Global Garden Pesticides Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

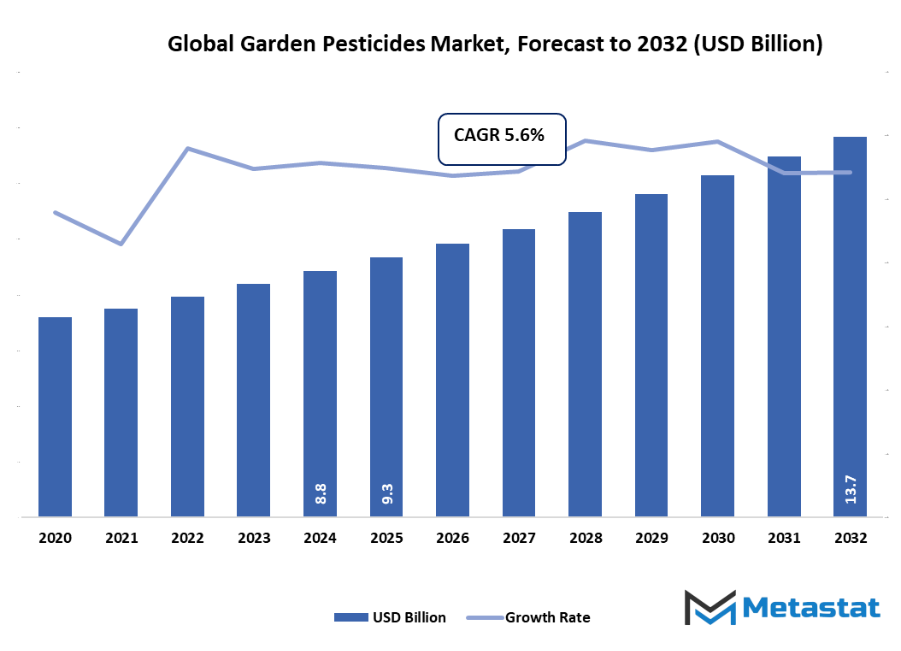

- The global garden pesticides market valued at approximately USD 9.3 billion in 2025, growing at a CAGR of around 5.6% through 2032, with potential to exceed USD 13.7 billion.

- Powder account for a market share of 44.2% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing demand for home gardening and landscaping activities, Rising awareness about crop protection and garden aesthetics

- Opportunities include: Shift toward organic and eco-friendly pesticide alternatives presents growth opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global garden pesticides market is a segment that is situated in the agricultural and home care industry, which is the essential segment that deals with the needs of plant protection in both residential and commercial gardening applications. This is a market that, through focusing specifically on ornamental plants, household gardens, landscaping projects, and small-scale cultivation, will go some way beyond traditional agriculture, where pest management has been the decisive factor for healthy growth and aesthetic value. In contrast to large-scale farming inputs, garden pesticides are designed for more targeted use and hence, usually, look like products in convenient packaging and compositions are for those who are not commercial users such as home gardeners, horticulture professionals, and municipal landscaping agencies.

The market will revolve around a wide assortment of products that includes insecticides, fungicides, and herbicides formulated to protect gardens from pests, fungal infections, and weeds. The demand for eco-friendly and residue-free solutions/products is the key to product development worldwide, with the transition being towards bio-based formulations and integrated pest management techniques. These innovations will not only enable safe use in residential areas but will also keep the product's effectiveness intact against the most common garden threats. In addition, the consumer's access to ready-to-use sprays, granular formulations, and organic solutions is further enhanced by the fact that they make the application easier and correspond with the growing preference for sustainability.

The global garden pesticides market will keep on growing as a result of the improvements made in the field of technology, packaging, and digital campaigns that promote the correct use of the product and the achievement of the expected results. In this industry, which is in the process of becoming more and more urbanized and where gardening is becoming a way of life as well as a part of the community's design, will be one of those aspects that will establish the industry as a factor of household well-being and environmental care. The future of the industry will be determined by how well it marries the themes of effectiveness, environmental safety, and user convenience.

Market Segmentation Analysis

The global garden pesticides market is mainly classified based on Formulation Type, Type, Distribution Channel.

By Formulation Type is further segmented into:

- Powder

Garden pesticides in powder form are widely used as they are easy to keep, last for a long time, and are cheap. Such pesticides can be applied directly on the plants or the sprayed solution can be used. Powders are the choice of both gardeners and farmers as they can penetrate fungi and insects deeper and thus, less waste occurs. They also become less cumbersome to transport due to their light packaging. But they may be subject to problems like irregular distribution during application and greater likelihood of wind drift, particularly in outdoor use. - Liquid

Liquid gardening pesticides are widely used for their quick action and convenience of application via sprays. They provide more uniform plant coverage and are commonly developed for both preventive and curative applications. Liquids find extensive use in home gardens and commercial landscaping since they ensure fast absorption and targeted application of pests. Most contemporary liquid products ensure minimum impact on the environment through reduction in chemical run-off. While effective, they need proper storage and handling to avoid spilling or incorrect use.

By Type the market is divided into:

- Herbicides

Herbicides in garden pesticide industry are crucial to destroying unwanted weeds that rob plants of nutrients, water, and sunlight. Herbicides come in selective and non-selective forms, providing gardeners with choices based on requirement. Not only are herbicides gaining traction due to the rising demand for decorative gardening and residential landscaping, but the market is also looking at environment-friendly and organic herbicides. These products are coming up to cater to the consumers who are eco-conscious. On the other hand, the condition of the soil and the presence of toxic residues are still the main issues causing anxiety. - Insecticides

Insecticides continue to be a leading segment of the garden pesticides industry, targeting pests such as aphids, beetles, caterpillars, and ants that can cause damage to crops and ornamental plants. Their types vary from chemical-based sprays to organic ones that employ neem or essential oils. There is increasing demand for safer insecticides with lower harmful residues driven by awareness of sustainable gardening. For domestic use, insecticides are used in small amounts, but for commercial landscape gardening and horticultural establishments, huge applications are made. - Fungicides

Fungicides play a key role in pre-emptive and curative control of diseases of plants that are caused by fungi, including powdery mildew, rusts, and blights. Fungicides prevent ornamental crops and food crops from suffering huge losses. Due to climate change and varying weather patterns, fungus infections in gardens are now increasingly common, and this stimulates demand for fungicides. Growing use of bio-fungicides from natural extracts is also picking up pace. Excessive use of chemical fungicides, though, can create resistant fungus forms, and hence the requirement to innovate in formulations. - Fumigants

Fumigants are applied to treat soil and kill pests in sealed garden spaces, greenhouses, or storage units. Fumigants emit a gas that deeply pervades soil and plant material, killing pests, larvae, and fungal spores. Although they are very effective, fumigants are not commonly used in home gardens because they raise safety issues. Commercial nurseries and large gardening operations utilize them to sterilize ground before they plant. Increasing regulations over chemical fumigants are opening up green alternatives to those that have lesser toxicity.

By Distribution Channel the market is further divided into:

- Online

Online channel is transforming the garden pesticides market at a fast rate, with the increasing convenience of doorstep delivery and extensive variety of products. E-commerce websites enable customers to compare several pesticide brands, check reviews, and access chemical as well as organic offerings with ease. With growing digital acceptance, even farm consumers in rural areas are opting for online purchases of agri-inputs. Repeat buyer groups such as gardeners and landscapers are also seeing subscription-based delivery models. But unavailability of products immediately and authenticity issues continue to be drawbacks in online commerce. - Offline

Even though the garden pesticides market is near the West Pointers, offline channels still have a considerable market share in the area. In the neighbourhood, offline channels continue to have a large share of the pesticide market for gardens, especially in developing countries, where local retailers and farm supply stores are still the most popular places to buy. Consumers who buy in brick-and-mortar locations get to see the products physically, get consultation, and make purchases on the spot without waiting for delivery. Garden centers, nurseries, and hardware stores still draw visitors who need the advice of experts. However, despite some trust and interaction between buyers and sellers occasioned by offline sales, limited stock in relation to online shops and availability issues in distant locations pose big problems.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9.3 Billion |

|

Market Size by 2032 |

$13.7 Billion |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

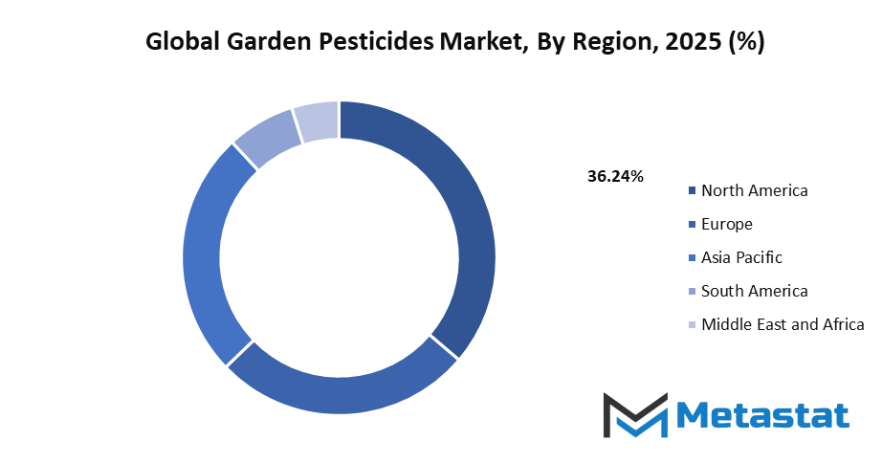

By Region:

The garden pesticides market in North America encompasses the U.S., Canada, and Mexico. These markets have home gardening, landscape, and increased consumer interest in organic produce as their main growth drivers. Furthermore, the use of eco-friendly pesticides and the administrations' attempts to limit the use of pollutants have become a leading trend in the market of this area.

The UK, Germany, France, and Italy along with other EU countries are the leaders of the European market where strict EU regulations play a major role in fostering environmentally friendly practices. The market in these countries is advancing due to the need for bio-based pesticides and the popularity of urban gardening, among other factors. Meanwhile, the Asia-Pacific region consisting of India, China, Japan, and South Korea is moving at a very fast pace due to the combination of rapid urbanization, rising disposable incomes, and the home-grown fruits and vegetables trend.

South America as well as the Middle East and Africa are two of the largest emerging markets that have not yet fully developed. Brazil and Argentina are leading on the trend of change in South America as they have shown an increasing interest in both agricultural and residential gardening. Whereas, the GCC countries, Egypt, and South Africa are the leaders of the Middle East & Africa region that are benefiting from the increasing number of landscaping projects, the development of modern gardening solutions and the slow but steady change in the attitude towards the use of environmentally safe pesticides, thus the area is expanding.

Market Dynamics

Growth Drivers:

Growing demand for home gardening and landscaping activities

The expansion of city gardening, home lawn, and landscaping has converted the request of garden pesticides in rise. Buyers are progressively viewing gardening as a leisure activity and a method of decorating their living areas, thus propelling the sale of herbicides, insecticides, and fungicides. The market will probably experience prolonged growth with the trend of more people investing in the creation of environmentally friendly and pest-free places. Ease of use of products by amateur gardeners also stimulates broader usage among household segments.

Rising awareness about crop protection and garden aesthetics

As there is an increasing emphasis on healthier living, individuals are realizing more than ever the need to protect plants against pests while creating garden beauty. For food crops in home gardens or garden flowers in private living spaces, pesticides are being viewed as indispensible for safeguarding plant health. Growing awareness campaigns, combined with expanding demand for high-end landscaping in urban culture, are driving market adoption. People now connect well-maintained gardens with safety as well as beauty, further solidifying demand.

Restraints & Challenges:

Health and environmental concerns over chemical pesticide usage

The higher awareness level about the negative effects of chemical-based pesticides on human health, pets, and the environment serves as a major restraint for the market. Excessive use of these kinds of products can potentially contaminate the ground and water and be toxic to children and animals. As consumers become more aware, demand for chemical-intensive products is going down. Regulatory agencies and pressure groups further consolidate such concerns, pushing producers to innovate new products and move towards safer, less toxic garden protection products.

Stringent regulations on pesticide formulations and sales

Government regulation of pesticide use, labeling, and distribution remain a challenge. Strict conditions are required to protect users and the environment, hence slowing down product approval and increasing compliance costs for manufacturers. Retailers and distributors also face issues with restricted sales of certain high-strength pesticides, hence limiting access to end-users. Although a necessity for public health, the regulations serve to limit market growth and discourage smaller market players because of excessive compliance.

Opportunities:

Shift toward organic and eco-friendly pesticide alternatives presents growth opportunities

The growing popularity of gardening, lawn in homes, and landscaping has resulted in the increased use of garden pesticides. Increasing numbers of people are resorting to gardening as a hobby, as well as an activity for making their dwellings more attractive, thereby creating greater demand for herbicides, insecticides, and fungicides. As long as people continue to seek out green, pest-free surroundings, the market will continue to expand at a steady rate.

Competitive Landscape & Strategic Insights

The global garden pesticides market is influenced by the combination of international leaders and regional players who are new in this area, thus the market is highly competitive. Besides, there are also several major companies, including Central Garden & Pet Company, S.C. Johnson & Sons Inc., Bayer AG, The Scotts Company LLC, and Syngenta, holding tightly the market throughout their vast product offerings and a great number of distribution channels. The fact that they have already set up makes them not only the trendsetters but also the standard setters in the quality and safety of the products.

The above-mentioned market players are supporting the development of their brand by going for sustainable and eco-friendly solutions with particular respect to a worldwide consumer community that is increasingly being concerned with the environment and looking for healthy lifestyles. Companies like Organic Laboratories, Inc., Reckitt Benckiser Group PLC, DuPont de Nemours, Inc., BASF SE, and Willert Home Product are funding research and development to come up with bio-based and organic products. The shift towards more environmentally responsible products is not only their edge over other companies in the market but also their advantage in benefiting from the trust of their customers.

Regional competitors are increasingly attracting customers by presenting cost-effective solutions suitable for local gardening practices, mainly in emerging markets. Cross-border partnerships, the shift into organic product lines, and the adaptation of innovative distribution methods are some of the factors that are driving competitiveness all over the different regions. The expansion of home gardening, urban landscaping, and sustainable farming practices will further drive these competitive dynamics, leading to the industry landscape being revolutionized and further innovation shaping market behaviour.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 9.3 billion in 2025 to over USD 13.7 billion by 2032. Garden Pesticides will maintain dominance but face growing competition from emerging formats.

The global garden pesticides market will gradually expand its market share as the gardening, landscaping, and urban greening trends are spread across the globe. Earlier consumers' awareness regarding environmentally friendly and safe solutions, the manufacturers are launching the new products with bio-based formulations and in easy-to-use packaging. Although stricter regulations and environmental issues might challenge the sector, the market's flexibility-which is one of its most significant strengths-will allow it to overcome such difficulties. By promoting sustainability and developing products that meet consumers’ changing needs, the market will go further in qualifying its position as a source of garden health and beauty.'

Report Coverage

This research report categorizes the garden pesticides market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the garden pesticides market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the garden pesticides market.

Garden Pesticides Market Key Segments:

By Formulation Type

- Powder

- Liquid

By Type

- Herbicides

- Insecticides

- Fungicides

- Fumigants

By Distribution Channel

- Online

- Offline

Key Global Garden Pesticides Industry Players

- Central Garden & Pet Company

- S.C. Johnson & Sons Inc.

- Bayer AG

- The Scotts Company LLC

- Syngenta

- Organic Laboratories, Inc.

- Reckitt Benckiser Group PLC

- DuPont de Nemours, Inc.

- BASF SE

- Willert Home Product

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383