MARKET OVERVIEW

The Europe Spiced Rum market embodies a rich tapestry of flavors and cultural nuances, mirroring the diverse palates of its consumers across the continent. This spirited industry has transcended the conventional boundaries of the beverage sector, emerging as a fascinating blend of tradition, innovation, and the ever-changing preferences of European consumers.

The Europe Spiced Rum market lies an intricate web of distilleries, each weaving its own narrative of craftsmanship and heritage. From the sun-soaked shores of the Mediterranean to the misty landscapes of the British Isles, the production of spiced rum has become a manifestation of regional identity and distinct taste profiles. These distilleries, deeply rooted in their respective locales, craft their rums with a meticulous blend of local spices, reflecting the unique terroir of the European landscape.

The allure of spiced rum extends beyond the confines of its ingredients; it is a cultural artifact that intertwines with the social fabric of European societies. The market serves as a canvas for the expression of regional histories, encapsulated in the nuanced aromas and flavors of each bottle. From the warming notes of cinnamon in the Nordic regions to the zesty citrus undertones prevalent in the Mediterranean, every sip narrates a story of tradition and evolution.

In navigating the Europe Spiced Rum market, one encounters a dynamic landscape shaped by the fusion of age-old recipes and contemporary innovations. Artisanal distillers, drawing inspiration from ancestral methods, create small-batch spiced rums that defy mass production norms. This commitment to craftsmanship not only preserves time-honored techniques but also ensures that every bottle is a unique testament to the distiller's expertise.

The market's resilience lies in its ability to adapt to evolving consumer tastes while maintaining the authenticity that defines spiced rum. As discerning palates seek novel experiences, the industry responds with an array of experimental infusions, pushing the boundaries of flavor without compromising on the essence of the spirit. From exotic botanicals to unconventional spice combinations, the Europe Spiced Rum market is a playground for both distillers and enthusiasts, fostering a culture of exploration and creativity.

The diverse landscape of the Europe Spiced Rum market is mirrored in its consumer base, representing a mosaic of preferences and cultural influences. It has transcended the confines of being a mere beverage choice, evolving into a cultural statement embraced by a spectrum of demographics. Whether sipped neat in the quiet corners of a historic pub or blended into vibrant cocktails at trendy urban bars, spiced rum has woven itself into the social fabric, bridging generations and forging connections.

The Europe Spiced Rum market is a captivating journey through the realms of taste, tradition, and creativity. It serves as a testament to the rich diversity of European cultures, encapsulating the essence of each region within its amber depths. As the industry continues to evolve, the spirit of spiced rum remains a dynamic force, weaving together the past, present, and future in every aromatic drop.

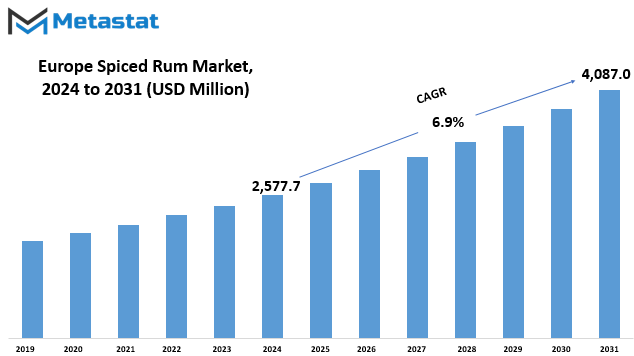

Europe Spiced Rum market is estimated to reach $4,087.0 Million by 2031; growing at a CAGR of 6.9% from 2024 to 2031.

GROWTH FACTORS

The European Spiced Rum market is currently witnessing a significant upswing, driven by a combination of factors that shape consumer preferences and industry dynamics. One of the primary catalysts for this surge is the increasing fascination among consumers for distinctive and craft inspired flavors. In response to this demand, spiced rum distillers in Europe are on a continuous quest for innovation, striving to introduce novel and appealing taste profiles to captivate the discerning palate of consumers.

Moreover, the thriving cocktail culture and the prevailing trend of mixology in Europe are further propelling the demand for spiced rum. Renowned for its versatility and rich flavor, spiced rum has become a preferred choice as a base spirit in an array of cocktails. This trend not only reflects evolving consumer tastes but also underscores the adaptability of spiced rum in the dynamic landscape of European drinking preferences.

Despite the promising trajectory of the market, spiced rum producers face challenges on the regulatory front. Europe imposes stringent regulations on the production and labeling of alcoholic beverages, presenting a potential stumbling block for spiced rum producers. Navigating through these compliance requirements necessitates diligence and adherence, often resulting in increased costs and administrative complexities. Such regulatory hurdles underscore the delicate balance that producers must strike between innovation and adherence to legal frameworks.

Adding another layer of complexity is the economic landscape, where uncertainties and fluctuations in consumer spending pose potential risks, especially within the premium spiced rum segment. The European market is not immune to external events that can impact consumer sentiment and influence purchasing decisions. Economic uncertainties, exacerbated by regional events, create an environment of caution, particularly for premium spiced rum, where price sensitivity becomes a critical consideration.

On a more optimistic note, there is a silver lining for spiced rum producers in the form of the growing emphasis on sustainability among consumers. The increasing awareness of environmental issues has led to a shift in consumer preferences towards eco-friendly and responsibly sourced products. For spiced rum producers, this presents a unique opportunity to align their practices with sustainability principles. Adopting eco-friendly production methods, responsibly sourcing ingredients, and marketing products as environmentally conscious choices can resonate well with the environmentally conscious consumer base in Europe.

The European Spiced Rum market is currently navigating a landscape shaped by a delicate interplay of consumer preferences, regulatory challenges, economic uncertainties, and sustainability trends. As distillers continue to innovate and cater to evolving tastes, the market holds promise for those who can adeptly navigate the complexities and align with the changing expectations of consumers in the region.

MARKET SEGMENTATION

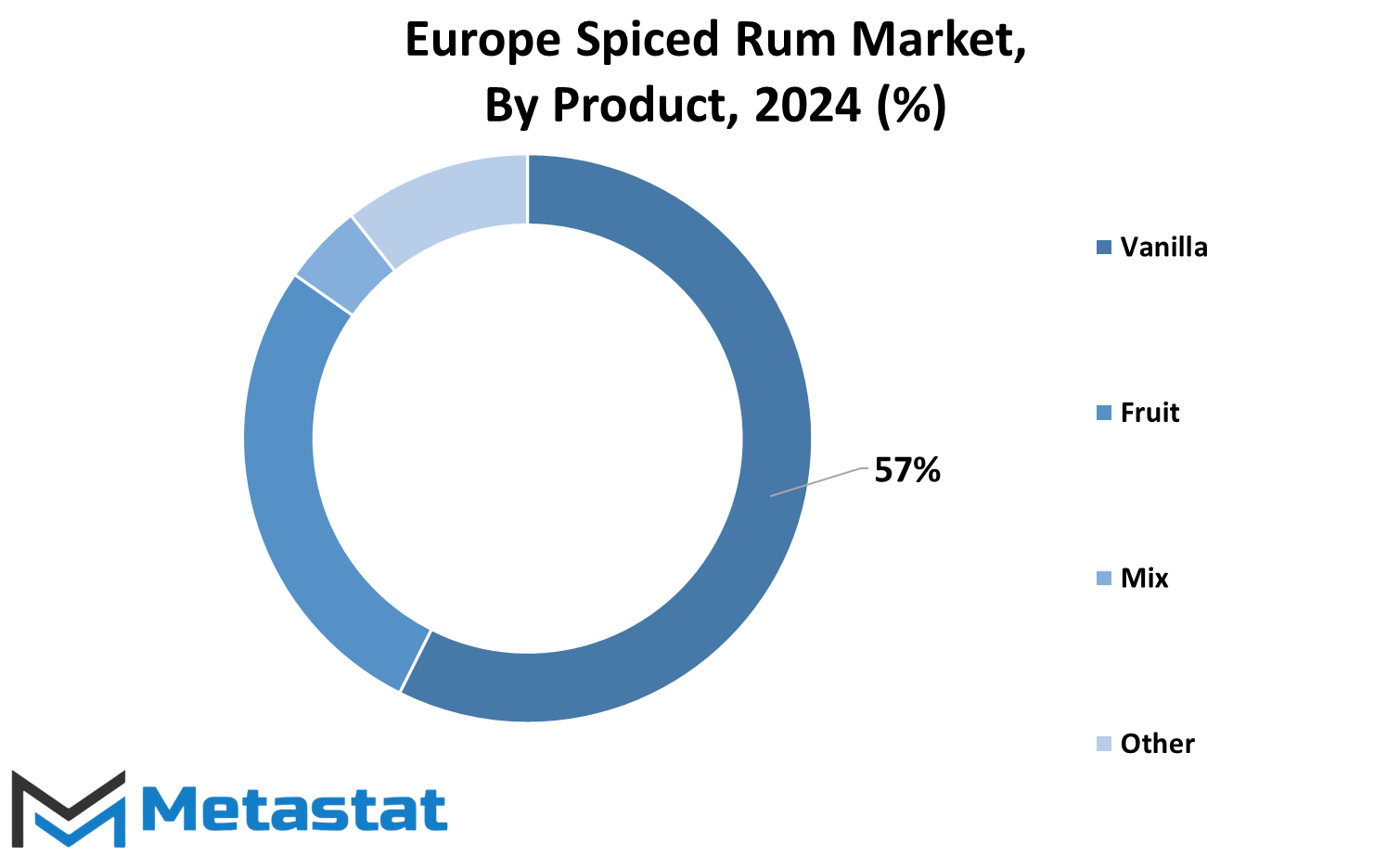

By Product

Starting with Vanilla, it stands out as a classic and widely appreciated flavor in the spiced rum scene. The smooth and mellow notes of vanilla add a comforting touch to the drink, making it a popular choice among consumers. Whether enjoyed on the rocks or mixed into cocktails, Vanilla Spiced Rum has carved a niche for itself in the market.

Moving on to the Fruit category, it introduces a vibrant and fruity dimension to spiced rum. The infusion of fruits brings a burst of flavors, ranging from citrusy notes to the sweetness of tropical fruits. This variety appeals to those seeking a more refreshing and lively experience, especially in warmer weather or social settings.

The Mix category offers a versatile option for those who enjoy experimenting with their drinks. This segment encompasses a blend of various flavors, creating a dynamic and engaging taste profile. Mix Spiced Rum provides a canvas for mixologists and enthusiasts to create unique concoctions, allowing for a personalized drinking experience.

The Other category encompasses a range of unconventional and innovative spiced rum variations. This includes blends that may not fit neatly into the Vanilla, Fruit, or Mix categories. The Other segment caters to individuals with a more adventurous palate, encouraging them to explore and discover new flavor combinations within the spiced rum market.

In recent years, the European Spiced Rum market has witnessed a surge in popularity, and the product segmentation reflects the industry's efforts to cater to a diverse consumer base. The Vanilla, Fruit, Mix, and Other categories offer something for everyone, contributing to the overall growth and dynamism of the market.

Consumers today are not just looking for a beverage; they seek an experience. The availability of diverse spiced rum options allows them to choose drinks that align with their personal preferences and occasions. Whether it's a laid-back evening with Vanilla Spiced Rum, a lively gathering with Fruit-infused variations, an experimental session with Mix options, or an adventurous exploration into the Other category, the market provides ample choices to meet varying consumer needs.

The European Spiced Rum market, segmented by Vanilla, Fruit, Mix, and Other, exemplifies the industry's commitment to offering a wide array of choices to consumers. This diversity not only enhances the drinking experience but also reflects the evolving and inclusive nature of the spiced rum market in Europe. As consumers continue to explore and appreciate the distinct characteristics of each category, the market is poised for sustained growth and innovation in the years to come.

By Consumer Demographics

The Europe Spiced Rum market has witnessed significant segmentation based on consumer demographics, reflecting the diverse preferences within the region. This segmentation provides valuable insights into the market dynamics and helps stakeholders tailor their strategies to cater to specific consumer groups.

One notable demographic division is based on age, highlighting the distinct preferences of different age groups in the consumption of spiced rum. Among these, the Young Adults segment emerges as a key player in the market, with a valuation of 602.9 USD Million in the year 2022. This segment comprises individuals in the early stages of adulthood, generally characterized by ages ranging from the late teens to the mid-30s. The substantial market value attributed to this group underscores their significant impact on the overall consumption patterns within the spiced rum market.

Moving on, the Adults segment represents another substantial market share, valued at 863.1 USD Million in 2022. This segment caters to individuals in the prime of their adulthood, typically ranging from the mid-30s to the mid-50s. The noteworthy valuation of this segment suggests a strong affinity for spiced rum among individuals in this age bracket, contributing significantly to the overall market dynamics.

The Middle-Aged Adults segment, encompassing individuals in their mid-50s to mid-60s, also plays a noteworthy role in the Europe Spiced Rum market. With a valuation of 440.9 USD Million in 2022, this segment reflects a distinct consumer demographic with specific preferences and buying behaviors. The market value associated with Middle-Aged Adults further accentuates the diverse landscape of the spiced rum market, indicating a broad appeal across different age groups.

The Senior Citizens segment, representing individuals aged 60 and above, contributes to the market with a valuation of 134.4 USD Million in 2022. While this segment may appear comparatively smaller in terms of market value, it signifies a unique consumer base with preferences that should not be overlooked. The presence of spiced rum in the Senior Citizens segment highlights the beverage's versatility and acceptance across generations.

The Europe Spiced Rum market's segmentation by consumer demographics sheds light on the nuanced preferences of various age groups. From the vibrant and trendsetting Young Adults to the seasoned and discerning Senior Citizens, each demographic contributes to the market's overall growth and diversity. Understanding these consumer dynamics is imperative for businesses operating in the spiced rum industry, enabling them to craft targeted strategies that resonate with the specific tastes and preferences of each demographic segment. As the market continues to evolve, staying attuned to these demographic nuances will be crucial for sustained success in the dynamic landscape of the spiced rum industry.

By Distribution Channel

When we examine the distribution channels in the European Spiced Rum market, we find a distinct division between online and offline channels. The online segment, valued at 1962.8 USD million in 2022, stands as a testament to the increasing trend of consumers turning to digital platforms for their purchases. This surge in online transactions reflects the changing preferences and convenience sought by consumers in the modern era. The ease of browsing through an array of options and making purchases from the comfort of one's home has contributed significantly to the growth of the online segment in the Spiced Rum market.

On the other hand, the offline segment, valued at 78.5 USD million in 2022, represents the traditional brick-and-mortar stores and retail outlets. Despite the rise of online shopping, a substantial portion of consumers still prefer the tangible experience of physically selecting and purchasing products from a store. The offline segment caters to this demographic, offering a hands-on shopping experience that resonates with a certain segment of the consumer base.

The choice between online and offline channels is not just a matter of personal preference for consumers; it also reflects the strategies adopted by Spiced Rum producers and distributors. In an era dominated by e-commerce, online platforms provide a global reach, allowing brands to tap into a broader consumer base beyond geographical boundaries. This accessibility is particularly crucial for international brands looking to establish a foothold in the European market.

On the flip side, offline channels play a vital role in establishing a local presence and fostering a sense of community. Physical stores allow for direct interaction between consumers and retailers, creating opportunities for brand engagement and customer loyalty. Moreover, some consumers still value the expertise and personal touch that comes with face-to-face interactions, making the offline segment an essential component of the overall market strategy.

The duality of online and offline channels in the European Spiced Rum market underscores the importance of a diversified approach for businesses operating in this industry. Striking the right balance between the virtual and physical realms is essential to cater to the diverse preferences and behaviors of the consumer base.

The European Spiced Rum market is not just about the quality of the product; it's also about how effectively it reaches the hands of the consumers. The interplay between online and offline distribution channels reflects the evolving nature of consumer behavior and the adaptability of businesses in response to these changes. As we navigate this market, it becomes evident that success lies in understanding and harnessing the strengths of both online and offline channels to create a holistic and effective distribution strategy.

REGIONAL ANALYSIS

The Europe Spiced Rum market undergoes a comprehensive regional analysis to gain insights into its diverse landscape. This examination is crucial for understanding the market dynamics and tailoring strategies to specific geographical nuances.

Starting with Western Europe, this region exhibits a robust presence in the Spiced Rum market. Countries like the United Kingdom, France, and Germany stand out as key players in contributing to the market's overall growth. The popularity of Spiced Rum in Western Europe can be attributed to a cultural inclination towards diverse and flavorful alcoholic beverages. The United Kingdom, in particular, boasts a rich tradition of enjoying spirits, and Spiced Rum has seamlessly found its place in this beverage repertoire.

Moving eastward, Central Europe plays a significant role in shaping the Europe Spiced Rum market. Countries like Poland, Hungary, and the Czech Republic have witnessed a rising demand for Spiced Rum, reflecting changing consumer preferences. The dynamic nature of consumer taste in this region has paved the way for Spiced Rum to carve a niche for itself among the various alcoholic options available.

The Southern European countries, including Italy, Spain, and Greece, bring their unique flair to the Spiced Rum market. In these regions, Spiced Rum has managed to captivate consumers looking for a fusion of tradition and innovation in their drinking experiences. The warm climate and vibrant social scenes contribute to the popularity of Spiced Rum, making it a sought-after choice among the diverse range of spirits available.

Heading north, the Nordic countries make their mark on the Europe Spiced Rum landscape. Nations like Sweden, Norway, and Denmark have embraced Spiced Rum as part of their drinking culture. The growing trend of experimentation with cocktails and mixology in these countries has further fueled the demand for Spiced Rum, positioning it as a versatile and exciting spirit for consumers.

Exploring the Eastern European segment, countries such as Russia and Ukraine are gradually becoming important contributors to the Spiced Rum market. The evolving preferences of consumers in these regions indicate a growing interest in exploring new and exotic alcoholic beverages, and Spiced Rum fits seamlessly into this evolving landscape.

The Europe Spiced Rum market unfolds as a tapestry woven with diverse cultural threads. Each region brings its unique influences to the table, contributing to the overall growth and popularity of Spiced Rum. Understanding these regional dynamics is essential for market players to tailor their products and strategies, ensuring a successful and resonant presence across the varied landscapes of Europe.

COMPETITIVE PLAYERS

In recent times, the European Spiced Rum market has seen significant growth, with various key players making their mark in the industry. Among the notable contributors are Diageo plc, recognized for their Captain Morgan brand, Pernod Ricard, Bacardi Limited, and William Grant & Sons Limited, famous for Sailor Jerry. These companies have played a crucial role in shaping the landscape of the Spiced Rum sector.

Diageo plc, known for their Captain Morgan label, has been a prominent player in the European Spiced Rum market. The brand's popularity has soared, resonating with consumers who appreciate a blend of enticing flavors. The company's commitment to quality and innovation has contributed to its success, making Captain Morgan a household name in the Spiced Rum category.

Pernod Ricard is another key player that has left an indelible mark on the Spiced Rum industry in Europe. Their strategic approach to crafting unique and appealing blends has garnered them a significant market share. Pernod Ricard's commitment to delivering exceptional products has solidified its position as a leader in the competitive world of Spiced Rum.

Bacardi Limited, a global player in the spirits industry, has also made substantial inroads in the European Spiced Rum market. With a rich heritage and a diverse portfolio, Bacardi has successfully tapped into the preferences of consumers seeking high-quality Spiced Rum. The brand's ability to adapt to evolving consumer tastes has been a key factor in its sustained success.

William Grant & Sons Limited, the force behind Sailor Jerry, has brought its own distinctive flair to the Spiced Rum scene in Europe. The brand's commitment to craftsmanship and a unique blend of spices has resonated with consumers looking for a bold and memorable Spiced Rum experience. William Grant & Sons Limited has carved a niche for itself, showcasing the diversity within the Spiced Rum market.

The European Spiced Rum market has experienced a dynamic shift with these key players influencing consumer preferences and market trends. The competition among these industry giants has spurred innovation and a continuous quest for excellence, benefiting consumers who now have access to a wide array of high-quality Spiced Rums.

As consumer tastes evolve, the Spiced Rum market in Europe is likely to witness further developments. The influence of key players like Diageo plc, Pernod Ricard, Bacardi Limited, and William Grant & Sons Limited will continue to shape the industry's trajectory. This dynamic landscape reflects the resilience and adaptability of the Spiced Rum market, providing a compelling narrative of growth and exploration.

Spiced Rum Market Key Segments:

By Product

- Vanilla

- Fruit

- Mix

- Other

By Consumer Demographics

- Young Adults

- Adults

- Middle-Aged Adults

- Senior Citizens

By Distribution Channel

- Online

- Offline

Key Europe Spiced Rum Industry Players

- Diageo plc (Captain Morgan)

- Pernod Ricard

- Bacardi Limited

- William Grant & Sons Limited (Sailor Jerry)

- One Eyed Spirits (Hell or High Water Rum)

- Proximo Spirits (Kraken Rum)

- Westerhall Estate Ltd.

- Maison Ferrand (Plantation Rum)

- St. Lucia Distillers Group Ltd. (Chairman's Reserve)

- Albert Michler Distillery Int. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383