MARKET OVERVIEW

The global fleet management software market will continue to transform the transport and logistics industry in ways that are outside its existing scope. Traditionally seen as a tool to track fleets and track driver behavior, the future uses of the software will cross various industries, transforming operational models and paradigms of service. Its promise does not rest with fleet management alone but with the design of unbroken integration of business operations needing mobility, effectiveness, and prompt decision-making.

As digital ecosystems in industries become more integrated, fleet management software will develop to support broader enterprise operations. Retailers with delivery fleets, for instance, will begin to utilize such systems to manage stock levels, shipping schedules, and customer preferences in one interface. Logistics firms will utilize future versions of the software to interact with supply chain partners beyond their fleets, offering transparency that supports predictive servicing and inventory allocation based on vehicle movement patterns.

The application will also become a strategic weapon for non-transport industries. In the healthcare sector, ambulatory care will leverage advanced fleet platforms to reduce patient waiting times, plan routes in real time, and incorporate emergency response requirements. Mobile units of energy companies based in remote locations will also rely on predictive functions of such applications to reduce downtime, plan fuel loads, and schedule mobile workforce. The global fleet management software market will be the technology backbone that makes such inter-sector extensions possible. Data ownership and analysis will be at its core of value in the future.

Not only will assets be monitored, but actionable team-level insights will be generated. Scenario planning will be the way forward, where businesses enact supply chain disruption, labor shutdown, or rain-related delay scenario simulation and reinspect operations within minutes. The change will recast the way organizations think about planning for operational risk. With increasingly intelligent software, businesses will begin to factor in its influence not just on fleet costs, but also customer experience, reputation, and asset allocation. In addition, the future of electric and autonomous vehicles will demand software other than location and diagnostics. Charging logistics, sensor monitoring, and real-time tweaking will be needed for self-driven fleets. Governments will be increasingly involved in the global fleet management software market through regulation tools and smart city infrastructure, and private operations will be increasingly unrecognizable from public control.

Emerging economies will experience a peculiar form of growth, wherein adoption will be propelled by the need for compliance with regulations, safety enforcement, and enhanced visibility of assets within disintegrated logistics landscapes. In such an instance, the software will be both an operating solution as well as a driver of market formalization and confidence among clients and service providers.

As business segments prepare for lasting digital resilience, the global fleet management software market will transform from a solution for cars alone to being a center of decision-making nodes.

The debate will no longer be about fleet management but about intelligent orchestration of movement, data, and service with accuracy and strategic foresight. This trajectory sets the stage for the day when movement itself becomes a dynamic, adaptive factor in enterprise growth and sustainability.

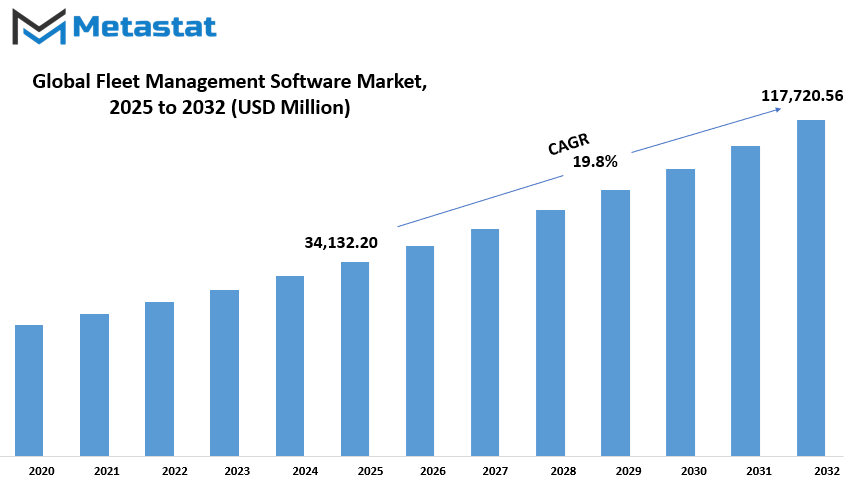

Global fleet management software market is estimated to reach $117,720.56 Million by 2032; growing at a CAGR of 19.8% from 2025 to 2032.

GROWTH FACTORS

The global fleet management software market is witnessing a steady growth, which is mostly caused by the rising number of companies seeking better means of automating and streamlining their automobile functions. As organizations grow and transport becomes part of day-to-day operations, the need to track vehicles, cut down fuel, and maximize driver performance grows higher. Here's where fleet management software comes into play. It helps in the tracking of routes, planning management, and monitoring of fuel consumption. The idea is to help fleets run better at lower cost of ownership. Due to this, several industries ranging from delivery fleets to construction fleets have been exploring the utilization of these solutions.

One of the reasons behind growing interest stems from the enhanced use of IoT and telematics technologies. With these technologies, fleet managers can get real-time information about driver performance, vehicle efficiency, and location. With this, companies can make immediate decisions, prevent delays, and improve safety. For example, when a truck has broken down or is off route, the managers can react instantly. These technologies also allow for anticipation of when a vehicle will need maintenance, avoiding repairs and downtime.

Even with these benefits, however, there remain certain barriers to the expansion of the market. Perhaps the largest of these is that installing and implementing fleet management software can cost a lot of money. Small businesses may find it difficult to cover the cost of this technology, especially if they are unsure about the return on investment. There are also concerns with the security of data. Since fleet management software collects a tremendous amount of sensitive information, businesses are apprehensive about the possibility of a cyberattack or data breach. Such apprehensions might make certain businesses refrain from adopting the software.

Notwithstanding this, the prospects of this industry are shining bright. Amongst one of the most interesting advancements is the use of Artificial Intelligence (AI) in fleet analytics. AI can help businesses to better analyze massive amounts of data, spot trends and patterns that would not necessarily be visible. Using this data, business is able to plan routes more effectively, improve fuel efficiency, and more effectively manage risks. AI helps automated decision-making as well, which can reduce time spent and lower the risk of human error. With the increased use of AI, it is likely to bring new opportunities in the fleet management software market and acquire even more users.

MARKET SEGMENTATION

By Type

The global fleet management software market is growing increasingly with more and more businesses using online software in managing their transport needs. It gives the companies the potential to track and manage their fleets in real time, thereby making the operations perfect and efficient. The software reduces errors less, enhances decision-making, and allows businesses to save money and time through giving the companies control of their vehicles and drivers. As more businesses expand and transportation is more and more a required part of most firms, there is more and more demand for this software.

There is market segmentation by various industries based on application. One of the most powerful is Operations Management, with a huge market value of $12,587.06 million. It includes scheduling, dispatching, and routing in an attempt to allow companies to deliver on time and conserve fuel. And then there is the very important segment of Vehicle Maintenance and Diagnostics, which keeps the vehicle in shape through wear-and-tear tracking, reminding the owner to bring it in for a service, and avoiding unexpected breakdown. It keeps it safe and saves maintenance expenses in the long run.

Performance Management is also a very relevant segment, wherein the software keeps an eye on driver behavior, fuel consumption, and vehicle performance. Companies can identify performance improvement areas, wastage savings, and driver accountability by tracking the data. Fleet Analytics & Reporting offers valuable insights from the data gathered in the fleet. It enables managers to understand trends, track key results, and make improved decisions regarding future expansion. The "Others" category contains features such as fuel management, compliance tools, and integration with other systems, which make the software more convenient and practical for various business purposes.

Fleet management software is so convenient because it can integrate all these features within a single system. Rather than having separate tools for separate purposes, organizations can use one system to keep everything in place. It not only makes it more efficient but also easier to update with changes or correct problems at ease. As more businesses attempt to save money, offer better service, and achieve green objectives, integrating such software becomes more of a necessity than an option.

With technology advancing and businesses expanding, the global fleet management software market will increasingly become necessary to allow companies to remain productive, safe, and competitive.

By Fleet Type

The global fleet management software market is growing at a very high rate as more business organizations understand how important it is to increase their vehicle and operating efficiency. The market is divided by fleet into passenger vehicles and commercial vehicles. This segmentation is important because of the difference in requirements and problems between them, which are solved by the software. For commercial fleets, including delivery trucks, trucks, and service vehicles, the software helps businesses track routes, fuel usage, and regular maintenance. These are essential features as they avoid delays, reduce expenses, and improve overall efficiency. Businesses relying on product deliveries or field services are the ones most benefited by these features as a slight delay impacts customer satisfaction as well as revenue.

Passenger car fleets, nonetheless, are often used by government offices, corporate headquarters, and car rental businesses. In such a case, the focus for fleet management software is on driver behavior, mileage tracking, and responsible use of vehicles. The software will typically remind the user if the vehicle is abused or driven recklessly. It will also track insurance renewals, registration due dates, and other reminders, reducing the risk of missing deadlines. These systems give businesses more control over how their vehicles are being utilized and avoid unnecessary expense or damage.

New technology is also impacting the software industry. GPS tracking, real-time updates, and mobile apps are now common features. They enable managers to remain in contact with their fleet twenty-four hours a day. For instance, if a car is in danger of breaking down or strays from the track, the manager would be instantly notified and able to respond in time. They are especially convenient for big fleets, where keeping tabs on each and every single vehicle manually would be impracticable. Information collected from the software also comes in handy by allowing companies to schedule better routes, reduce idling time, and manage drivers' schedules better.

Overall, whether attention is being given to commercial trucks or passenger vehicles, fleet management software is proving to be a useful tool. It helps lower costs, improve safety, and improve performance. As more companies look for smarter ways to manage their vehicles, its use will grow. The gap between requirements in commercial and passenger fleets will remain to affect how the software is written and used in the future.

By Deployment

The global fleet management software market is growing at a steady pace due to rising demand for enhanced vehicle tracking, maintenance scheduling, and fuel monitoring. Amongst the key parameters that decide how businesses determine their fleet management system is the manner in which software is deployed. Based on deployment, the market is also segmented into On-premises and Cloud. Each one has different advantages, and companies usually choose on the basis of their size, security needs, and general goal.

On-premises deployment refers to software being installed and executed on computers located inside the company's physical offices. With this installation, the company maintains full control of the software as well as the data that is processed. It is typically best suited for organizations with tight data security protocols or organizations in industries where privacy is an utmost requirement. Organizations that pursue this method tend to be well-established and have the capability to fund the infrastructure and technical personnel required to host and maintain the software internally. However, one of the limitations is that it is more costly upfront since it involves purchasing servers and hosting the system internally.

Web-based fleet management software, however, is hosted on the internet and opened through the use of a web browser or application. This method is increasing in popularity since it offers flexibility, lower capital costs, and easy upgrades. Organizations that opt for cloud deployment can access information from anywhere in the world, which is particularly useful for drivers and managers who are constantly mobile. It provides quicker implementation and simpler scaling up as the company expands. One issue with cloud deployment, however, is the dependence on internet connectivity and the security of off-site storage of data. Nevertheless, numerous providers provide robust protection mechanisms, so this remains an appropriate option for companies of any size.

Selecting On-premises or Cloud is usually a matter of what is more important to the company control or convenience. Certain businesses may begin with a cloud solution and then shift to an on-premises solution as they evolve. Others will stay with the cloud due to ease and minimal maintenance requirements. Either way, both deployment methods are likely to continue to cater to the world's need for efficient and intelligent fleet management solutions. As more vehicles become connected and enterprises look for real-time data, the method of deployment of fleet management software will continue to be a key decision point for enterprises globally.

By End-User Industry

The global fleet management software market is divided into many end-user industries like Manufacturing, Logistics, Transportation, Oil & Gas, Chemical, and Others. All of them use fleet management software to increase efficiency, reduce cost, and optimize control over the vehicle's operation. In manufacturing, the need for timely movement of raw material and product makes the fleet management software a suitable application. It helps coordinate delivery schedules, track vehicle routes, and prevent delays on the production calendar. It leads to better inventory control and more efficient operations as a whole.

Logistics companies rely primarily on the software for managing large numbers of vehicles and shipments in numerous locations. The software helps them monitor delivery time, route assignment, and driver adherence while scheduling. Logistics companies can reduce fuel consumption, impose appropriate driver behavior, and make quick decisions in delays or disruptions by using real-time data. This ensures customer satisfaction and cost-effective operation.

In the transport sector, the software plays a critical role in scheduling and tracking public or private transport services. It helps companies track vehicle usage, schedule maintenance, and access performance data. All these operations are crucial when it comes to avoiding sudden failures and maintaining services uninterruptedly. In the Oil & Gas industry, fleet management software is utilized to guarantee safety measures and monitor equipment operating under severe conditions. Such companies usually operate in huge distances and dangerous routes, and the software delivers an extra layer of safety and control.

Chemical companies also benefit by using the software to track the movement of hazardous materials, ensuring that right regulations are in place and safety is paramount. It helps them to plan secure routes, keep records, and respond rapidly in emergency situations. The "Others" category comprises companies with little but important needs for fleet management, such as utilities or service companies that are dependent on high levels of traveling to perform field work.

Overall, fleet management software serves a wide range of industries by offering features that ease the daily tasks and make them more reliable. Be it scheduling and tracking or safety and compliance, it offers benefits that go beyond vehicle management. With such industries growing further, the use of such software is bound to become more common, enabling companies to remain competitive and efficient in their processes.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$34,132.20 million |

|

Market Size by 2032 |

$117,720.56 Million |

|

Growth Rate from 2025 to 2032 |

19.8% |

|

Base Year |

2024 |

|

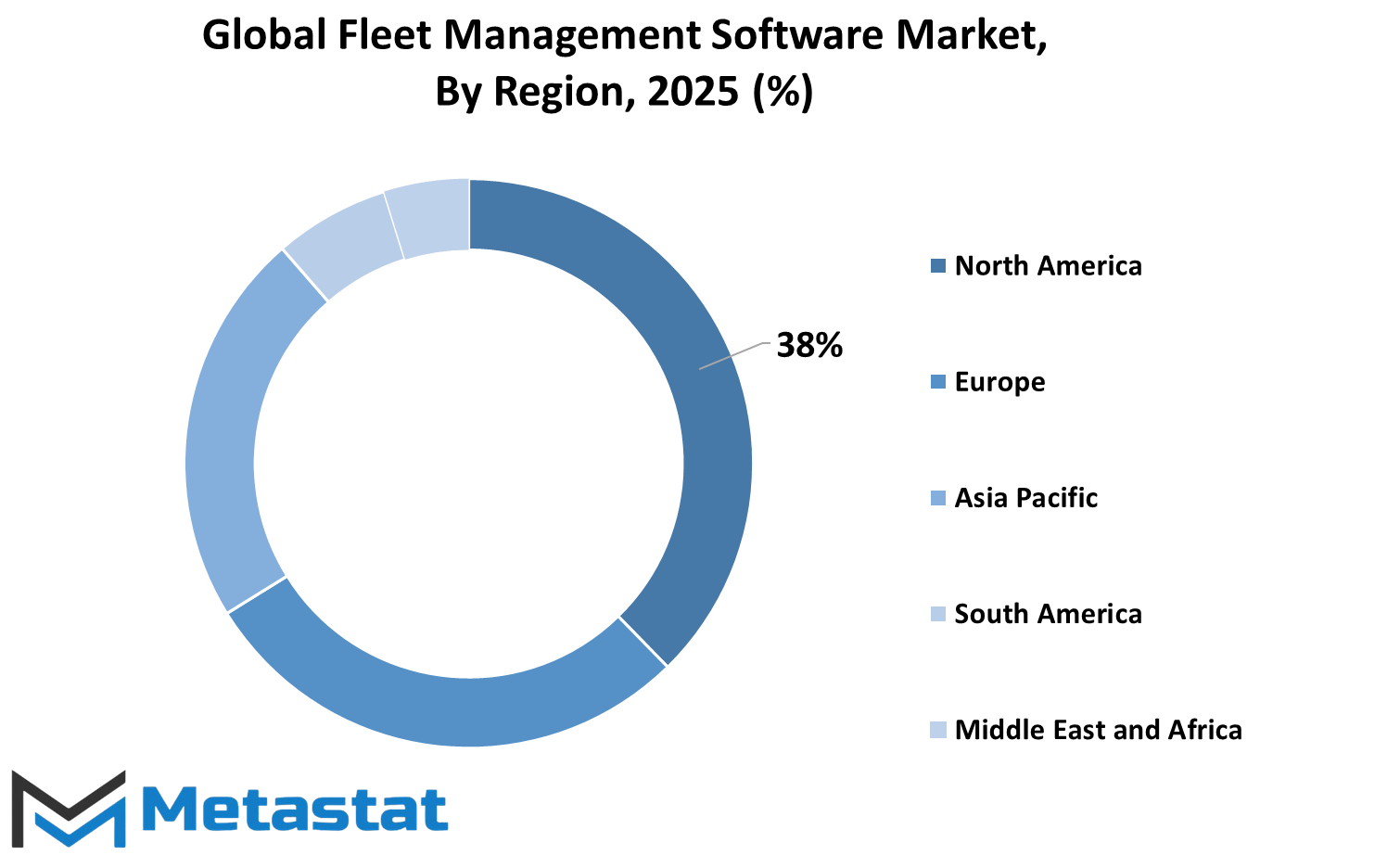

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global fleet management software market is spread over the world, contributing differently to the development of the market. Based on geography, it is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. The principal countries in North America are the United States, Canada, and Mexico, and among them, the United States takes the lead due to the superior infrastructure developed here and strong demand for logistics and vehicle tracking solutions. Both Canada and Mexico also witness growth on a regular basis as the business in these regions comes to appreciate the need to use software in managing fleets effectively.

Europe is also a significant market, covering the UK, Germany, France, Italy, and Rest of Europe. All these nations are focusing more on lowering costs, improving fuel efficiency, and complying with more stringent environmental regulations, which is generating the demand for smart fleet solutions. The UK and Germany are specifically hectic implementing technology to maximize transport and logistics operations. Concurrently, Rest of Europe countries are catching up by adopting newer systems to keep pace with global standards.

Asia-Pacific is comprised of the market, which includes India, China, Japan, South Korea, and Rest of Asia-Pacific. Asia-Pacific is growing rapidly, backed by increasing industrial activity, increasing e-commerce, and increasing commercial vehicles on roads. China and India are the leaders with well-established logistics networks and government support for digitalizing transport. Japan and South Korea are also strong players, highlighting technology-based systems to improve efficiency and safety.

South America includes Brazil, Argentina, and the Rest of South America. The continent is slowly adopting fleet management tools, with Brazil leading the pack. More companies are now turning to such systems to track vehicles and manage fuel costs better. Though the pace is slow compared to other parts of the world, there is a clear shift towards modernization.

Middle East & Africa is divided into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. The region is beginning to appear promising as businesses are seeking to improve transportation and delivery mechanisms. The GCC countries are investing specifically in digital solutions, while South Africa and Egypt are witnessing slow adoption. Businesses are realizing that fleet software can help reduce delays, lower costs, and improve customer service.

All these markets play a part in shaping the international market. With more awareness and technology being accessible, fleet management software will be expanding its presence worldwide.

COMPETITIVE PLAYERS

The global fleet management software market is increasing steadily as the demand for effective vehicle tracking, fueling, and maintenance planning is growing. This software allows businesses to handle large fleets of vehicles by providing real-time information, route planning, driver behavior monitoring, and compliance features. As more firms use fleets for delivery, transportation, or services, demand for software that can lower costs and enhance operations is increasing. The software operates by gathering data from GPS systems and sensors that are installed in vehicles. This data is then analyzed to assist fleet managers in making better choices, including selecting more optimal routes, decreasing idle time, and scheduling timely vehicle maintenance. These improvements not only conserve money but also prolong the life of vehicles and enable organizations to achieve safety and environmental requirements.

Major players in the Fleet Management Software sector are Verizon Connect, Trimble Transportation, Geotab, Omnitracs, Fleet Complete, Teletrac Navman, GPS Insight, Samsara, FleetUp, Fleetio, LeasePlan Corporation N.V., Azuga, IBM Corporation, Zoho Corporation, Fleet Board GPS, Ctrack, Chevin Fleet Solutions, and Lytx. They provide various sorts of software solutions according to the requirements of small, medium, to large fleet operators. Some specialize in sophisticated analytics and reporting, but others offer more intuitive tools for routine management functions. Having a wide range of options means that companies can select products to suit their size, budget, and particular objectives.

The drive toward cleaner energy and government regulations on emissions are also influencing the market. Fleet management software is increasingly being utilized to monitor carbon footprints and keep vehicles within permitted emission levels. This assists businesses to not just meet regulations but demonstrate their support towards sustainability as well. A fast-growing trend which is increasing popularity is using smartphone apps. Nowadays, several organizations provide smartphone applications that enable the driver and the fleet manager to easily communicate with each other, report any incident at the field, and have real-time connectivity. Such connective connectivity augments the reaction time and also enhances service efficiency.

With advancing technology, increasingly features such as predictive maintenance and AI-driven insights are being integrated. Nevertheless, the emphasis continues to be on enabling businesses to enhance safety, minimize waste, and remain competitive. With so much to offer, fleet management software is emerging as an indispensable tool for companies that rely on vehicles to make their operations smooth.

Fleet Management Software Market Key Segments:

By Type

- Operations Management

- Vehicle Maintenance and Diagnostics

- Performance Management

- Fleet Analytics & Reporting

- Others

By Fleet Type

- Commercial

- Passenger Cars

By Deployment

- On-premises

- Cloud

By End-User Industry

- Manufacturing

- Logistics

- Transportation

- Oil & Gas

- Chemical

- Others

Key Global Fleet Management Software Industry Players

- Verizon Connect

- Trimble Transportation

- Geotab

- Omnitracs

- Fleet Complete

- Teletrac Navman

- GPS Insight

- Samsara

- FleetUp

- Fleetio

- LeasePlan Corporation N.V.

- Azuga

- IBM Corporation

- Zoho Corporation

- Fleet Board GPS

- Ctrack

- Chevin Fleet Solutions

- Lytx

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252