to manage scheduling, routing, and cargo tracking. Strong protection guards against shocks, drops, and constant movement between vehicles and warehouses. Fast scanning and stable connectivity help maintain real-time accuracy across delivery and inventory operations. - Others:

Other end users adopt rugged devices to support daily work in conditions involving heavy equipment, outdoor movement, or unstable surroundings. Reinforced structures and secure software help maintain consistent performance. Steady operation supports planning, monitoring, and documentation tasks across multiple professional fields.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9.8 Billion |

|

Market Size by 2032 |

$20.9 Billion |

|

Growth Rate from 2025 to 2032 |

11.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

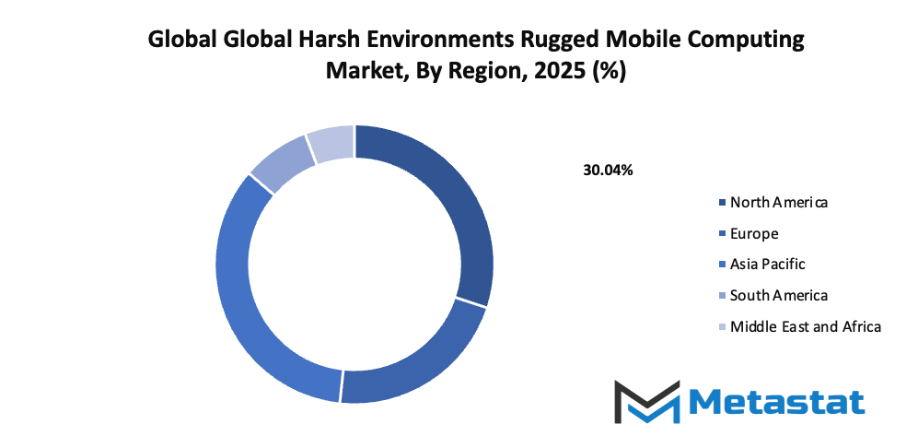

By Region:

- Based on geography, the global harsh environments rugged mobile computing market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Rising demand for durable computing solutions in defense, mining and field operations:

Growing activity in defense, mining and field operations continues to fuel demand for durable computing solutions that support heavy outdoor use. Strong performance extended lifespan and dependable operation help organizations manage harsh tasks with fewer disruptions. Expanding project volumes and tougher working conditions further strengthen this momentum across the global harsh environments rugged mobile computing market.

Growing adoption of connected field-service workflows and IoT rugged devices:

Connected field-service workflows and IoT-enabled rugged devices support faster decision-making, clearer communication and smoother coordination across dispersed teams. Rugged hardware supports outdoor tasks without frequent failures, allowing stronger operational flow. Expanding digital transformation efforts across industrial sites encourage wider adoption and sustained interest in associated technologies.

Restraints & Challenges:

Higher cost of devices and limited accessory ecosystems compared to consumer devices:

Rugged devices often require reinforced materials, specialized testing and advanced protective features, leading to higher pricing than mainstream consumer hardware. Accessory ecosystems also remain limited, creating fewer customization choices for organizations. These factors slow broader adoption, especially within cost-sensitive sectors that prioritize affordability and flexible product availability.

Shorter product refresh cycles due to ruggedization requirements and certification:

Strict ruggedization requirements and certification standards accelerate product refresh cycles, placing additional financial pressure on organizations seeking long-term stability. Frequent updates demand repeated evaluations and procurement planning, creating disruptions within operational budgets. This environment reduces predictability and adds complexity for teams managing technology lifecycles in demanding outdoor settings.

Opportunities:

Increasing opportunity for 5G-enabled rugged tablets and edge computing solutions in remote environments:

Expanding interest in 5G-enabled rugged tablets and edge computing solutions supports stronger data handling and faster communication across remote work areas. Enhanced connectivity allows real-time processing near field locations, reducing delays tied to distant servers. Growing remote operations create new adoption pathways for advanced rugged devices that sustain reliable performance under tough outdoor conditions.

Competitive Landscape & Strategic Insights

A steady shift within the global harsh environments rugged mobile computing market has created a landscape shaped by long-established corporations and newer regional forces. Each participant delivers technology shaped for demanding conditions, and each organization works toward steady reliability and strong performance standards. Attention given to durable materials, long battery life, and dependable connectivity has encouraged constant product updates, and strong competition has encouraged careful consideration of durability goals. Clear differences appear through design style, field support, and specialized features that guide purchasing choices across industrial, defense, construction, and emergency response sectors.

Major contributors such as Panasonic Corporation, Getac Technology Corporation, Zebra Technologies Corporation, Dell Inc., Leonardo DRS, Honeywell International Inc., Samsung Electronics Co., Ltd., Trimble Inc., Sonim Technologies, Inc., Datalogic S.p.A., DT Research, MobileDemand, AAEON, and MilDef offer long histories of technical knowledge along with steady improvement of rugged tablets, handheld systems, and reinforced laptops. Each brand directs production toward harsh-condition performance, and each organization strengthens product lines through material upgrades, reinforced frames, shock resistance, and dependable screens able to support bright outdoor settings. Strong demand from transportation, utility maintenance, and field service workers continues to encourage steady improvement among all competitors.

Regional producers add more choices through flexible pricing and focused designs shaped for local field conditions. These producers often respond faster to specialized requests, leading to broader options for organizations needing custom accessories or task-specific layouts. Growing interest in secure data handling has also shaped current development, encouraging strong encryption support, dependable wireless connections, and hardened operating features. Rugged devices now serve as central tools for mapping, diagnostics, logistics, and on-site reporting, creating a strong link between hardware reliability and daily performance in high-stress locations.

Overall growth across this industry reflects rising demand for field-ready digital tools that offer steady service without failure during harsh use. Durable construction, reliable software support, and strong manufacturer commitment continue to define progress, and expanding competition encourages broader access to dependable rugged mobile systems for challenging work conditions.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 9.8 billion in 2025 to over USD 20.9 billion by 2032. Harsh Environments Rugged Mobile Computing will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global harsh environments rugged mobile computing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global harsh environments rugged mobile computing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global harsh environments rugged mobile computing market.

Harsh Environments Rugged Mobile Computing Market Key Segments:

By Type

- Rugged Laptops

- Rugged Tablets

- Rugged Smartphones

- Rugged Handheld Devices

- Rugged Wearable Devices

By Application

- Field Service

- Public Safety (Police, Fire, EMS)

- Military & Defense

- Mining Operations

- Energy & Power

- Transportation & Logistics

- Industrial Manufacturing

- Automotive Repair (Garage)

- Others

By End User

- Public Safety Departments (Police, Fire, EMS)

- Military & Defense Forces

- Mining Companies

- Energy & Power Companies

- Transportation & Logistics Firms

- Others

Key Global Harsh Environments Rugged Mobile Computing Industry Players

- Panasonic Corporation

- Getac Technology Corporation

- Zebra Technologies Corporation

- Dell Inc.

- Leonardo DRS

- Honeywell International Inc.

- Samsung Electronics Co., Ltd.

- Trimble Inc.

- Sonim Technologies, Inc.

- Datalogic S.p.A.

- DT Research

- MobileDemand

- AAEON

- MilDef

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383