MARKET OVERVIEW

The global green steel market is a nascent sector of the steel industry, yet it holds immense potential to disrupt traditional steel production. Unlike other processes related to the production of steels, which reach deep into coal and coke usage, Green Steel is focused on bringing down carbon emissions with the help of renewable energies and innovative technologies. On this note, such an approach corresponds perfectly to global sustainability efforts, where pressing environmental concerns are being voiced in parallel with rapidly growing demand for steel.

Green Steel is going to revolutionize the way in which steel is being produced and used globally. During its process, it does not only reduce carbon dioxide emissions but also helps in making a definite decrease in reliance on fossil fuels through the integration of renewable sources of energy like wind, solar, and hydropower. This development would be imperative in mitigating the high contribution of the steel industry to Green House Gas emissions and hence helps the international targets and commitments in Climate Change.

Technologies for green steel As such, technologies for green steel incorporate a variety of new technologies that include hydrogen-based direct reduction of iron ore, biomass-based reduction processes, and carbon capture and storage. They are methodologies that avoid or radically diminish carbon emissions along the steel production lifecycle. Moreover, material science and engineering are further maximizing the efficiency and feasibility of the technologies but have the added advantage of turning them more competitive in the global market.

Besides the environmental benefits, the adoption of green steel holds some economic opportunities. This means that, as countries around the world and governments at large put in place stricter environmental regulation systems and carbon pricing mechanisms, demand for low-carbon steel alternatives would increase. Such a shift encourages technological innovation at the same time as fostering investment in sustainable infrastructure and manufacturing capabilities.

A variety of initiatives and investments that have been flowing in from main stakeholders across this value chain of steel feed the global green steel market. The practice of collaboration in which steel manufacturers, technology developers, and policymakers are engaging will help spur development and commercialization of technologies for green steel. Close collaboration in scaling up production capacities and bringing down costs will help enormously in terms of ease and affordability of access to green steel in the coming years.

Moreover, increasing awareness in consumers and their preferences towards green products are driving the market dynamics, forcing industries to make Green Steel one of the priorities in their supply chains. In this scenario, exponential growth would eventually be occupied by the global green steel market in a larger share of the global steel market over the coming decade. Evidently, therefore, it points out that green steel is going to be transformative to the future of steel production.

The market takes center stage in the progressive change underway within the steel industry at large, through innovation, sustainability, and environmental stewardship. In this light, with continued technological evolution and increasing global demand for low-carbon solutions, green steel will no doubt find itself in the center of delivering a more sustainable and resilient long-term future for the steel sector and beyond. green steel has a high probability of being one of the cornerstones of the industrial landscape in the twenty-first century because stakeholders worldwide are investing and innovating relentlessly in it, which does point rather promisingly toward a carbon-neutral economy.

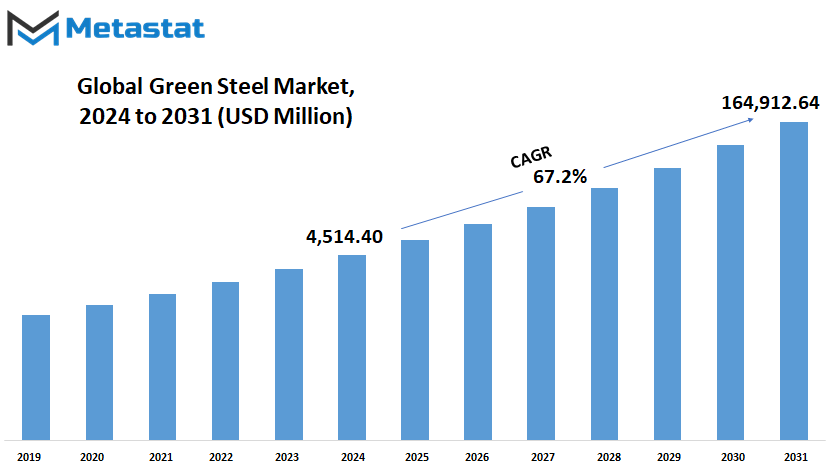

Global green steel market is estimated to reach $164,912.64 Million by 2031; growing at a CAGR of 67.2% from 2024 to 2031.

GROWTH FACTORS

The global green steel market is exhibiting exponential growth, driven by growing environmental awareness and harsh regulations for sustainable industries. Green Steel has been gaining fast popularity globally, as it is produced through renewable energy sources combined with innovative technologies to bring down carbon emissions from production processes. This trend has been catalyzed by growing concerns about climate change and the urgent need to decrease the environmental impacts of conventional methods of steel production.

Other future drivers of the global green steel market include rising fish, coupled with rapid adoption of renewable energy sources such as solar and wind power in steel production. These offer a cleaner alternative to the use of fossil fuels and thus reduce greenhouse gases emitted during the manufacturing process. In addition, advancements in technology for instance, hydrogen-based steelmaking processes further enhance the market growth potential. These technologies were designed to avoid carbon-intensive processes, as stated by global climate goals. However, the market growth might be restrained by challenges such as high initial investment costs and technological barriers. Green Steel requires a massive shift in capital investment into new infrastructure and technologies that come at a hefty price tag compared to traditional steel production routes. Other challenges to industry players when it comes to these innovative processes are scaling-up complexities.

Notwithstanding these odds, the global green steel market will still benefit from new opportunities that will be opening up in the next few years. Government initiatives on sustainable development and carbon neutrality targets will seriously increase demand for green steel products. Besides this, environmental friendliness-tagged products by consumers and sustainability goals of companies are further expected to boost the market growth. As Industries start moving with a faster-paced environment-friendly mode, Demand for green steel is likely to soar, enabling stakeholders across the value chain to cash in on some rewarding opportunities.

The rise in demand for green steel is a function of increasingly high considerations of the environment and technological innovation in methods of sustainable steel production. While such a development process is beset with real challenges costly and littered with technical complexities the market is ripe for exponential growth. Government support, raising awareness about climate change, and the resultant surge in demand for green steel will be some of the most vital factors governing the future trajectory of the global green steel market thereby making it a very exciting area for investment and innovation in the coming decade.

MARKET SEGMENTATION

By Industry Verticals

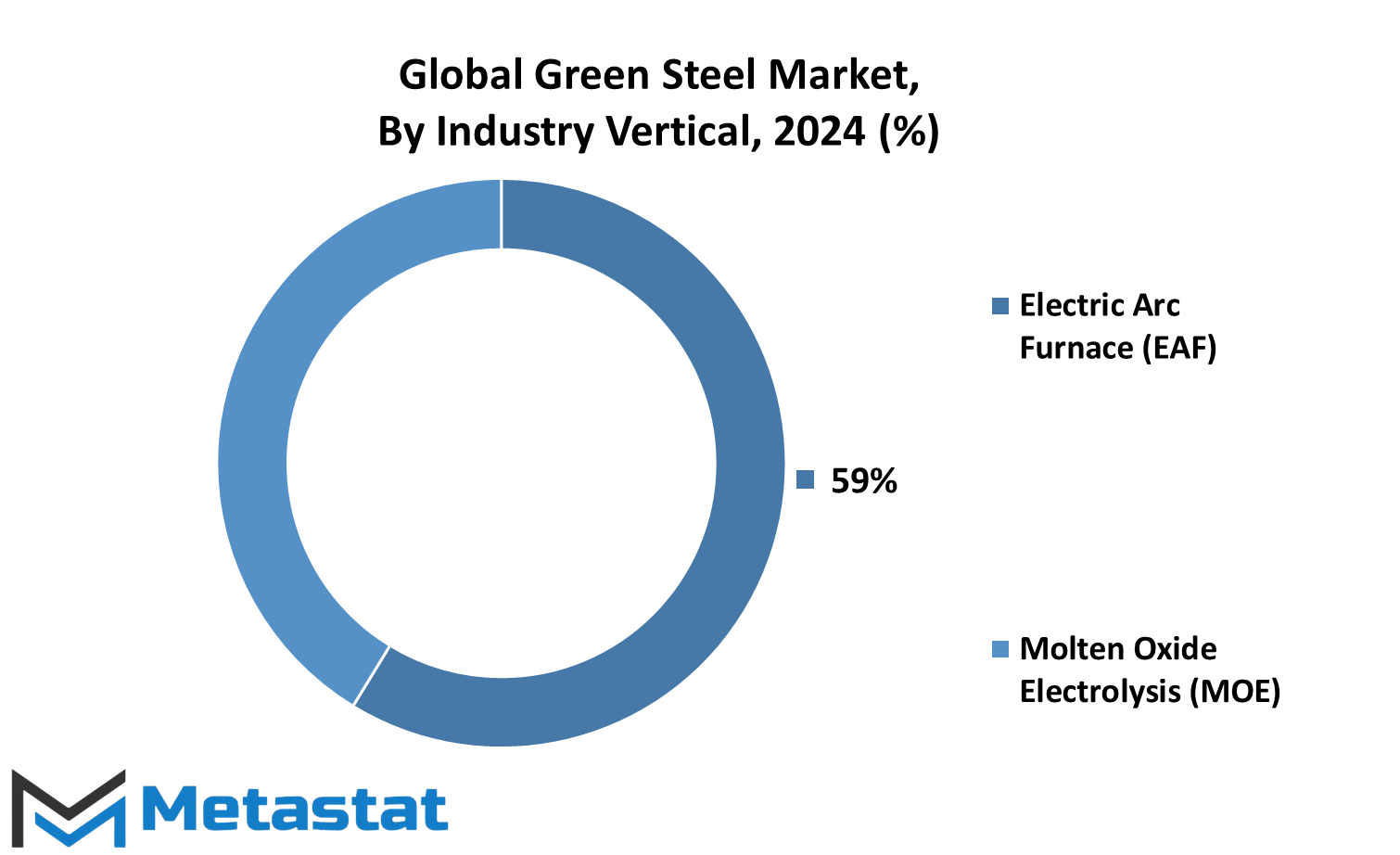

The global green steel market shall advance at a significant growth rate across all major verticals, such as Electric Arc Furnace and Molten Oxide Electrolysis, in the near future. Green Steel alludes to the practice of producing sustainable steel through methods that involve reduced carbon emissions and environmental impact.

The Electric Arc Furnace process uses electricity to melt scrap steel, therefore reducing the use of coal and associated greenhouse gas emissions. This technology thus performs a function in the chain of recycling and at the same time meets the global challenge of low carbon footprint processes for manufacturing.

On the other hand, one such promising technology is Molten Oxide Electrolysis, which processes renewable electricity for iron production from its ore without carbon dioxide emission. This yet-to-develop technology has huge potential for changing the outlook of the steel industry by opening ways through which, with minimal harm to the environment, steel would be produced.

In a way, growing environmental sustainability awareness among industries and consumers has unusually influenced the growth in the global global green steel market. The world governments are trying to rein in carbon emissions with strict regulations at their helm, which has compelled industries to turn toward cleaner production methods. As a result, demand for green steel could be seen rising as companies get busy meeting these regulatory requirements and consumer preferences for eco-friendly products.

By Energy Source

The world is fast entering the realms wherein a surge of demand for green products is rising. Among them, one such prominent industry is represented by the Global global green steel market. Green steel refers to low-carbon steel production, which is likely to have less ecological harm compared to traditional processes.

As the awareness about climate change is increasing, and the practice of corporate sustainability comes into play in heavy industries, global green steel market is on its way to full bloom. At the same time, it draws strength from several energy sources themselves. Hydrogen is just one such emerging clean alternative against coal-based routes of production. If used in steelmaking, hydrogen could help bring down CO2 emissions markedly a much-needed step toward achievement of global climate goals.

Another influential factor and strong energy source behind the global green steel market is coal gasification. It would be to convert the coal into synthetic gas that could, in turn, eventually replace carbon usage in steelmaking. Though it remains carbon, the process of coal gasification is still viewed as a transitional technology that reduces general emissions versus the traditional coal-based approaches.

Electricity also holds center stage in the green steel revolution. Because renewable electricity, harnessed from wind, solar, and hydropower and able to be used to power electric arc furnaces and a method that has less carbon emission than the energy consumed from traditional blast furnaces this ties well with an adoption of renewable energy that is rapidly growing across industries worldwide.

Green Steel is the paradigm shift of the industry, striving for sustainable development not at the cost of quality or performance. And so, manufacturers and policy makers alike are seriously funding research and development to scale these technologies up and make them relevantly cheap on global levels.

By End User

The global green steel market is going to exhibit a good growth rate in the end-user industries like Construction, Automotive, Electronics, and Others. This would be driven by extensive research and development activities for process innovation by major players, thereby making the production of steel environment-friendly by reducing carbon emissions.

One such example is Volvo's pledge to use 100% green steel in car production and manufacturing processes by 2050. This is in support of the SteelZero initiative launched in July 2022, where leading industry companies have joined hands to achieve net-zero carbon emissions in the steel sector. Everything has its part in this initiative, ranging from accelerating growth within the global green steel market through its shift toward sustainable practices.

Faced with growing environmental concerns and ripe regulatory pressures, companies have increased investments in research and development to better the efficiency of green steel production. They range from optimizing energy supply and the exploitation of renewable sources of energy through complex technologies under carbon capture and storage.

Construction is one of the largest customers for green steel. This may be accredited to the increase in demand for green building material, notably in infrastructure construction, around the world. Also, being lighter and having a reduced carbon footprint compared to conventional steel produced from coal, the automotive industry is right behind the previous in rapidly shifting to green steel as it increases the fuel efficiency of vehicles.

The global green steel market is driven by innovation. Further developments are yet to be rolled out, probably causing a noteworthy reduction in the carbon emission factor of the industry. This would require the use of new alloys and refinement of recycling for trimming down wastes and saving resources.

The high consumer awareness and government policies for sustainable development further create a favorable setting in which green steel can develop. Companies that have made environmental stewardship part of their operations have competitive advantages, as consumers and businesses are gradually becoming more sustainable in their purchasing decisions.

Knowing this, stakeholders across sectors are working together toward ambitious sustainability targets in the future global green steel market. In this regard, such industrialists are therefore opening pathways to a more sustainable future the one in which, through green technology investments and strategic partnerships, steelmaking goes with the preservation of the environment.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$4,514.40 Million |

|

Market Size by 2031 |

$164,912.64 Million |

|

Growth Rate from 2024 to 2031 |

67.2% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

This might take several years to develop, but the market for green steel is nonetheless huge at this point, mainly due to the rising concerns of people about the environment and the changing trend towards sustainable methods of production. Such production of steel using renewable sources of energy with recycled materials is already making waves around the world.

In North America, particularly in the United States, Canada, and Mexico, demand for green steel is likely to increase due to increasingly strict environmental laws and regulations and growing integration of green technology. Growing investments on greener ways of production by manufacturers have seen a decrease in carbon emissions, thereby minimizing the pernicious impact on the environment.

Europe, comprising countries like the UK, Germany, France, Italy, and others, continues to lead the revolution in green steel. The European Union has set stringent emission targets, asking steel makers to resort to greener production processes, thereby increasing demand for green steel in the continent. Investments in renewable energy and continuous improvements in recycling technologies add further momentum to market growth.

Industrialization and urbanization are proceeding at a more rapid pace in Asia-Pacific, as in major economies like India, China, Japan, and South Korea, with the consequent increase in steel consumption.Further, with growing awareness towards environmental sustainability, countries in the region are also integrating renewable sources of energy into their method of steel production. The demand for green steel is going to soar in Asia-Pacific since several governments and industries have already begun working on carbon neutrality and sustainable development.

Green Steel is also being adopted by South America, including Brazil and Argentina, as one of the means toward attaining sustainable development. Enormous natural resources and an expanding industrial base give scope for the momentum in eco-friendly steel manufacturing.

In the Middle East & Africa GCC Countries, Egypt, and South Africa the green steel market is at a nascent stage. Governments understand the need to bring down carbon footprints while promoting sustainable industrial growth. Investments in renewable energy infrastructure and green technologies will help pave the way for green steel to rise organically in the region.

The overall growth of the global green steel market, across all these regions, looks promising in the future, with stakeholders increasingly leaning toward environmental sustainability. With increasing technology and rising consumer awareness, Green Steel is likely to be at the top in prospects, thus shaping the future of the steel industry worldwide.

COMPETITIVE PLAYERS

The global global green steel market is an exciting space for sustainable metals production, and a segment that maintains a dynamic landscape with a handful of top industry players driving innovation and competition. JFE Steel Corporation, Hbis Group, Arcelor Mittal, Green Steel Group Inc., NIPPON STEEL CORPORATION, Nucor Corporation (Nucor Tubular Products), Voestalpine, H2 Green Steel, Jindal Steel & Power Ltd., United States Steel Corp, Tata Steel, Salzgitter AG, Thyssenkrupp, Deutsche Edelstahlwerke Services, Hydnum Steel, SSAB, JSW Steel, and Liberty Steel Group are among the prominent companies associated with the growing sector. These companies are the vanguard of new technologies aimed at reducing the environmental harm of making steel. The momentum for green steel, which is characterized by marginal carbon footprints and green practices, is growing because companies worldwide are under pressure to meet high standards of environmental regulations and various stakeholders' demand for green products.

Competition among such major key players is therefore leading toward some drastic changes in the production of green steel. New processes are coming into play; examples remain the use of hydrogen in steel-making and other means such as the use of renewable sources of energy. These technologies, targeted at providing ways of minimizing greenhouse gas emissions, also enhance the effectiveness and sustainability of steel manufacturing.

The market dynamics in the green steel sector are at the core of a complex interaction between technological innovation, regulatory frameworks, and consumers' preferences. Companies are investing heavily in research and development while scaling up production capacities with high standards of environmental stewardship. This is important to meet growing global demand for steel products used in a sustainable way in industries such as automotive, construction, and renewable energy.

These players will grow in the expanding global green steel market and put to use their current knowledge and resources not only as competitors but also to capture the potential market that they will have a share in with the present firms. This likely will include more shares through strategic partnerships, merging and acquisition as firms try to build on technological ability and grow their geographical reach.

The global green steel market is witnessing robust growth globally, with a competitive landscape characterized by key players' commitment to sustainability and innovation. This development does not only promise a greener future for steel production but also highlights the transforming potential of industrial advances in a more sustainable way of doing things one that will successfully face down critical environmental impacts on a global scale. The continued success of these companies will be key to determining the future of the steel sector and sustainable development goals around the world.

Green Steel Market Key Segments:

By Industry Verticals

- Electric Arc Furnace (EAF)

- Molten Oxide Electrolysis (MOE)

By Energy Source

- Hydrogen

- Coal Gasification

- Electricity

By End User

- Construction

- Automotive

- Electronics

- Others

Key Global Green Steel Industry Players

- JFE Steel Corporation

- Hbis Group

- Arcelor Mittal

- Green Steel Group Inc.

- NIPPON STEEL CORPORATION

- Nucor Corporation (Nucor Tubular Products)

- Voestalpine

- H2 Green Steel

- Jindal Steel & Power Ltd.

- United States Steel Corp

- Tata Steel

- Salzgitter AG

- Thyssenkrupp

- Deutsche Edelstahlwerke Services

- Hydnum Steel

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252