Market Definition

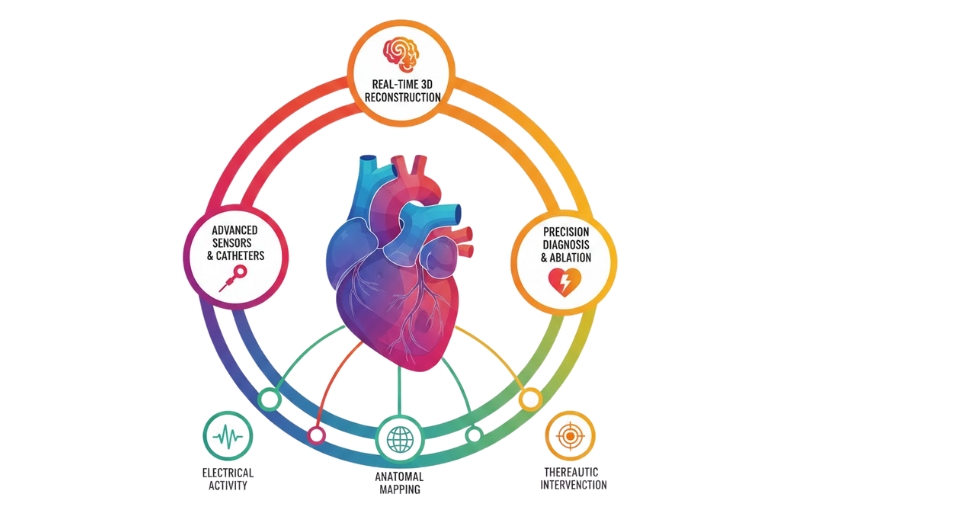

Electrophysiology (EP) is a test performed to assess the heart's electrical activity and is used to diagnose abnormal heartbeats and arrhythmia. Electrophysiology is performed by inserting catheters and wire electrodes, that measure electrical activity, through blood vessels in the heart.

Global electrophysiology market is estimated to reach $XX billion by 2026; growing at a CAGR of 11.4% till 2026.

Market Dynamics

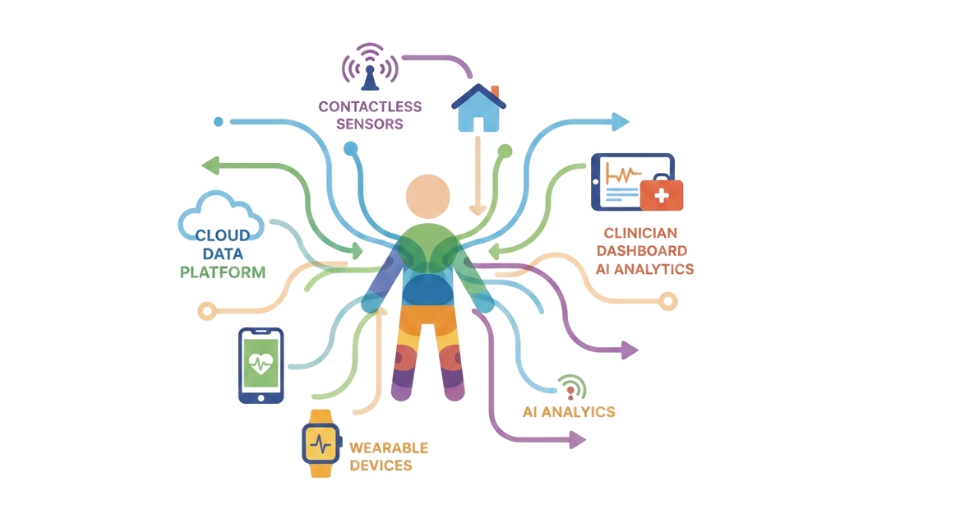

Rising prevalence of arrhythmia is driving the demand for the electrophysiology market. Globally, around 70% of people with AFib are between the ages of 65 and 85. The prevalence of AFib is higher in men. According to the American Heart Association, around 2 million Americans are living with atrial fibrillation. 1 in 4 Adult Americans over the age of 40 has developed an irregular heartbeat. The prevalence of AFib in the United States ranges from about 2.7 million to 6.1 million. In the United States, that number of AFib cases is estimated to rise to 12.1 million in 2030. According to the Centers for Disease Control and Prevention (CDC), 2% of people younger than 65 years old have AFib, while about 9% of people ages 65 and older suffer from AFib. According to the European Society of Cardiology, in 2016, 7.6 million people age over 65 in Europe had atrial fibrillation, and the cases are expected to increase by 89% to 14.4 million by 2060. In Europe, the prevalence is set to rise by 22%, from 7.8% to 9.5%. In Australia, around 330,000 people suffer from atrial fibrillation. Further, technological advancements in electrophysiology devices is a key driving factor of the market. Electrophysiology technology has been advancing rapidly with new ablation tools to improve atrial fibrillation (AF) treatments, miniaturized diagnostic monitoring systems, and new implantable rhythm management devices that are making procedures less invasive. However, the high cost of the electrophysiology device might hamper market growth. Most of these electrophysiology products are premium-priced products, including the cardiac 3D mapping systems and electrophysiology recording systems. The average price of cardiac 3D mapping systems ranges from USD 175,000 to 800,000. The cost of an electrophysiology recording system is USD 160,000, owing to the high capital, training, and maintenance costs. The electrophysiology procedures are generally expensive. Moreover, rising investments for electrophysiology would provide lucrative opportunities for the market in the coming years.

Market Segmentation

The global electrophysiology market is mainly classified based on type, indication and end user. Type is further segmented into Electrophysiology Laboratory Devices, Electrophysiology Ablation Catheters, Electrophysiology Diagnostic Catheters, Access Devices, and Others. By indication, the market is divided into Atrial Fibrillation, Atrial Flutter, Atrioventricular Nodal Reentry Tachycardia (AVNRT), Wolff-Parkinson-White Syndrome (WPW), and Others. By end user, the market is further divided into Hospitals, Ambulatory Surgery Centers, and Others.

Electrophysiology Ablation Catheters was dominating the electrophysiology market in 2019, owing to the increase the market presence and strong product portfolio by the market players by rising R&D activities for electrophysiology ablation catheters, regulatory approvals for electrophysiology ablation catheters, technological advancement, and commercialization of new electrophysiology ablation catheters products. For instance, Abbott has introduced HD grid mapping catheter, sensor-enabled in India. The catheter allows physicians to capture and analyze data and create highly detailed maps of the heart that differentiate healthy from unhealthy tissue. The new mapping catheter improves physicians cardiac ablation procedures, including cardiac mapping systems and treatment catheters.

Regional Analysis

Based on geography, the global electrophysiology market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

North America was dominating the electrophysiology market in 2019, due to the rising prevalence of cardiac arrhythmias, the companies are increasing focus for developing and commercializing technologically advanced electrophysiology devices, the companies are collaborating to expand their electrophysiology business and regulatory approval of electrophysiology devices. For instance, BioSig Technologies, Inc., has received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its PURE EP System. The PURE EP is a computerized system intended for acquiring, filtering, measuring, digitizing, amplifying, and calculating, displaying, recording and storing of electrocardiographic and intracardiac signals for patients undergoing electrophysiology (EP) procedures.

Competitive landscape

Key players operating in the electrophysiology industry include Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson, Medtronic plc, Koninklijke Philips N.V., GE Healthcare, Biotronik SE & Co. KG, Microport Scientific Corporation, Siemens AG, and Japan Lifeline Co., Ltd.

The collaboration between companies to jointly develop and distribute electrophysiology devices, increasing R&D activities, rising investment and funds for electrophysiology devices and the commercialization of technologically advanced electrophysiology devices for gaining a competitive edge in the market are some of the strategies adopted by the major companies. For instance, Boston Scientific has introduced DIRECTSENSE Technology, a tool for monitoring the effect of radiofrequency (RF) energy delivery during cardiac ablation procedures. The technology is available on the RHYTHMIA HDx Mapping System. It is the only tool to monitor changes in local impedance, electrical resistance around the tip of the INTELLANAV MiFi Open-Irrigated (OI) ablation catheter.

Electrophysiology Market Key Segments:

By Type

- Electrophysiology Laboratory Devices

- Electrophysiology Ablation Catheters

- Electrophysiology Diagnostic Catheters

- Access Devices

- Others

By Indication

- Atrial Fibrillation

- Atrial Flutter

- Atrioventricular Nodal Reentry Tachycardia (AVNRT)

- Wolff-Parkinson-White Syndrome (WPW)

- Others

By End User

- Hospitals

- Ambulatory Surgery Centers

- Others

Key Global Electrophysiology Industry Players

- Boston Scientific Corporation

- Abbott Laboratories

- Johnson & Johnson

- Medtronic plc

- Koninklijke Philips N.V.

- GE Healthcare

- Biotronik SE & Co. KG

- Microport Scientific Corporation

- Siemens AG

- Japan Lifeline Co., Ltd.

What Report Provides

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252