Global Fill Finish Manufacturing Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global fill finish manufacturing market has transitioned from a specialized pharmaceutical process to a fundamental part of the biopharmaceutical industry across several decades. The mid-20th century was the era when sterile drug production first required the very exact, filling and sealing of vials and syringes. Manual operations prevailed at first with only little automation and even lower safety standards. As the use of injectable drugs in medical treatments became more widespread, the demand for very precise filling practices that were free of contamination became the basis for what was later refined into a highly advanced and professional manufacturing discipline.

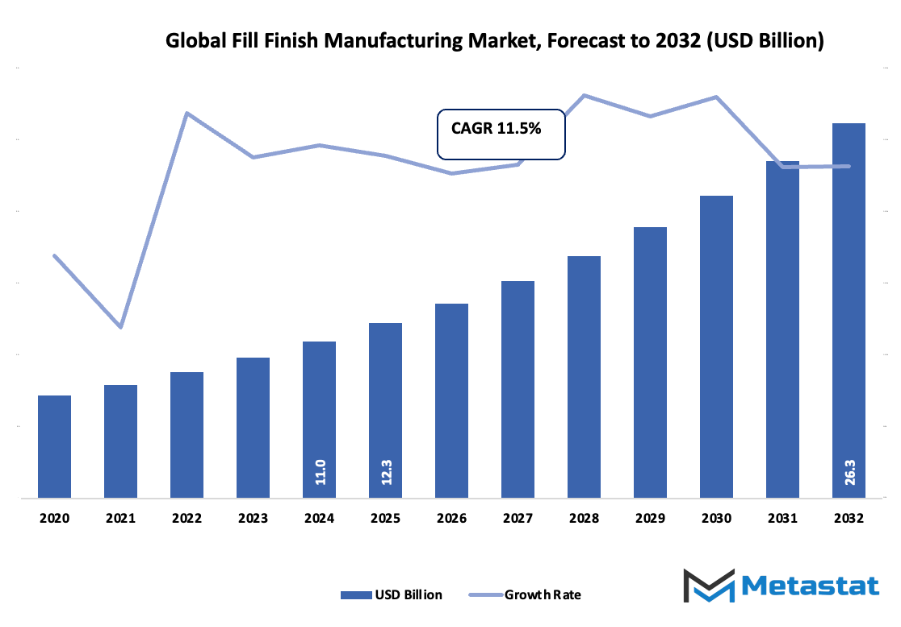

- Global fill finish manufacturing market was estimated to be around USD 12.3 Billion in 2025, with a surge of about 11.5% yearly to reach more than USD 26.3 Billion in 2032.

- Consumables represent almost 62.9% of the total market and are the main factor of the innovation process and applications through intense research.

- Major trends that spur market growth include: Biologics hot demand, Filling and sealing technologies improvement

- Personalized medicine which is one of the opportunities that the market is gaining attention.

- The insight reveals that the market is going to increase its value tremendously over the next ten years thus revealing huge growth possibilities.

The 1980s marked the advent of biotechnology, and along with it, the introduction of biologics completely changed the industry’s perspective. Drug formulations got so complex that traditional glass vials and rubber stoppers were no longer suitable. The pharmaceutical firms, then, just like one after another, started to invest in cleanroom facilities, aseptic filling systems, and advanced validation methods. These developments not only increased the safety of the products, but also permitted the manufacturers to deal with high-value biologic products without crippling the quality. The entire industry’s transition from small molecule drugs to biologics was a watershed moment that affected production protocols and also the design of equipment.

The first decade of the new millennium saw the global fill finish manufacturing market going for automation and robotics as a solution to the consequence of biologic product complexity that was ever-growing. Alongside, the demand for ready-to-use prefilled syringes skyrocketed, as the medical personnel needed nothing but the utmost precision and convenience in drug administration. This transition was indicative of a wider movement towards patient-friendly answers wherein efficiency and safety in drugs’ delivery took equal precedence with the drug itself. The agencies regulating the industry were also very strict and following the manufacturers’ every step, as they had to comply with even higher standards for sterility and traceability than before.

The last few years have seen the market impacted by the astonishing pace of development of single-use systems, isolator technology, and digital monitoring tools. These advancements have cut down the human intervention to almost zero, thereby lowering the risk of contamination and increasing flexibility in production. The inflow of personalized medicine and small-scale production would be the major factor driving the future changes, causing the production facilities to be designed as modular and adaptive ones. Since biologics, vaccines, and gene therapies are the leading products in the pharmaceutical pipelines, the global fill finish manufacturing market will continue to be at the crossroads of science, technology, and regulation.

Market Segments

The global fill finish manufacturing market is mainly classified based on Product, Modality , Material, End User.

By Product is further segmented into:

- Consumables: The consumable products utilized in the world's Fill Finish Manufacturing industry consist of single-use materials, vials, stoppers, and syringes which are vital for the packaging of sterile medications. The safety and efficacy of the product's life cycle are assured by these supplies. With the rise in biopharmaceutical manufacturing and the trend towards ready-to-use materials, the market for such items keeps expanding.

- Instruments: In the Fill Finish Manufacturing sector, the market's instruments are filling machines, control systems, and packaging machines that ensure accurate dosing and keep the product's quality intact. The use of automation in these instruments not only minimizes the risk of contamination but also heightens the speed and accuracy of the final drug packaging operation at the same time.

By Modality the market is divided into:

- Recombinant Proteins: The global fill finish manufacturing market is greatly influenced by the recombinant proteins due to their essential use in the production of vaccines and therapeutic treatments. The processing of these proteins demands top-notch filling and packaging systems that not only prevent contamination but also ensure the stability of the proteins, thus enabling the development of biologics.

- Monoclonal Antibodies: The market is heavily reliant on monoclonal antibodies as they are the primary medications for various diseases, cancer, and autoimmune disorders. Filling systems need to be very precise and sterile in order to produce consistently high-quality complex biological products.

- Vaccines: Vaccines represent a significant portion of the market and the trend is projected to continue with increasing demand for large-scale production. Vaccine filling, sealing, and packaging processes must be very accurate to maintain efficacy and avoid contamination, thereby ensuring safe delivery to healthcare providers around the globe.

- Cell Therapies and Biological Therapies: Cell and biological therapies are among the segments that are rapidly expanding in the market. Such treatments require cutting-edge filling technology capable of manipulating delicate materials while simultaneously ensuring sterility and viability. Consequently, innovation in filling systems leads to the quicker and safer release of personalized treatment.

- Gene Therapies: Gene therapies contribute significantly to the growth of the market, focusing on treatments for genetic disorders. The filling and packaging processes must be carefully controlled to preserve the integrity of genetic material, ensuring safety and effectiveness in clinical applications.

- Others: Other modalities within the global fill finish manufacturing market include peptide-based drugs and novel biological products. These require customized filling and packaging methods designed to protect sensitive formulations and maintain high quality throughout production and distribution.

By Material the market is further divided into:

- Glass: Glass remains the dominant material in the global fill finish manufacturing market for vials and syringes due to their strength and drug stability preservation. Nevertheless, the breakage and difficulty in compatibility have prompted the development of coated and strengthened glass materials as an alternative.

- Plastic: The market prefers plastic materials over glass due to their properties of being lightweight, economical, and easily customizable. The increasing use of plastics is enabled by the advancements in polymer science which not only enhance their resistance to chemicals but also ensure their compatibility with various drug formulation.

- Others: The global fill finish manufacturing market is also open to hybrid and composite materials that are developed to join the best features of both glass and plastic. The new materials not only boost safety but also lower the chances of contamination and provide better efficiency in drug packaging.

By End User the global fill finish manufacturing market is divided as:

- Pharmaceutical Companies: Pharmaceutical companies are primary users of the market, relying on high-quality filling and packaging systems for large-scale drug production. These companies invest heavily in automation and technology to improve accuracy, maintain sterility, and meet global regulatory standards.

- Biotechnology Companies: Biotechnology companies actively contribute to the expansion of the market. Their focus on biologics and novel therapies drives demand for advanced filling solutions that ensure the integrity of sensitive materials while enabling flexible, small-batch production.

- Contract Manufacturing Organizations (CMOs): Contract Manufacturing Organizations play a vital role in the market by providing specialized services to pharmaceutical and biotech firms. CMOs help companies reduce production costs and time while maintaining compliance with stringent safety and quality standards.

- Other: Other end users in the global fill finish manufacturing market include research institutes and healthcare facilities involved in small-scale production and testing. These entities depend on reliable filling and packaging systems that support efficient preparation and handling of various drug products.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$12.3 Billion |

|

Market Size by 2032 |

$26.3 Billion |

|

Growth Rate from 2025 to 2032 |

11.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

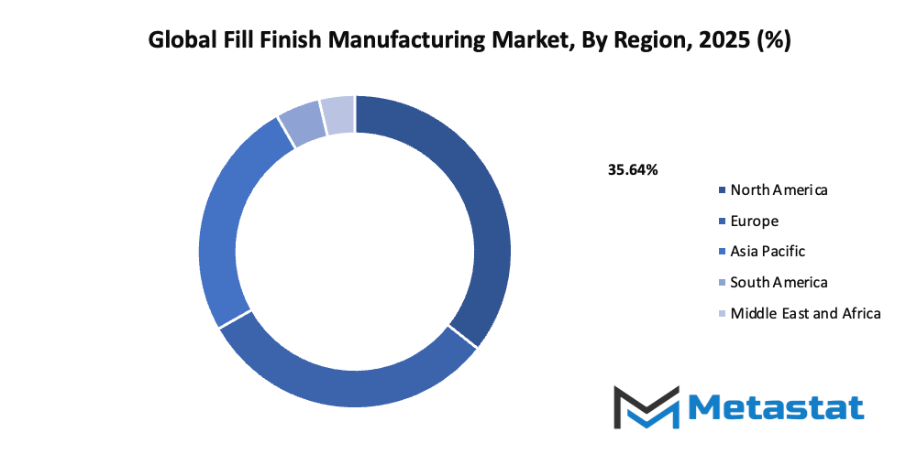

By Region:

- Based on geography, the global fill finish manufacturing market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for biologics: The global fill finish manufacturing market is seeing strong growth due to the rising use of biologics for treating various chronic and rare diseases. As biologics require specialized packaging and handling to maintain quality and stability, manufacturers are expanding production capacities to meet this growing demand. This trend will continue to support market expansion.

- Advancements in fill finish technologies: The market is benefiting from technological progress that improves efficiency, safety, and accuracy during the final stages of drug production. Automation, robotics, and advanced sterile systems are helping to reduce contamination risks and enhance product consistency. These innovations will help drive faster and more reliable manufacturing processes.

Challenges and Opportunities

- Stringent regulatory requirements: The global fill finish manufacturing market faces challenges from strict regulatory guidelines that govern product quality, sterility, and safety standards. Meeting these regulations often requires time-consuming validation processes and continuous monitoring. While these rules ensure patient safety, they can delay product approvals and increase operational complexity for manufacturers.

- High initial investment costs: The market involves significant upfront costs due to the need for advanced equipment, cleanroom facilities, and skilled labor. Smaller companies may find it difficult to enter this field because of high financial barriers. However, long-term returns remain promising as demand for sterile drug production continues to rise

Opportunities

- Growing focus on personalized medicine: The global fill finish manufacturing market is gaining opportunities from the shift toward personalized treatments that require smaller, more flexible production batches. Custom drug formulations and targeted therapies demand precise filling and packaging solutions. This focus on patient-specific medicines will create new growth avenues for specialized manufacturing services.

Competitive Landscape & Strategic Insights

The global fill finish manufacturing market continues to grow as demand for efficient pharmaceutical production increases. This growth is mainly driven by the need for advanced packaging and filling solutions that ensure safety, accuracy, and compliance with strict regulations. The process plays a vital role in the final stages of drug production, where sterile products are carefully filled into containers such as vials, syringes, and cartridges. A rise in biologics, vaccines, and injectable medicines has created a strong need for improved fill finish systems that can handle complex formulations while maintaining product integrity.

Automation and technology are transforming production lines, making them faster and more precise. Companies are investing heavily in machinery that minimizes contamination risk and supports flexible manufacturing processes. Single-use systems, robotics, and integrated quality control tools are becoming standard across modern facilities. These innovations not only improve output but also reduce operational costs, making production more sustainable and reliable.

The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Syntegon Technology GmbH, West Pharmaceutical Services, Inc., I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A, Becton, Dickson and Company, Gerresheimer AG, Stevanato Group, Terumo Corporation, OPTIMA packaging group GmbH, Groninger & Co. GmbH, Vetter Pharma International GmbH, SKAN AG, AbbVie Inc., Catalent, Inc., Sartorius AG, Lonza Group Ltd., and GEA Group AG in market. Each company contributes through technological expertise, innovation, and strong distribution networks, shaping how products are filled, sealed, and packaged worldwide.

Partnerships between pharmaceutical firms and equipment manufacturers are also increasing. Such collaborations help accelerate product development and bring safer medicines to market faster. Quality assurance remains a top priority, as even small errors in the filling stage can impact patient safety and company reputation. Continuous training, strict hygiene standards, and the use of advanced monitoring systems help maintain precision in every batch produced.

Market size is forecast to rise from USD 12.3 Billion in 2025 to over USD 26.3 Billion by 2032. Fill Finish Manufacturing will maintain dominance but face growing competition from emerging formats.

The global fill finish manufacturing market is expected to expand further as healthcare demands rise globally. Growth in contract manufacturing organizations and the introduction of new biologic therapies will continue to drive technological progress. With a focus on efficiency, safety, and flexibility, the market will keep advancing to meet the evolving needs of pharmaceutical production while maintaining the highest standards of quality and reliability.

Report Coverage

This research report categorizes the global fill finish manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fill finish manufacturing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global fill finish manufacturing market.

Fill Finish Manufacturing Market Key Segments:

By Product

- Consumables

- Instruments

By Modality

- Recombinant Proteins

- Monoclonal Antibodies

- Vaccines

- Cell Therapies and Biological Therapies

- Gene Therapies

- Others

By Material

- Glass

- Plastic

- Others

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Other

Key Global Fill Finish Manufacturing Industry Players

- Syntegon Technology GmbH

- West Pharmaceutical Services, Inc.

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A

- Becton, Dickson and Company

- Gerresheimer AG

- Stevanato Group

- Terumo Corporation

- OPTIMA packaging group GmbH

- Groninger & Co. GmbH

- Vetter Pharma International GmbH

- SKAN AG

- AbbVie Inc.

- Catalent, Inc.

- Sartorius AG

- Lonza Group Ltd.

- GEA Group AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252