Global Construction Equipment Fleet Management Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global construction equipment fleet management market and industry will well surpass the ability to simply track assets in the future. There, corporations will outline how creation companies manipulate, hold, and make use of their heavy equipment for years to come. From really recording device usage, the market will grow to a massive landscape wherein predictive analytics, advanced connectivity, and virtual ecosystems will establish new standards for efficiency. Construction firms will now not view fleet control as an isolated function but as a strategic layer integrated into every segment of a mission, from planning to shipping.

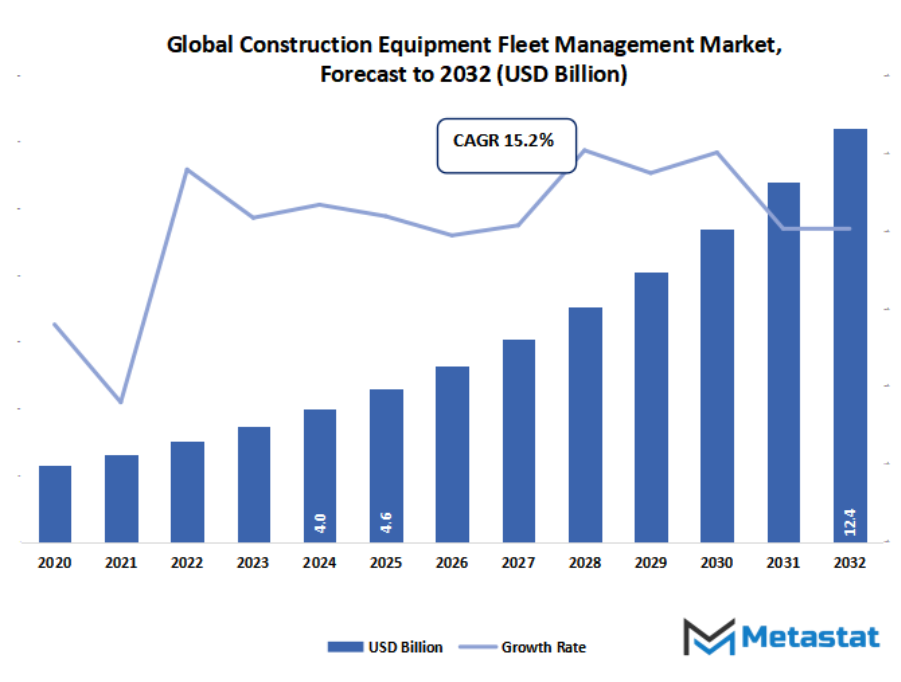

- Global construction equipment fleet management market valued at approximately USD 4.6 Billion in 2025, growing at a CAGR of around 15.2% through 2032, with potential to exceed USD 12.4 Billion.

- Solution account for nearly 69.2% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Need to reduce operational costs through improved equipment utilization and fuel efficiency., Strict project timelines requiring maximum equipment availability and reliability.

- Opportunities include Predictive maintenance using IoT sensors to prevent costly breakdowns.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

How will virtual technology and telematics reshape the manner construction organizations monitor, maintain, and optimize their gadget fleets in the coming years? Could rising sustainability worries and stricter emission norms disrupt conventional fleet operations at the same time as establishing doorways for greener and smarter options? To what extent will records-pushed decision-making and predictive maintenance rework the efficiency and cost-effectiveness of fleet control in this evolving market?

In the destiny, this market will expand its attain past creation web sites, influencing supply chains, power management, and sustainability practices. The adoption of smarter systems will permit contractors to assume downtime earlier than it occurs, lowering operational delays and setting new benchmarks for mission reliability. Companies will start embedding fleet management systems with different digital equipment, developing a continuing change of facts among equipment, operators, and challenge managers. This integration will reshape choice-making, making it quicker and more facts-pushed than ever before.

The global construction equipment fleet management market will even have a more position to play in environmental stewardship. With companies global shifting towards cleaner operations, fleet answers will adapt to tune emissions, reveal gasoline utilization, and streamline routes in manners that reduce environmental impacts. In the long term, this may bring about a shift in which fleet management will now not handiest be for productiveness but compliance with sustainability norms.

Market Segmentation Analysis

The global construction equipment fleet management market is mainly classified based on Component, Deployment, Functionality, End Users.

By Component is further segmented into:

- Solution - Advanced solutions will dominate the global construction equipment fleet management market in the future. Advanced solutions will incorporate real-time data access and provide predictive insights for proper machinery utilization. With the complexity of projects, it will make sure operational efficiency, reduced downtime, and high productivity occur in large-scale construction jobs.

- Service - Service will extend further in the global construction equipment fleet management market. Support offered in a timely manner, technical know-how, and customized support will help equipment function smoothly throughout projects. Services in the future will not only repair issues but will also foresee problems before they occur, and resources will be saved with a better fleet performance overall.

By Deployment the market is divided into:

- Cloud-based - Cloud-based deployment within the global construction equipment fleet management market will prevail because of its flexibility and accessibility. Construction projects worldwide will employ cloud systems to monitor fleets in real-time. Cloud deployments will provide scalable solutions, enabling companies to coordinate more effectively and minimize management expenses with secure data-based decisions.

- On-premises - On-premises deployment in the global construction equipment fleet management market will continue to be vital for companies requiring complete control and security. Such sensitive projects will opt for this arrangement because it keeps data within the organization. On-premises growth in the future will come in the form of improved integration with the already existing networks to make better decisions.

- Hybrid - Hybrid deployment will increase incrementally in the global construction equipment fleet management market. It will give construction firms the combination of cloud flexibility and on-premises control. It will enable companies to customize systems based on project size, budget, and security requirements, providing a flexible solution for varied operations.

By Functionality the market is further divided into:

- Equipment Tracking and Monitoring - Equipment monitoring and tracking will continue to be an integral component of the global construction equipment fleet management market. Upcoming tools will include more than location tracking, providing detailed performance information, predictive usage trends, and auto-alerts. Such evolution will enable companies to make better decisions on resource allocation and prevent unnecessary spending on large construction projects.

- Maintenance and Repair Management - Maintenance and repair management will improve the global construction equipment fleet management market. Automated systems will predict maintenance needs ahead of breakdowns, providing extended productivity. Construction companies will enjoy lower repair costs and extended equipment life, changing maintenance from a reaction to a proactive and predictive process.

- Fuel Management - Fuel management will be a crucial aspect of the global construction equipment fleet management market. Monitoring systems with advanced technology will monitor usage, identify inefficiencies, and recommend remedial actions. In the coming times, companies will use these products to minimize fuel wastage, reduce environmental footprint, and decrease the increasing operational costs.

- Compliance Management - Compliance management will become the focus in the global construction equipment fleet management market as regulations become more stringent globally. Automated platforms will ensure construction companies achieve environmental, safety, and legal compliance without delay. Future technology will reduce penalties, simplify audits, and establish a clear operational framework that increases stakeholders' confidence.

- Performance Analysis and Reporting - The next stage for the global construction equipment fleet management market will entail performance analysis and reporting. Using smart dashboards, firms will discover the critical points of improvement. They will be data-driven in providing recommendations based on such scenarios. This will allow projects to be executed within budget while maintaining accountability at every point in the construction process.

By End Users the global construction equipment fleet management market is divided as:

- Construction Contractors - Construction contractors will remain the biggest consumers of the global construction equipment fleet management market. They will rely on sophisticated systems to manage machinery, reduce expenses, and increase timelines. Upcoming contractors will be at a benefit by employing predictive analytics, as it will make projects complete on time with fewer operational delays.

- Equipment Rental Companies - Construction equipment rental companies will increasingly adopt the global construction equipment fleet management market to manage bulky inventories. Such systems will give real-time visibility into asset usage, condition, and availability. Rental companies by adopting these tools will maximize their returns, avoid misuse, and enhance customer satisfaction with properly maintained equipment.

- Infrastructure Development Firms - Construction equipment fleet management market will mostly depend on infrastructure development companies. Highway construction, bridges, and city development are large-scale projects that will require effective fleet management. Future technologies will provide these companies real-time monitoring, which will ensure maximum productivity and cost-effectiveness with timely completion of vital infrastructure.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4.6 Billion |

|

Market Size by 2032 |

$12.4 Billion |

|

Growth Rate from 2025 to 2032 |

15.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

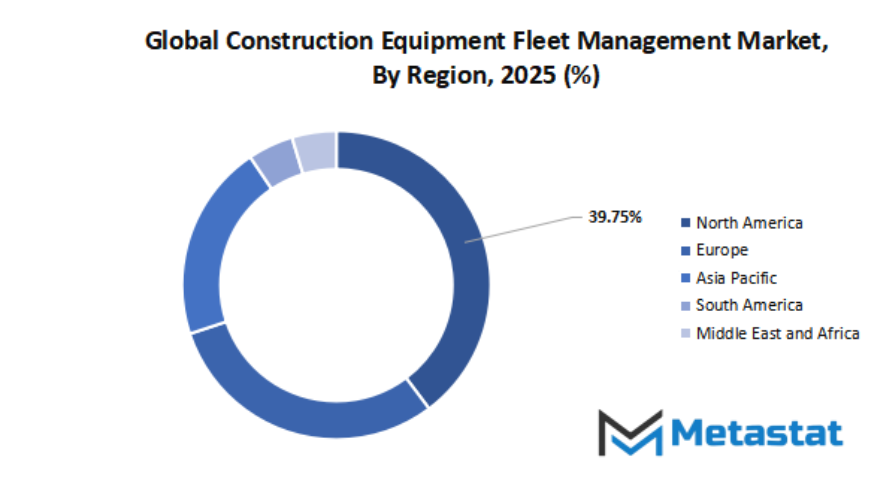

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The international production device fleet management market is becoming an important part of the enterprise as businesses are searching for approaches to enhance efficiency, reduce downtime, and lower costs. Fleet control generation permits operators to track equipment usage, display performance, and expect protection wishes. This has created a robust call for solutions that not most effective control motors but additionally combine records analytics, automation, and actual-time tracking. The capacity to control and optimize fleets will increasingly more be important as creation projects maintain to scale and develop more complicated, however it's going to remain the fundamental driving force of this marketplace's destiny.

There is a aggregate of numerous advanced worldwide leaders and up-and-coming regional competition that continue to shape the enterprise with sparkling approaches. Well-recognized names inclusive of Caterpillar, Hitachi Construction Machinery, John Deere, and Komatsu continue to be at the leading edge by using providing advanced structures that enhance productiveness and protection. Alongside those global giants, newer generation-driven companies like Samsara and Teletrac Navman are introducing progressive virtual answers that combine cloud systems, sensors, and AI to offer construction organizations sharper insights into their device operations. This blend of lifestyle and innovation is developing a surprisingly competitive landscape.

Companies along with Trimble, Topcon Positioning Systems, and Zebra Technologies are also strengthening their presence via that specialize in smart monitoring, positioning, and telematics. Their offerings permit organizations to screen system fitness and gasoline intake, whilst additionally supporting with group of workers and mission management. Volvo Construction Equipment adds any other measurement by integrating sustainable practices into its fleet control answers, reflecting the broader move in the direction of greener production operations. These numerous contributions spotlight how opposition in this space is not just about the wide variety of machines however about the intelligence in the back of dealing with them.

Looking beforehand, the market will preserve to extend as digital transformation gains momentum in the creation enterprise. Remote tracking, predictive analytics, and information-driven choice-making will push groups to adopt greater advanced fleet management structures. Global leaders will probably preserve a sturdy presence, but regional gamers who understand neighbourhood demanding situations and value sensitivities may even thrive. The growing mix of hooked up manufacturers and tech-centered entrants guarantees that the global creation gadget fleet control marketplace will remain dynamic and full of opportunity for years yet to come.

Market Risks & Opportunities

Restraints & Challenges:

High initial investment in telematics hardware and software systems. - Exorbitant initial investment in telematics software and hardware systems will be a restraint for the global construction equipment fleet management market. Numerous construction firms will struggle to justify the initial investment, despite the long-term gains enhancing efficiency and lowering operating costs considerably.

Resistance from equipment operators and traditional workflows to new technology. - Resistance from traditional work processes and equipment operators to new technology will still be a challenge for the global construction equipment fleet management market. Most workers will be reluctant to work on digital platforms, with the fear of job transitions or sophistication. This can be overcome through training, awareness campaigns, and step-by-step implementation of smart systems.

Opportunities:

Predictive maintenance using IoT sensors to prevent costly breakdowns. - Predictive preservation using IoT sensors will open a large opportunity in the global construction equipment fleet management market. Machines could be monitored in real-time, and minor faults will be detected in time, so that you can save you breakdowns. Thus, it will now not simply keep prices however also ensure higher productiveness, much less downtime, and higher asset lifestyles.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 4.6 Billion in 2025 to over USD 12.4 Billion by 2032. Construction Equipment Fleet Management will maintain dominance but face growing competition from emerging formats.

What lies beyond the scope of the cutting-edge industry is a shift toward autonomy and machine-to-machine verbal exchange. Equipment will finally have interaction independently, sharing operational facts and adjusting workloads without human intervention. As these advancements spread, the global construction equipment fleet management market will go beyond its present obstacles, positioning itself as a critical force in shaping the construction industry of the future.

Report Coverage

This research report categorizes the Construction Equipment Fleet Management market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Construction Equipment Fleet Management market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Construction Equipment Fleet Management market.

Construction Equipment Fleet Management Market Key Segments:

By Component

- Solution

- Service

By Deployment

- Cloud-based

- On-premises

- Hybrid

By Functionality

- Equipment Tracking and Monitoring

- Maintenance and Repair Management

- Fuel Management

- Compliance Management

- Performance Analysis and Reporting

By End Users

- Construction Contractors

- Equipment Rental Companies

- Infrastructure Development Firms

Key Global Construction Equipment Fleet Management Industry Players

- Caterpillar

- Hitachi Construction Machinery

- John Deere

- Komatsu

- Samsara

- Teletrac Navman

- Topcon Positioning Systems

- Trimble

- Volvo Construction Equipment

- Zebra Technologies

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252