MARKET OVERVIEW

The global fungicide market is a focal component of the agrochemicals industry and will continue to define the way that farmers and suppliers deal with crop protection. It will be an area where effective solutions for disease control by fungus will cross over with sustainability objectives and regulatory demands. The sector will be an array of chemical and biological compounds meant to protect crops against fungal diseases, and it will be vital in ensuring protections for yields, populations to eat, and environmental stability.

In the coming years, this industry will seek alternatives to conventional synthetic chemistries. Biologically sourced agents, microbial applications, and naturally derived extracts will receive increased focus. These new strategies will move to minimize chemical residues in soils and decrease environmental impact while providing consistent disease control. Suppliers will leverage microbiological, fermentation, and precision delivery advances to produce options that are more targeted and quicker to break down. Regulators across the world will modify approvals and labeling rules, encouraging companies toward cleaner products and science-based safety profiles. Industry players will invest to follow the path that pathogens take to develop and circumvent current treatments, infusing discovery and formulation with a dynamic rhythm.

The organization of this market will mirror the tussle and tension between large established companies that hold significant proprietary ingredients and smaller innovators who will introduce new biological substitutes. Distributors, cooperatives, and online extension platforms will link growers to recommendations that will be specific to the local climate, disease cycles, and crop rotation regimes. Online tools will enable producers to foresee fungal attacks before signs of disease appear. Drones, weather-activated sensors, and artificial intelligence-driven decision tools will be utilized to recommend timing, dosage, or even whether a biological control might be a superior alternative to conventional therapy.

At the same time, fungicide demand will follow changing agronomic trends. As horticulture, specialty cropping, and high-value vegetable crops grow, specialized products with lower volumes but more precision application become the norm. Greenhouse and vertical farm operations will have contained systems of application, where closed-loop delivery will keep drift and excess to a minimum. Export markets will have residue limits that will require formulators to reformulate chemistry profiles and create post-harvest treatments that meet tighter regulations.

Bulk ingredient producers will optimize processes to reduce environmental impacts. They will adopt cleaner supply chains, employing renewable raw materials or energy-intensive synthesis. Firms will use lifecycle analyses to demonstrate value from cradle through field, and they will pursue transparency initiatives that will enable customers to compare carbon footprints or water consumption. That public transparency will drive purchase decisions and reputation, affirming that sustainability no longer will be a choice in this space.

In the years ahead, collaborations between agrochemical firms, start-ups, and academic institutions will become more standard. Cooperative efforts will enable promising biocontrol products to be expanded more rapidly or with lowered chemical complements to extend utility. Joint tests will assist in demonstrating effectiveness under actual farm conditions, meeting growers' and regulators' approval. That synergy will assist in broadening the box of tricks at agronomy professionals' disposal.

Finally, the global fungicide market will embody a combination of heritage and innovation, bringing together historical crop protection practices with new, science-driven solutions for tomorrow's needs. It will be a realm where the heritage of the established actives and the potential of new options will exist together, guiding agriculture to safer, smarter, and more responsive practices for the threats on the horizon all while assisting those in the field to plant, protect, and thrive.

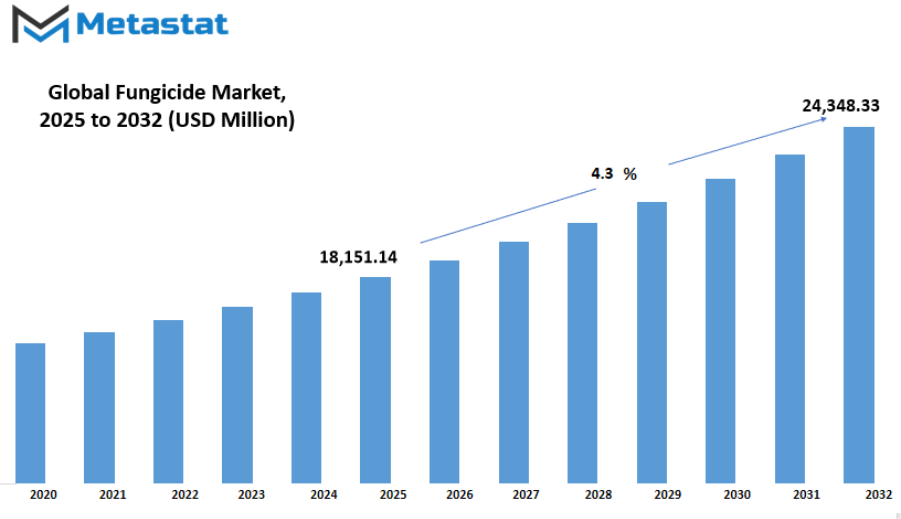

Global fungicide market is estimated to reach $24,348.33 Million by 2032; growing at a CAGR of 4.3% from 2025 to 2032.

GROWTH FACTORS

The global fungicide market will continue to gain attention in the coming years as agricultural production faces increasing pressure to meet the growing demand for food. With rising populations and the need for higher crop yields, farmers are adopting advanced crop protection solutions to safeguard production and maintain consistent quality. This trend will drive steady growth as modern farming techniques rely on efficient and reliable fungicide applications to protect crops from harmful fungal infections that can significantly reduce output.

A major factor supporting this growth will be the rising prevalence of fungal diseases affecting high-value crops such as fruits, vegetables, and cereals. As farming systems intensify to meet demand, conditions often become more favorable for fungal infestations, creating the need for more effective and targeted solutions. The global fungicide market will benefit from this demand as producers seek treatments that not only prevent yield losses but also enhance overall crop health and quality to satisfy strict consumer and commercial standards.

Despite these promising developments, certain challenges will slow the pace of growth. Regulatory restrictions on chemical residues remain a significant hurdle, often delaying product approvals and limiting the availability of new chemical-based formulations. Authorities are becoming increasingly cautious in approving new products, focusing on environmental safety and health impacts. Additionally, the growing resistance of fungi to existing fungicides reduces long-term effectiveness, forcing producers to invest more in research and innovation to keep pace with evolving threats in the field.

Opportunities for future growth remain strong, especially in the area of bio-based fungicides. As sustainable farming practices gain importance worldwide, the shift toward biological and environmentally friendly alternatives will open new possibilities for the global fungicide market. These bio-based solutions are gaining traction for their ability to provide effective disease management while meeting stricter regulatory and safety requirements. Continued advancements in biotechnology and research will support the creation of innovative products that combine efficiency with sustainability, appealing to both large-scale farmers and smaller agricultural enterprises.

Overall, the global fungicide market will experience a balanced growth path driven by technological innovation, rising food demand, and a clear shift toward sustainable solutions. Strategic investments in research and development, along with collaborations between technology providers and agricultural producers, will help overcome challenges related to regulation and resistance. As farming continues to modernize, the market will position itself as a critical component of the agricultural value chain, supporting productivity and food security for future generations.

MARKET SEGMENTATION

By Crop Type

The global fungicide market is witnessing consistent growth, driven by the rising demand for effective crop protection solutions. By crop type, this market is further segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and others. In 2025, the valuation stands at USD 9,412.53 million, with cereals and grains contributing USD 2,568.24 million, fruits and vegetables reaching USD 4,664.81 million, oilseeds and pulses holding USD 1,505.56 million, and the remaining value spread across other crop types. This expansion reflects the increasing importance of reliable fungicide applications in modern farming practices, aiming to secure high-quality yields and protect crops from damaging diseases.

Growing global population levels will keep increasing the demand for food, and this will push the need for advanced and efficient fungicide solutions. Cereals and grains will continue to dominate the market due to their critical role in food security. Fruits and vegetables, however, will show faster growth, supported by rising health awareness and the shift toward diets rich in fresh produce. This steady growth indicates that agricultural producers will prioritize protecting their crops from fungal diseases to meet global consumption needs without compromising quality.

Technological innovations will also shape the future of the global fungicide market. The integration of precision farming techniques, smart application tools, and eco-friendly solutions will enhance efficiency while reducing environmental impact. Research and development efforts will lead to the creation of safer, more targeted fungicides that protect crops while maintaining soil health. With climate patterns becoming less predictable, the demand for products that ensure crop resilience will keep increasing.

In addition, the expansion of trade in agricultural products will boost the adoption of fungicides across emerging markets. Countries with growing agricultural exports will invest more in sustainable crop protection methods to meet international quality standards. This trend will create opportunities for collaborations between technology providers and agricultural producers, helping to introduce innovative formulations tailored for different crop segments.

Looking ahead, the global fungicide market will not only grow in value but also evolve in terms of sustainability and efficiency. Farmers and producers will rely on advanced solutions that combine productivity with environmental responsibility. This transformation will help maintain steady growth while addressing global challenges such as food security, climate change, and sustainable farming practices. By 2025 and beyond, continued investment and innovation will ensure that the market remains an essential part of agricultural progress, supporting higher yields and healthier crops for a growing population.

By Type

The global fungicide market will continue to expand as the demand for effective crop protection grows worldwide. Rapid urbanization, population growth, and the increasing need for high-yield agricultural production are driving steady market progress. Advanced farming techniques and the integration of smart agricultural practices will push the market toward greater efficiency and innovation. Rising concerns about crop diseases and unpredictable weather patterns will create a stronger need for reliable solutions that protect crops and ensure food security.

By type, the global fungicide market is divided into biological, triazoles, dithiocarbamates, strobilurins, inorganics, chloronitriles, and others. Biological fungicides will see significant growth, supported by the rising shift toward sustainable farming and the demand for environmentally friendly solutions. These products will gain more attention as regulations tighten on chemical usage and as farmers seek safer alternatives that support soil health and biodiversity. Triazoles will remain a key segment due to their strong effectiveness against a wide range of fungal diseases, especially in staple crops that support global food systems.

Dithiocarbamates will continue to hold an important position because of their cost-effectiveness and broad application in different crop categories. Strobilurins will advance due to ongoing innovations that improve resistance management and enhance yield quality. Inorganics and chloronitriles, though more traditional in their applications, will still contribute to market stability, particularly in regions where these solutions are well-established and cost advantages remain strong. The “others” segment, which includes newer and niche formulations, will likely grow steadily as research and development efforts lead to the introduction of advanced solutions designed to target specific crop challenges.

Looking forward, technological advancements will transform the global fungicide market. Data-driven tools, precision agriculture, and automated spraying systems will allow for better monitoring and targeted application, reducing waste and increasing overall effectiveness. Greater investments in research will lead to the development of next-generation products with longer-lasting effects and improved safety profiles.

Regulatory changes will also play a major role in shaping the market’s future. Stricter environmental policies will encourage the shift toward biological and low-impact options, while global collaboration in research will help address resistance issues and ensure reliable crop protection. The growing adoption of integrated pest management programs will also boost demand for balanced and innovative fungicide strategies that work in harmony with other crop protection methods.

Overall, the global fungicide market will maintain strong momentum, driven by the combined need for productivity, sustainability, and technological innovation. Continuous progress in science and agriculture will ensure that future solutions meet the evolving challenges of crop production across diverse regions.

By Mode of Application

The global fungicide market will continue to grow as agriculture moves toward more advanced and efficient methods of protecting crops. With the rising demand for higher yields and healthier produce, the need for reliable disease control will remain a driving factor. By mode of application, the market is divided into seed treatment, soil treatment, foliar, and others. Each method plays a critical role in enhancing crop protection and ensuring that productivity goals are met, and this balance will shape how the market develops in the future.

Seed treatment will remain one of the most effective methods, as it allows protection to start at the earliest stage of crop growth. This method will see wider adoption because it reduces early losses and gives plants a better start, leading to healthier yields. As technology advances, treatments will likely become more precise, targeting specific pathogens while using smaller amounts of chemicals to reduce environmental impact.

Soil treatment will continue to gain attention because it works directly in the growth environment of crops. Healthy soil is the foundation of strong agriculture, and treating soil for fungal threats helps prevent damage before crops even sprout. Future approaches will focus on integrating soil biology and smart technologies, helping farmers apply treatments more accurately to conserve resources and protect ecosystems.

Foliar applications, which involve applying fungicides to leaves and stems, will remain a vital option for rapid and targeted disease control. These treatments allow farmers to respond quickly when crops show signs of infection, limiting the spread and saving large portions of harvests. In the coming years, advancements in spraying techniques and drone technology will likely make this method even more efficient, ensuring better coverage with less waste.

The others category in the global fungicide market will also evolve. This includes innovative methods such as controlled-release systems and biological treatments that harness natural organisms to combat harmful fungi. These solutions will likely expand as agriculture places more focus on sustainability and reducing chemical residues in food and the environment.

Overall, the global fungicide market will adapt to meet the changing needs of modern farming. With population growth increasing the demand for food, protecting crops from fungal threats will be more important than ever. Technological improvements, precision application methods, and a stronger emphasis on sustainability will define the future of this market, ensuring that farming practices remain productive while addressing environmental concerns.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$18,151.14 million |

|

Market Size by 2032 |

$24,348.33 Million |

|

Growth Rate from 2025 to 2032 |

4.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global fungicide market is expected to experience steady growth in the coming years, driven by the increasing need to protect crops from fungal infections and ensure higher yields. Agriculture is evolving with modern techniques, and the rising demand for quality produce is encouraging greater adoption of effective crop protection solutions. Continuous improvements in chemical formulations and the introduction of bio-based alternatives will further strengthen the market’s position, meeting the need for safer and more sustainable farming methods.

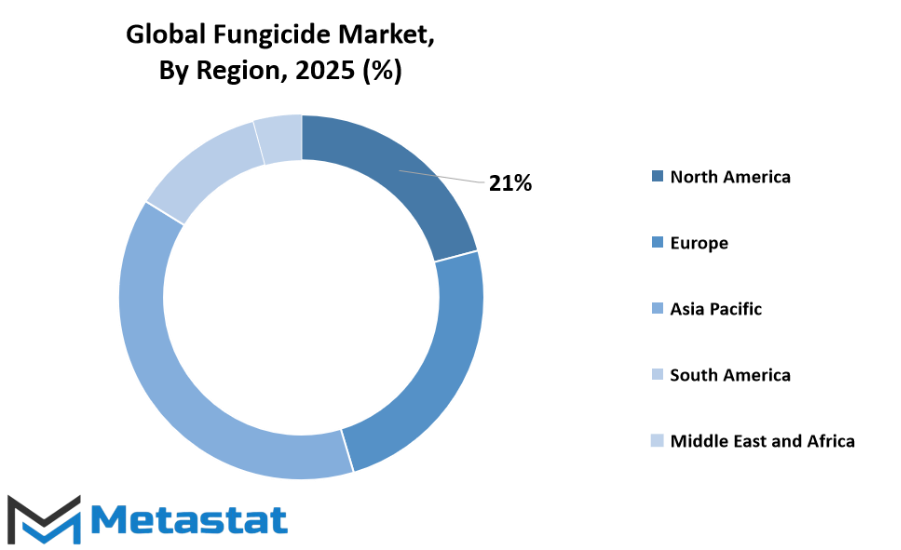

Based on geography, the global fungicide market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America includes the U.S., Canada, and Mexico, with the U.S. leading due to advanced agricultural practices and large-scale crop production. Europe consists of the UK, Germany, France, Italy, and the Rest of Europe, where stringent regulations and growing demand for organic products are shaping market trends. In Asia-Pacific, with India, China, Japan, South Korea, and the Rest of Asia-Pacific, rapid population growth and the expansion of agricultural activities will push for higher adoption of fungicides to secure consistent food production. South America, which includes Brazil, Argentina, and the Rest of South America, is witnessing strong growth as large farming areas increasingly depend on crop protection to sustain export demands. The Middle East & Africa, categorized into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, will continue to show rising demand due to the expansion of modern farming systems and investments in agriculture technology.

Looking ahead, technological advancements will play a major role in shaping the global fungicide market. Precision agriculture and digital monitoring tools will help farmers apply fungicides more efficiently, reducing waste and improving crop health. The market will also see stronger investments in research and development to create eco-friendly products that minimize environmental risks while maintaining effectiveness. In addition, supportive government policies and the rise of integrated pest management strategies will encourage the responsible use of fungicides across all regions.

Climate change will remain a significant factor influencing market dynamics, as changing weather patterns often create favorable conditions for fungal diseases. This shift will drive innovation in product development, pushing manufacturers to offer solutions tailored to specific regional challenges. Over time, the global fungicide market will not only expand in volume but also evolve toward smarter, sustainable, and technologically enhanced solutions that support both productivity and environmental balance.

COMPETITIVE PLAYERS

The global fungicide market will move toward a future where innovation and strategic partnerships shape its direction. competition among major players plays a central role in driving growth and setting new trends. this essay explores how key organizations currently operating within the fungicide industry contribute to that evolution and how their approaches suggest what lies ahead.

UPL South Africa (PTY) LTD stands out by focusing on integrated solutions suited to local conditions. activities emphasize combining modern chemistry with learnings from regional needs. Syngenta carries forward a long tradition of research and strong product pipelines, and that foundation helps in adapting offerings to new challenges. Bayer Crop Science benefits from a global presence and deep research background. that background supports the shift toward more sustainable active ingredients. BASF SE brings experience in chemistry and global production, staying ahead by shaping manufacturing processes and efficiency.

ADAMA leans into cost-effective options, ensuring access for farmers in price-sensitive markets. Corteva Agriscience brings broad agricultural knowledge and connections. that background supports moving fungicide options into integrated plant health systems. FMC Corporation applies strong technical skills, especially in formulation development, contributing to more user-friendly fungicides. Nufarm Africa balances local market focus with global support, making it agile in adapting products to emerging threats.

Sipcam Oxon Spa brings chemical strength from European roots and combines it with targeted marketing strategies. Rovensa Next adds fresh ideas, especially in biocontrol and greener approaches that hint at what fungicide offerings may look like. Dhanuka and Godrej Agrovet reflect how firms outside traditional global hubs will shape the future, drawing on local insight and broad industrial support. Crystal Crop Protection Ltd. builds a strong pipeline through collaborations, moving into newer markets with creative partnerships. Indofil draws on decades of experience while embracing change through new formulations adapted to modern conditions. Rallis India Limited (TATA) combines trust from a long corporate heritage with efforts to modernize, showing how established names evolve under pressure to deliver better performance.

Competition in the global fungicide market will revolve around balancing innovation, sustainability, affordability, and local relevance. key players each influence that balance in their own ways, experimenting with new chemistry, developing safer options, forming alliances, or strengthening supply chains. moving forward, outcomes will come from what each firm tries next and how quickly adaptation happens. The global fungicide market will grow smarter, more inclusive, and better equipped to meet future challenges thanks to the efforts of these competitive players.

Fungicide Market Key Segments:

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Type

- Biological

- Triazoles

- Dithiocarbamates

- Strobilurins

- Inorganics

- Chloronitriles

- Others

By Mode of Application

- Seeds Treatment

- Soil Treatment

- Foliar

- Others

Key Global Fungicide Industry Players

- UPL South Africa (PTY) LTD

- Syngenta

- Bayer Crop Science

- BASF SE

- ADAMA

- Corteva Agriscience

- FMC Corporation

- Nufarm AFrica

- Sipcam Oxon Spa

- Rovensa Next

- Dhanuka

- Godrej Agrovet

- Crystal Crop Protection Ltd.

- Indofil

- Rallis India Limited (TATA)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252