MARKET OVERVIEW

The global gas sensors market will be a witness to growth that expands well beyond traditional industrial applications, shaping new dimensions in many areas. The industry is expected to cross traditional borders, which typically integrate advanced sensory technologies in areas associated with gas detection. In the coming years, the development of gas sensors will unlock the possibilities that reflect the growing demand for transfer of technical preferences and real-time, accurate environmental monitoring.

A region where the global gas sensor market will expand in the market is largely in smart cities and urban infrastructure. As cities develop in interconnected ecosystems, gas sensors will play an important role in ensuring air quality management, public safety and efficient energy use. Streetlights, embedded sensors in public transport and buildings will continuously monitor dangerous gases, provide data that enables quick reactions to pollution spikes or gas leaks. This integration will change urban management systems, making them more responsible and data-operated than ever.

In addition to the urban environment, there will be a remarkable change in the use of gas sensory technologies in the agricultural sector. Traditionally focused on industrial safety and environmental monitoring, global gas sensor markets will find new applications in accurate farming. The sensors capable of detecting soil emissions and greenhouse gases will help farmers to use fertilizer and manage the footprints of greenhouse gas. This progress will not only improve crop yields but will also contribute to permanent agricultural practices by reducing environmental damage.

An unconventional affected by healthcare gas sensor technologies will also emerge as a promising area yet. Future development will include respiratory monitoring systems and sensitive gas detection devices in clinical devices. Breath analysis will benefit from the sensor capable of identifying trace gases with high accuracy to detect initial disease or monitor the status of metabolism. It will purely mark infection of gas sensors from environmental or industrial equipment to important components in individual medicine.

The transport sector will benefit from innovations within the global gas sensor market. In addition to ensuring safety in attached places such as tunnels or vehicles cabins, the gas sensor will be integrated into the emission control systems of the next generation vehicles. As the regulatory pressure increases on the reduction in emissions, the sensors will provide real -time response, which will enable adaptive engine control and ensure compliance with stringent environmental standards. The rise of electric and hybrid vehicles will also create new sensor requirements related to battery safety and gas leakage detection.

Energy production and distribution will continue to exploit the gas sensors with methods of more than current expectations. Beyond the monitoring of leaks in pipelines or storage facilities, future gas sensor technologies will help in transition to renewable energy sources. For example, detection of gases released during biofuel production or hydrogen storage will be necessary for safety and efficiency. The global gas sensor market will closely align with these emerging energy trends, which will help reduce risks and customize production processes.

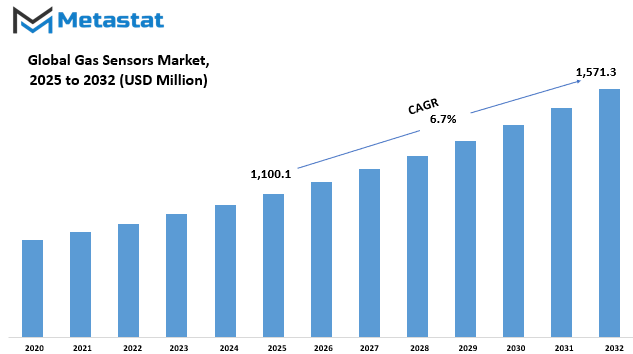

global gas sensors market is estimated to reach $1,571.3 Million by 2032; growing at a CAGR of 6.2% from 2025 to 2032.

GROWTH FACTORS

The global gas sensors market at large, accounting in the growth and development of the market. Air quality monitoring is increasingly becoming a necessity in industrial and residential settings alike. Expanding industries and an increasing urban population are creating a demand for reliable gas sensors to either detect harmful gases or help maintain a safe environment. This trend gains importance in settings where exposure to hazardous gases is an actual health risk for the workers. Concurrently, governments across the globe are in the process of implementing hostage strict emission and safety regulations. Such regulations serve to compel industries to institute better monitoring systems, which then act as direct growth factors to the global gas sensors market.

In opposition to these growth factors are those that have the tendency to act as restraining forces. To cite examples: gas sensors in general require a high initial investment, which becomes an inhibiting factor to either small businesses or a fresh set of users. Besides, the sensor has to be carefully calibrated to give accurate results, which can often be a complicated and time-taking process. These complexities add to the factors keeping away a possibly substantial potential user base. Also, there is a lack of awareness of gas sensors in several developing regions. This lack-products keep the adoption rate low in that region, which ultimately shrinks the overall growth of the market.

On the other hand, there are promising opportunities that can lead to further expansion. A major sector of development is the integration of gas sensors in Smart City Projects and Internet of Things (IOT) applications. Since the cities are more connected and focus on stability, gas sensors will play an important role in management of pollution and ensure public safety.

MARKET SEGMENTATION

By Product

The global gas sensors market play an vital position in shielding people and keeping air pleasant in various industries and environment. These devices are used to stumble on and degree the presence of gases within the air, to save you injuries, monitor pollution and make certain right functioning fame. As industries develop and the want for higher air monitoring increases, the demand for gas sensors is likewise growing continuously. This growth isn't best inspired by means of safety issues, but additionally inspired by using rules that require higher monitoring of gases, mainly in places which include factories, energy plant life and cars.

The global gas sensors market product category is broken in many sorts, serving a specific objective. Among them, oxygen (O2)/Lambda sensors stand out with a marketplace length of $ 139.Four million. They are often used in motor car and business applications to govern gasoline performance and emissions. Carbon dioxide (CO2) sensors are used in heating, air flow and air con structures to degree indoor air first-class, at the same time as carbon monoxide (CO) sensors are required to detect this dangerous fuel in homes, places of work and public homes. Nitrogen oxide (NOX) sensors are usually used to lessen emissions in cars and enhance engine overall performance.

In addition to these, the methyl mercopton sensor helps detect the presence of this gas, which has a strong odor and is often found in natural gas pipelines. The "other" category includes sensors for hydrogen, ammonia, and hydrogen sulfide - used in different regions such as agricultural, chemical plants and mining. These sensors are important for detecting leaks or gas buildups that can be dangerous if anyone's attention is noticed.

As technology improves, these sensors are becoming more accurate, smaller and easy to install and use. Wireless connectivity and smart features are being added, which provide real -time monitoring and quick reactions. These updates make them more effective and user friendly, supporting better decision making in industries relying on gas monitoring.

By Type

Gas sensors are devices that detect and measure the presence of gases in an environment. They play an essential position in diverse industries together with healthcare, car, production, and environmental tracking. As protection rules develop stronger and era will become superior, the call reliable gas sensors keep increasing. These sensors help prevent accidents, make certain places of business protection, and help environmental safety by means of figuring out fuel leaks or dangerous emissions early.

The global gas sensors market has seen regular increase due to growing concerns approximately air quality and industrial protection. More agencies and governments are making an investment in smart technology that monitors air pollutants, toxic gases, and flammable materials. These sensors are actually utilized in homes, factories, cars, or even wearable devices. They assist come across gases like carbon monoxide, methane, ammonia, and nitrogen dioxide, that can pose fitness and safety risks if left out.

By type, the global gas sensors market is divided into wireless and stressed-out fuel sensors. Wired gasoline sensors are often desired in industrial settings in which a stable connection is important for non-stop tracking. These sensors are commonly related to a strength source and records device, supplying excessive accuracy and regular performance. They are utilized in regions like electricity, vegetation, oil refineries, and production facilities where actual-time fuel detection is essential.

On the other hand, wireless gasoline sensors are gaining reputation due to their flexibility and ease of set up. They are perfect for locations in which wiring is difficult or highly-priced, which include remote areas or brief worksites. Wireless sensors can ship facts over networks, making it easier to reveal situations from a distance.

These types are often used in smart buildings, mining operations, and portable safety equipment. As the use of Internet of Things (IOT) increases, wireless sensors are becoming more normal due to their compatibility with connected systems.

The global gas sensors market is also being operated with increasing awareness about indoor air quality and cleaner environment. People are getting more health-conscious, and gas sensors help maintain safe air in homes, offices and public places. Governments are encouraging industries to establish these sensors to reduce harmful emissions and comply with environmental standards. As technology becomes more cheap, more businesses and individuals are expected to adopt gas sensors in their daily operations and living places. This trend will probably continue as security and stability remains top priorities worldwide.

By Technology

The global gas sensors market is progressively growing, pushed with the aid of rising concerns over safety, environmental rules, and growing commercial programs. Gas sensors play an vital position in detecting harmful gases inside the surroundings and industries, assisting to save you accidents and make certain protection. These sensors are widely used in sectors which includes oil and gasoline, mining, production, automobile, healthcare, and residential regions, where even small leaks can lead to serious outcomes. The demand for those sensors is growing now not handiest because of commercial growth however also because of the growing need for indoor air quality monitoring in homes and workplaces.

By technology, the global gas sensors market is in addition divided into Electrochemical, Semiconductor, Solid State/MOS, Photo-ionization Detector (PID), Catalytic, Infrared (IR), and Others. Each of these technology has its very own unique use relying at the sort of gasoline being monitored and the environment it's miles utilized in. Electrochemical sensors are famous for their accuracy and are generally used for detecting toxic gases consisting of carbon monoxide and nitrogen dioxide. Semiconductor sensors, however, are regularly utilized in domestic environments due to the fact they're value-effective and smooth to apply. Solid State or Metal Oxide Semiconductor (MOS) sensors are long lasting and perform properly in severe situations, making them appropriate for business settings.

Photo-ionization Detectors (PID) are pretty sensitive and are used to detect risky organic compounds, often observed in offices like chemical vegetation. Catalytic sensors are particularly used for detecting flammable gases and are a relied-on preference for industries handling flammable substances. InfraRed (IR) sensors are particular and paintings nicely in environments wherein other sensor sorts might not perform successfully, specifically in detecting gases like carbon dioxide and methane. The "Others" class consists of rising or specialised technology that serve precise or precise detection purposes.

As the notice of air fine and worker protection continues to grow, industries and governments are investing extra in technology that may offer reliable and actual-time facts. This shift is encouraging producers to expand advanced fuel sensors which might be more touchy, inexpensive, and user-pleasant. As a result, the global gas sensors market is not only increasing but additionally turning into extra competitive. This trend will likely preserve as new technologies emerge and guidelines become stricter, pushing organizations to prioritize protection and environmental standards more than ever before.

By End-user

The global gas sensors market is developing progressively as various industries discover extra makes use of for those devices. Gas sensors help hit upon the presence of gases in an area, frequently as a part of a safety system. They are critical in preventing unsafe conditions and improving the general safety and functionality of operations. One of the maximum essential aspects of the global gas sensors market is how it is divided with the aid of quit-users, as each sector uses gasoline sensors otherwise primarily based on its unique needs.

In the medical area, gas sensors are utilized in equipment like ventilators, anesthesia machines, and oxygen monitors. These devices must provide correct readings to make certain patient protection and powerful remedy. As the healthcare enterprise grows and extra interest is given to affected person monitoring and protection, the call for for gasoline sensors on this area will keep to rise.

Building automation and home home equipment additionally rely upon gas sensors. These are frequently located in heating structures, gasoline stoves, and smoke detectors. In clever homes and cutting-edge homes, gasoline sensors assist maintain air high-quality and detect any fuel leaks that might lead to fires or health troubles. As extra humans shift in the direction of smart dwelling and more secure housing, the usage of gasoline sensors on this location is anticipated to growth.

Environmental monitoring is another key zone where gas sensors are crucial. They assist detect pollution in the air, contributing to efforts to reduce pollution and track harmful emissions. With rising concerns over air quality and climate trade, governments and agencies are turning to fuel sensors as a dependable device to screen environmental situations.

The petrochemical industry depends on the gas sensor to detect heavy leaks and to ensure safety in plants and refineries. These environments include handling of flammable and toxic gases, so it is important to detect precise gas. Similarly, the motor vehicle sector uses gas sensors in vehicle emission systems to monitor and control pollutants, which helps to meet environmental standards and improve fuel efficiency.

In the industrial sector, gas sensors support manufacturing processes, especially where chemicals or gases are involved. Agricultural uses gas sensors to monitor the status of greenhouse, ensuring growth and safe storage of healthy crops. Finally, other areas such as mining or fire fighting also benefit from gas sensors for safety and operational accuracy.

Since each of these regions continue to increase and improve security standards, the global gas sensors market will be followed. With a wide range of applications and increasing requirement of accuracy, the gas sensor will remain an important component in modern systems in industries.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,100.1 million |

|

Market Size by 2032 |

$1,571.3 Million |

|

Growth Rate from 2025 to 2032 |

6.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

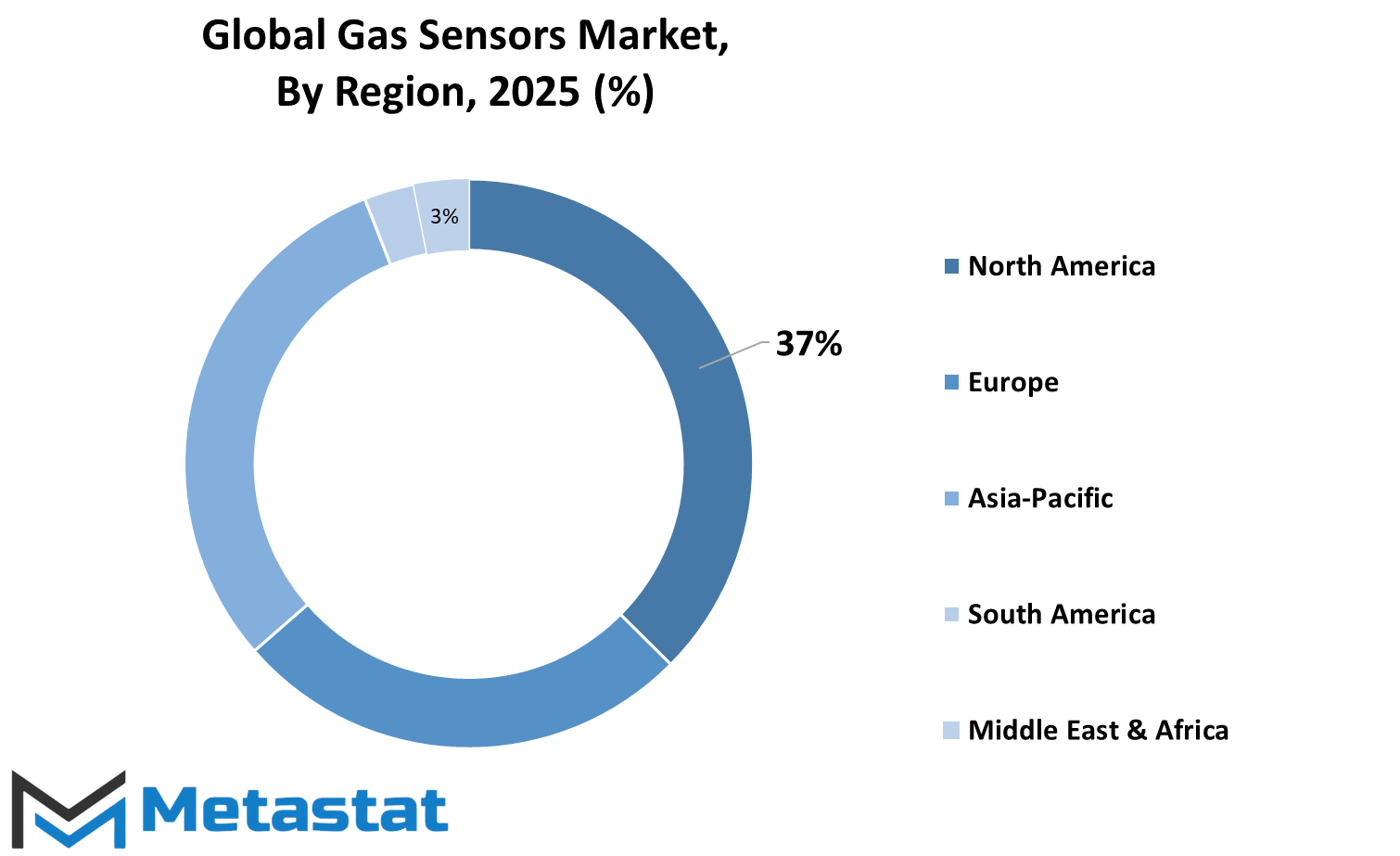

The global gas sensors market is spread across several key regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions contributes in its very own manner, primarily based on demand, development, and industrial interest. North America is broken down into the USA, Canada, and Mexico. Among those, the U.S. Performs a first-rate position because of its strong commercial base, developing safety guidelines, and increasing use of gas sensors in home and business settings. Canada and Mexico are also displaying steady growth, especially in manufacturing and environmental monitoring.

In Europe, the gas sensors marketconsists of the United Kingdom, Germany, France, Italy, and the Rest of Europe. Germany stands proud as a chief contributor because of its awareness on car and commercial automation, both of which rely heavily on fuel detection systems. The UK and France also are essential gamers, pushed with the aid of stricter guidelines around health and safety, and a developing focus of environmental problems. Italy and other European nations aren't a long way in the back of, because the demand for air pleasant tracking and clever infrastructure maintains to rise.

Asia-Pacific is made up of India, China, Japan, South Korea, and the Rest of Asia-Pacific. This vicinity is predicted to develop swiftly because of the growing tempo of urbanization and industrial improvement. China, specifically, is main the manner with a strong push for safety in factories and the growth of smart metropolis projects. India is likewise seeing a upward thrust in the adoption of gasoline sensors because of its efforts to improve air best and implement place of work protection policies. Japan and South Korea maintain to put money into advanced technologies, such as gas detection systems, across diverse sectors which include healthcare, automobile, and patron electronics.

South America includes Brazil, Argentina and the rest of South America. Brazil is a major market here, thanks to its growing energy and industrial areas, where gas sensors are becoming more common. Argentina is also raising speed, especially in food processing and mining industries where gas monitoring plays an important role.

Finally, the Middle East and Africa is divided into GCC countries, Egypt, South Africa and the rest of the Middle East and the rest of Africa. The GCC region shows strong capacity, especially in oil and gas where gas detection is important. Egypt and South Africa are looking at increasing use in healthcare and environmental applications, while the rest of the field is gradually holding because awareness increases and technology becomes more accessible.

COMPETITIVE PLAYERS

The global gas sensors market are essential tools that help detect the presence of gases in an environment. These sensors play a major role in ensuring that workplace, home and public sector are safe. Whether it is detecting changes in toxic gases, leaks, or air quality, gas sensors consume people on time to take necessary action. They are used in industries in construction, motor vehicle, oil and gas, healthcare and even domestic products. The need for gas sensors increases due to safety concerns and increase in strict environmental regulations.

Gas sensors work by responding to some gases and by converting that information into signal. This signal is then used to trigger the alarm, turn off the system or record data for further use. The accuracy and reliability of these sensors is very important, especially in places where life or valuable equipment may be at risk. Over time, gas sensors have improved in terms of performance, size and cost, which has made them more popular and accessible to a wide range of use. There are different types of gas sensors based on technology such as electrochemical, infrared, metal oxide and cattle -catalytic sensors. Each type has its own strength and to detect it is chosen based on the type of gas and the environment in which it will be used.

The global gas sensors market is expected to increase. More people are becoming aware of the air quality and the dangers of harmful gases. Governments and organizations are also focusing more on security and pollution control. It is motivating companies to invest in better sensing technologies. Some of the leading players working in the gas sensor industry include ABB Limited, Alphasense, Emphenol Advanced Sensor, AMS AG, Bosch Sensor GMBH, City Technology Limited, Dynamant Limited, Figaro Engineering Inc., Membrapor AG, Nemoto & Co., Ltd., Senseair AB, Sensirion AG, and Siemens AG. These companies are leading the way by offering advanced solutions and constantly working to improve sensor design and function.

Gas Sensors Market Key Segments:

By Product

- Oxygen (O2)/Lambda Sensors

- Carbon Dioxide (CO2) Sensors

- Carbon Monoxide (CO) Sensors

- Nitrogen Oxide (NOx) Sensors

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

By Type

- Wireless

- Wired

By Technology

- Electrochemical

- Semiconductor

- Solid State/MOS

- Photo-ionization Detector (PID)

- Catalytic

- Infrared (IR)

- Others

By End-user

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

Key Global Gas Sensors Industry Players

- ABB Ltd.

- AlphaSense

- Amphenol Advanced Sensors

- AMS AG

- Bosch Sensortec GmbH

- City Technology Ltd.

- Dynament Ltd.

- Figaro Engineering Inc.

- Membrapor AG

- Nemoto & Co., Ltd.

- Senseair AB

- Sensirion AG

- Siemens AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383