MARKET OVERVIEW

The Global Emergency Shutoff Valves market is a vital segment within the industrial automation and safety industry, playing a crucial role in ensuring the safe and efficient operation of various industrial processes. Emergency shutoff valves are designed to halt the flow of hazardous materials or critical fluids in response to safety triggers or emergency conditions, thereby preventing accidents, minimizing environmental impact, and safeguarding human lives. These valves are essential components in industries such as oil and gas, chemical manufacturing, power generation, and water treatment, where the potential for dangerous leaks or system failures necessitates robust safety mechanisms.

In the oil and gas sector, for instance, emergency shutoff valves are indispensable for preventing catastrophic events such as oil spills or gas explosions. These valves are strategically installed at various points along pipelines, processing plants, and storage facilities to provide an immediate response to any irregularities detected by monitoring systems. Similarly, in chemical plants, these valves play a critical role in controlling the flow of reactive or hazardous chemicals, thereby mitigating the risk of accidental releases that could lead to fires, explosions, or toxic exposures.

The demand for emergency shutoff valves is driven by stringent safety regulations and standards imposed by governments and industry bodies worldwide. Regulatory frameworks mandate the use of these valves in high-risk environments to ensure compliance with safety protocols and to minimize the potential for industrial disasters. As industries continue to expand and modernize their operations, the need for advanced and reliable emergency shutoff systems will grow, further propelling the market.

Technological advancements are also shaping the future of the Global Emergency Shutoff Valves market. Innovations in valve materials, design, and actuation mechanisms are enhancing the performance and reliability of these critical safety devices. For instance, the integration of smart technologies and automation in emergency shutoff systems allows for real-time monitoring and remote control, thereby improving response times and reducing the likelihood of human error. These advancements not only enhance safety but also contribute to the efficiency and cost-effectiveness of industrial operations.

The market is characterized by a diverse range of products tailored to meet the specific needs of different industries and applications. Manufacturers are continuously developing new valve technologies to address the unique challenges posed by various operational environments. For example, in cryogenic applications, where valves must operate at extremely low temperatures, specialized materials and designs are employed to ensure reliable performance. Similarly, in high-pressure environments, valves are engineered to withstand intense forces without compromising safety.

Geographically, the market for emergency shutoff valves spans across regions with significant industrial activities, including North America, Europe, Asia-Pacific, and the Middle East. Each region presents unique opportunities and challenges, influenced by factors such as industrial growth rates, regulatory landscapes, and technological adoption. Emerging economies, in particular, are expected to witness increased demand for these valves as they invest in infrastructure development and industrialization.

The Global Emergency Shutoff Valves market is a critical component of the industrial safety infrastructure, ensuring the protection of both human life and the environment in various high-risk industries. With ongoing advancements in technology and the ever-present need for stringent safety measures, the market will continue to evolve, providing innovative solutions to meet the growing demands of modern industrial operations. The emphasis on safety and regulatory compliance will remain a driving force, shaping the future of this essential market.

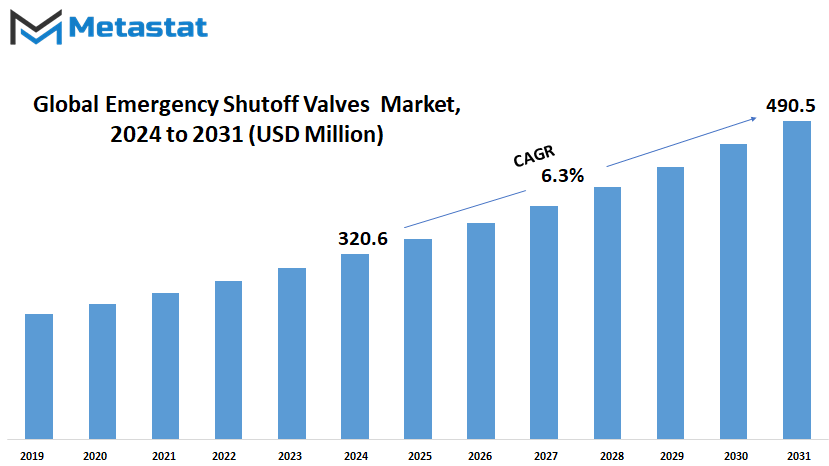

Global Emergency Shutoff Valves market is estimated to reach $490.5 Million by 2031; growing at a CAGR of 6.3% from 2024 to 2031.

GROWTH FACTORS

The global market for emergency shutoff valves is driven by the growing need for stringent safety regulations and a heightened focus on preventing accidents. As industries become more aware of the potential risks and the importance of protecting both the environment and their operations, the demand for reliable emergency shutoff valve systems continues to rise. These systems are critical in minimizing the impact of accidental releases of hazardous materials, thus safeguarding the environment and ensuring the safety of workers and surrounding communities.

One of the primary factors propelling the market is the increasing awareness of environmental protection and risk mitigation strategies. Companies across various sectors are recognizing the importance of implementing robust safety measures to prevent catastrophic incidents. This growing consciousness is leading to a surge in the adoption of emergency shutoff valves as an integral part of their safety protocols.

However, there are significant challenges that could impede the widespread adoption of these systems. The high initial costs associated with the installation, maintenance, and compliance with safety standards can be a major deterrent for many companies. Furthermore, the complex engineering requirements and compatibility issues with existing infrastructure add another layer of difficulty in implementing these systems effectively. These challenges necessitate careful planning and investment, which some companies might be reluctant to undertake.

Despite these hurdles, the future of the emergency shutoff valves market looks promising, especially with the development of advanced sensor technology and automation features. These innovations are set to enhance the speed and effectiveness of emergency shutoff valve operations, thereby improving overall system safety and reliability. As technology continues to evolve, it will bring about more efficient and user-friendly solutions, making it easier for industries to adopt these crucial safety systems.

Looking ahead, the market is likely to see substantial growth as more industries recognize the value of investing in safety and environmental protection. The advancement in sensor technology and automation will not only address the current challenges but also open up new opportunities for innovation and improvement in emergency shutoff valve systems. Companies that prioritize safety and compliance will be better positioned to mitigate risks and protect their operations, ultimately contributing to a safer and more sustainable future.

While the high costs and engineering complexities pose challenges, the increasing emphasis on safety and environmental protection, coupled with technological advancements, will drive the growth of the emergency shutoff valves market in the coming years. The continued development of more efficient and reliable systems will ensure that industries can effectively manage risks and maintain safe operations, fostering a more secure and responsible industrial landscape.

MARKET SEGMENTATION

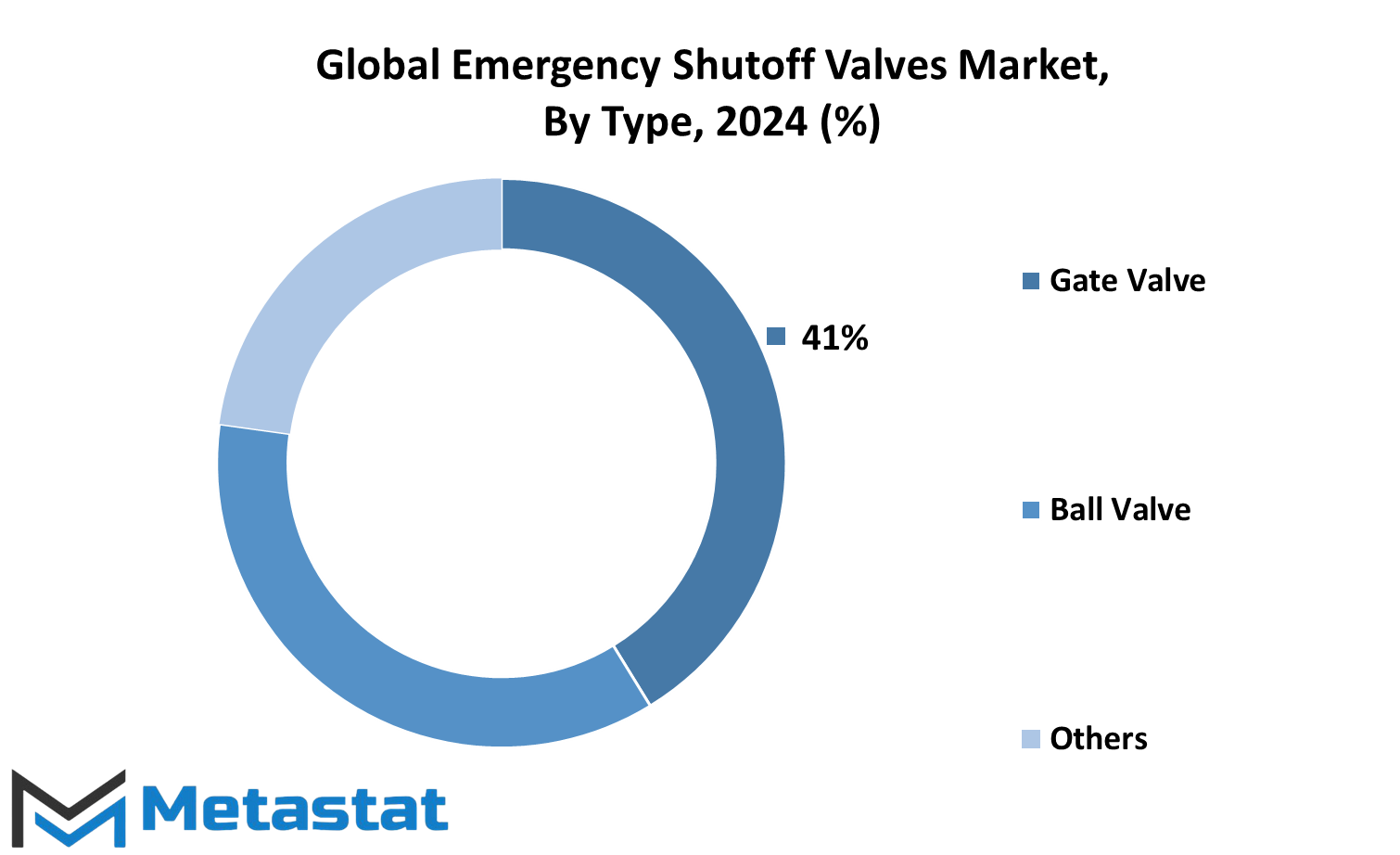

By Type

The market for Global Emergency Shutoff Valves is an important area of focus for industries worldwide. These valves play a critical role in ensuring safety and preventing catastrophic failures by shutting off the flow of dangerous substances in emergencies. As industries continue to prioritize safety and efficiency, the demand for different types of shutoff valves, such as gate valves, ball valves, and others, will likely increase.

Gate valves, one of the primary types of emergency shutoff valves, are known for their ability to provide a secure and reliable seal. They are commonly used in applications where a straight-line flow of fluid and minimum restriction is needed. The future of gate valves looks promising as industries look for ways to enhance safety measures and operational efficiency. Advances in materials and technology will likely lead to more durable and responsive gate valves, meeting the increasing demands of various sectors

Ball valves are another significant type of emergency shutoff valve. These valves are praised for their quick shut-off capability, which is crucial in emergency situations. The design of ball valves allows them to close quickly and effectively, making them ideal for controlling the flow of liquids and gases. As technology progresses, ball valves are expected to become even more efficient and reliable, with innovations that enhance their performance in critical applications. The ongoing research and development in this area will likely lead to smarter and more automated ball valves, which will be essential in future industrial safety systems.

Other types of emergency shutoff valves include butterfly valves, plug valves, and diaphragm valves. Each of these valves has unique features that make them suitable for specific applications. The versatility and adaptability of these valves will be crucial as industries face new challenges and requirements. The continuous improvement in valve technology will ensure that these alternatives remain relevant and effective in various scenarios.

By Material

The global market for emergency shutoff valves is expanding rapidly, with increasing emphasis on safety and efficiency driving demand across various industries. By material, this market is segmented into steel, brass, aluminum, and others. Each of these materials brings its own set of advantages and is chosen based on specific requirements and environmental conditions.

Steel, known for its strength and durability, is a popular choice in the emergency shutoff valves market. Its robustness ensures reliable performance even in extreme conditions, making it suitable for industries where safety is paramount. As technology advances, steel valves are expected to become even more efficient, integrating smart technology to allow for remote monitoring and control. This evolution will likely enhance their appeal and utility in high-stakes environments like oil and gas, where prompt and reliable shutoff capabilities are critical.

Brass valves, on the other hand, are valued for their corrosion resistance and ease of installation. Their use is prevalent in water distribution systems and other environments where resistance to corrosion is essential. In the future, the development of more advanced brass alloys could further improve their performance, making them an even more attractive option for various applications. The ability to withstand different environmental factors while maintaining functionality will likely drive the demand for brass valves in numerous sectors.

Aluminum valves offer a lightweight alternative without sacrificing durability. They are especially useful in applications where weight is a concern, such as in aerospace and automotive industries. As industries continue to innovate, the demand for lightweight, efficient materials like aluminum is expected to rise. Future advancements in aluminum processing and alloy development could lead to valves that are even lighter and stronger, catering to the growing need for high-performance components in various technological fields.

Other materials, such as advanced polymers and composites, are also making their mark in the emergency shutoff valves market. These materials often provide unique benefits, such as enhanced resistance to extreme temperatures and chemical exposure. As research in material science progresses, we can anticipate the emergence of new materials that will further diversify the market. These innovations will likely lead to valves that can meet the specific demands of even the most challenging environments.

By Application

The Global Emergency Shutoff Valves market is set to experience significant growth, driven by their critical applications in various industries. As safety and efficiency become more paramount, these valves are becoming indispensable. The primary sectors utilizing these valves include oil and gas, chemicals, petrochemicals, pharmaceuticals, and water and wastewater treatment, among others. Each of these sectors relies heavily on emergency shutoff valves to maintain safety and operational integrity.

In the oil and gas industry, the need for emergency shutoff valves is particularly acute. Given the high-risk environment and the potential for catastrophic incidents, having reliable emergency shutoff systems is essential. These valves can rapidly isolate sections of a pipeline or processing plant to prevent accidents or contain them when they occur. With the ongoing expansion of oil and gas exploration, especially in new and challenging environments, the demand for advanced and reliable emergency shutoff valves will likely increase.

The chemical industry also sees substantial use of these valves. In chemical manufacturing, where hazardous materials are often handled, safety is a top priority. Emergency shutoff valves help prevent leaks and spills, protecting workers and the environment. As chemical production scales up to meet global demands, the adoption of more sophisticated and responsive shutoff systems will follow.

Petrochemicals, a subset of the chemical industry, also heavily relies on emergency shutoff valves. The processes involved in petrochemical production are complex and often involve flammable substances. Any malfunction can lead to serious hazards. Emergency shutoff valves play a vital role in preventing these hazards by providing a quick response mechanism to isolate problematic areas, thus minimizing the risk of fire or explosion.

In the pharmaceutical sector, precision and safety are critical. Emergency shutoff valves help maintain these standards by ensuring that any deviation in the process can be immediately addressed. This is crucial not only for the safety of the workforce but also for ensuring the quality of pharmaceutical products. As the pharmaceutical industry continues to grow and innovate, the integration of advanced shutoff valves will be necessary to keep up with new safety standards and regulatory requirements.

Water and wastewater treatment facilities also benefit significantly from emergency shutoff valves. These facilities handle large volumes of potentially contaminated water, making it essential to have systems in place to quickly stop the flow if an issue arises. This helps prevent the spread of contaminants and protects public health. As populations grow and water management becomes more critical, the role of emergency shutoff valves in these facilities will become even more crucial.

By End-user

The global market for emergency shutoff valves is growing rapidly, driven by increasing safety and regulatory requirements across various sectors. By examining the market based on end-users, it is evident that these valves are crucial in industrial, commercial, and residential settings.

In the industrial sector, emergency shutoff valves are essential for maintaining safety and preventing accidents. Factories and plants that handle hazardous materials need reliable mechanisms to quickly stop the flow of dangerous substances in case of an emergency. The future of this market segment will likely see advancements in automation and remote control technologies, allowing for faster and more precise responses to potential hazards. As industries adopt more sophisticated systems, the demand for advanced emergency shutoff valves is expected to rise.

Commercial applications of emergency shutoff valves are also significant. In buildings such as shopping malls, office complexes, and hospitals, these valves play a key role in protecting people and property from potential gas leaks or water damage. The commercial sector's focus on safety and compliance with strict building codes will continue to drive the market for these valves. Future trends might include the integration of smart building technologies, where shutoff valves are connected to central monitoring systems, enabling automatic responses to detected threats. This evolution will enhance the efficiency and reliability of safety measures in commercial spaces.

The residential market for emergency shutoff valves is expanding as homeowners become more aware of safety concerns. With the increasing use of gas appliances and the need to safeguard against potential water leaks, more households are investing in these valves. Looking ahead, we can expect a surge in smart home technologies that incorporate emergency shutoff features. These smart systems will allow homeowners to monitor and control their safety mechanisms remotely, providing peace of mind and preventing costly damage. Additionally, regulatory bodies may implement stricter guidelines for residential safety, further boosting the adoption of emergency shutoff valves in homes.

Overall, the global emergency shutoff valves market is poised for substantial growth across all end-user segments. Industrial, commercial, and residential users will all benefit from advancements in technology and increasing safety awareness. The future will likely see more interconnected and automated systems, enhancing the reliability and efficiency of these crucial safety devices. As we move forward, the emphasis on safety and the integration of smart technologies will be the key drivers shaping the evolution of the emergency shutoff valves market. This progression will ensure that individuals and businesses alike are better protected against potential hazards, making the world a safer place for everyone.

REGIONAL ANALYSIS

Based on geography, the global Emergency Shutoff Valves market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

COMPETITIVE PLAYERS

Key players operating in the Emergency Shutoff Valves industry include Keihin Co., Ltd., Morrison Bros. Co., Marshall Excelsior Co., MISUMI Group Inc., Miyairi Valve Mfg. Co., Ltd., BORSIG GmbH, Dover Corporation, Valmet Oyj, Pacbrake Company, Unimech Marine Equipment Sdn. Bhd., Yokota Manufacturing Co., Ltd., ESD Valves, Kundinger, SAWAMURA VALVE, Emerson, Inteka, OPW Global, Williams Valve Corporation, MARLIA Ingeniero, ECONTROL

Emergency Shutoff Valves Market Key Segments:

By Type

- Gate Valve

- Ball Valve

- Others

By Material

- Steel

- Brass

- Aluminum

- Others

By Application

- Oil & Gas

- Chemical

- Petrochemical

- Pharmaceutical

- Water & Wastewater Treatment

- Others

By End-user

- Industrial

- Commercial

- Residential

Key Global Emergency Shutoff Valves Industry Players

- Keihin Co., Ltd.

- Morrison Bros. Co.

- Marshall Excelsior Co.

- MISUMI Group Inc.

- Miyairi Valve Mfg. Co., Ltd.

- BORSIG GmbH

- Dover Corporation

- Valmet Oyj

- Pacbrake Company

- Unimech Marine Equipment Sdn. Bhd.

- Yokota Manufacturing Co., Ltd.

- ESD Valves

- Kundinger

- SAWAMURA VALVE

- Emerson

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383