Global Digital Isolator Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global digital isolator market in the electronics and semiconductor sector will experience an interesting transformation in the years to come. First appearing in the latter half of the 20th century as designers looked for safer, more efficient replacements for optical coupling devices, the digital isolator started its life as specialized components applied in highly specialized uses. Initial versions depended on magnetic coupling to propagate signals without electrical contact, providing greater speed and longer life than available alternatives. Towards the early 2000s, silicon-based technologies' integration provided more compact, stable forms for these devices, extending opportunities beyond industrial controls to consumer devices and automotive systems.

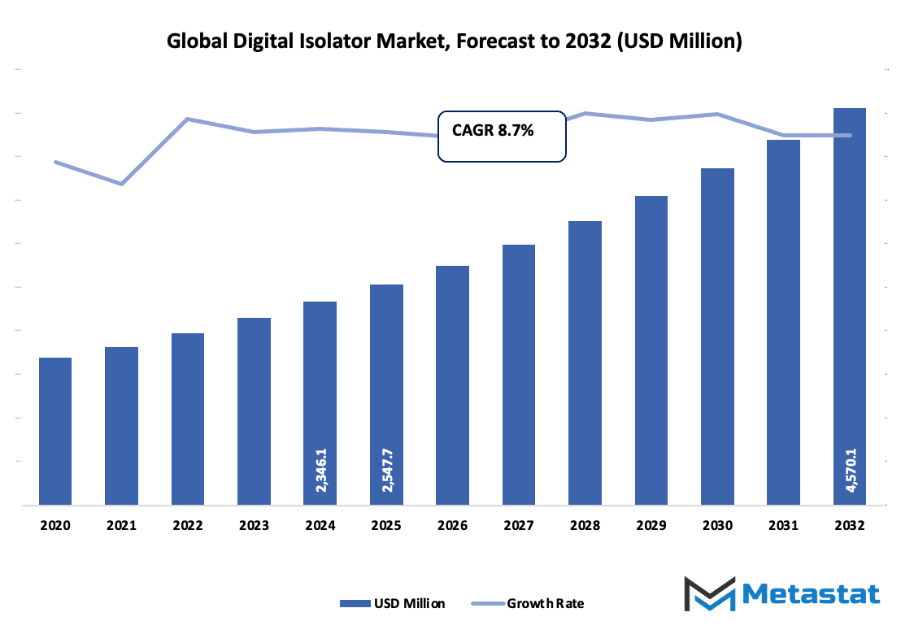

- Global digital isolator market of around USD 2547.7 million in 2025, growing with a CAGR of nearly 8.7% from 2032, with scope to grow beyond USD 4570.1 million.

- Capacitive Coupling hold close to 49.5% market share, leading to innovation and increasing uses through rigorous research.

- Key trends fuelling expansion: Rising need for high-speed and power-efficient isolation solutions across industrial automation, Increased uptake in electric vehicles and renewable energy systems for enhanced performance and safety

- Key opportunities include: Increased use of digital isolators across 5G infrastructure and next-generation communication systems

- Key observation: The market is likely to expand exponentially in value over the ten-year period ahead, underlining strong growth opportunities.

Throughout its timeline, several milestones will have defined the global digital isolator market trajectory. The adoption of CMOS technology enhanced isolation performance and reduced power consumption, making these devices viable for broader applications. Regulatory shifts, particularly stricter safety and electromagnetic compatibility standards in Europe and North America, will push manufacturers to prioritize isolation quality, prompting innovations that ensured compliance while maintaining efficiency. In the meantime, the growth of renewable power systems and smart grids will have created a demand for isolators that can withstand higher voltages and harsher operating conditions. Shifts in consumer needs will continue to shape the market's landscape. With the shrinking of devices but increased power, the demand for miniature isolators with high-speed communication will grow.

Automotive electrification will promote solutions that facilitate fast data transfer without harming safety, while industrial automation will prefer isolators that can withstand demanding conditions. Emerging technologies like silicon carbide and gallium nitride could redefine performance standards with quicker switching speed and thermal endurance. Market players will also address global trends toward sustainability by creating energy-efficient products that comply with environmental rules. Through the path it has followed from initial magnetic couplers to sophisticated semiconductor-based isolators, the global market for digital isolators will show the crossing of innovation, safety, and flexibility. Its development shows how changing technologies, regulatory forces, and changing application requirements all contribute to a niche segment of the electronics business. The future will hold further optimization and specialization, making digital isolators fundamental building blocks in the systems that form the basis of modern technology.

Market Segments

The global digital isolator market is mainly classified based on Technology, Insulating Material, Data Rate, Industry Vertical.

By Technology is further segmented into:

- Capacitive Coupling: Capacitive coupling technology will remain significant in the global digital isolator market owing to its capacity to offer high-speed data transfer with electrical isolation. Capacitive coupling technology will be the first choice for low power consumption and compact design applications, providing reliability and efficiency in emerging electronic systems.

- Magnetic Coupling: Magnetic coupling shall continue to be a principal technology in the market. It shall enable devices to work in harsh environments and offer high-quality electrical isolation. With improvements in material science and design, magnetic coupling shall be able to deliver improved performance, stability, and safety and find uses in several industrial and automotive applications.

- Giant Magnetoresistive: Giant magnetoresistive technology will increase in the market due to its sensitivity and accuracy in magnetic field detection. It will be used in industries where precise signal transmission and low energy loss are vital. This technology will cater to the need for trusted high-speed communication and integration of contemporary electronic devices.

- Others: Other technologies will persist in enabling niche uses in the global digital isolator market. These products will address specialized needs where generic technologies are not able to satisfy unique performance, size, or environmental needs. Technological advancements in these areas will lead to varied applications across a variety of industries.

By Insulating Material, the market is divided into:

- Polyimide-based: Polyimide-based materials will contribute heavily to the global digital isolator market. Due to their excellent insulation properties, chemical resistance, and high thermal stability, they will find applications in rigorous electronic applications. This material will enable isolators to perform well in sophisticated devices under harsh conditions.

- Silicon Dioxide (SiO2)-based: Silicon dioxide (SiO2)-based materials will remain critical in the market. They will ensure superb electrical insulation, robustness, and dependability. The capability to incorporate SiO2 in small form factors will enable high-performance device growth and ensure signal integrity in intricate circuits.

- Others: Other insulating products will enable new applications in the global digital isolator market. They will provide substitute solutions where conventional products are unable to fulfill needs. These products will enable producers to achieve new design options while sustaining security and effectiveness in electronic systems.

By Data Rate the market is further divided into:

- Up to 25 Mbps: Data rates up to 25 Mbps will continue to serve applications in the global digital isolator market that do not require high-speed communication. These rates will remain important for cost-effective and energy-efficient devices, particularly in industries that prioritize reliability over extreme data throughput.

- 25 - 75 Mbps: Data rates from 25 to 75 Mbps will become more prevalent in the market. This range will support growing demand for faster communication without significant increases in power consumption. Devices operating within this range will meet performance needs in automotive, industrial, and medical sectors.

- Above 75 Mbps: Data rates above 75 Mbps will drive advanced applications in the global digital isolator market. Higher speeds will enable real-time data transmission and support complex electronic systems. This segment will grow with the increasing need for fast and reliable communication in high-performance and next-generation devices.

By Industry Vertical the global digital isolator market is divided as:

- Medical Devices: The medical devices sector will expand its use of global digital isolator market solutions to ensure patient safety and accurate data transfer. These isolators will protect sensitive electronics in diagnostic and therapeutic equipment while maintaining signal integrity.

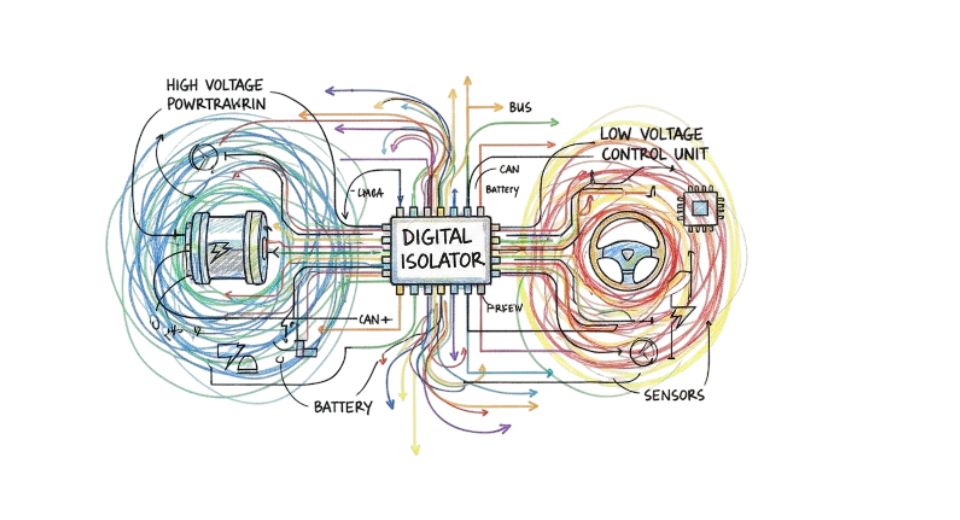

- Automotive: The automotive industry will adopt market products to enhance safety, connectivity, and performance. Isolators will be used in electric vehicles, battery management systems, and advanced driver-assistance systems, supporting reliable operation in challenging automotive environments.

- IT and Telecommunications: IT and telecommunications will increasingly depend on market solutions to maintain secure and fast communication networks. Isolators will prevent data loss, reduce interference, and ensure consistent performance across complex systems and high-speed networks.

- Aerospace & Defense: Aerospace and defense applications will continue to use market products to protect critical systems. High reliability, resistance to harsh conditions, and precise signal transmission will be essential for aircraft, satellites, and defense electronics.

- Consumer Electronics: Consumer electronics will integrate market solutions for safer and more efficient devices. Isolators will allow compact, energy-efficient designs while protecting circuits from electrical noise and ensuring stable performance.

- Energy & Power: Energy and power systems will benefit from market products to improve safety and efficiency. Isolators will be used in power management, renewable energy systems, and industrial power electronics, enabling reliable operation under high voltage conditions.

- Others: Other industries will adopt global digital isolator market products to meet specialized requirements. These applications will include niche sectors where isolation, speed, or durability is critical, expanding the market beyond mainstream industrial and commercial uses.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2547.7 Million |

|

Market Size by 2032 |

$4570.1 Million |

|

Growth Rate from 2025 to 2032 |

8.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

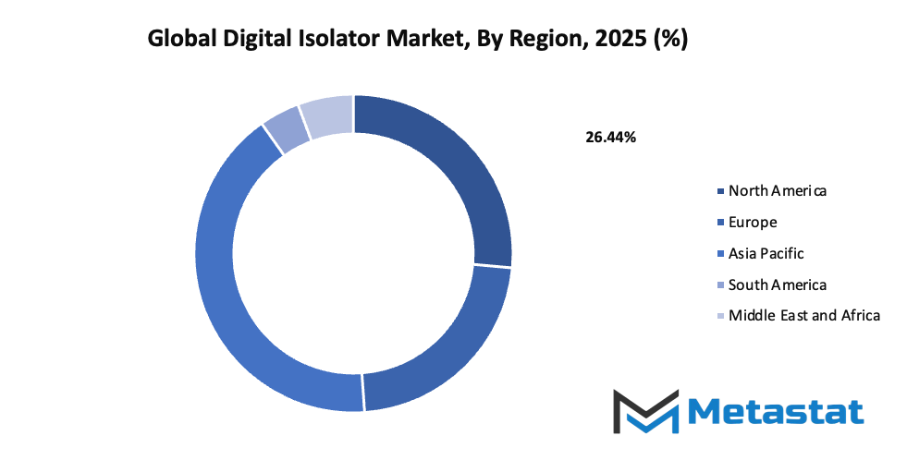

By Region:

- Based on geography, the global digital isolator market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for high-speed and energy-efficient isolation solutions in industrial automation: The global digital isolator market will experience growth as industries look for faster and more energy-efficient isolation solutions. Industrial automation systems will benefit from reliable signal transmission, reduced power loss, and improved safety. As factories adopt smarter technologies, demand for digital isolators will continue to rise.

- Rising adoption in electric vehicles and renewable energy systems for safety and performance: Electric vehicles and renewable energy systems will increasingly rely on digital isolators to ensure safety and maintain high performance. Efficient isolation will protect sensitive electronics from voltage spikes and improve energy efficiency. As sustainable technology advances, these sectors will become major drivers of market growth.

Challenges and Opportunities

- High cost compared to conventional isolation technologies: Digital isolators will remain more expensive than traditional isolation solutions. This higher cost could slow adoption in cost-sensitive industries, yet companies focused on long-term performance and reliability will see value in investing in these advanced components.

- Design complexity and integration challenges in compact electronic systems: Integrating digital isolators into compact electronic systems will be complex. Engineers will need to balance size, performance, and energy efficiency while maintaining signal integrity. Overcoming these challenges will require innovative designs and improved manufacturing techniques.

Opportunities

- Growing use of digital isolators in 5G infrastructure and advanced communication systems: Digital isolators will become essential in 5G networks and advanced communication systems. They will ensure signal integrity, reduce interference, and support higher data rates. As 5G and next-generation communication technologies expand, demand for these components will increase significantly.

Competitive Landscape & Strategic Insights

The global digital isolator market is witnessing significant growth and transformation as technology continues to advance rapidly. This market is a mix of well-established international leaders and emerging regional competitors, each striving to innovate and capture a larger share. Companies such as Texas Instruments Incorporated, Analog Devices, Inc., Skyworks Solutions, Inc., Infineon Technologies AG, NVE Corporation, ROHM CO., LTD., Broadcom, Vicor Corporation, STMicroelectronics, Renesas Electronics Corporation, Murata Manufacturing Co., Ltd., Semiconductor Components Industries, LLC (Onsemi), TT Electronics, TE Connectivity, Advantech Co., Ltd., Amphenol Corporation, NXP Semiconductors, Microchip Technology Inc., Littelfuse, Inc., Monolithic Power Systems, Inc., Kinetic Technologies, and MORNSUN Guangzhou Science & Technology Co., Ltd. are playing pivotal roles in shaping the future of the market.

The demand for digital isolators is expected to increase as industries continue to seek solutions that provide better safety, efficiency, and signal integrity in electronic systems. Advancements in automation, electric vehicles, industrial equipment, and renewable energy are likely to drive the need for more reliable and high-performance isolators. The ongoing focus on reducing energy losses and improving system protection will push companies to develop products that are faster, more compact, and capable of handling higher voltages.

Innovation will continue to be a central factor in the global digital isolator market, with companies exploring new materials and designs that enhance performance and durability. The integration of digital isolators with emerging technologies such as smart grids, IoT-enabled devices, and advanced communication systems will create opportunities for growth. As regional competitors rise alongside established players, the competition will drive improvements in both product quality and cost efficiency, making digital isolators more accessible to a wider range of applications.

Market size is forecast to rise from USD 2547.7 million in 2025 to over USD 4570.1 million by 2032. Digital Isolator will maintain dominance but face growing competition from emerging formats.

Looking ahead, the market will experience expansion not only in traditional industrial sectors but also in new areas that require compact and energy-efficient solutions. The development of next-generation isolators capable of meeting stringent safety standards and high-speed communication demands will define the market's trajectory. Companies that invest in research and development and collaborate with technology innovators will have the opportunity to shape the future landscape of this market, ensuring that digital isolation solutions remain crucial to electronic system design for years to come.

Report Coverage

This research report categorizes the global digital isolator market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global digital isolator market.

Digital Isolator Market Key Segments:

By Technology

- Capacitive Coupling

- Magnetic Coupling

- Giant Magnetoresistive

- Others

By Insulating Material

- Polyimide-based

- Silicon Dioxide (Sio2)-based

- Others

By Data Rate

- Up to 25 Mbps

- 25 - 75 Mbps

- Above 75 Mbps

By Industry Vertical

- Medical Devices

- Automotive

- IT and Telecommunications

- Aerospace & Defense

- Consumer Electronics

- Energy & Power

- Others

Key Global Digital Isolator Industry Players

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Skyworks Solutions, Inc.

- Infineon Technologies AG

- NVE Corporation

- ROHM CO., LTD.

- Broadcom

- Vicor Corporation

- STMicroelectronics

- Renesas Electronics Corporation

- Murata Manufacturing Co., Ltd.

- Semiconductor Components Industries, LLC (Onsemi)

- TT Electronics

- TE Connectivity

- Advantech Co., Ltd.

- Amphenol Corporation

- NXP Semiconductors

- Microchip Technology Inc.

- Littelfuse, Inc.

- Monolithic Power Systems, Inc.

- Kinetic Technologies

- MORNSUN Guangzhou Science & Technology Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252