Global Energy Security Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global energy security market will continue to be a determining factor in shaping the world's future energy shape. Its origins lay in the oil shocks of the 1970s, when nations became cognizant of the weakness of relying so heavily on foreign energy. These early jolts prompted governments to establish strategic petroleum reserves and seek alternative sources of energy, laying the groundwork for a reliability, diversification, and risk management-driven market. Over the decades, the market has seen defining moments such as deregulation of energy companies in the 1990s, increased investment in alternative energy in the early 2000s, and international collaborations to reduce dependence on single energy sources. Each milestone has gradually transformed the world Energy Security market into a forward-thinking and multi-dimensional industry from a backward one.

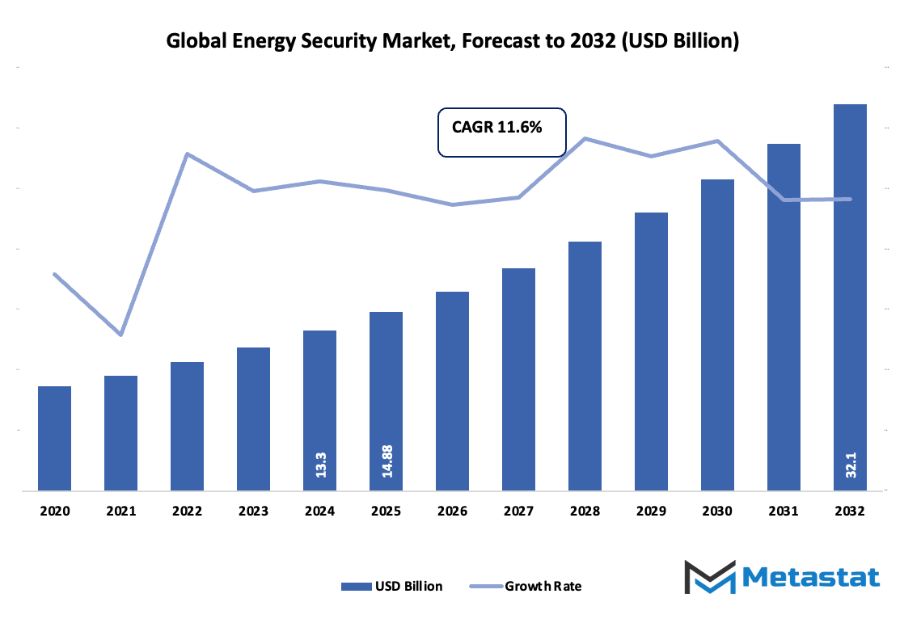

- Global energy security market valued at about USD 14.9 Billion in 2025, growing at a CAGR of about 11.6% from 2032, with scope to reach over USD 32.1 Billion.

- Physical Security constitutes nearly 47.3% market share, driving innovation and expanding applications through stringent research.

- Key growth drivers: Rising Energy Demand Owing to Population Increase and Economic Development, Transition Towards Renewable Sources to Improve Energy Independence

- Opportunities: Integration of Energy Storage Technologies

- Key observation: The market will expand exponentially in value during the next ten years, offering important growth opportunities.

- Consumer needs will increasingly shape the market, as societies expect unintermittent power supply, cleaner energy options, and affordable access.

Energy storage units, smart grids, and digital monitoring units will transform the way security is maintained and managed, making energy systems more resilient to outages. Meanwhile, changes in regulation will dictate the approach of corporations and governments. Emission cuts policies, international sharing of energy, and energy efficiency standards will direct the market towards integrated and sustainable practices. Technological advancements will keep defining the world's Energy Security market in ways previously unheard of. Advanced next-generation forecasting, AI-driven energy distribution, and advanced cybersecurity shielding for infrastructure will be the standard. They will not only render supply more consistent but also reduce exposure to natural disasters, geopolitics, or cyberattack. The future world Energy Security market will be an extensively networked and responsive business, rapidly responding to incoming dangers while serving economic development needs and global environmental responsibilities.

Its journey from the horrors of the 20th century to a regulation-aware and technologically supported sector is testimony that the market can evolve in response to shifting priorities. As the energy systems are becoming diversified and modernized, the market will still have its function to ensure energy availability to address current and future world demands.

Market Segments

The global energy security market is mainly classified based on Technology, Power Plant, End-user Industry.

By Technology is further segmented into:

- Physical Security: Physical security in the global energy security market will focus on surveillance systems, automation, and secure access control. Future deployments will be AI-based threat detection and smart barriers for preventing unauthorized access to secure energy infrastructure worldwide.

- Network Security: Network security will be the largest contributor to the world Energy Security market by protecting digital infrastructure from cyberattacks. As energy systems continue to be more and more interconnected, AI-driven intrusion detection, blockchain-authentication, and predictive cybersecurity solutions will make safe transmission of data and trustworthy energy operation across the globe possible.

By Power Plant the market is divided into:

- Thermal and Hydro: Thermal and hydro power plants in the World Energy Security market will employ smart monitoring, predictive maintenance, and automatic emergency response. The plans for the future will be to enhance operational reliability while lowering environmental risks, so that these plants can continue producing electricity safely and efficiently.

- Nuclear: Nuclear power plants will adopt state-of-the-art containment, online monitoring, and AI-driven safety solutions in the global Energy Security industry. Safety will be engineered to prevent accidents, reduce human error, and enhance resistance to physical and cyber threats in future energy production.

- Oil and Gas: Intelligent detection systems, safe pipelines, and automated safety controls will be incorporated in oil and gas plants. The Energy Security market globally will facilitate the prevention of leaks, sabotage, and cyber attacks, thus providing continuous and secure supply of energy along with fulfilling environment and operating requirements.

- Renewable Energy: Solar and wind renewable energy facilities will have digital monitoring, remote security management, and predictive analytics. The global energy security market will be centered on protecting against physical and cyber threats for continual energy generation and enabling a growing demand for clean power.

By End-user Industry the market is further divided into:

- Residential: Residential Energy Security will focus on smart home systems, safe energy delivery, and automated alerts. The global energy security market will encourage technologies that make homes secure from power cuts and intrusions, ensuring safe and secure energy supply to homes in the future.

- Commercial: Commercial energy users will adopt converged monitoring, cybersecurity protocols, and safe infrastructure. Within the global energy security market, the steps will enable businesses to maintain constant operations, seal off illegal access, and meet growing energy demands with high-level, futurist security equipment.

- Industrial: Industrial power systems shall rely on predictive maintenance, digital monitoring, and sophisticate cybersecurity. The global energy security market will foster greater protection for industry and heavy industry, allowing secure operation, reduced downtime, and immunity to physical and cyberattack.

- Transportation: Transportation energy systems will have safe fuel networks, surveillance through automation, and cyber protection. The global energy security market will be founded on prevention of supply chain disruptions, having fuels in inventory, and ensuring safe operation of transport systems in a changing energy environment.

- Other: Healthcare, government, and public utilities are other sectors that will be covered. The Energy Security market around the world will provide customized solutions like remote monitoring, artificial intelligence-based security, and quick response systems to provide constant and secure energy supply, combating physical and digital challenges in various applications.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$14.9 Billion |

|

Market Size by 2032 |

$32.1 Billion |

|

Growth Rate from 2025 to 2032 |

11.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

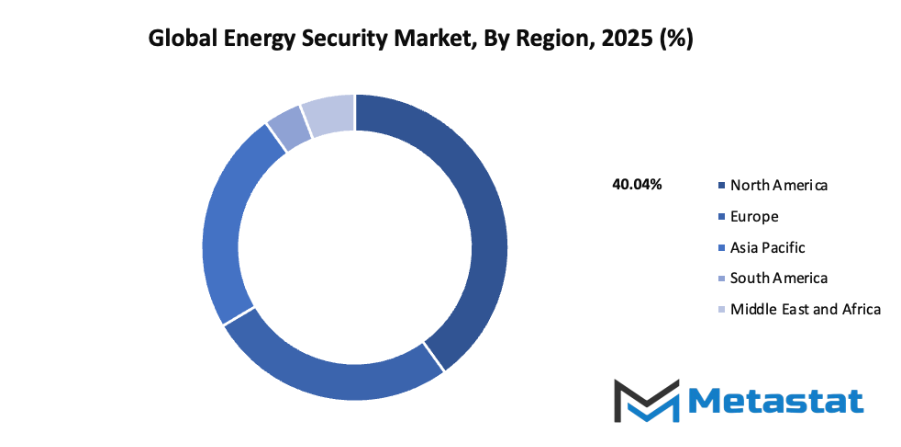

By Region:

- Based on geography, the global energy security market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Energy Demand Due to Population Growth and Economic Development: Rapid population growth and expanding economies will increase energy consumption significantly. Industrialization and urbanization will raise electricity and fuel needs, pushing the global energy security market to develop solutions that guarantee uninterrupted energy supply. Meeting these growing demands will require planning and investment in both traditional and modern energy systems.

- Shift Towards Renewable Energy Sources to Enhance Energy Independence: A strong push toward renewable energy sources such as solar, wind, and hydropower will help reduce reliance on imports. Governments and industries will invest in clean energy projects, enhancing energy independence. This transition will support the global energy security market by providing sustainable and reliable alternatives while lowering environmental risks.

Challenges and Opportunities

- Energy Infrastructure Vulnerabilities: Aging and insufficient energy infrastructure will pose significant risks to the global energy security market. Transmission lines, power plants, and distribution systems may fail under stress, causing disruptions. Investments in modernization, monitoring, and resilient design will be essential to reduce vulnerabilities and ensure consistent energy availability for all sectors.

- Dependency on Fossil Fuels: Heavy reliance on fossil fuels will continue to challenge the global energy security market. Price volatility and environmental concerns will drive the search for alternative sources. Reducing dependence will require policy reforms, technological adoption, and international cooperation, ensuring energy stability while transitioning toward cleaner energy systems.

Opportunities

- Integration of Energy Storage Technologies: Incorporating advanced energy storage solutions will support the global energy security market by ensuring energy availability during demand peaks. Batteries, pumped storage, and other technologies will stabilize supply and reduce dependency on intermittent sources. The widespread adoption of storage will enhance grid flexibility and strengthen overall Energy Security strategies.

Competitive Landscape & Strategic Insights

The global energy security market will continue to grow as demand for stable and reliable energy sources increases. The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Petronas, PT Pertamina (Persero), PTT Public Company Limited, Thales Group, Siemens AG, ABB Ltd, Honeywell International Inc, Adaro Energy Tbk, CLP Holdings Limited, Aramco, Exxon Mobil Corporation, Royal Dutch Shell plc, Sempra, Southern Company, Iberdrola, S.A., Lockheed Martin Corporation, and Tesla, Inc. These companies will play a significant role in shaping the future of Energy Security by investing in new technologies, infrastructure, and sustainable solutions.

As the world increasingly relies on a combination of traditional and renewable energy sources, the market will see stronger collaborations and competition among these companies. Energy Security will no longer focus solely on supply stability but also on integrating smart technologies to monitor, predict, and optimize energy distribution. Companies like Siemens AG and ABB Ltd will likely lead efforts in automation and digital solutions, while traditional energy giants such as Aramco and Exxon Mobil Corporation will continue investing in large-scale production and global distribution networks.

Regional players such as Petronas, PT Pertamina (Persero), and PTT Public Company Limited will strengthen their presence by leveraging local resources and government support. Meanwhile, firms like Tesla, Inc and Honeywell International Inc will push for innovation in energy storage, smart grids, and efficient energy management. Over time, this mix of established leaders and emerging competitors will drive a dynamic shift in how energy is produced, stored, and secured across different regions.

Market size is forecast to rise from USD 14.9 Billion in 2025 to over USD 32.1 Billion by 2032. Energy Security will maintain dominance but face growing competition from emerging formats.

The market will also respond to environmental concerns and regulatory changes, which will influence investment in cleaner technologies and renewable solutions. Collaboration between international and regional companies will accelerate development in sustainable energy systems, creating new opportunities for growth while addressing Energy Security challenges. The convergence of advanced technology, investment in infrastructure, and strategic partnerships will ensure that the global energy security market continues to evolve, offering solutions that meet both current and future energy demands.

Report Coverage

This research report categorizes the global energy security market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global energy security market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global energy security market.

Energy Security Market Key Segments:

By Technology

- Physical Security

- Network Security

By Power Plant

- Thermal and Hydro

- Nuclear

- Oil and Gas

- Renewable Energy

By End-user Industry

- Residential

- Commercial

- Industrial

- Transportation

- Other

Key Global Energy Security Industry Players

- Petronas

- PT Pertamina (Persero)

- PTT Public Company Limited

- Thales Group

- Siemens AG

- ABB Ltd

- Honeywell International Inc

- Adaro Energy Tbk

- CLP Holdings Limited

- Aramco

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- Sempra

- Southern Company

- Iberdrola, S.A.

- Lockheed Martin Corporation

- Tesla, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252