MARKET OVERVIEW

The Cosmetic Testing Service Market segment encapsulates a wide array of services, each geared towards addressing the unique needs and demands of cosmetics and personal care product manufacturers. From assessing the skin compatibility of new formulations to conducting comprehensive safety evaluations, the Cosmetic Testing Service Market is an indispensable ally to brands striving for consumer trust and success in the market.

Cosmetic manufacturers continually seek to develop innovative products that address evolving consumer preferences and needs. To achieve this, they rely on the Cosmetic Testing Service Market to assess the performance of new formulations. These assessments include stability testing, compatibility testing, and performance testing to determine the effectiveness and shelf-life of products. This enables brands to refine their formulations and release products that meet the highest quality standards.

Consumer demand in the cosmetics industry is a driving force behind the creation of new products. The Cosmetic Testing Service Market assists manufacturers in understanding consumer preferences and expectations by conducting consumer perception studies and preference testing. These studies provide valuable feedback on scent, texture, and packaging, allowing brands to fine-tune their products to better resonate with their target audience.

The Cosmetic Testing Service Market is integral to the cosmetics industry's success. By facilitating regulatory compliance, fostering product innovation, and catering to consumer preferences, these services help cosmetic manufacturers navigate the complexities of an industry shaped by constant change. Furthermore, their commitment to ethical and sustainable practices reflects the growing global consciousness of responsible consumption. As consumer expectations continue to evolve, the role of the Cosmetic Testing Service Market remains pivotal in ensuring that cosmetic products meet the highest standards of quality, safety, and consumer satisfaction.

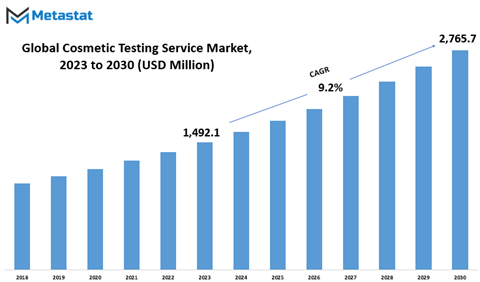

Global Cosmetic Testing Service market is estimated to reach $2,765.7 Million by 2030; growing at a CAGR of 9.2% from 2023 to 2030.

GROWTH FACTORS

The Global Cosmetic Testing Service market is influenced by several key factors. One significant driver is the increasing consumer demand for safe and effective cosmetic products. Consumers today are more conscious about the products they use on their skin, hair, and body. They seek assurance that these products are not only effective but also safe for their health. This growing awareness and demand for safety drives the need for rigorous testing of cosmetic products to ensure they meet the highest standards of quality and safety.

Another driver for the cosmetic testing service market is the growing regulatory requirements for cosmetic product testing. Regulatory bodies around the world are becoming more stringent in their requirements for testing and safety assessments of cosmetic products. This is particularly evident in regions such as Europe and North America, where regulations have been tightened to protect consumers from potentially harmful ingredients and ensure product safety.

However, there are certain restraints that the cosmetic testing service market faces. One of these is the high costs associated with cosmetic testing services. Conducting comprehensive and reliable testing on cosmetic products can be an expensive process. Companies need to invest in state-of-the-art equipment, employ skilled professionals, and undergo extensive testing procedures, all of which come at a significant cost. These expenses can deter smaller cosmetic companies from accessing such testing services, limiting market growth.

Ethical concerns related to animal testing also pose a restraint on the cosmetic testing service market. Many consumers and advocacy groups are against animal testing for cosmetics due to ethical reasons. This has led to regulatory changes in various regions, such as the European Union, which has implemented strict bans on animal testing for cosmetic products. These ethical concerns can limit the scope of testing methods available to cosmetic companies, affecting the market.

On the other hand, an opportunity for the cosmetic testing service market lies in the rise of alternative testing methods. In vitro testing and computer modeling have emerged as viable and ethical alternatives to traditional animal testing. These methods offer accurate and reliable results without the need for animal experimentation. As these alternatives gain acceptance and regulatory approval, they present an opportunity for cosmetic testing service providers to expand their offerings and cater to a wider range of customers. By embracing these innovative testing methods, companies can enhance their market presence and meet the demands of both regulators and consumers, ultimately driving growth in the cosmetic testing service market.

MARKET SEGMENTATION

By Type

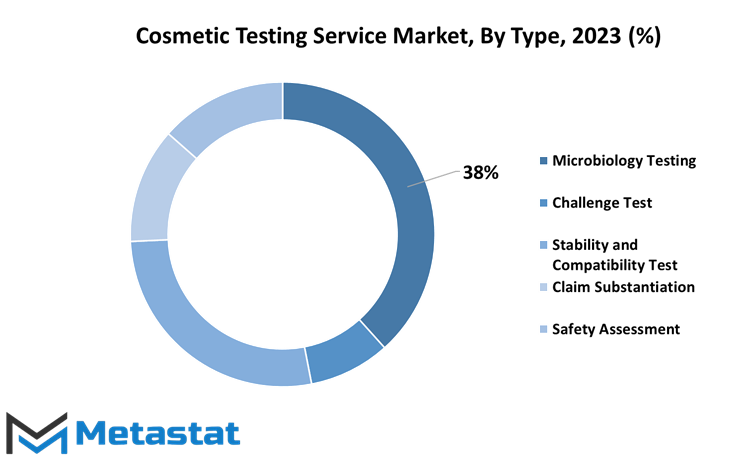

The Global Cosmetic Testing Service market is a dynamic industry, with various segments that cater to specific needs within the cosmetic and personal care sector. These segments play a pivotal role in ensuring the safety, quality, and effectiveness of cosmetic products that consumers use in their daily lives.

One of the key segments in this market is Microbiology Testing, which was valued at 529 USD Million in 2022. Microbiology testing is crucial for assessing the microbiological quality of cosmetic products. It involves the examination of these products to detect the presence of harmful microorganisms such as bacteria, yeast, and molds. This testing is essential to ensure that cosmetics are free from contamination, which could lead to skin irritations or other adverse effects on consumers.

The Challenge Test segment, valued at 118.9 USD Million in 2022, focuses on evaluating the effectiveness of preservatives in cosmetic products. Preservatives are essential to prevent the growth of harmful microorganisms in cosmetics, and the challenge test assesses how well these preservatives perform under various conditions. This testing ensures that cosmetic products remain safe for use throughout their shelf life.

Stability and Compatibility Test, with a value of 377.7 USD Million in 2022, is another critical segment within the cosmetic testing service market. This testing assesses the physical and chemical stability of cosmetic products. It helps determine whether a product's quality remains intact under different environmental conditions, such as temperature and humidity variations. Ensuring product stability is essential to guarantee that cosmetics maintain their intended properties over time.

Claim Substantiation, valued at 169 USD Million in 2022, is a segment that focuses on providing scientific evidence to support the claims made by cosmetic products. Cosmetic manufacturers often make various claims about the benefits of their products, such as anti-aging or moisturizing properties. Claim substantiation testing verifies these claims through rigorous scientific testing, ensuring that consumers receive products that deliver the promised benefits.

The Safety Assessment segment, valued at 187 USD Million in 2022, is fundamental to the cosmetic industry. It involves a comprehensive evaluation of the safety of cosmetic products, considering potential risks to consumers. This assessment takes into account the ingredients used in cosmetics, their concentrations, and possible exposure levels. It ensures that cosmetics are safe for use and do not pose any health hazards.

By Application

The Global Cosmetic Testing Service market offers a variety of services catering to different needs and preferences. These services are broadly categorized into two segments: Enterprise and Individual.

The Enterprise segment, with a value of 1017 USD Million in 2022, is a significant player in the market. This segment primarily serves businesses and organizations within the cosmetic industry. Enterprises often require extensive testing services to ensure the safety and efficacy of their products. They rely on cosmetic testing services to meet regulatory requirements and maintain the quality and reputation of their brands.

On the other hand, the Individual segment, valued at 364.7 USD Million in 2022, addresses the needs of individual consumers. Individuals may seek cosmetic testing services for various reasons. Some individuals opt for these services to ensure that the cosmetics they use meet safety standards and are suitable for their skin. Others may seek specialized testing to address specific concerns, such as allergies or skin sensitivities.

Both segments play a crucial role in the cosmetic testing service market. The Enterprise segment ensures that products in the cosmetic industry meet the necessary standards and regulations, contributing to overall product safety. Meanwhile, the Individual segment empowers consumers to make informed choices and address their unique cosmetic needs, promoting personal well-being and satisfaction.

The market's division into Enterprise and Individual segments reflects the diverse demands within the cosmetic industry. It highlights the adaptability of cosmetic testing services to cater to a wide range of customers, from businesses striving for product excellence to individuals seeking personal care and safety. This segmentation is a testament to the market's versatility and its ability to serve the needs of both corporate and individual clients in the dynamic and ever-growing cosmetic industry.

REGIONAL ANALYSIS

The global Cosmetic Testing Service market presents an intriguing landscape, driven by diverse factors that impact its growth and evolution. Among the various aspects influencing this market, geography plays a pivotal role in shaping its dynamics. The market's reach extends across different regions, with North America and Europe standing as prominent players in this scenario.

North America, with its robust cosmetic industry, is a key contributor to the global Cosmetic Testing Service market. The region's cosmetics market is marked by a relentless pursuit of innovation, driving the demand for testing services to ensure product safety and compliance with regulations. Cosmetic companies in North America prioritize consumer safety, which fuels the need for comprehensive testing, from skin irritation studies to toxicological assessments. The stringent regulatory environment in the United States and Canada reinforces the importance of thorough testing, making North America a significant hub for cosmetic testing services.

Whereas the Europe also holds a substantial share in the global Cosmetic Testing Service market. The European cosmetic industry has a rich history and is known for its commitment to quality and safety. Stringent regulations, notably through the European Union's Cosmetic Regulation, compel companies to conduct rigorous testing before products reach the market. This regulatory framework, coupled with a growing awareness of the importance of cruelty-free and sustainable cosmetics, propels the demand for specialized testing services. European cosmetic companies are keen to prove the safety and efficacy of their products, making the region a significant player in the global cosmetic testing landscape.

Both North America and Europe exhibit unique characteristics and market drivers that contribute to the growth of the Cosmetic Testing Service market. While North America's focus is on innovation and consumer safety, Europe's emphasis is on adherence to stringent regulations and ethical considerations. These regional distinctions create a diverse and dynamic global market, where cosmetic testing services play a vital role in ensuring the safety and quality of cosmetic products for consumers worldwide.

COMPETITIVE PLAYERS

In the cosmetic industry, ensuring product safety and efficacy is paramount. Cosmetic testing services play a pivotal role in this endeavor, offering a range of assessments and analyses to guarantee that cosmetics meet the highest standards of quality and safety.

These services encompass a wide array of testing methods, covering aspects like product formulation, performance, safety, and regulatory compliance. The Cosmetic Testing Service market is witnessing substantial growth, driven by the rising demand for new cosmetic products, increased consumer awareness, and stringent regulatory requirements.

One of the key players operating in the Cosmetic Testing Service industry is Eurofins Scientific SE. Eurofins is a global leader in laboratory testing and offers a comprehensive suite of services, including safety and quality testing for cosmetics. Their extensive network of laboratories and expert teams ensures that cosmetic products meet the necessary standards and regulations.

Another prominent player in this field is Intertek Group plc. Intertek provides a wide range of services, including testing, inspection, and certification, to various industries, including cosmetics. Their testing services cover aspects such as product safety, quality, and compliance with international regulations. They work closely with cosmetic manufacturers to ensure that products are safe for consumers and comply with legal requirements.

The Cosmetic Testing Service market is gaining momentum due to several factors. Consumer preferences are shifting towards safer and more sustainable cosmetics, which has led to a surge in demand for testing services. Additionally, the global cosmetics industry is witnessing a constant influx of new products, including skincare, haircare, and makeup items. As a result, manufacturers are seeking reliable testing services to validate the safety and effectiveness of their products.

Cosmetic Testing Service Market Key Segments:

By Type

- Microbiology Testing

- Challenge Test

- Stability and Compatibility Test

- Claim Substantiation

- Safety Assessment

By Application

- Enterprise

- Individual

Key Global Cosmetic Testing Service Industry Players

- Eurofins Scientific SE

- Intertek Group plc

- Cosmetic Testing Lab

- Microchem Laboratory

- way Regulatory Consultants Ltd.

- Consumer Product Testing Company

- QACS - The Challenge Test Laboratory

- Creative Biolabs, Inc.

- UL LLC

- Bureau Veritas SA

- SGS SA

- Catts Labs & Research Pvt. Ltd.

- Spectro Analytical Labs Pvt. Ltd.

- AEMTEK Inc.

- NorthEast Biolab

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252