MARKET OVERVIEW

The Global Quantum Computing and Communications market represents a dynamic and rapidly evolving industry at the forefront of technological innovation. Quantum computing and communication technologies have garnered significant attention due to their potential to revolutionize various sectors, including finance, healthcare, cybersecurity, and logistics. As traditional computing approaches reach their limits in processing power and efficiency, the emergence of quantum computing offers a paradigm shift in computational capabilities.

Quantum computing harnesses the principles of quantum mechanics to perform complex calculations at speeds exponentially faster than classical computers. Unlike classical bits, which can represent either a 0 or a 1, quantum bits or qubits can exist in multiple states simultaneously, enabling parallel processing and unlocking unprecedented computational power. This capability opens doors to solving complex optimization problems, simulating molecular structures for drug discovery, and enhancing machine learning algorithms.

In parallel, quantum communication technologies leverage quantum properties to enable secure transmission of information across vast distances. Quantum encryption techniques, such as quantum key distribution (QKD), utilize the principles of quantum mechanics to ensure the confidentiality and integrity of transmitted data. By leveraging the inherent properties of quantum mechanics, such as entanglement and superposition, quantum communication systems offer unparalleled levels of security, making them ideal for safeguarding sensitive information in fields such as government communications, financial transactions, and data privacy.

The Global Quantum Computing and Communications market encompasses a wide range of stakeholders, including technology providers, research institutions, government agencies, and end user industries. Companies are investing heavily in research and development to advance quantum computing hardware, software, and algorithms, with the aim of commercializing scalable quantum solutions. Research institutions and academia play a crucial role in advancing fundamental understanding and pushing the boundaries of quantum technologies.

Government initiatives and funding support further drive the growth of the quantum industry, with various countries recognizing the strategic importance of quantum computing and communication in maintaining economic competitiveness and national security. Collaborative efforts between industry, academia, and government entities aim to accelerate the development and adoption of quantum technologies, fostering innovation and driving market expansion.

Despite significant progress, the Global Quantum Computing and Communications market faces challenges on multiple fronts. Technical hurdles, such as qubit stability, error correction, and scalability, remain key obstacles to realizing the full potential of quantum computing. Moreover, the commercialization of quantum technologies requires overcoming barriers related to cost, complexity, and interoperability with existing infrastructure.

Market participants must navigate these challenges while capitalizing on the immense opportunities presented by the quantum revolution. As quantum computing and communication technologies continue to mature, they have the potential to reshape industries, drive breakthroughs in scientific research, and address some of the most pressing challenges facing society. The Global Quantum Computing and Communications market represents a frontier of innovation, where collaboration, investment, and ingenuity converge to shape the future of computing and communication.

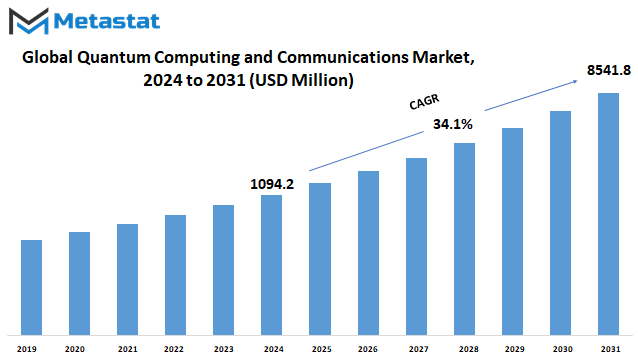

Global Quantum Computing and Communications market is estimated to reach $8541.8 Million by 2031; growing at a CAGR of 34.1% from 2024 to 2031.

GROWTH FACTORS

The Global Quantum Computing and Communications market is witnessing a surge in interest from tech giants and an increasing adoption of quantum computing technology across various industries and sectors. This burgeoning interest and adoption are fueled by several key factors. However, challenges such as error correction and limited quantum volume pose potential hurdles to market growth.

One of the primary driving forces behind the growth of the market is the growing interest from major players in the technology industry. Companies such as Google, IBM, and Microsoft are investing heavily in research and development efforts to advance quantum computing capabilities. This heightened interest is propelling the market forward as these tech giants explore the potential applications and benefits of quantum computing across different domains.

Additionally, the rising adoption of quantum computing technology across various industries is contributing to market growth. Industries such as finance, healthcare, and manufacturing are increasingly recognizing the transformative potential of quantum computing in solving complex problems and optimizing operations. From simulating molecular structures for drug discovery to optimizing supply chain logistics, quantum computing offers a wide array of applications that can revolutionize traditional processes.

However, despite the promising growth prospects, the market faces challenges that could impede its advancement. One significant challenge is error correction. Quantum systems are inherently prone to errors due to factors such as noise and decoherence. Developing robust error correction techniques is crucial for ensuring the reliability and accuracy of quantum computations. Addressing this challenge requires ongoing research and innovation to improve error correction algorithms and mitigate the impact of errors on quantum computing systems.

Another challenge facing the market is the issue of limited quantum volume. Quantum volume refers to the measure of the complexity and size of quantum computations that a system can perform. Increasing quantum volume is essential for scaling up quantum computing capabilities and tackling more complex problems. Overcoming this challenge requires advancements in hardware technologies, such as the development of more powerful quantum processors and improved qubit coherence.

Despite these challenges, the market presents lucrative opportunities, particularly in the realm of cybersecurity applications. Quantum computing has the potential to revolutionize cybersecurity by enabling the development of ultra-secure encryption methods that are resistant to quantum attacks.

As cyber threats continue to evolve, the demand for quantum-resistant encryption solutions is expected to rise, creating significant opportunities for market growth in the coming years.

The Global Quantum Computing and Communications market is experiencing robust growth driven by increasing interest from tech giants and the widespread adoption of quantum computing technology across various industries. While challenges such as error correction and limited quantum volume persist, the market presents promising opportunities, particularly in cybersecurity applications, which are poised to fuel future growth.

MARKET SEGMENTATION

By Deployment

The global market for quantum computing and communications can be divided into different deployment methods. One such method is On-premises, where the services are maintained and operated within the organization’s premises. In 2023, the On-premises segment was valued at 574.3 USD Million. This indicates a significant investment and reliance on internal infrastructure for quantum computing and communications.

Another deployment method is Cloud-based, where the services are accessed and managed remotely over the internet. In 2023, the Cloud segment was valued at 259.6 USD Million. This highlights the growing trend of leveraging cloud-based solutions for quantum computing and communications needs. Businesses and organizations are increasingly turning to cloud services for their scalability, flexibility, and cost-effectiveness.

The On-premises deployment offers organizations more control and security over their data and operations. It allows them to customize solutions according to their specific requirements and preferences. However, it also requires significant upfront investment in infrastructure and resources. Maintenance and upgrades are managed internally, which can be both a strength and a challenge depending on the organization’s capabilities and expertise.

On the other hand, Cloud-based deployment offers several advantages, including scalability, accessibility, and reduced operational overhead. Organizations can quickly scale up or down their computing resources based on demand without having to invest in additional hardware or infrastructure. Cloud services also provide greater flexibility for remote access, enabling employees to collaborate and work from anywhere with an internet connection.

Moreover, cloud providers often offer advanced security measures and compliance certifications, alleviating concerns about data security and regulatory compliance. This makes cloud-based solutions particularly attractive for organizations operating in highly regulated industries or those with stringent security requirements.

Despite the benefits of both deployment methods, organizations must carefully evaluate their needs, resources, and priorities when choosing between On-premises and Cloud-based solutions for quantum computing and communications. Factors such as data sensitivity, budget constraints, scalability requirements, and existing infrastructure investments will influence the decision-making process.

In some cases, a hybrid approach combining both On-premises and Cloud-based solutions may be the most suitable option. This allows organizations to leverage the benefits of both deployment methods while mitigating their respective drawbacks. For example, sensitive data and critical operations can be kept On-premises for maximum control and security, while less sensitive workloads can be offloaded to the cloud for scalability and cost-efficiency.

By Component

The global market for quantum computing and communications is segmented based on its components, which are hardware, software, and services. This segmentation allows for a better understanding of the various elements that contribute to the functioning of quantum technologies.

The hardware aspect of the market encompasses the physical components necessary for quantum computing and communication systems to operate effectively. This includes quantum processors, quantum bits (qubits), quantum memory, and other related hardware infrastructure. These components form the backbone of quantum systems, enabling the manipulation and processing of quantum information.

The software segment comprises the programs, algorithms, and protocols that facilitate the execution of tasks on quantum computing and communication platforms. Quantum software plays a crucial role in optimizing the performance of quantum systems and solving complex computational problems. It includes programming languages tailored for quantum computing, as well as simulation and emulation software for testing and debugging quantum algorithms.

The services category encompasses a range of offerings aimed at supporting the implementation, maintenance, and optimization of quantum computing and communication solutions. These services may include consulting, training, system integration, and technical support provided by vendors and service providers. Additionally, managed services for quantum computing and communication platforms may be offered to assist organizations in leveraging these technologies effectively.

By segmenting the market based on its components, stakeholders can gain insights into the specific areas of focus within the quantum computing and communications landscape. For example, hardware vendors may prioritize innovation and development efforts to enhance the performance and scalability of quantum processors and other hardware components. Meanwhile, software developers may focus on refining algorithms and programming tools to enable more efficient and reliable quantum computations.

The segmentation of the global quantum computing and communications market into hardware, software, and services provides a comprehensive framework for understanding the various components and functionalities of quantum technologies. This segmentation enables stakeholders to identify opportunities for innovation, investment, and collaboration within the rapidly evolving landscape of quantum computing and communication. As quantum technologies continue to advance and mature, the market segmentation will remain instrumental in guiding strategic decision-making and driving growth in this transformative field.

By Application

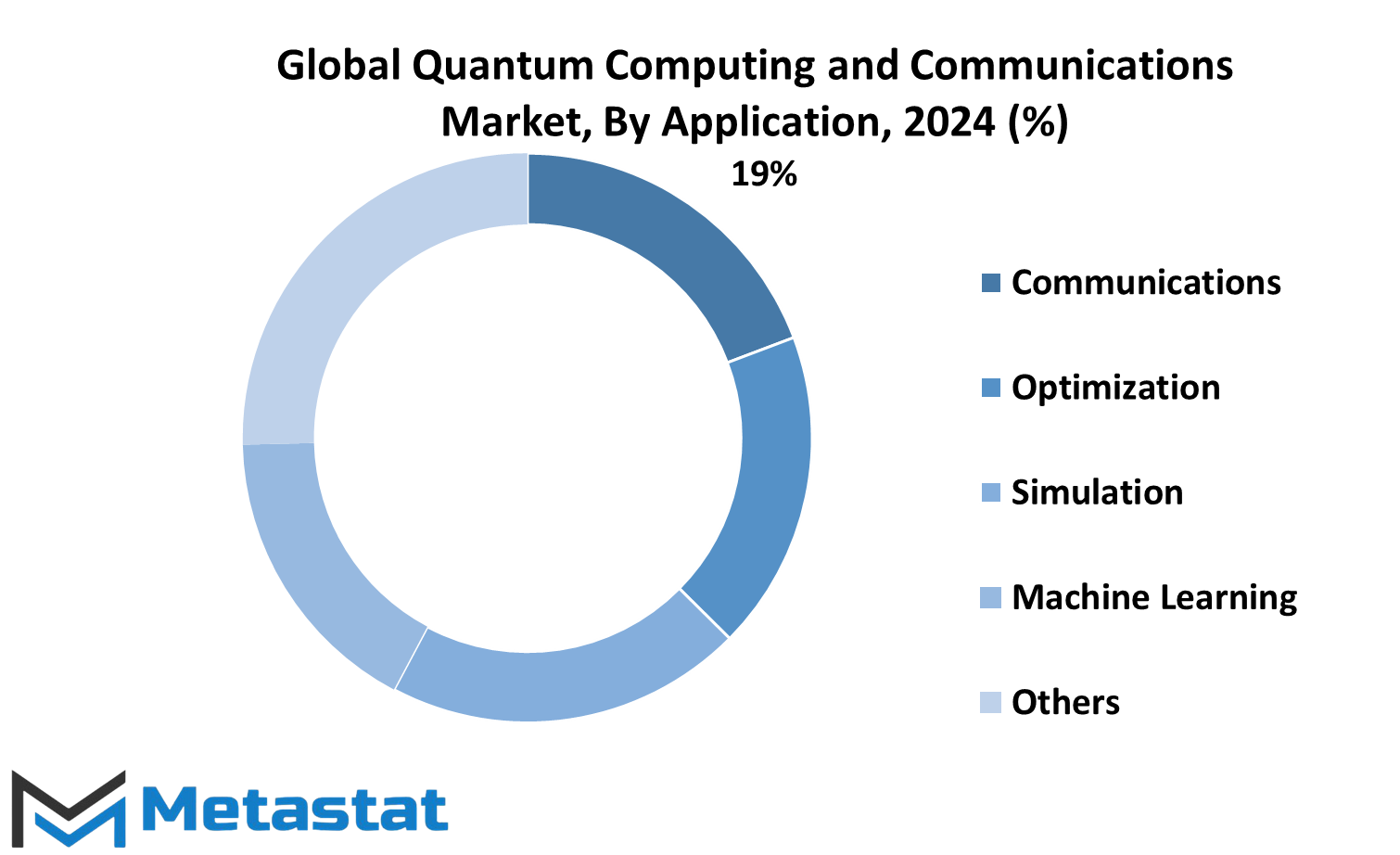

The global market for quantum computing and communications is a dynamic landscape, characterized by various applications catering to diverse needs. These applications are further divided into segments, each contributing to the overall market value.

One significant segment is communications, which plays a crucial role in facilitating information exchange across vast distances. In 2023, the communications segment of the market was valued at 159.7 million USD. This underscores its importance in enabling seamless connectivity and data transfer in an increasingly interconnected world.

Another notable segment is optimization, which focuses on enhancing processes and systems to achieve maximum efficiency. Valued at 152 million USD in 2023, optimization solutions are sought after by industries seeking to streamline operations and resource utilization.

Simulation is yet another key segment, offering the capability to model complex scenarios and predict outcomes with precision. With a value of 170.6 million USD in 2023, simulation technologies are instrumental in fields such as scientific research, engineering, and finance, where accurate forecasting is paramount.

Machine learning, a subset of artificial intelligence, is gaining prominence in various industries for its ability to analyze vast amounts of data and derive valuable insights. In 2023, the machine learning segment of the quantum computing and communications market was valued at 139.3 million USD, reflecting its growing adoption and impact.

Additionally, there are other segments within the market that contribute significantly to its overall value. These segments encompass a range of applications beyond communications, optimization, simulation, and machine learning. With a combined value of 212.2 million USD in 2023, these other segments underscore the diversity and breadth of offerings within the quantum computing and communications market.

Overall, the global market for quantum computing and communications is characterized by a variety of applications catering to different needs and industries. From enabling seamless connectivity to optimizing processes, modeling complex scenarios, and harnessing the power of machine learning, the market offers solutions that are driving innovation and transformation across sectors. As technology continues to advance, the market is poised for further growth and evolution, with new applications and opportunities on the horizon.

By End User

The global market for quantum computing and communications is segmented by end users, catering to various industries such as aerospace and defense, banking and financial services (BFSI), healthcare, automotive, energy and power, government, and others.

Quantum computing and communications technologies have gained significant traction across multiple sectors, including aerospace and defense. These industries leverage quantum computing for complex simulations, encryption, and data analysis, enhancing their capabilities in research, development, and security measures.

The banking and financial services sector is another key player in the adoption of quantum computing and communications. With the increasing demand for secure transactions and data protection, quantum technologies offer advanced encryption methods and improved data processing speeds, ensuring robust cybersecurity measures and efficient financial operations.

In the healthcare industry, quantum computing holds promise for revolutionizing medical research, drug discovery, and personalized medicine. Quantum algorithms enable faster and more accurate analysis of genomic data, leading to advancements in disease diagnosis, treatment optimization, and healthcare delivery systems.

The automotive sector is exploring quantum computing applications for optimizing vehicle design, manufacturing processes, and supply chain management. Quantum-enabled simulations allow for predictive modeling of materials, performance, and environmental impact, driving innovation in electric vehicles, autonomous driving, and sustainability initiatives.

Energy and power companies are harnessing quantum computing for optimizing energy distribution networks, grid management, and resource allocation. Quantum algorithms support complex optimization problems, enabling efficient energy production, distribution, and consumption strategies while minimizing environmental impact and maximizing resource utilization.

Government agencies are increasingly investing in quantum computing and communications to bolster national security, defense capabilities, and public services. Quantum encryption ensures secure communication channels for sensitive information exchange, while quantum sensors enhance surveillance, monitoring, and detection capabilities in various domains.

Other industries, including telecommunications, logistics, and entertainment, are also exploring the potential of quantum technologies to drive innovation, improve efficiency, and address complex challenges in their respective fields.

Overall, the global market for quantum computing and communications is witnessing significant growth and diversification, driven by the diverse needs and applications across various end-user industries. As these technologies continue to evolve and mature, they are poised to revolutionize traditional computing paradigms and unlock new opportunities for innovation and progress on a global scale.

REGIONAL ANALYSIS

The global market for quantum computing and communications is analyzed on a regional basis, considering various geographical locations such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. This segmentation helps in understanding the market dynamics and trends specific to each region.

North America holds a significant share in the global quantum computing and communications market. This can be attributed to the presence of key players, technological advancements, and high investment in research and development activities in countries like the United States and Canada.

Moreover, the increasing adoption of quantum computing technologies across various industries such as healthcare, finance, and aerospace further drives the market growth in this region.

Europe is another prominent region in the global market, with countries like Germany, the UK, and France leading in terms of technological innovation and adoption. The supportive government initiatives and funding for quantum computing research projects contribute to the market expansion in Europe. Additionally, collaborations between research institutions, academia, and industry players foster the development of quantum computing and communication technologies in this region.

The Asia Pacific region is witnessing rapid growth in the quantum computing and communications market, primarily driven by countries like China, Japan, and India. The growing investments in infrastructure development, coupled with the rising demand for advanced computing solutions, propel market growth in this region. Furthermore, increasing partnerships and collaborations between international and domestic players fuel innovation and technological advancements in quantum computing and communications across Asia Pacific.

Latin America and the Middle East & Africa regions are also expected to witness substantial growth in the quantum computing and communications market. Factors such as improving economic conditions, increasing awareness about quantum technologies, and government initiatives to promote digitalization contribute to market growth in these regions.

The regional analysis of the global quantum computing and communications market highlights the significant contributions of different geographical areas towards the overall market growth. Understanding the regional dynamics helps stakeholders in making informed decisions and devising effective strategies to capitalize on emerging opportunities in the quantum computing and communications sector.

COMPETITIVE PLAYERS

In the global Quantum Computing and Communications market, several prominent players compete for dominance. These companies, namely IBM Corporation, Google LLC, and Microsoft Corporation, play a pivotal role in shaping the landscape of quantum computing and communication technologies.

IBM Corporation stands out as a frontrunner in this competitive arena. With its extensive experience and expertise in the field, IBM has been at the forefront of developing quantum computing systems and advancing quantum communication technologies. Through its ongoing research and development efforts, IBM continues to push the boundaries of what is possible in the realm of quantum computing.

Google LLC is another major player in the Quantum Computing and Communications industry. Leveraging its vast resources and technical capabilities, Google has made significant strides in the development of quantum computing hardware and software. The company's Quantum AI research team is dedicated to exploring the potential applications of quantum computing and driving innovation in this rapidly evolving field.

Microsoft Corporation rounds out the list of key players in the Quantum Computing and Communications market. With its Quantum Development Kit and Azure Quantum platform, Microsoft is actively working to democratize access to quantum computing resources and empower developers to build quantum applications. The company's commitment to advancing quantum computing technology is evident through its collaborations with leading research institutions and industry partners.

As these competitive players vie for market share and technological leadership, their innovations and breakthroughs have the potential to revolutionize industries and transform the way we approach computing and communication. However, with great opportunity also comes great challenges. The development of practical quantum computing systems and scalable quantum communication networks requires overcoming significant technical hurdles and addressing complex engineering and scientific challenges.

IBM Corporation, Google LLC, and Microsoft Corporation are key players in the global Quantum Computing and Communications market. Their contributions to advancing the field of quantum computing and communication technologies are driving innovation and shaping the future of computing and communication. As competition intensifies and technology continues to evolve, these companies will play a crucial role in unlocking the full potential of quantum computing and communication.

Quantum Computing and Communications Market Key Segments:

By Deployment

- On-premises

- Cloud

By Component

- Hardware

- Software

- Service

By Application

- Communications

- Optimization

- Simulation

- Machine Learning

- Others

By End User

- Aerospace & Defense

- BFSI

- Healthcare

- Automotive

- Energy & Power

- Government

- Others

Key Global Quantum Computing and Communications Industry Players

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Rigetti Computing

- D-Wave Systems Inc.

- IonQ Inc.

- Honeywell International Inc.

- Intel Corporation

- Fujitsu Limited

- Toshiba Corporation

- Accenture Plc

- Xanadu Quantum Technologies Inc.

- Quantum Circuits Inc.

- Hitachi, Ltd.

- QC Ware

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252