Global Glass Ceramics Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global glass ceramics market has grown from a niche materials science experiment into a cornerstone of multiple industries, including electronics, healthcare, construction, and aerospace. Its journey began in the mid-20th century when researchers discovered that controlled crystallization within glass could yield materials with exceptional strength, thermal stability, and aesthetic versatility. What had begun as curiosity in the lab soon found its application in cookware and telescope mirrors, beginning the first stage of commercial uptake. With decades gone by, the trend of the industry changed as consumer and industrial demands changed.

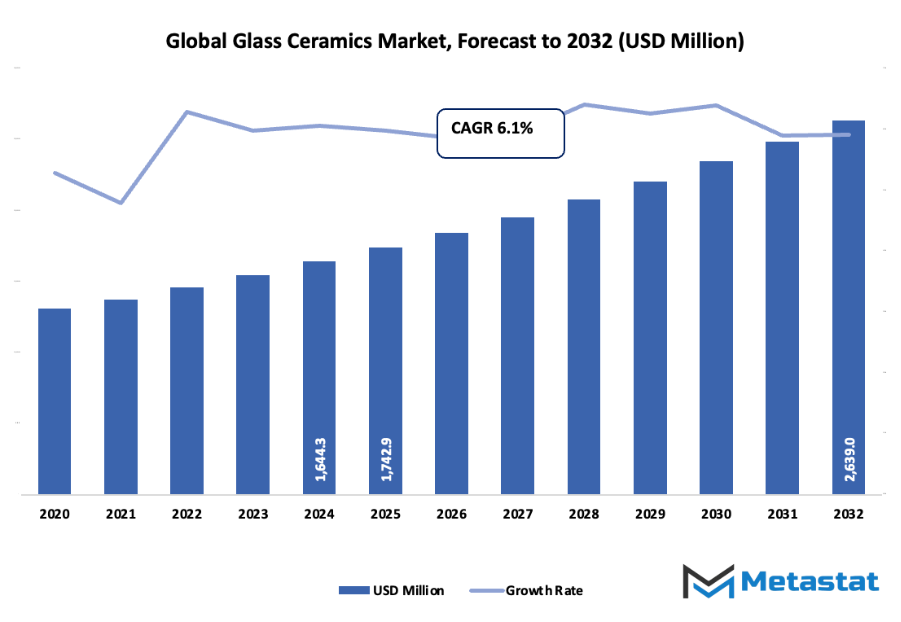

- Global glass ceramics market worth around USD 1742.9 million in 2025, at a CAGR of approximately 6.1% through 2032, has the potential to reach above USD 2639 million.

- Lithium occupy almost 44.2% market share, fueling innovation and increasing applications through strenuous research.

- Major trends fueling growth: Rising demand for aesthetically attractive and long-lasting dental restorations., Widening use of glass ceramics in electronics for their optical and mechanical attributes.

- Opportunities are: Creation of innovative glass ceramic formulations with improved properties for niche applications.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The early history of the global glass ceramics market was one of experimentation with crystallization technologies and proprietary formulation of compositions which combined strength with design versatility. In the 1970s and 1980s, as there was growing demand for tough and heat-resistant materials, glass-ceramic surfaces found widespread use in home and industrial applications. The turning point was when manufacturers optimized manufacturing technologies, allowing scale consistency and tailoring of materials for particular performance needs.

As technology evolved, so did demands. The electronics and digital market started demanding substrates that could handle high temperatures and mechanical forces, creating pressure on the market for more advanced formulations. Medical and dental uses also grew, with bio-compatible glass ceramics finding their way into surgical implants and restorative materials. Environmental regulations over the last couple of decades will keep affecting the manner in which manufacturers source raw materials and deal with wastes, creating pressures for investment in cleaner production techniques and recycling efforts.

Consumer taste is anticipated to continue developing towards sustainability and efficiency of performance. Electric vehicles, smart devices, and renewable power systems will probably require innovative glass-ceramic products suitable for harsh environments. Architectural applications will shift towards applying such materials for incorporation both aesthetically and functionally—balancing energy conservation, transparency, and durability.

From its roots in science to its current technological advancement, the global glass ceramics market will remain an intersection of innovation and adjustment. Its future will rely on how well producers frame their approach to future industrial norms, environmental concerns, and a new generation of performance-oriented design requirements.

Market Segments

The global glass ceramics market is mainly classified based on Material, Application, , .

By Material is further segmented into:

- Lithium: Lithium glass ceramics are renowned for their excellent stability and thermal shock resistance. They are therefore best suited to applications where they are expected to offer stable performance under variable temperatures. The material has extensive application in cookware, telescope mirrors, and precision tools. Its expanding use is supported by the ongoing industrial interest in high-performance materials.

- Magnesium: Magnesium glass ceramics are known for their light structure and tough mechanical properties. The material is applied in situations where there is a need for strength and minimized weight. It has high optical transparency and thermal stability. The demand has increased in production fields that specialize in strong and energy-efficient materials.

- Zinc: Zinc-based glass ceramics are emerging as their electrical conductivity and corrosion resistance are noteworthy. Due to these characteristics, they find their application in electronic components and specialty coatings. The high stress and temperature resistance of the material makes it a valuable alternative for contemporary manufacturing and engineering applications.

- Other: Other substances employed in glass ceramics are alumina, silica, and titanium-based materials. These materials are selected for usage where there is a need for special mechanical or chemical resistance. The application of such substances increases performance and provides flexibility with varying industrial requirements. Their range aids innovation in all sectors of production.

By Application the market is divided into:

- Building & construction: In building and construction, glass ceramics are applied for flooring, wall panels, and countertops due to their strength and aesthetic value. Their ability to resist scratches and heat makes them suitable for both residential and commercial projects. Sustainable construction practices also increase their use in this sector.

- Electrical & electronics: The electrical and electronics industry benefits from glass ceramics because of their excellent insulating properties. They are used in circuit boards, sensors, and insulating components. Their thermal stability and precision under high temperatures ensure long-lasting performance, which supports their continuous use in this field.

- Healthcare: Glass ceramics in healthcare are used for dental restorations, medical devices, and implants. Their biocompatibility and strength make them ideal for medical applications. The material ensures durability and safety, improving treatment outcomes and supporting innovation in medical technology. Demand continues to rise with healthcare advancements.

- Aerospace: In aerospace, glass ceramics are used in engine components, windows, and thermal shields. Their high resistance to heat and pressure ensures reliable performance in demanding environments. Lightweight properties also contribute to improved fuel efficiency. The growing aerospace industry further supports their global demand.

- Optical: Optical applications of glass ceramics include lenses, mirrors, and precision instruments. The material’s clarity and stability under various light conditions make it highly effective for optical systems. Its ability to maintain accuracy and reduce distortion has expanded its use in scientific and industrial optical equipment.

- Others: Other applications of glass ceramics include laboratory equipment, artistic products, and household items. Their combination of strength, style, and heat resistance enhances product quality. The wide adaptability of the material continues to open new opportunities in multiple consumer and industrial markets.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1742.9 Million |

|

Market Size by 2032 |

$2639 Million |

|

Growth Rate from 2025 to 2032 |

6.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

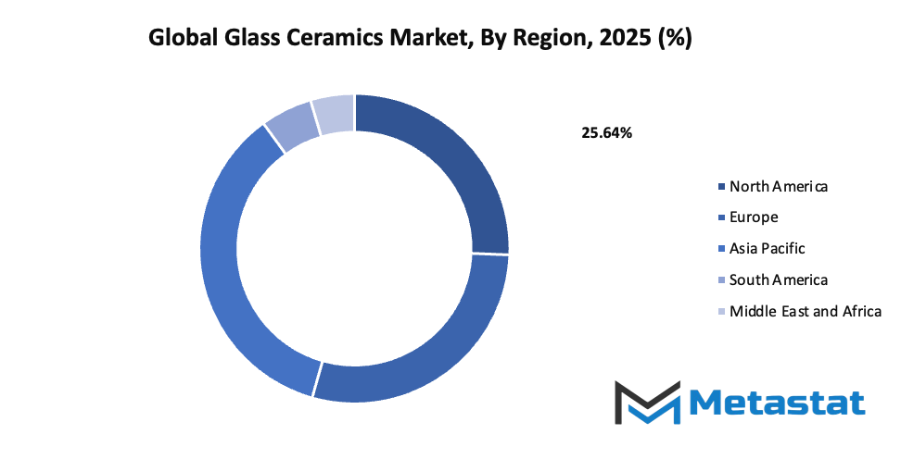

By Region:

- Based on geography, the global glass ceramics market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing demand for aesthetically pleasing and durable dental restorations: The global glass ceramics market is witnessing strong growth due to the increasing use of glass ceramics in dental applications. These materials offer both visual appeal and durability, making them ideal for crowns, bridges, and veneers. Their ability to mimic the natural look of teeth, combined with high resistance to wear, drives their demand in restorative dentistry. As patients seek long-lasting and natural-looking solutions, the use of glass ceramics in dental procedures continues to rise, strengthening market growth.

- Increasing adoption of glass ceramics in electronics for their optical and mechanical properties: The global glass ceramics market is also expanding due to rising adoption in the electronics sector. Glass ceramics provide excellent thermal stability, electrical insulation, and optical transparency, making them valuable in components such as substrates, displays, and sensors. These features improve performance and reliability in modern electronic devices. With rapid advancements in technology and miniaturization, the need for materials that maintain efficiency under stress is increasing, further supporting market expansion in this segment.

Challenges and Opportunities

- High production costs associated with manufacturing glass ceramics: The growth of the global glass ceramics market is restrained by high production expenses. The process of manufacturing requires advanced equipment, precise temperature control, and expensive raw materials. These factors make production costly and limit the accessibility of glass ceramics for small-scale manufacturers. Maintaining consistent quality and performance also adds to overall costs. Addressing these issues through efficient processes and material optimization remains crucial to achieving cost-effectiveness in production.

- Limited availability of skilled workforce proficient in working with glass ceramics: Another challenge affecting the global glass ceramics market is the shortage of skilled professionals. Producing and processing glass ceramics require expertise in specialized manufacturing techniques and equipment handling. The lack of trained workers results in slower production rates and quality inconsistencies. Investment in technical training and workforce development can help overcome this gap, ensuring improved productivity and higher-quality output across industries using glass ceramics.

Opportunities

- Development of innovative glass ceramic formulations with enhanced properties for specialized applications: The global glass ceramics market holds promising opportunities through innovation. Continuous research is leading to advanced formulations with improved mechanical strength, heat resistance, and optical clarity. These new materials are suitable for industries such as aerospace, healthcare, and electronics, where high performance is essential. Developing such advanced glass ceramics can open doors for broader applications, helping manufacturers meet specific industrial needs and strengthen their position in competitive markets.

Competitive Landscape & Strategic Insights

The global glass ceramics market is shaped by a combination of international industry leaders and regional competitors that continue to influence technological growth and production efficiency. Companies such as Corning Incorporated, Schott AG, Saint-Gobain, Morgan Advanced Materials plc, Kedi Glass-Ceramic Industrial Co. Ltd., Ohara Corporation, Kanger Glass-Ceramic Co., Ltd., Ferro Corporation, EuroKera, and Nippon Electric Glass Co., Ltd. play an important role in defining the structure and direction of this industry. Each company brings its own expertise and product innovation, contributing to a competitive environment that drives research, sustainability, and advanced applications.

From a futuristic point of view, the global glass ceramics market will move toward greater integration with high-tech industries, including electronics, healthcare, aerospace, and renewable energy. These materials are valued for their strength, heat resistance, and ability to be precisely engineered for specific uses. As global demand grows for devices that are lighter, stronger, and more energy-efficient, glass ceramics will become increasingly important. The combination of optical clarity, chemical durability, and thermal stability makes them suitable for next-generation applications such as advanced medical equipment, satellite components, and energy-efficient construction materials.

The industry will likely witness a shift toward environmentally responsible production. Companies will invest in processes that reduce carbon emissions, recycle raw materials, and optimize energy consumption. Technological advancements will help improve the precision of production methods, ensuring consistency in quality while lowering manufacturing costs. International leaders are expected to continue investing heavily in research and development to expand their presence in emerging markets, while smaller regional producers will focus on niche applications and customized solutions to remain competitive.

Collaboration between established manufacturers and new entrants will foster innovation and help meet the diverse demands of global customers. This cooperation will also encourage the use of artificial intelligence and automation in production, improving the efficiency of glass-ceramic design and testing. The result will be a more dynamic and responsive industry, capable of adapting quickly to changing technological and environmental standards.

Market size is forecast to rise from USD 1742.9 million in 2025 to over USD 2639 million by 2032. Glass Ceramics will maintain dominance but face growing competition from emerging formats.

Looking ahead, the market will continue to evolve as industries like consumer electronics and renewable energy expand. The increasing focus on sustainability and performance will encourage further material innovation, leading to new forms of glass ceramics with improved resistance, transparency, and design flexibility. These developments will strengthen the role of glass ceramics as essential materials in future technologies and sustainable manufacturing.

Report Coverage

This research report categorizes the global glass ceramics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global glass ceramics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global glass ceramics market.

Glass Ceramics Market Key Segments:

By Material

- Lithium

- Magnesium

- Zinc

- Other

By Application

- Building & construction

- Electrical & electronics

- Healthcare

- Aerospace

- Optical

- Others

Key Global Glass Ceramics Industry Players

- Corning Incorporated

- Schott AG

- Saint Gobain

- Morgan Advanced Materials plc

- Kedi Glass-Ceramic Industrial Co. Ltd.

- Ohara Corporation

- Kanger Glass-ceramic Co., Ltd.

- Ferro Corporation

- EuroKera

- Nippon Electric Glass Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252