Global Digital ATC Towers Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global digital ATC towers market will preserve to reshape the air site visitors control industry, redefining how manipulate operations are conducted and monitored. This market will pass beyond the traditional obstacles of aviation technology by merging superior virtual structures with far off operations, making air traffic manipulate more green, bendy, and scalable. In the future, airports across extraordinary regions will rely on digital towers no longer simplest for fee optimization but also for advanced safety and precision in selection-making. The growing shift towards automation and clever aviation infrastructure will set the inspiration for full-size recognition of digital control structures.

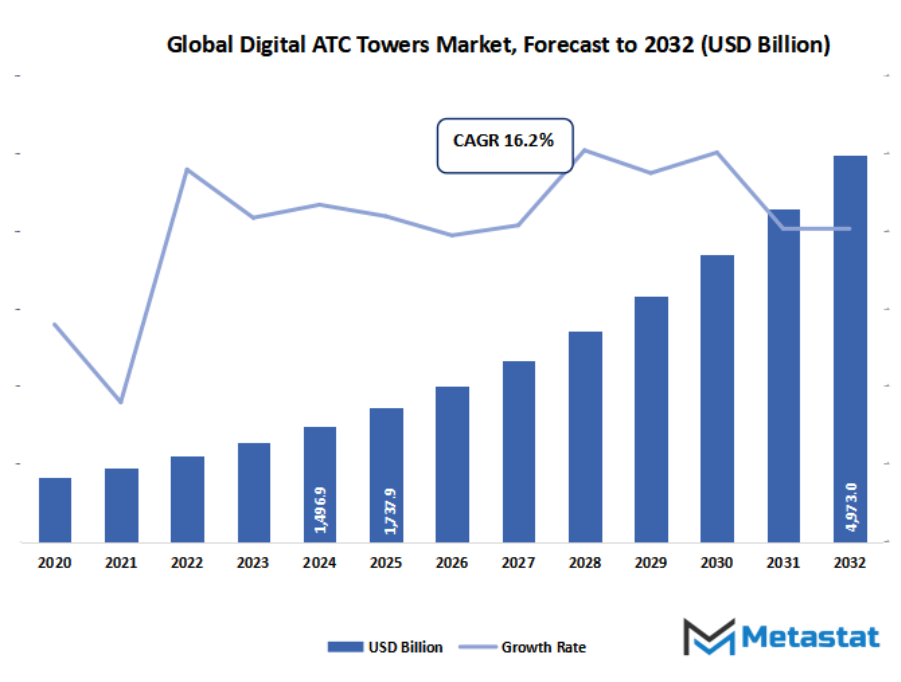

- Global digital ATC towers market valued at approximately USD 1737.9 Digital ATC Towers market valued at USD 1,737 million in 2025, growing at a CAGR of 16.2% during forecast period, with potential to exceed USD 4,973 million by 2032in 2025, growing at a CAGR of around 16.2% through 2032, with potential to exceed USD 4973 million.

- Hardware account for nearly 35.9% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing air traffic and demand for efficient airspace management., Adoption of advanced technologies like AI, IoT, and remote sensing in aviation.

- Opportunities include Expansion in emerging markets with growing aviation infrastructure and limited space for traditional towers.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

How will the adoption of faraway and digital air traffic control towers redefine airport operations and safety requirements across the globe? Could the growing reliance on automation and facts-pushed choice-making disrupt conventional ATC frameworks or expose new cybersecurity vulnerabilities? As airports of various scales embrace this generation, will virtual towers truly deliver on their promise of cost efficiency and operational resilience, or will unexpected demanding situations slow their global enlargement?

As air site visitors volumes continue to grow, the global digital ATC towers market will play a critical role in assisting the modernization of airport communication frameworks. The adoption of actual-time information visualization, high-definition video analytics, and synthetic intelligence will make stronger situational cognizance for controllers coping with a couple of airfields concurrently. This transformation will permit smaller airports to operate with the same accuracy and reliability as main worldwide hubs, bridging the technological gap among local and international aviation networks.

Market Segmentation Analysis

The global digital ATC towers market is mainly classified based on Component, Type, End-User, Deployment Mode.

By Component is further segmented into:

- Hardware - The global digital ATC towers market will witness a steady demand for advanced hardware additives that allow seamless air visitors operations. High-decision cameras, communication systems, and radar sensors will play a crucial role in making sure safe and actual-time tracking of airspaces. Continuous improvements in visible and sensing technology will strengthen operational efficiency throughout airfields, driving future adoption in each industrial and defense sectors.

- Software - The market will see software program answers becoming the center of clever air traffic management. Integrated platforms will enable automated information analysis, far off manipulate, and predictive choice-making for improved situational consciousness. Future software program innovations will ensure adaptability to dynamic site visitors conditions and improve the protection, accuracy, and coordination of aircraft moves international.

- Services - Within the global digital ATC towers market, offerings will play a vital component in preserving and helping digital infrastructure. Installation, preservation, and training offerings will make certain easy operation and overall performance optimization of virtual towers. Future service models will encompass AI-pushed diagnostics and far flung help, presenting price-effective and uninterrupted tower control for international aviation networks.

By Type the market is divided into:

- Single Remote Tower - The global digital ATC towers market will make bigger with the developing adoption of single far flung towers that manipulate visitors for one airport from a far off location. This model will lessen operational expenses and enhance staffing performance even as keeping safety standards. Future implementations will depend on real-time video analytics and automation for stepped forward selection accuracy.

- Multiple Remote Tower - The market will benefit from the development of multiple far flung tower systems capable of handling several airports simultaneously. This setup will optimize resource allocation and beautify manipulate efficiency, mainly in areas with smaller airports. Future advancements will permit synchronized operations supported with the aid of AI, enhancing local airspace coordination.

- Contingency Remote Tower - The global digital ATC towers market will also witness an increasing want for contingency remote towers designed for backup operations. These systems will act as emergency alternatives all through technical disasters or natural disruptions, making sure continuous air site visitors safety. Future answers will integrate quicker switch-over mechanisms and resilient community connections to decrease downtime.

By End-User the market is further divided into:

- Airports - Airports will remain one of the essential adopters within the global digital ATC towers market. The growing passenger site visitors and growth of regional airports will inspire the deployment of virtual towers to handle complicated air operations correctly. Future airports will depend closely on AI-enabled visualization and far flung control to ensure safety and operational continuity.

- Air Traffic Control Centers - Air Traffic Control Centers will keep to invest inside the market to enhance command skills. The integration of actual-time surveillance and communication equipment will enable better coordination between control facilities and flight operations. Future upgrades will include superior statistics-sharing systems, assisting quicker and more correct decision-making.

- Military Bases - Military bases will increasingly more integrate digital tower answers inside the global digital ATC towers market to ensure steady and specific control of protection air operations. Enhanced surveillance and encrypted conversation technology will give a boost to venture safety. Future military applications will prioritize automation and cyber-secure connectivity to assist rapid-response operations.

By Deployment Mode the global digital ATC towers market is divided as:

- On-Premises - The global digital ATC towers market will revel in endured use of on-premises deployment for more manage and records protection. This setup will remain preferred for high-visitors airports and defense centers requiring localized infrastructure. Future on-premises structures will evolve with hybrid capabilities that allow confined remote accessibility with out compromising safety.

- Cloud - The market will move toward cloud-based deployment for flexibility and scalability. Cloud systems will allow real-time data sharing between multiple control centers and airports, improving coordination. Future advancements will bring more secure, faster, and energy-efficient cloud networks that will reshape how air traffic is monitored and controlled globally.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1737.9 million |

|

Market Size by 2032 |

$4973 million |

|

Growth Rate from 2025 to 2032 |

16.2% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

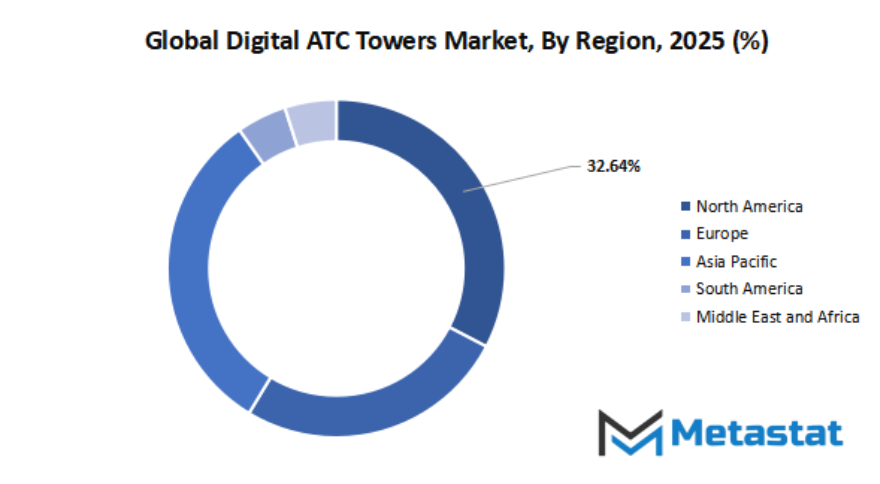

Geographic Dynamics

Based on geography, the global digital ATC towers market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global digital ATC towers market is witnessing tremendous momentum as air site visitors management systems keep to modernize across the world. Digital air site visitors manage towers, often known as remote towers, are transforming how airports control flight operations. They allow air traffic controllers to oversee more than one airports from an unmarried location through excessive-definition cameras, sensors, and facts hyperlinks. This shift will not simplest decorate operational efficiency however also reduce the expenses related to building and preserving traditional towers. With growing call for automation, protection, and actual-time visibility, the marketplace is anticipated to increase step by step in the coming years.

The industry today displays a strong combination of global leaders and emerging nearby competitors working to form the future of aviation control. Companies like Aquila Air Traffic Management Services Limited, Avinor AS, BAE Systems, DFS Deutsche Flugsicherung GmbH, Frequentis AG, Harris Corporation, Honeywell International Inc., and Indra Sistemas S.A. Are some of the pioneers riding technological improvements in virtual tower structures. These firms are specializing in growing flexible, stable, and scalable answers that can be tailored to airports of all sizes. Their collective efforts are directed in the direction of improving verbal exchange systems, visual monitoring, and information integration to decorate situational focus and operational reliability.

Alongside those principal names, players inclusive of Kongsberg Gruppen, L3Harris Technologies, Inc., Leonardo S.P.A., Lockheed Martin Corporation, NATS Holdings Limited, and Northrop Grumman Corporation are introducing smart software program platforms and incorporated structures that enhance choice-making in air visitors manage. The enterprise is also witnessing developing cooperation among technology companies and aviation authorities to make certain that new structures meet regulatory requirements and are seamlessly included into present infrastructures.

Furthermore, companies along with Raytheon Technologies Corporation, Rohde & Schwarz GmbH & Co KG, Saab AB, Searidge Technologies, SkySoft-ATM, and Thales Group are that specialize in advanced analytics, artificial intelligence, and remote tracking technology. Their goal is to create more linked and shrewd airspace management surroundings. These traits will allow for higher coordination between airports, decorate security measures, and improve the general passenger experience. As worldwide air site visitors continues to rise, the need for efficient, digitalized air site visitors control will stay crucial.

In conclusion, the market is on a promising path closer to redefining the aviation landscape. It brings collectively some of the maximum influential era organizations and protection contractors, every contributing to a greater computerized and stable destiny for air travel. The mix of established leaders and revolutionary regional gamers guarantees that opposition will drive non-stop development and modernization. As airports adopt digital tower structures international, the market will maintain to play an essential position in supporting safer, smarter, and more sustainable air traffic control.

Market Risks & Opportunities

- High preliminary setup and maintenance fees of digital tower infrastructure: The global digital ATC towers market will face giant demanding situations because of the large investment required for initial setup and ongoing preservation. Establishing advanced virtual structures, excessive-definition cameras, and stable communique networks demands heavy monetary commitments. Smaller airports and growing regions may conflict to justify these fees, potentially slowing adoption prices. Furthermore, preservation of sophisticated device would require specialised technical expertise, adding to lengthy-time period operational charges. Despite those limitations, sluggish fee reductions via technological development and standardization will in the end ease the burden, permitting broader marketplace participation in the future.

- Regulatory and cybersecurity challenges in remote air site visitors operations: The market will encounter complexities arising from regulatory frameworks and cybersecurity vulnerabilities. Aviation authorities will want time to set up consistent requirements for virtual control operations, in particular for pass-border or far off air visitors management. Strict compliance protocols may be essential to make sure safety and reliability in communique among faraway towers and aircraft. Additionally, with growing reliance on virtual connectivity, the hazard of cyberattacks and device breaches will grow. Securing statistics integrity, conversation networks, and operational continuity would require sturdy cybersecurity measures and consistent device tracking to prevent disruptions in air traffic control.

Opportunities:

- Expansion in emerging markets with growing aviation infrastructure and limited space for traditional towers. The global digital ATC towers market will witness sturdy capacity in emerging areas where aviation infrastructure is expanding unexpectedly but spatial barriers restrict traditional tower installations. Digital towers will provide a price-green and flexible opportunity by using allowing far off air visitors control operations without the need for big physical structures. As growing nations modernize their airports to deal with increasing passenger and cargo volumes, digital answers becomes an attractive option for enhancing efficiency and safety. The ability to centralize multiple airports underneath one digital manipulate center will further enhance operational scalability, making digital ATC structures a key part of destiny aviation boom strategies international.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1737.9 million in 2025 to over USD 4973 million by 2032. Digital ATC Towers will maintain dominance but face growing competition from emerging formats.

Furthermore, the marketplace’s destiny can be driven by means of the combination of advanced connectivity and cloud-based totally structures, permitting seamless data change between remote facilities and on-floor operations. With governments and aviation government predicted to invest more in digital infrastructure, the call for for stable, adaptable, and remotely operated control towers will continue to upward thrust. Beyond the scope of modern applications, this marketplace will pave the manner for a new generation of air traffic control systems.

Report Coverage

This research report categorizes the global digital ATC towers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global digital ATC towers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global digital ATC towers market.

Digital ATC Towers Market Key Segments:

By Component

- Hardware

- Software

- Services

By Type

- Single Remote Tower

- Multiple Remote Tower

- Contingency Remote Tower

By End-User

- Airports

- Air Traffic Control Centers

- Military Bases

By Deployment Mode

- On-Premises

- Cloud

Key Global Digital ATC Towers Industry Players

- Aquila Air Traffic Management Services Limited

- Avinor AS

- BAE Systems plc

- DFS Deutsche Flugsicherung GmbH

- Frequentis AG

- Harris Corporation

- Honeywell International Inc.Indra Sistemas S.A.

- Kongsberg Gruppen

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- NATS Holdings Limited

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rohde & Schwarz GmbH & Co KG

- Saab AB

- Searidge Technologies

- SkySoft-ATM

- Thales Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383