MARKET OVERVIEW

The Global Copper Wire Rod market stands as a crucial segment within the broader copper industry, serving as a foundation for various applications across multiple sectors. Copper wire rods are essential intermediates in the production of electrical wiring, cables, and various other electrical and electronic products. Their significance is underscored by their wide usage in industries such as construction, telecommunications, automotive, and electronics. As technology continues to advance, the demand for high-quality copper wire rods will inevitably rise, driving market dynamics in new directions.

One of the defining characteristics of the Global Copper Wire Rod market is its responsiveness to technological advancements and industrial needs. Copper, known for its excellent conductivity, durability, and malleability, is a preferred material for electrical and electronic applications. These properties make copper wire rods indispensable in the manufacturing of transformers, motors, and power generation equipment. As industries worldwide push towards energy efficiency and sustainability, copper wire rods will play a pivotal role in supporting these initiatives.

In the construction sector, copper wire rods are extensively utilized for electrical wiring in residential, commercial, and industrial buildings. With urbanization and infrastructure development continuing to accelerate globally, especially in emerging economies, the market for copper wire rods will experience substantial demand. Similarly, the automotive industry relies heavily on copper wire rods for wiring harnesses, electric vehicles (EVs), and various electronic components. As the automotive industry transitions towards greener technologies, the integration of copper wire rods in EVs and hybrid vehicles will become even more pronounced.

The telecommunications sector also heavily relies on copper wire rods for the production of telecommunication cables and fiber optics. As global communication networks expand and the demand for high-speed internet grows, the need for robust and efficient copper-based infrastructure will increase. This sector's evolution will significantly influence the dynamics of the Global Copper Wire Rod market, highlighting the interconnection between technological progress and material demand.

Trade policies and economic factors play a significant role in shaping the Global Copper Wire Rod market. Variations in copper prices, driven by supply-demand imbalances, geopolitical tensions, and mining activities, directly impact the market. Additionally, environmental regulations and sustainability initiatives will influence production practices, encouraging the adoption of eco-friendly technologies and recycling methods. Companies within this market are likely to invest in advanced manufacturing processes and sustainable practices to meet regulatory requirements and reduce their environmental footprint.

Innovation will be a key driver in the future of the Global Copper Wire Rod market. Advances in manufacturing technologies, such as continuous casting and rolling, will enhance production efficiency and product quality. Moreover, research into alternative materials and alloys that can complement or enhance the properties of copper wire rods will continue to evolve. These innovations will not only meet the rising demand but also address the challenges related to resource scarcity and environmental impact.

The Global Copper Wire Rod market will continue to be a cornerstone of multiple industries, driven by the inherent properties of copper and the ever-growing demand for electrical and electronic applications. As the world progresses towards more sustainable and technologically advanced systems, the market will adapt and innovate, ensuring that copper wire rods remain integral to future developments across various sectors. The interplay between market forces, technological advancements, and regulatory frameworks will shape the trajectory of this market in the years to come.

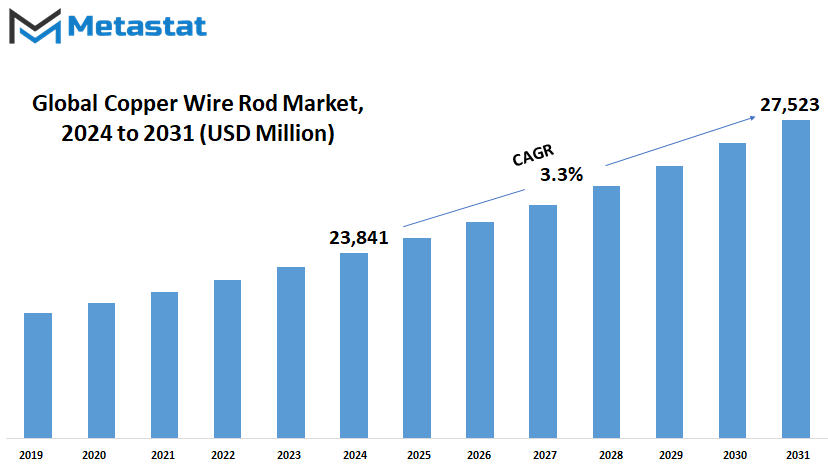

Global Copper Wire Rod market is estimated to reach $27523 Million by 2031; growing at a CAGR of 3.3% from 2024 to 2031.

GROWTH FACTORS

The Global Copper Wire Rod market is witnessing significant growth due to several key factors. One major factor is the increasing demand for electricity infrastructure and electrical products, especially in developing economies. As these economies continue to grow and urbanize, the need for reliable electricity supply becomes more pressing, driving up the demand for copper wiring.

Additionally, the rising adoption of renewable energy sources like wind and solar power is contributing to the demand for copper wiring. Copper is an essential component in the transmission and distribution systems of these renewable energy sources, making it indispensable in the transition to a greener energy mix.

However, the market faces challenges such as fluctuating copper prices, which are influenced by global supply and demand dynamics. These fluctuations can impact the profitability of copper wire rod manufacturers and affect investment decisions in the industry.

Furthermore, there is competition from alternative materials or technologies that offer cost or performance advantages in certain applications. For instance, some industries may opt for aluminum wiring instead of copper due to its lower cost or lighter weight. This competition poses a threat to the growth of the copper wire rod market, especially in segments where alternative materials are gaining traction.

Despite these challenges, technological advancements in copper production processes offer promising opportunities for the market. Innovations aimed at enhancing efficiency and reducing the environmental impact of copper production can provide a competitive edge to manufacturers. These advancements include processes that optimize resource utilization, minimize waste, and lower energy consumption.

In the coming years, continued innovation in copper production technology will likely drive market growth by improving the cost-effectiveness and sustainability of copper wire rod manufacturing. Additionally, the growing emphasis on sustainability and environmental stewardship will create opportunities for companies that can offer environmentally friendly copper products.

Overall, while the Global Copper Wire Rod market faces challenges from fluctuating prices and competition from alternative materials, technological advancements and the growing demand for electricity infrastructure and renewable energy sources will drive its growth in the future. Companies that can adapt to changing market dynamics and invest in innovation will be well-positioned to capitalize on emerging opportunities in the copper wire rod market.

MARKET SEGMENTATION

By Type

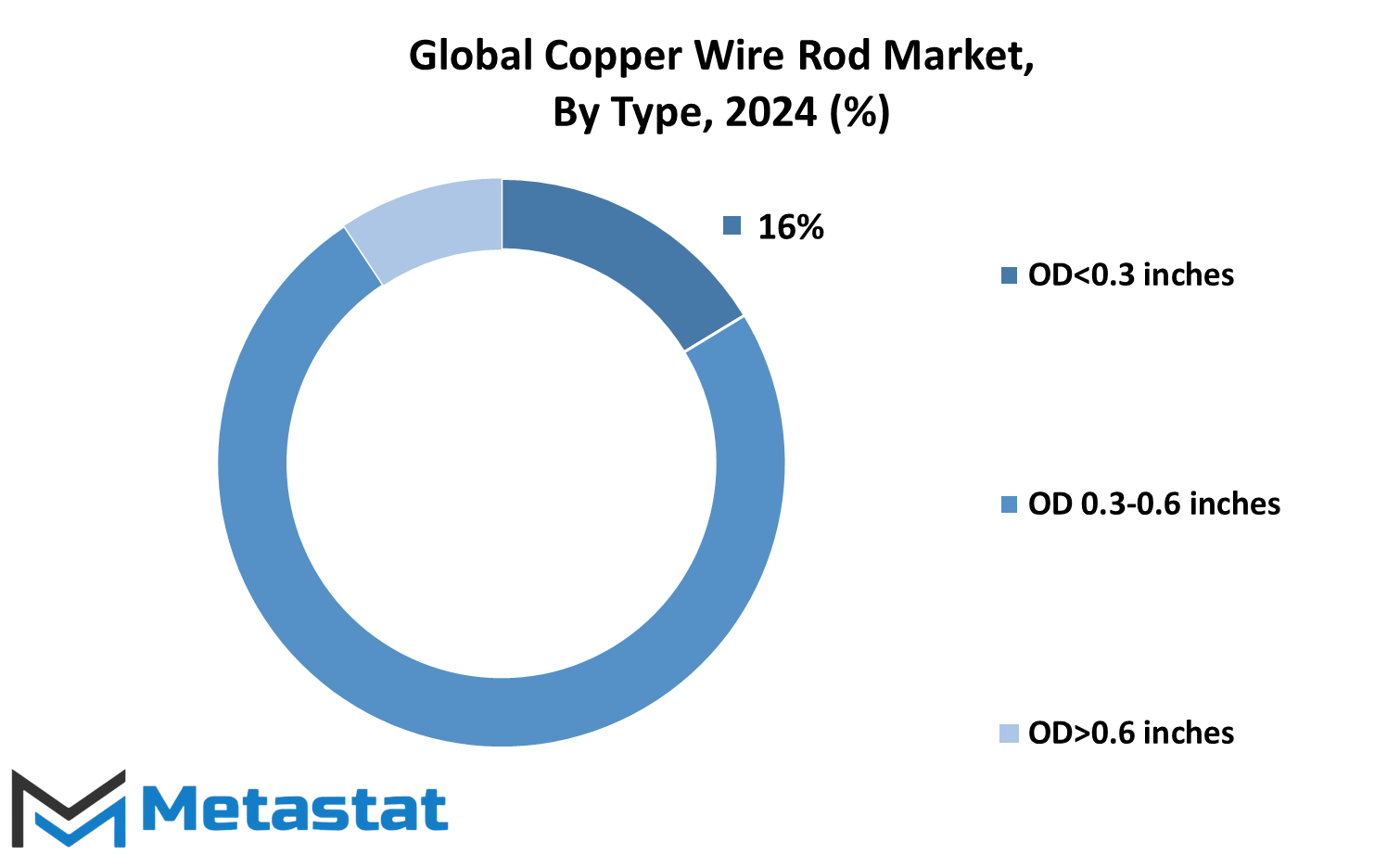

The global copper wire rod market is categorized by type, with further subdivisions based on outer diameter (OD). These divisions are OD below 0.3 inches, OD between 0.3 to 0.6 inches, and OD above 0.6 inches. This segmentation aids in understanding the market dynamics and allows for more targeted analysis.

By classifying the copper wire rod market into these segments, analysts and businesses can gain insights into the specific requirements and preferences of different customer groups. For instance, products with an OD below 0.3 inches might cater to applications that demand finer and more delicate wiring, such as electronics or telecommunications. On the other hand, wire rods with larger ODs, like those above 0.6 inches, could be utilized in heavy-duty industrial applications such as construction or power transmission.

Understanding these distinctions is vital for stakeholders in the copper wire rod industry as it enables them to tailor their products and strategies to meet the diverse needs of the market. By recognizing the varying demands across different OD segments, manufacturers can optimize their production processes, ensure efficient resource allocation, and enhance overall competitiveness.

Moreover, this segmentation also facilitates a deeper analysis of market trends and forecasting future demand. By tracking the performance of each segment over time, analysts can identify emerging patterns and anticipate shifts in consumer preferences or industry dynamics. For instance, if there is a growing demand for wire rods with an OD between 0.3 to 0.6 inches, businesses can adjust their production capacities accordingly to capitalize on this trend.

Furthermore, this segmentation can also inform strategic decision-making regarding product development and innovation. By understanding the specific requirements and challenges associated with each OD segment, companies can focus their research and development efforts on designing solutions that address these needs effectively. This targeted approach can lead to the creation of innovative products that offer distinct advantages over competitors, thereby enhancing market penetration and profitability.

By Application

In the vast landscape of global commerce, the Copper Wire Rod market stands as a crucial player, its significance spanning across various sectors and applications. As we gaze into the future, the market's trajectory unfolds with distinct clarity, driven by the diverse array of applications it serves.

One of the primary sectors where copper wire rods find their utility is in telecommunications. In the coming years, the demand for seamless connectivity and high-speed data transmission will continue to surge, propelling the need for advanced infrastructure. Copper wire rods, with their exceptional conductivity and reliability, will remain indispensable in powering the networks that facilitate our interconnected world.

Similarly, the realm of power cables will witness sustained growth, fueled by the ongoing expansion of urban centers and industrial complexes. As the need for efficient energy distribution grows, so too will the demand for copper wire rods, which form the backbone of robust power transmission systems.

Building wires, another key application segment, will witness a steady rise in demand as construction activities escalate worldwide. Copper's superior conductivity and durability make it the preferred choice for wiring solutions in residential, commercial, and industrial buildings, ensuring safe and reliable electrical connections.

In the aerospace industry, where precision and reliability are paramount, copper wire rods will continue to play a vital role in powering electronic systems and components. From aircraft communication systems to navigation instruments, copper's unmatched electrical properties will enable the seamless operation of aerospace technologies

The automotive sector, too, will drive significant demand for copper wire rods, particularly in the production of automotive harnesses. With the ongoing electrification of vehicles and the integration of advanced electronic systems, the need for high-quality wiring solutions will only intensify, further solidifying copper's position as a preferred material.

Beyond these prominent sectors, copper wire rods will find applications in diverse fields such as energy and heat transfer systems, where their thermal conductivity and corrosion resistance prove invaluable. Additionally, emerging industries and innovative technologies will continue to unlock new avenues for copper's utilization, ensuring its relevance in an ever-evolving market landscape.

REGIONAL ANALYSIS

The global market for Copper Wire Rod is analyzed on a regional basis, taking into account various geographical regions. These regions include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

North America is further segmented into the United States, Canada, and Mexico. In Europe, the countries considered are the United Kingdom, Germany, France, Italy, along with the Rest of Europe. Moving to Asia-Pacific, the market is divided into India, China, Japan, South Korea, and the Rest of Asia-Pacific. South America is represented by Brazil, Argentina, and the Rest of South America. Lastly, the Middle East & Africa region is categorized into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa.

This regional breakdown allows for a more detailed understanding of the market dynamics within each area. For instance, by examining the North American market separately, we can gain insights into the specific trends and factors influencing copper wire rod demand and supply in the United States, Canada, and Mexico individually. Similarly, the European market analysis enables us to identify key drivers and challenges in countries like the UK, Germany, France, and Italy, as well as the overall European region.

In the Asia-Pacific region, understanding the market dynamics in major economies such as India, China, Japan, and South Korea is crucial due to their significant contribution to global manufacturing and infrastructure development. By examining these countries individually, we can anticipate demand fluctuations and adapt our strategies accordingly.

South America, with its prominent economies like Brazil and Argentina, presents unique market dynamics influenced by factors such as industrial growth and infrastructure projects. Analyzing these markets separately allows for targeted interventions and strategies to address specific challenges and opportunities.

The Middle East & Africa region, encompassing countries like GCC Countries, Egypt, and South Africa, offers insights into the demand for copper wire rod driven by construction, electrical, and automotive sectors. Understanding the nuances of each market within this region enables businesses to tailor their offerings and marketing strategies effectively.

A regional analysis of the global Copper Wire Rod market provides valuable insights into localized trends, challenges, and opportunities, allowing businesses to make informed decisions and capitalize on emerging market dynamics.

COMPETITIVE PLAYERS

In the realm of the global Copper Wire Rod market, there exists a competitive landscape shaped by several key players. These companies play a significant role in driving the dynamics of the industry and influencing its trajectory.

Among the prominent names in this market segment are Aurubis, Jiaangxi Copper, Walsin Lihwa, LS Group of companies, Liljedahl Group, Sumitomo Electric Industries, Ltd., KGHM, TDT Copper, Mitsubishi Materials, DUCAB, Artyomovsk Non-ferrous metals processing works, Bajoria Group, Hindalco Limited, Kocbay Metal, and Vedanta Industries Ltd.

These companies are not merely participants in the market; rather, they are active contributors to its evolution. Their presence signifies a diverse array of expertise, resources, and strategies, each aimed at securing a competitive edge in the industry.

Aurubis, for instance, is known for its strong focus on sustainability and innovation. The company's commitment to environmental responsibility and technological advancement positions it as a leader in the Copper Wire Rod market, setting benchmarks for others to follow.

Similarly, Jiaangxi Copper leverages its extensive experience and robust infrastructure to maintain its position as a key player. With a steadfast dedication to quality and customer satisfaction, the company has established itself as a trusted partner in the industry.

Walsin Lihwa, LS Group of companies, and Liljedahl Group bring their unique strengths to the table, contributing to the diversity and dynamism of the market. Whether it's through their cutting-edge production processes, comprehensive product portfolios, or global market reach, these companies play pivotal roles in shaping industry trends and standards.

Sumitomo Electric Industries, Ltd., KGHM, and Mitsubishi Materials are renowned for their relentless pursuit of excellence. Through continuous innovation and strategic investments, they continually raise the bar for performance and efficiency in the Copper Wire Rod market.

Meanwhile, DUCAB, Artyomovsk Non-ferrous metals processing works, Bajoria Group, Hindalco Limited, Kocbay Metal, and Vedanta Industries Ltd. each bring their unique perspectives and capabilities to the forefront. From operational excellence to market agility, these players contribute to the vibrancy and competitiveness of the industry.

In an ever-evolving global landscape, these competitive players will continue to shape the Copper Wire Rod market, driving innovation, fostering growth, and meeting the evolving needs of customers worldwide. Their collective efforts not only define the present state of the industry but also pave the way for its future trajectory.

Copper Wire Rod Market Key Segments:

By Type

- OD Below 0.3 inches

- OD 0.3-0.6 inches

- OD Above 0.6 inches

By Application

- Telecommunications

- Power cables

- Building wires

- Aerospace industry

- Automotive harnesses

- Energy and heat transfer system

- Others

Key Global Copper Wire Rod Industry Players

- Aurubis

- Jiaangxi Copper

- Walsin Lihwa

- LS Group of companies

- Liljedahl Group

- Sumitomo Electric Industries, Ltd.

- KGHM

- TDT Copper

- Mitsubishi Materials

- DUCAB

- Artyomovsk Non-ferrous metals processing works

- Bajoria Group

- Hindalco Limited

- Kocbay Metal

- Vedanta Industries Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252