MARKET OVERVIEW

The global digital audio workstation market for the music production industry will continue to be distinctively positioned as audio creation and editing procedures move increasingly further into digital environments. The market involves the development, delivery, and utilization of software platforms exclusively for recording, mixing, editing, and mastering audio. These computer platforms will determine how professional audio creators and enthusiasts deal with complex soundscapes without relying much on traditional studio hardware. As hobby and pro creativity overlap even more, this software-only approach to music creation will attract an increasingly diverse base.

Digital audio workstations, or DAWs by their nicknames derived from the abbreviation, will remain at the center of producers', composers', audio engineers', and sound designers' arsenal. They run on various operating systems and are supported by plug-ins and virtual instruments that can completely revolutionize how the audio is made. Whereas these tools have long been the domain of the studio, they will become ever more portable, flexible, and software-compatible with an expanding range of hardware peripherals. Software-based production methods will become increasingly popular, leading to shrinking studios and distributed recording facilities globally.

What sets this market apart is not just the software itself but the ecosystem that exists behind it. Independent and commercial communities contribute a treasure of presets, plug-ins, sound libraries, and tutorial resources that encircle every basic workstation. Creators will keep looking for means of improving user interfaces, reducing latency, and optimizing integration between devices and formats. Efficiency and ease of use will remain the spotlight as creative professionals look for faster ways to produce quality content without sacrificing depth or control.

Across regional markets, usage patterns for the platforms will vary. As North America and parts of Europe have traditionally supported a robust professional base, Asia, Latin America, and Africa's emerging creators will start to shape new consumption patterns and types of content. What was once a market grounded in the creation of Western commercial music will begin to be reflective of a more global mosaic of sonic cultures and user needs. This expansion will impact not just software design, but pricing models and distribution channels, so access will be even more of an issue.

Educational institutions and cutting-edge learning facilities will play their part. As schools and training schools embrace the incorporation of music and sound production in their curricula, future generations will be exposed to commercial tools at an earlier age than ever. Those first tastes of digital workstations will set the bar for functionality and use that will have an impact on future development and sales campaigns.

In the future, the global digital audio workstation market will respond to evolving user expectations, regional innovation, and demand for end-to-end digital workflows. The convergence of artificial intelligence, spatial audio, and cloud collaboration will introduce new capabilities and redefine how people work with these platforms. Although the basic objective producing and refining sound will remain the same, how it gets done will change always. This market will not just serve music professionals but increasingly enable independent artists, game developers, teachers, and content creators in a wide variety of industries.

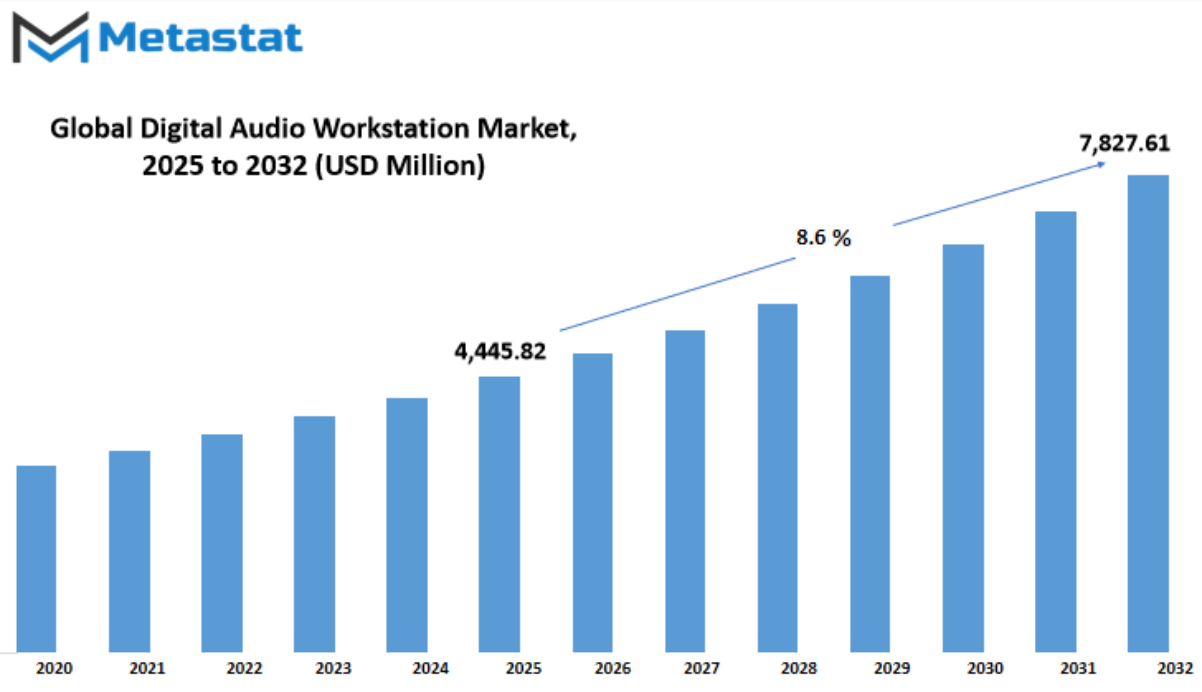

Global digital audio workstation market is estimated to reach $7,827.61 Million by 2032; growing at a CAGR of 8.6% from 2025 to 2032.

GROWTH FACTORS

The global digital audio workstation market is expected to witness steady growth in the coming years, mainly driven by shifts in how people create and consume audio content. A significant factor fueling this growth is the rising interest in home studios. With better access to affordable recording equipment and digital tools, more individuals are turning to music production from their own homes. This trend isn't just limited to musicians. Many content creators, including podcasters and video producers, are now using digital audio workstations to shape high-quality sound for their online work.

The increased demand for podcasts and other online content has made audio production more essential than ever. As digital media continues to grow, the need for tools that help creators produce clean and professional sound will keep increasing. The shift towards digital platforms for both music and spoken content encourages more people to look for software that gives them control and creative flexibility. In many cases, these users prefer tools they can use independently without having to rely on large studios or teams.

Despite the growth, the global digital audio workstation market still faces some real challenges. Professional-grade software often comes with a high price tag and can be complicated to use. This becomes a barrier, especially for beginners or people who aren't technically trained. The time it takes to learn how to use some of these platforms can discourage new users, which might slow the adoption rate in some areas of the market.

However, the future looks promising with new developments that are expected to ease these limitations. The introduction of cloud-based platforms is changing how creators work together. Instead of being limited to one device or location, producers can now collaborate in real time, from anywhere. This is especially useful for artists and teams working across different cities or countries. Alongside this, the rise of artificial intelligence in audio tools is making complex processes easier and faster. With features like automated mixing, mastering, and noise removal, even users with little experience can produce professional-quality audio.

As technology continues to improve, more people will likely explore creative audio projects, boosting the need for flexible, user-friendly tools. The global digital audio workstation market stands at a point where innovation can open new doors, making digital audio production more accessible and appealing to a wider audience.

MARKET SEGMENTATION

By Component

The global digital audio workstation market is shaping the future of how audio content is produced, edited, and shared. As more people around the world engage with digital media whether for music, podcasts, film, or streaming the demand for user-friendly and powerful tools continues to grow. These platforms are no longer just for professionals in large studios; they are now widely used by independent creators, educators, and even hobbyists who want to create high-quality sound from their personal devices.

A big part of this shift comes from the way the market is segmented by component. Software and services are the two key parts that define this category. On the software side, we’re seeing tools that are getting smarter and more flexible. Features such as multi-track editing, real-time collaboration, and built-in virtual instruments are making production faster and more intuitive. What was once limited to expensive hardware can now be accessed from a laptop or tablet. Many of these programs also offer cloud integration, allowing users to save projects online and work across different devices. This flexibility is especially useful for remote teams or artists on the move.

On the services side, the global digital audio workstation market is expanding in equally promising ways. Companies are not just offering products they’re building ecosystems. Users can now get access to regular updates, customer support, and learning resources through subscription-based models. Some services even provide AI-assisted editing tools that help clean up audio tracks or suggest changes based on common patterns. These kinds of support systems make it easier for people with limited technical knowledge to create professional-quality audio.

Looking ahead, this market is expected to grow even more as technology continues to advance. Voice recognition, real-time sound translation, and even virtual reality-based sound design might become standard tools in the future. As the cost of entry drops and accessibility rises, more people from different parts of the world will have a chance to be part of the digital audio space. Education, storytelling, and entertainment will likely benefit the most from this growth.

The global digital audio workstation market, especially when viewed through the lens of software and services, is on a clear path toward greater innovation and broader use. This will reshape not only how content is made but also who gets to make it.

By Deployment

The global digital audio workstation market is expected to grow steadily as more industries and individuals rely on technology to produce and edit sound. With the rise of digital content, there's a growing need for tools that allow users to create high-quality audio efficiently. This market includes both professional audio engineers and everyday users who want to produce music, podcasts, or sound for video. One of the main factors influencing this growth is the choice of deployment: On-premise or Cloud.

On-premise setups have long been trusted by professionals because they give users more control over software and hardware. These systems are installed locally and can offer better performance without depending on an internet connection. Studios with high-end equipment often prefer this option because it allows them to work in a stable environment where they can manage updates and system changes on their own terms. However, these setups can be costly, require ongoing maintenance, and may not be as flexible when teams are working from different locations.

Cloud-based solutions, on the other hand, are changing how people approach audio production. As internet speeds improve and storage becomes more affordable, cloud platforms have become more attractive. They offer access to tools from anywhere, making collaboration easier. Someone working on a project in one country can now team up with someone thousands of miles away without needing to transfer large files manually. This approach also reduces the need for expensive equipment since many tasks can be done online using remote processing power.

Looking ahead, the global digital audio workstation market will likely lean more toward cloud deployment. With more companies offering subscription models and regular updates through the cloud, users can always have the latest features without having to install anything themselves. This trend will support not just professionals but also schools, creators, and businesses that need fast, flexible tools. While on-premise systems won't disappear anytime soon, especially in industries with strict security needs, the convenience of the cloud is hard to ignore.

As more people create digital content every day, the demand for powerful yet easy-to-use audio tools will continue to rise. The line between professional and personal use will keep getting thinner, and this shift will play a big role in shaping the future of the global digital audio workstation market.

By End Use

The global digital audio workstation market is expected to see continued growth in the years ahead, shaped by shifts in technology, user behavior, and creative demands. Digital audio workstations, often called DAWs, are software tools used for recording, editing, mixing, and producing sound. They are now used by everyone from professional studios to individual creators working from their homes. As more people get access to better technology, the use of DAWs has expanded beyond just professional environments.

The global digital audio workstation market is moving in a direction that combines simplicity with power. Software developers are creating DAWs that are not only more advanced but also easier to use. This means even someone without formal training can start making music, podcasts, or other audio projects. With the popularity of online content, social media, and video sharing, more users are searching for ways to produce high-quality sound. This trend is expected to push the market forward. Cloud-based platforms are also making it easier for people to collaborate, store projects, and work from different locations. This feature will likely become more standard as remote work and global teams continue to grow.

Looking ahead, artificial intelligence will play a bigger role in how people use DAWs. Features like auto-mixing, voice recognition, and smart editing tools are being developed to help users finish projects faster. These tools won’t replace human creativity, but they will make the process smoother. As the software becomes more flexible, users can expect it to fit a wider range of creative needs, from complex music production to simple voice recordings.

When the global digital audio workstation market is looked at based on end use, it can be split into commercial and non-commercial sectors. Commercial users include recording studios, film production companies, broadcasters, and professional musicians. These users usually need more powerful tools and support. Non-commercial users include hobbyists, students, and content creators who may not have the same technical background but still want to make professional-sounding work. Both of these groups are growing, and developers are paying attention to what each group wants. In the future, the difference between these two groups might get smaller as tools become more affordable and user-friendly.

Overall, the global digital audio workstation market will keep growing as technology advances and more people look for ways to create and share audio content easily.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,445.82 million |

|

Market Size by 2032 |

$7,827.61 Million |

|

Growth Rate from 2025 to 2032 |

8.6% |

|

Base Year |

2024 |

|

Regions Covered |

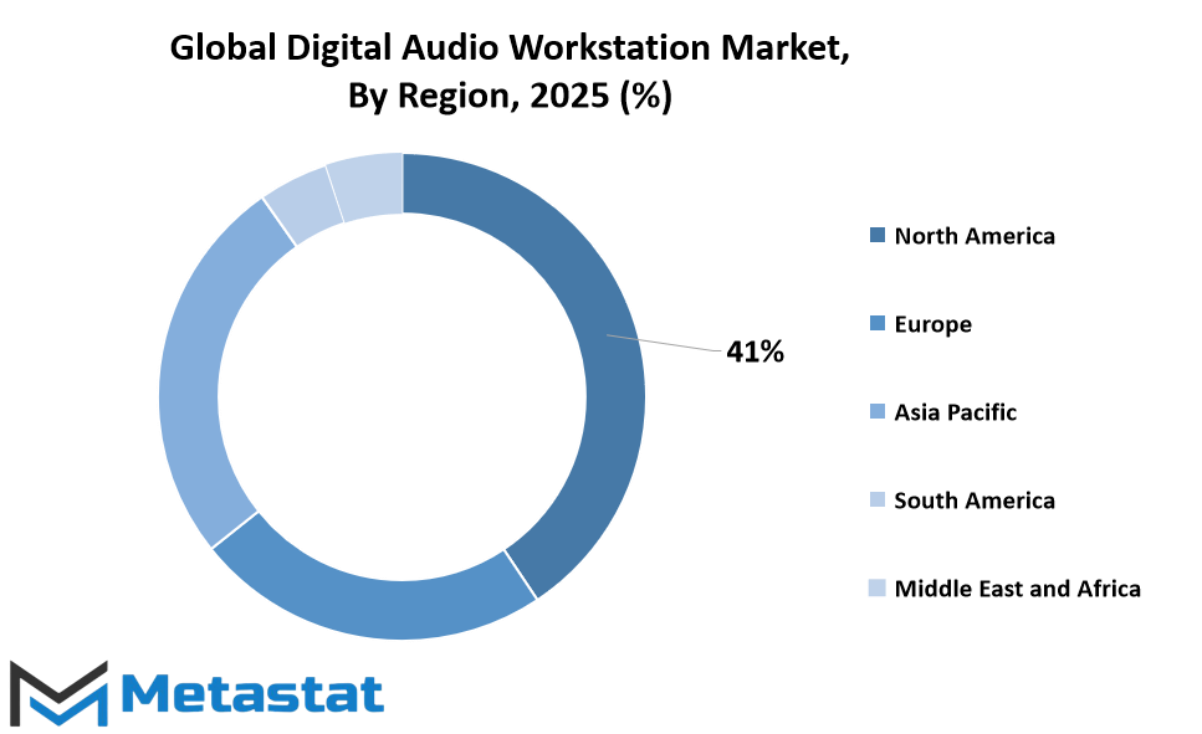

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global digital audio workstation market is showing steady growth and will likely expand even further in the coming years. As music production and audio editing continue to move into digital platforms, these workstations have become an essential part of how sound is created and managed. The demand for user-friendly tools that offer high-quality output is pushing the market forward. From professional studios to independent creators, more people are depending on digital tools to shape their audio content. This shift is expected to grow stronger with better internet access, cloud storage options, and improved hardware.

Looking at the market from a regional angle, it is clear that every part of the world is contributing in its own way. North America, especially the United States, has always been a leader due to its early adoption of technology and strong entertainment industry. Canada and Mexico are also stepping up, providing more space for music tech businesses to thrive. Europe is another key area, with countries like the UK, Germany, France, and Italy offering strong support through both consumer demand and software development. Each of these countries brings something unique, and together they make Europe a solid region for digital audio advancements.

In the Asia-Pacific region, countries such as China, India, Japan, and South Korea are moving forward at a fast pace. These nations have growing populations of tech-savvy creators, which is helping the market spread. More young people are exploring music and audio production as both a hobby and career, and local companies are rising to meet their needs. This region is expected to see a sharp increase in users over the next decade.

Meanwhile, South America, including Brazil and Argentina, is starting to attract attention too. Although it's a smaller segment for now, improvements in infrastructure and better access to technology will help it grow. The same goes for the Middle East and Africa. Countries such as South Africa, Egypt, and those in the GCC are beginning to invest in digital production tools. As these areas build stronger connections to global markets, they will likely become more important players in the future.

Overall, the future looks promising for the global digital audio workstation market. As digital creativity becomes more common and tools become more advanced, this market will continue to develop and reach more people worldwide.

COMPETITIVE PLAYERS

The global digital audio workstation market is expected to continue growing steadily, shaped by ongoing innovation, changing consumer needs, and expanding access to music and audio production tools. As technology becomes more affordable and user-friendly, more people from beginners to professionals are turning to digital audio workstations (DAWs) to create, mix, and edit audio content. The future of this industry will likely see stronger integration with artificial intelligence, cloud-based platforms, and mobile applications, making music production more flexible and accessible across different devices.

Leading companies are constantly competing to introduce new features, better sound quality, and smoother workflows. Among the notable names in the field are Ableton AG, Bitwig GmbH, Renoise, Apple Inc, Harrison Consoles, MOTU, Inc, Cakewalk, Inc, Presonus Audio Electronics Inc, Adobe, Steinberg Media Technologies GmbH, MAGIX Software GmbH, Acoustica, Inc, and Avid Technology, Inc. Each of these companies brings something unique to the table. For instance, some focus on user interface design to simplify the production process, while others invest heavily in tools that improve sound processing or offer innovative plugin options.

This competition will likely lead to a broader set of tools for artists and creators. Future versions of DAWs may offer real-time collaboration, where musicians in different parts of the world can work on the same track at once, with minimal delay. AI tools might help with suggestions for melody, harmony, or arrangement, helping creators stay focused while still having room for originality. Also, cloud-based services will help users manage their projects, presets, and libraries without being limited by hardware or location.

Another trend that will likely shape the future is the growing focus on supporting independent creators. Many companies are already offering affordable or even free versions of their software, giving users a chance to learn and experiment without a big investment. This approach is expected to continue, encouraging more diversity and creativity in the music and audio world. Companies will also compete by building communities around their products, offering tutorials, user forums, and integrated support systems.

As the global digital audio workstation market moves forward, the focus will stay on offering more freedom, speed, and creativity to users. The competition among these key players will keep pushing boundaries, not just by adding new features, but by changing the way people interact with sound. This ongoing progress will open new paths for artists, educators, and content creators across the world.

Digital Audio Workstation Market Key Segments:

By Component

- Software

- Services

By Deployment

- On-premise

- Cloud

By End Use

- Commercial

- Non-Commercial

Key Global Digital Audio Workstation Industry Players

- Ableton AG

- Bitwig GmbH

- Renoise

- Apple Inc

- Harrison Consoles

- MOTU, Inc

- cakewalk, Inc

- Presonus Audio Electronics Inc

- Adobe

- Steinberg Media Technologies GmbH

- MAGIX Software GmbH

- Acoustica, Inc

- Avid Technology, Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383