MARKET OVERVIEW

The global gelatin market will experience a definite shift in the future years, a shift not characterized by conventional growth patterns or demand cycles, but by a consistent redefine of its applications and reputation. The shift will not be left upon the shoulders of foods or drugs, but will spread to unexpected industries and push the dimensions of how gelatin will be applied, modified, or even defined within new processes.

Gelatin's classic functions of gelling, thickening, and stabilizing will take a backseat to limited when new applications come along. There will be a shift by manufacturers and scientists to view gelatin as an active substance with responsive properties rather than simply as a commodity ingredient. Its use in biotechnology and tissue engineering will edge gradually out of the experimental laboratory and into manufacturing streams. It will be a soft but powerful transformation that will propel the global gelatin market from passive consumption to active innovation, especially in regions where organic and biodegradable will be the driving theme.

The market will also begin to intersect with high-tech material science. Rather than restricting gelatin to capsules or confectionery, companies will explore its interaction with other biomaterials to create hybrid materials for purposes beyond health and nutrition. These developments will occur gradually at first, without mass business launches, but the inherent change will be evident. Gelatin films will probably be engineered to serve as media in 3D bioprinting, and gelatin's molecular characteristics at specific temperatures and pressures will be mapped for custom industrial use.

Cultural and ethical currents will also subtly divert the course of the global gelatin market. As more communities insist on transparency in production and sourcing, the origin of gelatin especially from animal by-products will be challenged. This will not necessarily exclude traditional sources but will create a tangent wave of demand for gelatin alternatives or reformulated gelatin created by sustainable processes. Future ventures will navigate this territory cautiously, balancing time-honored customs and newer-world realities.

Digital technologies will play an invisible back-end role of optimizing gelatin manufacture. The product itself will remain physical and touchable, while the processes employed to gauge quality, adjust properties, or ensure consistency will become ever more reliant on algorithmic understanding. Information will drive improvements in a way that is not spellbinding but, rather, precise adjustments that shift pH levels, molecular weights, or cross-linking densities to yield answers formerly theoretical.

This transformation of the Global Gelatin industry will not be accompanied by big headlines and revolutionary innovations. Instead, it will arrive with incremental layering of ideas, trials, and consumer response. The path forward will not be linear. It will bend in the direction of specialization and mission-based manufacturing, away from the mass manufacturing paradigms prevalent today. The enterprise will not merely produce gelatin it will reimagine it. And in this way, it will bring the substance's significance to the furthest corners of science, design, and culture that are just beginning to take notice.

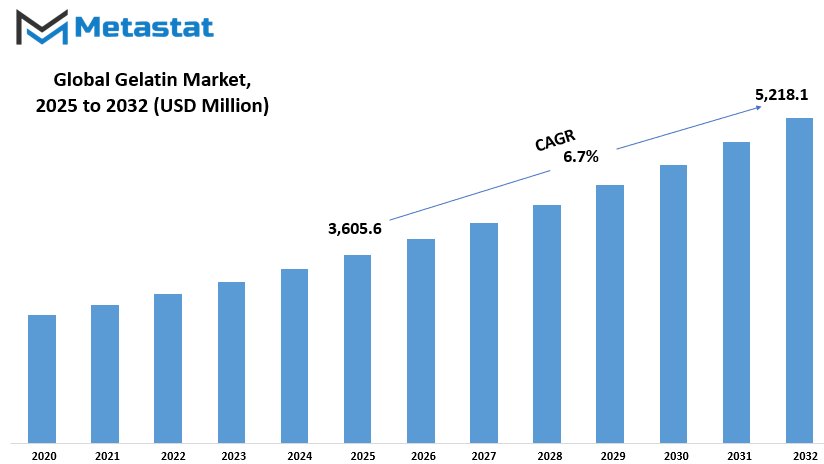

Global gelatin market is estimated to reach $5,218.1 Million by 2032; growing at a CAGR of 6.7% from 2025 to 2032.

GROWTH FACTORS

The global gelatin market is looking at major changes with developing customers' needs and technological progress in various industries. One of the main drivers for this growth is the increasing demand for clean-labeled and natural products, especially in the food and beverages industry. These days consumers are more conscious of what they eat. Consumers desire foods that are simple, recognizable, and free from artificial additives. Gelatin, being a natural protein, mainly sour from collagen, is perfect for this requirement. It is widely used in jellies, gummy sweets, yogurt, and even low-fat milk for its texturing and stabilizing qualities.

Apart from food, gelatin is also being incorporated into the pharmaceutical and nutraceutical sector. It is extensively used to manufacture capsules since it acts as a harmless and potent coating that enables swallowability and protects against what is inside. It is also being added to supplements to boost the health of joints, skin elasticity, and general well-being. Such uses are also growing as individuals more and more look for health-promoting commodities that can be swallowed easily.

Nevertheless, the market is not free from issues. One of its main problems is the volatile cost of raw materials. Gelatin production relies significantly on animal by-products like skins and bones, whose prices vary extremely based on availability conditions. It causes fluctuations in production costs, therefore affecting producers' profit margins. A problem also concerns religion and ethics. Since conventional gelatin is animal-based, it will not be suitable for the vegetarian, vegan, or certain religious dietary restrictions and, therefore, its market is limited in those areas.

Despite these problems, the market also has emerging opportunities. Innovation is now at center stage, more so with the development of plant-based and alternative gelatins. Companies are testing alternative ingredients like agar-agar, pectin, and modified starches to provide the identical function and texture without relying on animal sources. Not only is this pleasing to ethical consumers but also evades religious restrictions. Gelatin use is also being adopted widely in the cosmetic and personal care industry. Its firming and texture-improving properties render it of value in face masks, creams, and shampoos.

Overall, while the worldwide gelatin market is not without its problems, the ongoing demand for natural products and the need to innovate in substitutes are keeping it on a steady growth path.

MARKET SEGMENTATION

By Source

The global gelatin market has been growing gradually owing to its wide range of applications in food, pharmaceuticals, cosmetics, and photography. Gelatin is a protein from natural animal collagen. It has major uses in the production of capsules, gummies, marshmallows, yogurts, dermo-cosmetic products, and even film coatings. The origin of gelatin is a vital aspect that reflects its quality, price, and use. Segmented by source, the market once more is split into Bovine, Porcine, Chicken, and Marine. Of these, the largest is the Bovine segment worth $2,604.3 million. This gelatin is obtained from cows and is used extensively due to its high gel strength as well as stability. It is mostly utilized in pharmaceuticals and food products.

Pigs provide porcine gelatin as a close second and are popular due to its similar gelling and lower cost. It does have some limitations in some countries where pork is not universally accepted through cultural or religious reasons. Chicken gelatin is in less demand but is gaining popularity as a specialty item, especially for those looking for alternatives. Marine gelatin from fish has become more appealing in recent years, especially for persons with dietary restrictions that include meat. It is also appealing to persons who consume products derived from fish due to health or ethical reasons.

The choice of gelatin source is subject to many factors including religious food regulations, economic considerations, consumer demand, and needs of the application. Companies are becoming more careful while selecting the type of gelatin they use to meet their customers' needs. For example, in countries with a large population that adheres to Halal or Kosher diets, manufacturers use bovine or sea gelatin. But where there is no such restriction and cost is a larger factor, porcine gelatin may be an acceptable option.

Overall, the gelatin market is growing as it is used in more products and is a multifaceted ingredient present in most products. As the awareness increases and the consumer demand becomes more specific, companies are reacting by offering more source-specific products. Clean-label, clear, and ethical production are also increasing, forcing companies to be more conscious of where and how they produce their gelatin. With bovine constituting the highest proportion, porcine, chicken, and marine in that order, historical use combined with changing customer preferences shape the market.

By Functionality

The global gelatin market is growing continuously due to its multi-functional application across different industries. The most prominent method of analyzing the market is upon functionality. Depending on its application, gelatin is used for various purposes, and the market is classified based on those functions. These basic tasks are stabilizer, thickener and galling agents. Each of these uses has a special function in various products and industries, which is to shape demand and market trends.

Used as a stabilizer, prevents gelatin content from isolating. It is especially useful in food and drink products, where it makes the texture better and final product uniform. For example, for dairy foods such as curd or dessert based on cream, gelatin is used to prevent the texture from uneven and to prevent making it rough. Its use is not limited to food alone. In the drug and cosmetics industry, gelatin is used to stabilize drugs such as capsules and creams to preserve their form and spoil very quickly.

Used as a thicker, gelatin helps to add weight and body to products. It is useful in products such as soup, sauce and confectionery items. The addition of gelatin in small amounts helps to give the products the desired texture without affecting the taste. This use is useful when used in pet foods and health supplements, where texture not only needs to be appetizing but also digestible.

Its use as a gelling agent is possibly its most common application. It helps create a jelly-like shape that is hard but elastic when used in this form. It has widespread applications in desserts like jelly, marshmallows, and gummy sweets. Its ability to create colorless, tasteless, and hard gels gives it an advantage over other products in users' eyes. It is also used in scientific laboratories, for example, when making culture media for the growth of bacteria, where its sanitary gelling nature is extremely important.

Overall, the segmentation of the gelatin market on the basis of functionality simplifies the producers' and consumers' understanding of how and where exactly it can be used. Each function be it stabilization, thickening, or gelling adds some value to a product, hence making gelatin a valuable and desired material. Such a focus on functionality is likely to remain guiding the gelatin market's way forward as industries look for reliable and effective ingredients.

By Nature

The global gelatin market keeps growing gradually with increased demand from different sectors. The primary manner to consider this market is by analyzing it through nature-based segmentation. The market has been divided into two broad categories Conventional and Organic. Both play a particular role in guiding consumer preference and industrial usage.

Classic gelatin is the most common type for a long time and is generally used extensively in food, drugs, and cosmetics. It is mainly produced with animal collagen and has proven to be affordable and useful to use. From gummy bears to capsules, classic gelatin continues to fill the need of manufacturers for stability, clarity, and texture. Due to its beneficial history and availability, it remains a popular choice among small and large producers. However, as consumers are more aware and their focus leads to healthy and more natural products, organic gelatin has started gaining land.

Organic gelatin is produced without any artificial additive or chemical processing. It is commonly produced from animals frost on organic feeds that do not contain antibiotics or hormones. While it costs more to produce, it is attractive to more and more consumers that are growing more healthy about foods that they consume. Organic gelatin is particularly favored in top markets where health, stability and clean label are of great importance. Although still smaller than traditional gelatin, this section will see a rapid growth over the next few years due to the increasing demand for organic and moral products.

Gelatin businesses are also trying to meet both conventional and organic demand through altering production practices, supply sources, and certifications. With ever-changing health trends and consumers ever more preferring label clarity, businesses are re-evaluating their supply base and investing in both types of gelatin in order to reach a broader clientele.

The division of the global gelatin market according to nature Traditional and Organic reflects the change in consumer behavior and industry practices. Traditional gelatin remains the stronghold of the market, but organic gelatin is making its mark with steady growth. This change reflects the fact that the industry is not only adapting to consumer values but also setting the stage for an age where both quality and values go hand in hand while taking decisions.

By End-Use

The global gelatin market is seeing a stable increase as the industry develops various applications of this useful food item. Gelatin is made from animal collagen and is found widespread use with its natural thickening, geling and stabilization properties. It has a major role for playing and eating in most of the everyday products used by us. Its most common use is in food, especially as foods such as confectionery, dairy foods, meats and poultry foods, and desserts. Its application combines the texture and shelf life of food items and therefore, enhances their consumer appeal. For example, in the dessert, gelatin forms a soft and smooth texture in foods such as jelly, marshmallow and pudding.

Dairy foods also use gelatin to help maintain a creamy, firm texture. It is used exclusively in yogurt and cream foods. In meat and poultry foods, gelatin is often used as a stabilizer or binder and helps maintain the structure and moisture of processed meat. In liquids, it can help in clarification, adding clean, appealing appearance to drinks. These food applications are the most important part of the gelatin market and are likely to continue to be so with increased demand for packaged and processed food on a worldwide level.

In addition to typical food items, gelatin is also commonly utilized in protein bars and powders. With the increased focus on health and fitness, increasing demand for clean-label protein supplements is being witnessed. Gelatin is a natural source of protein, hence an easy-to-use ingredient in active lifestyle products. It helps muscle recovery and can be mixed with other nutrients without any issues in shakes and snack foods. The trend is set to grow, especially due to the rise in health awareness among young people and sportspersons.

The food and drink industry uses gelatin in a number of uses, including dressings and sauces, where it stabilizes the product and adds thickness. Other uses are collectively known as "Others," where they use it in pharmaceutical and cosmetic uses. Even though these are not part of the food industry, they still account for size and value in the market.

The global gelatin market based on end-use is classified broadly into protein bars and powder, food and drinks, confectionery, dairy products, meat and poultry foods, desserts, drink, and others. As there grows the need for convenience, nutrition, and quality in food and thus applying gelatin in different industries.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3,605.6 million |

|

Market Size by 2032 |

$5,218.1 Million |

|

Growth Rate from 2025 to 2032 |

6.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

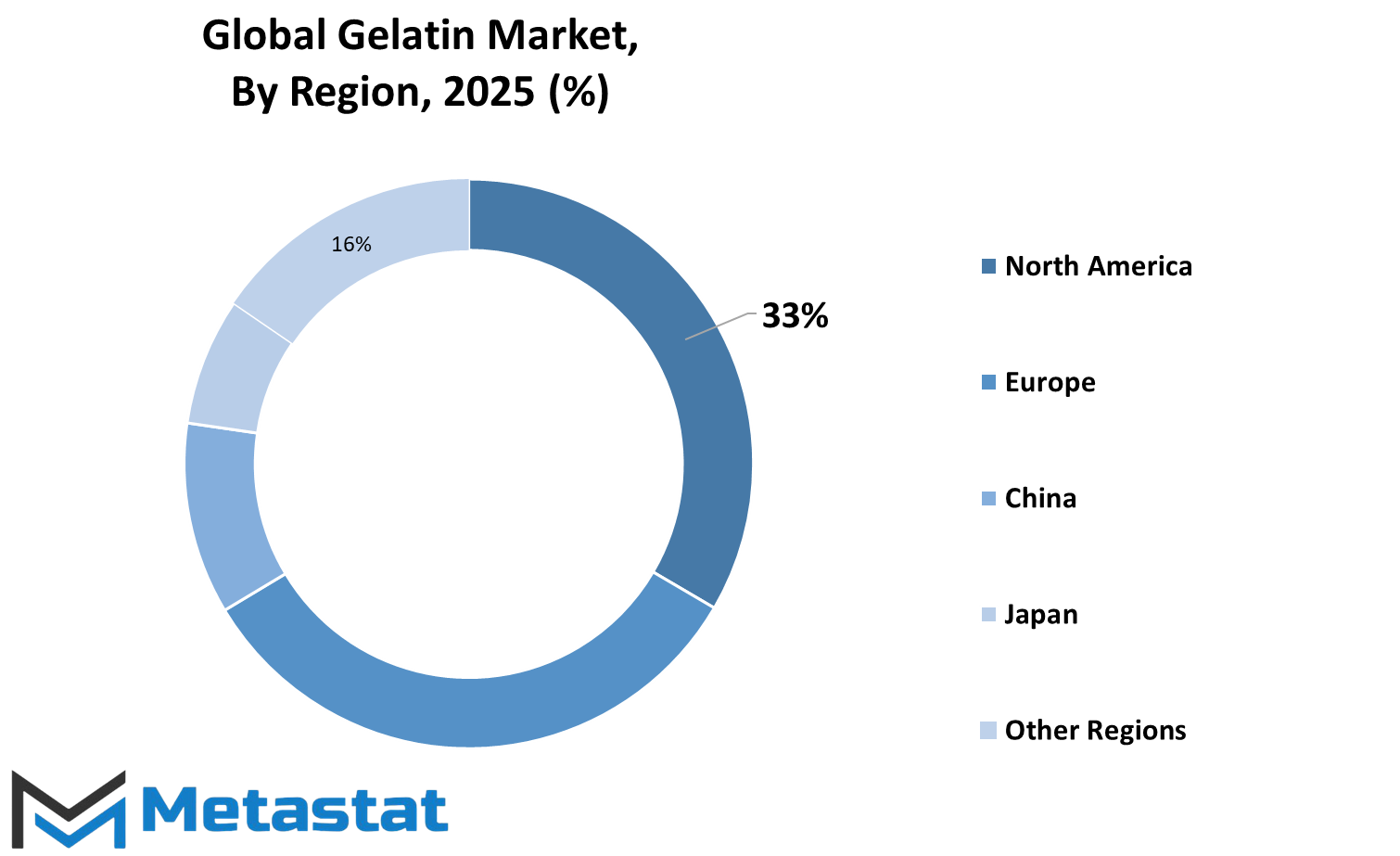

The global gelatin market is influenced by its availability in various parts of the globe. It is segmented as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions contributes to the market in its own manner, depending upon the demand of the people, production capacities, and the availability of key players. North America comprises the U.S., Canada, and Mexico, with the need for gelatin increasing due to usage in food, drug, and cosmetics products. The U.S. is a pioneer in innovation and production, while Canada and Mexico contribute consistently by way of regional demand and exports.

Europe is another prominent region in this market, with the UK, Germany, France, and Italy being the prominent ones. These nations are famous for their rich food processing sectors and highly developed pharmaceutical industries that both heavily depend on gelatin. The Rest of Europe also contributes to the market with lower but steady contributions. In Asia-Pacific, nations such as India, China, Japan, and South Korea power growth owing to increased awareness of healthcare and the growing application of gelatin in different consumer products. This is one of the most rapidly growing markets since demand and production are both growing rapidly. The Rest of Asia-Pacific region comprises nations which are increasingly using gelatin-based products, propelling additional growth in the region.

Brazil and Argentina are the market leaders in South America. These nations are experiencing an increase in the usage of gelatin, particularly in food and personal care applications. The Rest of South America is also a contributor, although to a smaller degree. The demand here is fueled by shifting consumer trends and increasing industries. The Middle East & Africa segment consists of GCC Countries, Egypt, South Africa, among others. Although this region remains undeveloped in terms of production and consumption, it has growth potential as awareness widens and the food and healthcare industries expand.

Every region of the world contributes significantly to the global gelatin market. Varying economic conditions, development of industries, and consumer behavior all impact how the market grows in each area. With increasing consciousness of health and wellness, and industries constantly discovering new applications for gelatin, the market is likely to expand in all these regions even more. With every region providing something distinct, the international gelatin market is a blend of stable demand and increasing opportunities.

COMPETITIVE PLAYERS

The global gelatin market has been consistently on the rise year after year due to a surge in demand from a number of industries like food, pharma, cosmetics, and photography. Gelatin is a protein extracted using animal collagen processed from animals like pigs, cows, and fish bones, skins, and connective tissues. Its special characteristics of gelling, thickening, and stabilizing make it useful in items such as gummy sweets, capsules, yogurts, marshmallows, and so forth. In the drug industry, gelatin finds extensive usage in the production of hard and soft capsule shells due to its safety, ease of digestion, and compatibility with liquid and powder formulations. The food industry also finds it helpful because it helps enhance the texture and consistency without affecting the flavor and nutritional content of the product.

Consumer consciousness regarding clean-label offerings and the demand for natural ingredients has also increased the demand for gelatin. Most individuals now seek products containing fewer additives and ingredients that they know and recognize, and gelatin is no exception. Moreover, growth in the wellness and fitness market has also contributed to growing application in protein supplements, particularly in the form of collagen peptides. These are said to improve skin health, joint mobility, and muscle recovery and, therefore, are widely sought by health-conscious consumers.

Even with its popularity, the market is not without challenges. There has been concern for animal well-being and increased cases of vegetarianism and veganism, calling for alternatives. Nevertheless, gelatin maintains a dominant position based on its unmatched functionality and long-term confidence between consumers and manufacturers alike. In a bid to remain competitive, major companies are turning their attention to creating innovative solutions that cater to both classic requirements and new desires.

Some of the most prominent players in the global gelatin market are Gelita, Rousselot, PB Gelatins, Nitta Gelatin, Weishardt Group, Sterling Gelatin, Ewald Gelatine, Italgelatine, Lapi Gelatine, Great Lakes Gelatin, Dongbao Bio-Tec, BBCA Gelatin, Qunli Gelatin Chemical, Yasin Gelatin Manufacturer, Xiamen Hyfine Gelatin, and Cda Gelatin. These players continuously enhance their processes, increase their global presence, and invest in research and development to develop better, safer, and more sustainable gelatin. With increasing demand in various applications and geographies, the market for gelatin is also likely to continue its upward trajectory with the help of both innovation and the firm foundation established by such premium brands.

Gelatin Market Key Segments:

By Source

- Bovine

- Porcine

- Chicken

- Marine

By Functionality

- Stabilizer

- Thickener

- Gelling Agent

By Nature

- Conventional

- Organic

By End-Use

- Protein Bars and Powder

- Food & Beverage

- Confectionery

- Dairy Products

- Meat & Poultry Products

- Desserts

- Beverage

- Others

Key Global Gelatin Industry Players

- Gelita

- Rousselot

- PB Gelatins

- Nitta Gelatin

- Weishardt Group

- Sterling Gelatin

- Ewald Gelatine

- Italgelatine

- Lapi Gelatine

- Great Lakes Gelatin

- Dongbao Bio-Tec

- BBCA Gelatin

- Qunli Gelatin Chemical

- Yasin Gelatin Manufacturer

- Xiamen Hyfine Gelatin

- Cda Gelatin

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252