Global Flare Monitoring Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global flare monitoring market evolved from an imperative industrial requirement to be able to quantify and control gas flaring more efficiently. Flaring was once a necessary waste gas disposal consequence of oil and gas production a good means of waste gas disposal when processing stations were full. With green awareness starting to catch on in the late twentieth century, though, the practice started to encourage the industry to think again. Against this backdrop, governments and environmental officials started questioning whether unregulated flaring was sustainable, and a change process was underway that would ultimately lead to the development of modern flare monitoring systems.

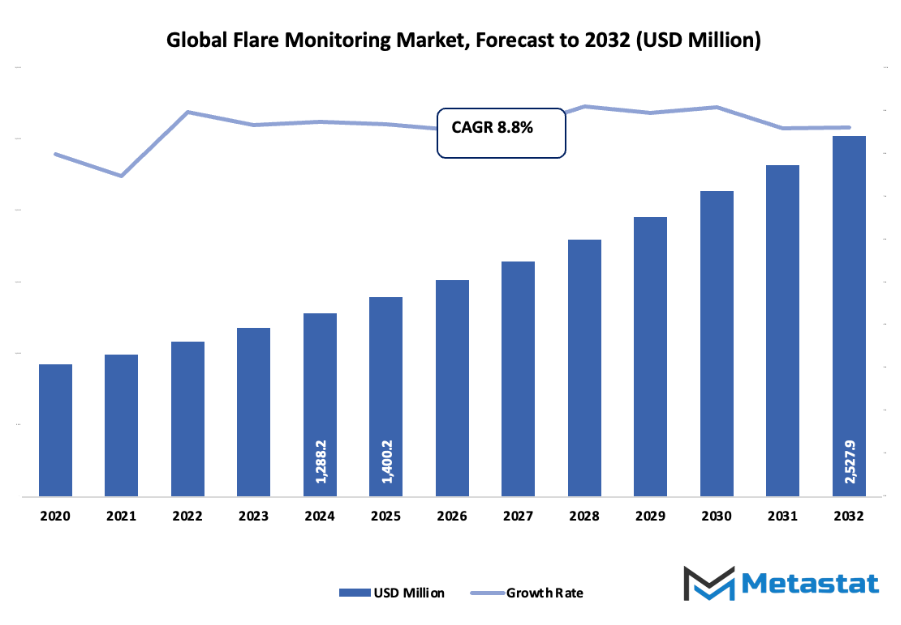

- Global flare monitoring market worth of about USD 1400.2 million in 2025, at a CAGR of about 8.8% from 2032, with the potential to grow beyond USD 2527.9 million.

- Process-Mass Spectrometers hold close to 38.6% market share, pioneering innovation and increasing applications through aggressive R&D.

- Major growth-enabling trends: Strict Environmental Legislation (e.g., United States EPA regulations, European Union directives), Growing Emphasis on Reducing Emissions and Improving Air Quality

- Opportunities are: Internet of Things (IoT) and Remote Monitoring Solutions adoption

- Major insight: The market will grow exponentially in value over the next decade with a high growth opportunity.

- The first phase of the market was marked by primitive infrared technology and rudimentary manual observation that could detect only large fires and guess how hot they were.

With the growth of the companies, particularly in areas of high hydrocarbon production, there was a need for more precise and ongoing monitoring devices to be available. The advancements in advanced sensors and computerized data systems in the 1990s transformed the refinery and petrochemical plant practices in flaring management. It helped in gathering real-time information so that decision-makers could respond based on facts and minimize environmental damage. Over time, more stringent environmental regulations and increasing focus on business sustainability compelled the global flare monitoring market to advance its technology further. Through the use of digital communication networks, cloud computing, and satellite imagery, monitoring extended beyond the fence line of the manufacturing plants. What was once under physical observation could now be monitored remotely, conserving time and enhancing safety. In the coming few years, the market will continue to evolve as industries demand greater transparency in reporting and optimization through automation. The requirement of precise emission tracking will drive the capex on smart analytics and IoT-based systems with the capability of even microscopic detection of variation of flare pattern.

Additionally, as governments raise the reporting threshold and global energy organizations pledge to net-zero, monitoring technologies will be the mark of distinguishing compliance and operations planning. Having begun life as a protection mechanism, in its present state as a key environmental and operations tool, the global Flare Monitoring industry will be at the forefront of business finding balance between productivity and responsibility in the era of big data.

Market Segments

The global flare monitoring market is mainly classified based on Mounting Method, Component, Industry, .

By Mounting Method is further segmented into:

- In Process-Mass Spectrometers: Process-Mass Spectrometers are utilized to analyze gas composition in real time for flares. They assist in the detection of contaminants and provide precise measurements that enhance process control. They are beneficial in limiting harmful emissions and ensuring regular monitoring in operations due to their precision and fast response.

- Gas Chromatographs: Gas Chromatographs in flare measurement systems determine the chemical compounds in gases to find out their composition. The function separates and examines gas content to give emission standards. The process assists industries in measuring variations in flare gases, enhancing plant efficiency and minimizing environmental effects.

- Gas Analyzers: Gas analyzers find extensive application in the determination of the concentration of flared gas. Gas analyzers facilitate continuous monitoring, and this increases safety as well as regulatory compliance. Leak or abnormal detection is simplified and accelerated with the aid of gas analyzers, thereby making emission control processes safer.

- Other: Other forms of mounts are sophisticated sensor-based and hybrid monitoring systems that integrate various technologies to produce more accurate results. The systems are easy to install and are deployable in flexible form and can be tailored to suit the needs of a particular industry. They are adaptable and therefore convenient for large-scale operation and in remote areas.

By Component the market is divided into:

- Gas Analyzers: Gas Analyzers as a component play a key role in detecting and measuring gases in flare stacks. These devices provide real-time data that helps industries control emissions effectively. Improved sensor technology has made these analyzers more efficient, leading to better accuracy and faster detection of harmful gases.

- Optical Detectors: Optical Detectors identify flare intensity and combustion efficiency by detecting light emitted from flares. These detectors support safe plant operations by signaling irregular burning or flare malfunction. Their non-contact measurement approach allows reliable data capture even in extreme conditions, ensuring consistent performance and safety compliance.

- Thermal Imaging Cameras: Thermal Imaging Cameras are essential tools for visual monitoring of flares. These cameras detect heat patterns to identify changes in flare temperature and operation. The technology helps detect unlit flares or incomplete combustion, allowing operators to respond quickly to prevent safety risks and environmental violations.

- Software Solutions: Software Solutions manage and analyze data collected from various flare monitoring components. These programs support predictive maintenance, compliance reporting, and real-time monitoring. Advanced software integrates with industrial systems to improve efficiency, reduce downtime, and support decision-making through accurate and accessible data analysis.

- Other: Other components include sensors, transmitters, and data logging devices that complement main monitoring systems. These additional tools enhance overall performance by improving signal accuracy and system reliability. They are often used in combination with primary components to create a comprehensive monitoring setup tailored to industrial needs.

By Industry the market is further divided into:

- Oil & Gas Industry: The Oil & Gas Industry forms a major segment of the global flare monitoring market. Monitoring systems in this sector ensure safe flaring, prevent gas leaks, and support environmental compliance. Continuous emission tracking in refineries and drilling sites helps reduce carbon output while maintaining efficient energy production processes.

- Chemical Industry: The Chemical Industry uses flare monitoring systems to control emissions generated during chemical processing. These systems detect hazardous gases and ensure safety in complex chemical reactions. Real-time monitoring reduces environmental risks, supports compliance with regulations, and maintains safe working conditions in chemical manufacturing units.

- Petrochemical Industry: The Petrochemical Industry relies on flare monitoring to manage combustion processes and minimize pollutant release. The technology helps track flare performance, detect faults, and ensure that flaring occurs within safe and legal limits. Continuous improvement in monitoring accuracy has made it vital for sustainable petrochemical operations.

- Power Generation: Power Generation facilities adopt flare monitoring systems to maintain emission standards and operational safety. These systems help identify gas leaks and manage waste gas burning efficiently. Monitoring technology supports cleaner production by ensuring proper combustion and reducing the environmental impact of energy generation.

- Other: Other industries, including waste management and manufacturing, also use flare monitoring systems for safety and compliance purposes. These systems ensure that gas emissions remain within acceptable limits and reduce the risk of environmental hazards. Their adaptability makes them useful across various industrial applications.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1400.2 Million |

|

Market Size by 2032 |

$2527.9 Million |

|

Growth Rate from 2025 to 2032 |

8.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

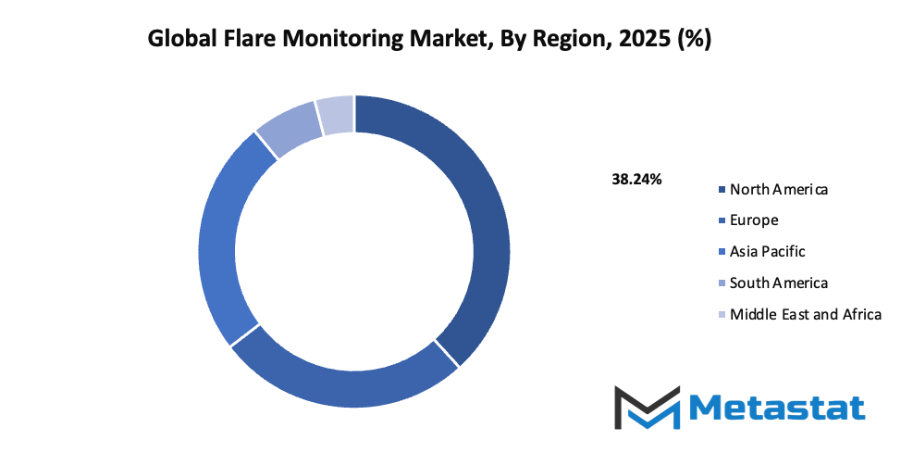

By Region:

- Based on geography, the global flare monitoring market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Stringent Environmental Regulations (e.g., EPA regulations in the United States, European Union directives): The introduction of strict environmental regulations such as those from the EPA and European Union is one of the major reasons for the expansion of the global flare monitoring market. These regulations mandate continuous monitoring of industrial flares to control air pollution and protect public health. Companies are required to track and report emissions accurately, pushing them to adopt advanced monitoring technologies. Compliance with these laws helps industries avoid penalties while contributing to environmental conservation.

- Increasing Focus on Emission Reduction and Air Quality Improvement: The growing global concern over climate change and deteriorating air quality is encouraging industries to reduce their carbon footprint. The global flare monitoring market benefits from this trend, as flare systems play a key role in identifying and minimizing waste gas emissions. Governments and organizations are promoting clean technologies and sustainable industrial operations, leading to wider use of monitoring systems. This focus on emission control helps build a cleaner environment and supports public health improvement efforts worldwide.

Challenges and Opportunities

- High Initial Investment Costs: One of the major challenges for the global flare monitoring market is the high initial investment required for system installation and maintenance. Advanced monitoring systems involve the use of sensitive sensors, data analyzers, and communication devices that increase setup expenses. Small and medium enterprises often find these costs difficult to manage, slowing adoption. However, in the long term, these systems help reduce operational losses and ensure compliance, making the investment beneficial over time.

- Complexities in Integration with Existing Plant Infrastructure: Integrating flare monitoring systems into existing plant setups can be challenging due to differences in design, technology, and operation. Many older industrial facilities lack the infrastructure needed for advanced digital monitoring, requiring modifications that add time and cost. These complexities can delay implementation and reduce efficiency. However, modern retrofit solutions and modular systems are helping overcome these difficulties, allowing industries to upgrade without major disruptions.

Opportunities

- Adoption of Internet of Things (IoT) and Remote Monitoring Solutions: The use of IoT and remote monitoring is creating major opportunities for the global flare monitoring market. IoT-based systems allow real-time data collection and analysis, improving accuracy and response time. Remote monitoring solutions help operators track performance from different locations, reducing manual checks and improving safety. These technologies not only enhance efficiency but also make operations more transparent and environmentally responsible, supporting global sustainability goals.

Competitive Landscape & Strategic Insights

The global flare monitoring market is undergoing significant transformation as technological progress and environmental awareness continue to reshape industrial operations. The industry is a mix of both international industry leaders and emerging regional competitors, each striving to develop more accurate, efficient, and sustainable monitoring systems. As stricter environmental regulations push industries toward cleaner operations, companies are investing heavily in advanced flare monitoring solutions that can precisely measure emissions, reduce waste, and improve overall plant safety. This shift marks a future where monitoring systems will not only serve compliance purposes but also function as essential tools for operational optimization and environmental protection.

Prominent players such as AMETEK Inc., ABB Ltd., Honeywell International Inc., Siemens AG, and Fluenta are at the forefront of innovation, introducing technologies that enhance data accuracy and real-time monitoring capabilities. These established corporations continue to expand their product lines through automation, artificial intelligence, and sensor-based advancements. Alongside them, companies such as MKS Instruments, Inc., Thermo Fisher Scientific Inc., John Zink Hamworthy Combustion, Advanced Energy, FLIR Systems, Inc., and ZEECO, INC. are driving progress through continuous research and development. Their goal is to create systems capable of detecting even the smallest flare emissions while maintaining reliability under harsh industrial conditions.

Regional participants, including LumaSense Technologies Inc., Eaton (HERNIS Scan Systems AS), Williamson Corporation, Providence Photonics, LLC, FLUXUS, Baker Hughes Company, Sensia Solutions S.L., and Tempsens Instrument Pvt. Ltd., are also strengthening their positions by focusing on customized solutions that address specific regional and sectoral demands. Many of these companies are leveraging partnerships, mergers, and collaborations to integrate new technologies and enhance their global reach. This growing competition is fostering innovation and accelerating the adoption of smarter flare monitoring systems across industries such as oil and gas, petrochemicals, and power generation.

Looking ahead, the future of the global flare monitoring market will be driven by digitalization, sustainability goals, and automation. The next generation of systems will likely feature advanced connectivity, integrating with industrial Internet of Things platforms for seamless data sharing and predictive analytics. Real-time emission tracking will become standard, enabling industries to prevent unplanned releases and optimize energy usage. Artificial intelligence will further improve monitoring accuracy by identifying patterns and anomalies that might go unnoticed by conventional systems.

Market size is forecast to rise from USD 1400.2 million in 2025 to over USD 2527.9 million by 2032. Flare Monitoring will maintain dominance but face growing competition from emerging formats.

Moreover, as global attention continues to focus on climate change and energy efficiency, the importance of flare monitoring will increase. The market will expand beyond compliance-driven demand and move toward performance-driven adoption, where companies use flare data to guide process improvements and achieve carbon reduction goals. With strong international and regional competition, constant innovation, and regulatory encouragement, the global flare monitoring market will continue to evolve into a critical component of sustainable industrial development.

Report Coverage

This research report categorizes the global flare monitoring market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global flare monitoring market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global flare monitoring market.

Flare Monitoring Market Key Segments:

By Mounting Method

- In Process-Mass Spectrometers

- Gas Chromatographs

- Gas Analyzers

- Other

By Component

- Gas Analyzers

- Optical Detectors

- Thermal Imaging Cameras

- Software Solutions

- Other

By Industry

- Oil & Gas Industry

- Chemical Industry

- Petrochemical Industry

- Power Generation

- Other

Key Global Flare Monitoring Industry Players

- AMETEK Inc.

- ABB Ltd.

- Honeywell International Inc.

- Siemens AG

- Fluenta

- MKS Instruments, Inc.

- Thermo Fisher Scientific Inc.

- John Zink Hamworthy Combustion

- Advanced Energy

- FLIR Systems, Inc.

- ZEECO, INC.

- LumaSense Technologies Inc.

- Eaton (HERNIS Scan Systems AS)

- Williamson Corporation

- Providence Photonics, LLC

- FLUXUS

- Baker Hughes Company

- Sensia Solutions S.L.

- Tempsens Instrument Pvt. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252