MARKET OVERVIEW

Probably, through its industry, the Europe Orthodontics Appliance market is poised to play a leading role in changing the dental health landscape of Europe for the better in the years to come. Orthodontic appliances for braces, aligners, retainers, and specialized appliances in general are very essential tools for a full dental care scheme, addressing problems ranging from a misaligned mouth to rather complicated craniofacial disorders. These appliances enable orthodontists and dentists to provide treatments that can straighten teeth, correct bites, and aesthetically enhance patients' faces-orientations highly valued by European societies. The European orthodontics market is characterized not only by the variety of products, but also by the technological leadership which propels this sector forward. Growing dental awareness will also lead to growing demand for quality orthodontic services all over the continent.

The Europe Orthodontics Appliance market scope is differentiated not only by traditional braces but also comprises clear aligners, lingual braces, and self-ligating brackets targeting different needs of patients and preferences of consumers. For instance, clear aligners have become extremely popular among the adults and adolescents mainly due to their comfort and aesthetics. This will indicate a broader pattern in the European market of orthodontics, where demand is shifting to move from traditional appliances towards the aesthetics. A portfolio of products with lots of variety covers every demographic group, and practitioners can give treatment plans that are specific to the needs of patients. Additionally, research on materials continues to help companies manufacture better appliances that are more reliable and comfortable for the patient. This could result in better outcomes in patient care.

The European market, particularly its public and private healthcare sectors, plays a huge role in determining accessibility and affordability of orthodontic care. In many European countries, orthodontic treatment is partially covered in public health insurance for the younger patients, thus reiterating the universal stance on preventive dental care. Contrastingly, a robust private sector also exists in the Europe Orthodontics Appliance market where private healthcare providers and clinics focus on satisfying premium orthodontic needs of patients, including customized aligners or the expedited treatment cycle. This diversity of public and private funding models creates diversity in the market environment, supporting innovations while making orthodontic care more accessible for the population.

Technology will help sketch the future of the market for Europe Orthodontics Appliance. Digital technology that has been introduced, including 3D imaging and intraoral scanning, is really revolutionizing the process of treatment planning in orthodontics, whereby the practitioner could achieve higher precision levels with respect to diagnosis and treatment. These will provide the possibility of appliances being customized for specific patients' dental structures-a type of personalization previously unimaginable even a few decades ago. Further on in the future, this may be optimized by integrating with AI technology and predicting what will be required and adjusting real-time treatment plans.

The years ahead are going to be all about the comfort of the patients and efficient treatment, which would continue to take shape over the forecasts of Europe Orthodontics Appliance in terms of consumer preferences and technology. Manufacturers are investing into research and development and manufacturing appliances that not only are very effective but also limit discomfort and decrease treatment duration. The increased interest in preventive and corrective orthodontic care among European populations, coupled with the rapidly developing domain of digital tools and material science, will serve as a driving force for the Europe Orthodontics Appliance market. In a region where dental aesthetics and health hold considerable cultural value, the Europe Orthodontics Appliance market is like to be a dynamic marketplace that keeps on evolving, and it will be a necessary component of the dental industry on the continent.

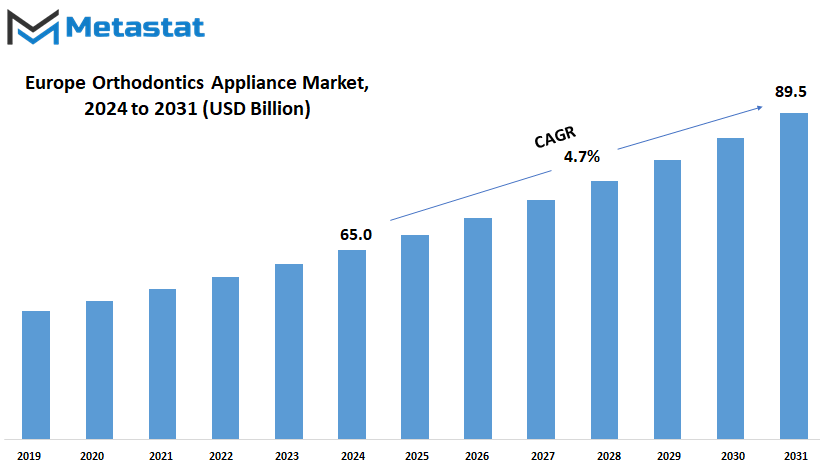

Europe Orthodontics Appliance market is estimated to reach $89.5 Million by 2031; growing at a CAGR of 4.7% from 2024 to 2031.

GROWTH FACTORS

Europe Orthodontics Appliance market will also fuel growth in the coming years, mainly due to more heightened awareness on dental health and aesthetics. While being able to focus on oral wellness, growing awareness ensures that more people in Europe want to visit orthodontic treatments for improving dental alignment so there will be improvement in appearance and personal confidence. The demand for orthodontic applications is increasingly being driven by many people who value perfectly aligned teeth, which is now becoming a growing trend among the younger generations. An awareness being propagated through media and healthcare initiatives will surely boost demand in the near future.

The major adopters of modern orthodontic appliances, such as clear aligners and self-ligating braces, are driving the market. In contrast to the conventional metallic counterparts, new devices are often more tolerable in comfort, aesthetic invisibility, and maintenance ease, appealing to those who do not just highly prize convenience but also appearance. The most popular type are clear aligners-a removable version that can be conveniently removed for meals or proper dental hygiene. It has thus become more favorable for adult and teenage use in greater numbers than other brands. Self-ligating braces reduce the significance of periodic adjustments, and that is why most of the patients prefer this for an efficient and less demanding treatment course.

However, there exist some barriers to the growth of the orthodontics appliance market in Europe. Among these barriers are: the cost associated with the treatments and appliances, which usually affects a considerable percentage of the population, thereby not fully embracing orthodontic treatments and appliances. Insurance will cover some portion of the treatments, but out-of-pocket cost will prove too high for most people, and the waiting times and some discomfort associated with the traditional appliances may prohibit potential consumers seeking them.

Future technologies are going to alter the scenario of Europe Orthodontics Appliance market and significantly enhance the customization and efficiency of their solutions. Innovations such as 3D-printed aligners, can change the industry by offering custom-made, precision fits for increased comfort and faster treatment times. Further development may be seen in the use of AI-driven treatment plans; orthodontic processes could become far less cumbersome, allowing practitioners to devise optimized, individualized plans based on unique dental anatomy. Besides promising better quality and accessibility in orthodontic treatment, these emerging technologies do, of course, provide companies with the chance to service a much wider range of customers, including those who want faster and perhaps more comfortable solutions.

MARKET SEGMENTATION

By Type

This market is increasingly on the growth and transformation path in Europe. Orthodontic appliances are part of the essential dental care tools that most patients today require. The demand for aesthetic and corrective treatments has driven increased usage of orthodontic appliances, and thus it covers fixed appliances like braces and removable appliances such as aligners. Each variety offers various advantages, and dental practitioners can utilize each to find a solution to the specific case of crooked teeth, and both are increasingly in demand these days.

Fixed orthodontic appliances have been practiced for years, particularly among younger patients, as it is an appliance that gives precise, and permanent adjustments. Traditional braces are perhaps one of the most widely used forms of fixed appliances and are generally used for more complex cases of the oral cavity. They use brackets and wires to push the teeth into position for a more attractive smile, and the modern brace is much less painful and potent than it once was. Advancements in materials have also fabricated lighter, less cumbersome appliances that appeal to a larger market, including adults who may have been deterred from orthodontia services in the past because as much out of aesthetics.

Removable orthodontic appliances are changing patient experiences across the board. These are due to growth in clear aligners, whose popularity is witnessed with its rise, through which patients achieve nearly invisible and convenient correction options for mild to moderate misalignment. Clear aligners particularly appeal to adults and teens seeking flexibility and desiring an invisible means of correcting their teeth without the limitations of traditional braces. The ability to remove the aligners and customize them affords a degree of personalization that accommodates modern lifestyle demands.

Future Prospects

The Europe orthodontics appliance market will be driven by various factors in the coming years. Higher awareness of oral hygiene benefits, along with the aesthetic value of straight teeth, will boost the demand for orthodontic treatments. In addition, digital technology shifts this field from 3D scanning into computer-aided design, thereby engendering further precise treatment planning and quicker turnaround for customized appliances. With such improvements in technology, orthodontic care becomes faster, more comfortable, and more accessible, further broadening the possible patient market.

Fourth, consumers in Europe are demanding more about their oral health and aesthetics. Thus, orthodontic appliances will keep changing as the expectations change. Right from better materials that would enhance comfort for the patient to application of artificial intelligence in treatment planning, innovation will drive market growth. In this paradigm, fixed as well as removable orthodontic appliances are sure to hold higher importance for people in attaining healthier, well-aligned smiles across Europe over the coming years.

By Age Group

The European orthodontics appliance market is growing and evolving due to the increased interest in dental health and cosmetic dentistry. Orthodontic appliances, including the conventional metal braces and more modern clear aligners, form an important part of the treatment of the dental disease. Further, three categories - children, teenagers, and adults-pointed out the different needs and desire. Orthodontic treatments are nowadays more in demand because more people are looking for effective, comfortable, and aesthetic solutions to enhance their smiles or proper alignment of their teeth.

For most children and teenagers, orthodontic treatments focus on correcting early problems or improper jaws and spacing of the individual's teeth. This age group has been the most common target for orthodontic appliances, as treatment in these years can prevent more massive problems from later. More and more clear aligners and braces being designed for young patients are becoming popular, just because they provide a comfortable and less noticeable option. In the case of younger patients, orthodontic companies are constantly introducing new, innovative designs and materials that are adaptable to their needs for as smooth an orthodontic experience as possible.

Orthodontic appliances have grown in popularity in the adult market with the development of cosmetic dentistry. People are trying to get perfect smiles of any age. Adults, especially, have a growing demand for discreet, flexible, and minimally invasive options. Clear appliances are appealing to adult patients, who like the fact that these appliances are almost invisible and can be removed for convenience. Adult patients often require customized solutions because they might present more complex dental conditions than do young patients. Manufacturers are responding with advanced appliances that focus on functional and aesthetic issues, so adults can achieve a healthier, more attractive smile without having to feel embarrassed about their visible orthodontic appliances.

The demand for orthodontics appliances in Europe, looking ahead, will be promising as new opportunities are emerging with the advancement of technology. In fact, technologies such as digital impressions, 3D printing and artificial intelligence are changing how orthodontic appliances are conceived, manufactured, and fitted, and treatments can now be performed with more accuracy and efficiency. Thus, apart from enhancing the effectiveness of treatments, these technologies also help avoid discomfort and shorten the period of orthodontic treatment. Furthermore, awareness of dental health will increase and adults and young people will increasingly seek orthodontic solutions, which will result in steady growth of the European market for orthodontic appliances. The companies operating in this market are very aptly placed to address the needs of a growing and increasingly diverse patient population across Europe as they focus on developing more accessible, effective, and appealing products.

By Material

The Europe Orthodontics appliance market has potential growth in store, with changes happening under dental care and the demand for orthodontic solutions augmenting across all age groups. These orthodontic appliances are produced to correct misalignments, enhance aesthetics, and generalize oral health. The demand in these appliances grows because patients have been showing increased awareness and greater interest in maintaining a healthy, well-aligned smile.

Europe Orthodontics Appliance market has shown a clear trend of shifting from the traditional metal towards more comfortable and discreet material options over the past few years. Thereby, with the gradual progress of the market, expectations for aesthetic and functional advancement from patients' sides will continue to shape up market trends. As for the classification, the market includes several types based on materials, namely, metal, ceramic, plastic, as well as other advanced material options. The fact that metal is still a strong category because of its durability and cost-effectiveness makes it the most preferred material to this end, especially for patients who are young enough that whatever will be put on the face needs to survive for years. The inventions of ceramic and plastic have made orthodontic treatments more aesthetic and less noticeable and hence highly preferred to adult patients, who might be concerned with how they look apart from functionality.

Plastic-based orthodontic appliances, especially clear aligners, are gaining tremendous ground in the market. As removable appliances, they become even more convenient for easier personal oral hygiene than fixed fixed orthodontic braces. The trend towards more accessible products shows significant sensitivity of the market toward patients' demand for convenience and comfort. In the future, plastic-based solutions will be able to take up a larger share of the market as better customization and shorter treatment times become possible through technology.

Innovation in materials is the largest catalyst that can continue to keep shifting the Europe Orthodontics Appliance market. For instance, the market may even see the emergence of biocompatible materials that are more aimed at soothing the discomfort of a patient and yet retaining adequate rigidity to an appliance for it to be functional. Innovations in the 3D printing technologies can be leveraged to produce appliances with high precision levels customized for patients to obtain faster results with effective orthodontic solutions.

Other factors impacting the European orthodontics appliance market will be the demographics of a healthier and wellness-conscious population and an older population. Increasingly, adults will seek orthodontic treatment as people mature and realize their dental health is part of their individual wellness. These demands will require an increased number of products developed ceramic and plastic to have more functionality and subtlety in appearance.

Overall, the future course of the Europe Orthodontics Appliance market would be impacted by uninterrupted improvement in materials and technology, which would concurrently enhance patient comfort, aesthetic appeal, and outcome from treatment. As the innovation continues, the market will offer ever more effective solutions for orthodontic treatment, which would cater to an increasingly varied set of patient requirements and preferences across Europe.

By End-User

The Europe orthodontics appliance market is undergoing a dynamic growth phase, which has, to large parts, been fueled by growing awareness about dental health as well as orthodontic treatments. The market encompassing dental clinics, hospitals, orthodontic centers, and homecare solutions is shaping up to respond to both traditional and new demands. Dental clinics and hospitals are the two main pillars of the market. These will remain the first point of reference for specialized and accessible care for a wider demographic. With technological advances and a growing interest of the patients in seeking treatments that are convenient and accessible, orthodontic centers and homecare solutions are becoming more relevant. These end-users influence the way the market will grow and embrace the trends in patient preferences across Europe.

The most potent growth driver in this market, however is aesthetically pleasing orthodontic solutions. Teenagers and young adults in Europe are developing an increased interest in the clear and ceramic orthodontic appliances. These have transformed the orthodontic treatment mode from being purely a functional correction method to a life-style choice. For this reason, dental clinics and orthodontic centers continue investing in training and equipment in order to introduce new treatments into their portfolios, therefore also expanding the scope of solutions from orthodontics.

Hospitals, that focus on a more complicated dental case, also play a very important role in the treatment of advanced orthodontic care, with a priority for surgical orthodontics in case of severe dental condition.

There is also an emerging interest in the homecare segment in the Europe orthodontics appliance market. This has allowed home-based orthodontic treatments to emerge, which include at-home clear aligner kits. Although this cannot ultimately replace the expertise of a dental professional, it appeals to the individual in seeking ease in the management of parts of their treatment from the comfort of their home. These innovations are an expression of the trend toward patient-centered care and give patients greater control over managing their orthodontic needs fitfully and independently. More customers are coming out with their open arms to accept homecare orthodontic appliances, so this is going to grow even further in the near future.

Innovation has been a primary mover of the expansion of the Europe orthodontics appliance market. Technology continues to re-shape the industry from the application of digital impressions to 3D printing of orthodontic appliances. These innovations are being adopted by patients, practitioners, and manufacturers alike, which would eventually usher in an era of more efficient, more personal, and more accessible orthodontic care. And, it is through this union of consumer demand for comfort and aesthetics and technological advancements that the Europe orthodontics appliance market is poised for further growth over the next few years, promising an exciting area within the broader healthcare landscape.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$65.0 million |

|

Market Size by 2031 |

$89.5 Million |

|

Growth Rate from 2024 to 2031 |

4.7% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The market for Europe Orthodontics Appliance is currently growing gradually and is to face immense growth in the near future. Orthodontic treatments are increasingly becoming in demand due to the changing needs of consumers and an ever-growing importance of dental aesthetics. Actually, younger generations and adults are increasingly interested in aesthetic treatments of the dental field. This increased demand has led to an influx of innovation within the European market as companies try to deliver orthodontic solutions that suit the needs of searching patients in quest for something effective and less noticeable.

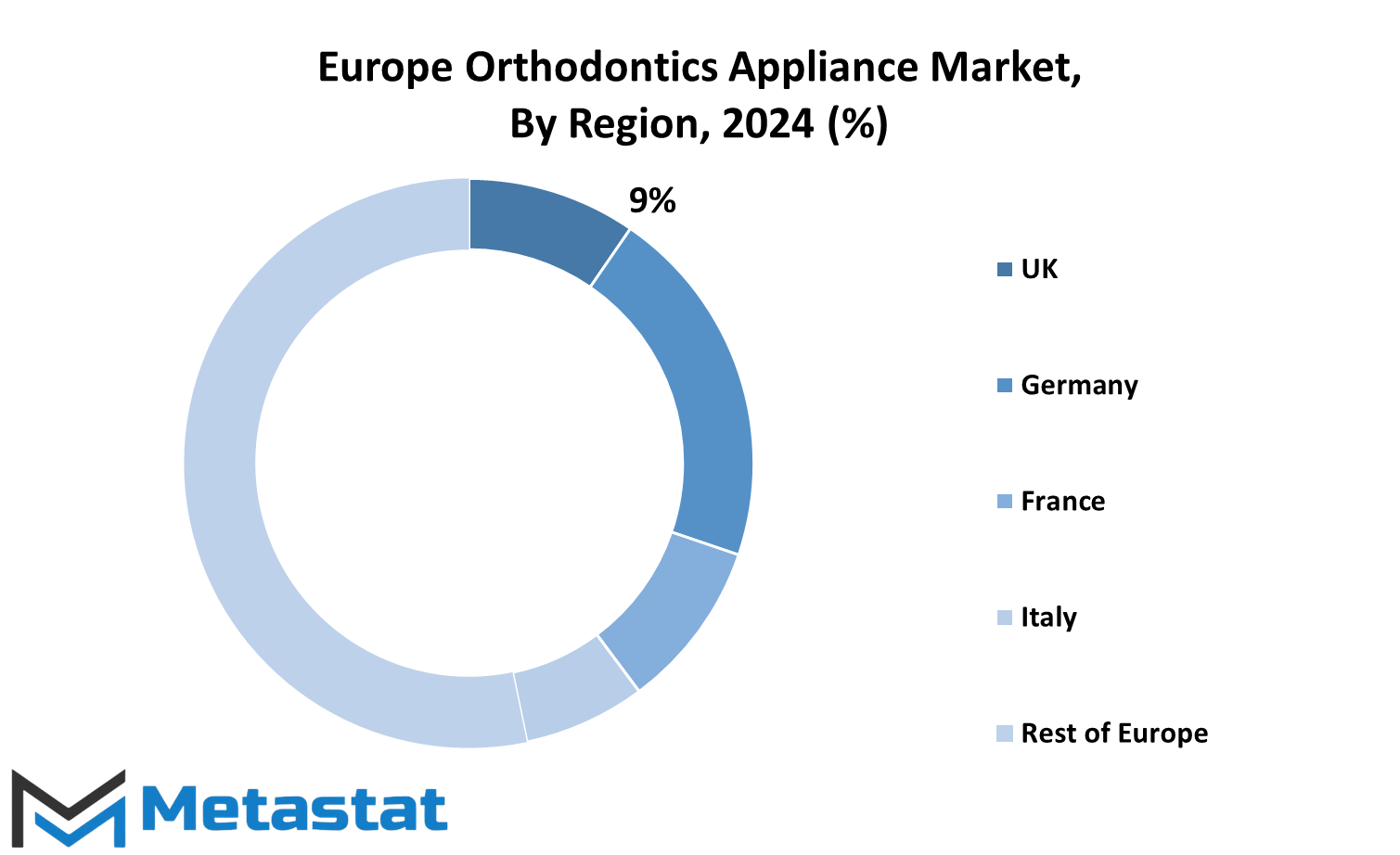

Regional dynamics position Europe at the center of this growing market, drawn from neighboring influence as well as maintaining a 'trend-setting' position within the boundary of the region. The European orthodontic appliance market can be classified based on specific regions; each region possesses its own distinct characteristics. Such key countries in Europe as UK, Germany, France, and Italy are undergoing tremendous growth to be a prime hub for orthodontic innovations. This is mainly due to increased dental awareness programs and the need for preventive care. With greater awareness of the importance of straight oral cavities in the countries, the demand for orthodontic treatment that also drives growth in these countries has increased.

Another important role is played by a broader regional view of the market, including North America, Asia-Pacific, South America, and the Middle East & Africa. Even though the orthodontics appliance market in Europe is mature, North America, especially the U.S., Canada, and Mexico, also depicts maturity with high demand for sophisticated treatments of orthodontics. Asia-Pacific is a growing market due to increasing middle-class populations, higher health expenditures, and awareness regarding aesthetic dentistry.

This gives Europe a unique position in taking the lead in innovation and access, with a higher level of interest in using advanced technologies such as 3D imaging and clear aligners, and therefore orthodontic treatment that is more precise and minimally invasive. Digital solutions make it easier for an orthodontist to plan and personalize treatments to the requirements of patients who prefer quicker, easier alternatives. The market in Europe is also expected to continue its current rise because such technologies are constantly developing, attracting an onshore audience as well as foreign consumers.

The Europe Orthodontics Appliance market will probably demonstrate strong growth due to increased demand, technological advancements, and investment into health care infrastructure in various regions. Keeping in view the needs of consumers and maintaining modern technologies, Europe is probably going to be the greatest region when talking about orthodontics, especially considering the treatment that can give both aesthetic and health objectives to the diverse range of patients.

COMPETITIVE PLAYERS

Europe Orthodontics Appliance market is highly competitive, and product innovation along with patient demand along with higher-end players who can push the industry on to newer grounds. Where oral health awareness increases, more patients increasingly look towards effective orthodontic solutions from early interventions for children to slight corrective options for adults. Thus, this trend fosters an environment propitious for expansion, innovation, and variety in orthodontics appliance providers. Companies are interested in user-friendly solutions like clear aligners, which have the appeal of less conspicuous treatments. A prominent example of a company that shows how important companies can be in changing patient preferences and expectations within this market is Align Technology, Inc., which specializes in clear aligner systems. 3M Unitek Corporation and Dentsply Sirona, other big companies among several others, improve their products with new advanced materials and technologies and focus on the comfort, flexibility, and quick result-oriented treatment desires for the patients.

3M Unitek holds reputation in orthodontic appliances such as the traditional braces with the long life but up-to-date quality material that makes it competitive even in a crowded market. Equally significant are Ormco Corporation and American Orthodontics, which share experience and sophisticated technologies to respond to the ever increasing demand for appliance. The above companies contribute very importantly because every firm confines its focus towards developing solutions appropriate for the times. In the short term future, this market is expected to witness both personalized solutions and integration with digital forms.

Companies are investing in digital scanning technologies and virtual treatment planning to make the experience of a patient in treatment more efficient and better. Henry Schein, Inc. and Straumann Group have had experiences and a tendency to combine hardware with digital platforms which allow for a very customized solution. As digital dentistry advances so will these companies advance the planning and management of orthodontic treatments perhaps making the experience easier on patients as well as the providers. Multinationals and transnational corporations with headquarters in Europe also operate in this region. In addition, companies like TP Orthodontics, Inc. and GC Orthodontics have a solid footprint in Europe, meaning that respective availability and orthodontic appliance accessibility improve. G&H Orthodontics and Leone S.p.A. are some of the less important companies but on the go and pursue niche solutions for unique clinical needs in order to increase diversity within the treatment options on the region.

Therefore, based on the growth of interest of key players in developing Europe Orthodontics Appliance for better treatment and patient experiences, this market could be one of the best places to invest in the most advanced technology and patient-centered approach, thereby fitting the ever-changing needs of patients with the most flexible, efficient, and comfortable orthodontic treatment.

Europe Orthodontics Appliance Market Key Segments:

By Type

- Fixed Appliances

- Removable Appliances

By Age Group

- Children & Teenagers

- Adults

By Material

- Metal

- Ceramic

- Plastic

- Others

By End-User

- Dental Clinics

- Hospitals

- Orthodontic Centers

- Homecare

Key Europe Orthodontics Appliance Industry Players

- Align Technology, Inc.

- 3M Unitek Corporation

- Dentsply Sirona

- Ormco Corporation

- American Orthodontics

- Henry Schein, Inc.

- GC Orthodontics

- G&H Orthodontics

- TP Orthodontics, Inc.

- Straumann Group

- Rocky Mountain Orthodontics

- Dentaurum GmbH & Co. KG

- Great Lakes Orthodontics

- Leone S.p.A.

- Adenta GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383