MARKET OVERVIEW

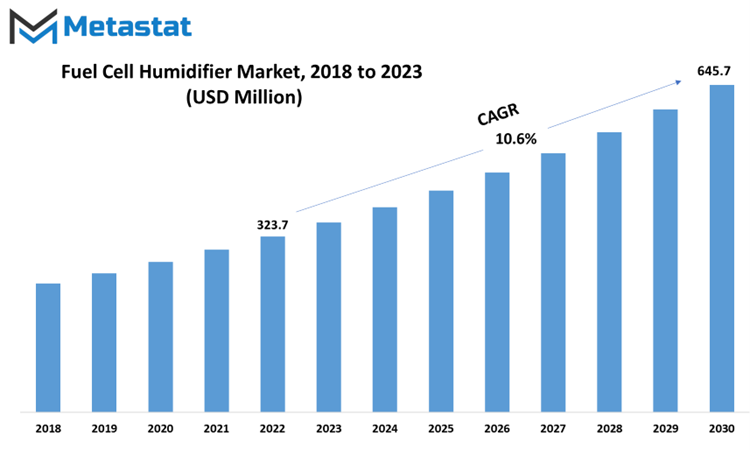

The Global Fuel Cell Humidifier market is estimated to reach $645.7 Million by 2030; growing at a CAGR of 10.6% from 2023 to 2030.

The Global Fuel Cell Humidifier Market plays a crucial role in the broader landscape of fuel cell technology. While it may not always be in the limelight, fuel cell humidifiers are essential components for ensuring the efficiency and longevity of fuel cell systems. As the world shifts towards cleaner and more sustainable energy solutions, the market for fuel cell humidifiers is poised for growth, with innovations and advancements on the horizon.

The energy industry is undergoing a significant transformation, with an increasing emphasis on sustainable and environmentally friendly power generation and fuel cells have emerged as an important player in this transformation, offering a promising solution for clean and efficient electricity generation. Among the critical components of a fuel cell system is the fuel cell humidifier, a technology that ensures the proper functioning of fuel cells by managing humidity levels in the cell's core.

The future of the Global Fuel Cell Humidifier Market appears promising. As fuel cell technology continues to advance, driven by a global shift toward clean energy, the demand for efficient humidification systems is expected to increase. Advancements in materials, designs, and manufacturing processes will likely contribute to the market's growth. Additionally, ongoing research and development efforts aim to create fuel cell humidifiers that are more adaptable, reliable, and economically feasible.

GROWTH FACTORS

One of the key drivers in the Fuel Cell Humidifier market is the integration of humidifiers with fuel cells. Humidifiers play a crucial role in maintaining the functionality of fuel cell stacks by adding moisture to the cell membranes. This moisture is essential for the efficient operation of fuel cells in vehicles, which utilize electrochemical reactions for power generation. Humidifiers are positioned near the primary fuel cells, acting as heat and moisture exchangers. They help maintain thermal energy and humidity levels, ensuring a continuous flow of electrons and reducing resistance in the machinery. The increasing demand for integrating humidifiers with fuel cells enhances operational efficiency, longevity, and performance, driving market growth.

Another significant driver is the adoption of fuel cell technology in long-haul commercial vehicles. High fuel costs and concerns about emissions have led the automotive industry to explore eco-friendly options for these vehicles. Fuel cell stacks offer a weight-efficient alternative to battery-powered vehicles, eliminating the need for heavy batteries. The adoption of fuel cell technology in these vehicles has increased the demand for humidifiers. Humidifiers prevent fuel cell stacks from drying up, ensuring continuous operation. This growth in fuel cell adoption supports the sale and integration of humidifiers.

On the flip side, high initial investments present a notable restraint in the Fuel Cell Humidifier market. The development of fuel cell humidifiers and the purchase of fuel cell electric vehicles involve substantial initial investments. Advanced materials and technology contribute to high manufacturing costs, resulting in expensive vehicles. These costs can discourage potential consumers from investing in fuel cell electric vehicles, affecting the growth of the Fuel Cell Humidifier market.

Additionally, the challenge of establishing a robust hydrogen fueling infrastructure poses a significant restraint. The lack of hydrogen refueling stations in many regions limits access to hydrogen fuel, hampering the adoption of fuel cells and humidifiers in vehicles. This infrastructure issue creates uncertainty in fuel supply and negatively impacts humidifier sales.

Despite these restraints, there are promising opportunities for the Fuel Cell Humidifier market. One such opportunity lies in the growing interest in alternative fuel technologies. There is a growing global awareness of the environmental impact of traditional fuel sources, leading to increased interest in alternative automotive technologies. Electric vehicles, especially those powered by batteries and hydrogen, have gained popularity. Hydrogen fuel cells have advantages over battery-powered vehicles, as they eliminate space and weight constraints. Humidifiers are essential components for maintaining moisture levels within fuel cell stacks.

Moreover, federal initiatives to reduce vehicular emissions align with the incorporation of fuel cells in the automotive sector. This alignment creates opportunities for humidifier manufacturers to expand their businesses and generate revenue. The Fuel Cell Humidifier market is being driven by the need for improved fuel cell efficiency and the adoption of fuel cell technology in long-haul commercial vehicles. However, high initial investments and the lack of hydrogen fueling infrastructure pose challenges, while growing interest in alternative fuel technologies offers promising opportunities for market growth.

MARKET SEGMENTATION

By Type

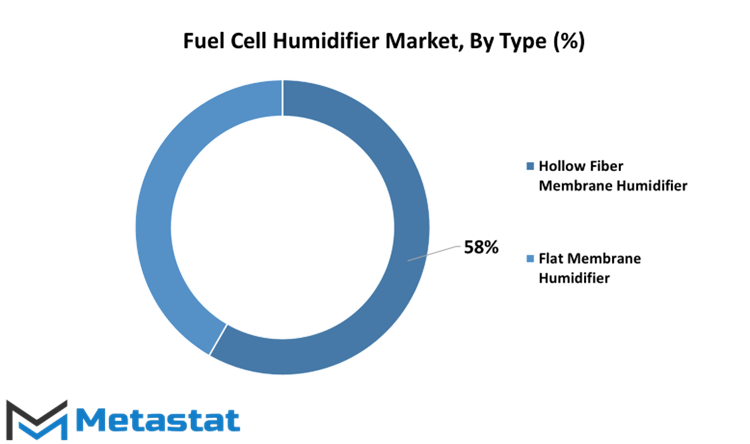

This segmentation, by type, sheds light on the different categories within this market, offering a more detailed perspective. Two key segments in this categorization are the Hollow Fiber Membrane Humidifier and the Flat Membrane Humidifier.

The Hollow Fiber Membrane Humidifier segment was valued at 141.4 USD Million in 2020. This means that within the market, products falling under this category accounted for a substantial economic value. These humidifiers are characterized by the use of hollow fiber membrane technology, a design that plays a pivotal role in their functioning.

On the other hand, we have the Flat Membrane Humidifier segment, which held a value of 101.8 USD Million in 2020. This segment represents another significant portion of the market. Flat membrane humidifiers have their distinct features and applications, which contributed to their economic value within the market.

These segments, Hollow Fiber Membrane Humidifier and Flat Membrane Humidifier, offer consumers and industry stakeholders a choice between different technologies and designs, each with its own advantages and applications. Such segmentation helps in catering to the diverse needs and preferences of the market, creating a dynamic landscape for the Global Fuel Cell Humidifier Market. It reflects the market's adaptability to various technologies and its capacity to accommodate different economic values associated with these segments.

By Application

In the year 2020, the Commercial Vehicle segment exhibited a valuation of 92.2 USD Million. This underlines the substantial presence of fuel cell humidifiers in the commercial vehicle sector. It speaks to the utilization of this technology in vehicles designed for commercial purposes, such as trucks and buses.

On the other hand, the Passenger Vehicle segment displayed a value of 151 USD Million in the same year. This segment encapsulates the use of fuel cell humidifiers in vehicles primarily intended for personal transportation, including cars and smaller vehicles.

This division based on application serves as a vital indicator of the versatility and adaptability of fuel cell humidifiers. It highlights their presence in both commercial and personal vehicles, underlining their importance in enhancing fuel cell performance and efficiency across a spectrum of automobile types. This differentiation allows for a more precise understanding of where and how these humidifiers are employed, contributing to the broader comprehension of their impact in the automotive industry.

REGIONAL ANALYSIS

In the context of the Fuel Cell Humidifier Market, a notable aspect lies in the division of the market by key regions. It is important to recognize that this division extends far and wide, encompassing various geographical areas. North America Fuel Cell Humidifier market. In the year 2015, its estimated value stood at 35.6 USD Million. This implies that within North America, the market for Fuel Cell Humidifiers had reached a significant valuation.

Similarly, the Europe Fuel Cell Humidifier market. In 2015, this market held an estimated value of 38 USD Million. This denotes a noteworthy presence and activity within the European region in the domain of Fuel Cell Humidifiers. It's indicative of the substantial economic worth attached to these devices in Europe. The significance of these figures lies in the fact that they represent not just numbers, but the economic vigor and the adoption of Fuel Cell Humidifiers within these regions. The value attached to these markets is reflective of the demand for and utility of Fuel Cell Humidifiers in North America and Europe. It indicates that these regions have embraced this technology, and it plays a substantial role in their respective industrial landscapes.

Understanding the market value in these regions provides insights into the dynamics of the Fuel Cell Humidifier Market and the preferences and needs of industries and consumers in North America and Europe. It's a testament to the global presence and relevance of Fuel Cell Humidifiers as a technology that caters to the needs of diverse markets and regions. These numbers offer a snapshot of the economic implications and the market's footprint, reinforcing the importance of Fuel Cell Humidifiers in various corners of the world.

COMPETITIVE PLAYERS

The Fuel Cell Humidifier Market involves numerous players. Among them, Shenzhen Yi Teng Di New Energy Co., Ltd. stands out. This company's clientele includes significant names like Freudenberg Filtration Technologies SE & Co. KG KOLON, Pentair Engineered Filtration, dPoint Technologies, and more. Furthermore, Emprise Corporation is actively engaged in the manufacturing of customized test equipment. They also specialize in the design of specialized test facilities, catering to the aerospace, automotive, and military sectors. This corporation operates as an engineering consulting firm, offering its services to the automotive, aerospace, industrial, and alternate power industries.

These players play a pivotal role in the Fuel Cell Humidifier Market. Shenzhen Yi Teng Di New Energy Co., Ltd. boasts an impressive list of clients, reflecting its influence and reach in the industry. On the other hand, Emprise Corporation's involvement in the manufacturing and consulting sectors underscores its importance in providing essential support to various industries, including automotive and aerospace. Both these players contribute to the dynamic landscape of the Fuel Cell Humidifier Market, each in its unique way.

Fuel Cell Humidifier Market Key Segments:

By Type

- Hollow Fiber Membrane Humidifier

- Flat Membrane Humidifier

By Application

- Commercial Vehicle

- Passenger Vehicle

Key Global Fuel Cell Humidifier Industry Players

- Perma Pure LLC

- Mann+Hummel

- Freudenberg Filtration Technologies SE & Co. KG KOLON

- Pentair Engineered Filtration

- dPoint Technologies

- Shanghai Super Power Technology Co.Ltd

- Szextender

- Pentair

- Smart Fog

- Emprise

- Norsk Analyze AS

- Ballard Power Systems

- Toyota Motor Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383