MARKET OVERVIEW

The global forex and bullion OTC trading platform market is one sector under the broad financial services field. It gives access to a decentralized market in which foreign currencies and precious metals such as gold and silver are traded. This market creates a stage where parties, such as the retail trader, financial institutions, or large corporate bodies, can trade since they provide the much-needed liquidity in the market. This is unlike other exchanges that offer over-the-counter platforms for buying and selling, as parties deal directly with each other without a central authority overseeing, thereby making it flexible when it comes to trade size, time, and counterparties; hence its widespread usage among people who need alternatives for exchange-based markets.

The trading of foreign exchange on this platform promotes the selling and buying of currencies. Some of their major pairs include USD/EUR, GBP/JPY, and many more. This segment depends on different conditions of the global economy. Participants are highly responsive to the monetary policies, economic indicators, and more geopolitics; everything impacts currency pairs values. The exchange rates offer a potential to generate profit in currency pairs using proper trading. In this regard, bullion trading provides a trading access to gold and silver, which are usually a save haven while investing in uncertain times. It focuses on both currencies as well as metals, further extending the reach of the market because it appeals to a wide variety of investors who may differ in their appetite towards risk.

One of the distinguishing features that distinguishes the global forex and bullion OTC trading platform market is its 24/7 nature. Unlike a stock exchange that operates within strict business hours, such platforms allow the participants to trade 24 hours a day during the weekdays. Currency and precious metal markets are indeed global, and this implies that availability is continuous; the trader can react immediately to an event that moves the market, be it a central bank policy announcement or the sudden change in geopolitical tension. It is this easy access to the global forex and bullion OTC trading platform market, which may very well be the thing that makes it so attractive to so many: one can indeed enter and exit positions with relative ease when compared to traditional markets.

Technological progress has, quite importantly, emerged as the factor driving this market’s future. The state-of-the-art trading systems with which clients will be able to interact-up-to-date, analytical tools, and automated trading systems, which will allow more accurate and informed decisions – signify how this new platform is to be more finely attuned with retail and institutional client demands, among other enhanced security aspects as well as increased access towards a broad spectrum of assets.

The growing popularity among retail and institutional investors of the Global Forex and Bullion OTC Trading Platform is likely to continue increasing in the future. With an increasingly entrenched tendency toward globalization and even by virtue of the fact of the rising role of crossborder sectors in world economy, demand for productive and secure trading platforms for currencies and precious metals is expected to be increasing. Therefore, market players are going to increasingly search for those markets that can provide greater liquidity as well as transparency, thereby keeping the global forex and bullion OTC trading platform market competitive and dynamic.

global forex and bullion OTC trading platform market remains an essential element of the global financial world; it’s decentralized, thus providing flexibility and efficiency for traders worldwide. Its future will be determined by technological innovation and growth in interest coming from various investors, which will ensure that the product continues playing its role in global financial markets.

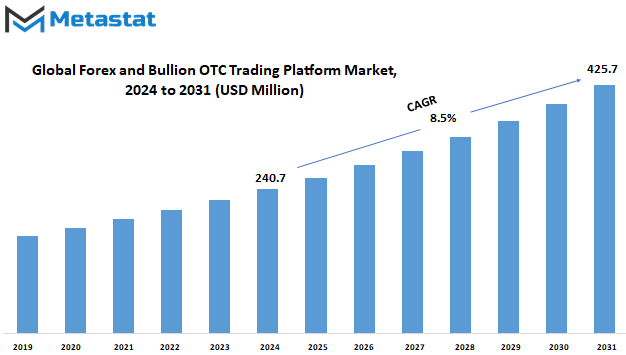

Global forex and bullion OTC trading platform market is estimated to reach $425.7 Million by 2031; growing at a CAGR of 8.5% from 2024 to 2031.

GROWTH FACTORS

The global forex and bullion OTC trading platform market should experience tremendous growth in the forthcoming years, which is led by several key factors. The most obvious reason for such growth is the investment options that provide easy liquidity and flexibility. The investors are always in search of platforms where they can trade foreign currencies and metals like gold and silver, which hold value irrespective of the economic environment. Markets all over the world do not seem to stabilize their economy, and Forex and bullion are a safe bet, and hence the popularity of the OTC trading platform.

Technological advancements also play an important role in the growth of this market. Trading has never been easier with the advent of digital platforms and mobile applications. There are no longer traditional brokers and financial institutions people need to access in order to Forex or bullion trading. Now, they can turn to online platforms, sources which present real-time information, fast transactions, and user-friendly interfaces. This will attract even more players into the market, thereby expanding it further.

However, there are some factors that could stand in the way of market growth. One major one is that of regulatory hurdles. As governments worldwide try to strengthen their grips on financial markets, the regulations could become stiff, controlling traders’ freedom. Other factors could include a level of volatility that forex and bullion markets present and which makes some investors run to shelve their interests for fear of the associated risks. If not addressed properly, the following might hinder the growth of the market.

Despite that, the global forex and bullion OTC trading platform market also appears well-positioned for future beneficial opportunities. It is likely to expand through emerging markets from Asian and African regions. As more people from these regions get access to digital trading platforms and education about financial matters, their requirements for Forex and bullion trading would be much higher. In addition, constant development in artificial intelligence and machine learning will make trading platforms smarter and more efficient. That is why it will open its way to the masses.

While challenges are prevalent and hugely threaten an industry with constantly changing needs, the global forex and bullion OTC trading platform market is ready to grow. Technological developments and increasing attraction to Forex and bullion trading will probably shape the course of this market, opening new windows for investors as well as platform providers in the near future.

MARKET SEGMENTATION

By Type

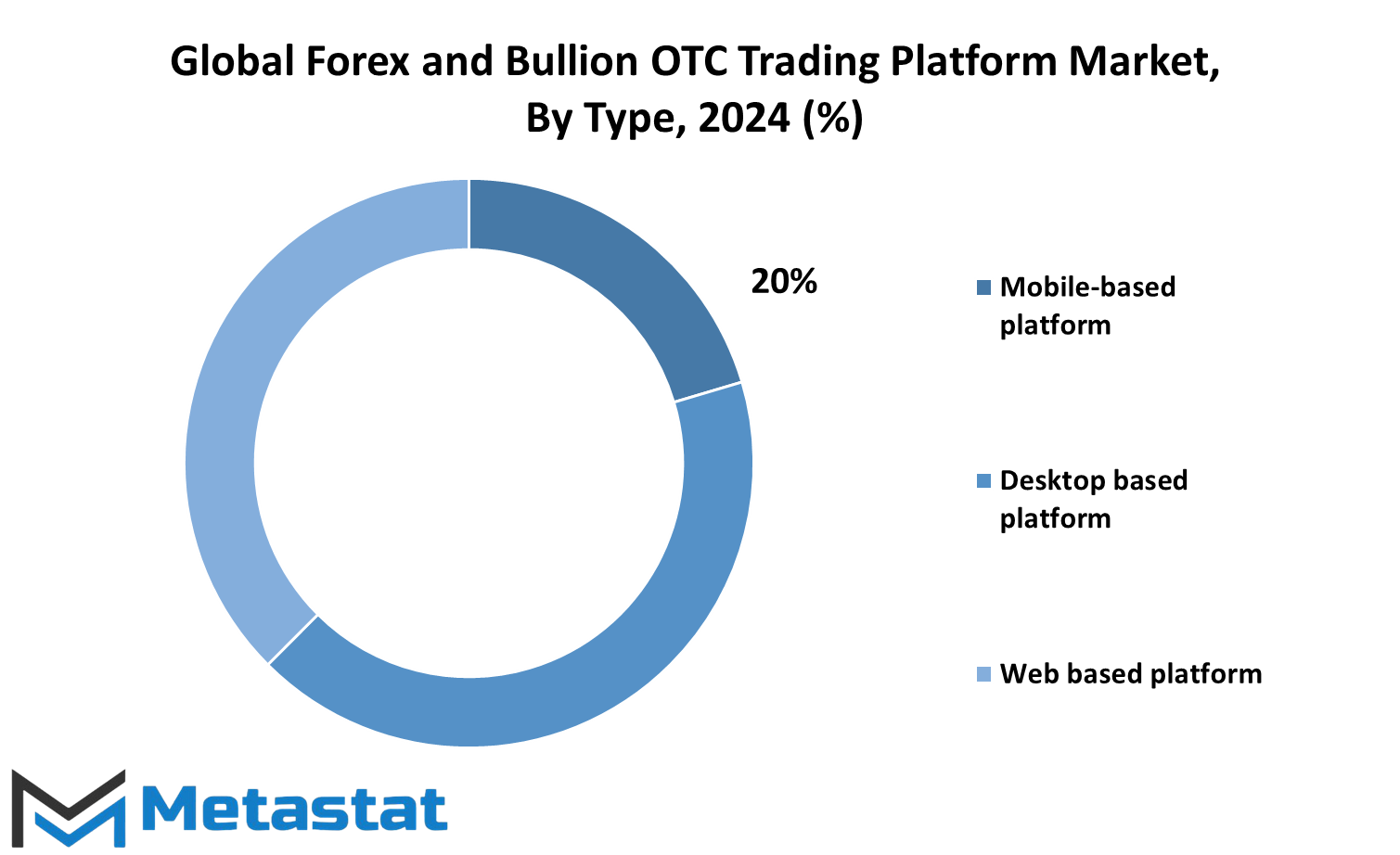

The global forex and bullion OTC trading platform market is bound to grow at a good rate in the years to come with improving technology and huge numbers of participants. It is expected that increasing accessibility and easy trading will grow the demand for such platforms in the global context ones that could efficiently manage forex and bullion transactions. The market is differentiated by the type of platforms, which include mobile-based, desktop-based, and web-based. Each of them has a special advantage catering for the preference of users as well as their technological capability.

Mobile-based platforms gained special popularity since nowadays, mobile phones are widely used and allow great convenience in transactions. It means one can keep in pace with the fast nature of the market and the users have access to the current market data and make decision-making in real time, which is very crucial in the case of the volatile forex and bullion markets. As mobile technology continues to increase bandwidth with faster Internet speeds and new features in apps, mobile platforms may eventually be the ultimate choice for an increasing number of traders. This could actually lead to even more innovation, since focus may soon be placed on developing solutions that are much friendlier and efficient for mobile.

However, there is also still substantial penetration of these traditional desktop-based applications, used mostly by the more conservative traders who need the stability and functionality provided in these systems. Desktop applications generally offer a more powerful trading experience, with graphing and more processing power, which might better suit those who believe in detailed market analysis. Even though mobile platforms are gaining grip, there is still scope for desktop-based platforms. It ensures that those customers who actually require more data and flawless performance are not disappointed.

Web-based platforms also account for a large part of the global forex and bullion OTC trading platform market. Online platforms allow customers to access any place at any time, either with or without any installed software. Web-based platforms will bring in the convenience of mobile apps with the functionality of desktop platforms. As the security technology of the cloud and webs increases, such platforms are likely to rise in usage among traders looking for both accessibility and strong performance.

In the near future, it is likely to see higher maturation of different types of platforms to cater to the emerging needs and demands of the traders in the global forex and bullion OTC trading platform market. Mobile, desktop, and web-based platforms will likely coexist, each catering to a separate group of users who like certain features or shall not require others. It is a dynamic market that gives an enormous scope for growth and innovation with this highly integrating trend toward the cutting-edge technology of trading.

By Application

Heavily reshaped by the latest technological advancements and the increasing demand for efficient trading solutions, the global forex and bullion OTC trading platform market is likely to become even more sophisticated while moving towards the future with better tools for more extensive users. It is actually through such platforms that traders get the opportunity to engage in the trade of currencies and metals. These have been perceived lately as more popular owing to the rising trend of global markets and also due to the access that they afford through online means. Retail as well as institutional investors are now capable of tapping into the market through the online platform. Through its application, analysis of the global forex and bullion OTC trading platform market has shown that it is mainly between brokerages and financial institutions.

A brokerage is important because it allows investors to have their trades executed on their behalf. The future of brokerages, such as technology, should be increasingly efficient to enable clients with improved tools of market analysis, faster execution, and greater transparency. The use of artificial intelligence and machine learning should further transform how the trades are conducted, hence enabling brokerages to offer more personalized experiences to their clients based on trading patterns and preferences. They have a much bigger presence in the financial market.

They are mostly involved in Forex and bullion trading for hedging, risk management, or mere speculation. In the future, we could expect financial institutions to increase efficiency and reduce human error further by using advanced algorithms and automation. We can also see blockchain being implemented within the business in ways that more securely and transparently record transactions, encouraging many institutions to use these platforms in search of greater reliability and security within their trading activities. More, the further increase in globalization of markets will continue to increase access to the global forex and bullion OTC trading platform market. Mobile trading applications will then be matched with higher availability of high-speed internet all around the globe, so it will be easier for everyone on earth to participate. Thus, the future looks bright, mainly because participation from both brokerages and financial institutions is expected to increase.

Hence, the global forex and bullion OTC trading platform market is likely to spread further. Brokerages and financial institutions are going to play very important roles in this industry to create its bright future and innovate the market. It will make the market feasible for every trader across the globe.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$240.7 million |

|

Market Size by 2031 |

$425.7 Million |

|

Growth Rate from 2024 to 2031 |

8.5% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global forex and bullion OTC trading platform market is considerably influencing various regions in the world and is displaying one-of-its-kind trends and opportunities. Geographically, this market covers North America, Europe, Asia-Pacific, South America, and the Middle East & Africa and contributes differently to the development of the overall market in every region.

North America, especially the U.S., Canada, and Mexico, has provided large scale for the Forex and Bullion OTC Trading Platform market. The U.S. has an established financial infrastructure and more advanced technology, so it is well-poised to continue being a leader in the next few years. The framework in Canada is conducive to the global forex and bullion OTC trading platform market because of its regulatory structure, and Mexico is fast emerging as a strong partner, increasing in awareness and participation for forex trading.

Europe, which includes the UK, Germany, France, Italy, and the Rest of Europe, is another significant geography in the global forex and bullion OTC trading platform market. The UK has for a long time been regarded as one financial center around the world and is expected to maintain its hold on the market. Conversely, Germany and France have recently attracted numerous interested parties in trading forex and bullion due to economic changes and an increased demand by investors that have made individuals move toward these markets. This trend is likely to continue as more people and organizations look for alternative investment opportunities in an uncertain economic climate.

The region of Asia-Pacific which includes India, China, Japan, South Korea, and the Rest of Asia-Pacific is expected to be one of the fastest growing regions in this market. The growing economic power of China and improving financial literacy of Indians have created space for boom demand in Forex and Bullion OTC trading platforms. Japan and South Korea, whose economies are dominated by leading high-tech industries, are also crucial for this market to grow. Growth of the region is expected to accelerate further as more participants start to view global trading opportunities.

South America- Other notable markets include Brazil and Argentina; there is an increased interest in exchange and bullion trading platforms. Though the region has seen challenges in its financial sector, there is growing recognition of the value such platforms will bring that will lead to a slow growth of markets. Promise improves as infrastructure and financial systems continue to evolve.

Middle East & Africa, especially the GCC countries, Egypt, and South Africa, are also growing in the Forex and Bullion OTC Trading Platform market. While the GCC nations are influenced by healthy economies and the investment capabilities, the same cannot be said for South Africa and Egypt, though these regions do hold considerable promise for future market growth as awareness of the market increases with the evolution of financial systems in this region.

COMPETITIVE PLAYERS

Latest technological advancements and persistent demand for accessible, efficient trading solutions are propelling growth in the global forex and bullion OTC trading platform market going forward. The market has further become competitive with the explosion of online trading platforms across various participants in the global forex and bullion OTC trading platform market, from institutional investors to individual traders. More and more people have been of interest in these markets, and main players continue to develop and enhance the platforms in response to users' changing needs. A few well-established market leaders are m-FINANCE Ltd., MetaQuotes Ltd., and Spotware Systems Ltd. (cTrader).

These trading platforms propose a rich set of tools and features that facilitate intuitive and efficient trading for users. MetaQuotes Ltd., for instance, has branded its names in operating very reliable and flexible MetaTrader platforms. Spotware Systems is particularly unique with the cTrader platform, which is simply simple transparency and user-friendly experience. Among others are NinjaTrader, LLC. With Act Trader Technologies Limited, the company received much respect for its advanced trading system meant specifically for professional traders. The market would logically become keener as it expands.

Innovative developers like Integral Development Corp and State Street Corporation continue developing new products that can be their competitive edge. These players would focus on adding artificial intelligence and machine learning technology to their systems for a customized and streamlined trading experience. On the other hand, X Open Hub and XTB S.A. Other promising contenders also have platforms that separate themselves based on user education and market analysis. This will further help traders base their decisions on data rather than emotional influences. The more recent technological advances will give the global forex and bullion OTC trading platform market further 'future-proof' ability by incorporating more developed technologies that will increase what is possible in automation and in analysis.

Traders will seek executable seamless and fast executions along with tools to better aid in more informed decisions. Key players will always compete, and this alone will always drive continuous improvements so that the market evolves with user needs and expectations. These developments will keep the market dynamic, push their boundaries, and offer more sophisticated options for participants at the global level.

Forex and Bullion OTC Trading Platform Market Key Segments:

By Type

- Mobile-based Platform

- Desktop based Platform

- Web based Platform

By Application

- Brokerages

- Financial Institutions

Key Global Forex and Bullion OTC Trading Platform Industry Players

- m-FINANCE Ltd.

- MetaQuotes Ltd

- Spotware Systems Ltd. (cTrader)

- NinjaTrader, LLC

- Act Trader Technologies Limited.

- Integral Development Corp

- State Street Corporation

- X Open Hub

- XTB S.A.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252