Global Courier, Express, and Parcel Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global courier, express, and parcel market will go much further than the existing operational frontiers, becoming a service business characterized by intelligence, accuracy, and customer experience. As trade accelerates even further, the market will cease being limited to the mere transportation of parcels between destinations. Instead, it will become a network where technology-based speed, transparency, and efficiency will transform the exchange of goods across the globe. Operations of the future will be dependent on digital monitoring, automated logistics, and environmentally friendly delivery systems that aim to minimize time as well as environmental footprint.

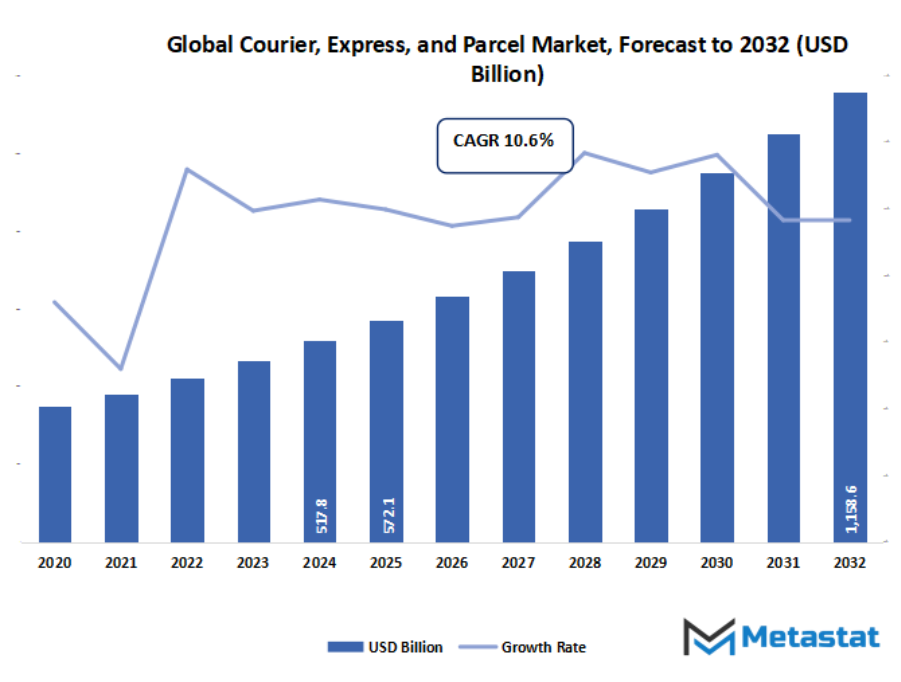

- Global courier, express, and parcel market valued at approximately USD 572.1 Billion in 2025, growing at a CAGR of around 10.6% through 2032, with potential to exceed USD 1158.6 Billion.

- Standard Delivery account for nearly 50.3% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rapid growth of e-commerce boosting last-mile delivery demand., Increasing cross-border trade and global logistics integration.

- Opportunities include Adoption of automation and drone delivery technologies for faster operations.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

What if the growing shift toward e-trade and digital logistics completely redefines how parcels flow throughout borders? Could automation and drone deliveries disrupt conventional courier networks quicker than predicted? And as sustainability becomes a global precedence, how would possibly the global courier, express, and parcel market adapt to stability velocity with environmental duty?

This market will increasingly be about forging better relationships between the global and local trade networks. As cross-border business grows at a rapid pace, parcel and courier businesses will implement more intelligent systems that predict delays, optimize routes, and tailor services to both enterprise and individual consumers. The destiny of this marketplace may even witness corporations using information-knowledgeable procedures to map nearby desires, enhance transport reliability, and drive customer satisfaction via real-time intelligence.

Market Segmentation Analysis

The global courier, express, and parcel market is mainly classified based on Service, Delivery, Mode of Transport, End Use.

By Service is further segmented into:

- Standard Delivery

The global courier, express, and parcel market will see incredible increase through well-known transport services. This segment will continue to be a relied on option for organizations searching out less costly logistics solutions. Through higher scheduling systems and automated routing, general shipping could be greater streamlined, offering consistent timelines whilst retaining affordability for bulk shipments.

- Express Delivery

Express shipping will solidify its presence in the market as purchaser demand for speedy shipping continues on growing. The use of AI-based totally tracking, predictive logistics, and excessive-cease sorting centers will facilitate quicker shipping cycles. This will in shape industries with time-sensitive consignments in mind, even as client pleasure stages improve.

- Same-Day Delivery

The day-of-delivery segment will revolutionize the market by way of conforming to the contemporary need for instantness. Retailers and on-line shops will increasingly depend upon this carrier to boom competitiveness. Electric automobiles, drone generation, and streamlined city logistics networks will also speed up identical-day achievement.

- Last-Mile Delivery

Last-mile delivery will become the defining section of the global courier, express, and parcel market. There will be a shift in the direction of hassle-loose, era-supported solutions that supply advanced end-consumer enjoy. With growing urbanization and virtual exchange, innovations like automated lockers, actual-time visibility, and touchless transport will rule this area.

By Delivery the market is divided into:

- International

The go-border transport phase will increase its attain within the global courier, express, and parcel market resulting from developing move-border change and international online purchasing. Digital customs clearance investments, AI-powered risk control, and blockchain-based documentation will cut down on delays and inspire smoother global logistics processes.

- Domestic

Domestic shipping will remain a dominant phase of the market, propelled by using boom in neighbourhood online purchases and nearby enterprise-to-commercial enterprise transactions. With improving infrastructure, actual-time region monitoring, and direction optimization technology, domestic delivery might be faster and greater efficient.

By Mode of Transport the market is further divided into:

- Roads

Roads will remain the spine of the global courier, express, and parcel market due to adaptability and price-effectiveness. Smart fleets, electric trucks, and automatic site visitors management structures will make a contribution to road delivery turning into more sustainable and on-time, able to assisting each rural and urban deliveries successfully.

- Airways

Airways turns into a key enabler for growing the market, specifically for excessive-cost and time-sensitive shipments. Combining virtual shipment control and AI-based totally flight scheduling will reduce transit instances, making air transport an attractive mode for global express services.

- Railways

Rail transport will become increasingly good sized within the market as countries put money into excessive-velocity freight corridors. This mode will provide a stability of cost effectiveness and speed, with an environmentally pleasant choice for transporting bulk parcels over lengthy distances.

- Waterways

Waterways will assist the market by making mass global shipments at decrease charges. New advances in port automation, digital field tracking, and green transport techniques will make maritime logistics extra dependable and carbon-efficient.

By End Use the global courier, express, and parcel market is divided as:

- E-commerce

E-commerce will propel full-size adjustments within the global courier, express, and parcel market. As online retailing continues to upward push, logistics companies will implement predictive analytics, sensible warehousing, and automatic packaging era to address extended volumes of orders in an efficient manner and decorate remaining-mile transport experiences.

- Healthcare

Healthcare will stay an essential industry inside the market. Temperature-controlled and secure transport call for will grow with the growth of pharmaceutical and scientific device distribution. IoT sensor integration and GPS tracking will provide warranty of compliance, safety, and actual-time tracking of sensitive shipments.

- Manufacturing

Manufacturing will play a first-rate role within the market with the transportation of system, raw materials, and components. Highly advanced supply chain automation, computerized inventory control, and route optimized transport will maximize commercial enterprise effectiveness and minimize downtime in business logistics.

- Wholesale & Retail

Wholesale and retail operations will preserve to persuade the market. Timely replenishment, powerful stock movement, and responsive distribution structures will continue to be the thrust. Technological improvements will make it extra obvious and quicker turnaround from warehouses to save shelves.

- Others

These industries, consisting of schooling, authorities, and private transport services, will back steady boom inside the market. Through digitization and adaptive delivery models, these industries will undertake state-of-the-art verbal exchange and logistics era.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$572.1 Billion |

|

Market Size by 2032 |

$1158.6 Billion |

|

Growth Rate from 2025 to 2032 |

10.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

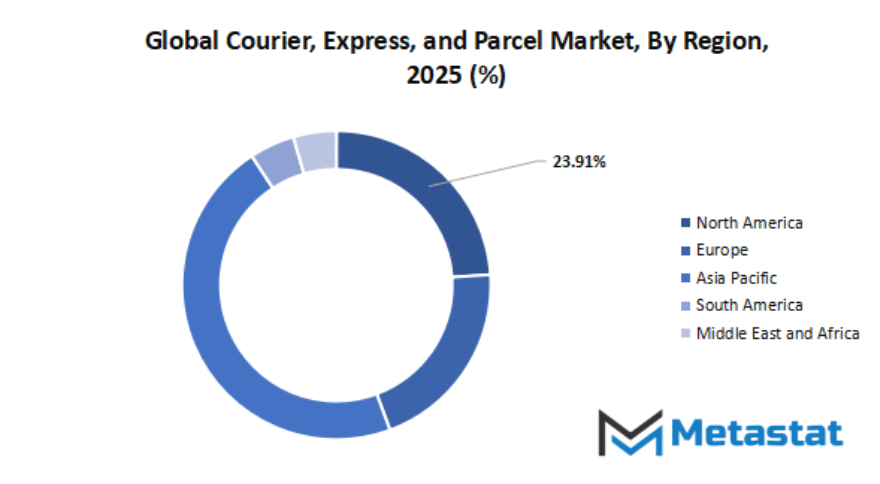

Based on geography, the global courier, express, and parcel market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global courier, express, and parcel market file by means of Metastat Insight mirrors the accelerating charge of alternate, era, and purchaser expectations beyond borders. The zone has come to be a critical part of worldwide logistics, linking agencies and customers via speedy, secure, and dependable transport solutions. With e-commerce continuing to develop, demand for timely parcel delivery has reached unheard of levels. Both corporations and people depend distinctly on these offerings nowadays, both for comfort and ensuring commercial enterprise continuity and customer delight. The market will maintain evolving to cope with increasing demands for speed, transparency, and sustainability.

The market is a combination of global players and nearby gamers that make a contribution to its fast evolution. Well-set up brands like FedEx, Aramex, TNT Express, Amazon Logistics, Blue Dart Express Ltd., Qantas Airways Limited, Deutsche Post DHL Group, Royal Mail Group Limited, Yamato Transport Co., Ltd., SF Express (Group) Co. Ltd., One World Express Inc. Ltd., and United Parcel Service Inc. Dominate the worldwide community. They come with massive assets, state-of-the-art infrastructure, and state-of-the-art monitoring technology that increase new benchmarks for reliability and performance. Along with them, newer nearby players introduce range into the market with localized strategies, adaptive pricing, and remaining-mile answers unique to customers' wishes.

The increase of virtual structures and mobile logistics control has revolutionized the courier and explicit enterprise. Parcels can now be tracked in real-time, deliveries remotely controlled, and faster turnaround instances predicted. This exchange has ensured innovation and generation attractiveness is not a desire but a demand for businesses to remain aggressive. Automation, synthetic intelligence, and information analytics at the moment are being applied extra to streamline transport routes, decrease operating charges, and decorate standard carrier performance.

Sustainability is also an increasing problem within the industry. Several top gamers are switching towards inexperienced options, which include electric delivery motors and recyclable packaging materials, as they intention to lower their carbon footprint. This shift follows growing pressure from customers and governments to encourage greener logistics options. As companies search for new ways to stability cost, velocity, and sustainability, the industry will shift towards an environmentally conscious destiny.

In the years ahead, the global courier, express, and parcel market will enjoy more integration of state-of-the-art technologies and strategic alliances. Competition among conventional leaders and regional players will provide room for elevated innovation and enhancement of offerings. With on-line alternate continuing to grow throughout the globe, the market will remain a crucial aspect of current alternate, influencing how merchandise are transported around the globe with tempo, accuracy, and dependability.

Market Risks & Opportunities

Restraints & Challenges:

- Premium fuel and transport costs impacting income margins: The global courier, express, and parcel market will continue to be below the pressure of growing gasoline and transportation charges. With growing logistics networks and delivery volumes, operational prices will maintain exercise stress on the profit margin. Sustainability within the future will depend on utilizing alternative energy resources and enhancing route effectiveness to offset costs.

- Limited infrastructure in rural and developing regions: The market will have challenges with logistics hurdles in regions that do not have good enough delivery and warehousing centers. Narrow avenue networks, vulnerable postal infrastructure, and lagging connectivity will avoid delivery speed. Overcoming those boundaries will involve sizeable investment in nearby infrastructure and contemporary digital monitoring structures.

Opportunities:

- Implementation of automation and drone delivery technology for progressed velocity: The global courier, express, and parcel market will see outstanding improvement thru automation and drone-based totally logistics. Automated sorting, AI-driven transport control, and unmanned aerial motors will revolutionize efficiency, making deliveries faster and more accurate. These trends will change the worldwide transport timeline and reframe the future of parcel transport.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 572.1 Billion in 2025 to over USD 1158.6 Billion by 2032. Courier, Express, and Parcel will maintain dominance but face growing competition from emerging formats.

Additionally, sustainability can be a key motive force in framing the direction of the enterprise. Electric fleets, drone deliveries, and recycling applications can be common, supporting corporations in aligning with the world's environmental targets. With e-commerce continuing to reign splendid, the global courier, express, and parcel market becomes an included community that serves now not just logistics however additionally innovation in trade accessibility and customer revel in as properly. Those lines between era, logistics, and sustainability will converge, growing an industry as a way to live and breathe on accuracy, flexibility, and worldwide cooperation.

Report Coverage

This research report categorizes the global courier, express, and parcel market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global courier, express, and parcel market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global courier, express, and parcel market.

Courier, Express, and Parcel Market Key Segments:

By Service

- Standard Delivery

- Express Delivery

- Same-Day Delivery

- Last-Mile Delivery

By Delivery

- International

- Domestic

By Mode of Transport

- Roadways

- Airways

- Railways

- Waterways

By End Use

- E-commerce

- Healthcare

- Manufacturing

- Wholesale & Retail

- Others

Key Global Courier, Express, and Parcel Industry Players

- FedEx

- Aramex

- TNT Express

- Amazon Logistics

- Blue Dart Express Ltd.

- Qantas Airways Limited

- Deutsche Post DHL Group

- Royal Mail Group Limited

- Yamato Transport Co., Ltd.

- SF Express (Group) Co. Ltd.

- One World Express Inc. Ltd.

- United Parcel Service Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252