MARKET OVERVIEW

The Global Animal Parasiticides market epitomizes an expansive industry dedicated to safeguarding the health and well-being of animals worldwide. It encompasses a diverse array of products and services aimed at combating parasitic infestations that afflict various animal species, ranging from livestock and companion animals to wildlife. This industry plays a crucial role in ensuring the vitality and productivity of animal populations, thereby contributing significantly to global food security, public health, and economic stability.

The Global Animal Parasiticides market revolves around the development, manufacturing, and distribution of pharmaceuticals, pesticides, and other veterinary interventions designed to control and eliminate parasites that pose threats to animal health. These parasites can include internal organisms like worms and protozoa, as well as external pests such as ticks, fleas, and mites. Given the diverse nature of parasitic threats and the myriad of animal species they affect, the market offers a wide range of products tailored to specific parasites, host animals, and administration methods.

Key players in the Global Animal Parasiticides market include pharmaceutical companies, agrochemical manufacturers, veterinary product suppliers, and research institutions. These entities engage in extensive research and development efforts to innovate new formulations and delivery mechanisms that enhance the efficacy, safety, and convenience of parasiticides. Additionally, they collaborate with regulatory agencies to ensure compliance with stringent safety and efficacy standards governing the use of these products in animals destined for human consumption.

The application of animal parasiticides spans various sectors, including livestock farming, pet care, and wildlife conservation. In the livestock industry, parasitic infestations can have devastating consequences, leading to reduced productivity, compromised animal welfare, and economic losses for producers. Therefore, farmers and ranchers rely on parasiticides to protect their livestock from debilitating diseases like parasitic gastroenteritis and tick-borne infections, thereby preserving the health and productivity of their herds.

Similarly, in the realm of companion animal care, parasiticides play a vital role in preventing and treating infestations that can jeopardize the health of pets and pose risks to human households. By administering parasiticides regularly, pet owners can safeguard their furry companions from diseases transmitted by parasites, ensuring their longevity and quality of life. Furthermore, parasiticides contribute to public health by reducing the prevalence of zoonotic diseases that can be transmitted between animals and humans.

In wildlife conservation efforts, parasiticides are used to mitigate the impact of parasitic diseases on endangered species and ecosystems. By controlling parasite populations in vulnerable wildlife populations, conservationists can help maintain ecological balance and biodiversity, thereby preserving the natural heritage of our planet.

The Global Animal Parasiticides market serves as a cornerstone of the veterinary pharmaceutical industry, providing essential tools and solutions for protecting animal health and well-being on a global scale. Through ongoing innovation, collaboration, and regulatory oversight, this dynamic industry continues to evolve and adapt to emerging challenges, ensuring the continued resilience of animal populations and the sustainability of human-animal ecosystems.

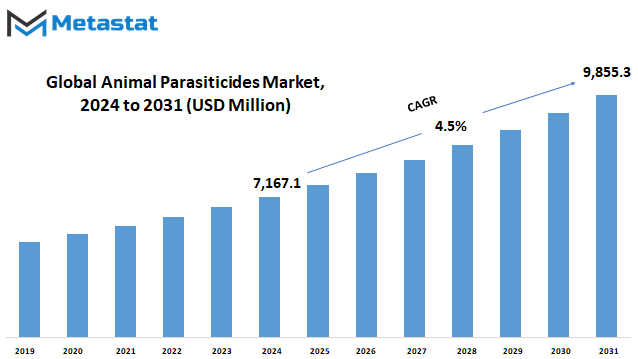

Global Animal Parasiticides market is estimated to reach $9,855.3 Million by 2031; growing at a CAGR of 4.5% from 2024 to 2031.

GROWTH FACTORS

The global market for animal parasiticides is influenced by various factors that drive its growth, pose challenges, and present opportunities. One significant driver is the rise in incidences of zoonotic diseases, which are illnesses that can be transmitted between animals and humans. With the increasing interaction between humans and animals, there has been a parallel increase in the spread of such diseases, necessitating the use of parasiticides to control their transmission.

Another driving factor is the growing awareness about animal healthcare among pet owners and livestock farmers. As people become more informed about the importance of maintaining the health and well-being of animals, there is a greater demand for products like parasiticides that can help prevent and treat diseases caused by parasites.

Additionally, the demand for protein-rich diets, particularly in developing countries, is fueling the growth of the animal farming industry. Livestock farmers are increasingly investing in parasiticides to protect their animals from parasites, ensuring the production of healthy livestock for human consumption.

However, the market faces certain restraints that hinder its growth. One such challenge is generic erosion, which occurs when patent protection expires for branded parasiticide products, allowing generic versions to enter the market at lower prices. This can lead to a decline in sales and profitability for original manufacturers.

Furthermore, the lengthy regulatory approval process for new parasiticide products poses a barrier to market entry for companies seeking to introduce innovative solutions. The extensive testing and evaluation required by regulatory authorities delay product launches, delaying potential revenue generation for manufacturers.

Despite these challenges, there are opportunities for growth in the market, particularly through vertical integration in the livestock industry. By integrating various stages of the supply chain, from farming and production to distribution and retail, companies can streamline operations, reduce costs, and gain greater control over product quality and distribution channels.

The global animal parasiticides market is driven by factors such as the rise in zoonotic diseases, increasing awareness about animal healthcare, and the demand for protein-rich diets. However, challenges like generic erosion and lengthy regulatory approval processes exist, alongside opportunities for growth through vertical integration in the livestock industry.

MARKET SEGMENTATION

By Type

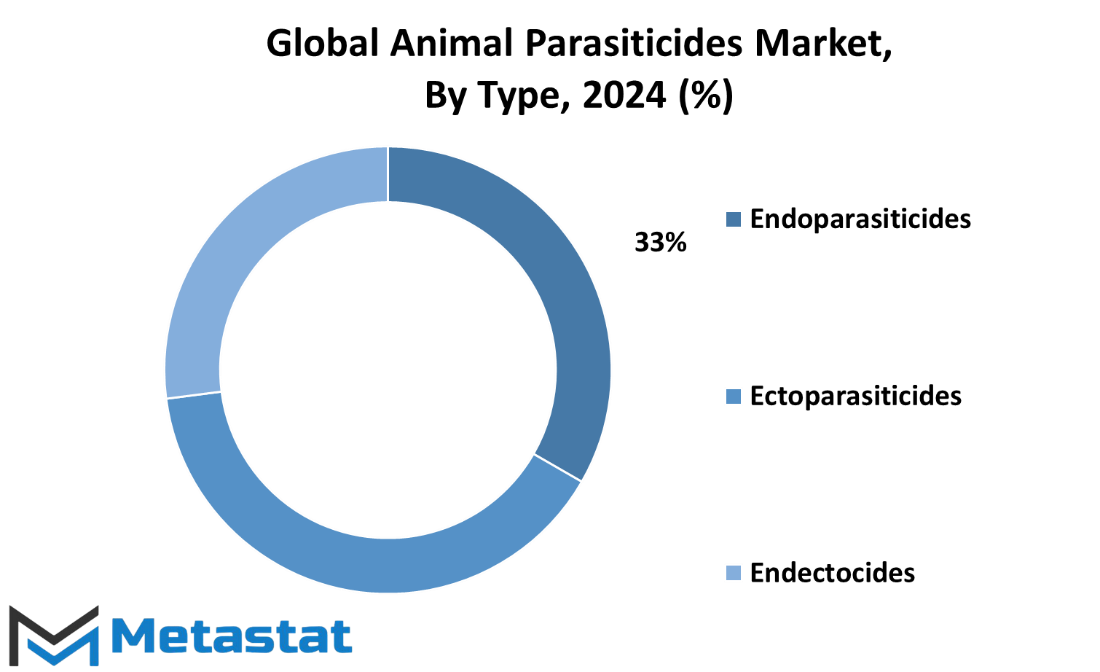

The global market for animal parasiticides, categorized by type, branches into three main segments: Endoparasiticides, Ectoparasiticides, and Endectocides. These segments play crucial roles in managing and controlling parasitic infestations in animals. Let's delve deeper into each segment to understand their significance in the animal healthcare industry.

Endoparasiticides primarily target internal parasites that inhabit the gastrointestinal tract, lungs, or other internal organs of animals. These parasites, such as worms and protozoa, can cause various health issues ranging from digestive disturbances to severe organ damage if left untreated. Endoparasiticides come in various forms including oral drenches, injections, and feed additives. They work by either paralyzing or killing the parasites, thereby preventing further harm to the animal's health.

Ectoparasiticides, on the other hand, focus on external parasites like fleas, ticks, mites, and lice that infest the skin, fur, or feathers of animals. These parasites not only cause discomfort and irritation to the animals but can also transmit diseases and adversely affect their overall health. Ectoparasiticides are commonly available in the form of sprays, spot ons, shampoos, and powders. They work by directly targeting and killing the parasites upon contact or ingestion, providing relief to the affected animals.

Endectocides, as the name suggests, have a dual action against both internal and external parasites. They are broad-spectrum parasiticides effective against a wide range of parasites including nematodes, arthropods, and ectoparasites. Endectocides are typically administered through injections or pour-ons and are known for their systemic distribution throughout the animal's body, ensuring comprehensive protection against parasitic infestations.

The market for animal parasiticides is driven by various factors including the rising prevalence of parasitic infections in livestock and companion animals, increasing awareness about animal health and welfare, and advancements in veterinary therapeutics. Additionally, stringent regulations governing the use of parasiticides, coupled with the growing demand for safe and effective parasiticidal products, further fuel the market growth.

By Animal Type

The global market for animal parasiticides encompasses various segments categorized by animal type. These segments include dogs, cats, cattle, pigs, poultry, horses, and others. Each segment represents a significant portion of the market, contributing to its overall value.

In 2019, the dogs segment held a substantial share of the market, with a value of 923.5 million US dollars. This indicates a high demand for parasiticides to protect dogs from various parasites such as ticks, fleas, and worms. The well-being of dogs is a priority for pet owners, leading to a consistent need for effective parasiticides to ensure their health and comfort.

Similarly, the cats segment also contributed significantly to the market, with a value of 686.9 million US dollars in 2019. Cat owners prioritize the health and welfare of their feline companions, driving the demand for parasiticides to safeguard them against common parasites like fleas, ticks, and ear mites. The market for cat parasiticides reflects the strong bond between owners and their pets, fostering a lucrative industry dedicated to feline health.

Cattle represent another substantial segment of the animal parasiticides market, with a value of 1,096.2 million US dollars in 2019. Livestock farmers rely on parasiticides to protect their cattle from parasitic infestations that can negatively impact their health and productivity. Parasites such as worms and ticks can cause significant economic losses in the cattle industry, highlighting the importance of effective parasiticides in maintaining herd health and profitability.

Pigs also constitute a significant portion of the market, with a value of 854.1 million US dollars in 2019. Pig farmers utilize parasiticides to prevent and control parasites like roundworms, mange mites, and lice, which can affect pig health and growth rates. Ensuring the welfare of pigs is crucial for meeting quality standards and maximizing profitability in the swine industry.

In addition to these major segments, the market for animal parasiticides also includes poultry, horses, and other animals. Poultry farmers utilize parasiticides to protect chickens, turkeys, and other birds from parasites such as mites, lice, and worms, which can impact egg production and meat quality. Similarly, horse owners invest in parasiticides to safeguard their equine companions from parasites like bots, strongyles, and ticks, ensuring their health and performance.

The market for animal parasiticides continues to grow as advancements in veterinary medicine lead to the development of more effective and innovative products. With a growing awareness of the importance of parasite control in animals and increasing pet ownership worldwide, the demand for parasiticides is expected to remain strong in the years to come. As such, the global market for animal parasiticides presents lucrative opportunities for manufacturers and suppliers catering to diverse animal species and their specific parasite control needs.

By End-use

The global animal parasiticides market is a significant sector in the veterinary and animal care industry. It plays a crucial role in safeguarding animal health and ensuring the well being of livestock and pets alike. This market encompasses various products and treatments aimed at controlling and eliminating parasites that can harm animals.

When we consider the end-use of these parasiticides, we typically categorize them into three main segments: veterinary hospitals and clinics, animal farms, and home care settings. Each of these segments serves a distinct purpose in addressing the parasite control needs of animals.

Veterinary hospitals and clinics represent a fundamental component of the animal healthcare system. These facilities provide medical care and treatment to animals suffering from various health issues, including parasitic infestations. Veterinarians in hospitals and clinics administer parasiticides to treat and prevent parasites in pets and livestock under their care. They conduct thorough examinations, diagnose parasite-related conditions, and prescribe suitable parasiticides based on the specific needs of the animals.]

Animal farms constitute another vital sector that relies heavily on parasiticides. These farms rear livestock such as cattle, sheep, poultry, and pigs for various purposes, including meat, milk, eggs, and wool production. Parasites pose a significant threat to the health and productivity of farm animals, potentially causing diseases, reduced growth rates, and decreased reproductive efficiency. To mitigate these risks, farmers implement parasite control programs and regularly administer parasiticides to their animals. By doing so, they help maintain the health and welfare of their livestock, ensuring optimal productivity and profitability.

Apart from veterinary establishments and animal farms, home care settings also play a role in the management of animal parasites. Pet owners and caretakers often encounter parasitic infestations in their beloved companions, such as dogs, cats, and horses. These parasites, including fleas, ticks, and worms, not only affect the health of pets but can also pose risks to human health in some cases. Therefore, it is essential for pet owners to take preventive measures and treat their animals with appropriate parasiticides. They can obtain these products from veterinary clinics, pet stores, or online retailers and administer them according to the instructions provided.

In conclusion, the global animal parasiticides market serves diverse end-users, including veterinary hospitals and clinics, animal farms, and home care settings. Each of these segments plays a critical role in ensuring the health and well-being of animals by controlling and preventing parasitic infestations. By understanding the specific needs of these end users, manufacturers and suppliers of parasiticides can develop effective products and solutions to address the evolving challenges posed by animal parasites. Ultimately, the collective efforts of all stakeholders contribute to the promotion of animal health and welfare worldwide.

REGIONAL ANALYSIS

The global market for Animal Parasiticides is divided into several regions based on geography, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. This division allows for a closer examination of how these products are utilized and distributed across different parts of the world.

North America encompasses countries such as the United States and Canada. In this region, the use of animal parasiticides is influenced by factors such as climate, agricultural practices, and regulations. For instance, in regions with a significant livestock industry like the Midwest, parasiticides play a crucial role in maintaining animal health and productivity. Moreover, stringent regulations by authorities such as the Environmental Protection Agency (EPA) in the United States ensure that these products are safe for animals and the environment.

Moving on to Europe, countries like Germany, France, and the United Kingdom are major players in the animal parasiticides market. Here, factors such as advancements in veterinary medicine and a growing awareness of zoonotic diseases drive the demand for effective parasiticides. Additionally, the European Medicines Agency (EMA) regulates the approval and sale of these products, ensuring their safety and efficacy.

In the Asia-Pacific region, countries like China, India, and Australia are witnessing significant growth in the animal parasiticides market. Rapid urbanization and industrialization have led to changes in livestock farming practices, increasing the need for parasiticides to prevent diseases and enhance animal welfare. Moreover, the presence of a large population dependent on agriculture and animal husbandry further fuels the demand for these products in the region.

South America, including countries like Brazil and Argentina, also contributes to the global animal parasiticides market. Here, factors such as extensive grazing systems and tropical climates create favorable conditions for the spread of parasites among livestock. As a result, farmers rely on parasiticides to control infestations and prevent economic losses. Regulatory agencies such as the Brazilian Ministry of Agriculture, Livestock, and Supply oversee the approval and usage of these products in the region.

The Middle East & Africa region presents unique challenges and opportunities for the animal parasiticides market. Countries like South Africa and Kenya have a significant livestock industry, but limited access to veterinary services and products in some areas hinders the widespread use of parasiticides. However, increasing investments in agriculture and animal health initiatives by governments and international organizations are expected to drive market growth in this region.

The regional analysis of the global Animal Parasiticides market provides valuable insights into the diverse factors shaping its dynamics across different parts of the world. Understanding the specific needs and challenges faced by each region is crucial for stakeholders to develop targeted strategies and solutions to address them effectively.

COMPETITIVE PLAYERS

The global market for animal parasiticides is marked by intense competition among several key players. These companies play a significant role in providing solutions for controlling parasites in animals, thereby ensuring their health and well-being. Among the prominent players in this industry are Bayer AG, Bimeda Animal Health, Boehringer Ingelheim GmbH, Ceva Santé Animale, Elanco Animal Health Incorporated, Eli Lilly and Company, Huvepharma, Merck & Co., Inc., Norbrook, Perrigo Company PLC, PetIQ, Inc, Sanofi SA (Merial), Vetoquinol S.A., Virbac SA, and Zoetis, Inc.

Bayer AG stands as a major contender in the global market, offering a range of parasiticide products for various animals. Bimeda Animal Health is another significant player known for its commitment to animal health through innovative parasiticides. Boehringer Ingelheim GmbH is recognized for its quality products and extensive research in this field, contributing to the competitiveness of the market.

Ceva Santé Animale is a key player that focuses on developing solutions to combat parasitic infestations in animals, addressing the diverse needs of livestock and companion animals. Elanco Animal Health Incorporated, a well-established company, is dedicated to providing effective parasiticides for the betterment of animal health worldwide.

Eli Lilly and Company, with its subsidiary Elanco, actively participates in the animal health sector, offering a wide range of parasiticides for various species. Huvepharma is known for its comprehensive portfolio of parasiticides catering to different animal health requirements.

Merck & Co., Inc., a renowned pharmaceutical company, extends its expertise to the animal health sector, contributing to the competitive landscape of animal parasiticides. Norbrook is a significant player known for its commitment to providing high-quality veterinary products, including parasiticides.

Perrigo Company PLC, with its focus on animal health and wellness, offers a range of parasiticides to address the needs of both livestock and companion animals. PetIQ, Inc, specializes in developing affordable parasiticide solutions, ensuring accessibility to a broader range of consumers.

Sanofi SA (Merial), a prominent player in the animal health industry, emphasizes innovation and research to develop effective parasiticides for various animal species. Vetoquinol S.A. is known for its dedication to animal health and welfare, reflected in its range of parasiticidal products.

Virbac SA is a global leader in animal health, offering a wide array of parasiticides to address the needs of different markets and species. Zoetis, Inc, a major player in the animal health industry, continually innovates to provide advanced parasiticides for livestock and companion animals, contributing to the competitive dynamics of the market.

The global animal parasiticides market is characterized by the presence of several competitive players, each contributing to the development and provision of effective solutions for controlling parasites in animals. These key players play a crucial role in ensuring the health and well-being of animals worldwide.

Animal Parasiticides Market Key Segments:

By Type

- Endoparasiticides

- Ectoparasiticides

- Endectocides

By Animal Type

- Dogs

- Cats

- Cattle

- Pigs

- Poultry

- Horse

- Others

By End-use

- Veterinary hospitals and clinics

- Animal farms

- Home care settings

Key Global Animal Parasiticides Industry Players

- Bayer AG

- Bimeda Animal Health

- Boehringer Ingelheim GmbH

- Ceva Santé Animale

- Elanco Animal Health Incorporated

- Eli Lilly and Company

- Huvepharma

- Merck & Co., Inc.

- Norbrook

- Perrigo Company PLC

- PetIQ, Inc

- Sanofi SA (Merial)

- Vetoquinol S.A.

- Virbac SA

- Zoetis, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383