MARKET OVERVIEW

The Global Cyber Security Insurance market embodies a vibrant space within the umbrella of the larger insurance industry ecosystem, where technological advancement meets the management of risks and financial security. It becomes a strong line of defense in the rising cyber threats as an indemnity for risk mitigation products for companies maneuvering in perilous waters digital interconnectedness.

In this nascent industry, insurers rely on a mosaic of data analytics, threat intelligence, and actuarial modeling to assess and underwrite cyber risks. Policies are crafted to address a spectrum of cyber perils, encompassing data breaches, ransomware attacks, business interruption, and regulatory non-compliance. With the increased connected devices and coming of Industry 4.0, demand for cyber insurance will increase due to the businesses being more vigilant against the dynamic change in cyber threat landscape.

Paradigmatic shift in risk perception triggers Global Cyber Security Insurance companies to recalibrate their underwriting strategies in light of emerging threats such as supply chain vulnerabilities, cloud security risks, and geopolitical cyber tensions. As cyber adversaries employ more sophisticated tactics, insurers have devised innovative products to mitigate contingent liabilities and enhance cyber resilience in the various industries: finance, healthcare, manufacturing, and so on.

The market is converging on the integration of cyber insurance with additional risk management offerings, like incident response services, threat intelligence, and vulnerability assessments. Strategically, most of the reinsurers and security companies are coming forward to make collaborations with these insurances and have an overall comprehensive view over them.

The Global Cyber Security Insurance market is not without its challenges. Insurers face the inherent opacity of cyber risk as the evolving threat landscape defies conventional actuarial models and historical data analysis. Moreover, regulatory fragmentation and divergent data breach notification requirements present a labyrinthine compliance landscape for insurers operating across jurisdictions.

Looking ahead, the Global Cyber Security Insurance market is expected to grow exponentially on account of cyber threats, regulatory imperatives, and digital transformation imperatives. The insurers have to be innovation- and agile-minded to beat the curve of growth, especially with emerging technologies such as AI, blockchain, and machine learning for better risk assessment, claims processing, and fraud detection.

The Global Cyber Security Insurance market represents a nexus of innovation and resilience in an era defined by digital disruption and cyber insecurity. With businesses today dealing with the vagaries of the digital age, cyber insurance remains a crucial bulwark: financial protection in an uncertain world.

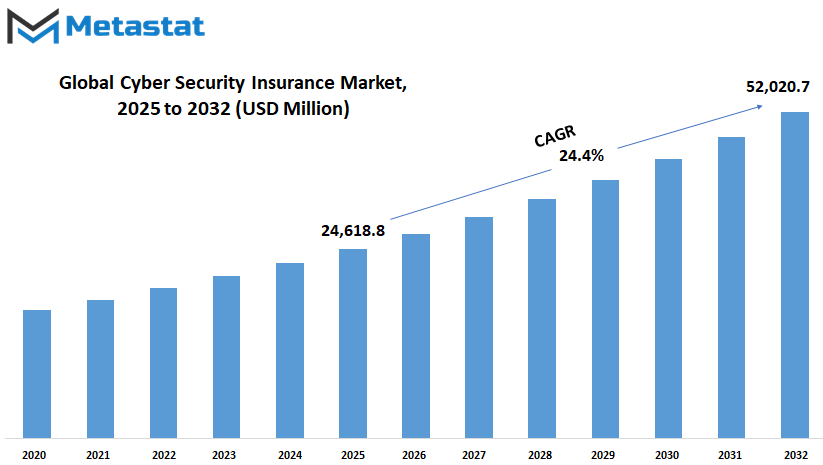

Global Cyber Security Insurance market is estimated to reach $ 52,020.7 Million by 2032; growing at a CAGR of 24.4% from 2025 to 2032.

GROWTH FACTORS

With current trends, Global Cyber Security Insurance market is showing quite a boost because of several elements that have shaped the manner with which organizations conduct risk management through the digital window. The escalation in frequency and severity of attacks is one reason for this advancement. This ranges from data breaches to ransomware attacks, which have focused attention on weaknesses in the existing digital architecture of the world, thus compelling organizations to strengthen their defenses. In this respect, in response to this imperative, organizations increasingly apply cyber insurance as a strategic form of protection against potential financial impacts from such an event.

On the other hand, regulatory mandates have had a big impact on the direction that the cyber insurance market has taken. The regulations demand that companies apply strict security controls and notify as soon as there is a breach. Businesses must, therefore, have coverage for compliance purposes as well as avoidance of punitive damages from non-compliance.

Nevertheless, in the midst of this emerging demand, a lack of standard metrics for assessing cyber risk remains a significant issue. This absence of commonly agreed-upon measures makes underwriting and pricing cyber insurance policies particularly challenging for insurers, who have to make best estimates of how much risk exposure their clients face.

This is further complicated by the absence of historical data and actuarial models unique to cyber risk. These foundational resources are in short supply most of the places; therefore, insurers cannot have clear outlines of the risk profile, which, naturally, means higher premiums and fewer coverages.

While the various challenges have thrown up some adversity, a silver lining emerges when it comes to growing business recognition of the critical need for managing cyber risks. With enterprises increasing awareness of cyber attacks and financial consequences, this is going to be an unprecedented appetite for whole-of-value coverage insurance. A fertile terrain emerges for insurers with a prospect for expansion of the cyber insurance book and entry into new markets-a trajectory for this market to keep growing in the future.

The Global Cyber Security Insurance market is poised for exponential growth, driven by an amalgamation of factors ranging from escalated cyber threats to regulatory imperatives and evolving market dynamics. While challenges persist, the prevailing trends augur well for insurers poised to capitalize on the burgeoning demand for comprehensive cyber insurance solutions.

MARKET SEGMENTATION

By Type

Global Cyber Security Insurance Market is going to increase as cyber threats are increasing. The world has become digital and the companies have become highly dependent on technology, so cyber threats are becoming very high and more advanced, hence companies of all sizes will suffer from huge losses due to hacking, data breach, etc. So cyber security insurance becomes inevitable for all those organizations seeking stability. This market will likely be steady as industries realize the importance of safeguarding their digital operations. The market will be shaped by two key areas: solutions and services.

Solutions will focus on software and tools that help detect, prevent, and respond to cyber threats. These include firewalls, encryption systems, and AI-driven security tools that identify risks before they cause damage. New protection methods will become available as a response to further sophistications on the part of cybercriminals. Companies are bound to buy into new technology with better protecting powers to counter increasing security requirements.

On the other hand, services are going to form a significant chunk of the businesses’ cyber risks management. It includes consulting and risk assessment followed by response strategies that guide the companies on effective handling of cyber incidents. The insurers will consult with the clients to formulate policies that will include financial losses as a result of cyberattacks in order to get the businesses to recover fast.

With the evolving complexity of cyber threats, expert guidance will increase demand, thereby making services integral to the market’s growth. The future of the Global Cyber Security Insurance market will be shaped by new threats and technological advancements. AI and machine learning will play a bigger role in identifying vulnerabilities and predicting potential attacks.

Automation will help insurers process claims faster, reducing downtime for affected businesses. Additionally, blockchain technology may improve security by offering transparent and tamper-proof data storage, reducing fraud risks. These will nudge the industry toward more efficient and reliable insurance solutions. Other impacts of market expansion would be given by regulations and government policies.

As cyber threats are affecting more industries than ever, stricter security laws will be introduced by the government, which would force companies to strengthen their defenses in the digital world. Demand for insurance against such cyber risks would come from compliance with such laws, thus opening new avenues for underwriters while developing policies to address risks specific to a particular industry. The global cyber security insurance market shall continue to thrive with the increment of digital threat.

Companies must have stronger solution and expert service to protect themselves from the wrong operations. Based on the future development of this technology and compliance, this remains a vital space in the context of global commerce, enabling such organizations to enter the realm with confidence.

By Technology

The global cyber security insurance market will be booming because companies and individuals are increasingly relying on digital platforms. Such rapidness in technological development has brought about the need for protection against cyber threats more than at any time in history. Cyberattacks, data breaches, and financial losses due to hacking incidents have forced companies into finding better security solutions.

There is no such security measure taken in terms of cyber because they prevent attacks but do not ensure complete protection. This is where cyber security insurance steps in, giving financial protection in case of possible losses that occur due to cyber incidents. As technology develops, businesses tend to store and process vast amounts of sensitive information, which they become the focal point for cybercriminals.

The demand for insurance policies to cover a multitude of threats will continue to increase. Companies have started to realize that one breach can lead to devastating financial and reputational loss. This change in perception is fueling the use of cyber security-specific insurance policies, which vary between data breaches, data loss, and liability from cyber attacks.

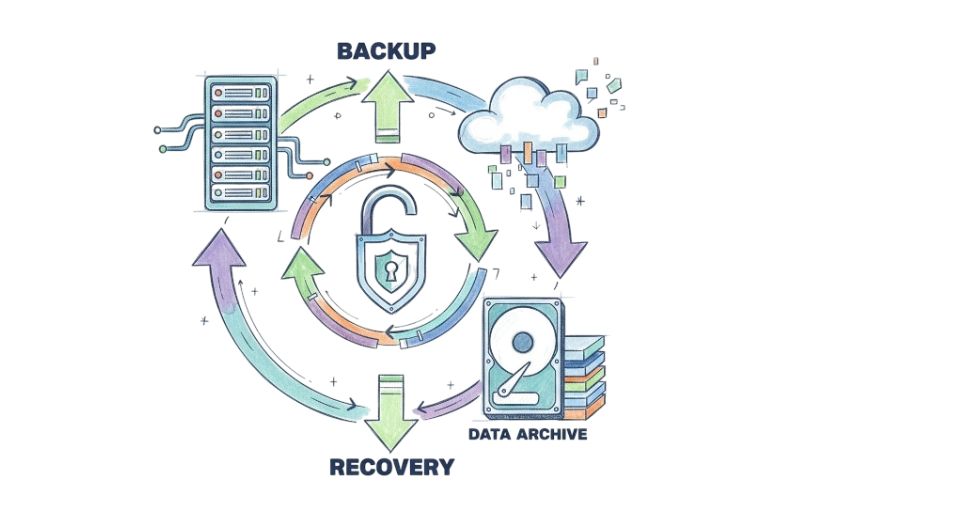

These kinds of insurance aids businesses in coping with attacks through compensation to include legal fees, fines, cost for notification of customers, and also ransom payment in instances of ransomware. Data breaches are among the largest risks businesses today face. Hackers exploit the vulnerabilities of a system to get unauthorized access to sensitive information. This includes the customer data, financial records, and trade secrets.

A breach can cause widespread disruptions, lead to lawsuits and financial penalties, and result in a loss of reputation. Because cyber threats evolve with time, insurance providers will continue to review their policies for better protection of such incidents. As artificial intelligence and machine learning become integral to security measures, insurers will likely adjust their coverage based on how well a company's security infrastructure is maintained.

Data loss is another major concern, whether due to cyberattacks, accidental deletions, or system failures. Businesses that lose critical data risk operational setbacks, regulatory violations, and loss of customer trust. In the future, insurers may offer policies that not only cover data recovery costs but also help companies implement stronger preventive measures. Organizations with advanced data protection strategies might receive better policy terms, encouraging proactive cybersecurity efforts.

Cyber security liability is another influential factor in the Global Cyber Security Insurance market. If a firm fails to protect its users' data, then liability may be held. Such lawsuits and fines can be costly and overwhelming to a small business firm. With more efficient and harsh data protection policies from governments, firms will need insurance coverage for all matters related to these policies.

Technological innovations, stringent regulations, and increasing cyber threat sophistication are some of the major factors that will determine the future of the market. As businesses become increasingly dependent on digital operations, demand for the right kind of insurance policies, therefore, will definitely increase, and even be a factor of financial stability in an increasingly digital world.

By Insurance Type

The Global Cyber Security Insurance market has been witnessing rapid growth. As businesses have started to be more dependent on digital technologies, the market will continue to expand. With growing cyberattacks, cyber insurance becomes an essential product for companies wishing to protect themselves from data theft and potential loss. The future of the market for cyber security insurance will emerge in the following years as it is expected to evolve with growing demand for custom-made solutions from businesses. Within this market, two types of insurance are gaining prominence: packaged and stand-alone.

Packaged cyber security insurance is a comprehensive form of coverage. It offers various coverages in one package, providing broader protection to businesses. This includes data breaches, business interruption, and liability among others, as a one-stop solution for an organization looking to protect itself against a range of cyber threats. Companies are going to be attracted to packaged policies because it is relatively easy to use and very convenient. It also comes in a variety of forms whether it is a small startup or even a large corporation. One more benefit about having packaged policies is the saving which it gives to the businesses because it gives a compilation of many protections into just one policy or plan.

Looking toward the future, the demand for both packaged and stand-alone cyber security insurance policies will continue to grow. As cyber threats increasingly become sophisticated against businesses, demand for customized comprehensive coverage will increasingly be required. Companies will ask for insurance coverage that provides sufficient protection but in a flexible model to accommodate each company’s requirement. The demand for cyber security insurance is set to become fiercer, thus forcing insurers into innovation of more products to try and keep abreast with increased demand for protection of digital risk.

It Is clear that, as the landscape of cyber threats evolves, businesses will have to rely much on cyber insurance to help them navigate the risks of the digital age. The two packaged and stand-alone options will play great roles in keeping organizations secure and protecting their assets from online dangers. With the frequency and complexity of cyberattacks increasing by the day, it is only a matter of time before businesses around the world realize the need for cyber security insurance as part of their overall risk management strategy.

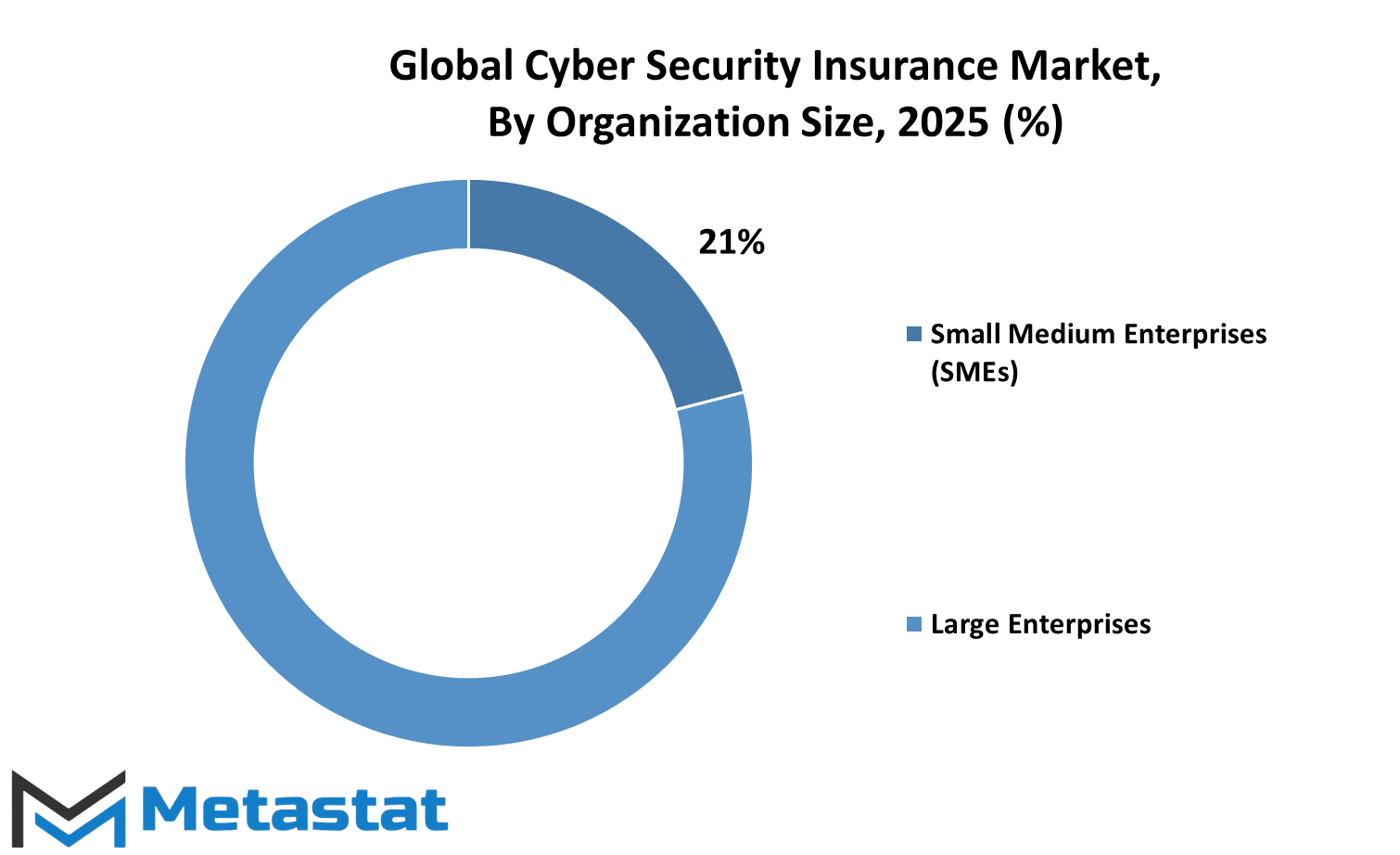

By Organization Size

With the increasing frequency and sophistication of cyber attacks, companies are recognizing the need to protect themselves from potential threats. One emerging solution to mitigate the risks associated with cyber attacks is cyber security insurance.

Cyber security insurance provides financial protection to organizations in the event of a cyber attack or data breach. It helps cover the costs associated with remediation, such as forensic investigations, legal fees, and customer notification. Additionally, it can provide coverage for business interruption losses and extortion payments to hackers.

The global Cyber Security Insurance market is experiencing significant growth as organizations seek to safeguard their digital assets. By offering financial protection against cyber threats, cyber security insurance enables businesses to manage their risks more effectively. As a result, the market is expected to continue expanding in the coming years.

One factor driving the growth of the cyber security insurance market is the increasing adoption of digital technologies by businesses of all sizes. Large enterprises, as well as small and medium-sized enterprises (SMEs), are recognizing the importance of protecting their data and systems from cyber threats. As a result, the demand for cyber security insurance is rising across various industries and sectors.

Large enterprises have long been the primary targets of cyber attacks due to their valuable data and extensive digital infrastructure. However, SMEs are increasingly becoming targets as well, as hackers recognize the potential vulnerabilities in their systems. As a result, both large enterprises and SMEs are investing in cyber security insurance to protect themselves from potential financial losses.

In response to the growing demand for cyber security insurance, insurance providers are offering a wide range of coverage options tailored to the needs of different organizations. These options may include basic coverage for data breach response and liability protection, as well as more comprehensive policies that cover additional expenses such as business interruption and extortion.

REGIONAL ANALYSIS

In today's interconnected world, the issue of cybersecurity has become increasingly paramount. As our reliance on digital systems and networks continues to grow, so too does the need to protect them from cyber threats. One emerging solution to this problem is cyber security insurance.

The global cyber security insurance market is a multifaceted landscape, with different regions around the world facing unique challenges and opportunities. Geographically, this market is divided into several key regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

Within North America, the market is further segmented into the United States, Canada, and Mexico. Each of these countries has its own distinct cyber risk profile, shaped by factors such as the size of its economy, the maturity of its digital infrastructure, and the prevalence of cybercrime

Europe is another important region in the global cyber security insurance market, with countries such as the United Kingdom, Germany, France, Italy, and others playing significant roles. The European market is characterized by a diverse range of regulatory frameworks and cultural attitudes towards cybersecurity, which can influence the demand for insurance products.

Moving to the Asia-Pacific region, we encounter a dynamic and rapidly evolving landscape. Countries like India, China, Japan, and South Korea are experiencing rapid digital transformation, driven by factors such as urbanization, economic growth, and technological innovation. As a result, the demand for cyber security insurance is expected to rise significantly in these markets in the coming years.

South America is also an important region to consider in the global cyber security insurance market, with countries like Brazil and Argentina emerging as key players. Like other regions, South America faces its own unique set of cyber risks, including issues related to political instability, economic inequality, and insufficient regulatory oversight.

The Middle East & Africa region presents both challenges and opportunities for the cyber security insurance market. Countries in this region, such as the GCC Countries, Egypt, and South Africa, are investing heavily in digital infrastructure and cybersecurity capabilities. However, they also face challenges such as geopolitical instability, cultural barriers, and a lack of awareness about cyber risks.

The global cyber security insurance market is a complex and dynamic ecosystem, shaped by factors such as geography, regulation, and technological innovation. As cyber threats continue to evolve, so too will the demand for insurance products that can help organizations mitigate their risks and protect their digital assets.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$19,685.8 million |

|

Market Size by 2032 |

$52,020.7 Million |

|

Growth Rate from 2024 to 2031 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

COMPETITIVE PLAYERS

In the fast-paced digital landscape of today, the importance of cybersecurity cannot be overstated. With the ever-increasing reliance on technology, businesses and individuals alike face a multitude of cyber threats that can jeopardize sensitive information and disrupt operations. In response to these challenges, the Global Cyber Security Insurance market has emerged as a critical safeguard against cyber risks.

Key players in the Cyber Security Insurance industry span various sectors, including End Users, Technology Providers, and Insurance Providers. Among the prominent names in this market are AXA XL, AIG, Berkshire Hathaway, Zurich Insurance, Chubb, AON, Insureon, Lockton, Security Scorecard, Allianz, Munich Re, Axis, BitSight, Prevalent, RedSeal, and Arthur J. Gallagher & Co, as well as Cyber Indemnity Solutions.

As cyber threats continue to evolve and become more sophisticated, organizations are increasingly turning to cyber insurance to mitigate the financial impact of potential breaches. Cyber insurance policies typically cover a range of expenses associated with a cyber incident, including forensic investigations, legal fees, notification costs, and even extortion payments. Additionally, some policies may also provide coverage for business interruption losses and reputational damage.

For businesses, investing in cyber insurance can provide peace of mind knowing that they have financial protection in the event of a cyber attack. Furthermore, having cyber insurance in place can also help organizations demonstrate to their customers and partners that they take cybersecurity seriously, which can enhance trust and credibility.

However, it's important to note that cyber insurance is not a one-size-fits-all solution. Policies can vary significantly in terms of coverage limits, exclusions, and deductibles, so it's essential for organizations to carefully evaluate their cyber insurance needs and select a policy that aligns with their specific risks and budget.

Moreover, cyber insurance should not be viewed as a substitute for robust cybersecurity measures. While insurance can provide financial assistance after a breach occurs, preventing breaches in the first place should remain a top priority for organizations. This includes implementing strong security controls, regularly updating software and systems, conducting employee training, and staying informed about emerging cyber threats.

The Global Cyber Security Insurance market is poised for continued growth as organizations recognize the importance of protecting themselves against cyber risks. By partnering with reputable insurance providers and implementing comprehensive cybersecurity strategies, businesses can better safeguard their assets and mitigate the potentially devastating consequences of cyber attacks.

Cyber Security Insurance Market Key Segments:

By Type

- Solutions

- Services

By Technology

- Data Breach

- Data Loss

- Cybersecurity Liability

By Insurance Type

- Packaged

- Stand-alone

By Organization Size

- Large Enterprises

- SMEs

Key Global Cyber Security Insurance Industry Players

- AXA XL

- AIG

- Berkshire Hathaway

- Zurich Insurance

- Chubb

- AON

- Insureon

- Lockton

- Security Scorecard

- Allianz

- Munich Re

- Axis

- BitSight

- Prevalent

- RedSeal

- Arthur J. Gallagher & Co

- Cyber Indemnity Solutions

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252