MARKET OVERVIEW

The Global Drill Pipe market is an industry that focuses on the manufacturing, distribution, and application of drill pipes. This is an oil and gas exploration sector essential tool. Drill pipes are essentially tubular steel pipes used in linking the surface drilling equipment to the drilling bit; they have an important role to play in transmitting torque and drilling fluids in the extraction process. This market serves the demands for efficient, long-lasting drilling solutions across onshore and offshore energy and resource-based industries.

It goes beyond simply serving the scope of traditional exploration of energy due to the influences that it places on other industrial activities dependent on cutting-edge drilling. With the increasing focus on accessing deeper reserves and untapped resources, the industry will continue to address the need for robust drill pipes capable of withstanding extreme pressures, high temperatures, and complex geological formations. Manufacturers in this space will emphasize innovation to improve performance, longevity, and operational efficiency, ensuring that drill pipes meet the evolving requirements of exploration projects worldwide.

The market's presence will extend across several geographical regions, including high-energy places such as North America, the Middle East, and Asia-Pacific. In a place like North America, it will be due to shale gas exploration, which is expected to boost the use of drill pipes, while the Middle East would see investments in advanced drilling equipment for maintaining levels of crude oil production. Similar is the case with energy consumption in the Asia-Pacific, which will raise the bar in exploration, specifically in offshore areas, thereby generating a higher requirement for advanced technological drill pipes which can sustain aggressive conditions.

Going forward, global drill pipe will not be used only in the oil and gas industry. They will be required by geothermal energy and also water well drilling. Although not as big compared to the latter, they could still serve a diversification scope for the drill pipe manufacturers. In areas where energy sources are diversified more, geothermal projects will obviously become more emphasized so that the potential application of drill pipes will only expand. Moving forward, as the demand of lightweight yet robust materials such as aluminum or composite pipe increases, both will be extensively used in subsequent drilling operations.

Emerging trends of automation and digitalization are poised to reshape the Global Drill Pipe market. The inclusion of advanced technologies such as real-time monitoring systems and digital twins in drilling will ensure better accuracy and lower instances of downtime. This new direction in intelligent operations would open opportunities for drill pipe manufacturers to collaborate with technology providers in smart solutions.

The trajectory of the market will also be influenced by environmental concerns as the governments and other regulatory bodies will implement stern guidelines to ensure drilling in sustainable ways. This will mean that manufacturers are pushed to innovate ways of reducing environmental impacts while improving efficiency. The second aspect that will influence the aftermarket segment of this industry is recycling and reconditioning services for drill pipes.

In a nutshell, the market for Global Drill Pipe will continue to change with times in exploration and resource extraction industries. This is set to be a tool that is indispensable in the production of energy while responding to the vast changes that come with technological advancement, regional shifts, and sustainability goals. With increasing demands for more advanced and sustainable drilling solutions, this market will make a critical contribution to global energy requirements.

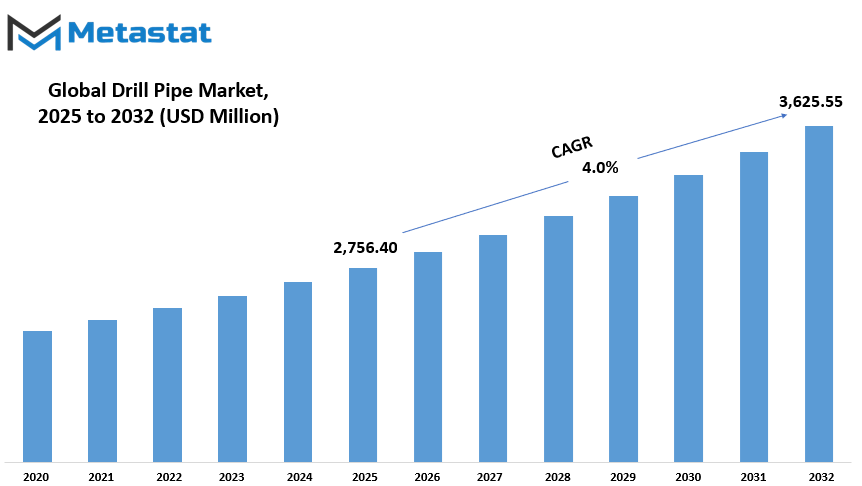

Global Drill Pipe market is estimated to reach $3,625.55 Million by 2032; growing at a CAGR of 4.0% from 2025 to 2032.

GROWTH FACTORS

The global drill pipe market is picking up in recent years, and the growth indicates a steady trend. There are many drive factors for the expansion of the industry. One of the growth drivers is ever-increasing demand for energy, primarily in the oil and gas sector. Energy discovery through drilling and development has encouraged people to drill more. The requirement for reliable drill pipes is soaring with discovery. With growing energy demands, the market for drill pipes is expected to rise significantly in drilling operations, which access underground oil and gas reserves through pipes.

The technological advancement in drilling equipment is also another reason that has led to the growth of the market. Advanced materials such as stronger, more durable alloys have been developed. Improvements in the design of drill pipes also increase the efficiency of drilling operations. Moving into deeper and more challenging environments, these advanced materials and designs help ensure that the pipes can withstand higher pressures and temperatures, thus driving demand in the market.

The global drive toward renewable energy also indirectly is complementing the drill pipe market. On one hand, renewable sources are growing, but on the other, oil and gas are the primary sources of fuel globally. The extent of the infrastructure required in the upstream area remains high, and this also weighs strongly on both the demand and usage of drill pipes even as renewable energy use increases.

However, the growth of the global drill pipe market comes with some considerable challenges. Fluctuating prices of raw materials, such as steel, may become a threat to the production costs of drill pipes. Any sudden hike in raw material prices may directly raise the cost of drill pipes, which in turn may adversely impact the profit of oil and gas companies operating using these drill pipes. The other factor may be political instability in key regions for oil production that may affect the supply chain and subsequently cause a downward spiral in the market.

Despite the various challenges that these factors have imposed on drill pipes, opportunities for growth in this industry still exist. Growing demand for deepwater and ultra-deepwater drilling operations is going to generate more demand for high-end drill pipes. High-end drill pipes are designed for high-pressure, extreme conditions at sea, which means they will form a key component of offshore explorations. Increased investment in deepwater exploration by oil and gas companies will have positive implications for the drill pipe market on a global level.

The global drill pipe market will register a tremendous growth rate over the coming years. The aforementioned challenges might develop, but more demand for energy, technological advancement, and the rising activity of deepwater drilling operations is likely to pose profitable opportunities before the market. The growing pace of the energy sector will help continue the market development for drill pipes as it continues in the process for more efficient, long-lasting machinery.

MARKET SEGMENTATION

By Type

The Global Drill Pipe market is the most important energy and oil market, providing the drilling industry with crucial tools for the operations. This market is going to experience a steady growth trend in the near future as the demand for drilling operations increases, especially in regions with plenty of natural resources. The increasing need for energy in Turn boosts the demand for drilling activities. As industries in every corner of the world begin to delve deeper into finding more complex oil reserves, this market is poised to expand immensely for drill pipes.

Looking into further detail of the market, the Global Drill Pipe market can be divided by type. Types include Standard Drill Pipe, Heavy Weight Drill Pipe, and Drill Collar. Each one offers specific characteristics and is utilized differently in accordance with drilling types. The most significant segment of the market, Standard Drill Pipe, would have a value of $1,108.91 million. This is widely used for it is cost-effective and versatile for use in most drilling environments. As more oil and gas companies focus on optimization of their operations, standard drill pipes demand is sure to remain.

On the other hand, Heavy Weight Drill Pipe will perform another kind of job, but which will likely grow. They will help maintain weight downhole as much as the stability to a well that might have unstable bottoms during the process of drilling operations; for deep drilling environments and some even tougher places offshore or into deeper water, so they also represent increasing market demand due to expansion by the oil industry companies going into those regions to begin extracting resources. The Heavy Weight Drill Pipe segment will be on the increase with respect to market share as more untapped resources are explored.

The Drill Collar segment is also vital for the overall market. These special pipes are used to add weight to the drill string, which aids in the penetration of hard formations. As the industry becomes increasingly challenging with more sophisticated drilling projects, Drill Collars will continue to be in greater demand, particularly in markets that have deep drilling operations as a standard practice. Future advancements in technology can further make Drill Collars more lasting, efficient, and cost-effective, continuing the expansion of their use in the Global Drill Pipe market.

In conclusion, the Global Drill Pipe market has a steady growth trend due to the growing demands for efficient drilling operations worldwide. The segmentation in the market into Standard Drill Pipe, Heavy Weight Drill Pipe, and Drill Collar indicates various applications and requirements across the industries. As energy demands continue to rise, the market will adapt to new challenges, ensuring that drill pipes remain a fundamental component of the global energy infrastructure.

By Grade

Global Drill Pipe market will experience a large number of changes since it is aligned with the increase in demand in the oil and gas industry. In the future, as industries move forward and a better extraction process becomes necessary, this market will be expanded further. The Global Drill Pipe market has been classified on the basis of grade. The two primary categories in this market are API Grade and Premium Grade drill pipes, which serve two different purposes and cater to two different requirements.

API Grade drill pipes are more commonly used as it is according to the American Petroleum Institute (API). The pipes adhere strictly to the standards set by the institute; in this way, they benefit and also align to the minimum and maximum limits for a typical drilling operation. These pipes are applied in many conventional cases of drilling, with standardized pressure, temperature, and environmental conditions. Although they are stronger and perform well, their capability might be insufficient for high pressure or temperature applications.

On the other hand, Premium Grade drill pipes are created for drilling with a bit greater challenge. High pressure, depth of drilling, and adverse environmental factors can be experienced in such challenging environments. Sometimes, the drilling pipes have the improved materials with special coatings applied, or sophisticated manufacturing processes so that the equipment can perform properly in adverse conditions or challenging geology formations for offshore drilling sites. Their increased strength also allows them to last longer, thus reducing the number of replacements and, consequently, the cost of operations in the long term.

Going forward, it is likely that the Global Drill Pipe market will be driven by the growing emphasis on energy exploration in deeper waters and more challenging terrains. As drilling technology continues to evolve, Premium Grade drill pipes will continue to be in greater demand, as companies look for reliability and long-term solutions. Still, for less complex operations, API Grade drill pipes will be essential and, therefore, ensure a high market share.

The continued growth of both the API Grade and Premium Grade segments in the Global Drill Pipe market reflects the diverse needs of the oil and gas industry. While API Grade pipes will serve as a cost-effective solution for many projects, the increasing emphasis on more challenging drilling conditions means that Premium Grade pipes will become more critical for ensuring optimal performance and safety. Future direction of the Global Drill Pipe market will thus rest with technological innovations directed toward meeting ordinary and specialized requirements for drilling operations.

By Application

Global Drill Pipe market will continue to expand as the need for energy will continue to grow across the world. Drill pipes are the key equipment in drilling operations, where pipes are used to join the drilling rig with the drill bit. It is an integral component of both onshore and offshore drilling operations, which constitute the two primary applications of the drill pipe market. As the world’s needs for energy production increase, advanced onshore and offshore drilling operations would be required that would increase the demand for higher-quality drill pipes and innovation in technologies used.

Onshore drilling, in which drilling happens on land, has been another major contributor in the Global Drill Pipe market. Increasing exploration and production of resources based on land within countries would generate a need for strong, hardy, and efficient drill pipes. Typically, onshore drilling requires very special drill pipes capable of withstanding extremely challenging environments: high pressures and temperatures or abrasive materials. Therefore, advanced technologies will eventually enable deeper access to harder-to-reach onshore reserves; that means increased demand for sturdier, more effective drill pipes and thus expanding the market further.

Offshore drilling has become more important as the world’s focus shifts toward extracting energy resources from beneath the ocean’s surface. Offshore drilling presents unique challenges due to the harsh environmental conditions, such as high pressure, salty water, and strong waves. Drill pipes used in offshore drilling operations must be highly resistant to corrosion and wear. With these explorations becoming further and deeper offshore, deep-sea drill pipes shall become necessary. The pipes used for such extreme purposes should be able to perform under extreme pressure and also require durability.

In the future, the Global Drill Pipe market shall expand due to the increase in oil and gas exploration and the inclusion of highly advanced drilling technologies. Innovations will be the focus of manufacturers, who will continue drilling and finding better drill pipe designs, materials, and manufacturing processes. There will be a demand for more efficient and durably designed drill pipes for onshore and offshore drilling. Increased automation in drilling operations will boost the demand in drilling pipes that will accommodate such advanced technologies.

In summary, expansion of onshore and offshore drilling activities continues to have an influence on the Global Drill Pipe market. Demand for high-quality and durable drill pipes will continue to grow with advancements in technology and the increasing need for energy resources. The future of the market will depend on innovation through continuous advancement and adaptation to challenges presented by the ever-changing drilling landscape.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,756.40 million |

|

Market Size by 2032 |

$3,625.55 Million |

|

Growth Rate from 2024 to 2031 |

4.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

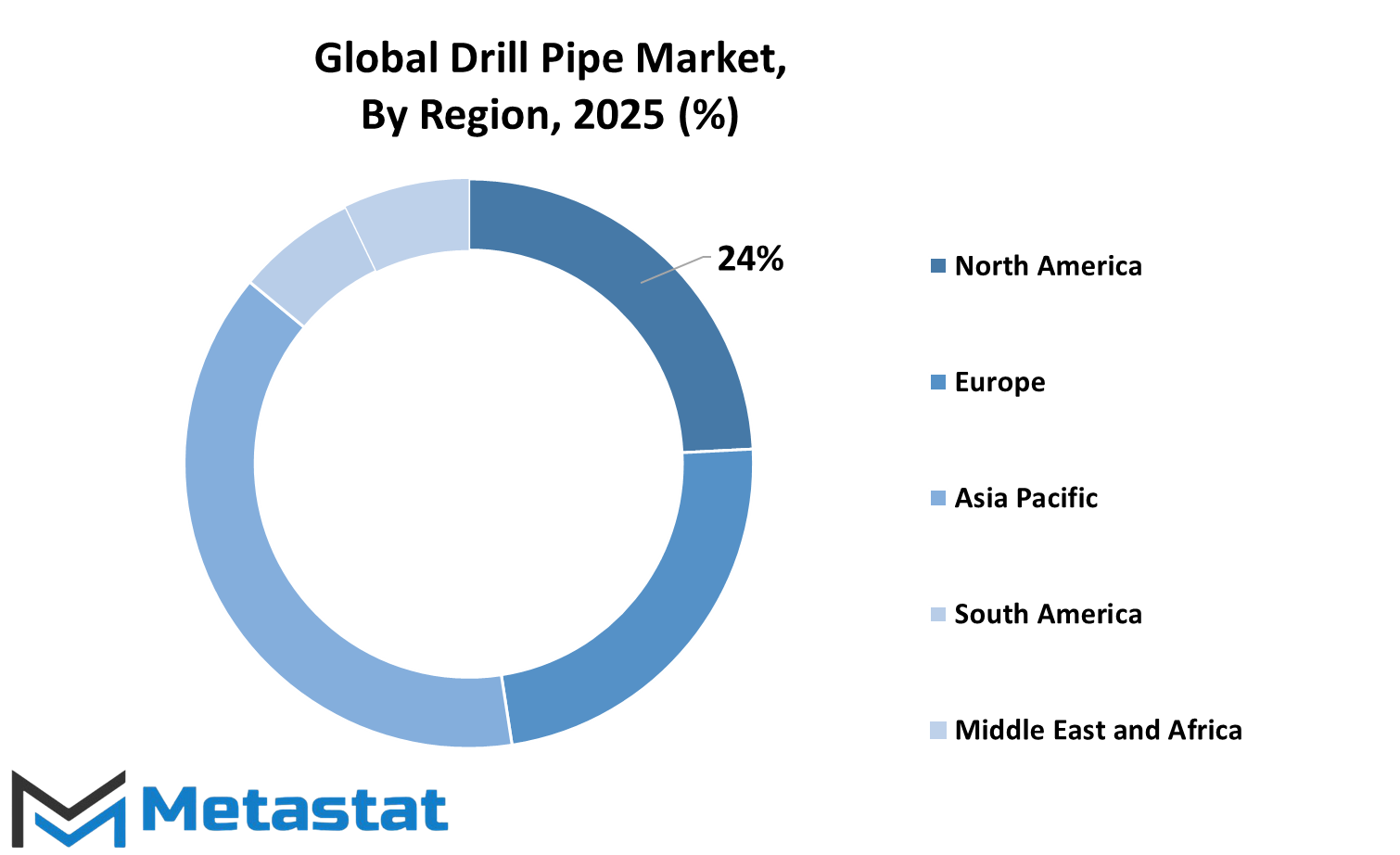

As the demand for oil and gas exploration is rising across various regions, the global market for drill pipes has been growing steadily and is seen to continue doing so. Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, each with their own unique drivers and challenges in demand. The regional dynamics will play a critical role in the future landscape of the drill pipe market as the global energy industry shifts and adjusts to new technologies.

North America is one of the largest and most significant markets for drill pipes, driven primarily by the United States. The region's advanced infrastructure for oil and gas, including ongoing exploration and extraction activities, will likely promote the demand of high-quality drill pipes. Influence factors in this region of the market can be new techniques of drilling as well as production of shale oil and gas alongside the increasing urgency for energy independence. While other regions see stable growth or have slower-growth markets in comparison, drill pipes will face continued demand within North America based on the construction of oil sands facilities in Canada and deepwater platforms in Mexico.

Europe continues steady growth although with a slowing trajectory compared with the North America space.". The demand in Europe will be primarily driven by the region's shift toward energy security, exploration in offshore oil and gas fields, and efforts to modernize existing infrastructure. The UK, Germany, France, and Italy are the key players in this region, where the push for more efficient and sustainable drilling solutions will drive the market forward. As environmental concerns further shape energy policies, the push for green energy will also shape Europe's development regarding the drill pipe market in the coming years.

The Asia-Pacific region, representing major oil and gas producing countries such as China, India, Japan, and South Korea, is expected to contribute the most toward the growth in the global drill pipe market. The rate of industrialization and energy consumption in these countries will be a huge source of demand for drill pipes, especially for offshore exploration and deepwater explorations. Investments by China in the energy sector coupled with India's increasing exploration will be two key drivers for this market.

South America, specifically Brazil and Argentina, will further contribute to this growing global demand for drill pipes. Offshore oil reserves will be developed across the region, especially in Brazil, which plans to heavily invest in its development of oil production capabilities. The Middle East & Africa is a major region for oil and gas production, and the global drill pipe market will continue to be dominated by this region. Countries like Saudi Arabia, UAE, and South Africa will keep driving demand since these regions are more dependent on the oil and gas industry for economic stability.

Overall, the global drill pipe market will be prone to varied growth across different regions; North America and Asia-Pacific will be the drivers. As for the drivers of future demand within each region, they will be different, but in a nutshell, the trend is likely to shift toward increased dependence on technological advancement in drilling and increased improvements in infrastructure worldwide. The future of the market will depend on how these regions adapt to technological advancements and shifting energy demands, ensuring that the global drill pipe market remains a key player in the future energy landscape.

COMPETITIVE PLAYERS

The Global Drill Pipe market is witnessing rapid growth. A combination of factors, such as the growing demand for energy, technological advancement, and investments in exploration and production activities, has led to growth in this market. This industry is the core of the oil and gas sector because drill pipes are essential components used in the drilling process to extract resources from deep beneath the Earth’s surface. With the ever-increasing global population, coupled with continuous energy demands, the market will also continue to demand more drill pipes because they play a very vital role in both conventional and unconventional reservoir drilling.

A total of the well-known companies play in the market, including Maharashtra Seamless Ltd. (MSL), Tenaris S.A., Complete Tubular Products, National Oilwell Varco, Inc, TMK, Tube Technologies INC, TSC (Tubular Services Company) which are followed up by Hunting PLC, TPS-Technitube Röhrenwerke GmbH, Oil Country Tubular Limited and so on are DP-Master Manufacturing, Jiangsu Shuguang Huayang Drilling Tool (Shuguang Group) with Tejas Tubular Products Inc., Drilling Pipe International, LLC is Texas Steel Conversion Inc, China KGR Industries, Premier Drill Products, LLC.,, Challenger International Inc. These companies are going to take the industry forward through innovations and expanding their production capacities to meet the increasing demand.

The Global Drill Pipe market will witness a technological advancement in the near future. New manufacturing techniques, advanced materials, and automation will revolutionize the industry. For instance, the adoption of non-rusting, low-weight materials will make drill pipes more durable as well as efficient while saving oil and gas companies some money. Automation technologies might, therefore, vastly reduce the amount of time required to manufacture and maintain drill pipes, meaning increased operational efficiency.

Increased offshore and deepwater drilling projects will also drive demand for drill pipes. As the energy demand increases around the world, companies will try to drill deeper and in harder environments, including deeper waters and unconventional oil fields. Advanced drill pipes that can sustain extreme temperatures and pressures will be needed for this kind of drilling.

The competitive landscape of the market will continue to evolve as companies strive to develop cutting-edge solutions and expand their market share. Strategic partnerships, mergers, and acquisitions will likely play a significant role in shaping the future of the Global Drill Pipe market. As energy companies look to improve their drilling capabilities, the demand for high-quality, reliable drill pipes will continue to grow, ensuring that the market remains robust for years to come.

Drill Pipe Market Key Segments:

By Type

- Standard Drill Pipe

- Heavy Weight Drill Pipe

- Drill Collar

By Grade

- API Grade

- Premium Grade

By Application

- Onshore Drilling

- Offshore Drilling

Key Global Drill Pipe Industry Players

- Tenaris S.A.

- Tube Technologies INC

- Maharashtra Seamless Ltd. (MSL)

- National Oilwell Varco, Inc.

- Complete Tubular Products

- DP-Master Manufacturing

- TSC (Tubular Services Company)

- Hunting PLC

- TMK

- TPS-Technitube Röhrenwerke GmbH

- Drill Pipe International, LLC

- Oil Country Tubular Limited

- Tejas Tubular Products Inc.

- Texas Steel Conversion Inc

- KGR Industries

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252