Global Contactless Remote Patient Monitoring Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

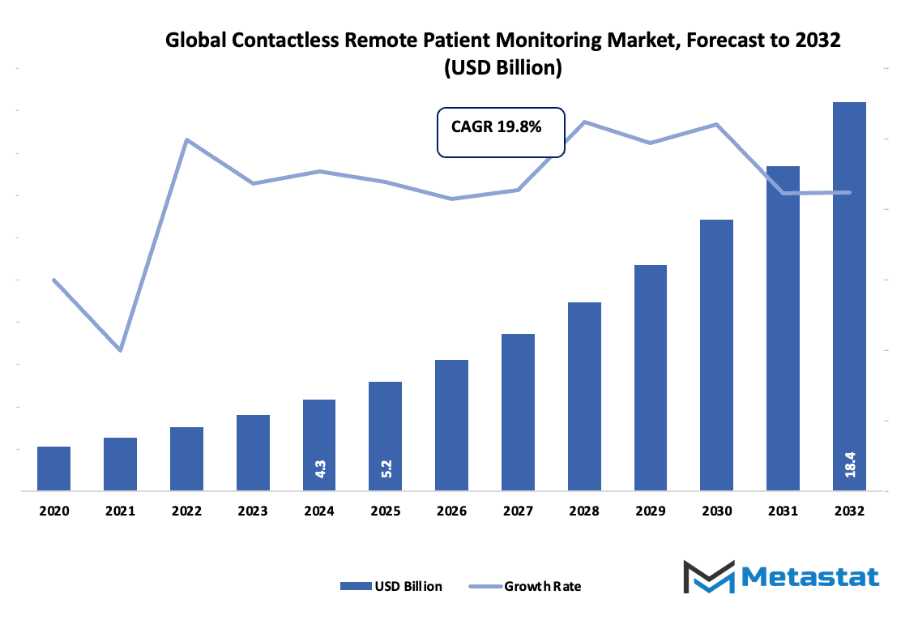

- The global contactless remote patient monitoring market valued at approximately USD 5.2 Billion in 2025, growing at a CAGR of around 19.8% through 2032, with potential to exceed USD 18.4 Billion.

- Wearable Devices account for a market share of 38.0% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising telehealth adoption and need for non-invasive patient monitoring post-COVID-19., Increasing focus on early detection and continuous monitoring for chronic diseases at home.

- Opportunities include: Growing opportunity in AI-driven contactless monitoring platforms and home-based RPM ecosystems.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global contactless remote patient monitoring market industry will continue to shape the way healthcare interacts with individuals outside traditional clinical walls, yet its path began decades earlier with gradual experimentation in wireless sensing and telehealth. Its earliest roots can be traced to hospital-based trials in the late 1990s, when research groups tested infrared and microwave technologies to record breathing and heart activity without attaching devices to the body. These early proofs of concept, documented in engineering reports from university medical centers, showed that patients responded positively to non-invasive observation, especially in intensive care settings where conventional wires limited mobility.

Through the 2000s, authorities health corporations in North America and Europe endorsed pilot applications that used non-touch sensors for chronic ailment tracking. Regulatory committees later posted protection tips for radio-frequency monitoring, which allowed device makers to transport past experimental setups and prepare systems for home use. When broadband connectivity expanded globally, patron expectancies shifted toward continuous virtual fitness assist, and this marketplace observed momentum. Public health records released at some stage in the 2009-2015 duration confirmed a constant rise in remote monitoring enrollments, with hospitals noting decreased readmissions for sufferers who used touch-loose gadgets in the course of post-surgical restoration.

A defining turning factor arrived in 2020, whilst health ministries international recorded a dramatic surge in remote monitoring adoption. Reports from the U.S. Centers for Medicare & Medicaid Services confirmed that far off physiologic tracking claims extended extra than fivefold in a unmarried year, driven by way of the want to study patients without physical touch. This shift validated years of technological improvement and pushed producers to refine radar-primarily based, thermal, and optical sensors able to capturing important symptoms with medical accuracy.

Market Segmentation Analysis

The global contactless remote patient monitoring market is mainly classified based on Type, Application, End User.

By Type is further segmented into:

- Wearable Devices:

The global contactless remote patient monitoring market growth is supported by wearable devices that track health signals through sensors placed on the body. Continuous measurement of vital signs helps healthcare teams access real-time readings. Steady improvements in comfort, accuracy, and battery life support wider acceptance, while simple data displays help users understand health trends without confusion. - Non-Wearable Devices:

Non-wearable devices help collect health information without direct attachment to the body. Many tools use contactless sensing methods, offering comfort for users who prefer minimal physical connection. Data from these systems helps healthcare teams observe changes in health patterns. Improved accessibility and simple setup encourage adoption in homes, clinics, and long-term support settings. - Software & Applications:

Software and applications act as the digital connection between devices and healthcare teams. Platforms gather information, sort data, and show health patterns in clear layouts. Strong cybersecurity tools protect sensitive information, while user-friendly features support people with different levels of digital skill. Regular updates help maintain smooth performance and reliable communication. - Services:

Services support device use by offering installation help, data handling, and continuous system oversight. Skilled support teams address technical concerns and guide users through setup steps. Training sessions help build confidence in device use, while responsive assistance ensures steady operation. Strong service quality encourages long-term trust in remote health management systems.

By Application the market is divided into:

- Chronic Disease Management:

Chronic disease management gains support from steady data tracking that highlights shifts in long-term health patterns. Contactless monitoring helps healthcare teams notice changes early and adjust treatment plans quickly. Smooth information flow reduces unnecessary visits and helps maintain stable care routines. Predictable tracking encourages steady control of conditions across diverse user groups. - Post-Operative Care:

Post-operative care benefits from systems that watch healing progress outside medical facilities. Devices observe vital signs and healing markers, helping healthcare teams respond to early warning signals. Reduced travel supports comfort during recovery. Reliable tracking encourages timely adjustments in care plans, lowering the likelihood of complications and supporting faster recovery paths. - Elderly Care:

Elderly care programs use contactless monitoring to support safety, comfort, and early detection of health concerns. Continuous observation helps caregivers understand daily health shifts. Simple interfaces help older users manage devices with ease. Quick data transfer assists healthcare teams in guiding treatment decisions, strengthening overall support for aging populations. - Fitness Monitoring:

Fitness monitoring uses sensors to record movement, heart rate, and energy patterns. Clear display of progress encourages steady improvement and helps users adjust activity plans based on daily performance. Contactless systems allow comfortable on-the-go tracking. Health professionals can review reports to guide safe training routines tailored to individual capability levels. - Mental Health Monitoring:

Mental health monitoring uses digital tools to record sleep patterns, stress markers, and mood signals. Gentle tracking methods offer comfortable support without adding pressure. Data patterns help specialists understand changes that need attention. Easy-to-use applications allow regular input, helping create a clearer picture of emotional balance over longer periods. - Infectious Disease Monitoring:

Infectious disease monitoring uses contactless sensors to track temperature, oxygen levels, and related signs. Early alerts help healthcare teams control spread risks and guide timely care. Remote observation limits unnecessary contact, supporting safer community environments. consistent measurement helps build accurate health records during periods of heightened concern.

By End User the market is further divided into:

- Hospitals:

Hospitals use contactless monitoring tools to expand oversight beyond traditional bedside systems. Real-time readings help medical staff respond quickly to changes in patient stability. Central data dashboards support smooth coordination across departments. Accurate remote observation also helps reduce crowding, freeing resources for urgent care and improving efficiency in daily operations. - Home Healthcare:

Home healthcare programs use remote tools to support safe care delivery in living spaces. Continuous tracking sends important updates to care teams, reducing unexpected complications. Comfortable device setups encourage steady use, while simple instructions help users manage daily measurements. Strong data flow strengthens communication between caregivers and medical professionals. - Clinics:

Clinics use contactless monitoring to support quick assessments during routine visits and follow-up checks. Automatic data transfer reduces manual recording errors. Clear readings help medical staff make timely decisions and guide care with confidence. Compact devices allow flexible use across departments, improving service flow for both short-term and long-term needs. - Long-term Care Facilities:

Long-term care facilities benefit from continuous observation that supports residents with varied health needs. Contactless tools help staff stay aware of vital changes without causing discomfort. Faster detection of health shifts supports safer living conditions and better planning. Smooth data sharing helps coordinate care among multiple specialists. - Ambulatory Surgical Centers (ASCs):

Ambulatory Surgical Centers use remote monitoring to support patients before and after procedures. Quick access to recorded health signals helps medical teams confirm readiness for surgery and observe recovery patterns. Reduced in-person checks support efficient scheduling. Accurate, steady data encourages safer discharge plans and smoother transitions back to daily routines.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5.2 Billion |

|

Market Size by 2032 |

$18.4 Billion |

|

Growth Rate from 2025 to 2032 |

19.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

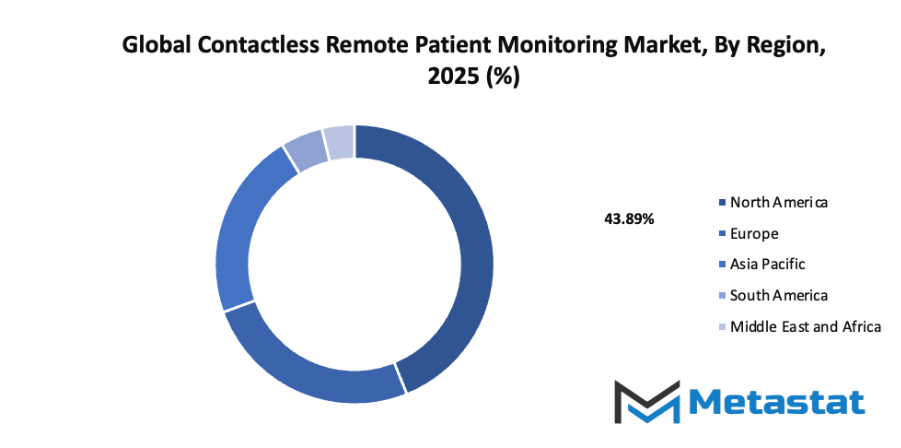

By Region:

- Based on geography, the global contactless remote patient monitoring market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Increasing adoption of telehealth; requirement for non-invasive patient monitoring publish COVID-19

Strong call for for remote care will similarly push the broader adoption of non-invasive gear, as hospitals and home-care settings rely on smooth strategies of tracking. Expanding the usage of telehealth will, in turn, inspire faster integration of sensor-primarily based structures that help regular fitness tracking with out physical contact, thereby building self assurance in safer lengthy-distance healthcare get admission to.

Increasing focus on early detection and continuous monitoring for chronic diseases at home

Health systems will invest in tools that support continuous observation of chronic conditions for quicker alerts and reduced emergency visits. Treatment will be guided through early detection using contact-free technology, which will help households support long-term care without constant clinic visits, encouraging the shift toward proactive monitoring.

Restraints & Challenges:

Privacy and data security concerns with continuous monitoring and sensor data

Increasing use of sensor networks will raise one serious concern for information safety that will encourage strict protocols for the protection of sensitive records. Data handling will have to be done with tighter controls to prevent misuse, and stronger safeguards will mold trust in distant monitoring, especially when more devices send health details directly to digital platforms.

Interoperability issues with the existing Healthcare IT infrastructure

Health settings will grapple with uneven digital systems that impede seamless communication among devices and systems. Older software programs will be in need of upgrading to support the newest monitoring tools, and limitations in coordination will hold back the fluidity of data movement. Technical alignment shall require major investments before consistent and accurate monitoring is widely dependable.

Opportunities:

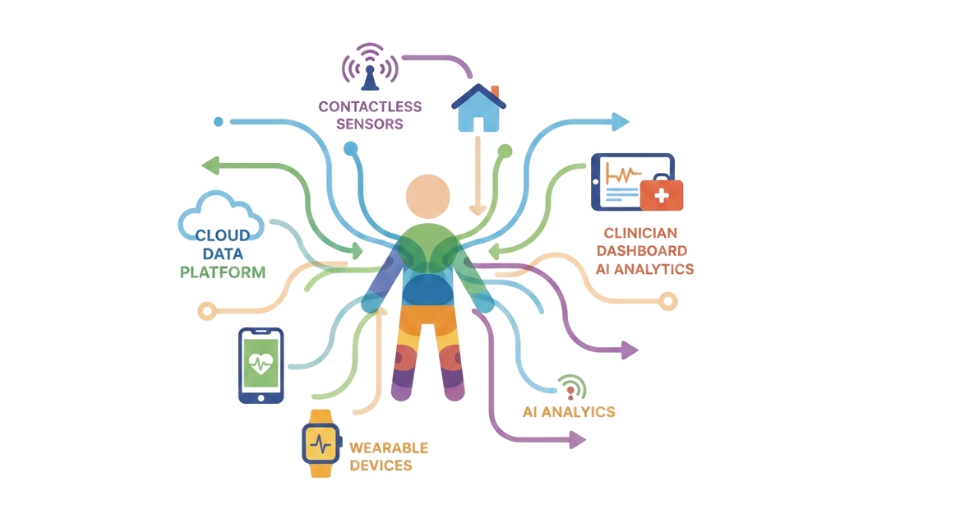

Growing opportunity in AI-driven contactless monitoring platforms and home-based RPM ecosystems

Advancement in predictive analytics will open fresh space for smarter monitoring systems that guide personalized care. Home-based setups will support daily health insights, making contact-free tools central to routine checkups. Increasing AI use will allow for stronger decision support, creating a wider digital pathway for connected care networks.

Competitive Landscape & Strategic Insights

The enterprise gives a combination of lengthy-mounted international corporations and bold nearby gamers, growing a placing shaped by means of steady development, cautious innovation, and growing interest in advanced care answers. Growth within the contactless far flung patient tracking discipline comes from rising focus of virtual fitness needs, wider get right of entry to to linked devices, and robust call for for safer and extra handy monitoring strategies in homes, clinics, and network care facilities. This movement encourages hospitals, caregivers, and technology agencies to work towards sensible systems that assist early detection, quicker response, and clear verbal exchange among medical groups and sufferers.

Major competition which include Philips Healthcare, GE Healthcare, Medtronic, Abbott Laboratories, Teledoc Health Inc., Boston Scientific, Omron Healthcare, Masimo Corporation, Vivify Health, Inc., Biotronik, Honeywell Life Care Solutions, Vivalink, Blue Spark Technology, Turtle Shell Technologies Pvt Ltd, and Clear Arch, Inc. Power steady improvement across hardware, software program, and records offerings. Each corporation provides distinct strengths, from sensor improvement and tool production to analytics platforms and incorporated tracking networks. This huge variety of contributions facilitates build stable supply alternatives for hospitals and helps continuous enhancements in far off care.

Market movement also reflects rising attention from smaller groups focused on flexible and affordable solutions. Many of these groups concentrate on simple device operation, stronger battery performance, user comfort, and secure data handling. Such progress encourages broader adoption in areas with limited clinical staff or growing demand for preventive care. Support from governments, insurance groups, and private investors also helps create steady momentum for large-scale deployment.

Clear communique, dependable measurements, and smooth facts switch remain critical dreams for all stakeholders. Strong partnerships among generation groups, healthcare vendors, and educational businesses help refine product first-rate and make bigger real-world testing. As lengthy as studies stays steady and collaboration continues, contactless far off affected person tracking will advantage wider acceptance and offer safer, greater green health management for a vast variety of groups.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 5.2 Billion in 2025 to over USD 18.4 Billion by 2032. Contactless Remote Patient Monitoring will maintain dominance but face growing competition from emerging formats.

Today, the market will keep expanding as cloud platforms, edge computing, and AI-enabled analytics become standard features in hospitals and home-care programs. Consumer expectations for comfort, discretion, and accuracy continue to influence design choices, while updated regulatory frameworks aim to protect patient data as devices collect larger volumes of physiologic information. As national health systems publish new digital-care roadmaps and invest in smart-home health infrastructure, the global contactless remote patient monitoring market will move toward broader everyday use, shaping a future in which continuous care feels natural rather than imposed.

Report Coverage

This research report categorizes the Contactless Remote Patient Monitoring market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Contactless Remote Patient Monitoring market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Contactless Remote Patient Monitoring market.

Contactless Remote Patient Monitoring Market Key Segments:

By Type

- Wearable Devices

- Non-Wearable Devices

- Software & Applications

- Services

By Application

- Chronic Disease Management

- Post-Operative Care

- Elderly Care

- Fitness Monitoring

- Mental Health Monitoring

- Infectious Disease Monitoring

By End User

- Hospitals

- Home Healthcare

- Clinics

- Long-term Care Facilities

- Ambulatory Surgical Centers (ASCs)

Key Global Contactless Remote Patient Monitoring Industry Players

- Philips Healthcare

- GE Healthcare

- Medtronic

- Abbott Laboratories

- Teledoc Health Inc.

- Boston Scientific

- Omron Healthcare

- Masimo Corporation

- Vivify Health, Inc.

- Biotronik

- Honeywell Life Care Solutions

- Vivalink

- Blue Spark Technology

- Turtle Shell Technologies Pvt Ltd

- Clear Arch, Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383