MARKET OVERVIEW

The Global GPS and GNSS Correction Services market is a complex web of technologies and services that enhance the precision and reliability of global navigation and positioning systems. At its core, the market offers correction services for Global Positioning System (GPS) and Global Navigation Satellite System (GNSS) signals. These corrections are crucial for ensuring accuracy, reducing errors, and enabling real-time positioning, especially in scenarios where even slight discrepancies could result in significant consequences.

The Global GPS and GNSS Correction Services market fills a critical need by ensuring that our world operates with unprecedented precision. Its importance extends to both economic and societal aspects, enhancing productivity, safety, and environmental sustainability.

The Global GPS and GNSS Correction Services market, far from being an obscure realm of technology, is at the core of our modern way of life. It empowers industries and individuals alike with the tools needed for accurate positioning and navigation, influencing everything from our daily commutes to the construction of infrastructure and the growth of our crops. As this market continues to evolve, its significance and need are destined to only grow stronger, further cementing its pivotal role in shaping our future.

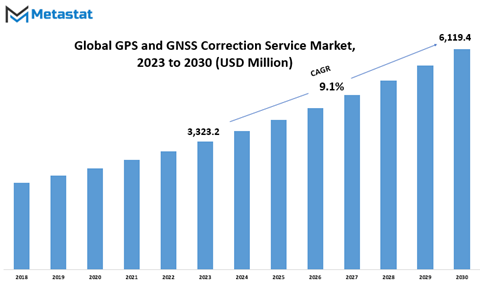

Global GPS and GNSS Correction Services market is estimated to reach $6,119.4 Million by 2030; growing at a CAGR of 9.1% from 2023 to 2030.

GROWTH FACTORS

The GPS and GNSS Correction Services Market has been witnessing significant growth due to several key factors. One of the primary drivers of this market is the increasing demand for precise navigation across various industries. This demand has become particularly pronounced in fields like agriculture, surveying, and mapping, where accuracy is paramount.

In the agricultural sector, for instance, precise navigation is essential for tasks such as field mapping, crop monitoring, and autonomous farming equipment. Farmers and agricultural professionals rely on GNSS (Global Navigation Satellite System) correction services to ensure that their machinery can operate with high accuracy, minimizing waste and optimizing crop yields.

Surveying and mapping industries also heavily depend on accurate positioning information for their work. GNSS correction services enable surveyors and cartographers to create detailed and precise maps, collect data for construction and infrastructure projects, and perform land surveys with a high degree of accuracy.

Another driving force behind the GPS and GNSS Correction Services Market is the growing adoption of GNSS-based technologies in autonomous vehicles and unmanned aerial vehicles (UAVs). These technologies rely on GNSS signals to navigate and make critical decisions. For autonomous vehicles, whether on the road or in the air, precise positioning and navigation are essential to ensure safety and operational efficiency.

However, it's important to note that the adoption of GNSS correction services comes with certain challenges. One of the notable challenges is the high cost associated with these services. GNSS correction services typically require specialized equipment and infrastructure, which can be expensive to set up and maintain. This cost factor can sometimes be a barrier to entry, especially for smaller businesses and organizations.

Furthermore, the interference and jamming of GNSS signals due to various reasons pose a significant challenge. Interference can be intentional, as in cases of jamming by hostile entities, or unintentional due to atmospheric conditions or physical obstacles. Such interference can disrupt the accuracy and reliability of GNSS data, which is a critical concern for many applications that rely on this technology.

To address these challenges and enhance the GPS and GNSS Correction Services Market, there is a strong focus on the development of new correction techniques and technologies. These innovations aim to improve the accuracy and reliability of GNSS data, even in the presence of interference. Additionally, research and development efforts are directed towards making correction services more cost-effective and accessible to a wider range of users.

MARKET SEGMENTATION

By Type

The GPS and GNSS Correction Services Market is a dynamic and evolving industry, with various segments that cater to different needs. One of the key aspects of this market is the segmentation by type, which includes Precise Point Positioning (PPP), Real-Time Kinematic (RTK), and Real-Time Kinematic with Precise Point Positioning (RTK-PPP).

Precise Point Positioning (PPP) is a segment that held a value of 1833.1 USD Million in 2022. This technology is known for its high level of accuracy and is widely used in applications where precision is of utmost importance. It has found its place in various sectors due to its ability to provide accurate positioning information.

Real-Time Kinematic (RTK) is another significant segment, valued at 796.8 USD Million in 2022. RTK technology is known for its real-time accuracy and is extensively used in applications that require instant and precise location data. It is particularly useful in scenarios where immediate decision-making is crucial.

Real-Time Kinematic with Precise Point Positioning (RTK-PPP) is a segment valued at 465.9 USD Million in 2022. This technology combines the real-time accuracy of RTK with the precision of PPP, making it suitable for applications that demand the best of both worlds. It provides high-precision positioning in real-time, which is vital for a range of industries.

By Application

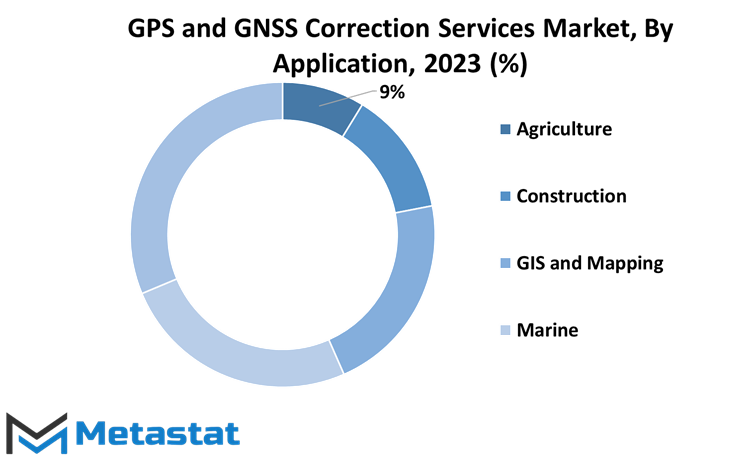

In addition to the segmentation by type, the market is also categorized by application. The key application segments include Agriculture, Construction, GIS and Mapping, Marine, and Others (Road, Location-based services).

The agriculture segment, valued at 274.3 USD Million in 2022, relies on GPS and GNSS correction services for precision farming. These services are essential for activities such as crop monitoring, yield mapping, and tractor guidance. The accuracy of positioning is critical in optimizing agricultural processes.

The Construction segment, valued at 411.9 USD Million in 2022, benefits from GPS and GNSS correction services in tasks like land surveying, site preparation, and building construction. These services ensure that construction projects are executed with precision and efficiency.

GIS and Mapping, a segment valued at 662.1 USD Million in 2022, heavily depends on accurate positioning data. Geographic Information Systems (GIS) and mapping applications require reliable GPS and GNSS correction services to create accurate maps, conduct geospatial analysis, and make informed decisions.

The Marine segment, valued at 779.9 USD Million in 2022, relies on GPS and GNSS correction services for navigation, vessel tracking, and marine surveying. These services are crucial for the safety and efficiency of maritime operations.

The Others segment, valued at 967.6 USD Million in 2022, includes a wide range of applications such as road navigation and location-based services. GPS and GNSS correction services play a role in enhancing location accuracy for various purposes, including transportation and mobile applications.

REGIONAL ANALYSIS

The GPS and GNSS Correction Services Market is influenced by geography. It's not a uniform landscape but varies based on location. These services are used worldwide, but their effectiveness and demand depend on where they are applied.

In developed regions like North America and Europe, the adoption of GPS and GNSS correction services is more widespread. The infrastructure to support these services is well-established, and the demand is high due to various applications, including agriculture, surveying, and transportation. These areas benefit from reliable and accurate correction data, ensuring precise positioning.

In contrast, emerging economies face different challenges. While the need for accurate GPS and GNSS services exists, the adoption rate may be slower due to various factors. Limited infrastructure, economic constraints, and a lack of awareness can hinder the growth of these services in certain geographic regions.

In the Asia-Pacific region, the market is diverse. Developed countries like Japan and South Korea have a robust demand for correction services, primarily driven by industries such as agriculture, construction, and geospatial applications. In contrast, developing countries in Southeast Asia may have slower adoption due to infrastructure limitations and economic constraints.

In South America, the demand for correction services is growing, especially in precision agriculture. However, the market's growth varies by country. For instance, Brazil has a more developed market compared to other South American nations.

Africa, with its unique challenges and opportunities, also plays a role in the global landscape. The adoption of GPS and GNSS correction services varies widely across the continent. In countries with a strong agricultural sector, there is a higher demand for precision farming solutions, while other regions may lag due to infrastructure limitations.

The Middle East is another region where the market is on the rise. Industries such as construction, oil and gas, and geospatial applications are driving the demand for accurate positioning services.

The GPS and GNSS correction services market is not a one-size-fits-all scenario. Geography plays a crucial role in shaping the demand and adoption of these services. While developed regions have a more mature market, emerging economies are gradually catching up, each facing its unique set of challenges and opportunities. Understanding the geographical nuances is essential for businesses operating in this dynamic market.

COMPETITIVE LANDSCAPE

The GPS and GNSS Correction Services market is a dynamic and competitive landscape, with key players operating to deliver high-precision positioning services. Two notable companies in this field are Emlid Tech Kft. and Eos Positioning Systems.

Emlid Tech Kft. is a prominent player in the GPS and GNSS Correction Services industry. They have carved a niche for themselves by providing innovative solutions that enhance the accuracy and reliability of global navigation satellite systems. Their technology is widely adopted in various sectors, including agriculture, surveying, and mapping. Emlid Tech Kft. offers a range of correction services that cater to the diverse needs of their customers. Their commitment to quality and customer satisfaction has established them as a trusted name in the market.

Eos Positioning Systems is another key player in this industry. They specialize in high-accuracy GNSS solutions that enable precise geospatial data collection. Eos Positioning Systems has a strong presence in the field of GIS (Geographic Information Systems) and mapping. Their dedication to providing cutting-edge technology for field data collection and mapping has earned them a solid reputation among professionals in the geospatial industry. Their correction services are designed to meet the demands of various applications, from utilities to environmental monitoring.

Both Emlid Tech Kft. and Eos Positioning Systems play pivotal roles in the GPS and GNSS Correction Services market. They share a common goal of enhancing location accuracy and enabling users to collect precise geospatial data. Their innovative solutions cater to a wide range of industries, providing them with the tools needed to achieve accurate positioning and efficient data collection. As key players in this ever-evolving market, Emlid Tech Kft. and Eos Positioning Systems continue to drive advancements in the field of GPS and GNSS correction services, contributing to the success of various sectors that rely on precise positioning and data collection.

GPS and GNSS Correction Services Market Key Segments:

By Type

- Precise Point Positioning (PPP)

- Real-Time Kinematic (RTK)

- Real-Time Kinematic with Precise Point Positioning (RTK-PPP)

By Application

- Agriculture

- Construction

- GIS and Mapping

- Marine

- Others (Road, Location-based services)

Key Global GPS and GNSS Correction Services Industry Players

- Emlid Tech Kft.

- Eos Positioning Systems, Inc.

- Fugro N.V.

- Swift Navigation, Inc.

- Hexagon AB

- Oceaneering International, Inc.

- Septentrio N.V.

- Topcon Corporation

- Trimble Inc.

- u-blox

- Beijing Unistrong Science & Technology Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252