MARKET OVERVIEW

The Global Warehouse Management market will be continuing to change and redefine the way goods are stored, tracked, and distributed as it operates within the context of an increasingly complex commercial environment in the logistics and supply chain industry. At its most basic, this pertains to the development and deployment of software and systems to control warehouse operations, the movement of inventory in a more streamlined fashion, and in support of real-time decision-making. The thrust of the market will be for enterprises that seek to improve accuracy and visibility of operations particularly across multi-location storage networks and cross-border distribution centers.

The modern warehouse ecosystem systems operate and manage high throughput of products, quick order fill-up, and accuracy under varying demand conditions. The Global Warehouse Management market would cater to the retail, manufacturing, pharmaceuticals, e-commerce industry side, enabling such industries to sort out storage workflows, contact equipment usage, and support labor allocation. These systems will not only structure stock data but will also define how businesses will characterize distribution strategy and warehouse efficiency across the scale.

Here, in this market, such advanced solutions will be adopted by the companies, which will connect warehouse operations to the overall planning systems within the enterprise. This integration will connect inventory control with procurement, with transportation scheduling, and with financial systems, leading to much tighter coordination between the various operational segments. Therefore, Global Warehouse Management would meet anywhere the growing requirements of end-to-end visibility in the supply chain, thus allowing the organization to act quickly on stock deviations, shipment delays, and last-minute changes in orders.

As warehouse footprints will be global, increases in complexity will be with them as well. Global Warehouse Management will develop solutions to meet the challenges of dispersed facilities, variable storage conditions, and movement of both finished goods and raw materials. These will have to work in highly automated environments, interact seamlessly with robotics, automated guided vehicles, and intelligent sorting systems. Warehouse managers will use these systems for asset tracking, real-time reporting, and risk mitigation.

The strategic application of data analytics and machine learning algorithms will shape the design and continuous fine-tuning of their storage and picking workflow by such companies. Further, the Global Warehouse Management market would pre-allocate resources based on predictive insights derived from historical patterns and foreseen future spikes in demand. Businesses would, therefore, improve fulfillment accuracy and minimize waste through smarter inventory rotation and expiry management. Indeed, as warehouse configurations become even more tailored for product types and consumer behavior, so will the systems deployed need to adapt.

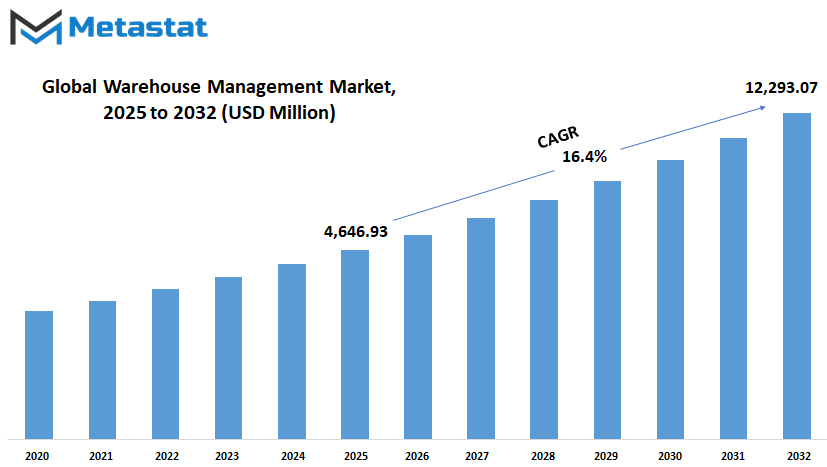

Global Warehouse Management market is estimated to reach $12,293.07 Million by 2032; growing at a CAGR of 16.4% from 2025 to 2032.

GROWTH FACTORS

The Global Warehouse Management market will be set for great changes in the near future in terms of growth and challenges moving in the opposite direction. The key factor driving the expansion is enthusiastic growth in e-commerce. The rising tide of such consumers shopping online translates pressure on businesses to fulfill orders quickly and much more accurately. This scenario weighs exceedingly on warehouse operations, encouraging them to seek means of streamlining processes and reducing errors. Faster order processing and real-time tracking have moved from being conveniences to necessities.

Adjoining this, automation has also increasingly become the order of the day in warehouse environments. Many companies turn to technologies that facilitate real-time inventory monitoring and assist with everyday tasks once carried out manually. Time is saved, and moreover, there is a danger reduction in the possibility of mistakes. Thus, smoother operations take place. Furthermore, they are helping warehouses to run high volumes of goods without overwhelming operators. The bar for the technology is for continued improvement, hence more organizations are likely to be joined on the path to competitiveness.

However, strong drivers cannot overcome certain factors that still slow down progress. One of the key factors, however, is the very high cost of investment in advanced warehouse management systems in the form of initial set up costs for many companies, especially smaller businesses, as they become too great a burden for them to carry. There is, additionally, the challenge of trying to integrate new technologies into existing older systems. Most warehouses operate on traditional ERP and supply chain solutions, and getting everything to work together can be, at times, a long and complicated process. Barriers like these often slow down the modernization of solutions and, in many cases, make it harder for some companies to move forward.

On the other hand, the future looks bright for more artificial intelligence in warehouse management. AI-based Analytics is developing its role by making warehouses take decisions based on patterns and data about them. These systems are capable of predicting future trends, preventing problems from happening beforehand, and improving overall performance. This not only makes warehouses more efficient but also creates possibilities for new revenue streams. As AI tools become more sophisticated and available, they may affect the operations of warehouses worldwide profoundly. The Global Warehouse Management Market is heading toward a future defined by innovation, smart planning, and the ever-demanding need to meet customer expectations.

MARKET SEGMENTATION

By Component

Environed by numerous changes in the last few years, the Global Warehouse Management market has observed prominent changes due to the increasing inclination of the organizations towards having systems assist them in managing their inventory, logistics, and supply chains. The way in which goods are stored, moved, and monitored has drastically changed and is continuously evolving based on rising customer demands and international trade, as well as the pressure to provide faster delivery. This is indeed no trend; it has become of necessity for an industry to step further in its continuous improvement approach to handling goods within its supply chain. Warehouse management solution providers now increasingly enjoy being associated with more than the elementary control mechanisms in their systems; clients want tools that tighten accuracy, cut out wasteful use of time, and reduce human error.

When looking at this market by types of components, it is usually subdivided into hardware, software, and services. Each of these components contributes to making warehouse operations more efficient and smoother. Hardware contains tools and physical devices such as barcode scanners, mobile computers, and RFID systems that help in accurately tracking and storing items. These devices are being continuously improved and are becoming more reliable and user-friendly, which will help workers to do their tasks faster.

Software would hold the central part for complete warehouse management systems. All its moving part would be linking this software to provide detail of inventory levels, how orders move and are processed, and the insight of labor management. The future of this software will surely encompass more automation, improved data analysis, and prediction tools of stock that are going to run out. The advancement in technology will also make these systems know better what they do and be easy to use for companies to remain ahead of demand and off the over-inventorying.

Services under this market include installation, training, and support. These signify a lot in case some companies undergo alterations with what they invested in. With systems growing steeper, service providers would have to extend ongoing guidance, updates, and repairs to keep everything happening as expected. These also assure businesses that they are not jumping into new technology with no support.

More businesses will be thinking of terms of flexible systems that will grow with the company as the Global Warehouse Management market continues to evolve. Future warehouses are anticipated to employ more intelligent devices, faster communication, and even more data to enhance efficiency. The transition into better warehouse management systems is not only keeping abreast-it's but actually being prepared for what is next and remaining ready in a rapidly moving world.

By Deployment Mode

The Global Warehouse Management market is gradually moving toward major transformation, with technology becoming increasingly pivotal in warehouse functioning. As demands around faster delivery and better inventory tracking continue to grow, businesses are rethinking their storage, labor, and distribution management.

There are two main ways that organizations are deploying warehouse management systems-cloud-based and On-Premises. While Cloud-based systems allow businesses to access their tools and data almost anywhere, thus minimizing downtime and backing quick decision-making, On-Premises continues to be adopted by firms wanting to hold great control with their data and infrastructure. Such systems tend to be designed according to one organization’s exact specifications, and many prefer the one-time investment for a much better fit with future plans.

Businesses nowadays tend to be going toward either the end of the spectrum-drastically advancing and innovating their systems or undergoing little to no change in the way that they handle the warehouse. Very Few organizations are coming to terms with the changing scenarios of warehouse management functions. From the earlier system of dipping warehouse storage in the unoccupied areas to leveraging technology for more efficient warehouse functions, things are gradually moving toward a big transformation for the Global Warehouse Management market today. Demand is more than just meeting supply; it comes with pre-requisites of compliance. Long-awaited investments have forced changes in how companies look at, design, and implement warehouse systems, especially when choosing the deployment modes.

By End Users

The Global Warehouse Management market is expected to grow by huge digits as industries seek new ways to manage the maturity and cost-effectiveness of supply chains. Companies need excellent performance to level up against growing consumer expectations and optimization in operations. Warehouse Management Systems (WMS) are advanced to play increasingly critical roles in order fulfilment as such; they help companies acquire inventory tracking, order management, warehouse space optimization, and cost reduction- all of which are critical at such high competition market rates. Indicating demand, the future of warehouse management innovation will possibly adapt to fast-changing consumer behavior and market trends.

The vast market is available as many industries are benefiting from developments in warehouse management. Then, by end users, it will contain many segments of very heterogeneous demands and growth areas. The most important one among them is the food and beverage industry, which puts a high demand on storage and transportation for the appropriate maintenance of its products. Food has a short shelf life, making it necessary that a system guarantees proper handling and timely distribution of goods to ensure the success of companies in this line.

Automobile manufacturers, indeed, rely on good warehouse management systems. Their supply chains tend to be quite complex, with many parts and components that have to be delivered to the right place at the right time. Optimized warehouse management facilitates faster production cycles, reduced lead times, and less stock cost—all of which provide automotive companies with a competitive advantage.

Pharmacy is the fastest-growing segment among warehouse-management categories. Pharmaceutical products require stringent temperature controls and secure handling. With the demand for health care products ever-increasing, warehouse systems designed with these specific requirements will be among the most sought after. It is primarily caused by the increasing need for timely and accurate distribution, coupled with the increasing number of global health challenges where rapid access to critical supplies becomes necessary.

Consumer goods are expected to form the largest category in the globally instituted warehouse management market. As expectations continue to rise for ever-faster and ever-more-accurate delivery from consumers, the call for ever-more-efficient warehouse operations remains unrelenting. The emerging technologies of warehouse automation and artificial intelligence are being utilized to facilitate managers, especially in retail and e-commerce, in better inventory management in reducing lead time from order to delivery.

Strong warehouse management systems are vital for manufacturing, chemicals, retail and e-commerce, and electricals and electronics. All of these sectors have to depend upon such systems for efficiency in operations within the supply chains. With advancement in technology, warehouse management solutions will continue to advance to meet the specific needs of these disparate industries. The future of the market is going to be dynamic, with innovation making efficiency even more within reach of companies that scale up operations as demand grows.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,646.93 million |

|

Market Size by 2032 |

$12,293.07 Million |

|

Growth Rate from 2025 to 2032 |

16.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Warehouse Management market has witnessed tremendous change over the years, with technology influencing the manner in which warehouses are managed and operated. The market diverges by geography, creating different opportunities and challenges in different regions. Each of the North America, Europe, Asia-Pacific, South America, and the Middle East & Africa provides input in its particular way toward the development and growth of this market. In the face of the discrimination between the regions, now-and-future acceptance of different strategies and technologies for enhanced efficiency and cost-reduction would be the commonality among the regions as the e-commerce and logistics demands rise.

North America, which includes countries like the U.S., Canada, and Mexico, has seen a burgeoning demand for warehouse management applications. The need for cutting-edge solutions competent enough to handle wide varieties of product flow coupled with a focus on automation has fueled the growth of this region. Warehouses use AI, robotics, and the Internet of Things (IoT) to facilitate their working by reducing human error and enhancing productivity. The technological transition is expected to sustain its precedence in North America as it competes in the market to satisfy the evolving needs of consumers.

Europe, with its diverse markets like the UK, Germany, France, Italy, among others, has been at the forefront of the warehouse management solutions adoption. The European market has particularly been interested in promoting sustainability and lowering environmental impacts, with a number of warehouses integrating green practices into their operations. As the increased role of eCommerce and need for efficient logistics weigh heavily on warehouse management systems, demand in the region is anticipated to shift. European companies are likely to continue innovating and adopting next-generation solutions to stay ahead as the regulations become stricter and consumer expectations increase.

Asia-Pacific, incorporating strong players like India, China, Japan, and South Korea, is predicted to be the most crucial growth area for the Global Warehouse Management market. Rapid growth in the e-commerce sphere in this region has led to demand for faster and reliable warehouse operation. Many companies within Asia-Pacific are investing heavily in automation and digitalization to satisfy a burgeoning populace, and trends on online shopping keep on increasing. Continued industrialization and improvement in technological capabilities will see the warehousing management sector in a central role in supporting these economic shifts.

The South American market is gradually catching up with warehouse management solutions on a global scale in Brazil and Argentina. As infrastructure improves and e-commerce continues to grow, there will be increased demand for effective logistics solutions. Therefore, with time, there will be increased adoption of automated systems to help streamline operations and increase competitiveness in South America.

COMPETITIVE PLAYERS

The Global Warehouse Management market is a dynamic and ever-expanding industry that has constant thrust from the increasing demand for efficient logistics and inventory systems. With businesses racing against the growing demand for fast and accurate order fulfillment, WMSs are becoming more advanced. The market hosts several players who are spearheading developments in technology, providing businesses with weapons to sharpen their operational efficiency. These companies are critical in defining the future of warehouse management through integration of new technologies, innovation, and optimization of warehouse operations for the maximum output.

In the near future, competition between the foremost companies in this sector will intensify, with each trying to increase its market share by providing ever-increasing services. Among the most influential players are Blue Yonder Inc., Indigo Software Limited, and Infor Inc., all well known for providing state-of-the-art solutions addressing unique needs in respect to warehouse operations. These firms are committed to designing and developing software by employing artificial intelligence, machine learning, and data analytics to enable companies to forecast demand, achieve better inventory accuracy, and automate more manual functions.

Körber AG, Synergy Logistics Ltd., and Manhattan Associates Inc. are also important contributors to the development of warehouse management technologies. Their solutions focus on increasing efficiency, lowering operating costs, and speeding up warehouse processes. As warehouses become more complex and larger, these companies will continue to stretch the limits on integration between such systems and the supply chain and on all aspects of warehouse management visibility.

Oracle Corporation, Zebra Technologies Corporation, and SAP SE are also making significant advancements by incorporating the cloud in their respective warehouse management solutions. Cloud computing gives businesses the ability to access real-time information and best fine-tune their strategies to meet emerging trends. By delivering flexible yet scalable solutions, these companies are positioning themselves as vital allies for companies seeking to optimize operations and stay competitive in an ever-evolving marketplace.

Meanwhile, Epicor Software Corporation, IBM Corporation, and Tecsys A/S are fine-tuning the systems that will not just enhance the warehouse management function but also render supply chain efficiency. Emphasizing automation systems alongside innovations in the Internet of Things (IoT) technology and robotics, these companies are ensuring the routers become more autonomous and self-sustained. As these companies continue to release newer products and technologies, competition in the Global Warehouse Management market will only increase further improvements in warehouse operations and logistics across the globe.

Warehouse Management Market Key Segments:

By Component

- Hardware

- Software

- Services

By Deployment Mode

- Cloud

- On-Premises

By End Users

- Food and Beverages

- Automotive

- Pharmaceuticals (Fastest-Growing Category)

- Consumer Goods (Largest Category)

- Manufacturing

- Chemicals

- Retail and E-commerce

- Electricals and Electronics

- Others

Key Global Warehouse Management Industry Players

- Blue Yonder Inc.

- Indigo Software Limited

- Infor Inc.

- Körber AG

- Synergy Logistics Ltd.

- Manhattan Associates Inc.

- Oracle Corporation

- Zebra Technologies Corporation

- SAP SE

- Epicor Software Corporation

- IBM Corporation

- Tecsys A/S

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252