Global Feed Ingredients Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global feed ingredients market is an enterprise that will play an ever-growing role in shaping the future of livestock and aquaculture production globally. Essentially, this market will not only supply raw material for animal feeding but also form the foundation of food security and agricultural sustainability. It will be a mixed group of processors, producers, and suppliers that will focus on delivering ingredients that meet the nutritional requirements of poultry, swine, cattle, and aquaculture production. During the next few years, the industry will undergo a shift to finding ingredients that have better traceability and assured quality. Farmers and feed manufacturers will seek products that will enhance animal well-being and reduce the need for synthetic additives. This trend will create avenues for alternative proteins, organic nutrients, and novel blends that will redefine traditional feed mixes.

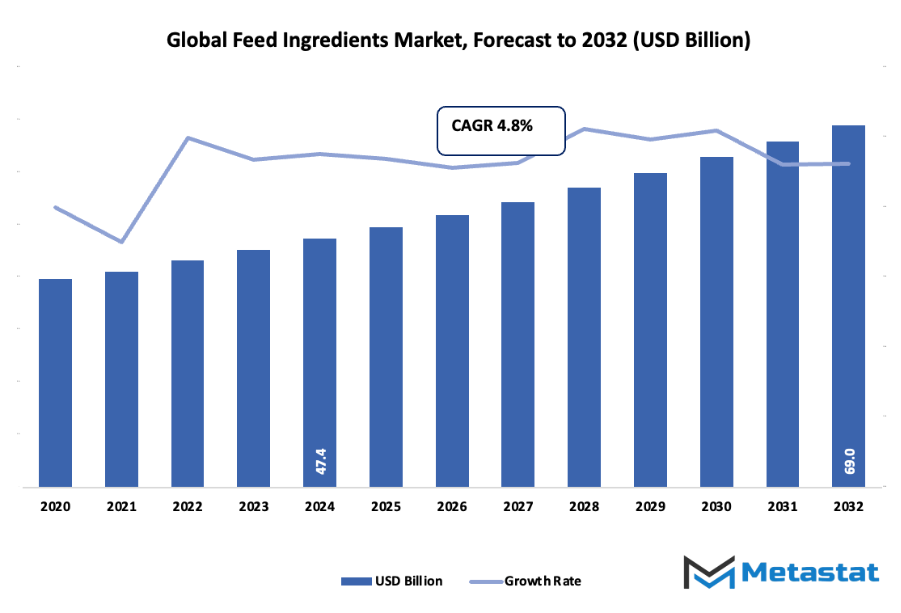

- Global feed ingredients market of approximately USD 49.7 Billion in 2025 with a CAGR of approximately 4.8% over the forecast period of 2032 and can grow to well over USD 69 Billion.

- Poultry capture a market share of close to 43.7%, stimulating innovation and expanding application through extensive research

- Key growth drivers: Increasing global demand for animal protein, especially meat, dairy, and eggs., Accelerating uptake of high-quality and specialty feed ingredients to boost animal productivity and well-being.

- Opportunities: Gains in using environmentally friendly and alternative feed ingredients like insect protein, algae, and fermentation products.

- Key takeaway: The market will exponentially grow in value during the next decade, pinpointing substantial growth prospects.

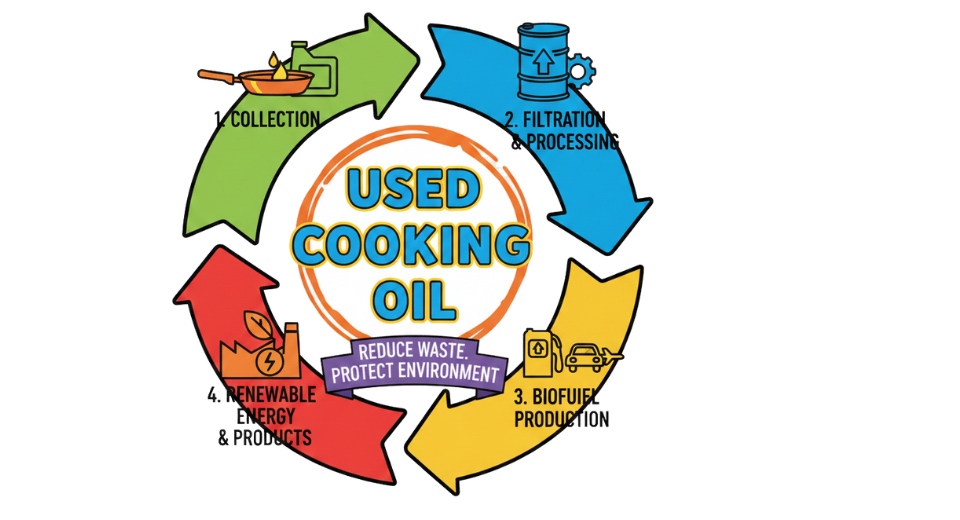

The global feed ingredients industry will also be playing its part in balancing efficiency and sustainability. There will be pressure on stakeholders to identify methods of minimizing waste, lowering emissions, and maintaining circular behaviour, such as recycling by-products into edible feed components. The outcome will be an industry that does not only provide volume but also value in nutritional balance and environmental impact.

As trade flows and consumer taste evolve, the market will adapt by diversifying supply chains and entering regions where demand for animal protein continues to rise. The shift will turn the global feed ingredients market into the backbone of new agriculture, shaping how food is being made as well as how it's going to be consumed in the future.

Market Segments

The global feed ingredients market is mainly classified based on Animal Type, Nutrient Type, Form

By Animal Type is further segmented into:

- The global feed ingredients market by type of animal indicates solid growth in poultry feed in response to increased global demand for chicken meat and eggs. Ongoing development in feed formulation is enabling poultry producers to increase production efficiency, diminish risks from diseases, and deliver enhanced growth performance, defining future patterns of sustainable agriculture practices.

- Swine feed demand for the global feed ingredients market is driven by increasing pork consumption in developing countries. Proper nutrition is critically important in maximizing weight gain and maximizing feed conversion ratios. Swine feed ingredient developments of the future will be driven by digestibility, environmental sustainability, and cost-reduction on the farm for producers.

- Cattle feed constitutes a major share of the market due to the increasing demand for beef and dairy. Nutritional enhancement is still vital to sustain increased milk output and improved meat quality. Innovation in cattle feed will focus on sustainable sources without compromising productivity in small as well as large farms.

- Aquaculture expansion consolidates the market on the back of growing seafood demand. Feed manufacturers are developing sustainable substitutes for fishmeal based on plant protein and high-tech formulations. Future prospects indicate greater investment in high-quality aquafeed to enhance growth rates, fish health, and environmental control, facilitating global aquaculture growth.

- Sheep and goat nutrition in the market is picking up pace because of increasing demand for milk, meat, and fiber products. There is formulation of specialized feed to enhance digestion and overall well-being. Regional dietary habits and demand for environmentally friendly small ruminant production systems will determine the future growth.

- Other livestock types under the global feed ingredients market include specialty animals, rabbits, and horses. In these animals, feed solutions are more performance, health, and longevity-specific. As diverse demand comes from consumers for animal products, the market will invest in specialized feed solutions that effectively target various nutritional requirements.

By Nutrient Type the market is divided into:

- Energy sources dominate the global feed ingredients market by nutrient type, ensuring livestock receive adequate calories for growth and productivity. Corn, barley, and other cereals remain core ingredients, though alternative sources are under exploration. The future will likely emphasize sustainable, cost-efficient, and regionally available ingredients to support both farmers and feed manufacturers.

- Fat sources play an important role in the market as they enhance energy density and improve nutrient absorption. Animal fats and vegetable oils are widely used, with innovations focusing on stability and digestibility. Market expansion is expected as feed producers seek to improve efficiency while maintaining animal health and performance.

- Protein sources are central in the market, supporting muscle growth and overall animal development. Soybean meal continues to dominate, though insect proteins and other alternatives are gaining attention. Looking ahead, the focus will be on sustainable protein supply chains that balance efficiency, affordability, and reduced environmental impact across all livestock types.

- Vitamin supplements are increasingly important in the market to ensure optimal animal health, immunity, and productivity. Growing awareness among farmers about the role of micronutrients is shaping demand. Future developments will highlight precise supplementation strategies, ensuring livestock receive the right balance of vitamins for better yields and performance outcomes.

By Form the market is further divided into:

- Dry feed remains the most widely used form in the global feed ingredients market due to ease of storage, handling, and cost-effectiveness. Its long shelf life and adaptability make it a preferred choice. Market outlook indicates sustained demand for dry feed, with improvements in nutrient stability and reduced post-harvest losses playing a central role.

- Liquid feed applications are steadily growing within the market, especially for ruminants. These feeds allow for easy blending of nutrients and better intake consistency. Future demand is expected to rise as farmers look for innovative feeding methods that improve efficiency and ensure optimal nutritional delivery in modern livestock farming practices.

- Pellets represent a significant share of the market due to their uniform composition, reduced wastage, and higher palatability. Pelletization enhances feed efficiency and supports large-scale farming. Future advancements in pelleting technology will likely focus on energy-saving methods, improved binding agents, and enhanced nutrient retention for better overall livestock performance.

- Meals are another important category in the global feed ingredients market, commonly used for poultry, cattle, and aquaculture. Meals provide a concentrated nutrient profile at relatively lower costs. Future trends suggest innovation in processing techniques to improve digestibility and nutrient availability, ensuring better growth outcomes and sustainability across different animal production systems.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$49.7 Billion |

|

Market Size by 2032 |

$69 Billion |

|

Growth Rate from 2025 to 2032 |

4.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

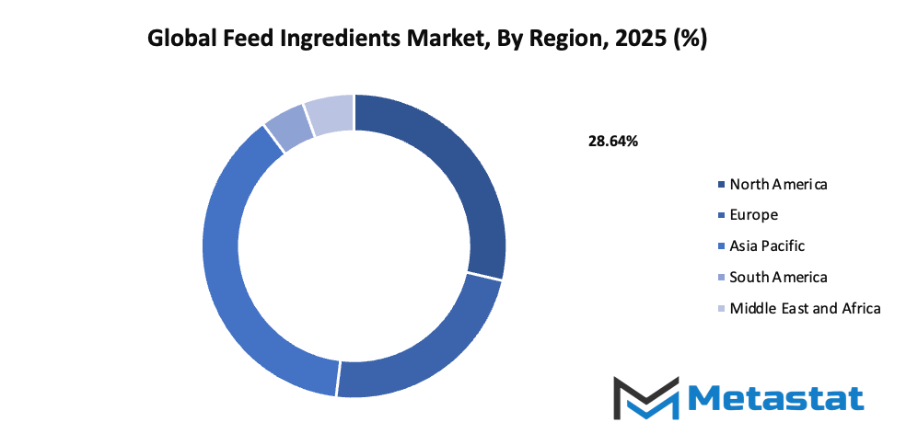

- Based on geography, the global feed ingredients market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Growing global demand for animal protein, particularly meat, dairy, and eggs:- The global feed ingredients market will continue to grow as the demand for animal protein such as meat, dairy, and eggs expands across both developed and developing regions. Rising population levels and increasing incomes will push consumption higher, creating a steady requirement for feed ingredients that support livestock growth and productivity.

Rising adoption of high-quality and specialty feed ingredients to enhance animal health and productivity: The global feed ingredients market will also be shaped by the rising use of high-quality and specialty ingredients. These additions improve animal health, enhance immunity, and optimize production efficiency. Nutritional innovation will gain importance as producers seek to maintain consistent output while meeting consumer expectations for healthier and safer animal-based food products.

Challenges and Opportunities

Volatility in raw material prices affecting production costs: The global feed ingredients market will face challenges due to volatile raw material prices. Fluctuations in crops such as corn and soybeans raise production costs and disrupt supply chains. These factors may create pressure on margins, making cost management and sourcing strategies essential for businesses operating in this sector.

Stringent regulations on feed additives and safety standards: The market must also respond to strict regulations around additives and safety standards. Governments and international organizations are tightening rules to ensure consumer protection and sustainable practices. Compliance with these measures will require investment in research, testing, and transparent labeling, but it will also build trust among end users.

Opportunities

Increasing use of sustainable and alternative feed ingredients such as insect protein, algae, and fermentation-derived products: The global feed ingredients market has opportunities through the adoption of sustainable and alternative sources. Innovations such as insect protein, algae-based nutrition, and fermentation-derived products are gaining acceptance. These alternatives can reduce pressure on traditional raw materials, support eco-friendly practices, and create long-term growth pathways for the industry.

Competitive Landscape & Strategic Insights

The global feed ingredients market is positioned for steady expansion, supported by the growing demand for efficient and sustainable solutions in animal nutrition. The industry is shaped by both established international leaders and dynamic regional competitors, creating a competitive environment that drives innovation and continuous improvement. With companies such as Dupont, Mosaic Company, Burcon Nutrascience Corporation, ADM, Alltech, Hamlet Proteins, DSM, CHS, J.R. Simplot Co., BRF, CropEnergies AG, Imcopa Food Ingredients B.V., Cargill, Catalysta, Titan Biotech, A Constantino, GRF Ingredients, CJ Cheiljedang Corporation, Evershining Ingredients Company, Darling Ingredients, Sojaprotein, Green Labs LLC., and Grain Millers, the market benefits from a diverse mix of strategies and technological approaches.

As global consumption of meat, dairy, and aquaculture products continues to rise, feed ingredients are becoming a central factor in ensuring both productivity and quality in animal-based industries. Producers are under increasing pressure to balance cost-efficiency with environmental responsibility, and this is pushing the industry toward innovative practices. New methods for extracting proteins, enzymes, and bioactive compounds are being introduced, offering sustainable alternatives to traditional raw materials. These shifts are not only reducing reliance on finite natural resources but also improving feed conversion rates, which will play a significant role in meeting future food security challenges.

The future direction of the global feed ingredients market will likely be shaped by advances in biotechnology and precision nutrition. Companies are investing in research that allows for more targeted ingredient development, focusing on animal health, improved digestibility, and reduced environmental impact. Such innovation will be vital as demand grows in regions with expanding livestock sectors. At the same time, regional players are emerging with localized solutions tailored to specific farming conditions, adding fresh competition to the established global companies. This balance between large-scale industry leaders and agile regional firms will define the competitive landscape in the years ahead.

Sustainability is another driving force that cannot be overlooked. Feed producers are exploring ways to integrate circular economy principles, such as using by-products from food and biofuel industries, to create value-added feed ingredients. Companies like Darling Ingredients and CropEnergies AG are already advancing in this area by utilizing waste streams to develop efficient, high-quality products. This trend is expected to become stronger as industries and governments worldwide adopt stricter sustainability targets.

Digital technology will also influence the progress of the global feed ingredients market. Tools that monitor animal growth, feed efficiency, and nutrient absorption are making it possible to design more precise ingredient blends. This kind of integration will improve transparency across the supply chain, ensuring that end-users can track both the quality and sustainability credentials of feed products. Over time, the adoption of artificial intelligence and data-driven platforms will transform how feed formulations are tested, produced, and delivered.

The global feed ingredients market is not just responding to present needs but is also preparing for the future of food production. With a growing world population and rising demand for high-protein diets, the sector will play a vital role in shaping sustainable agriculture. A combination of established expertise, regional innovation, and technological advancement will ensure that feed ingredients remain at the heart of global food security strategies. The coming years will reveal a market that is not only larger but also smarter, more sustainable, and better aligned with the environmental and nutritional challenges of the future.

Market size is forecast to rise from USD 49.7 Billion in 2025 to over USD 69 Billion by 2032. Feed Ingredients will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the Feed Ingredients market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Feed Ingredients market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Feed Ingredients market.

By Animal Type is further segmented into:

- Poultry

- Swine

- Cattle

- Aquaculture

- Sheep and Goats

- Others

By Nutrient Type the market is divided into:

- Energy sources

- Fat sources

- Protein sources

- Vitamin supplements

By Form the market is further divided into:

- Dry Feed

- Liquid Feed

- Pellets

- Meals

Key Global Temporary Power Industry Players

- Dupont

- Mosaic Company

- Burcon Nutrascience Corporation

- ADM

- Alltech

- Hamlet Proteins

- DSM

- CHS

- J.R Simplot Co.

- BRF

- CropEnergies AG

- Imcopa Food Ingredients B.V

- Cargill

- Catalysta

- Titan Biotech

- A Consantino

- GRF Ingredients

- CJ Cheiljedang Corporation

- Evershining Ingredients Company

- Darling Ingredients

- Sojaprotein

- Green Labs LLC.

- Grain Millers

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252