MARKET OVERVIEW

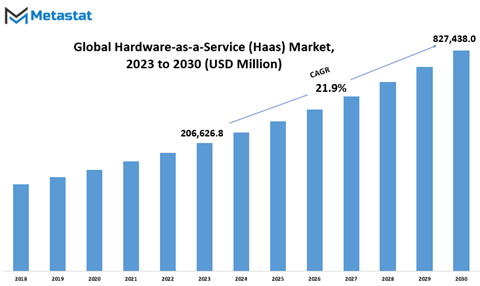

Hardware-as-a-Service (Haas) market was valued at 102 billion US$ in 2022 and is projected to reach 588.8 billion US$ by 2030, at a CAGR of 24.5% during the forecast period. Hardware-as-a-Service (HaaS) is a model of delivering hardware infrastructure on a subscription or pay-per-use basis, similar to how software is delivered through Software-as-a-Service (SaaS). Instead of purchasing and maintaining physical hardware, customers can access and use the hardware they need through a remote, cloud-based service. This allows businesses to scale their hardware resources up or down as needed, without the need for large upfront investments or ongoing maintenance costs.

The Hardware-as-a-Service (HaaS) market is a domain that has steadily emerged as a transformative force in the tech industry, offering a novel approach to meeting the dynamic demands of businesses. This innovative concept, characterized by its subscription-based model for procuring hardware, has found a strong foothold within the business world. The HaaS market's significance, importance, and relevance are underpinned by several market dynamics that reflect its growing appeal.

One of the primary driving forces behind the HaaS market's burgeoning importance is its ability to cater to the ever-evolving needs of businesses. In a fast-paced digital landscape, organizations require flexible and scalable solutions to remain competitive. Hardware-as-a-Service offers an antidote to the often rigid and costly traditional hardware procurement models. By allowing businesses to access and utilize cutting-edge hardware without the burden of substantial upfront investments, HaaS empowers companies to stay current with technology trends, which is essential in an era where innovation is paramount for survival.

Furthermore, the HaaS market is marked by its pivotal role in reducing the financial barriers to entry for many startups and small-to-medium-sized enterprises (SMEs). These businesses, often constrained by limited capital, face an uphill battle in acquiring the necessary hardware infrastructure for their operations. HaaS acts as a lifeline, enabling them to access top-notch equipment and remain competitive without an astronomical capital outlay. This democratization of technology, in turn, fosters innovation and competition in various sectors, contributing significantly to economic growth.

Global Hardware-as-a-Service (Haas) market is estimated to reach $827,438.0 Million by 2030; growing at a CAGR of 21.9% from 2023 to 2030.

GROWTH FACTORS

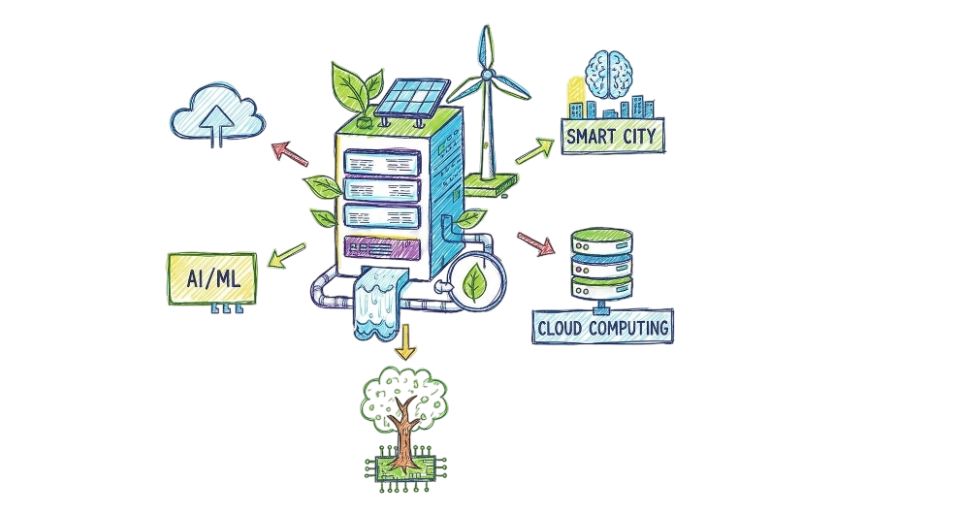

The Hardware-as-a-Service (HaaS) market is experiencing a notable surge in its growth trajectory, primarily attributed to the increasing adoption of cloud computing and virtualization technologies. This shift is fundamentally reshaping the landscape of IT infrastructure solutions.

Organizations are increasingly recognizing the need for cost-effective and flexible IT infrastructure solutions that adapt to their specific requirements. HaaS steps in as a promising solution to meet these needs. It offers a model where companies can access and utilize hardware resources, such as servers, storage, and networking equipment, without the burden of making substantial upfront investments in purchasing and maintaining these assets.

The concept of HaaS aligns with the broader trend in the tech industry - the move towards more efficient and agile operational models. It allows businesses to scale their IT infrastructure according to their needs, reducing the risk of over-provisioning or being constrained by outdated hardware.

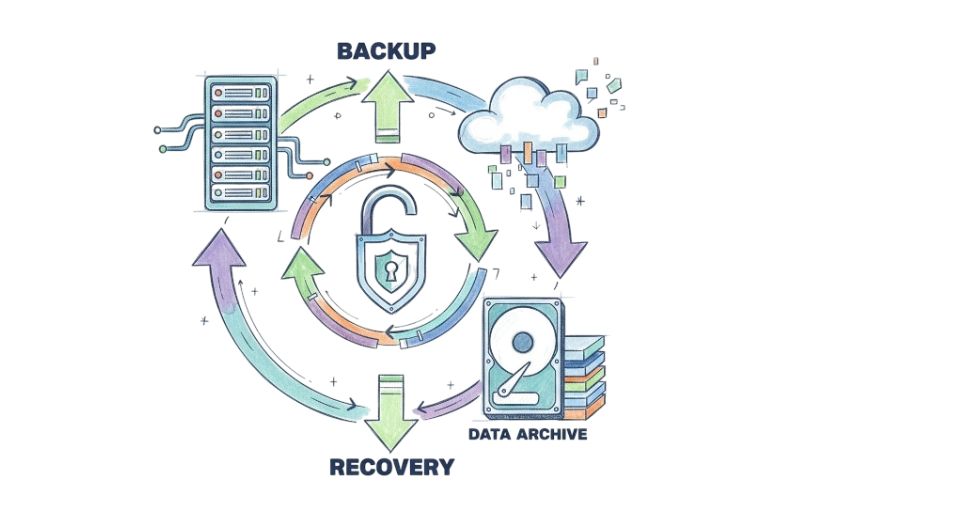

However, while the HaaS market displays immense potential, it is not without its challenges. Data security and privacy concerns loom large in a world where cyber threats are increasingly sophisticated. Companies looking to adopt HaaS solutions must grapple with ensuring the safety and confidentiality of their data, especially if it resides on external hardware resources.

Furthermore, the market faces a hurdle in the form of a lack of awareness and understanding, especially among Small and Medium-sized Enterprises (SMEs). These businesses often lag in recognizing the potential benefits of HaaS, which limits the market's reach and growth.

Nonetheless, the road ahead for the HaaS market appears promising. The expansion of the Internet of Things (IoT) and the growth of edge computing are anticipated to open up lucrative opportunities for the market. With the proliferation of IoT devices and the increasing need for real-time data processing at the edge of the network, HaaS can provide the required hardware support. This alignment of HaaS with emerging technologies positions it to be a pivotal enabler for many industries in the years to come.

MARKET SEGMENTATION

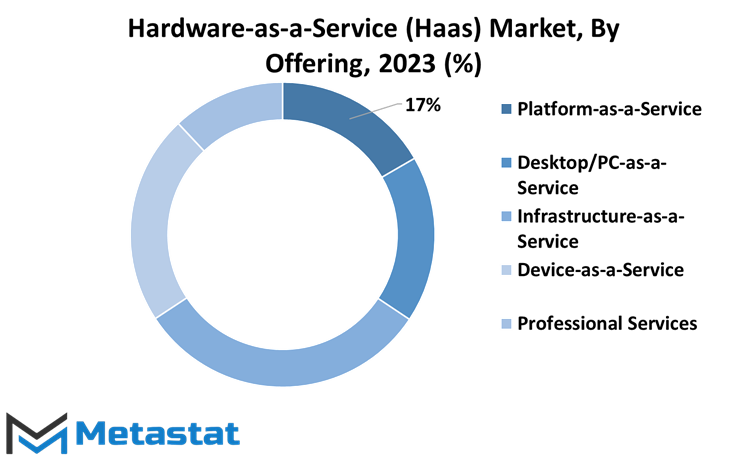

By Offering

The Global Hardware-as-a-Service (Haas) market, concerning its offerings, is subdivided into various segments. This segmentation includes Platform-as-a-Service, Desktop/PC-as-a-Service, Infrastructure-as-a-Service, Device-as-a-Service, and Professional Services.

Platform-as-a-Service, commonly known as PaaS, represents a cloud computing service that provides a platform allowing customers to develop, run, and manage applications without dealing with the complexities of building and maintaining the underlying infrastructure. PaaS offers a streamlined environment for developers, enhancing efficiency in application development.

Further, desktop/PC-as-a-Service, abbreviated as DaaS, is a cloud computing solution that enables users to access virtual desktops over the internet. This approach eliminates the need for organizations to invest in extensive physical infrastructure, providing flexibility and accessibility for users to connect to their desktop environments from various devices.

Moreover, infrastructure-as-a-Service, or IaaS, is a cloud computing model that provides virtualized computing resources over the internet. This includes virtual machines, storage, and networking, allowing businesses to scale their infrastructure without investing in and managing physical hardware. IaaS is particularly advantageous for its cost-effectiveness and scalability.

Additionally, device-as-a-Service, referred to as DaaS as well, is a subscription-based model that offers businesses access to hardware devices without the need for an upfront investment. This approach provides a convenient way for organizations to manage their hardware needs while avoiding the burden of ownership and maintenance costs.

Next, professional Services in the context of Haas encompass a range of support and consulting services. These services may include system integration, consulting, training, and maintenance. Professional services play a crucial role in ensuring the effective implementation and ongoing operation of hardware solutions within an organization.

The segmentation of the Global Haas market by offerings reflects the diverse needs and preferences of businesses in adopting hardware solutions. Whether it be the desire for a streamlined platform for application development, the flexibility of virtual desktops, the scalability of infrastructure resources, the convenience of device subscriptions, or the comprehensive support provided by professional services, these offerings cater to distinct requirements in the ever-evolving landscape of technology solutions. As businesses navigate the dynamic terrain of the digital era, the segmented offerings within the Haas market present adaptable options to meet the varied demands of modern enterprises.

By End-User Industry

The Global Hardware-as-a-Service (Haas) market, when considering End-User Industries, exhibits a multifaceted landscape. It delineates its presence across Retail/Wholesale, Education, BFSI, Manufacturing, Healthcare, IT and Telecommunication, and Other End-User Industries.

In the Retail/Wholesale sector, the Haas market intertwines itself with the operational fabric, offering scalable and cost-effective hardware solutions. These solutions cater to the dynamic demands of retail environments, ensuring a seamless technological backbone for efficient operations.

Education stands as another pivotal domain where Haas carves its influence. The academic sphere benefits from Haas by accessing cutting-edge hardware without the burden of significant upfront costs. This fosters an environment where educational institutions can stay technologically relevant and provide students with a contemporary learning experience.

Moving into the BFSI sector, Haas aligns itself with the financial industry's technological needs. The adaptable nature of Haas allows financial institutions to scale their hardware infrastructure in tandem with their evolving requirements. This ensures robust and secure operations critical for the financial landscape.

Manufacturing, as a cornerstone of global industry, finds a partner in Haas. The sector, driven by precision and efficiency, leverages Haas to streamline its hardware requirements. This not only optimizes processes but also facilitates the integration of emerging technologies within manufacturing setups.

The Healthcare industry, marked by its reliance on advanced technologies, sees Haas as a facilitator of technological agility. From medical devices to administrative hardware, Haas offers a flexible solution, ensuring healthcare institutions can focus on their core mission of providing quality care.

IT and Telecommunication, industries at the forefront of technological innovation, embrace Haas to navigate the dynamic landscape. The adaptability of Haas aligns with the fast-paced evolution of IT and Telecommunication, providing the necessary hardware infrastructure to support innovation and seamless connectivity.

Beyond these, Haas extends its influence into Other End-User Industries, recognizing the diverse array of sectors with unique hardware needs. This adaptability positions Haas as a versatile solution, capable of meeting the specific requirements of industries beyond the prominently mentioned sectors.

By Enterprize Size

The Global Hardware-as-a-Service (HaaS) market is segmented based on enterprise size, with a focus on distinguishing between Small & Medium Enterprises (SMEs) and Large Enterprises. This segmentation approach recognizes the diverse needs and capacities of businesses, contributing to a more nuanced understanding of market dynamics.

In enterprise size, Small & Medium Enterprises and Large Enterprises represent distinct categories, each with its own characteristics and requirements. Small & Medium Enterprises, commonly abbreviated as SMEs, are typically characterized by their smaller scale, limited resources, and often, a more localized operational focus. These enterprises play a crucial role in various economies, contributing to employment and fostering innovation.

For SMEs, the adoption of Hardware-as-a-Service presents a unique value proposition. Given their resource constraints, SMEs may find the HaaS model particularly attractive as it offers an alternative to traditional capital-intensive hardware procurement. Instead of upfront investments, SMEs can opt for a subscription-based model, allowing them to access the latest hardware technologies without a substantial initial financial outlay.

On the other end of the spectrum, Large Enterprises, with their expansive operations and greater financial capabilities, approach HaaS adoption from a different vantage point. While large enterprises may have the financial means to invest in hardware infrastructure outright, the HaaS model still holds appeal. It provides them with flexibility, scalability, and the opportunity to align technology expenditures with actual usage.

The market differentiation between SMEs and Large Enterprises is not merely about size but also about catering to the distinct operational landscapes and financial realities of these entities. SMEs, often characterized by agility and a focus on cost-effectiveness, can leverage HaaS to stay technologically competitive without significant upfront investments. For Large Enterprises, the flexibility offered by HaaS aligns with their dynamic and evolving IT requirements.

This segmentation strategy acknowledges that enterprises, irrespective of size, are navigating a business landscape where technological agility and cost-effectiveness are paramount. The Global Hardware-as-a-Service market, by categorizing enterprises into these two classes, recognizes the varied demands and preferences that arise from the diverse operational contexts of SMEs and Large Enterprises.

REGIONAL ANALYSIS

The Hardware-as-a-Service (Haas) market, in terms of its geographical presence, extends across the globe. This means that Haas offerings are available and accessible in various regions, making it a worldwide phenomenon. The global reach of Haas represents its widespread adoption and availability, catering to diverse markets and industries worldwide.

Haas is not confined to a specific geographical boundary, but rather, it is a flexible and adaptable concept that can be implemented in different countries and regions. This worldwide presence of Haas signifies its adaptability to various local needs and its capability to address the technological requirements of a broad spectrum of users, organizations, and industries across the world.

The global nature of the Haas market is a reflection of the interconnected world we live in today, where information technology services and solutions transcend borders and become integral to the functioning of businesses and institutions worldwide. It highlights the fact that technology, in the form of Hardware-as-a-Service, is no longer confined to a single location or market but has become a fundamental component of the global business landscape. Haas, with its worldwide presence, offers organizations the opportunity to access and leverage hardware resources, enabling them to meet their technology needs effectively and efficiently on a global scale.

Yhe Haas market's global reach underlines the universality of technology services in the contemporary era, where geographical boundaries are no longer barriers to accessing and benefiting from advanced hardware solutions. It demonstrates the role of Haas in facilitating the integration of technology into various sectors and regions, ultimately contributing to the enhancement of operational efficiency, scalability, and innovation on a worldwide scale.

COMPETITIVE PLAYERS

The Hardware-as-a-Service (HaaS) market is a dynamic landscape driven by the demand for technology solutions that offer flexibility and cost-effectiveness. HaaS represents a shift in how businesses acquire and manage their hardware resources, with key players operating in this evolving market.

HaaS fundamentally revolves around the idea of providing hardware resources as a service rather than a capital expenditure. This approach aligns with the changing needs of businesses seeking to stay agile and competitive. It offers benefits such as reduced upfront costs, access to the latest hardware, scalability, and maintenance services.

One of the prominent players in the HaaS market is Dell Technologies. Dell's HaaS offerings encompass a wide range of hardware solutions, from servers and storage to client devices. Their approach is to provide businesses with the flexibility to adapt their hardware infrastructure as needed, ensuring optimal performance and cost-efficiency.

Another notable player is HP Inc., offering a comprehensive HaaS portfolio. HP's services cover various aspects, including device as a service (DaaS) for personal systems, managed print services, and multi-vendor support. They recognize the importance of providing end-to-end hardware solutions with a focus on enhancing the user experience.

Lenovo is also a significant contender in the HaaS market, with a focus on device as a service. Their offerings span a variety of devices, including laptops, desktops, and tablets. Lenovo emphasizes the simplification of IT management and the reduction of total cost of ownership for businesses.

Cisco, a renowned name in networking and communications, extends its presence to the HaaS market. They provide hardware solutions that are aligned with the demands of modern businesses, emphasizing the importance of an integrated approach to networking and hardware infrastructure.

Hewlett Packard Enterprise (HPE) is a key player with a strong focus on hybrid IT solutions. HPE's HaaS offerings encompass a wide range of hardware resources, including servers, storage, and networking. They aim to provide businesses with the tools needed for seamless digital transformation.

IBM, a longstanding leader in technology, also offers HaaS solutions. Their approach is built on the idea of infrastructure as a service (IaaS), providing businesses with the necessary hardware resources to support cloud and data center operations.

The HaaS market is further enriched by the presence of companies like Rackspace Technology, which specialize in managed cloud services and infrastructure solutions. Their HaaS offerings are designed to simplify the complexities of managing hardware in the cloud era.

As the HaaS market continues to evolve, these key players are at the forefront, shaping the landscape with their innovative approaches to providing hardware resources as a service. Their offerings cater to the diverse needs of businesses, empowering them to leverage the benefits of HaaS to stay competitive and adaptable in the ever-changing technology environment.

Hardware-as-a-Service (Haas) Market Key Segments:

By Offering

- Platform-as-a-Service

- Desktop/PC-as-a-Service

- Infrastructure-as-a-Service

- Device-as-a-Service

- Professional Services

By End-User Industry

- Retail/Wholesale

- Education

- BFSI

- Manufacturing

- Healthcare

- IT and Telecommunication

- Other End-User Industries

By Enterprize Size

- Small & Medium Enterprizes

- Large Enterprizes

Key Global Hardware-as-a-Service (Haas) Industry Players

- Dell Inc.

- Design Data Systems, Inc.

- Engine Yard Inc.

- Fujitsu Limited

- Google LLC

- Heroku (Salesforce)

- Ingram Micro Inc.

- International Business Machines Corporation

- Lenovo Group Ltd.

- Mendix Technology BV

- Phoenix NAP, LLC

- Red Hat, Inc.

- SAP SE

- Dizzion, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252